Inflation may not have soared in June, but there are signs that higher tariffs are starting to push up prices. Americans are likely in for more pain in the near term.

The consumer price index was largely in line with estimates, but still jumped to 2.7% in June from 2.4% year over year in May. Core inflation, which removes the more volatile cost of food and energy, also inched up a tenth of a percentage point to 2.9%.

Meanwhile, wholesale inflation as measured by the producer price index released Wednesday, was unchanged in June from May. Core PPI, which excludes food and energy prices, was also flat compared with May.

The BLS, however, did say the headline and core PPI numbers for May were higher than it reported initially. And prices for finished goods rose 0.3% in June from May, which the BLS reported was the largest increase since February.

The recent upticks are by no means as dramatic as in early 2021, when inflation jumped roughly a full percentage point each month from February to May. But it cannot be ignored that the effects of President Donald Trump’s higher tariffs are starting to show up, both in the overall cost of goods and in core goods, which exclude food and energy. A number of factors, including a lack of significant gains in auto prices, ample inventories, and price-sensitive consumers, are masking the extent of the shift.

“We are seeing initial effects of tariff increases on core goods prices,” New York Fed President John Williams said Wednesday night.

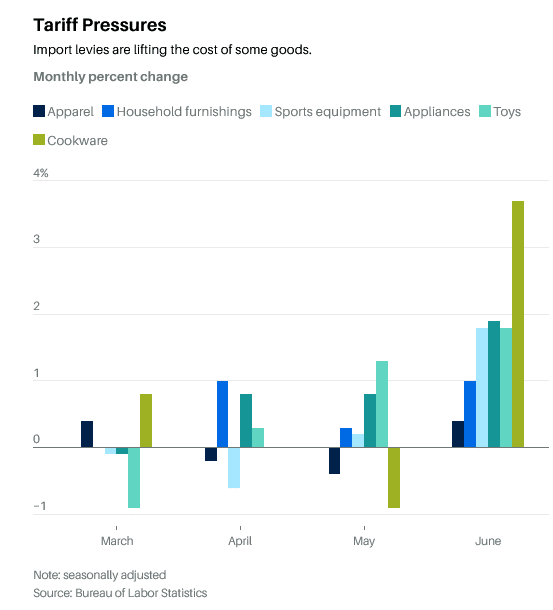

Notable increases appeared in categories such as furniture, sports equipment, appliances, clothing, and toys in June. An index of the cost of furnishing and running a household, in particular, rose 1% in June, after increasing 0.3% in May, the BLS reported Tuesday. The cost of recreation—the category includes sporting goods, movie tickets, and theme-park admissions—increased 0.4% over the month.

Prices of apparel, which showed little effect from higher tariffs in recent months, climbed 0.4% in June, reversing months of declines. And the overall cost of core goods saw the largest monthly increase since February.

The breadth of the rising inflation is important, said Omair Sharif, founder and president of the research shop Inflation Insights. He pointed out that nearly all core goods prices outside of autos increased in June, suggesting that companies in general are starting to pass their tariff costs on to their customers.

This “belies” the narrative that tariffs aren’t flowing through into consumer prices, wrote Michael Hanson, economist for J.P. Morgan. “The three-month increases for a range of goods, including household appliances, window and floor coverings, sporting goods, and other household and recreational items, are approaching—if not already well above—10% annualized,” he said.

According to Freya Beamish, chief economist at TS Lombard, 25% of the tariffs in force in June were passed through to customers, up from 15% in May.

That would be boosting the headline inflation numbers, if not for a few patterns that are unlikely to last through the summer. In the first place, frugal consumers are making it hard for businesses to raise prices. The Federal Reserve’s latest Beige Book, released Wednesday, showed businesses’ margins are coming under more pressure as a result.

Declines in the costs of cars and travel are a second factor. Prices for new vehicles fell by 0.3% month over month in June, while the cost of used cars and truck costs slid by 0.7%. Yet the latest readings of the Manheim Used Vehicle Value Index show that prices are on the rise, albeit incrementally. That means car prices will likely stop falling in July.

Read the full artice HERE.