Key Points

- Conflicting economic signals, including strong services growth but contracting employment, complicate the Federal Reserve’s upcoming rate decision.

- The Institute for Supply Management reported services sector expansion in November, while employment in services contracted for the sixth consecutive month.

- Investors anticipate a quarter-percentage-point Fed rate reduction next week, but concerns about consumer spending and a weakening job market persist.

Investors are getting mixed messages on health of the U.S. economy, leaving stocks in limbo ahead of next week’s Federal Reserve rate decision.

After being powered by the artificial-intelligence trade all year, stocks don’t seem to know where to head this month—traditionally one of the market’s strongest—thanks to data showing solid gains in some corners of the world’s biggest economy, and ongoing weakness in others.

Those conflicting signals are playing havoc with bets on how the Fed will proceed at next week’s rate-setting meeting—and how markets will react later this month once official economic data start filling in the blanks left by the government shutdown.

Lower Fed interest rates would almost surely support market valuations over the months ahead. But lukewarm jobs data and retailers’ shaky consumer outlooks could chip away at Wall Street’s projections for corporate earnings growth, which is key to the market’s

“Consumption isn’t just one of many factors in GDP … it is the factor, accounting for nearly 70% of all economic activity,” said Mark Malek, CIO at Siebert Financial.

“When the consumer wobbles, the economy wobbles. When the consumer spends, companies breathe. When the consumer tightens up, markets eventually follow,” he added.

That’s why the recent spate of economic data has been so vexing for Wall Street.

The Institute for Supply Management’s benchmark reading of activity around the services sector, the economy’s primary growth driver, expanded in November at the fastest pace since February, according to data released Wednesday. Input prices fell the most since March 2024—another positive for the sector.

Employment in services, however, contracted for a sixth consecutive month—echoing the weakness seen in payroll processing group ADP’s November employment report.

The ADP reading showed a net decline of 32,000 private sector jobs last month. In addition, wage gains for both workers remaining in their roles and those switching positions slowed notably from last year’s levels.

The official tally of U.S. job gains from the Bureau of Labor Statistics, usually published on the first Friday of each month, is delayed until Dec. 16 because of delays in collecting and processing data during the government shutdown.

The Bureau of Economic Analysis will publish official spending and inflation data on Friday, but the delayed report will only be comprised of data collected for September.

That leaves the Fed to focus on its own internal readings, ADP and other private sector readings, and anecdotal data, to calibrate both its Dec. 10 rate decision and its forecasts for near-term growth, inflation, and unemployment.

The CME Group’s FedWatch tool suggests markets are clearly anticipating a quarter-percentage-point reduction next week, but remain split as to how the central bank will signal its policy path into next year.

“Our expectation is that the doves will win out and we will see a number of rate cuts next year, but potentially fewer than are currently being forecast,” said Chris Zaccarelli, CIO at Northlight Asset Management.

Looser monetary policy could prove crucial for stocks. While the market has been powered by the artificial-intelligence trade, it also needs solid corporate earnings expansion over the whole of 2026 to justify the historically expensive valuations in nearly every sector of the S&P 500.

LSEG data suggest investors see collective profits for the benchmark rising 14.6% next year, with this year’s rate likely to climb to 13% once the fourth-quarter reporting season concludes in early March.

If the 2026 forecast is sound, aggregate earnings will rise to $309.28 a share. Wall Street’s biggest banks and investment groups, meanwhile, project the S&P 500 rising to around 7600 points by the end of 2026, based on forecasts collected by Barron’s. The benchmark index closed at 6850 points on Wednesday.

That would peg the S&P 500’s price-to-earnings ratio at 24.5 times, well north of the 10-year moving average of around 20 and above its current 23 times.

However, those earnings forecasts could be tested by a cautious consumer and a weakening job market—particularly if inflation pressures remain embedded in an economy that is already dealing with the highest nominal prices for food and energy in a generation.

“Earnings will do the heavy lifting next year,” said Savita Subramanian, Bank of America’s head of U.S. equity & quantitative strategy, who forecasts the S&P 500 finishing only at around 7100 points by the end of 2026.

“But we also worry about the tension between AI taking jobs verus consumption remaining resilient in 2026,” Subramanian added.

Some of the early signals on that front aren’t encouraging. Macy’s cautioned investors Wednesday that it’s expecting soft demand from low-income customers over the holiday season.

That view was also reflected in discount retailer Dollar Tree’s better-than-expected current-quarter outlook and Walmart stock’s record high close on Wednesday. Walmart holds a commanding lead in the middle-income market while taking an increasing share of more affluent consumers’ spending; its stock rally reflects investors’ bet that consumers will stay focused on value over discretionary spending.

Stocks are still within a whisker of their all-time highs. The combination of Fed rate cuts, the AI investment boom, and the tax and spending benefits from the One Big Beautiful Bill Act are expected to carry markets higher into next year.

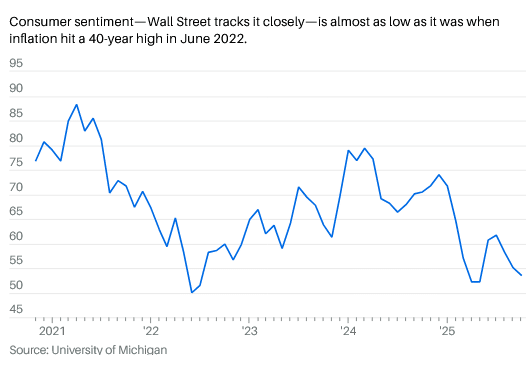

Repeating the market’s recent run of near 20% annual gains, however, will be a lot tougher sledding with rising unemployment and shoppers’ increased caution.

“There’s plenty of concern right now for the state of the U.S. consumer,” said Bret Kenwell, U.S. investment analyst at eToro.

“While this group has buoyed the economy over the last few years, persistent inflation, falling confidence, and a cooling labor market has investors anxious that consumers can continue to shoulder such a heavy load.”

Read the full article HERE.