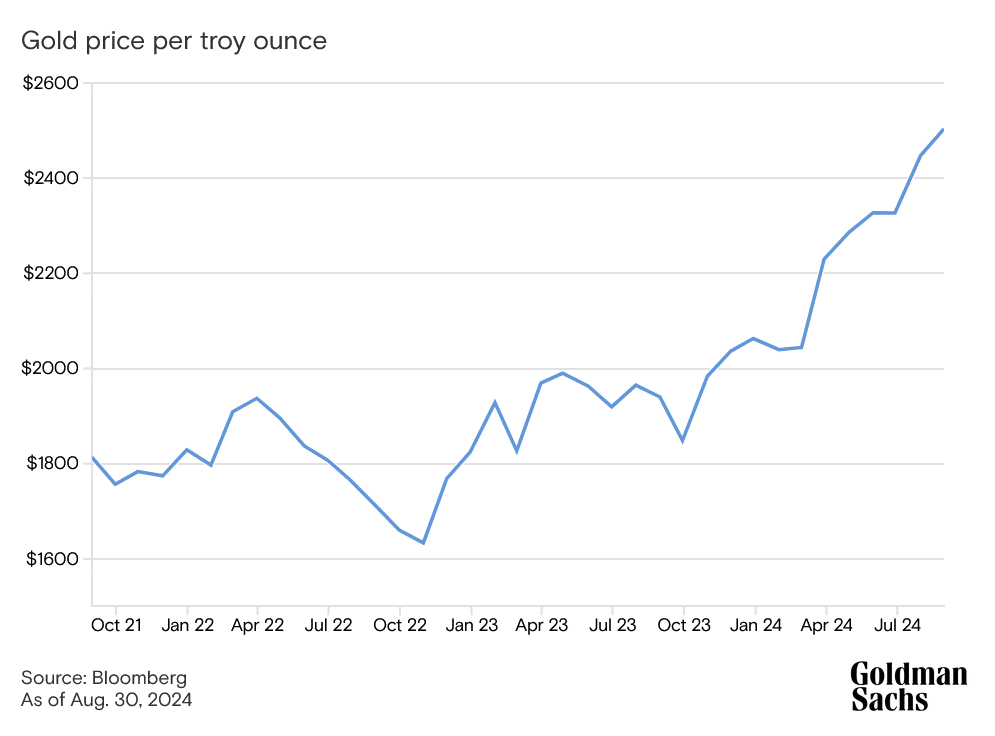

The price of gold has soared to new heights this year and is positioned to climb into early 2025, rising to new record highs, according to Goldman Sachs Research.

The precious metal has increased more than 20% this year, peaking at a record of more than $2,500 per troy ounce in August. Goldman Sachs Research forecasts the price will reach $2,700 by early next year, buoyed by interest rate cuts by the Federal Reserve and gold purchases by emerging market central banks. The metal could get an additional boost if the US imposes new financial sanctions or if concerns mount about the US debt burden.

Gold is our strategists’ preferred near-term long (the commodity they most expect to go up in the short term), and it’s also their preferred hedge against geopolitical and financial risks.

“In this softer cyclical environment, gold stands out as the commodity where we have the highest confidence in near-term upside,” Goldman Sachs Research strategists Samantha Dart and Lina Thomas write. They point to three factors in particular that could push gold prices higher:

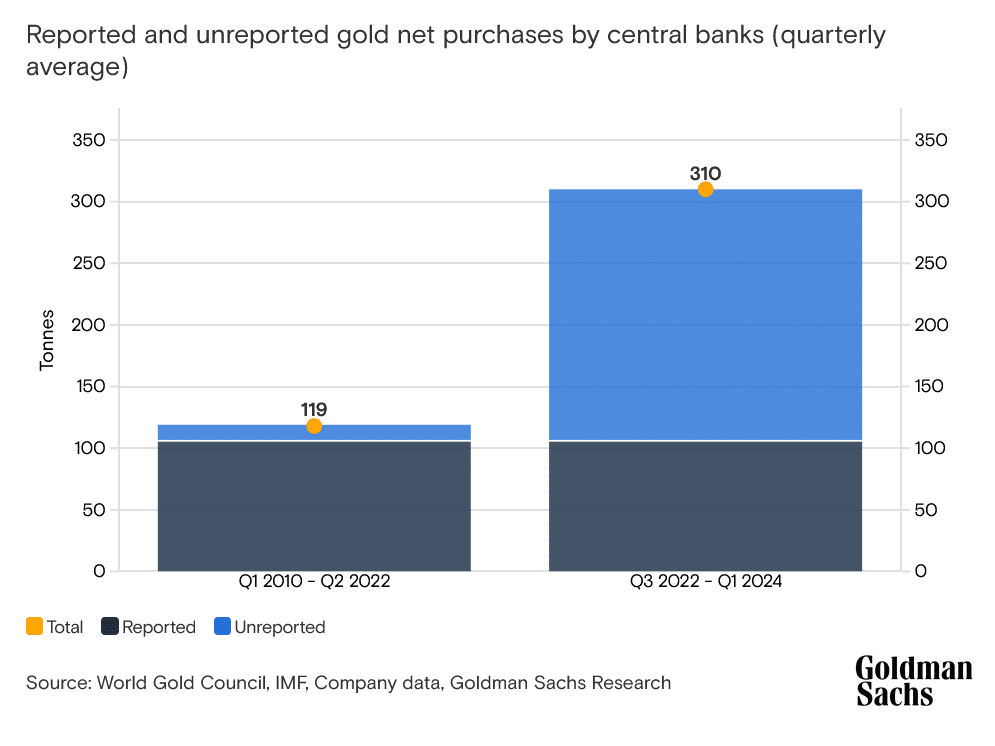

- Central bank purchases: Since Russia’s invasion of Ukraine in 2022, central banks have been buying gold at a brisk pace — roughly triple the amount prior. Goldman Sachs Research expects the buying spree to persist amid concerns about US financial sanctions and the growing US sovereign debt burden.

- Fed rate cuts: Higher interest rates tend to make gold, which doesn’t offer a yield, less attractive to investors. Rate cuts by the Fed will likely bring Western investors back into the gold market after largely being absent during the metal’s sharp rally over the past two years.

- Potential geopolitical shocks: Gold offers significant value as a portfolio hedge against developments such as tariffs, Fed subordination risk (i.e., the risk that its independence may be undermined), and debt sustainability fears. Our researchers see roughly 15% upside in gold prices under a rise in financial sanctions equal to the rise seen since 2021, and similar gains if mounting debt concerns spur US government credit-default swap spreads (a measure of credit worthiness) to widen by 1 standard deviation (13 basis points).

Investors may need to be more selective when investing in other commodities, given softening in the global economy, according to Goldman Sachs Research. Our strategists make note of several challenges:

- Oil: China’s oil demand growth has slowed, in part because of structural road fuel switching (to electric vehicles, for example) and weakness in demand for petrochemicals. The supply of liquids from the US is also outpacing expectations. The team reduced its range for Brent prices by $5 to $70-$85 per barrel and its 2025 average Brent forecast to $76 (versus $82 previously).

- Industrial metals: Refined copper production has been elevated even as China’s copper consumption appears to have fallen in March (year-over-year) and in early summer. Goldman Sachs Research doesn’t expect the metal, used in everything from home building to circuit boards, to reach its $12,000/ton target until post-2025. They made similar and related downward revisions to aluminum forecasts.

- Natural gas: An upcoming wave of global liquefied natural gas (LNG) supply will hit the market from 2025 and grow significantly through most of the second half of the decade. “We have long argued that lower energy prices lie on the horizon,” our strategists write.

Commodities still deserve a place in investors’ portfolios as they provide hedges against supply disruptions, among other things, according to Goldman Sachs Research. Select industrial metals could also experience sharp rallies, driven by a combination of long supply cycles and increased demand related to energy security and decarbonization efforts. Overall, our strategists expect a total return of 5% for the GSCI Commodity Index in 2025, down from the 12% total return it expects for this year.

Read the full article HERE.