Happy Fed day, in what will be a momentous decision not just for the fact that it will herald the beginning of an interest rate-cutting cycle but for the uncertainty over the magnitude of the reduction.

The last time the interest rate for a Fed decision was set more than 10 basis points away from market expectations was March 3, 2020 — the emergency cut at the beginning of the COVID pandemic, points out Michael Brown, senior research strategist at Pepperstone. That gives the interest-rate cycle a symmetry — uncertainty on the way up, and uncertainty on the way down.

But it may be a puzzle as to why the Fed is cutting rates at all when the economy is far from recession — the Atlanta Fed’s GDPNow estimate of third-quarter growth is a healthy 3% — and inflation is still above target.

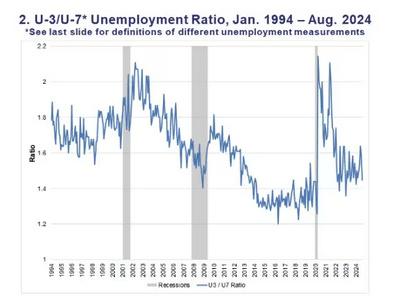

David Kotok, the chief investment officer of Cumberland Advisors who hosts an annual summer gathering in Maine of investors and other financial market participants, points to a warning from an employment measure that doesn’t officially exist. It’s called U-7, invented by David Blanchflower, the Dartmouth labor economist who served on the Bank of England’s monetary policy committee.

U-7 is actually not hard to compile — it’s a simple calculation involving two measures of underemployment that the Labor Department produces each month. It yields the number of part-time workers who want full-time jobs as a percentage of the workforce.

Kotok says the idea behind U-7 is that it isolates the most fragile element of the workforce. He says the way to use the number is to compare it with the main unemployment rate, which the Labor Department calls U-3. When the U-3 rises faster than the U-7, that’s a recession warning.

Blanchflower himself in a paper he co-authored said the U-7 segment also is key to understanding wage pressure. The idea is that it’s an indicator of the weak bargaining power of the full-timers. When there’s a bigger pool of underemployed, that naturally leads to less bargaining power for the fully employed.

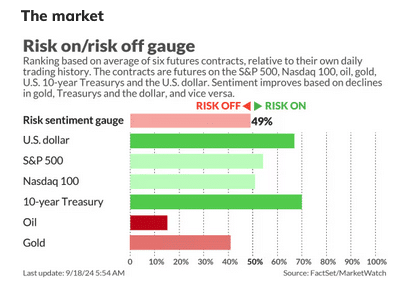

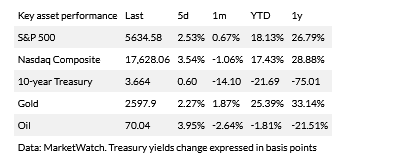

U.S. stock index futures ES00-0.09%, NQ00-0.06% edged higher early Wednesday, following the fourth highest close on record for the S&P 500 SPX-0.08% . Oil CL00-2.19% was trading below $70 per barrel. Gold GC000.16% was hovering around $2,600 an ounce.

The buzz

The Fed decision is due at 2 p.m. Eastern, with the market leaning toward a half percentage point, rather than 25 basis point, reduction. Jerome Powell’s press conference starts 30 minutes later.

Mortgage activity, and in particular refis, soared heading into the Fed decision, according to Mortgage Bankers Association data. Housing starts also rose, topping forecasts.

See the full article HERE.