Gold has surged despite macroeconomic headwinds, primarily due to central bank purchasing and geopolitical tensions. Could the rally see another gear after lower interest rates and a weaker dollar?

John Reade of the World Gold Council has seen gold rally to record highs of about $2,575 an ounce despite a strengthening dollar and rising interest rates in Europe and the U.S.

Now, he’s looking to the yellow metal to see how it performs when those headwinds are removed.

“Gold has been able to ignore some of the classic macro drivers,” he told Investing News Network. “But that may be changing now. … I think it’s going to be Western macroeconomic factors that probably take the lead in determining gold’s direction for the balance of this year and into 2025.

“Gold typically performs pretty well when rates are cut, and if those rate cuts lead to weakness in the U.S. dollar, which they certainly might, that could be a double tailwind helping the metal from here.”

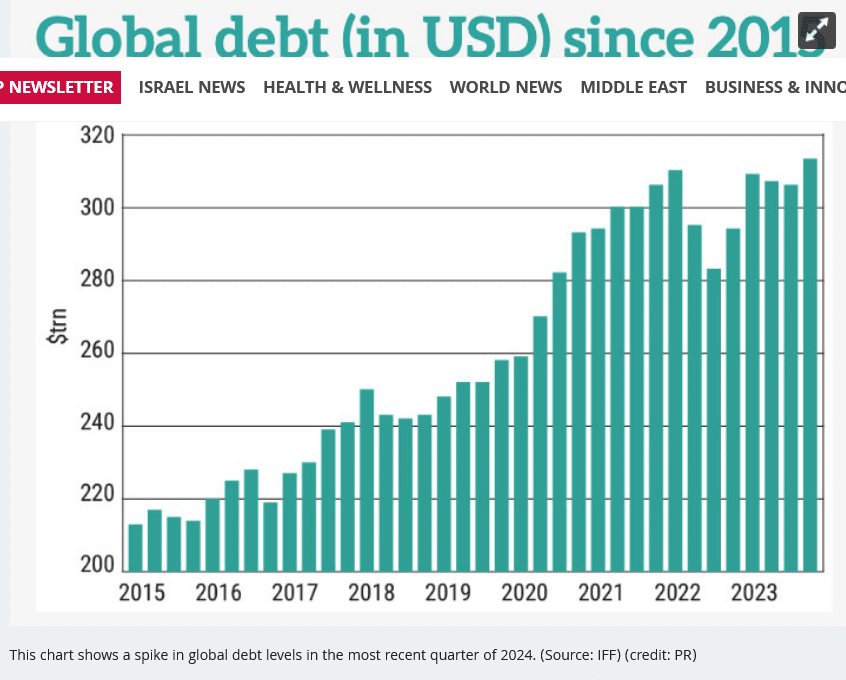

Global debt levels continue to rise

Global debt recently hit an all-time high after three consecutive quarterly reductions, which should turn investors to gold, according to Jupiter Asian Income manager Jason Pidcock.

“Fiscal policy globally is very loose, and that is a concern,” he told Portfolio Adviser. “Budget deficits — even when economies have supposedly been strong — have been way too high, and that’s why we’re invested in gold mines.”

Pidcock said Jupiter Asian Income is speculating a reduction in value among fiat currencies, which should lead to a rise in commodities prices.

“Everyone should have some exposure to gold, whether it’s as an insurance policy or just sensible diversification,” he said.

See full article HERE