The US presidential election is approaching, and the race between Kamala Harris and Donald Trump remains tight. The election outcome will significantly impact the gold (XAU) market, with key economic and geopolitical factors in the balance. Gold trades at historic highs, peaking at $2,790 on October 31, 2024. This article presents the movements in gold prices during historical events and discusses how these events may impact the gold price outlook. The price remains strong due to the US election and geopolitical uncertainty, and there are no signs of reversal in the short-term direction.

Gold Safe-Haven Status During Political Uncertainty

Investors have recognized gold as a reliable and safe-haven asset during political uncertainty. Its status as a store of value becomes more pronounced when global events introduce instability. In the context of US elections, policy shifts, and international tensions, investors turn to gold to protect their wealth from the potential devaluation of currencies and market volatility. The upcoming US presidential election on November 5, 2024, features a closely contested race between Kamala Harris and Donald Trump. Investors expect policy changes and geopolitical strategies that could ripple through the financial markets.

Gold Price Movements During US Election

The impact of political uncertainty on gold prices has been evident throughout history. Each administration’s decisions play a crucial role, from trade wars and changes in foreign policy to debates over energy investment and tariffs.

These decisions can influence the market’s perception of risk. During the current election cycle, uncertainty emerges from both candidates’ platforms. Trump focuses on aggressive trade measures, while Harris emphasizes domestic economic support and international alliances. This has contributed to maintaining gold’s appeal. Gold will likely remain attractive if questions about future policies and global stability persist. Investors will continue seeking it to mitigate risks in an unpredictable political landscape.

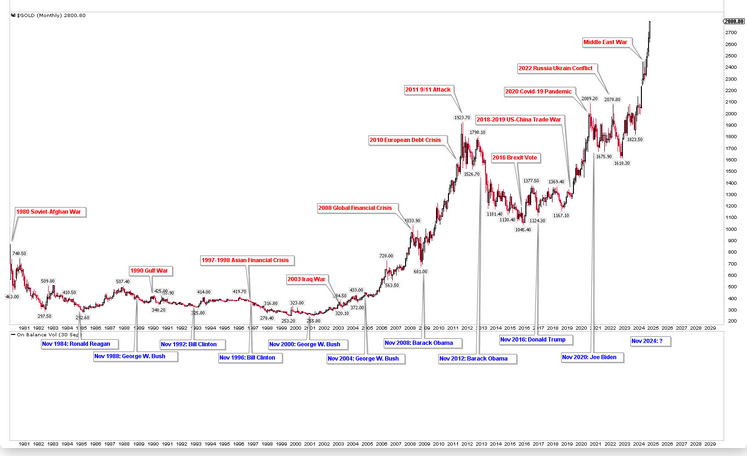

The monthly gold chart illustrates the impact of US presidential elections over the past four decades. It also highlights the geopolitical events that have contributed to significant gold surges during this period. The chart shows that gold price movements have generally been positive. However, the emergence of these events has triggered intense volatility in the gold market.

Key Historical Events Shaping Gold Prices

The major historical events that have triggered the gold rallies are discussed below.

1980 – Soviet-Afghan War & High US Interest Rates

Cold war tensions escalated with the Soviet invasion of Afghanistan. This war created geopolitical uncertainty. At the same time, high interest rates in the US impacted gold demand, and prices surged.

1990 – Gulf War

Iraq’s invasion of Kuwait created instability in the Middle East. This instability resulted in a peak in oil prices and boosted gold demand due to rising geopolitical risks.

1997-1998 – Asian Financial Crisis

The Asian financial crisis started with the collapse of the Thai baht. This crisis destabilized Southeast Asian economies, increasing gold’s appeal as a safe-haven asset.

2001 – 9/11 Terrorist Attacks

The September 11 attacks led to a surge in safe-haven demand for gold as global markets reacted to heightened uncertainty. Gold prices bottomed and started to surge.

2003 – Iraq War

The US invasion of Iraq fuelled concerns over Middle Eastern stability, adding to gold’s safe-haven appeal during heightened geopolitical tensions.

2008 – Global Financial Crisis

Triggered by the collapse of Lehman Brothers, this period saw massive economic fallout, and gold surged as investors sought stability amid market turmoil.

2010 – European Debt Crisis

Sovereign debt concerns in Greece, Spain, and other Eurozone countries led to a spike in gold demand as a hedge against currency instability.

2016 – Brexit Vote

The UK’s decision to leave the European Union introduced economic uncertainty, driving demand for gold as a safe haven amid fears of financial instability.

2018-2019 – US-China Trade War

The increased tariffs and trade tensions created volatility in global markets, and gold prices rose as investors turned to safe-haven assets.

2020 – COVID-19 Pandemic

The pandemic led to global economic shutdowns, extensive fiscal stimulus, and market volatility, which propelled gold demand.

2022 – Russia-Ukraine Conflict

Russia’s invasion of Ukraine destabilized markets, triggering a rush to gold due to concerns over global stability and economic sanctions on Russia.

Gold Trends Under Different Presidencies and 2024 US Election Outlook

Harris and Trump present competing visions that could drive distinct economic and geopolitical scenarios. Harris emphasized economic support for first-time homebuyers, families, small businesses, investments in renewable energy and continued backing of domestic oil production. Her commitment to supporting US allies in the context of the Russia-Ukraine conflict adds another layer of potential geopolitical impact. On the other hand, Trump focuses on policing, immigration, and boosting tariffs on Chinese goods, along with pledging to end the Russia-Ukraine war through diplomatic measures. The platforms of both candidates are starkly different. Key areas of focus include trade relations, energy investments, and the strength of the US dollar.

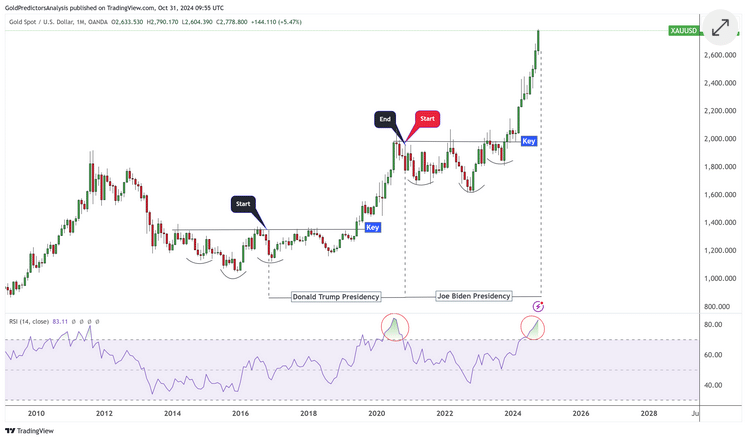

The chart below shows the gold price patterns during Donald Trump’s and Joe Biden’s presidencies. Donald Trump’s announcement as president drove the gold price sharply upward, breaking above the key level of $1,350. An inverted head-and-shoulders pattern determined this level, completed after his announcement. The gold value reached a record level of $2,075 just before the 2020 election.

On the other hand, the gold price consolidated below the key level of $2,075 during Joe Biden’s presidency. The price broke above $2,075 and initiated the next surge higher during the last year of Biden’s term. The market is now approaching the same overbought region observed just before the previous presidential election, as indicated by the RSI on the monthly chart.

Major Drivers of Gold Prices During Donald Trump’s Presidency

During Donald Trump’s presidency (2017-2021), gold prices experienced significant volatility and sharp increases due to geopolitical and economic events. Uncertainty arose from his administration’s aggressive stance on international trade, particularly the U.S.-China trade war. Tariffs on Chinese goods and countermeasures sparked fears of a global economic slowdown. Investors turned to gold as a safe haven against potential inflation and currency devaluation. Trump’s “America First” policy raised geopolitical isolation concerns, further driving gold demand. His economic policies, including tax cuts and extensive government spending, fueled worries about a growing federal deficit and long-term inflation. The Federal Reserve responded with rate cuts to stabilize markets. The COVID-19 pandemic in 2020 intensified these trends, as large stimulus packages increased inflation fears and pushed gold prices higher as a store of value.

Major Drivers of Gold Prices During Joe Biden’s Presidency

Economic policies and global geopolitical factors influenced gold prices during Biden’s presidency. The administration implemented the large-scale fiscal stimulus of the $1.9 trillion American Rescue Plan to aid economic recovery from COVID-19. This increased money supply and inflation fears prompted investors to turn to gold as a hedge against currency devaluation. The Federal Reserve kept interest rates low during the early presidency years, making gold more attractive. The Russia-Ukraine conflict boosted demand for gold as a safe haven. Moreover, U.S.-China relations and debt ceiling debates added further uncertainty. The inflation reached multi-decade highs in 2022, sustaining gold’s appeal even as the Fed raised interest rates to control inflation.

Gold Market Levels Tied to Trump and Harris Policies

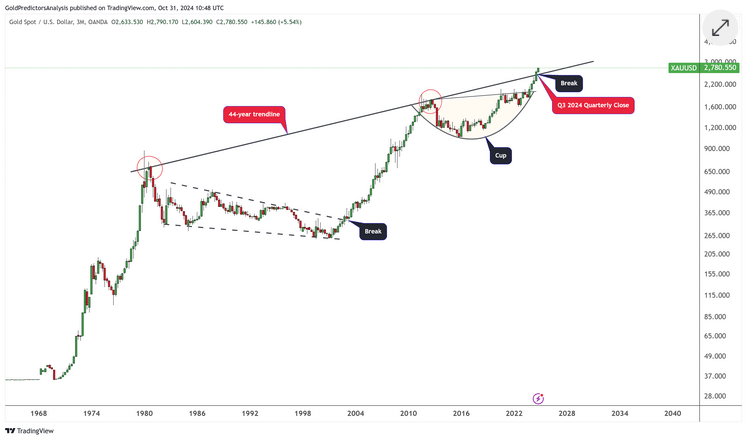

As the US election approaches, the gold price surges above a 44-year trendline on the quarterly log chart. The price closed Q3 2024 above this trendline, indicating a significant breakout. This breakout followed strong bullish patterns, including the cup formation, which was broken at the key level of $2,075.

Continuing the bullish trend after the strong quarterly close suggests that 2024 could be a strong year during the last months. Moreover, Q3 2024 was the biggest quarter in gold’s history regarding price gains in US dollars per ounce. The price may experience significant volatility as the election results approach, potentially pushing it back below this trendline or causing it to surge higher, depending on the election outcome.

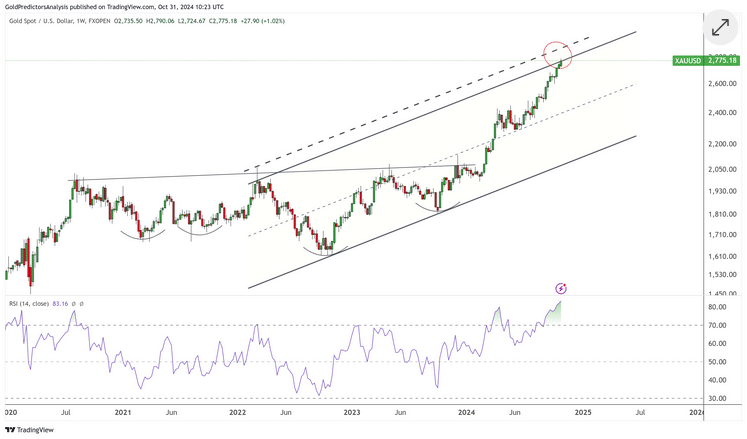

The price has hit strong resistance on the weekly chart, defined by the trendline of the ascending channel pattern. Moreover, the RSI is extremely overbought, signalling a potential correction. The black dotted trendline runs parallel to the ascending channel, indicating the extension of this resistance on the weekly chart. The price range of $2,800 to $3,000 highlights the strong resistance on the weekly chart.

How Trump and Harris Policies Influence Gold Prices?

If Kamala Harris wins the election, gold prices may experience a decline in the weeks following the outcome. This decline can be validated by the strong long-term resistance observed on the weekly chart, including the market overbought conditions. Her presidency is anticipated to be less inflationary than Trump’s, reducing the urgency of investors using gold as an inflation hedge. Harris’s administration would also likely uphold economic stability similar to that of the Biden administration, which could reduce gold’s appeal as a safe-haven asset. Nevertheless, should gold prices dip initially, they are projected to rise again in 2025 if US interest-rate cuts continue, enhancing gold’s long-term attractiveness. Furthermore, strong resistance on the weekly chart suggests that gold may encounter resistance around the $2,800-$3,000 levels, potentially triggering a significant correction.

On the other hand, if Donald Trump wins the election, gold prices are expected to climb due to increased inflationary pressures and heightened uncertainty. In this case, the price can break the resistance and continue to rise in a parabolic fashion. Trump’s policies, such as higher tariffs and a more aggressive stance on trade, could lead to greater market unpredictability and inflation. These dynamics boost gold’s appeal as a safe haven. His economic plan includes removing subsidies for electric vehicles and altering vehicle emission standards, which could raise oil demand and fuel inflation. These factors and the geopolitical risks tied to Trump’s unpredictable foreign policy would make gold an attractive investment as a safe-haven asset and a hedge against rising prices.

Final Words

In conclusion, the US presidential election between Kamala Harris and Donald Trump introduces significant potential for shifts in the gold market. Each candidate’s policies are likely to drive unique economic and geopolitical scenarios. Harris’s presidency could initially lead to decreased gold prices due to expectations of reduced inflationary pressure and a more stable economic outlook. However, long-term price increases may follow if interest rates are cut.

On the other hand, a Trump presidency is expected to increase inflation and geopolitical uncertainty, making gold a more attractive safe-haven investment. Investors must consider these dynamics and prepare for heightened volatility, as the election outcome will shape gold’s trajectory in conjunction with other economic indicators and Federal Reserve actions.

From a technical perspective, the gold market is at the intersection of strong, key long-term resistance, where a Trump presidency could push prices higher in a parabolic fashion. However, the price may experience a significant correction before the next upward move. Moreover, geopolitical uncertainties from the Middle East keep gold elevated, serving as a primary driver for recent rallies. The strong resistance in the gold market is $2800 to $3,000, and the next move will depend on the election outcome.

Read the full article HERE.