A Geopolitical Commentary

Gold has long been considered a crisis hedge and a store of value in the face of global volatility, market uncertainty, and economic distress. As we move toward year-end, a confluence of geopolitical factors has aligned to increase gold’s risk-off appeal creating an ideal buying opportunity for the world’s favorite safe haven.

Geopolitical Futures defines geopolitical risk as.

“… the potential political, economic, military, and social risks that can emerge from a nation’s involvement in international affairs. Typically, they emerge whenever there is a major shift in power, a conflict, or a crisis. These risks can have far-reaching implications for both the country itself and the global community at large. There are many factors that can contribute to geopolitical risks, such as a nation’s economic stability, its political relations with other countries, and its military strength.”

The Russia and Ukraine War

On February 24, 2022, Russia invaded Ukraine in a major escalation of Russia-Ukrainian War which started in 2014. Global aid to Ukraine has now reached a staggering $278 billion. As of the end of September, nearly $183 billion had been appropriated by the United States.[1] Meanwhile, the war has cost Russia about $211 billion[2] along with 200,000 casualties and half a million wounded.[3]

The war has also contributed to global instability and worldwide inflation by disrupting supply chains, damaging agriculture, and destroying infrastructure. According to the International Monetary Fund, the war has specifically undermined efforts to address extreme poverty, food insecurity and environmental degradation.[4]

The war has also resulted in an historic shift in the global energy markets.

“Any American around at the time will likely remember the 1973 oil embargo. That’s when Arab oil producers cut exports to the U.S. and other nations in retaliation for support of Israel during the Yom Kippur War. Gas stations ran dry. Prices skyrocketed. And the U.S. economy flattened. It also created a profound and permanent shift in energy markets as nations looked for new suppliers beyond the Middle East. Now, Russia’s invasion of Ukraine has created another major shift in energy.”[5]

This shift has injected extreme uncertainty into the energy market and increased price volatility. And according to Control Risks, a global risk consultancy, “greater disruption to both oil product and crude oil markets is credible if Ukraine further improves its drone capabilities and Russia fails to boost its air defences.”[6]

The Israel and Hamas Conflict

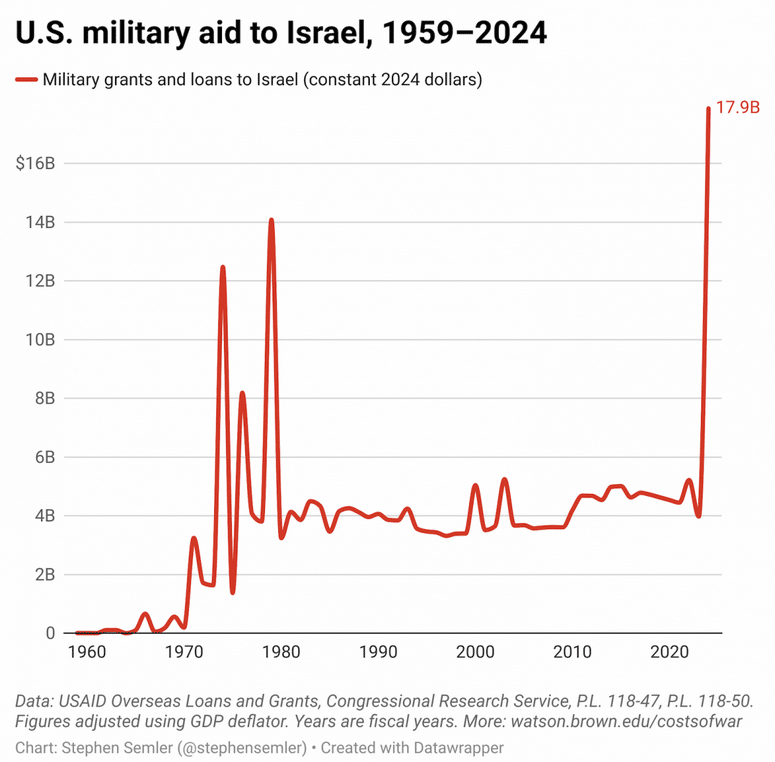

The U.S. has spent an estimated $23 billion on the Israel-Hamas conflict which started on October 7, 2023 after Hamas attacked Israel killing some 1200 Israelis and taking hostages. $17.9 billion has been to support Israeli military operations.[7] Israel has spent over $26 billion to fund the war against the terrorist group.[8] The cost of the war has caused Israel’s economic output to plummet 5.6%, the worst of any of the 38 countries in the Organization for Economic Cooperation and Development.[9]

The Associated Press reports the following:

Israel-Hamas War Statistics

- Number of Palestinians killed in Gaza: Over 41,000

- Number of Palestinians wounded in Gaza: Over 96,000

- Number of militants the Israeli military says it has killed: Over 17,000

- Number of Israeli soldiers killed since Oct. 7: Over 720

- Number of rockets fired at Israel from Gaza since Oct. 7: Over 9,500[10]

Internationally, the war has resulted in economic disruption, political realignment, new military vulnerabilities and a host of strategic challenges for the region reminiscent of the painful challenges of the past with Iraq and Afghanistan.[11]

And according to the Congressional Research service, the humanitarian toll has been simply staggering:

“About 90% of Gaza’s some 2.1 million residents have been displaced, with most facing unsanitary, overcrowded conditions alongside acute shortages of food, water, medical care, and other essential supplies and services. Obstacles to transporting aid through crossings and Israeli checkpoints and then safely delivering it have contributed to high levels of food insecurity.”

South Korean Martial Law

On December 3, 2024, the president of South Korea, Yoon Suk Yeol, declared martial law citing a threat from “anti-state” forces. It was the first time martial law had been declared in the East Asian country in over 40 years when a coup was carried out after the assassination of President Park Chung-hee back in 1979.[12]

The move plunged the nation of almost 52 million people into a national crisis. The martial law declaration by President Yoon was met with fierce backlash, condemnation and calls for reversal. Yoon did reverse the edict after just six-hours but then faced immediate calls for impeachment. While the vote for his removal from office failed, South Korean authorities have opened an investigation and are weighing possible insurrection charges against Yoon. According to CNN World, the president’s future is precarious at best

“While Yoon survived an impeachment vote in an opposition-led parliament on Saturday, his political survival now hangs in tatters. The travel ban on the country’s embattled leader was confirmed by the Corruption Investigation Office on Monday. His party previously said they will seek Yoon’s resignation and urged the president to be suspended from duties to protect the country from ‘grave danger.’”

The crisis has caused stocks on the Kospi (The Korea Composite Stock Price Index) and the South Korean won to collapse to levels not seen since 2009. As officials in Seoul are working frantically to prevent a market meltdown, the country is confronting deep political uncertainty and a period of prolonged volatility.

South Korea’s sudden instability threaten global tech supply chains, particularly for critical technology exports.

“As a major producer of memory chips, displays, and other critical tech components, South Korea plays an essential role in global supply chains for products ranging from smartphones to data centers … South Korea’s semiconductor ecosystem, driven by industry leaders like Samsung and SK Hynix, is a cornerstone of global technology supply chains. Its dominance in critical areas like memory chips makes it indispensable to industries worldwide.”[13]

The Toppling of the Syrian Government

After ruling Syria for 50 years, the Assad regime was toppled on December 8, 2024. After just two weeks of fighting, rebels converged on Damascus and seized control of the capital virtually unopposed — as Syrian leader Bashar al-Assad fled to Moscow.

“Three decades after his rise to prominence and almost a quarter century of rule, Bashar is gone and so is the Assad dynasty. Almost incomprehensively swept away over a two-week period during which the Islamist rebel group Ha’yat Tahrir al-Sham (HTS) and its partner, the Turkish-backed Syrian National Army (SNA), swept out of Idlib province to seize the country from Bashar who barely managed to put up a fight after his Russian and Iranian allies abandoned him.”[14]

But the sudden, collapse of the Assad regime raises fears of a power vacuum in Syria and the possibility that the country could fall into the hands of terror groups. Indeed, Abu Mohammed al-Golani, the leader of the largest of the rebel factions is a former al-Qaeda commander.

According to The Hill:

“al-Golani is promoting himself as a pragmatic, political leader and extending assurances for Syria’s multiethnic and religious populations. These promises run in direct contrast to the violence and human rights abuses carried out by the Islamist groups he aligned with in the past, such as ISIS and al Qaeda.”[15]

The collapse of the Syrian government has thrust the Middle East into even greater uncertainty. While Bashar al-Assad was a notoriously brutal dictator, the rapid collapse of his regime has left little time to for the country to chart a path forward. Syria’s economy contracted by 85% during its civil war, (which started back in March of 2011) and most of the country’s infrastructure has been destroyed. Inflation in Syria is in the triple digits and their economic recovery will require significant and ongoing support from the rest of the world.[16]

With war still raging in Europe, ongoing conflicts in the Middle East, and a new leadership crisis in South Korea and Syria — the world order seems to be fraying before our very eyes.

Gold thrives in a chaotic world as prices have historically increased during times of pronounced global uncertainty. As the world economy becomes increasingly more fragile, physical gold will become increasingly more attractive and look for prices to rise on unprecedented safe haven demand.

Thor Metals Group, was voted the “Best Overall Gold IRA Company” of 2024. For more information on acquiring gold or any other investment grade metal, call 1-844-944-THOR to speak to a precious metals expert.

[1] https://www.ukraineoversight.gov/Funding/

[2] https://www.defensenews.com/pentagon/2024/02/16/ukraine-war-has-cost-russia-up-to-211-billion-pentagon-says/

[3] https://www.economist.com/briefing/2024/11/28/the-war-in-ukraine-is-straining-russias-economy-and-society

[4] https://www.imf.org/en/Publications/fandd/issues/2022/03/the-long-lasting-economic-shock-of-war

[5] https://www.npr.org/2023/02/28/1160157753/how-russias-war-in-ukraine-is-changing-the-worlds-oil-markets

[6] https://www.controlrisks.com/our-thinking/insights/ukraine-war-remains-potential-disruption-to-energy-markets

[7] https://watson.brown.edu/costsofwar/papers/2024/USspendingIsrael

[8] https://www.timesofisrael.com/a-year-of-war-saps-israels-borrowing-strength-while-costs-balloon/

[9] https://apnews.com/article/israel-hamas-hezbollah-war-cost-military-spending-32a53a86d946418022ca636539a83f4f

[10] https://apnews.com/article/israel-palestinians-hamas-war-anniversary-statistics-e61765035c725b3c8d4840e2bab565cd

[11] https://www.wilsoncenter.org/article/five-global-dangers-gaza-war

[12] https://www.csis.org/analysis/yoon-declares-martial-law-south-korea

[13] https://www.cio.com/article/3617847/south-koreas-political-unrest-threatens-the-stability-of-global-tech-supply-chains.html

[14] https://www.cfr.org/expert-brief/after-fall-assad-dynasty-syrias-risky-new-moment

[15] https://thehill.com/policy/international/5030921-who-is-abu-mohammed-al-golani-leader-syrian-rebels-who-toppled-assad/

[16] https://www.dw.com/en/syria-after-assad-whats-next-for-the-devastated-economy/a-71003751