Wall Street got a rude awakening after the US downgrade by Moody’s Ratings, with stocks, bonds and the dollar falling amid renewed anxiety over the nation’s fiscal outlook at a time when there’s little clarity about the impacts of Donald Trump’s trade policy.

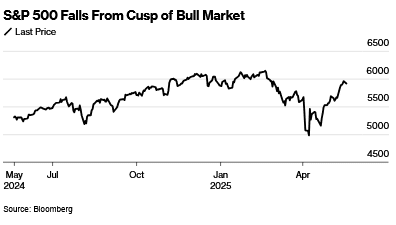

Following a torrid surge that put the S&P 500 on the brink of a bull market, the gauge fell about 1% on Monday. A selloff in big tech, which had led the equity rally from April’s lows weighed heavily on the market, with Tesla Inc. and Apple Inc. sliding at least 2.9%. Walmart Inc. slipped as Trump said the retailer should stop trying to blame tariffs as the reason for raising its prices.

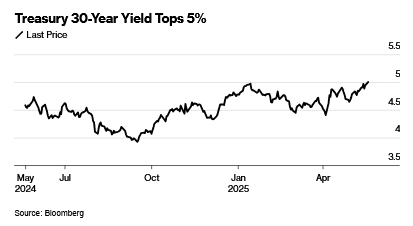

Long-dated Treasuries, which had already been moving higher before Moody’s statement, topped 5% amid investor concerns about a surging debt load. The US deficit has been in excess of 6% of gross domestic product for the past two years, an unusually high burden outside of economic recessions or world wars. The greenback dropped against most of its global peers. Gold climbed.

“The US credit rating downgrade adds to a long list of uncertainties that the stock market is weighing right now, including tariff, fiscal, inflation and economic ones,” said Clark Geranen, chief market strategist at CalBay Investments.

The S&P 500 fell 0.7%. The Nasdaq 100 slid 0.8%. The Dow Jones Industrial Average dropped 0.4%.

The yield on 10-year Treasuries advanced four basis points to 4.52%. The Bloomberg Dollar Spot Index fell 0.5%.

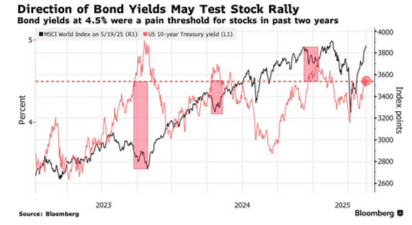

“The Moody’s downgrade of the US debt was not a shocking development, but it’s not what the Treasury market needed given that it’s on the cusp of signaling an important change in trend for long-term interest rates,” said Matt Maley at Miller Tabak. He also noted that news came at a time when the stock market is “overbought and overvalued,” helping trigger the pullback.

The US government lost its last triple-A credit score from a major international ratings firm after a downgrade by Moody’s on May 16, citing more than a decade of inaction by successive US administrations and Congress to arrest a trend of large fiscal deficits.

And there’s concern the situation could get worse, with Republican lawmakers discussing a tax and spending package from Trump that critics say would add trillions more to the federal debt over the coming decade.

Treasury Secretary Scott Bessent downplayed concerns over the US’s government debt and the inflationary impact of tariffs on companies, saying the Trump administration is determined to lower federal spending and grow the economy.

Asked about the Moody’s Ratings downgrade of the country’s credit rating Friday during an interview on NBC’s Meet the Press with Kristen Welker, Bessent said, “Moody’s is a lagging indicator — that’s what everyone thinks of credit agencies.”

“We view this latest credit action as a headline risk rather than a fundamental shift for markets,” said Mark Haefele at UBS Global Wealth Management. “We would also expect the Federal Reserve to step in if there were a disorderly or unsustainable increase in bond yields. So while the downgrade may lean against some of the recent ‘good news’ momentum, we do not expect it to have a major direct impact on financial markets.”

Investors should buy any dips in US stocks fueled by Friday’s credit rating cut, as the trade truce with China has reduced the odds of a recession, according to Morgan Stanley’s Michael Wilson.

The strategist sees a greater chance of a pullback in equities after the downgrade

by Moody’s Ratings pushed 10-year bond yields above the key 4.5% level. However, “we would be buyers of such a dip,” Wilson wrote in a note.

“By our measures sentiment and positioning is still flashing an unambiguous contrarian buy signal,” said Max Kettner at HSBC. “We see a S&P 500 dip on Moody’s US downgrade as a potential opportunity.”

Thomas Lee at Fundstrat Global Advisors also views the Moody’s downgrade as a “largely non-event,” while adding that in case of any stock weakness, he would be “buying this dip aggressively.”

“There is no “surprise” here as Moody’s is citing facts we already know, the sizable US deficit,” Lee said. “And we doubt any major fixed income manager is surprised. There is simply no incremental information here.”

Meanwhile, Goldman Sachs Group Inc. strategist David Kostin said he expects the Magnificent Seven group of technology stocks to resume outperforming the broader S&P 500 on robust earnings trends. The cohort has slumped so far this year as investors dumped pricey US stocks.

Corporate Highlights:

- Nvidia Corp. Chief Executive Officer Jensen Huang outlined plans to let customers deploy rivals’ chips in data centers built around its technology, a move that acknowledges the growth of in-house semiconductor development by major clients from Microsoft Corp. to Amazon.com Inc.

- Nvidia Corp. and Abu Dhabi investment vehicle MGX are partnering with French firms to establish what they say will be Europe’s largest artificial intelligence data center campus, advancing French and Emirati ambitions in the field.

- Novavax Inc. jumped after US regulators fully approved its Covid vaccine, easing investors’ concerns after the clearance was delayed and US Health and Human Services Secretary Robert F. Kennedy Jr. raised doubts about its efficacy.

- US-traded shares of Alibaba Group Holding Ltd. slumped after a report that the Trump administration has raised concerns over Apple Inc.’s potential deal with the Chinese technology firm

- Bankrupt genetic-testing firm 23andMe agreed to sell its data bank, which once contained DNA samples from about 15 millio

- B. Riley Financial Inc. named Scott Yessner, who has been serving as a strategic adviser for the past two months, to succeed Chief Financial Officer Phillip Ahn as the company grapples with overdue regulatory filings and probes.

- Blackstone Infrastructure agreed to acquire New Mexico utility owner TXNM Energy Inc. for about $5.7 billion, the latest in a flurry of power deals as US electricity consumption grows.

Stocks

- The S&P 500 fell 0.7% as of 9:43 a.m. New York time

- The Nasdaq 100 fell 0.8%

- The Dow Jones Industrial Average fell 0.4%

- The Stoxx Europe 600 fell 0.4%

- The MSCI World Index fell 0.4%

- Bloomberg Magnificent 7 Total Return Index fell 1.2%

- The Russell 2000 Index fell 1.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.6%

- The euro rose 0.8% to $1.1254

- The British pound rose 0.7% to $1.3370

- The Japanese yen rose 0.5% to 144.98 per dollar

Cryptocurrencies

- Bitcoin fell 1% to $103,022.57

- Ether rose 1.5% to $2,431.05

Bonds

- The yield on 10-year Treasuries advanced four basis points to 4.52%

- Germany’s 10-year yield was little changed at 2.60%

- Britain’s 10-year yield advanced three basis points to 4.68%

Commodities

- West Texas Intermediate crude fell 0.5% to $62.20 a barrel

- Spot gold rose 0.8% to $3,230.84 an ounce

Read the full article HERE