- Donald Trump threatened to impose a 50% tariff on Brazil over its domestic political affairs, citing the treatment of former President Jair Bolsonaro.

- Brazil’s leader Luiz Inacio Lula da Silva responded that his nation will not be “tutored” by anyone and that any unilateral rate hikes will be responded to using Brazil’s economic reciprocity law.

- According to Stephen Olson, visiting senior fellow at ISEAS–Yusof Ishak Institute, it’s unprecedented for the US to add a tariff onto a foreign country to stop a judicial proceeding, and “it signals to US trade partners that any and all issues that catch Trump’s attention could become a problematic part of the trade agenda”.

Donald Trump threatened to impose a 50% tariff on Brazil over its domestic political affairs, the most extreme case yet of the US president weaponizing trade policy to make unrelated demands.

Trump cited the treatment of former President Jair Bolsonaro — a right-wing populist leader — in his letter to Brazil on Wednesday, calling on authorities to drop charges against him over an alleged coup attempt. “This Trial should not be taking place. It is a Witch Hunt that should end IMMEDIATELY!” Trump wrote in the letter.

Brazil’s leftist leader Luiz Inacio Lula da Silva fired back in a social media post, saying his nation will not be “tutored” by anyone. He added that the case against those who planned a coup is a matter solely for the country’s justice system and “not subject to interference or threat.”

“Any unilateral rate hikes will be responded to using Brazil’s economic reciprocity law,” Lula wrote. “The sovereignty, respect and intransigent defense of the Brazilian people’s interests are what guide our relations with the world.”

Trump’s latest threat, against a nation that sells fewer goods to the US than it buys, risks reinforcing concerns that formal trade agreements may offer limited protection against future tariff hikes. It also again shows that the rates Trump unveiled in April on “Liberation Day” carry little meaning.

Trump has previously used tariff threats to accomplish other geopolitical goals. In January, he announced sweeping tariffs on Colombia before abruptly pulling the threat after reaching a deal on the return of deported migrants. He’s also put 20% tariffs on China for its alleged failure to stop the flow of fentanyl to the US, and threatened BRICS nations with higher duties for undermining the dollar.

Unprecedented

Still, it’s unprecedented for the US to add a tariff onto a foreign country to stop a judicial proceeding, according to Stephen Olson, visiting senior fellow at ISEAS–Yusof Ishak Institute and a former US trade negotiator.

“It signals to US trade partners that any and all issues that catch Trump’s attention could become a problematic part of the trade agenda,” Olson said. “It also raises questions as to whether the reciprocal tariff negotiations will ever really settle anything.”

So far, Trump’s flurry of new warnings have done little to rattle global markets as they did when the so-called reciprocal tariffs were announced in April, with traders focusing on Trump’s overall extension of the deadline to Aug. 1. That’s effectively given trading partners an extension for talks as skepticism persists on Wall Street that he will follow through on his import taxes.

Currency Hit

But the move on Brazil shook the real, which slumped as much as 2.9% against the US dollar. US equity futures retreated amid uncertainty over the Trump administration’s trade policies, with S&P 500 contracts slipping 0.2%, even as stocks gained in Europe and Asia.

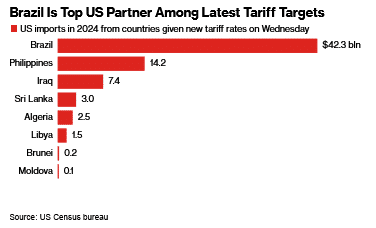

The Brazil letter was one of several sent by Trump on Wednesday. He levied a 30% rate on Algeria, Libya, Iraq and Sri Lanka, with 25% duties on products from Brunei and Moldova and a 20% rate on goods from the Philippines. They were largely in line with rates Trump previously announced, though he lowered them for Iraq and Sri Lanka while raising them on the Philippines, a US ally.

Brazil is the first country to receive one of Trump’s tariff notifications that was not on the initial list of trading partners when he announced higher so-called reciprocal tariffs in April. And the letter to Brazil also presents a warning shot to the BRICS group of developing nations, which Trump has cast as a threat to the US dollar’s status as the world’s key currency.

Brazil is unusual among Trump’s most recent tariff targets because it runs a deficit in trade with the US, while almost all the others post large surpluses. In 2024, Brazil imported some $44 billion of American products, while US imports from Brazil were around $42 billion, according to the Census Bureau — putting it among the top 20 American trading partners.

Asked what formula he was using to determine the appropriate duty rate for trading partners, Trump told reporters at a White House event on Wednesday that it was “based on common sense, based on deficits, based on how we’ve been over the years, and based on raw numbers.”

“They’re based on very, very substantial facts, and also past history,” he said.

Trump added to uncertainty earlier this week by claiming he was “not 100% firm” on that new cut-off date for talks. He has since sought to signal to investors and trading partners that he is committed to carrying out his tariff threats, vowing Tuesday that “all money will be due and payable starting AUGUST 1, 2025 — No extensions will be granted” on country-specific levies.

Deputy Treasury Secretary Michael Faulkender on Wednesday indicated that even if tariffs kicked into effect, negotiations could continue beyond the August deadline.

“There’s enormous progress that has been made with many of these countries, and for some of them it is just finalizing some of the terms of the framework,” he said in an interview with Bloomberg Television. “Now obviously, the details of the trade agreement will be worked out well beyond August 1st, but a general framework is the objective to have by August 1st.”

Still, the Brazil threat signaled that even if nations strike trade deals with the US by the Aug. 1 deadline, they may still face tariff escalation afterward, according to economists at Barclays Plc. led by Brian Tan.

BRICS, Copper

“We suspect President Trump’s announcement of a 50% tariff on Brazil is likely to erode Emerging Asian policymakers’ confidence that a deal would put an end to uncertainty over US trade policy,” they wrote.

The president has also raised the stakes for two key trading partners, saying the European Union could receive a unilateral tariff rate soon despite progress in negotiations, and vowing to hit India with an additional 10% levy for its participation in the BRICS.

He has raised the specter of more industry-specific tariffs, as well, floating a 50% rate on copper products that sent that metal climbing as high as 17% in New York on Tuesday, a record one-day spike. He also pitched tariffs as high as 200% on pharmaceutical imports if drug companies don’t shift production to the US in the next year.

While Trump has touted his tariff notification letters as deals, even the actual agreements he has managed to strike during the negotiating period with the UK and Vietnam have been far short of comprehensive, leaving many details unclear. Trump also secured a truce with China to lower rates and ease the flow of critical earth minerals.

The result of Trump’s criticism of BRICS economies and his high tariff threats may end up being that it only brings those economies closer together, according to Steven Okun, founder and CEO of APAC Advisors.

“It signals that countries should continue to expect Trump to use tariffs to get what he wants — and there’s limited scope for a reprieve,” he said by phone. “He can add tariffs for whatever reason at any time.”

Read the full article HERE.