- The risk of a bubble in stock markets is rising as monetary policy loosens alongside an easing in financial regulation, according to Bank of America Corp. strategists.

- The world policy rate has fallen to 4.4% from 4.8% in the past year and is forecast to drop further to 3.9% in the coming 12 months, according to Michael Hartnett.

- Michael Hartnett said “Bigger retail, bigger liquidity, bigger volatility, bigger bubble” in a note, warning of the potential for a bubble in the stock market.

The risk of a bubble in stock markets is rising as monetary policy loosens alongside an easing in financial regulation, according to Bank of America Corp. strategists.

The team led by Michael Hartnett said the world policy rate has fallen to 4.4% from 4.8% in the past year as central banks in the US, UK, Europe and China slashed borrowing costs. The rate is forecast to drop further to 3.9% in the coming 12 months, he said.

At the same time, policymakers are considering regulatory changes to boost the share of retail investors in the US. “Bigger retail, bigger liquidity, bigger volatility, bigger bubble,” Hartnett wrote in a note.

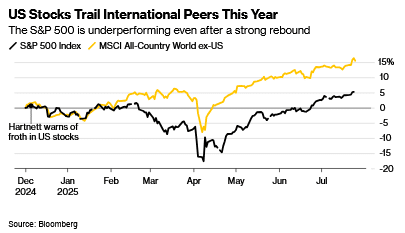

US stocks have rallied to record highs on optimism around resilient economic growth and corporate profits even in the face of higher tariffs. Some market forecasters such as Morgan Stanley’s Michael Wilson have said there’s reason to remain bullish given positive earnings momentum, robust operating leverage and cash tax savings.

However, strategists at JPMorgan Chase & Co. and UBS Group AG have warned the market may be getting too complacent about lingering trade risks. S&P 500 futures were little changed on Friday, as investors held off from making big bets ahead of the Federal Reserve’s policy meeting next week.

BofA’s Hartnett correctly forecast that international stocks would outperform the US this year. He had warned in December that equities were beginning to look frothy after a strong rally in 2024. The S&P 500 Index sank as much as 18% after he issued that call, before rebounding in early April.

The strategist said again in June that stocks could end up in a bubble on the back of expected rate cuts.

Read the full article HERE.