There’s no doubt that the dollar’s role in the international monetary system is changing. In a world teeming with armed conflicts, soaring debt, market manipulation and what the World Economic Forum calls “an increasingly fractured global landscape,”[1] central banks are looking to protect their economies. The world’s leading monetary authorities are responsible for trillions of dollars in global bank reserves, and they’re increasingly swapping their greenbacks for gold in an effort to diversify their holdings and reduce economic risk.

The Dethroning of ‘King Dollar’?

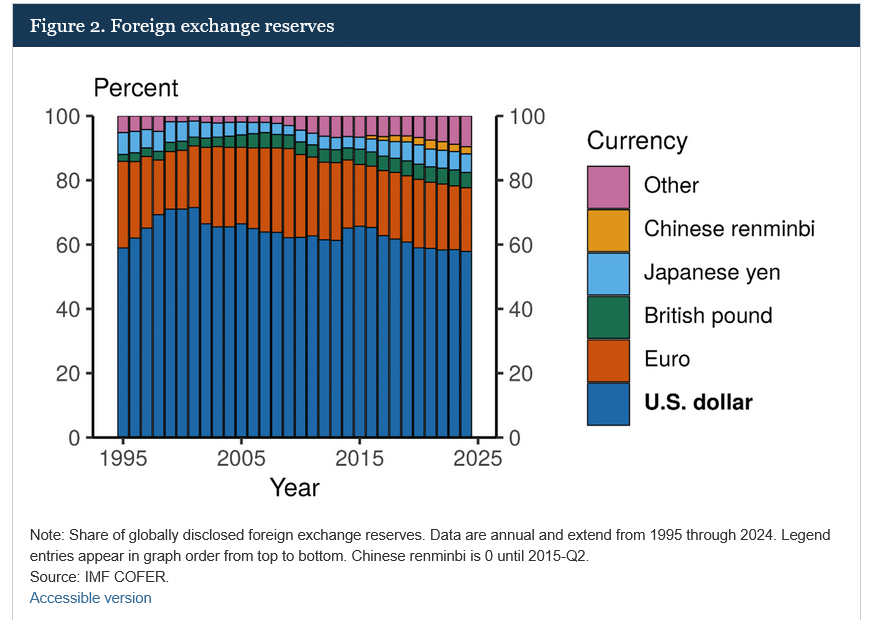

According to the Federal Reserve, the U.S. dollar represents about 58% of “disclosed global reserves” (2024) — and while it far surpasses foreign exchange reserves of other major currencies like the euro (20%), Japanese yen (6%), British pound (5%), and the Chinese renminbi (2%) — it has significantly declined from its peak of 72% back in 2001.[2]

Year-to-Date the dollar has fallen almost 9% in value, and this has gotten the attention of central banks looking to diversify their reserves to lower risk and reduce volatility. It has also prompted them to seek out higher yielding currencies and finite commodities like gold that traditionally have an inverse relationship with the dollar.

This shift reflects growing concerns about the greenback from its weakening safe haven status — to its changing role in the international monetary system. And for JP Morgan Private Bank, it also suggests a threat to U.S. exceptionalism.

“For decades, U.S. exceptionalism has been a cornerstone of global investing, powered by robust economic growth, tech dominance, high real (inflation-adjusted) yields and deep markets. Since the early 2010s, U.S. stocks have consistently outperformed, Treasuries have attracted steady demand, and the dollar has risen almost uninterruptedly … The tide may be turning. For the first time in years, the dollar looks to be unwinding its longstanding overvaluation, which could mean a 10%–20% decline over the medium term against major peers such as the euro and Japanese yen.”[3]

“The Damage Has Been Done!”

In the post-Cold War era most, major economies have feverishly amassed U.S. assets giving America “exorbitant privilege” effectively tilting the balance of economic power decidedly toward the United States.

But according to PIMCO, President Trump’s aggressive trade tactics have created added uncertainty and imbalances in the dollar-centric global financial system, reducing the attractiveness of American assets.

“With tariffs disrupting this balance, the financing of America’s twin current account and fiscal deficits may become more challenging unless there is fiscal support, as countries pursue greater economic and military self-reliance. The breakdown of longstanding global correlations could be painful for a global investor, who may be left wondering how many U.S. assets to own.”[4]

So, while Trump’s new tariff deals may be generating revenue and reducing the trade deficit with various countries, they may also be accelerating the decline of the dollar and setting the stage for a prolonged gold price surge. According to the head of foreign exchange research at Deutsche Bank, “The damage has been done. The market is reassessing the structural attractiveness of the dollar as the world’s global reserve currency and is undergoing a process of rapid de-dollarization.”[5]

The Dollar Loses Market Share

The U.S. has enjoyed immeasurable benefits of a dollar-dominated world from trade, to borrowing, to military power, and the imposition of crippling sanctions. According to the Atlantic Council, a strong dollar has not only been at the very heart of America’s superpower designation, it has also fostered global stability.

“Over the past eight decades, the status of the United States as an economic and geopolitical superpower and the role of the US dollar as the world’s dominant currency have reinforced each other. As a synonym for the dollar’s preeminent role in international currency transactions and foreign reserve holdings, dollar dominance has long been associated with the United States’ exorbitant privilege to finance large fiscal and current account deficits at low interest rates. This has helped the United States run a large defense budget and conduct extensive military operations abroad. In turn, the United States has used its military capabilities to support the free flow of goods and capital across the globe, boosting global growth.”[6]

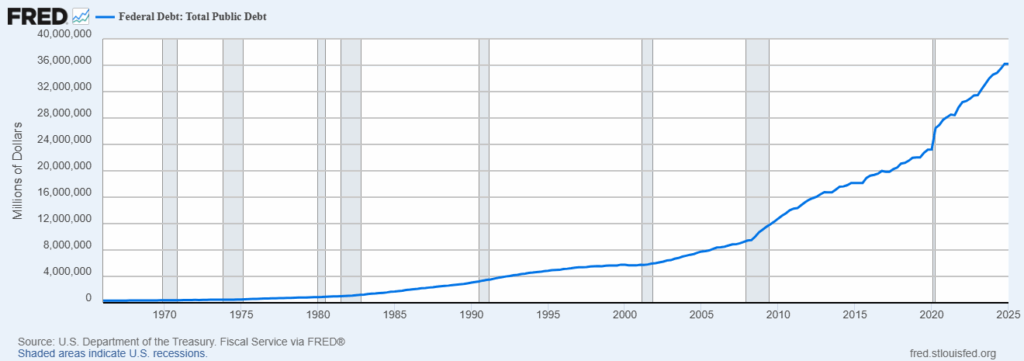

But the dollar’s share of central bank reserves is falling. U.S. debt has just eclipsed $37 trillion and is on track to grow by $22 trillion over the next decade, and according to the Congressional Budget Office, Trump’s ‘Big Beautiful Bill’ will increase deficits over the 2025–2034 period by another $2.4 trillion.

Is it any wonder that the dollar is losing market share? And its diminished capacity not only increases global uncertainty but the likelihood of economic chaos.

The Official Monetary and Financial Institutions Forum’s 2025 survey of 75 central banks and 15 public pension and sovereign funds with more than $7 trillion in combined assets — reveals the following:

- 96% of central banks flagged tariffs and trade protection as a main concern.

- 70% of central banks are increasingly worried about the US political environment

- 32% of central banks expect to increase gold holdings in the next 12–24 months, with over 20% forecasting the price to surpass $3,500 per ounce.[7]

The World Returns to Gold

The world’s central banks are stockpiling gold and have accumulated over 1,000 tons in each of the last three years, up significantly from the average of 400-500 tons over the preceding decade.[8]

The precious metal has also just surpassed the euro as the second largest global reserve asset in the world. And with the dollar down over 5% in the past year and gold up more than 37% — it is no longer just a hedge but the new face of fiscal privilege in the dramatically shifting economic world order.

To learn more about acquiring gold and for information on opening a precious metals retirement account visit: www.ThorMetalsGroup.com

[1] https://www.weforum.org/publications/global-risks-report-2025/

[2] https://www.federalreserve.gov/econres/notes/feds-notes/the-international-role-of-the-u-s-dollar-2025-edition-20250718.html#

[3] https://privatebank.jpmorgan.com/apac/en/insights/markets-and-investing/is-this-the-downfall-of-the-us-dollar

[4] https://www.pimco.com/us/en/insights/trade-wars-and-the-us-dollar

[5] https://www.theguardian.com/business/2025/apr/11/the-damage-is-done-trumps-tariffs-put-the-dollars-global-reserve-status-at-risk

[6] https://www.atlanticcouncil.org/content-series/atlantic-council-strategy-paper-series/why-the-us-cannot-afford-to-lose-dollar-dominance/

[7] https://www.omfif.org/global-public-investor-2025/

[8] https://www.gold.org/goldhub/research/central-bank-gold-reserves-survey-2025