- Gold edged higher as traders weigh the outlook for US monetary policy ahead of a key speech by Federal Reserve Chair Jerome Powell.

- Swaps are pricing in a high probability the Fed will cut borrowing costs by a quarter point next month, which would benefit gold as it doesn’t pay interest.

- Markets are watching US and European efforts toward a landmark meeting between Presidents Vladimir Putin and Volodymyr Zelenskiy, with any signs of a Russia-Ukraine ceasefire potentially easing demand for gold as a haven.

Gold edged higher as traders weigh the outlook for US monetary policy ahead of a key speech by Federal Reserve Chair Jerome Powell later this week.

Bullion traded near $3,330 an ounce as markets await clues from Powell’s annual address in Jackson Hole, Wyoming, on Friday. Swaps are pricing in a high probability the Fed will cut borrowing costs by a quarter point next month. Lower rates benefit gold as it doesn’t pay interest.

Still, the Fed’s monetary easing path has been complicated by a hotter-than-expected inflation print last week that caused some traders to dial back rate-cut expectations. In the face of mounting pressure from President Donald Trump for hefty reductions, Powell has expressed concern with import tariffs at the highest levels in a century.

Markets are also watching US and European efforts toward a landmark meeting between Presidents Vladimir Putin and Volodymyr Zelenskiy. Any signs of a Russia-Ukraine ceasefire could ease demand for the precious metal as a haven, but a peace deal is still elusive.

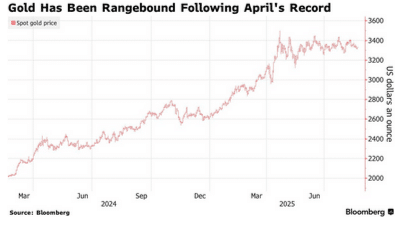

Gold has climbed more than a quarter this year, as trade-war fears and geopolitical tensions boosted its appeal as a safe asset, while central bank buying and inflows to exchange-traded funds also provided support. Though it has traded in a relatively tight range since reaching a record at roughly $3,500 in April, banks like UBS Group AG and Citigroup Inc. expect further gains.

Spot gold added 0.4% to $3,329.69 an ounce as of 12:22 p.m. in London. The Bloomberg Dollar Spot Index was flat. Silver and palladium declined, while platinum gained.

In base metals, copper fell 0.2% to $9,675.50 a ton on the London Metal Exchange. Aluminum and zinc edged higher.

Read the full article HERE.