For generations physical gold has served as a “safe haven” asset, meaning it tends to retain its value in times of economic volatility or crisis. Due to its physical properties, gold is often described as having intrinsic value attributable to its rarity, beauty, practical uses, and long history as a symbol of wealth.

In a modern financial portfolio, gold is considered to be a critical “hedge” or a type of investment that reduces the risk of losing money on another investment. Investopedia aptly describes it as “a risk management strategy to offset losses in investments by taking an opposite position in a related asset.”[2]

Indeed, gold has not only proven itself to be a consistent and reliable store of value, but it offers critical protection against some of the most credible threats to the savings and retirement accounts of everyday investors.

Inflation Hedge

When the price of food, housing, clothing, energy, healthcare, gasoline, and airfare skyrockets — it is deemed an ‘inflationary cycle.’ This can be particularly punishing for consumers since they get less goods and services for their money. During periods of inflation Americans lose ‘purchasing power’ which means the value of the dollar diminishes.

Gold is a celebrated inflation hedge which means it’s a stable store of value that retains its purchasing power when currencies depreciate. While paper money typically loses value over time, gold’s value holds steady due to its limited supply, universal acceptance, and historical significance.

“Back in 1929, the average house price in the US was around USD $6,500. Fast-forward to 2024 and the average house price shot up to around USD $420,000, showing just how much a dollar has fallen in value over that period. However, in 1929, 10kg of gold was worth around USD $7,300 – just enough to buy the average house. But by 2024, the same amount of gold was worth around USD $830,000 – nearly enough to buy two houses. Security risks aside, this suggests it’s a much better idea to stash away gold under your bed than cash.”[4]

Volatility Hedge

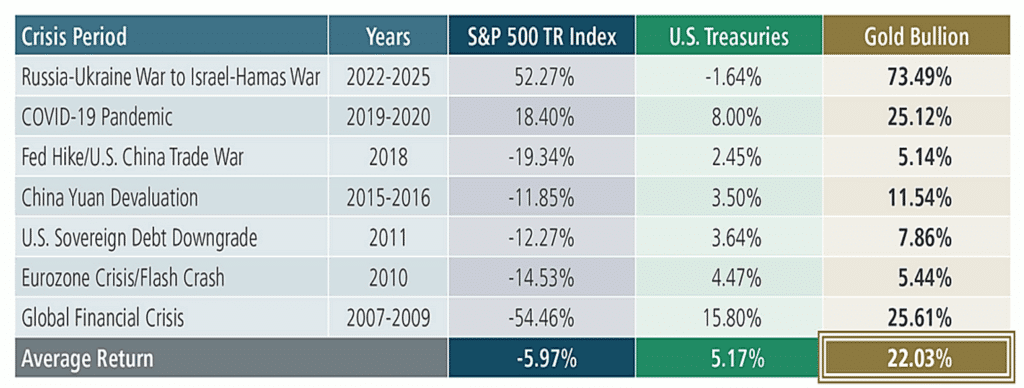

Historically, gold has had an inverse correlation to the stock market particularly during periods of pronounced market uncertainty and volatility. Since gold is considered to be a safe haven asset, investors tend to pile in when equities experience steep price swings, corrections, and/or panicked selling.

According to the World Gold Council, during periods of high-risk on Wall Street, gold’s wealth-protecting attributes set it apart and make it the preferred asset choice.

But it is during periods of economic downturn, crashes and recessions that gold shines brightest.

According to Sprott Management, gold is the ‘go-to’ safe haven during market moving events like Russia’s recent invasion of Ukraine, the pandemic of 2019-202,0 and the global financial crisis of 2007-2009.[6]

In 2025, as the stock market struggled with a significant mid-year downturn, gold reached consecutive all-time highs and outperformed other major assets classes, surging more than 37% year-to-date.

Recession Hedge

Gold is not only a viable hedge against Wall Street volatility; the price of the precious metal also tends to rise during full-blown economic downturns and recessions. Gold has experienced significant strength during financial contractions like those of the 1970s, 1990s, 2000s and the more recent Covid-19 recession.

This characteristic, underscores gold’s protective qualities amid financial turbulence.

Gold’s appeal during a recession not only hinges on its historical performance but also its safety attributes of stability, liquidity, limited supply, consistent demand and the psychological comfort of holding a tangible asset with material value.

The Corporate Finance Institute lists gold as a ‘hard asset’ which it deems to be a sound alternative to ‘soft assets’ particularly stocks and bonds during times of recession:

“Hard assets are non-perishable and possess intrinsic value … As an investment alternative, hard assets provide security in times of uncertainty, market instability, and volatility. They retain value regardless of how far their market prices may drop.”[8]

It is gold’s unique ability to preserve purchasing power, protect against a weak dollar, offset losses in a stumbling market, and preserve wealth amid a full-blown economic crisis that make it a hedge for now, for later, and for always.

Get information on buying Gold at: 1-844-944-THOR or visit: www.ThorMetalsGroup.com

[1] https://www.ig.com/en/trading-strategies/why-is-gold-valuable–230810

[2] https://www.investopedia.com/trading/hedging-beginners-guide/

[3] https://www.pgpf.org/article/what-is-inflation-and-why-does-it-matter/

[4] https://www.juliusbaer.com/en/insights/wealth-insights/how-to-invest/the-allure-of-gold-a-hedge-against-inflation-and-market-volatility/#

[5] https://www.gold.org/goldhub/data/gold-correlation

[6] https://sprott.com/investment-strategies/exchange-listed-products/physical-bullion-funds/the-case-for-gold-in-crises/

[7] https://discoveryalert.com.au/news/recession-impact-gold-prices-performance-2025/

[8] https://corporatefinanceinstitute.com/resources/commercial-lending/hard-assets/