Despite attempts by the White House to erode the central bank’s independence, Powell showed that he remains firmly in control.

What should one take away from this week’s Federal Reserve monetary policy meeting?

First, Chair Jerome Powell is firmly in control of the interest-rate setting Federal Open Market Committee, which on Wednesday lowered its target for the federal funds rate by 25 basis points to a range of 4% to 4.25%.

Going into the meeting, expectations were that there could be dissents on both sides, with some policymakers in favor of no cut and others in favor of a larger 50-basis-point reduction. And some thought Fed GovernorsChristopher Waller or Michelle Bowman — both appointed to the central bank during the first Trump administration—might join Stephen Miran, the head of the White House’s Council of Economic Advisors who was just sworn in Tuesday as a Fed governor to fill an open slot – in dissenting in favor of that larger cut.

But it wasn’t to be. Those that might have preferred to keep rates unchanged deferred to Powell. Not a surprising outcome, given that the disagreement was about timing rather than direction of rates. In such circumstances, no dissent was warranted.

For Bowman and Waller, it is more difficult to parse their motivations. But their unwillingness to dissent in favor of a larger cut shows that just because one is a Trump appointee doesn’t necessarily mean following his lead. (Recall that Trump has said rates should be closer to 1%.) Their actions demonstrate integrity, commitment to the Fed’s mission and the importance of sustaining the central bank’s independence. A very welcome development!

Second, the shift in the median Summary of Economic Projections to 75 basis points of rate cuts by year-end from the 50 basis points projected in June is not significant. Markets initially reacted positively to this development, but the gains turned out to be transitory because on closer examination it was obvious there was no clear consensus. Excluding the one forecast advocating for 150 basis points of cuts this year — which is almost certainly Miran’s projection — the rest of the FOMC was evenly split between one or two more rate cuts.

Third, at Powell’s press conference he was pressed about the apparent inconsistency between cutting the Fed’s rate target at the same time the FOMC raised its median forecast for both economic growth and inflation. I don’t think there is much tension here. The upward revisions were very small, amounting to 0.2 percentage points for both in 2026. More importantly, the motivation for the rate cut was not tied to the modal forecast, but instead was driven by the signs of labor market weakness evident in recent employment data that showed a sharp slowdown in payroll growth to just 29,000 on average over the past three months.

The rationale Powell offered for the rate cut was straightforward, which is that the downside risks to the labor market had increased and come into closer balance with the upside risks to inflation. Because he assessed monetary policy as being “clearly restrictive,” the shift in risks implied that monetary policy should be looser.

So where do we go from here?

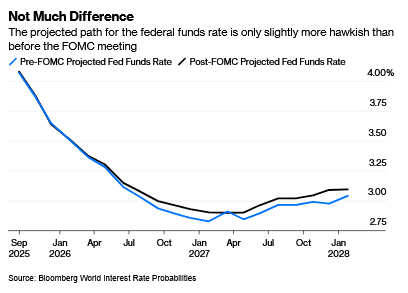

Future Fed actions will bedata dependent. Easing will be predicated mainly on whether the downside risks to the labor market are increasing, how the Trump administration’s tariffs pass through into prices and whether the resulting stickiness in inflation pushes up long-term inflation expectations. A series of stronger employment reports, a steady unemployment rate and persistent inflation could undercut support for further easing.

As Powell explained, conducting monetary policy is very difficult right now. First, because the dual mandate objectives of the Fed – full employment and price stability – are in conflict, the Fed has to set policy to balance the risks to those two objectives. As Powell put it, there is “no risk-free path.” Second, tariff policy remains uncertain, with the timing of the tariff impact on prices dependent in part on future court rulings that will govern which tariffs increases are legal. Moreover, while the pass-through of tariffs into prices has been more modest and slower than anticipated, this doesn’t necessarily mean the full effects will be smaller. Instead, the pass-through may just be delayed, reflecting the reluctance of companies to react until they have better visibility.

What about the threat to Fed independence?

Powell was very careful not to respond to questions about allegations by the Trump administration that Fed Governor Lisa Cook lied on mortgage applications or Treasury Secretary Scott Bessent’s critique that the central bank had been guilty of mission creep and should be subject to an independent review. Powell instead pointed to what the Fed was already doing, including the recent revisions to the Fed’s monetary policy framework and the planned 10% reduction in headcount across the Federal Reserve System. Powell concluded that the Fed is always open to ways of improving its operations. He understands that Fed credibility rests on the Fed doing its job — broadly defined — well.

With respect to the third mandate of monetary policy — keeping longer-term interest rates moderate – Powell emphasized that the Fed has not historically focused on this area for a simple reason: If it does a good job in achieving its other two goals of full employment and stable prices, longer-term rates will take care of themselves.

The threat to Fed independence is still very real. While Trump administration may not succeed in removing Cook for cause and not all of Trump’s Fed appointees will necessarily do the White House’s bidding, the efforts show the intent of the President to take control of the central bank. Plus, the administration may explore or invent other options to get its way. The divergence of Miran’s rate forecast from the rest of the FOMC indicates how much monetary policy would likely change if Trump lieutenants were firmly in control. If monetary policy were to follow Miran’s dictate, the result would soon be an overheated economy and higher inflation. Let’s hope that Fed independence with respect to how it conducts monetary policy to achieve the objectives set out for it by Congress prevails.

Read the full article HERE.