“Circularity” has become a buzzword in artificial-intelligence deals. Some investors have drawn comparisons between the megadeals of today and some excesses of the original dot-com bubble.

Today the dollars at stake are exponentially bigger, the deals are more complex, and the money trail is often harder to follow. But some similarities are real. One risk: If enthusiasm for spending money on data centers wanes, companies such as Nvidia NVDA -0.55%decrease; red down pointing triangle and Microsoft MSFT 1.11%increase; green up pointing triangle could be hit twice—with less revenue coming in and declining values for their equity investments in customers.

Broadly speaking, circular financing often goes something like this: One company pays money to another as part of a transaction, and then the other company turns around and buys the first company’s products or services. Without the initial transaction, the other company might not be able to make the purchase. The funding mechanism could take the form of an investment, a loan, a lease or something else.

During the late 1990s and early 2000s, such dependency loops mainly consisted of telecom-equipment makers lending money or extending credit to customers so the customers could afford to buy their gear. In those days, this was widely referred to as vendor financing.

The poster child for vendor financing run amok was Lucent Technologies. It lent billions of dollars to upstart telecom providers building out their infrastructure and networks. In the boom years, their purchases helped fuel Lucent’s rapid sales growth. When those customers went bust—because they ran out of cash and couldn’t raise fresh capital—Lucent had to write off their bad debts and book huge losses.

Some of Lucent’s biggest troubled customers, including telecom startup Winstar Communications, were publicly traded. As it turned out, investors sometimes could learn more about Lucent’s doomed vendor-financing deals from reading Winstar’s disclosures than they could from Lucent’s.

Vendor financing still exists. But it isn’t how the bulk of the latest attention-grabbing, circular deals are structured.

Take, for example, the strategic partnership announced in September by Nvidia and OpenAI, the company behind ChatGPT. The companies said Nvidia would invest as much as $100 billion in OpenAI, and that OpenAI is looking to buy millions of Nvidia’s specialized chips. That isn’t vendor financing, because it doesn’t involve a loan to finance a specific purchase. But it does look circular.

OpenAI isn’t publicly traded, so it doesn’t disclose financial reports. But it is known to be losing money, notwithstanding a recent secondary share sale that implied a $500 billion valuation. Nvidia’s investment will help OpenAI pay for its infrastructure build-out. Nvidia also stands to get money back from OpenAI through chip sales, boosting its revenue.

To bullish investors that might look like a win-win. It also provides fodder for skeptics who suspect the AI ecosystem is in a bubble and can’t expand without the companies subsidizing and leaning on each other. The actual deal terms weren’t disclosed, either, because Nvidia and OpenAI said they weren’t finalized. In a vendor-finance deal, the risk for the seller is it won’t get paid. For Nvidia, its OpenAI investment could fall in value, but it also has the chance for upside.

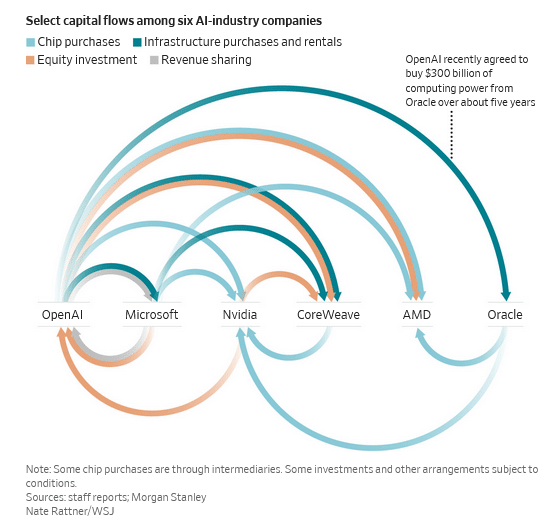

That is a relatively simple example. When Morgan Stanley analysts in an Oct. 8 report mapped out the AI ecosystem to show the capital flows between six companies—OpenAI, Nvidia, Microsoft, Oracle ORCL -0.95%decrease; red down pointing triangle, Advanced Micro Devices AMD -2.93%decrease; red down pointing triangle and CoreWeave CRWV -6.36%decrease; red down pointing triangle—the arrows connecting them resembled a plate of spaghetti.

OpenAI recently agreed to buy $300 billion of computing power from Oracle over about five years. It is far from clear how OpenAI will get all the money, or whether it would still be possible should Nvidia’s $100 billion investment fail to materialize. That in turn could mean Oracle has less money for Nvidia chips.

AMD, a rival to Nvidia, was so eager to land OpenAI as a customer that it issued warrants for OpenAI to buy as much as 10% of AMD at a penny a share. AMD said it expects tens of billions of dollars of revenue, but it’s basically paying OpenAI to become a customer.

CoreWeave, an AI-cloud infrastructure company that rents out data-center capacity, illustrates the industry’s complex ties. Nvidia owns about 5% of CoreWeave and sells chips to CoreWeave. Nvidia also committed to purchase any unsold cloud-computing capacity from CoreWeave through 2032, effectively backstopping its customer.

Meanwhile, CoreWeave’s biggest customer is Microsoft, which is an investor in OpenAI, shares revenue with OpenAI, buys chips from Nvidia and has partnerships with AMD. OpenAI also is a CoreWeave customer and shareholder, having made a $350 million equity investment in the company before its initial public offering.

Anyone trying to keep track of all the relationships would have a hard time. CoreWeave also has disclosed having some vendor-financing debt, but not the identity of the counterparty.

There isn’t necessarily anything untoward about these arrangements. AI is a transformational technology, and OpenAI is a juggernaut. The industry’s participants are in a race to build the infrastructure they need quickly.

Their efforts may pay off enormously if OpenAI and its competitors can ultimately generate strong cash flows to justify all the capital spending. But there also could come a point when investors grow tired of companies pouring so much capital into developing AI models and products, with little visibility into future returns.

That is when the AI ecosystem conceivably could hit a wall, and where the parallels may lie with the original internet bubble and the circular deals of that era. Circularity can be virtuous on the upside, and vicious on the downside. The deals can work fine, until they don’t.

Read the full article HERE.