Wall Street strategists often warn investors that the “stock market is not the economy.” But in 2025, the two feel increasingly intertwined as the surge in artificial intelligence demand has helped buoy both economic growth and stock market gains.

“We believe that AI has kept the economy out of recession,” says BNP Paribas chief U.S. economist James Egelhof.

Research from Egelhof’s economics team shows that AI related investments contributed roughly a quarter of the total gross domestic product (GDP) growth through the first two quarters of 2025.

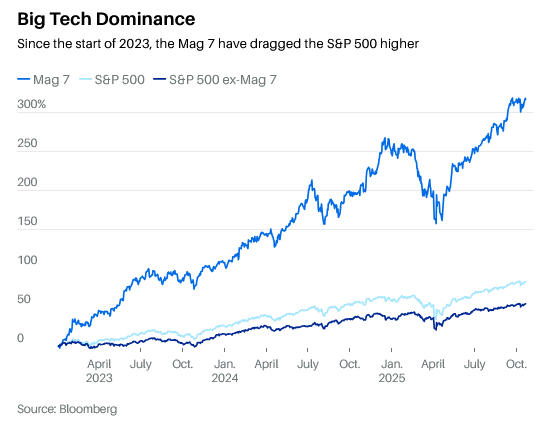

BNP Paribas’ economists note it’s normal for investment in any potential game-changing technology to contribute substantially to GDP. But the concentration risk feels more significant when considering how reliant the stock market rally has become on the AI boom. This year alone a combination of AI stocks—comprised of Apple, Amazon, Alphabet, Broadcom

Palantir, Tesla —have contributed about 58% of the S&P 500’s $7.58 trillion market cap gain.

The market’s most recent leg higher has featured large rallies in stocks driven by the announcements of future AI investments. Large language model leader OpenAI has penciled itself in for $300 billion of cloud computing services from Oracle and taken a stake in AI chip maker AMD. Meanwhile leading AI chip provider Nvidia has invested $100 billion into OpenAI.

“The economy’s fate is inexplicably intertwined with that of AI, so when the investments start looking circular, it’s a concerning sign,” Fundstrat economic strategist Hardika Singh writes in an Oct. 11 note to clients.

Wall Street strategists have largely pegged the path to future gains for the major stock indexes to continued growth in the AI story. In a note to clients that projected the S&P 500 to hit 7,200 by the end of 2026 on Sept. 9, Wells Fargo’s chief equity strategist wrote “[the] music stops when the AI capex stops.”

Investors aren’t the only ones wondering when the AI hype train will suddenly stop. Economists like Egelhof at BNP Paribas are pondering the same question when considering what can go wrong. Egelhof notes the economy is “levered” to AI not just because it’s significantly contributing to GDP. It’s also the reason surging stock markets are filling high-income wallets and boosting consumer spending.

“We tend to think that the economy is more responsive to market valuations than it has been in the past, because of the greater reliance of consumer spending on the higher end consumer than we’ve seen historically, and because that consumer is likely spending in contemplation of their equity market gains,” Egelhof says.

By this logic, a swift unwinding of the AI trade could impact consumer spending and weigh on economic growth. Add in the negative impacts of slowing capital spending from large tech firms, and there’s a clear case GDP could take a hit when the AI bubble bursts.

“If AI does not fulfill on the promises that it has made, then there is economic downside risk,” Egelhof says.

To be sure, Egelhof and others don’t think an AI downturn would clearly mean the legs would fully fall out of the U.S. economic growth story.

“If [AI] rolls out smoothly it shouldn’t cause a recession,” J.P. Morgan Asset Management chief global strategist David Kelly says.

Keep in mind that not all recessions are created equal either. When the dot-com bubble burst in 2000, the subsequent recession “wasn’t huge by historical standards at all,” says Kelly. The unemployment rate moved from 4.3% to 5.5% during that recession. It would rise from 5% to 9.5% during the recession prompted by the Great Financial Crisis.

“The economic impact of that pullback in capital spending on its own may not be that great,” Kelly said. “The real issue is, what does it do for portfolios.”

Read the full article HERE