Key Points

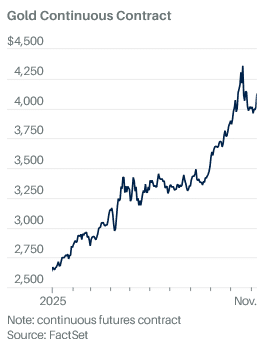

- Gold prices rebounded to around $4,100 an ounce after falling below $4,000, though they are still down 7% from a record high of nearly $4,400.

- UBS strategists predict gold could reach a new all-time high of $5,000 in 2026 or 2027, citing its growing role as a strategic asset.

- Factors like central-bank diversification, retail investor interest, a weakening dollar, and falling real yields are expected to support gold’s continued rise.

The recent correction in gold may not be the start of a deeper bear market for the shiny yellow metal. In fact, some on Wall Street see even brighter days ahead.

Gold prices have already rebounded to back above $4,100 an ounce after falling below $4,000 in late October. Gold is still down about 5% from the record high of just under $4,350 an ounce that it hit a few weeks ago. But strategists at UBS said in a report Monday that they think gold could hit a new all-time high of $5,000 at some point in 2026 or 2027.

“Core positions are becoming more resilient. Gold is increasingly viewed as a long-term strategic asset and a core part of asset allocation,” the UBS strategists wrote.

They argue that “there has been an acceleration in the broadening of gold’s investor base,” adding that “gold stands to benefit from a growing number of investors reallocating” from stocks, bonds, the dollar and other assets and that, “given the relative size of the gold market

to other asset classes, even a small shift can have a large impact if it is broad-based.”

The combination of more gold-buying by central banks looking to diversify their holdings away from the U.S. dollar, and a flock of retail investors buying the metal through exchange-traded funds, could catapult gold even higher again.

Jeff Jacobson, managing director and head of derivatives strategy for 22V Research, said in a report last week that he’s still bullish on gold as well.

He pointed to the fact that the metal has remained above its 50-day moving average, a key technical level, despite its recent slide. That’s a good sign.

“The fact that even after such a sharp decline gold remains in a very clear uptrend suggests you want to continue to add on such pullbacks,” Jacobson wrote.

He also noted that recent moves higher in both the U.S. dollar and long-term bond yields appear to have stalled. Jacobson expects the greenback and 10-year U.S. Treasury to slip back again. That should boost gold, which tends to do better during times of dollar weakness and lower interest rates.

Strategists at Pictet Asset Management also think that not much has changed for gold in the past few weeks—other than its price. Many of the bullish arguments that have lifted gold prices by more than 55% this year remain just as compelling today.

“Though we note the precious metal’s steep climb takes its valuation to lofty levels, the fundamentals continue to be supportive: real yields are coming down, the dollar continues to weaken and there’s the real risk of significant expansions in public sector deficits across the developed world,” the Pictet team wrote.

The rebound in gold—the price was up 2.8% at around $4112 in late afternoon trading Monday—is good news for gold mining stocks, too. Just look at some of the leading miners. Newmont Mining, one of the top-performing stocks in the S&P 500 this year and a recent Barron’s stock pick, is up nearly 15% since Oct. 27 on the back of gold’s comeback. Another miner, Barrick Mining, soared more than 5% Monday after reporting earnings and announcing that it was boosting its dividend and share-buyback program.

Yes, gold will likely continue to be volatile in the near term. Austin Pickle, an investment strategy analyst with the Wells Fargo Investment Institute, said in a report Monday that “gold was historically stretched” and that “the most recent pullback has been a much needed and healthy consolidation.” He conceded that it could take some time for some of the excesses in the market to be wrung out and that gold could be choppy over the next few months.

But it looks like conditions are in place to push it on toward the next milestone of $5,000 an ounce before long.

Read the full article HERE.