Stocks have experienced only brief downturns over the past 16 years, creating dangerous complacency

“How bad do you think it’s gonna be?”

When Michael Corleone asks Clemenza in “The Godfather” about the mob war he’s about to start, he gets the sort of reassurance that comes with experience. “These things gotta happen every five years or so, ten years. Helps to get rid of the bad blood…been ten years since the last one.”

There’s no saying when the next major bear market will send Americans to the mattresses—maybe through the collapse of AI mania, or possibly just a garden-variety recession. There have only been minor scrapes the past 16 years, and that’s actually a problem.

A downturn like 2007-09 when U.S. stocks fell by more than half can be both awful and therapeutic. It took 66 months for the S&P 500 to regain its previous high. Investors with a long-term perspective pounced on what in hindsight were solid, boring bargains near the bottom.

The five brief downturns since then that met the unofficial definition of a bear market taught the opposite lesson. Momentarily terrifying, they encouraged investors to “buy the dip” quickly and recklessly—the junkier the stocks, the better.

Remember the summer of 2020 when Nikola, the fraudulent hydrogen-truck company, became worth more than Ford, or when bankrupt Hertz’s shares were touted on social media and soared?

This year’s Liberation Day swoon felt similar: It took just 4.3 months for the S&P 500 to reach a fresh high. The advance was led by the theme du jour, artificial intelligence, plus many unproven, unprofitable companies.

Long bear markets accompanied by a recession discredit the last boom’s wildest themes and its cheerleaders. They also remind us of what capital markets are for: matching mostly good businesses with patient savers’ nest eggs.

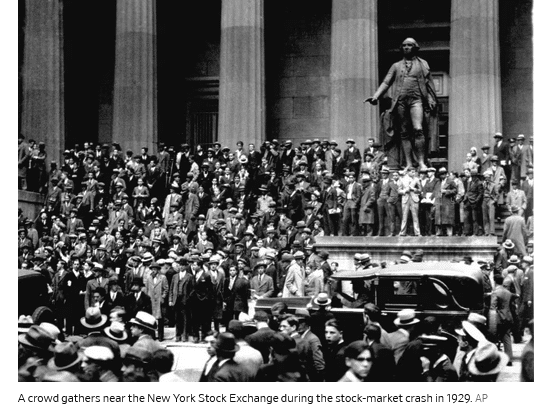

In the past century, there have been 26 bear markets, including some that barely met the definition, such as this year’s swoon.

The average time to reach the previous high when a bear market was accompanied by a recession was 81 months. It took just 21 without a recession. Over the past 16 years, downturns have lasted less than eight months before the old high was reached.

The model for buying the dip was set in the summer of 1998, after Russia defaulted and hedge fund Long-Term Capital Management collapsed. The Federal Reserve stepped in and the effect was electric, sending stocks back to a new high by that November.

The tech-heavy Nasdaq composite would go on to rally 255% over 17 months. In 1999 and 2000 combined, there were 631 technology initial public offerings, according to Jay Ritter, a University of Florida finance professor. Their average multiple of price-to-sales was nearly 50 when they began trading. Multiples of two to six are more typical.

That rewarding bounce made the tech bubble wilder, as did the fact that few people in the market in the late 1990s had personally experienced a really nasty, long downturn.

Sort of like today: Hardly anyone younger than 40 now even had a 401(k) during the 2007-09 wipeout. Most Wall Street pros hadn’t graduated from college yet.

Bear markets are educational, but the tuition is a doozy.

Read the full article HERE.