All that stands between the U.S. and a debt-market freakout is the dollar. Having the world’s reserve currency isn’t the unbreakable shield many assume.

Politics and debt don’t mix well. Americans would be wise to look across the Atlantic to see how tough things can get.

The U.K. government demonstrated the problem with its annual budget, where it is stuck in a trilemma, unable to please lenders and voters while also doing the right thing for the economy. Something had to give, so on Wednesday the government ignored its promises to go for growth, and focused on the bond market and its political base.

France has the same trilemma, only worse. Government debt is higher than in the U.K., the fiscal deficit is higher, and not only are tax rises politically impossible but taxes are already so high that raising them further might be self-defeating.

Spending cuts are even more difficult than in Britain—where welfare cuts have proved to be a political nonstarter—and securing a budget at all in a deeply riven French Parliament is a challenge. At least in London the bond panic during the supershort term of Prime Minister Liz Truss has shown the politicians that they have to pay attention to lenders.

Already some of the same issues are visible in the U.S.—along with a lack of political will to do anything to prevent the problem from festering. For now, all that stands between the U.S. and a debt-market freakout is the dollar. Having the world’s reserve currency, however, isn’t the unbreakable shield many assume.

Go back to the U.K. to see how dysfunctional politics limits action. The government floated the idea of an economically efficient income-tax rise in the run-up to the budget, and the bond market loved it. But politics made Chancellor of the Exchequer Rachel Reeves abandon the idea in favor of a series of smaller, delayed tax rises on pensions, corporate investment and driving that each slice a little off potential growth—but, she hopes, will get less attention from voters. The money raised goes into welfare spending forced on the government by its own members of Parliament, after it lost a fight earlier this year.

The parallel issue in the U.S. is tariffs: An inefficient tax on the purchase of certain foreign goods is possible (though the legality of the biggest tariffs is still to be determined), and even briefly popular. But U.S. politics is just as fragile as in the U.K., and when the bond market or voters objected, tariffs have been rolled back.

April’s so-called reciprocal tariffs were delayed and then slashed when the bond market panicked. They dropped from a peak effective rate of 28% to the current 18% calculated by the nonpartisan Budget Lab at Yale—far lower, although still the highest since 1934.

Likewise, rising voter concern about food prices has led to tariffs on imports of coffee, bananas and some beef being ditched. It was sensible to remove those, but it was especially bizarre to introduce charges on foodstuffs not even produced in the U.S. in the first place.

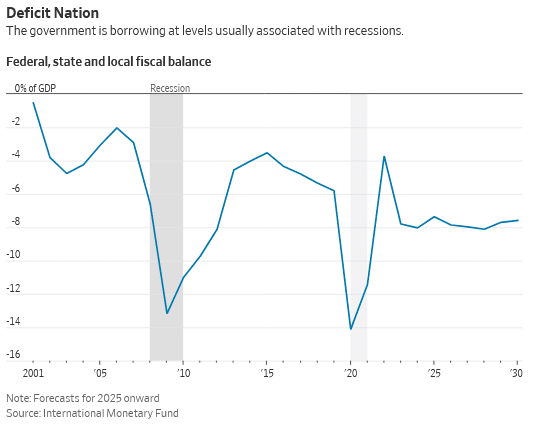

The U.S. doesn’t yet have the trilemma created by conflicting demands on tax, spending and borrowing, thanks to global demand for dollars funneling money into Treasurys. But there are worrying signs, and the fiscal situation suggests a growing chance of trouble ahead—despite faster economic growth than elsewhere.

Warnings of bond pressure have shown up in extreme situations. Most recent was the April revolt, where 10-year Treasury yields jumped and concern grew about a self-fulfilling liquidation of borrowing, akin to the U.K.’s Truss moment, before President Trump pulled back. In 2020, lockdowns showed how bad such a selling spiral can be, and the Federal Reserve was forced to buy more than $1 trillion of bonds to stabilize the market.

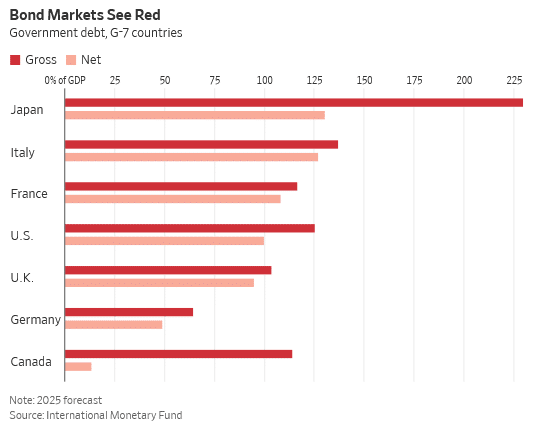

The fiscal situation in the U.S. is far worse than what Reeves has to deal with in Britain. The International Monetary Fund estimates that total U.K. government debt will hit 95% of gross domestic product this year, with a deficit of 4.3%. U.S. debt is expected to be a smidgen below 100%, with a deficit on course to be one of the biggest in the developed world at more than 7%.

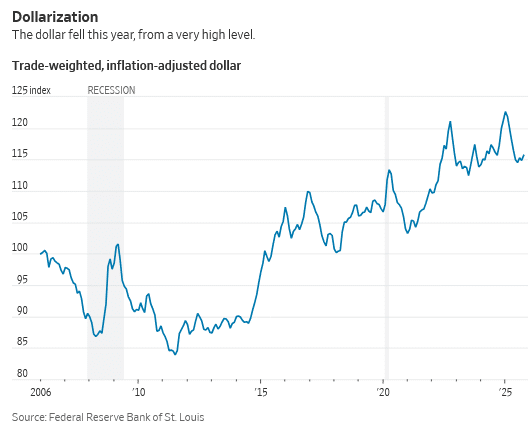

What saves American finance is the dollar’s status as the must-have global asset and trading currency. Both roles face challenges, though, and the more the U.S. exploits foreigners, the higher the risk they look elsewhere.

There are four overlapping threats to the dollar: supply, China, reserve safety and the pushing away of allies.

Supply is the big one, as the U.S. runs near-record peacetime deficits on top of a bulging current-account deficit. America has to attract a constant flow of foreign capital to finance government and imports, an unstable position.

China has shifted a little more trade into yuan, although the dollar remains by far the dominant currency for international payments. China, Russia and others including Turkey have been replacing some of their reserves with gold in the midst of rising concern about dollar-based reserves being frozen or confiscated by Washington. And while allied governments haven’t obviously cut their dollar exposure, they were spooked by Trump’s tariffs and talk of unilateral fees on reserves held in Treasurys.

None of these has, so far, dealt significant damage to the dollar’s reserve status. But they all hurt. The risk is that the market senses a shift coming and pushes up Treasury yields in anticipation of foreign buyers drifting away.

On the plus side, it is economically easy for the U.S. to head off the problem. It raises the lowest tax as a share of GDP of any Group of Seven country, at just 30%, so higher taxes are likely to damage growth less than elsewhere. Government spending, also the lowest in the G-7, is harder to cut, as the failure of Elon Musk’s Department of Government Efficiency demonstrated.

If the problem sounds familiar, it should be. Former Luxembourg Prime Minister and European Commission President Jean-Claude Juncker once said: “We all know what to do, we just don’t know how to get re-elected after we’ve done it.”

It isn’t clear that today’s politicians do, in fact, know what to do. But whether they know or not, getting re-elected while staying within the strictures of the bond market is going to be tough. America has the dollar to lean on—but probably not forever.

Read the full article HERE.