Despite year-end drops for gold and silver, both are still on pace for their biggest yearly percentage gains since 1979

Year-end turbulence was only modestly slowing the surge in silver, gold and copper in 2025, with the metals providing important ballast to portfolios as President Donald Trump’s tariffs rattled markets and a spending frenzy around artificial intelligence entered a new debt-funded chapter.

For the year, gold was up nearly 65% and silver was about 145% higher as of Wednesday, putting both on pace for their biggest annual percentage gains since 1979, according to Dow Jones Market Data based on the most-active metals contracts.

Copper’s roughly 40% jump this year, while slightly more modest, would still mark its largest yearly increase since 2009 and amount to more than double the S&P 500 index’s 17% gain so far this year.

The clamor around metals has stirred debate about potential bubbles forming in gold and silver that could end badly for investors, especially those arriving late to the party. Yet on the last trading day of 2025, all three metals were perched above their 50-day moving averages, a key technical level that can be a bullish signal for an asset’s price.

“Big picture, it means there’s a lot more buyers than sellers,” Sameer Samana, head of global equities and real assets at the Wells Fargo Investment Institute, said of the uptrend. “That has to do with the dollar weakness in the early part of 2025, plus, you could argue, a lot of uncertainty around how countries will manage their fiscal health going forward.”

The ICE U.S. dollar index a measure of the buck against a basket of rival currencies, booked its worst first half of the year since 1973, when Richard Nixon was president. It since has recouped some of its 2025 losses but was still 9.4% lower on the year through Wednesday, according to FactSet.

A turbo rally in silver

Unlike gold and silver, copper isn’t considered one of the world’s precious metals. Yet like silver, it was added to the U.S. Interior Department’s list of critical minerals this year, given its role in wiring, power generation and electrical transmissions, all which are essential to the AI buildout.

Recent bullishness helped silver gain more than 55% in the past three months alone, while copper shot up nearly 17%, gold rose 12.5% and the S&P 500 added 0.2% over the same span, according to FactSet data.

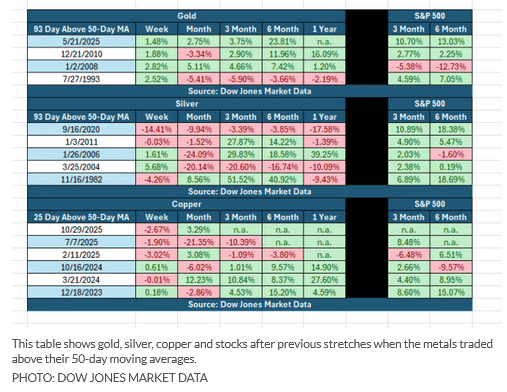

From a technical perspective, the most recent leg of the metals rally has pushed gold and silver above their 50-day moving averages for a relatively long 93 trading days through Wednesday, while copper was above that threshold for 25 trading days, according to Dow Jones Market Data based on most-active futures contracts.

That has happened only four other times for gold since 1993 and five other times for silver since 1982, according to Dow Jones Market Data. Shorter stretches of at least 25 days for copper have been fairly common in recent years.

While the past doesn’t predict the future, similarly long trading stretches above the 50-day moving average have tended to skew bullish for stocks and gold in the weeks and months that follow, while silver has been mixed and copper has seen most of its gains after the three-month mark.

Importantly, gold showed its resilience this year after equities sold off in April following Trump’s “liberation day” tariff announcement, which shocked investors and triggered an ugly reaction in the bond market.

“Fixed income sort of helped, but crypto also fell by the wayside, while gold held up,” Samana at Wells Fargo said. “Given the nature of the beast, you look at your last best hedge when markets sell off, and I think it’s fair to say that’s gold.”

Skepticism around inflation and whether it can be tamed next year, especially with tax breaks and the data-center boom likely to reaccelerate the economy, would likely work in favor of metals in 2026, Samana said.

Spending on AI infrastructure is also not expected to let up in the years ahead. The U.S. already has nearly 3,750 data centers, according to the Data Center Map, an industry research tool launched in 2007.

For every new data center, metals have a role in the process. “There’s copper for wiring and silver in a lot of chips,” Samana said. And at least globally, demands for power from data centers will mean harnessing alternative-energy sources, where silver has been playing a major role.

Read the full article HERE.