Julian Assange, the founder of WikiLeaks, is known for his role in revealing classified information and confidential documents that shed light on government operations worldwide. Among the myriad of leaks that have drawn public and media attention, one significant revelation pertains to the U.S. government’s alleged gold suppression policy.

Through WikiLeaks, Assange exposed documents that hint at covert strategies employed by the federal government to manipulate gold prices, thereby maintaining the dominance of the U.S. dollar in global markets.

Background on Gold Suppression Policy

Gold has historically been a cornerstone of economic stability, serving as a hedge against inflation and a reliable store of value. Its significance in the global economy makes it a critical asset for investors and governments alike. The U.S. dollar, as the world’s primary reserve currency, has a unique relationship with gold. A rise in gold prices often signals a lack of confidence in fiat currencies, particularly the dollar. Consequently, a high gold price can undermine the dollar’s value and, by extension, the U.S. economy’s stability.

The alleged gold suppression policy posits that the U.S. government, along with major financial institutions, engages in activities to artificially control and suppress gold prices. This could involve tactics such as large-scale selling of gold reserves or derivative contracts to flood the market and lower prices. The aim would be to make the dollar appear stronger in comparison, sustaining its role as the leading reserve currency.

WikiLeaks, under Assange’s direction, published several documents that suggest the existence of such a policy. One of the most notable leaks was a series of diplomatic cables from the U.S. embassy in Beijing. These cables reveal discussions between U.S. officials and Chinese counterparts, highlighting concerns over China’s growing interest in gold as a way to diversify its reserves away from the dollar. The cables suggest that U.S. officials were worried about the potential impact of China’s gold purchases on the global gold market and, implicitly, on the dollar’s value.

WikiLeaks also released documents from the International Monetary Fund (IMF) that indicate discussions around gold price manipulations. These documents point to collaborative efforts between the U.S. and other Western nations to maintain control over gold prices, ensuring that they remained at levels favorable to the dollar.

Key Implications of the Revelations

The exposure of these documents by WikiLeaks has several significant implications. Firstly, it fuels the long-standing debate over the legitimacy of the gold suppression theory. While some economists and market analysts have long suspected government interference in gold markets, the leaked documents provided a semblance of validation to these claims. The idea that major financial powers could be manipulating gold prices to serve their interests resonated with many, particularly those skeptical of government transparency and accountability.

Secondly, the revelations have a profound impact on the gold market itself. Following the leaks, there was an increase in gold purchases by both private investors and central banks. The perception that gold prices were being artificially suppressed led to a surge in demand, as investors sought to acquire gold before potential corrections could occur. The increased demand put upward pressure on gold prices, ironically counteracting the alleged suppression efforts.

Assange’s Role and the Broader Impact

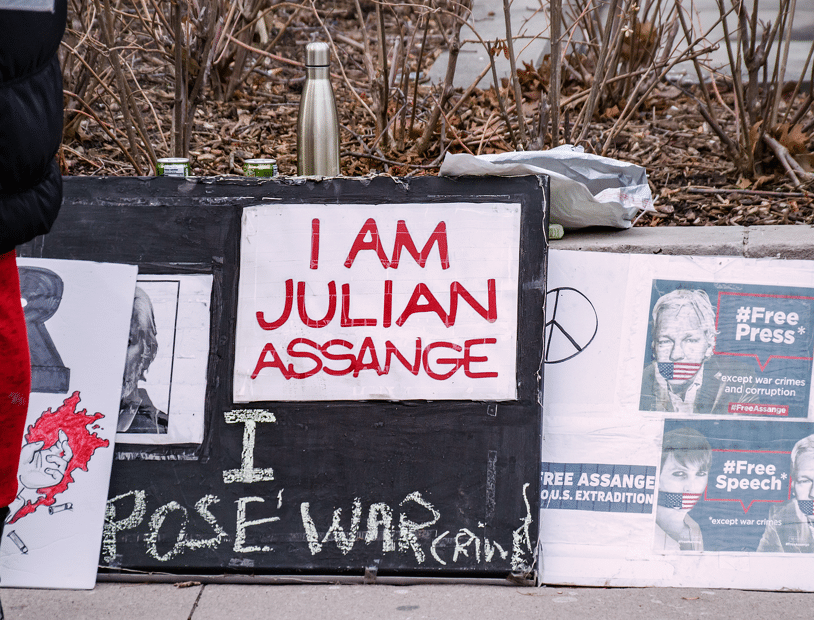

Julian Assange’s role in exposing the U.S. government’s alleged gold suppression policy underscores the broader mission of WikiLeaks: to promote transparency and accountability by unveiling hidden truths. By publishing classified documents, Assange aimed to inform the public about governmental actions that were conducted behind closed doors, without democratic oversight or consent.

The impact of these revelations extends beyond the financial markets and has sparked discussions on government secrecy and the balance between national security and the public’s right-to-know. Assange’s actions were praised by advocates of transparency and condemned by those who viewed them as reckless and potentially harmful to national interests.

The Hidden Mechanisms of Government

Julian Assange, through WikiLeaks, played a pivotal role in uncovering the U.S. government’s alleged gold suppression policy. The leaked documents provided insights into the covert strategies purportedly employed to manipulate gold prices, highlighting the intricate interplay between economic policies and global power dynamics. While the full extent and impact of these revelations continue to be debated, Assange’s work has undeniably contributed to the unmasking of the hidden mechanisms, policy manipulations, and monetary maneuvers that shape our world — and our economy.

Learn more about Thor Metals Group and get added insights on gold, silver, and market-moving financial news by visiting: www.ThorMetalsGroup.com