“This is no country for old men” said Irish poet WB Yeats in his lyrical poem Sailing to Byzantium back in 1926. It was a year marked by recession, political turmoil, and market volatility. It was just three years before the Wall Street crash, and gold was the asset of the well-to-do, the ‘powers that be,’ and the established class. Indeed, it was by far the preferred investment of tycoons, titans and yes — old men.

Almost 100 years later, everything has changed. Once an extravagance of the rich and famous, gold is now one of the best performing investments of the year. In 1926 an ounce of gold was a mere twenty bucks — now it has surpassed $3800/oz. While gold has long been considered a safe haven and a chaos hedge, a recent Blackrock Market Insight points to gold’s new long-term profit potential.

“Historically, higher real rates and a strong U.S. dollar have served as headwinds for gold. Recently the price of gold has continued to advance despite these factors with support stemming from central bank purchases and growing U.S. deficits. In this environment, gold is less likely to act as a hedge to equities but rather as a long-term store of value.”[1]

The allure of gold for investors has expanded to include those seeking economic security as well as anyone looking for a dynamic asset with a significant upside within the current economic landscape — particularly younger generations.

Gold is a Modern Portfolio Enhancer

Due to gold’s historically low correlation to other assets like stocks, bonds and cash — it continues to provide protection for financial portfolios that are heavily leveraged in paper investments. According to the World Gold Council (WGC), gold improves portfolio diversification particularly during periods of market volatility and economic crisis.

“Gold has a key role as a strategic long-term investment and as a mainstay allocation in a well-diversified portfolio. Investors have been able to recognize much of gold’s value over time by maintaining a long-term allocation and taking advantage of its safe-haven status during periods of economic uncertainty.”[2]

Gold increases portfolio balance and protection via three key attributes:

a) Its ability to generate returns b) Its power as a diversifier c) Its high liquidity as a universally recognized and desirable asset.

Central Banks are Hoarding Gold

Gold has never been more popular with central banks than right now. They have accumulated over 1,000 tons of gold each of the last three years — and are on track for a fourth year of robust buying.

They world’s leading monetary authorities are not only looking to diversify their portfolios by reducing their reliance on the U.S. dollar, but to also protect against economic sanctions, market uncertainty, and the fallout of destabilizing geopolitical conflicts.

“Central banks have been net buyers of gold for the past 15 years, but the speed of their purchases doubled in the wake of Russia’s invasion of Ukraine. As the US and its allies froze Russian central bank funds held in their countries, it underscored how foreign currency assets are vulnerable to sanctions.”[3]

And, there is no indication that the central bank gold grab will slow down anytime soon. A recent World Gold Council Central Bank Gold Reserves Survey suggests that 95% of central banks believe their gold reserves will continue to grow over the next year.[4]

Young Investors are Making Gold Great Again

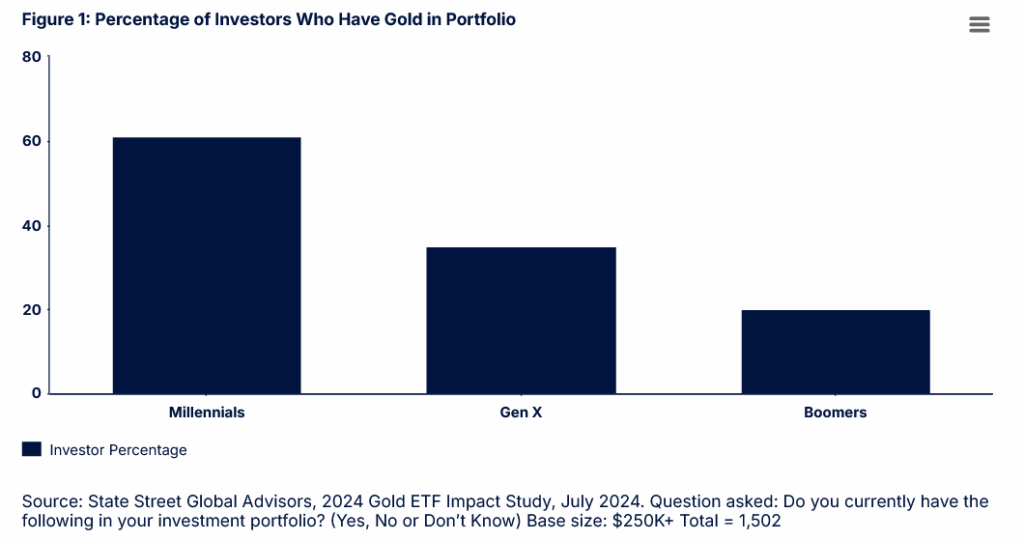

“More than 60% of millennials now include gold in their portfolios. That’s significantly higher than the 35% of Gen X and 20% of boomers who hold gold. What’s more, millennials’ average gold allocation has soared from 17% in 2023 to 29% today, well above the 10% and 13% respective averages for boomers and Gen X.”[5]

Like Millennials, Gen Zer’s are growing up amid a cost-of-living crisis, geopolitical uncertainty and crushing federal debt. They too are entering the precious metals market seeking a safe haven, a hedge against inflation, and to quell their sense of mistrust in government and financial systems.

“A younger generation, shaped by new financial crises, digital innovation, and a growing mistrust of traditional systems, is embracing gold in its own way. Gen Z, and Millennials, once seen as all-in on crypto, NFTs, tech stocks, and social trading, are now turning to gold as a tangible, time-tested asset … For Gen Z, gold’s appeal is not just about value preservation but also about privacy. They are finding that one of the simplest ways to achieve full privacy over their capital is to convert fiat currency, which exists as data in a highly transparent, centralised banking system, into physical gold held securely outside of it.”[6]

As these new generations, now some 145 million strong, continue to enter the gold market — they are reshaping the future of gold investing as well as the broader appeal of precious metals. Far more than the peer groups that preceded them, they understand that gold is a tangible asset that does not require an internet connection, a digital transaction, or a software application. And it is therefore not vulnerable to hacking, phishing, data breaches, cyber intrusion, digital infiltration and online privacy concerns.

In Sailing to Byzantium, WB Yeats alludes to gold’s permanence and timelessness as an enduring element. From a “gold mosaic on a wall” to the “hammered gold” of “Grecian goldsmiths,” it resides in “the artifice of eternity.” And this aspect of imperishability has clearly captured a new generation making gold sought after, highly valued, and hip again.

Courtesy of Thor Metals Group. 1-844-944-THOR.

[1] https://www.blackrock.com/us/individual/insights/stay-long-gold

[2] https://www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset

[3] https://www.bloomberg.com/news/articles/2025-09-18/gold-price-record-how-tariffs-inflation-us-rate-cut-are-fueling-bullion-rally

[4] https://www.gold.org/goldhub/research/central-bank-gold-reserves-survey-2025

[5] https://www.ssga.com/us/en/individual/insights/millennials-spearhead-gold-rush-as-safe-haven-appeal-soars

[6] https://masterinvestor.co.uk/latest/solomon-global-why-gen-z-and-millennials-are-buying-gold/#