Gold’s performance in 2025 has been staggering, and there’s no shortage of opinions about the strength and depth of its ongoing bull run. Prices of the yellow metal are up over 25% year-to-date and more than 86% over the past five years. Major investment banks and financial services firms like Goldman Sachs, JP Morgan, Bank of America, and UBS have been seemingly caught off guard by gold’s unrelenting rise, triggering repeated adjustments to their official price forecasts:

In May, analysts at Goldman Sachs concluded that gold is poised to break even more records:

“Gold is increasingly in focus among traders, investors — and central banks.

The precious metal, which has been used as a financial asset for millennia, is prone to dizzying rallies and deep slumps. But despite the commodity’s volatility, gold has repeatedly set records in recent years. Since March, investors have been increasing their holdings of gold, driven by concerns about the health of the economy and market volatility. Longer term, Goldman Sachs Research expects prices to be propelled by multi-year demand from central banks. Our analysts’ gold price prediction is for these two factors to push the metal to new record highs.”[1]

Similarly, JP Morgan cites geopolitical risks, policy uncertainty and financial volatility as propelling gold to as high as $4000/oz according to their head of Global Commodities Strategy.

“Earlier this year, we examined the structural shift in gold’s demand and geopolitically influenced pricing drivers fueling its rebasing higher, ultimately posing the question if $4,000/oz is in the cards — yes, we think it is, particularly now with recession probabilities and ongoing trade and tariff risks. We remain deeply convinced of a continued structural bull case for gold and raise our price targets accordingly.”[2]

The current gold run did not start this year however — with the onset of inflation, higher interest rates, and the Russia-Ukraine War — gold prices began a gradual but steady ascent in late 2022. Since that time a confluence of factors has pushed gold to more than 60 record highs over the past two years.

The U.S. Dollar’s Very Bad Year

Much has been written about the ‘era of the dollar’ coming to an end and indeed gold’s view as a safe haven stronghold can be attributed to increasing threats to the dollar’s reign as the world’s reserve currency.

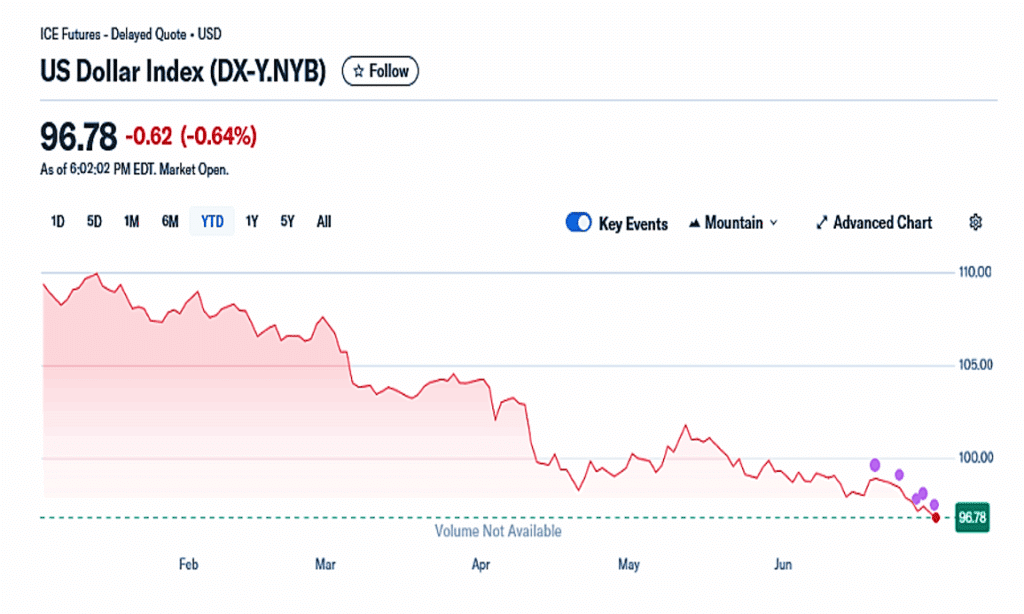

Last week, the dollar’s value fell to a 3-year low. The U.S. Dollar Index, which measures the of value of the buck relative to a basket of other currencies that include the Euro, Swiss Franc, Japanese, Yen and British Pound — started the year at: $108.49. It has since fallen to $96.78, setting a multi-decade record low.[3]

“The US dollar has had its worst first half-year in more than 50 years, as the financial markets over the last six months were dominated by geopolitical crises and Donald Trump’s trade war. The dollar has fallen by more than 10% against a basket of currencies since the start of 2025. That is its worst performance over the first six months of any year since 1973, and the worst half-year since the second half of 1991.This sell-off has pulled the dollar index down to its lowest level since March 2022.”[4]

There is a strong inverse relationship between gold prices and the U.S. dollar. Since gold is priced in bucks both at home and abroad, a stronger dollar makes the precious metal more expensive in other currencies, and this can suppress demand. But a weaker dollar reduces the price of gold to foreign buyers.

And there’s something else about the dollar that weighs heavily on gold prices. Many countries are actively reducing their reliance on the greenback. Whether it’s in response to trade wars, sanctions, or America’s unsustainable debt load — de-dollarization is in full swing as key nations around the world are now actively ditching dollars.

“Like many other trading powers in history, US administrations have not been averse to using economic leverage to motivate and subjugate their allies. From promoting decolonization to rebalancing expenditures, virtually every postwar American president has imposed powerful economic sanctions, or threatened to, on adversaries and allies alike to influence strategic outcomes in the US national interest. These moves had real consequences for the development of the world economy and financial markets. Above all, they stimulated a search among asset-holding governments and firms for new safe havens.”[5]

The World Turns to Gold

At this juncture in time, there is really no going back for the U.S. dollar. America’s exorbitant privilege has allowed us to borrow at lower rates, finance our deficits, exert undue influence, and grow into the world’s foremost economic superpower. But whether we’ve abused our privilege, failed to keep our books in order, or weaponized the greenback to the point of no return — other countries are embracing a world beyond the buck.

“Banks and brokers are seeing rising demand for currency derivatives that bypass the dollar, as trade tensions add a sense of urgency to a years-long shift away from the greenback. Firms are receiving more requests for transactions including hedges that sidestep the dollar and involve currencies such as the yuan, the Hong Kong dollar, the Emirati dirham, and the euro.”[6]

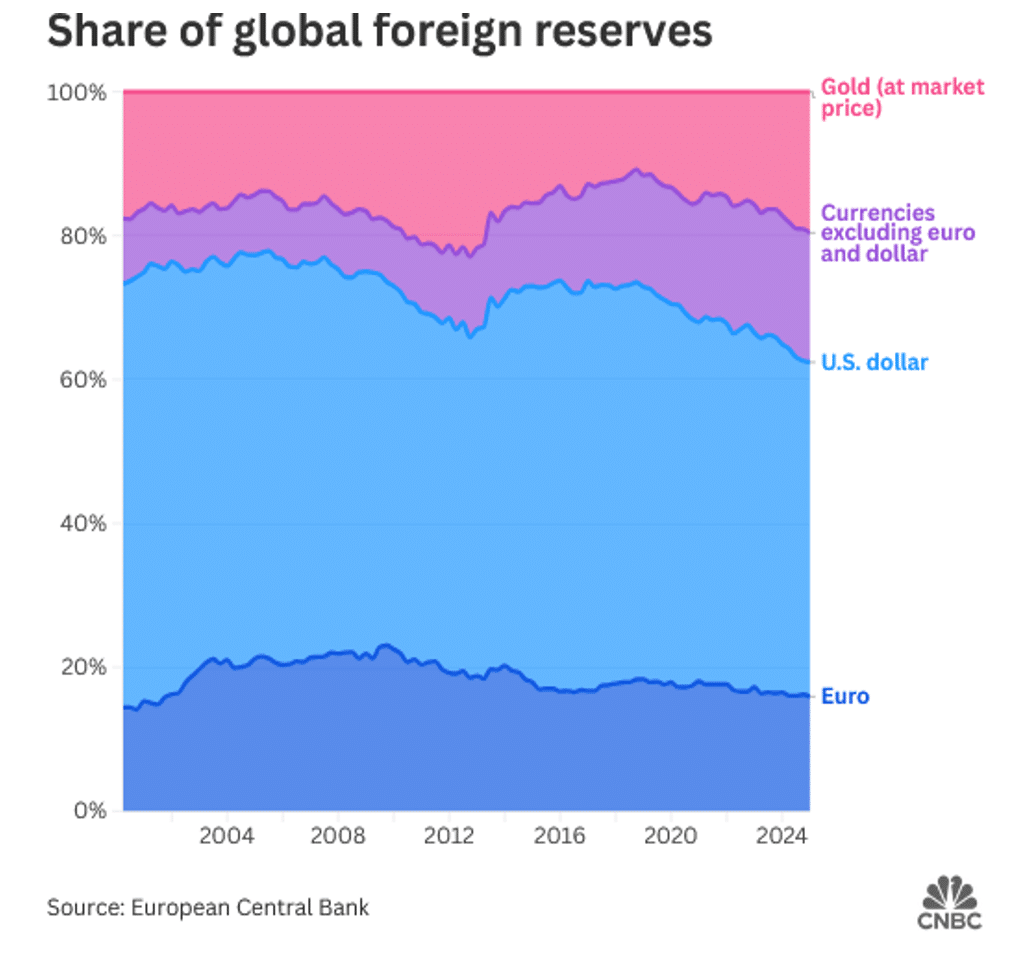

And gold is nipping at the dollar’s heels in terms of the world’s foreign reserve holdings. Due to historic hoarding by central banks, it has just overtaken the euro as the world’s second largest reserve asset. Central Banks are now on track to amass another 1000 metric tons of gold this year, marking the fourth consecutive year of an unrelenting gold grab. The world’s monetary authorities hold gold to protect their currencies and increase their financial safety net — and their current stockpile is at levels not seen since the 1960s.

“Central banks amass liquid assets such as foreign currencies and gold as a hedge against inflation and to diversify their holdings. It also allows them to sell these reserves to support their own currency in times of stress. Gold is seen providing long-term value and resilience through volatility, and central banks now account for more than 20% of its global demand, up from around a tenth in the 2010s.”[7]

Monetary Regime Change

Those of us who have been monitoring the dollar, market valuations, central bank activity, geopolitics, and trade relations — have been touting gold has a reliable hedge and financial safe haven. And now it seems, the entire world agrees.

Gold has reclaimed its place at the center of global finance and during this period of monetary regime change, it will once again serve as a critical bridge from the world of bills and bank notes — to whatever form of money comes next while maintaining its critical role as a timeless and transcendent store of value.

Courtesy of Thor Metals Group. 1-844-944-THOR.

[1] https://www.goldmansachs.com/insights/articles/why-gold-prices-are-forecast-to-rise-to-new-record-highs

[2] https://www.jpmorgan.com/insights/global-research/commodities/gold-prices

[3] https://finance.yahoo.com/quote/DX-Y.NYB/

[4] https://www.theguardian.com/business/2025/jun/30/us-dollar-first-half-trump-tariffs

[5] https://www.hinrichfoundation.com/research/wp/trade-distortion-and-protectionism/the-convergence-of-political-risk-economic-coercion-and-de-dollarization/

[6] https://www.bloomberg.com/news/articles/2025-05-09/global-shift-to-bypass-the-dollar-is-gaining-momentum-in-asia

[7] https://www.cnbc.com/2025/06/11/gold-overtakes-euro-as-second-biggest-global-reserve-asset.html