Wall Street, they say, has finally caught up with Main Street. For years, the latter has been warning that all is not well with the American economy.

Consumers Felt it First

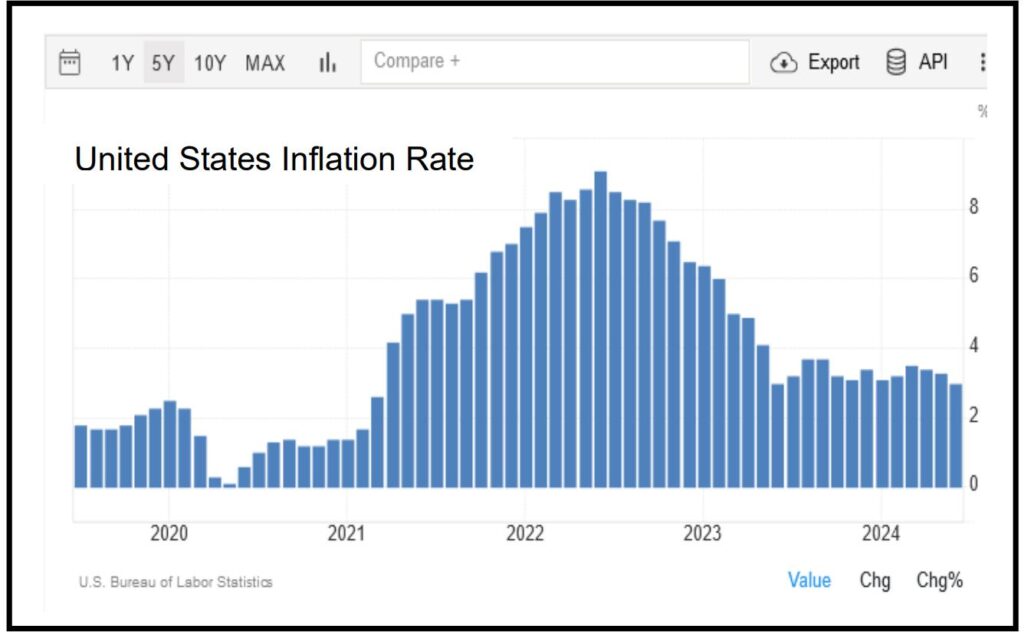

US consumers have been feeling stressed and stretched since inflation started rising in the Summer of 2020 impacting the price of groceries, clothing, housing, and even fast food. For consumers, $15 Big Macs and a dozen eggs approaching $5.00 — have become real-life symbols of economic hardship.1

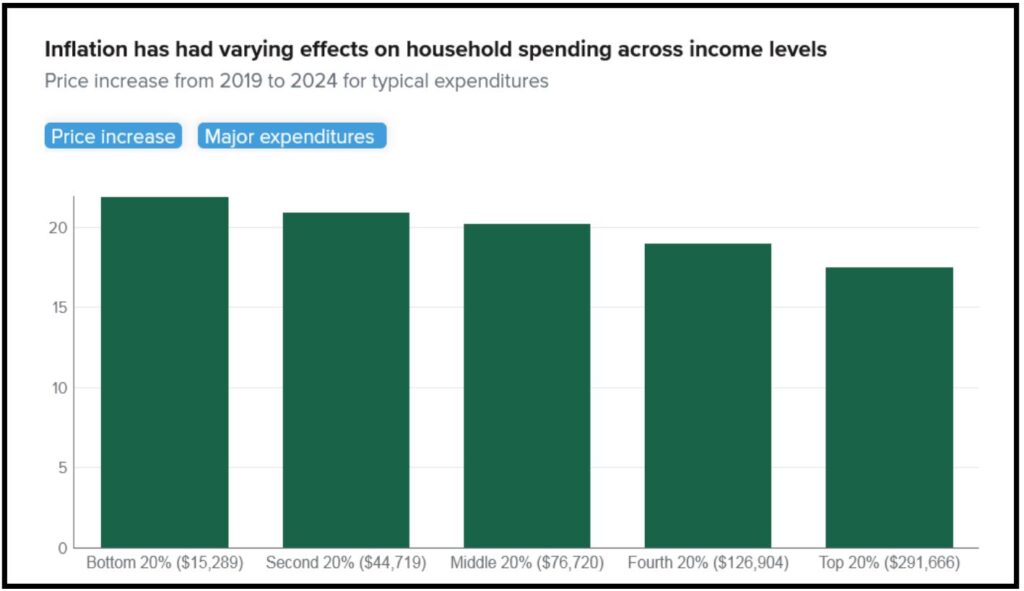

The impact of inflation hits lower income households hardest, since they spend the bulk of their money on necessities. California’s Public Policy Institute examined the impact of rising prices on various income levels:

“Food prices are up 27% compared to April 2019, and gasoline is up 29%. While expenditures on these goods and services make up large portions of most household budgets, lower-income households spend almost all of their resources (83%) on food, housing, transportation (including gasoline), and health care. Middle-income families spend 75% on these necessities, and high-income families spend 64%. Inflation has hit lower income Californians hardest … the same set of necessities would cost low income households 22% more today than in 2018–19. By comparison, middle-income households would spend 20% more, and high-income households would pay 17.5% more.”

While prices have come down, the PPIC concludes that the prolonged period of severe inflation has left economic “scars,” particularly on families and households making less. In July, the Index of Consumer Sentiment, a consumer confidence survey published monthly by the University of Michigan, dropped 7.1% year over year. Similarly, the Current Index of Economic Conditions was down 18% year over year.2

Jobs Seekers Knew Months Ago

American jobseekers knew that jobs were getting harder to find and keep long before the weak June jobs report showed that the economy added just 114,000 new jobs far short of the projected 185,000. In addition, unemployment rose to a worrisome 4.3%. Employers are grappling with inflation, political uncertainty, and higher interest rates — while workers are confronting a cooling labor market, rising layoffs, the impact of AI, and growing economic uncertainty.

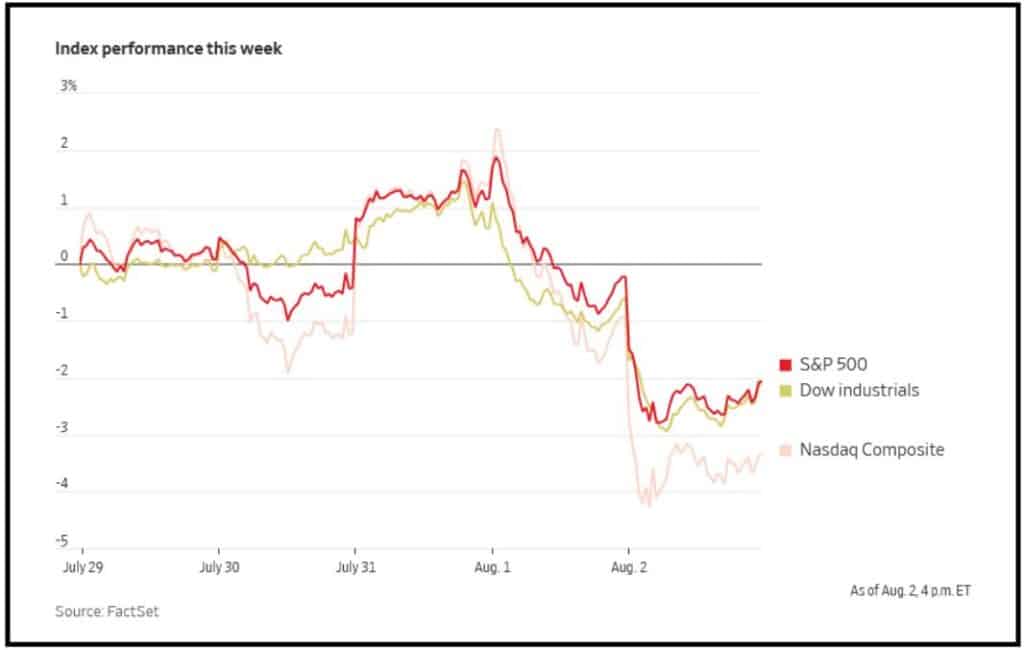

The report sent the financial markets into a tailspin and left some questioning whether the Fed has waited to long to cut rates as reported by the Wall Street Journal:

“In stocks, a broad-based selloff hammered the tech-heavy Nasdaq, which fell 2.4% and entered correction territory, down at least 10% from its recent high … For months, the economy seemed to be in a sweet spot, with inflation falling and growth humming along. Investors piled into the most economically sensitive corners of the market, wagering that the expansion had room to run. This week’s data has punctured some of those hopes and raised questions about whether the Federal Reserve has waited too long to trim interest rates … ‘Maybe things weren’t as rosy as we thought they were,’ said Eric Merlis, co-head of global markets at Citizens Financial Group.3

The pressure on Fed Chair Powell to cut rates has increased as the market turmoil continues and there has even been calls for emergency rate cuts sooner than September.

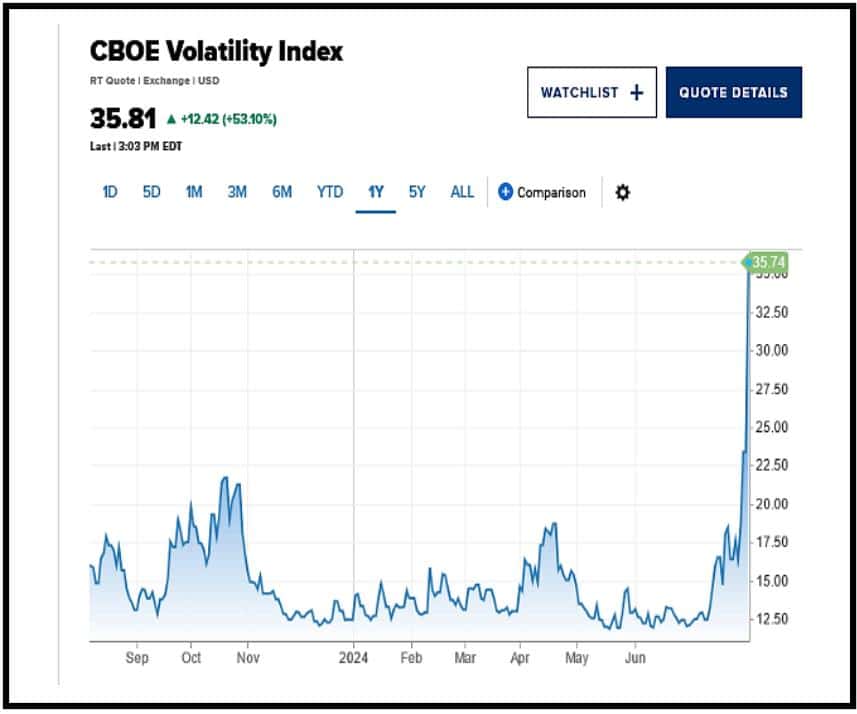

The Volatility Index Has Known for a While

The CBOE (Chicago Board Options Exchange) Volatility Index which measures the market’s expected volatility, started making noise last Fall. On Monday, it spiked to the highest level since the depths of the Covid-19 pandemic when the U.S. economy was in complete shutdown and at one point, it did something it has not done since the 2008 financial crisis.

“Earlier on Monday, the VIX was up 134% at 55, surpassing a 115% increase from Feb. 5, 2018, on a closing basis. On that day, the VIX more than doubled as several short-volatility exchange-traded products were forced to bid up VIX futures, sending a shudder through the broader market … For a brief period, the spread between the spot VIX and its second-month futures contract reached a deeply negative 30 points, exceeding its most recent lows reached during the depths of the COVID-19 selloff. On a closing basis, this would have been the widest level since October 2008.4

The VIX is a serious indicator that has been around for over three decades. It specifically tracks volatility in the S&P 500. According to Investopedia, “the VIX is calculated using a formula to derive expected volatility by averaging the weighted prices of out-of-the-money puts and calls.”5 The index reflects volatility expectations over the next 30 days and in that sense is a gauge of market risk. As a general rule, VIX readings below 20 indicate a low-risk environment while anything above 20 suggests a more volatile outlook.

Warren Buffet Knows All Too Well

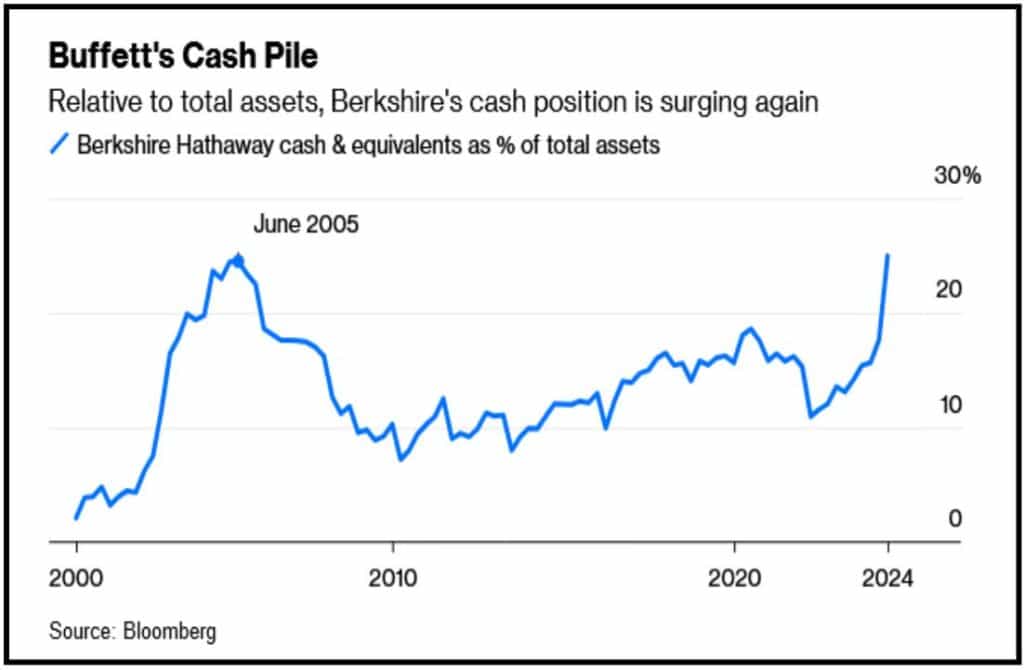

Warren Buffett’s Berkshire Hathway has apparently sold over $75 billion in stocks to boost its cash reserves. The multinational conglomerate’s stock dump includes almost half of its shares of Apple worth about $20 billion and $3.8 billion worth of Bank of America. This has prompted Elon Musk to suggest that Buffett knows a correction is coming.

Buffet is famous for saying, “Be fearful when others are greedy, and be greedy when others are fearful” which suggests that he may be accruing billions in cash to pick up bargain buys in the event of a recession. The move should not go unnoticed and is a clear wake-up-call for what has been an expensive and irrationally exuberant market.

Bloomberg calls Buffett’s move a clear warning that harkens back to the financial crisis of 2007-2009:

“The Berkshire news comes at a point of particular vulnerability in markets and the economy. Together with excess savings and low unemployment, high asset prices — sustained in part by elevated US large-cap valuations — have been one of the three pillars of US consumption in recent years. Excess savings have been dwindling for some time, but personal wealth and the labor market seemed to be holding up well until last week. Now, suddenly, the consumption story feels unstable. Two days after the Federal Reserve forwent an opportunity to cut policy rates, a Bureau of Labor Statistics report Friday showed that the unemployment rate rose to a nearly three-year high, starting the selloff that Buffett helped continue.6

Buffett’s cash pile has not looked this flush since June of 2005, just 18 months before the start of the Great Recession. The current stock rout was driven by Friday’s disappointing jobs report and mounting U.S. recession fears which triggered a global selloff just weeks after indices reached record highs. Since the start of the month, the Dow has lost over 1645 points, the S&P 500 has lost almost 260 points, and the Nasdaq has lost over 987 points. Apple, Amazon, and Google all declined sharply as did Nvidia and Microsoft which also raises concerns about the overall viability of the AI market boom.

Wall Street Doesn’t Want You to Know

Wall street has many secrets — from hidden fees and market manipulation, to cooking the books, and shameless stock promotion. Back in 2002, Bloomberg touched upon some of these in an article entitled: “How Corrupt is Wall Street?”

“Wall Street has always struggled with conflicts of interest. Indeed, an investment bank is a business built on them. The same institution serves two masters: the companies for which it sells stock, issues bonds, or executes mergers; and the investors whom it advises. While companies want high prices for their newly issued stocks and low interest rates on their bonds, investors want low prices and high rates. In between, the bank gets fees from both and trades stocks and bonds on its own behalf as well, potentially putting its own interests at odds with those of all its customers.7

While Wall Street’s big investment banks are mum about these conflicts, they’re also quiet about the behavioral economists they use to influence trades.

“Behavioral economists used to be guardians of America’s 95 million Main Street investors, with an aura of integrity, professionals with a fiduciary responsibility. No more. They’re the investors’ enemy, working for Wall Street banks, for Washington politicians, operating in the shadows, like the NSA, developing tools and technologies to secretly control data, manipulate the brains of savers, voters, taxpayers, and investors.8

And that’s not all. New structured investments create a false sense of security as outlined by the Wall Street Journal earlier this year.

“It might seem strange that volatility is so low when inflation, monetary policy and geopolitical conflicts make the global economy more uncertain than ever. Here is the problem: Structured products might themselves be what is lowering it … the Bank for International Settlements pointed out that the banks selling all these notes have been forced to take the other side of their clients’ bets. To hedge the risk, trading desks have been leaning against swings in stocks, selling them when they go up and buying large drops—a practice known as delta hedging. This has pulled down long-term volatility.9

These structured products have created a feedback loop reminiscent of 2017 and 2018 which resulted in an eventual explosion of volatility and a subsequent equities free fall.

So, it seems that Wall Street insiders not only knew about the coming volatility, in many respects, they orchestrated it by inflating values and manipulating market sentiment to the point of meltdown.

Whether poaching fees from nest eggs, funneling public pension plans into private equity conglomerates, or ignoring economic data — investment banks often put savers, retirees, and everyday investors at great risk. Lest we forget, it was predatory lending and subprime interest-only loans that contributed to the 2008 financial crisis and the subsequent housing crash.

Gold is a Hedge for the Unknown

On September 23, 2007 the Sunday New York Times read: “Gold, Again, Becomes a Shield Against the Unknown”10 as it urged a return to gold just months before one of the worst financial meltdowns in American history. To the victor go the spoils and while so many lost so much — those who listened emerged from the Great Recession with a commodity that nearly doubled in value.

Gold performs well in the face of financial mayhem. It is a physical asset driven by supply and demand making it fairly invulnerable to manipulation by big banks and big government. It is considered a critical commodity to hold in times of crisis due to its liquidity and longstanding reputation as a store of value.

There’s a famous saying, “stocks take the stairs up and the elevator down.” Gold does neither. It is a safe haven investment whose value remains fairly stable providing critical diversification for portfolios confronting inflation, uncertainty, volatility, and the many things we simply do not know about — until it is far too late.

Call Thor Metals Group at 1-844-944-THOR for more information about acquiring gold.

- https://tradingeconomics.com/united-states/inflation-cpi ↩︎

- http://www.sca.isr.umich.edu/ ↩︎

- https://www.wsj.com/livecoverage/stock-market-today-jobs-report-live-08-02-2024 ↩︎

- https://www.marketwatch.com/story/the-vix-just-did-something-it-hasnt done-since-2008-heres-why-this-could-be-a-buying-opportunity-for-stocks-c6c89d6b ↩︎

- https://www.investopedia.com/articles/active-trading/070213/tracking-volatility-how-vix-calculated.asp ↩︎

- https://www.bloomberg.com/opinion/articles/2024-08-05/warren-buffett-s-277-billion-hoard-after-unloading-apple-is-a-warning ↩︎

- https://www.bloomberg.com/news/articles/2002-05-12/how-corrupt-is-wall-street ↩︎

- https://www.marketwatch.com/story/why-investors-are-helpless-against-wall-streets-secret-brainwashing-machine-2015-05-29 ↩︎

- https://www.wsj.com/finance/investing/markets-are-lulling-themselves-into-a-false-sense-of-security-4e7f48eb ↩︎

- https://www.nytimes.com/2007/09/23/business/yourmoney/23gold.html ↩︎