Gold prices rose in Asian trade on Friday, recouping some recent losses after safe haven demand was buoyed by U.S. President Donald Trump threatening more trade tariffs, while geopolitical tensions in the Middle East also helped.

Strength in the dollar– which was headed for a weekly gain– kept gains in gold and most other metals subdued on Friday. But silver and platinum were set for strong weekly gains, vastly outperforming gold as they notched fresh multi-year highs this week.

Among industrial metals, U.S. copper futures fell sharply from recent peaks, seeing some profit-taking after Trump’s tariff threat drove stellar gains in the red metal earlier this week.

Spot gold rose 0.5% to $3,341.27 an ounce, while gold futures for September rose 0.9% to $3,354.60/oz by 01:28 ET (05:28 GMT).

Trump’s Canada tariff threat, Middle East tensions boost havens

Trump on Thursday evening said he will impose 35% tariff on Canada from August 1, higher than his previously threatened 25% tariffs and also blindsiding Ottawa after some signs of improving trade relations.

The announcement sparked a risk-off move across major risk-driven assets, and spurred some gains in havens such as gold, and the yen.

On the geopolitical front, signs of little immediate deescalation in the Israel-Hamas war, as Jerusalem continued to launch attacks against the Gaza Strip, kept geopolitical tensions high in the Middle East.

U.S. efforts to broker a ceasefire appeared to have yielded little progress in the past week, despite the White House’s claims that a deal was close.

This trend offered gold some relief, although the yellow metal was nursing a muted weekly performance as it came under pressure from a recovery in the dollar. Speculation over the path of U.S. interest rates also weighed on gold, with the yellow metal remaining squarely within a $3,300/oz to $3,500/oz trading range seen for most of the year.

Platinum, silver greatly outpace gold in recent weeks

Platinum and silver prices steadied near multi-year peaks, and were headed for weekly gains of between 1.9% and 3%. Both metals shot past gold in recent weeks, as they both benefited from increased speculation over tighter supplies and increasing demand in the coming months.

Platinum was set for a sixth consecutive week of gains, as the white metal continued to benefit from a bullish industry report released in late-May. Platinum futures rose 0.3% to $1,420.25/oz and were close a 11-year high.

Silver futures rose for a third straight week, and were up 2.2% to $38.140/oz on Friday– their highest level in nearly 14 years.

Among industrial metals, COMEX U.S. copper futures fell 1.2% to $5.5620 a pound, seeing extended profit-taking after Trump’s threat of a 50% tariff on the red metal sparked strong gains this week. U.S. copper futures had briefly hit record highs.

Benchmark copper futures on the London Metal Exchange were flat at $9,700.55 a ton.

Read the full article HERE.

- Donald Trump threatened to impose a 50% tariff on Brazil over its domestic political affairs, citing the treatment of former President Jair Bolsonaro.

- Brazil’s leader Luiz Inacio Lula da Silva responded that his nation will not be “tutored” by anyone and that any unilateral rate hikes will be responded to using Brazil’s economic reciprocity law.

- According to Stephen Olson, visiting senior fellow at ISEAS–Yusof Ishak Institute, it’s unprecedented for the US to add a tariff onto a foreign country to stop a judicial proceeding, and “it signals to US trade partners that any and all issues that catch Trump’s attention could become a problematic part of the trade agenda”.

Donald Trump threatened to impose a 50% tariff on Brazil over its domestic political affairs, the most extreme case yet of the US president weaponizing trade policy to make unrelated demands.

Trump cited the treatment of former President Jair Bolsonaro — a right-wing populist leader — in his letter to Brazil on Wednesday, calling on authorities to drop charges against him over an alleged coup attempt. “This Trial should not be taking place. It is a Witch Hunt that should end IMMEDIATELY!” Trump wrote in the letter.

Brazil’s leftist leader Luiz Inacio Lula da Silva fired back in a social media post, saying his nation will not be “tutored” by anyone. He added that the case against those who planned a coup is a matter solely for the country’s justice system and “not subject to interference or threat.”

“Any unilateral rate hikes will be responded to using Brazil’s economic reciprocity law,” Lula wrote. “The sovereignty, respect and intransigent defense of the Brazilian people’s interests are what guide our relations with the world.”

Trump’s latest threat, against a nation that sells fewer goods to the US than it buys, risks reinforcing concerns that formal trade agreements may offer limited protection against future tariff hikes. It also again shows that the rates Trump unveiled in April on “Liberation Day” carry little meaning.

Trump has previously used tariff threats to accomplish other geopolitical goals. In January, he announced sweeping tariffs on Colombia before abruptly pulling the threat after reaching a deal on the return of deported migrants. He’s also put 20% tariffs on China for its alleged failure to stop the flow of fentanyl to the US, and threatened BRICS nations with higher duties for undermining the dollar.

Unprecedented

Still, it’s unprecedented for the US to add a tariff onto a foreign country to stop a judicial proceeding, according to Stephen Olson, visiting senior fellow at ISEAS–Yusof Ishak Institute and a former US trade negotiator.

“It signals to US trade partners that any and all issues that catch Trump’s attention could become a problematic part of the trade agenda,” Olson said. “It also raises questions as to whether the reciprocal tariff negotiations will ever really settle anything.”

So far, Trump’s flurry of new warnings have done little to rattle global markets as they did when the so-called reciprocal tariffs were announced in April, with traders focusing on Trump’s overall extension of the deadline to Aug. 1. That’s effectively given trading partners an extension for talks as skepticism persists on Wall Street that he will follow through on his import taxes.

Currency Hit

But the move on Brazil shook the real, which slumped as much as 2.9% against the US dollar. US equity futures retreated amid uncertainty over the Trump administration’s trade policies, with S&P 500 contracts slipping 0.2%, even as stocks gained in Europe and Asia.

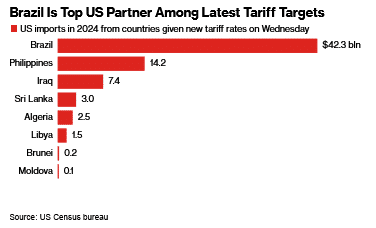

The Brazil letter was one of several sent by Trump on Wednesday. He levied a 30% rate on Algeria, Libya, Iraq and Sri Lanka, with 25% duties on products from Brunei and Moldova and a 20% rate on goods from the Philippines. They were largely in line with rates Trump previously announced, though he lowered them for Iraq and Sri Lanka while raising them on the Philippines, a US ally.

Brazil is the first country to receive one of Trump’s tariff notifications that was not on the initial list of trading partners when he announced higher so-called reciprocal tariffs in April. And the letter to Brazil also presents a warning shot to the BRICS group of developing nations, which Trump has cast as a threat to the US dollar’s status as the world’s key currency.

Brazil is unusual among Trump’s most recent tariff targets because it runs a deficit in trade with the US, while almost all the others post large surpluses. In 2024, Brazil imported some $44 billion of American products, while US imports from Brazil were around $42 billion, according to the Census Bureau — putting it among the top 20 American trading partners.

Asked what formula he was using to determine the appropriate duty rate for trading partners, Trump told reporters at a White House event on Wednesday that it was “based on common sense, based on deficits, based on how we’ve been over the years, and based on raw numbers.”

“They’re based on very, very substantial facts, and also past history,” he said.

Trump added to uncertainty earlier this week by claiming he was “not 100% firm” on that new cut-off date for talks. He has since sought to signal to investors and trading partners that he is committed to carrying out his tariff threats, vowing Tuesday that “all money will be due and payable starting AUGUST 1, 2025 — No extensions will be granted” on country-specific levies.

Deputy Treasury Secretary Michael Faulkender on Wednesday indicated that even if tariffs kicked into effect, negotiations could continue beyond the August deadline.

“There’s enormous progress that has been made with many of these countries, and for some of them it is just finalizing some of the terms of the framework,” he said in an interview with Bloomberg Television. “Now obviously, the details of the trade agreement will be worked out well beyond August 1st, but a general framework is the objective to have by August 1st.”

Still, the Brazil threat signaled that even if nations strike trade deals with the US by the Aug. 1 deadline, they may still face tariff escalation afterward, according to economists at Barclays Plc. led by Brian Tan.

BRICS, Copper

“We suspect President Trump’s announcement of a 50% tariff on Brazil is likely to erode Emerging Asian policymakers’ confidence that a deal would put an end to uncertainty over US trade policy,” they wrote.

The president has also raised the stakes for two key trading partners, saying the European Union could receive a unilateral tariff rate soon despite progress in negotiations, and vowing to hit India with an additional 10% levy for its participation in the BRICS.

He has raised the specter of more industry-specific tariffs, as well, floating a 50% rate on copper products that sent that metal climbing as high as 17% in New York on Tuesday, a record one-day spike. He also pitched tariffs as high as 200% on pharmaceutical imports if drug companies don’t shift production to the US in the next year.

While Trump has touted his tariff notification letters as deals, even the actual agreements he has managed to strike during the negotiating period with the UK and Vietnam have been far short of comprehensive, leaving many details unclear. Trump also secured a truce with China to lower rates and ease the flow of critical earth minerals.

The result of Trump’s criticism of BRICS economies and his high tariff threats may end up being that it only brings those economies closer together, according to Steven Okun, founder and CEO of APAC Advisors.

“It signals that countries should continue to expect Trump to use tariffs to get what he wants — and there’s limited scope for a reprieve,” he said by phone. “He can add tariffs for whatever reason at any time.”

Read the full article HERE.

Tweaks can’t solve the country’s debt problem. At some point, Washington will have to start over.

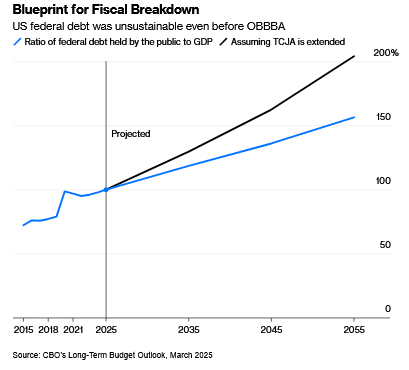

In a remarkable achievement, the One Big Beautiful Bill Act got worse with each iteration before finally being enacted last week. On plausible assumptions, the final version will add more than $5 trillion to deficits over the next 10 years, moving the track of public debt from unsustainable to all but unhinged. As Congress turns to its budget for next year, it must grapple realistically with this looming crisis.

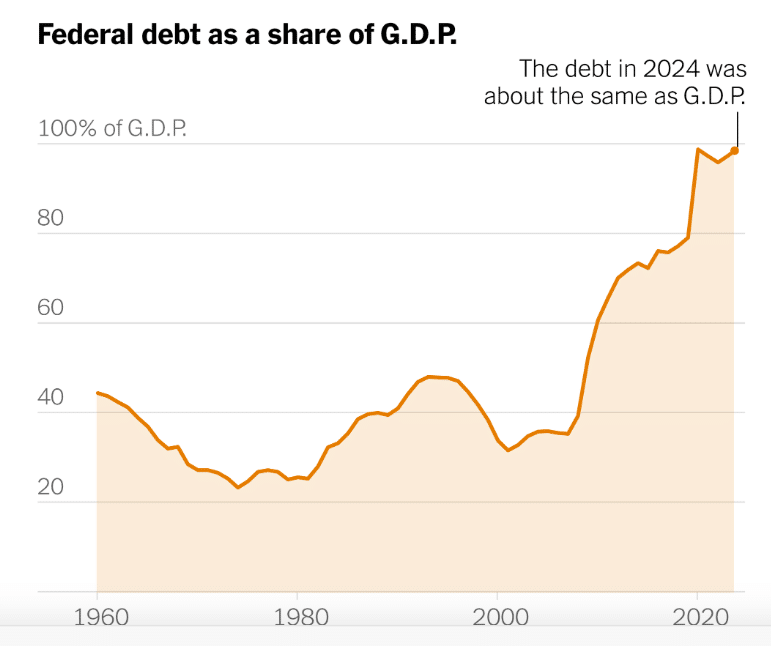

As written, the measure will add about $3 trillion to the expected 10-year deficit. Include interest payments, and the cost rises to nearly $4 trillion. Assume that assorted “temporary” measures are made permanent — which seems reasonable, given that most of the bill’s cost comes from extending supposedly temporary tax cuts passed in 2017 — and the total could be as much as $6 trillion. Federal debt held by the public would climb from 100% of gross domestic product today to 130% by 2034. (After that, it just keeps going up.)

Remember when fiscal conservatives wanted to balance the budget? This plan means annual deficits of more than 7% of GDP even if the economy remains at full employment. Add a recession during the next decade, and the numbers soar off the charts. As the debt rises, the steps needed to rein it in become ever more challenging.

Complicating the task going forward, many of the bill’s provisions were designed to obfuscate its true costs. Temporary tax and spending changes were timed so that the biggest deficit increases were piled into the early part of the decade. (First, the pleasure of lower taxes and higher spending; later, in theory, the pain of higher taxes and lower spending.) For accounting purposes, the bill’s supporters went as far as to claim that it actually reduces projected deficits — relative to a new “current policy” baseline. In effect, this declared the bill’s centerpiece, extending the 2017 Tax Cuts and Jobs Act at a cost of more than $3 trillion, to be a fiscal nonevent.

The magnitude of the challenge means that tweaks alone — such as the $9.4 billion “rescissions” package the president has requested, which the Senate may vote on next week — won’t cut it. Nor will some combination of tariffs, faster growth and cracking down on “waste, fraud and abuse.” What’s required is a comprehensive review of taxes and entitlements.

As a start, Congress should create a bipartisan fiscal commission, on the model of the 2010 Bowles-Simpson panel, to offer an honest assessment of the budget trajectory and propose reforms. The key is to put everything on the table, including Medicare and Social Security. Modest but broad-based tax increases — admittedly, not likely anytime soon — should also be under consideration. Likewise small budget cuts across an array of federal programs. Such changes will of course be unpopular, but the quicker they get underway, the less painful they’ll need to be.

Lawmakers will turn this week to negotiating next year’s budget, very much in a spirit of business as usual. That’s precisely the wrong approach. The Big Beautiful Bill has made the country’s fiscal picture much uglier, and reforms much more urgent. The sooner Washington understands that reality, the better.

Read the full article HERE.

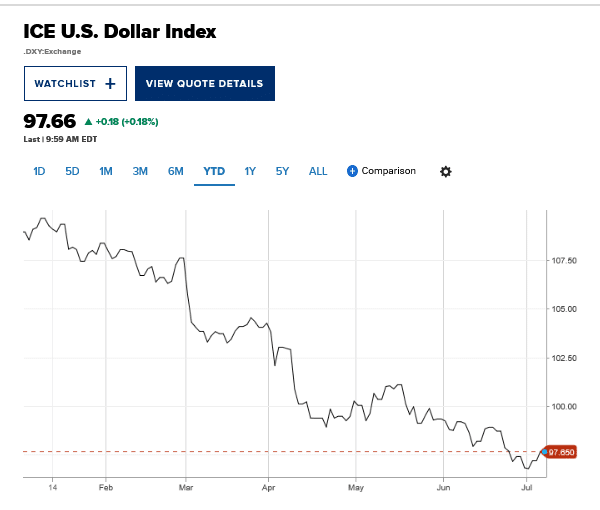

- The U.S. dollar tumbled 10.7% against its global peers through June, making it the worst first half since 1973.

- Many of the same factors causing weakness likely will stay on the minds of investors as they seek other avenues for safe havens.

- To be sure, the dollar’s continued decline is by no means a sure thing, and others on Wall Street think the trend down could reverse.

Fresh off its worst performance since Richard Nixon was president, the U.S. dollar faces a variety of headwinds heading into the second half of the year that could have important investing implications.

The greenback tumbled 10.7% against its global peers through June, making it the worst first half since 1973, back when Nixon broke the Bretton Woods gold standard. At its bottom, the currency hit its lowest point since February 2022.

The path ahead may not look much brighter.

That’s because many of the same factors — policy volatility, swelling debt and deficits and potential interest rate cuts from the Federal Reserve, just to name a few — likely will stay on the minds of investors as they seek other avenues for safe havens.

“Some of this was probably due, and then we’ve certainly given currency traders enough to contemplate for what’s the catalyst now,” said Art Hogan, chief market strategist at B. Riley Wealth Management. “You could check a lot of boxes. You’re running massive deficits, and nobody wants to stop that on either side of the aisle. You’re alienating friends both militarily and trade-wise. You’ve got enough potential negative catalysts. And then once momentum starts, it’s hard to kind of stop it.”

Indeed, the dollar’s slide started in mid-January and has shown only occasional signs of moderating since. Hopes that President Donald Trump’s tariffs would not be as steep as thought helped spark a brief rally in mid-April, but for the most part the gravitational pull has been lower.

Market impact

Of course, the dollar’s slide hasn’t exactly been poison for stocks.

With more than 40% of revenue for S&P 500 companies coming from international sales, a weaker dollar helps make American exports cheaper, an important point to consider amid the ongoing trade war.

However, the move lower has coincided with growing chatter about the potential end of American exceptionalism and dollar hegemony, with the public share of U.S. debt nearing $30 trillion and the 2025 deficit on track for close to $2 trillion. Should American assets such as the greenback and Treasury debt lose their prominence on the global stage, that could have strong ramifications for risk assets like stocks.

Global central banks, for one, are ramping up their gold purchases, to 24 tons a month, per the World Gold Council, as an alternative to U.S. assets. Gold had its best first-half run since 1979.

“We think central banks are buying gold to diversify reserves, reduce reliance on the [dollar], and hedge against inflation and economic uncertainty,” Lawson Winder, research analyst at Bank of America, said in a note. Winder said it’s “A trend that we think is set to continue, especially amid uncertainty surrounding US tariffs and fiscal deficit concerns.”

Likewise, TS Lombard is maintaining a short position on the greenback, which it calls “the gift that keeps on giving.”

“Trump’s attacks on the Fed and the administration’s explicit desire for a weaker dollar only add to that view,” wrote Daniel Von Ahlen, senior macro strategist at the firm. “The dollar remains overvalued on most FX metrics … With USD negatives ubiquitous, why not expect the dollar to become undervalued? We remain firmly short dollar across a range of trades in our book.”

The Federal Reserve also could exert more downward pressure by coming through on expected rate cuts in the back part of the year. However, the impact of Fed loosening can be tricky to handicap, considering that the dollar and Treasury yields rose sharply when the central bank last cut in 2024.

Hope for a reversal

To be sure, the dollar’s continued decline is by no means a sure thing, and others on Wall Street think the trend down could reverse.

Thomas Matthews, head of Asia Pacific markets at Capital Economics, said the recent rally in stocks points to growing comfort with U.S. assets, with the earlier dollar weakness perhaps just a product of the intended appreciation of other currencies as well as a switch in hedging strategies.

Wells Fargo also thinks dollar-related fears are overblown.

“Taking a statistical approach to analyzing the U.S. dollar’s role, it is clear to us that the greenback remains the linchpin of global trade and finance and is far from becoming irrelevant,” Wells Fargo investment strategy analyst Jennifer Timmerman wrote. “We believe the U.S. dollar benefits from deep-seated advantages (such as the rule of law, transparency, and a highly liquid financial market) that make a global shift away from the dollar an extremely difficult and slow-moving process – especially because of underlying weaknesses of the most visible dollar alternatives.”

Treasury Secretary Scott Bessent also weighed in, telling CNBC on Monday that the currency fluctuations are “not out of the ordinary.”

However, rising yields on Treasury debt also signifies that concerns over the dollar and other U.S. assets linger.

“We’re in that stage of being overdone to the downside in terms of the momentum,” said Hogan, the B. Riley strategist. “But fundamentally, you could certainly whiteboard out plenty of things that you’d be concerned about.”

Read the full article HERE.

Independent analyses – ranging from Yale University to the Wharton School to the Congressional Budget Office – have each said that President Donald Trump’s budget plan will add trillions of dollars to the U.S. deficit over the next 10 years.

What’s at stake if the deficit continues on its upward trajectory? This year, the U.S. deficit is exceeding 6% of GDP, a level roughly 63% higher than the average in the past five decades. And unlike past spikes, the current one isn’t driven by war or economic crisis, leading many to raise concerns about why America might be playing with fire when it comes to its fiscal health.

CNBC’s “America’s Deficit Reckoning” explores the consequences – not how to solve the budget deficit, but what’s at stake if we don’t.

Through interviews with more than a dozen top officials, economists, and investors, including Former Treasury Secretary Robert Rubin, macro investor Ray Dalio, and Former Chairman of the Joint Chiefs of Staff Mike Mullen, CNBC homes in on three potential areas of fallout: the markets, the economy, and international relations.

Markets at Risk: Persistent deficits have many prominent investors on high alert. Dalio says that the U.S. is showing “classic signs” of a late-stage debt cycle, ascribing a 50% chance of trauma in the next three years. PIMCO’s Chief Investment Officer Dan Ivascyn was a bit more sanguine – saying that he thinks a crisis of investor confidence is unlikely in the U.S., but has been diversifying away from Treasuries. That mirrors some recent activity in the bond market, which hasn’t been overtly reacting to the new budget plan. Still, the bond vigilantes will police the deficit when they feel it’s necessary: Ed Yardeni, who coined the term in the early ’80s, says they’re more powerful than ever.

Economic Strain: If Americans benefit from policies like tax cuts and higher spending, why should they care about the longer-term implications of wider deficits? The most apparent risk to the economy is inflation, which would keep interest rates higher and “crowd out” private investment. Additionally, when interest payments become a higher proportion of Federal outlays, they drain resources that would otherwise go to other budget line items, says Maya MacGuineas of the Committee for a Responsible Federal Budget. And it hinders the government’s ability to respond in the event of an emergency. But some of the worst economic effects will be felt by future generations, who, according to one GenZ’er interviewed by CNBC, are already concerned the deficit will impede their ability to collect social services.

International Implications: Admiral Michael Mullen, former chairman of the Joint Chiefs of Staff, once called the national debt the “greatest threat to national security.” His concern was that as debt levels increase and rates remain higher, that it could squeeze discretionary defense spending. As historian Niall Ferguson warns: a great power that spends more on interest payments than defense breaches a threshold that historically has preceded a decline. The U.S. crossed that red line last year. There’s also a significant interdependence between the U.S. and its foreign creditors – especially China and Japan, so if global investors begin to truly question America’s fiscal health, the ripple effects could extend beyond the bond markets.

The Clock Is Ticking: Experts at the Penn Wharton Budget Model estimate the U.S. has less than 20 years to fix its fiscal trajectory. After that, even aggressive tax hikes or spending cuts may not be enough to stave off default — implicit or otherwise. While the U.S. can technically print its way out of debt, doing so risks runaway inflation, economic contraction, and geopolitical fallout.

As former Treasury Secretary Rubin puts it, we may be entering uncharted territory. The time to prepare is now—before markets force our hand.

Read the full article HERE.

How economists evaluate the national debt.

President Trump’s domestic policy bill, which the House is debating now on the floor and is expected to vote on soon, would add $3.4 trillion to the federal debt over the next decade. That’s on top of $29 trillion the U.S. already owes.

Numbers that big can lose their meaning. But the debt is not all abstract; it’s money Americans enjoy today but future generations must pay off with interest. The interest America has to pay its lenders will exceed $1 trillion for the first time ever next year — more than we spend on Medicare.

But not all debt is created equal. A trillion dollars means something different in the U.S. than it does in, say, Ireland or Panama.

So how should Americans make sense of the debt? Economists have a few different ways of assessing that, beyond how big or small the total is. Today, I’ll break down three and explain how the U.S. fares on each.

1. Compare it to G.D.P.

Everything is relative. $29 trillion sounds like a lot — and it is. It’s among the biggest fiscal shortfalls ever recorded for a developed nation not at war. But the U.S. also has the largest economy in the world.

Economists often measure debt by how it compares to a country’s economic output, also known as G.D.P. America’s debt is now about the same size as its G.D.P. (Japan and Italy have also crossed that threshold, but few other countries have.)

The U.S. government is already slated to borrow an additional $21 trillion over the next decade. That, plus $3.4 trillion from the Republican bill, may soon push the debt well past the G.D.P.

2. Look at who owns it

Countries can issue bonds — tiny pieces of their debt — to investors at home and abroad.

Japan has the most debt of any wealthy nation relative to its G.D.P., but domestic investors own nearly 90 percent of it. That gives Japan’s economy a cushion. When the government pays interest on its debt, those outlays end up back in the hands of bondholders who reinvest the money locally.

Not so for foreign investment.

Foreigners hold nearly a third of America’s debt. That translates to $8.5 trillion, all of which the U.S. must eventually ship back to bondholders abroad. It’s a missed opportunity for domestic investment, and thus for economic growth.

3. Consider what’s coming

As the world changes, our financial needs change, so our debt may stretch or shrink. We can’t predict the future, but there are certain things we can be reasonably sure about.

- Tax revenue. The version of Trump’s policy bill that passed through a divided Senate on Tuesday locks in low tax rates for decades, my colleagues Andrew Duehren and Colby Smith explained on “The Daily.” Lower rates mean less tax revenue.

- Entitlement spending. Two-thirds of the federal budget is already set aside for mandatory programs like Social Security, Medicare and Medicaid, whose spending levels are set by laws rather than annual appropriations.

- Interest payments. Installments are due at regular intervals, with rates set far in advance, so we know approximately how much the government will need to pay out.

There are also things we can’t know, like whether Trump’s tax cuts will juice the economy, or whether his tariffs will raise enough money to offset costs.

But economists have enough information to forecast the direction of U.S. debt, and the arithmetic is unforgiving. The Congressional Budget Office estimates that America’s debt will grow 56 percent larger than its G.D.P. within 30 years. That’s uncharted territory for the U.S. — and the world.

More on the bill

- After a day and a night of wrangling, the House approved a vote to debate the bill on the floor. They are doing so now.

- Republicans put down a revolt by conservative holdouts that had threatened to sink the bill. Trump was frustrated: “What are the Republicans waiting for???” he wrote on social media. “MAGA IS NOT HAPPY, AND IT’S COSTING YOU VOTES!!!”

- Democrats are unified in their opposition to the bill.

- “Shame on the people who decided to launch that kind of all-out assault on the health and the well-being of everyday Americans,” Hakeem Jeffries, the Democratic leader, just said on the floor. He has no time limit, and has been speaking for more than an hour so far.

- Trump sought to woo reluctant House Republicans with signed merchandise and photos. He wants them to pass the bill by Friday.

- Will this be the time Republican fiscal hawks defy Trump and vote “no”? Party leaders are betting against that, writes Catie Edmondson.

Read the full article HERE.

Silver shined in June, returning almost 10% and beating out the returns delivered by the stock and bond markets in Japan, Europe, and the U.S. The momentum could continue as July tends to brings favorable returns for the precious metal.

What’s behind silver’s gain isn’t all that easy to pinpoint. Gold’s monstrous 43% climb over the past year could mean that it has incorporated all the good news, prompting traders to look at other stores of value and safer assets, like silver. Silver could also be benefiting from new applications in solar panels and its essential role in the semiconductor industry as artificial intelligence booms.

Investors convinced by all that can buy the iShares Silver Trust exchange-traded fund, the most liquid silver fund with $17 billion in assets. The ETF physically holds the metal in vaults in London, giving investors direct exposure to spot prices of silver, minus fund expenses.

What could work in investors’ favor this summer is something called seasonality analysis. Looking back over the past decade, July has been the strongest month for the fund, delivering an average gain of 4.5%. That far outpaces the next best month’s performance: December sports an average gain of 2.7% for the past 10 years, according to FactSet.

Investing in most actively traded futures contract is another option. Historical returns paint a similar picture there, with July’s 10-year average gain at 4.1%, the strongest out of all months. Investing in silver bars and coins are other options.

Of course, silver’s gain in July isn’t guaranteed. The iShares ETF has logged a positive return in July six out of 10 times—the other four times it hasn’t, with 2015 posting a big loss of 6.3%.

“It’s no sure thing,” Jay Kaeppel, a senior research analyst at SentimenTrader wrote in a note Tuesday. But the reality is silver has tended to go up more than down in July, and it’s currently on a good run.

“With silver already in a strong uptrend, the combination of favorable price action and a favorable seasonal trend is a scenario that often creates meaningful opportunities,” Kaeppel adds.

The iShares silver fund is up 25% this year, rivaling gold’s 27% gain.

Read the full article HERE.

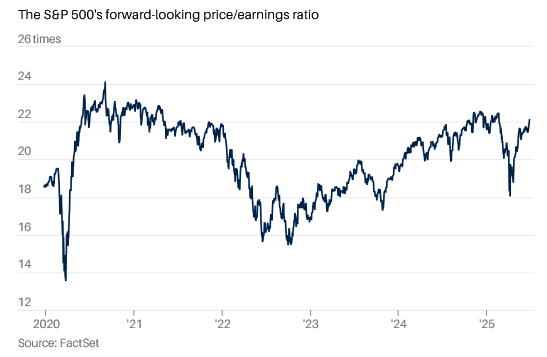

U.S. stocks are extending their scorching spring rally into the close of the second quarter, with the S&P 500 probing record levels as investors ride bets on Federal Reserve rate cuts, fading tariff risks, and stimulative tax and spending plans from Capitol Hill.

Now, the question is whether companies’ performances justify that second-quarter surge. With corporate earnings reports starting on July 15 with an update from JPMorgan Chase, some investors are worried that expensive stock valuations and subdued levels of market risk could suggest markets are pricing in more profit growth and a better economic performance than is likely over the coming year.

“The U.S. market remains the clear global leader, buoyed by strong earnings momentum, macro resilience, and AI-driven enthusiasm (and) reignited conversations about whether the “Buy America’ trade is making a comeback,” said Charu Chanana, chief investment strategist at Saxo Bank.

“However, with stretched valuations, this earnings season needs to confirm the second-half rebound story—or risk a market rethink.”

The S&P 500SPX-0.13%, which closed at a record high of 6201 points on Monday, is now trading at 22.8 times the collective earnings its constituents are expected to generate over the next 12 months.

That is not only historically expensive, according to data from Goldman Sachs Global Investment Research, but it also means the benchmark is more highly valued than the Nasdaq 100 and the Russell 2000RUT-0.18%.

“There’s clearly a bit of pull forward of earnings expectations,” said Louis Navellier of Navellier Calculated Investing. “There’s also a desire to get in front of the Fed beginning to cut rates.”

“Clearly, the geopolitical risks are being discounted as having little impact on growth prospects, as are the prospects of tariffs either having little impact on inflation or never actually becoming real,” he said. “As always, there are many fewer questions about bull markets than bear markets.”

Collective second-quarter earnings for the index are forecast to rise 5.9% from last year to around $529 billion, according to LSEG data, but that growth rate is only around half of the 10% gain the benchmark has recorded since the end of March.

Nearly half of the benchmark’s 11 subsectors, meanwhile, aren’t expected to see any earnings growth at all. Of the six sectors that will generate higher profits, around 82% of the increase will come from just two: communications services and information technology.

LSEG data point to earnings growth of 8.5% for the year. That implies that stocks are valued at 23.4 times earnings, compared with their current 22.8 times, even though that 8.5% is well below the 14% increase in profits expected at the start of the year.

And investors don’t seem to be demanding much extra return regardless of the risk implied by those high valuations. Calculations from WisdomTree indicate the so-called equity risk premium—the extra return investors can get by being in stocks rather than safe Treasury debt—is just 2.4 percentage points, the lowest since the early 2000s.

Measures of volatility are near the lowest levels of the year. The Cboe Group’s VIX index, priced at 16.62, suggests traders expect daily swings of around 65 points for the S&P 500 over July. That compares to a peak of around 105 points in early April.

Though Clark Bellin, president and chief investment officer at Bellwether Wealth in Lincoln, Neb., isn’t sure that the market can remain this complacent, he doesn’t see it as a worry.

“While stocks trading at record highs naturally leads many to believe that a pullback is imminent, that’s actually not usually the case, as new highs often beget new highs,” he said. “The positive momentum can continue for some time,” though volatility is always possible.

“The big conundrum facing investors for the second half of 2025 is how to deploy new cash, especially for investors who did not put new money to work during the April market pullback.”

Read the full article HERE.

- The dollar is under siege—from Trump’s Fed pressure to trillion-dollar deficits.

- With DXY testing key support, all eyes now turn to jobs data and Powell’s next move.

- Until then, markets remain stuck between political noise and policy uncertainty.

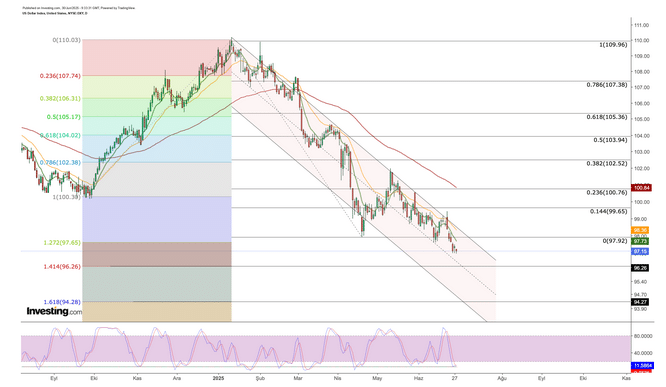

Confidence in the US dollar remains low in global markets. The dollar index (DXY), hovering around 97, is very close to its lowest level in the past three years. Domestic political uncertainties and signals of possible monetary policy intervention have played a key role in this decline. In particular, President Donald Trump’s increasing pressure on the Fed, and his open desire to replace Jerome Powell with a more dovish chair, have raised concerns in the markets about the Fed’s independence.

Political Pressure on the Fed: Monetary Policy Independence Back on the Agenda

Trump’s remarks on Fox News regarding interest rates—stating that the Fed should cut its policy rate to 1–2%—and his explicit wish to replace Powell have increased speculation about a “politically motivated monetary policy.” Reports last week that Trump may soon announce Powell’s successor have added to fears that he could speed up the process. This has brought the Fed’s independence back into question and is seen as a factor contributing to the medium-term structural weakening of the dollar.

Market pricing for the Fed’s next moves is also being shaped by this backdrop. Fed Chair Powell’s remarks in Congress, suggesting a rate cut was on the table if inflation does not rise significantly during the summer, were interpreted by markets as a clear dovish signal. According to market expectations, the probability of a 25 basis point rate cut in September has risen to 91.5%. While some analysts believe the market is pricing in too much, the underlying pressures on the dollar remain intact.

Trump’s Giant Budget Deficit Plan Also Challenges the Dollar

Another major factor undermining the dollar’s strength is concern over the Trump administration’s economic policies. The Congressional Budget Office (CBO) estimates that Trump’s $4.2 trillion tax cut and spending package—recently passed by the Senate—could widen the budget deficit by $3.3 trillion between 2025 and 2034. This could strain the U.S. debt outlook and weigh on the dollar’s long-term status as a reserve currency.

Trump’s aggressive rhetoric toward Iran and renewed trade tensions with Canada over the digital services tax are also dampening global risk appetite and reducing demand for the dollar. Although Canada has since reversed the tax and resumed talks with the U.S. and China, the threat of new tariffs after July 9 is reintroducing market anxiety.

On the macroeconomic side, May core PCE data in the U.S. came in above expectations at 2.7% year-over-year. This triggered a rise in bond yields but still indicated that inflation expectations remain anchored. The decline in University of Michigan inflation expectations supports this view.

However, the key data point this week will be the nonfarm payrolls report. If a labor market slowdown materializes as expected, the Fed may move more quickly toward a rate cut. If not, the optimism surrounding dovish expectations could fade. As such, data flow may lead to increased volatility this week.

XY Technical Outlook: Monitoring Critical Support Zone

The dollar index has recently fallen as low as 97, breaking below the support level at the Fib 1.272 extension—around 97.65—amid recent declines. This marks a move into the Fibonacci expansion zone from a technical standpoint.

The next support level in the DXY, which continues to move within a descending channel, stands at 96.25. If the intermediate support at the 97 level fails during the week’s volatility, we may see the index drop toward the 96 region. Conversely, if the 97 level holds, then 97.65 becomes the next immediate resistance. A break above that could trigger a move toward 98. Such a move would also represent an upward breakout from the descending channel. Should the DXY remain above 98 during the week on any rebound, this could establish a neutral outlook in the 98–100 band going forward. However, current developments suggest continued weakness in the dollar is more likely for now.

Trump’s strong criticism of the Fed, aggressive fiscal policies that widen the budget deficit, and lingering trade uncertainties continue to weigh on the dollar in both structural and short-term contexts. Expectations for a rate cut by September remain high and will likely support further downward pressure on the DXY. In the coming period, employment data, inflation readings, and Trump’s statements following July 9 will remain key drivers of the dollar index. In conclusion, while the DXY remains under pressure in the short term, Fed policy and macroeconomic data will play a decisive role in determining its medium-term direction.

Read the full article HERE.

- Federal Reserve Bank of Minneapolis President Neel Kashkari sees two interest-rate cuts as likely this year, with the first potentially in September.

- Kashkari warns that tariffs could have a delayed impact on inflation and policymakers should remain flexible.

- Kashkari praises the economy’s resilience in the face of higher-than-expected tariff announcements in April and notes that the labor market has “cooled gently.”

Federal Reserve Bank of Minneapolis President Neel Kashkari said he sees two interest-rate cuts as likely this year — with the first potentially in September — but warned that tariffs could have a delayed impact on inflation and policymakers should remain flexible.

“While we gather more evidence on the true tariff shock affecting the economy, I believe we should put more emphasis on the actual inflation and real economic data that we are seeing without committing to an easing policy path in case the effects of tariffs are merely delayed,” Kashkari wrote in an essay published Friday on his bank’s website.

Kashari said he has left his rate projections for 2025 unchanged since December. At that point, Fed policymakers had delivered a full percentage point of cuts, all in the final four months of the year, as price pressures cooled and the labor market showed signs of weakness. He expected just two cuts then because he was unsure inflation would continue to fall in this year, he wrote.

He kept that projection in March amid heightened tariff uncertainty and little further progress on inflation. Now, though there hasn’t been much evidence of a hit to prices from tariffs, he worries that may still materialize later this year.

Kashkari said his forecast for two rate cuts implies the first would come in September.

Fed officials left rates unchanged when they met last week. Since then, two Fed governors, Christopher Waller and Michelle Bowman, have signaled they might back lowering rates as early as next month. But most policymakers who spoke this week, including Kashkari, made clear they aren’t seriously considering a move in July.

President Donald Trump has repeatedly lashed out at Federal Reserve Chair Jerome Powell over over the bank’s position to hold interest rates steady.

In the essay, the Minneapolis Fed chief also said that the US central bank shouldn’t be bound to a particular policy path even if it resumes lowering rates in September.

“If the data called for it, we could hold the policy rate at the new level until we gained greater confidence that inflation was headed back to our target,” Kashkari wrote.

Kashkari praised the economy’s resilience in the face of higher-than-expected tariff announcements in April and said the labor market has “cooled gently.”

He said business leaders he’s spoken with have expressed a reluctance to pass tariff costs on to customers, but that if trade deals aren’t struck and tariff rates remain high, they might have to do so. Kashkari also pointed to the time required to ship goods to the US from Asia as another reason the tariff effect may materialize later.

Read the full article HERE.