As recession fears reverberate from Washington to Wall Street, Wednesday will bring the most comprehensive yardstick yet of the health of the U.S. economy when the government releases the first estimate of the country’s gross domestic product over the first three months of 2025.

Key Facts

The Bureau of Economic Analysis will release its estimate of first-quarter gross domestic product (GDP) at 8:30 a.m. EDT Wednesday here.

Consensus economist forecasts peg last quarter’s real GDP growth at a quarter-over-quarter, seasonally adjusted annual rate of 0.4%, according to Dow Jones data, a stark decrease from the prior period’s 2.4% expansion.

That would be the weakest economic growth for the U.S. since 2022’s second quarter.

Data from sources following underlying measures of economic activity suggest Wednesday’s GDP reading could be even worse than that.

The Atlanta Federal Reserve’s GDPNow model calls for -0.4% GDP during Q1 when excluding gold imports and exports, while Goldman Sachs’ tracker indicates a 0.2% contraction.

The U.S. has not had a quarter of economic contraction since Q1 2022, when GDP contracted by 1%.

Surprising Fact

Negative GDP growth is rare for the U.S., occurring just three times over the last decade: 2020’s first two quarters as the COVID-19 pandemic ground the global economy to a halt, including a record 28% GDP contraction during the second quarter, and Q1 2022, when the Fed enacted its first interest rate hike in more than three years as inflation soared to a multidecade high.

Will Gdp Indicate We Are In A Recession?

If Wednesday reveals subzero GDP growth, the U.S. will be one step closer to entering a recession, at least by one definition. A technical recession occurs when economic output contracts over consecutive quarters, meaning a negative reading during the second quarter would indicate such a downturn. The National Bureau of Economic Research defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months,” meaning consecutive quarters of slightly negative GDP growth may not officially trigger a recession. Some trusted observers of the economy believe the U.S. could already be on the cusp of a recession, such as BlackRock CEO Larry Fink, while major banks largely view it as a tossup whether or not the U.S. enters such a downturn, including the U.S.’ largest bank JPMorgan Chase, whose economists forecast a 60% chance of a recession this year.

Key Background

The GDP reading comes as economists debate the growing disconnect between “hard” and “soft” economic metrics. Hard data such as job growth and retail sales indicate a steady economy while survey-based measures reveal Americans’ faith in the economy has dropped precipitously, as the University of Michigan’s consumer sentiment poll revealed the weakest sentiment since July 2022. The disconnect comes as Trump has pursued the most aggressive tariffs since before World War I during the early stages of his second term. The ever-changing nature of Trump’s trade stances have also complicated analysis of the regularly scheduled updates on the U.S. economy. For example, this week’s GDP reading includes data through March 31 – two days before Trump’s “Liberation Day” tariff announcement which triggered historic stock market losses, and nine days before Trump backpedaled on many of his most aggressive country-by-country import taxes.

Crucial Quote

“Tariffs function like a tax hike, tighten financial conditions, and increase uncertainty for businesses,” Goldman economists led by David Mericle wrote in a Sunday note to clients, explaining how the levies weigh on GDP growth.

Read the full article HERE.

The waiting is the hardest part.

Whether it’s waiting for a delayed flight, to find out if we got that new job, or to see if we won the lottery, long periods of uncertainty are difficult to indulge. There’s a desire to do something—have a stiff drink, send one too many follow-ups, or spend money we don’t have—to make time go faster and to tamp down the anxiety that comes when faced with the unknown. The stock market finds itself in that position now, waiting to see whether President Donald Trump’s tariff policy will cause a recession or whether the U.S. can still emerge relatively unscathed.

Thankfully, the near certainty of doom that seemed apparent just a couple of weeks ago has faded after Trump blinked on tariffs. After gaining 4.6% this past week, the S&P 500 index has now climbed 11% from its April 8 closing low, and the temptation is to consider the worst over.

Resist that temptation. Sure, it’s easy to imagine a bull case—even a long-term one. The president, who this past week said tariffs on China will “come down substantially,” has bought himself time to work out one-on-one deals with countries around the globe, and just one deal, any deal, could cause markets to jump. His dealmaking could also push other countries to strike deals with one another. The result could be a world that hasn’t deglobalized but just reordered itself, as Jawad Mian writes in his Stray Reflections newsletter.

Adding to the case for upside, tech stocks finally showed signs of life this past week— ServiceNow jumped 21%, Texas Instruments gained more than 9%, and even Alphabet rose 7.7%, helped by its own results —good news given the underperformance of the Magnificent Seven since the DeepSeek selloff began near the end of January.

Yet the bear case seems just as reasonable. While Trump has dialed back the tariff rhetoric, the next Truth Social post could send stocks lower. And investors are still waiting to see what damage has already been done by the will-he-or-won’t-he nature of trade policy. The hard data have held up well because the penalties haven’t started yet, and that will probably be true for first-quarter gross domestic product, to be released on April 30, and April’s payrolls report on May 2. That has investors eyeing May’s or June’s results for the first sense of the damage done.

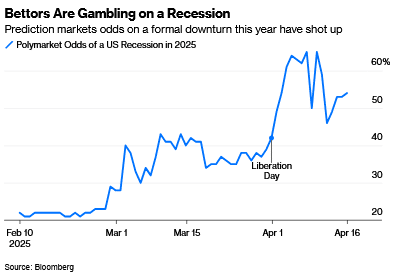

It could go either way. Polymarket puts the chances of a U.S. recession at 55%, and that seems about right, which means picking a direction, either direction, is probably no better than a coin flip. “In the very short term, the equity pain trade likely remains to the upside as the market pre-positions on tariff de-escalation,” writes J.P. Morgan strategist Dubravko Lakos-Bujas. “However, as the summer approaches, we could start to see some softness in activity due to aggressive tariff-related front-loading, lagged effects of other policies, and lower business investment activity.”

Read the full article HERE.

For centuries, gold has been the go-to haven asset in times of political and economic uncertainty. Its status as a reliably high-value commodity that can be transported easily and sold anywhere offers a sense of safety when everything else is in turmoil.

Not everyone’s a fan. Famed investor Warren Buffett has called the precious metal a “sterile” asset, telling Berkshire Hathaway Inc. shareholders in a 2011 letter that “if you own one ounce of gold for an eternity, you will still own one ounce at its end.”

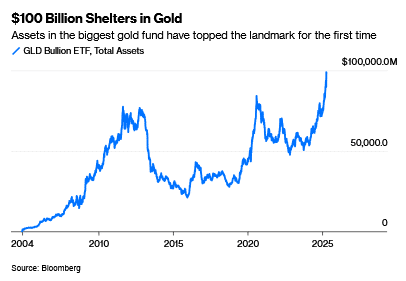

Nonetheless, investors have sought refuge in bullion as the trade and geopolitical agendas of US President Donald Trump send equities, bonds and currencies swinging. They’ve piled into gold-backed exchange-traded funds, with inflows reaching $21 billion in the first quarter, according to the World Gold Council, the highest level since the Covid-19 pandemic.

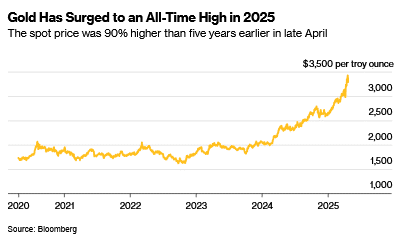

The rush to gold has pushed the spot price to a series of record highs, topping $3,500 in mid-April and extending a ferocious run from last year. The yellow metal has thus far outperformed nearly every other major asset class in 2025.

Demand in China — the top bullion producer and consumer — has been one of the key drivers of gold’s ascent, propelled by concerns about the punitive tariffs Trump has placed on US imports of goods from its largest trading partner.

Gold has a track record of increasing in value in times of market stress. It’s also seen as a hedge against inflation, when the purchasing power of currencies is eroded. Inflation worries are front of mind for many right now as the new duties Trump has imposed on imports into the US, as well as the retaliatory levies introduced by other countries, risk increasing prices across the global economy.

The safe-haven status of gold has been elevated as Trump’s trade agenda shakes confidence in other typical shelters from market gyrations — namely the US dollar and government bonds — and threatens to end the idea of American exceptionalism.

Gold has historically been negatively correlated with the dollar. Because bullion is priced in dollars, when the greenback weakens, gold becomes cheaper for holders of other currencies. In mid-April, the dollar was at a three-year low against other major currencies.

Beyond market movements, owning gold is deeply rooted in Indian and Chinese cultures — two of the world’s largest markets for the metal — where jewelry, bars and other forms of bullion are passed down through generations as a symbol of prosperity and security. Indian households own about 25,000 metric tons of gold, more than five times what’s stored in the US depository at Fort Knox.

They’re famously sensitive to prices, but when gold’s appeal to investors in financial markets starts to fade, physical buyers of jewelry and bars often step in to grab a bargain, putting a floor under prices in the process.

Is it just trade war fears pushing up the gold price?

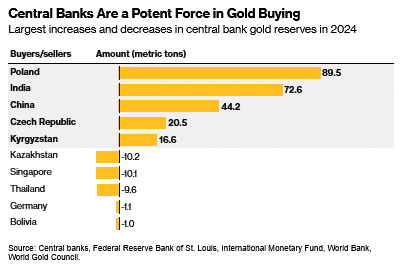

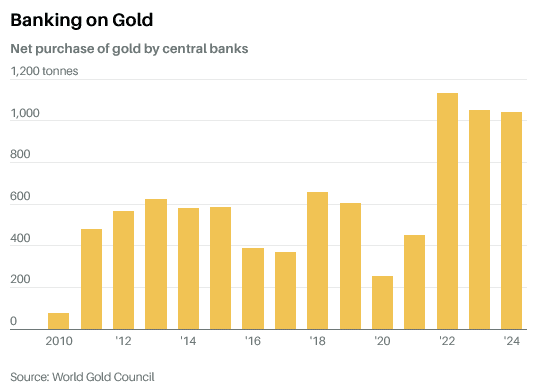

The metal’s blistering price rally since the start of 2024 was partly driven by huge purchases by central banks, particularly in emerging markets as they seek to reduce their dependency on the US dollar, the world’s primary reserve currency. Gold helps diversify a country’s foreign exchange reserves and guard against currency depreciation.

Central banks have been net buyers of gold for the past 15 years, but the speed of their purchases doubled in the wake of Russia’s invasion of Ukraine. As the US and its allies froze Russian central bank funds held in their countries, it underscored how foreign currency assets are vulnerable to sanctions.

In 2024, central banks bought more than 1,000 tons of bullion for the third year in a row, according to the World Gold Council, and they hold around a fifth of all the gold that’s ever been mined.

The sustained enthusiasm of central banks spurred Goldman Sachs Group Inc. to raise its year-end forecast for the gold price to $3,700 per ounce in April. It anticipates that $4,000 could be reached by the middle of next year.

What could halt gold’s rally?

Following a nearly uninterrupted upward march in the gold price since early last year, there could eventually be some consolidation as investors banks their gains. A major de-escalation of Trump’s tariffs and a peace deal between Russia and Ukraine could also spur a price decline.

But central banks have been the most important pillar of support for gold’s bullish momentum, meaning they have the power to do the most damage if they trim their reserves.

There’s no indication any large holder is considering this. The central banks of developed economies have sold very little gold in recent decades compared to the 1990s, when persistent sales sent bullion prices down by more than a quarter over the decade. Amid concerns that those uncoordinated sales were destabilizing the market, the first Central Bank Gold Agreement was struck in 1999, under which signatories agreed to limit their collective sales of bullion.

Does gold being a physical asset cause any issues for investors?

Owning gold typically isn’t free. Because it’s a physical object, holders have to pay for storage, security and insurance.

Investors buying gold bars and coins will usually pay a premium over the spot price. There can be geographic price differentials too and traders take advantage of these arbitrage opportunities.

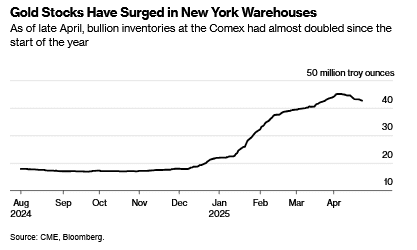

That’s what happened earlier this year when fears that Trump could introduce tariffs on bullion imports pushed gold futures on New York’s Comex significantly above spot prices in London. There was a worldwide dash among those in possession of the physical metal to shift it to the US to capture the large premium and potentially hundreds of millions of dollars in profit.

Gold is usually relatively simple to shift, stashed away in the cargo holds of commercial aircraft, unbeknown to the holiday and business travelers in the cabin above. But it’s not as straightforward as loading up a jet from Heathrow Airport to JFK thanks to a quirk in the global gold market: different size requirements. In London, 400-ounce bars are the standard, while for Comex contracts, traders must deliver 100-ounce or 1-kilogram bars.

That means bullion being sent to Comex warehouses has to first go to refiners in Switzerland to be melted down and recast to the correct dimensions, before journeying on to the US. This creates a bottleneck when there’s a particular rush to rejig the location of bullion stocks.

Read the full article HERE.

The efforts by President Donald Trump and his administration to reshape the global economy will likely damage the economy and financial assets, according to hedge fund giant Bridgewater Associates.

Co-CIOs Bob Prince, Greg Jensen, Karen Karniol-Tambour said in a newsletter Wednesday that the world is undergoing a “rapid shift to modern mercantilism” that could have a negative outcome for the economy.

“We expect a policy-induced slowdown, with rising probability of a recession,” the CIOs wrote.

The Bridgewater commentary comes as the stock market has already been rocked by Trump’s tariff policies. The S&P 500 is down 8.3% year to date and 5.2% since the April 2 rollout of Trump’s so-called reciprocal tariffs. Many of those levies have since been paused, but tensions have escalated between the U.S. and China.

Outside of the stock market, U.S. bonds and the dollar have also declined in recent weeks. Some Wall Street experts have suggested that the widespread decline could be a sign that foreign investors are backing away from the U.S. in the Trump era.

Bridgewater hinted at this idea in the newsletter, saying that the policy changes create “exceptional risks to US assets, which are dependent on foreign inflows.”

The combination of an economic slowdown and a shift away from the U.S. could unwind a lot of the conventional wisdom of investing from over the past decade, when America financial assets and economic growth broadly outperformed other major countries.

“This shift in asset allocations has created risks if the future is different than the past. Many portfolios are increasingly vulnerable to 1) any weakness in growth, 2) central banks not being able to ease into problems, 3) equity underperformance, and 4) US underperformance relative to the rest of the world,” the newsletter said.

Bridgewater, which was founded by Ray Dalio in 1975, reported having $92.1 billion in client assets as of Dec. 31.

Read the full article HERE.

Stocks are on the rebound Tuesday, bouncing back from another miserable day on Wall Street. But American financial markets are sounding all sorts of alarm bells that one day in the green can hardly overcome.

That’s because investors have been sending a clear message: President Donald Trump’s trade war is making America an unsafe place to invest.

We know this by looking at the broader markets and the assets that traders are buying and – let’s face it – mostly selling.

US stocks

Trump’s stock market is throwing off some jaw-dropping statistics. How extraordinary? We’re now making comparisons to the Great Depression.

The Dow Jones Industrial Average has tumbled 9.1% in the first three weeks of April, the 129-year-old index’s worst performance for any April since 1932. The only other April that was worse: April 1931.

The broader S&P 500 has plunged 14% over the course of Trump’s first term – the worst performance through April 21 for any president since records began in 1928, according to Bespoke Investments.

Even with a modest rebound on Tuesday – major indexes rose over 2% each – Trump has a long way to bounce back to avoid history. The next-worst start to a term for the US stock market in the first 63 days of trading was under former President Franklin Roosevelt in 1941, with a decline of just over 9%.

Dollar

Meanwhile, traders have given up on the US dollar. During Trump’s new term, the US dollar has fallen 5.5%, by far the record dating back to when data started being collected during former President Gerald Ford’s term beginning in 1974. The only other presidential term for which the dollar started off even remotely close to this abysmal a start: Trump, during his first term, when the dollar fell 3% in the first 63 days of trading.

The dollar hit a three-year low Monday.

Bonds

Typically, when investors get nervous, they pour money into the perceived safety of American Treasury bonds – historically the safe-haven assets to rule all safe-havens. But not this time: Government bond have sold off sharply. Yields, which trade in opposite direction to prices, have surged.

The 10-year US Treasury yield has risen to 4.4% just a month after it plunged below 4%. Bonds don’t usually swing that quickly.

Foreign stocks

As traders have pulled money out of American stocks and bonds, they’ve been pouring money into investments around the rest of the world. The MSCI All World index, excluding the United States, has risen 2.9% over the course of Trump’s new term. That’s roughly on par with the start to former President Joe Biden’s term and only slightly below Trump’s first term – two periods when US stocks were also booming.

Oil

Fearful of a global recession, traders have sold off oil dramatically, giving US crude its worst start to any presidential administration since former President Bill Clinton’s second term, according to Bespoke. Oil has fallen 19% during Trump’s second term as traders worry that demand for travel and shipping will tumble. Oil fell nearly 24% during in the first few months of 1997, as Clinton started his second term.

Gold

Meanwhile, investors are looking for secure places to park their money. Among the best-performing assets is gold, which surged again Tuesday above $3,500 an ounce, hitting yet another record.

Gold has skyrocketed nearly 25% during Trump’s new term, absolutely crushing the pervious record of 13.5% during former President Jimmy Carter’s start to his term in 1977. No other president in the early days of their administrations has come close to matching Trump’s recent gold boom.

What’s going on?

Trump’s trade war is sending the global economy into shock, the International Monetary Fund reported Tuesday.

“We are entering a new era as the global economic system that has operated for the last 80 years is being reset,” the IMF said in an alarming new report Tuesday that predicted rapidly slowing economic growth – particularly in the United States – while inflation is set to reignite.

That potentially disastrous combination of slowing growth and rising inflation is difficult to overcome. Although economists don’t yet expect anything close to the so-called stagflation of the 1970s, the rapid reordering of global trade dynamics is causing tremendous confusion and unease among consumers, businesses and traders.

“The April 2 Rose Garden announcement forced us to jettison our projections,” the IMF noted, referring to Trump’s “Liberation Day” tariff announcement in which he imposed 10% across-the-board tariffs and announced punishing “reciprocal” tariffs on dozens of countries that have since been paused for 90 days.

Goldman Sachs CEO David Solomon on CNBC Tuesday noted that the confusion around Trump’s ever-changing policy has hurt business’ ability to make necessary adjustments.

“The level of uncertainty is too high. It’s not productive,” he said. “It will have an effect on the growth of the economy, and we will see that, in my opinion, relatively quickly.”

Read the full article HERE.

Gold is on a historic run, fueled by uncertainty and buying by central banks and individuals. How it fits in a portfolio.

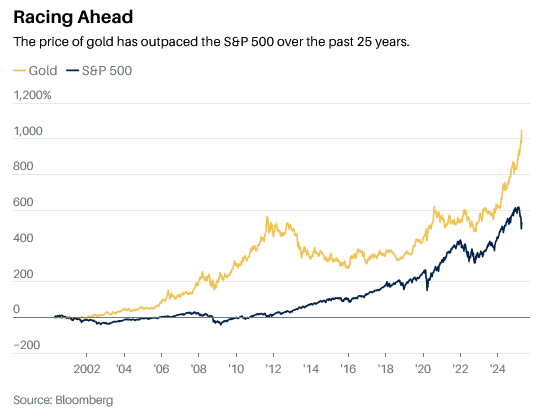

Give gold bugs their due. The yellow metal has been a light in the investing darkness. At a recent $3,406 per troy ounce, it’s up 30% this year, to the envy of stock, bond, and Bitcoin holders. Cash-flow purists will call this a flash in the pan, but they should look again. Over the past 20 years, SPDR Gold SharesGLD+0.13%, an exchange-traded fund, has surged 630%—85 points more than SPDR S&P 500, which tracks shares of the biggest U.S. companies.

That isn’t supposed to happen. If businesses couldn’t be expected to outperform an unthinking metal over decades, shareholders would demand that they cease operations and hoard bullion instead. So, what’s going on? If this were gasoline or Nike shoes or Nvidia chips, we would look to supply versus demand. With immutable gold, nearly every ounce that has ever been found is still around somewhere, so price action is mostly about demand. That has been ravenous and broad since 2022.

That year, the U.S. and dozens of allies placed sweeping sanctions on Russia, including its largest banks, and China went on a bullion spree. Its buying has since cooled, but other central banks have stepped in. Perhaps this is unsurprising, in light of a decadeslong diversification by finance ministers away from the U.S. dollar, which is down to 57% of foreign reserves from over 70% in 2000. But the recent uptick in gold stockpiling looks to JPMorgan Chase, the world’s largest bullion dealer, like a debasement trade. Investors are nervous about President Donald Trump’s tariffs, his browbeating of the Federal Reserve Chairman over interest rates, and blowout U.S. deficits.

Surging Demand

It isn’t just bankers. Demand among individuals for gold bars and coins has been surging, with some dealers experiencing sporadic shortages. Gold ETFs were bucking the trend, but flows there have turned solidly positive since last summer, including recently in China. All told, there is now an estimated $4 trillion worth of gold held by central banks, and $5 trillion by private investors. Calculated against $260 trillion for all financial assets, including stocks, bonds, cash, and alternatives, that works out to a global gold portfolio allocation of 3.5%, a record.

What’s next? BofA Securities says that central banks have room for much more gold buying, and that China’s insurance companies are likely to dabble, too. RBC Capital Markets analyst Chris Louney says ETFs could drive demand growth from here, especially if angst reigns. “Gold is that asset of last resort…the part of the investing universe that investors really look for when they have a lot of questions elsewhere,” he says.

Russ Koesterich, a portfolio manager for BlackRock, a major player in ETFs including the iShares Gold Trust

says that gold has proven itself as a store of value, and deserves a 2% to 4% weighting for most investors. “I think it’s a tough call to say, ‘Would you chase it here?’ ” he says. “There have been some pullbacks. Those might represent a good opportunity, particularly for people who don’t have any exposure.”

Daniel Major, who covers materials stocks for UBS, points out that gold miners mostly haven’t wrapped themselves in glory in recent years with their dealmaking and asset management. As a result, a major index for the group is trading 30% below pre-Covid levels relative to earnings. UBS increased its 2026 gold price target by 23%, to $3,500 per troy ounce, before gold’s latest lurch higher. Many miners are producing at a cost of $1,200 to $2,000. Major has bumped up earnings estimates across his coverage. “I think we’re gonna see further upward revisions to consensus earnings,” he says. “This is what’s attractive about the gold space right now.”

Major’s favorite gold stocks are Barrick Gold, Newmont, and Endeavour Mining. More on those in a moment. We also have thoughts on how not to buy gold—and what not to expect it to do: Don’t count on it to keep beating stocks long term, or to provide precise short-term protection from inflation spikes and stock swoons. But first, a little history, chemistry, and rules of the yellow brick road.

Flesh of the Gods

The first gold coins of reliable weight and purity featured a lion and bull stamped on the face, and were minted at the order of King Croesus of Lydia, in modern-day Turkey, around 550 BC. But by then, gold had been used as a show of riches for thousands of years. Ancient Egyptians called gold the flesh of the gods, and laid the boy King Tutankhamun to rest in a gold coffin weighing 243 pounds. The Old Testament says that under King Solomon, gold in Jerusalem was as common as stone. Allow for literary license; silicon, an element in most stones, is 28.2% of the Earth’s crust, whereas gold is 0.0000004%.

Marco Polo described palace walls in China covered with gold. Mansa Musa I of Mali in West Africa, on a pilgrimage to Mecca in 1324, is said to have splashed so much gold around Cairo on the way that he crashed the local price by 20%, and it took 12 years to recover. To Montezuma, the Aztec king whose gold lured Cortés from Spain, the metal was called, as it still is by some in Central Mexico, teocuitlatl —literally, god excrement. Golden eras, gold medals, the Golden Rule, and golden calf—so deep is the historical association between gold and wealth, excellence, and vice that it seems to have a mystical hold on humanity. In fact, it’s more a matter of chemical inevitability.

Trade and savings are easier with money. Pick one for the job from the 118 known elements. Years ago on National Public Radio, Columbia University chemist Sanat Kumar used a process of elimination. Best to avoid elements that are cumbersome gases or liquids at room temperature. Stay away from the highly reactive columns I and II on the periodic table—we can’t have lithium ducats bursting into flame. Money should be rare, unlike zinc, which pennies are made from, but not too rare, unlike iridium, used for aircraft spark plugs. It shouldn’t be poisonous like arsenic or radioactive like radium—that rules out more elements than you might think. Of the handful that are left, eliminate any that weren’t discovered until recent centuries, or whose melting points were too high for early furnaces.

That leaves silver and gold. Silver tarnishes, but rarer, noble gold holds its luster. It is malleable enough to pound into sheets so thin that light will shine through. And, despite the best efforts of Isaac Newton and other would-be alchemists, it cannot be artificially created—profitably, anyhow. Technically, there is something called nuclear transmutation. If you can free a proton from mercury’s nucleus or insert one into platinum’s, you’ll end up with a nucleus with 79 protons, and that’s gold. Scientists did just that more than 80 years ago using mercury and a particle accelerator. But what little gold they produced was radioactive. If you think you can do better, you’ll likely need a nuclear reactor to prove it, but a large gold mine is one-fifth the cost, and we have to believe the permitting is easier.

We passed over copper due to commonness, but it has become too valuable to use for pennies. The 95% copper content of a pre-1982 penny is worth about 3 cents today. The equivalent amount of silver goes for $3.10, and gold, more than $320. But the three trade in different units. A pound of copper is up 17% this year, at $4.72. Silver and gold are typically quoted per troy ounce, a measure of hazy origin and clear tediousness, which is 9.7% heavier than a regular ounce. A troy ounce of silver is $32.70, up 13% this year.

Some Finer Points

Confused? This won’t help: The purity of investment gold, called its fineness, is measured in either parts per thousand, or on a 24-point karat scale. A karat is different from a carat, the gemstone weight, but our friends in the U.K.—who adopted troy ounces in the 15th century—often spell both words with a ‘c’. Gold bricks like the ones central banks swap are called Good Delivery bars, and weigh 400 troy ounces, give or take, worth more than $1.3 million. If you buy a few, lift with your legs; each weighs a little over 27 regular pounds (as opposed to troy pounds, which, it pains us to note, are 12 troy ounces, not 16).

There are many options for smaller players, like Canadian Maple Leaf coins, which are 24-karat gold; South African Krugerrands, at 22 karats, and alloyed with copper for durability; and Gold American Eagles, 22 karats, with some silver and copper. Proof coins cost extra for their high polish, artistry, and limited runs, and may or may not become collectibles. Humbler-looking bullion coins are bought for their metal value. Prefer the latter if you aren’t a coin hobbyist. Avoid infomercials and stick with high-volume dealers. Even so, markups of 2% to 4% are common. Costco Wholesale, which sells gold in single troy ounce Swiss bars, charges 2%, but often runs out, and limits purchases to two bars per member a day. Factor in the cost of storage and insurance, too.

ETFs are more economical. For example, iShares Gold Trust costs 0.25%, not counting commissions. For long-term holders, as opposed to traders, there is a smaller fund called iShares Gold Trust Micro, which costs 0.09%.

Resist fleeing stocks for gold. The surprisingly long outperformance of gold is mostly a function of its recent run-up. From 1975 through last year, gold turned $1 invested into about $16, versus $348 for U.S. stocks. That starting point has a legal basis. President Franklin Roosevelt largely outlawed private gold ownership in 1933; President Richard Nixon delinked the dollar from gold in 1971; and President Gerald Ford made private ownership legal again at the end of 1974.

Gold has been a so-so inflation hedge over the past half-century, and at times a disappointing one. In 2022, when U.S. inflation peaked at a 40-year high of over 9%, the gold price went nowhere. The problem is that high inflation can prompt a sharp increase in interest rates. “If people can clip a 5% coupon on a T-bill, often they’d prefer to do that than have either a lump of metal or an ETF that doesn’t produce cash flow,” says BlackRock’s Koesterich.

Likewise, while gold has generally offset stock declines this year, it hasn’t always done so in the heat of the moment. Recall tariff “liberation day” early this month, which sent U.S. stocks down close to 11% in three days, and pulled gold down nearly 5%, too. “This isn’t an uncommon scenario,” says RBC’s Louney. “When investors were losing elsewhere in their portfolio, gold was sold as well to cover those losses.”

Our top tip on how gold behaves is this: It doesn’t. People do the behaving, and they are appallingly unreliable. Use bonds as a stock market hedge. If they don’t work, fall back to patience. For inflation protection, think of assets that are a better match than gold for the goods and services that you buy every week. A diversified commodities fund has precious metals but also industrial ones, along with energy and grains. Treasury inflation-protected securities are explicitly linked to the consumer price index, which measures inflation for a theoretical individual whose buying patterns differ from your own, but are close enough.

Own a house. Stick with a workaday, reliable car. Yes, cars deteriorate. But so does nearly everything on a long enough timeline. Rely mostly on stocks, which represent businesses, which wouldn’t endure if they couldn’t turn raw inputs like commodities into something more profitable. There’s even a miner, Newmont, in the S&P 500.

The Case for Mining Stocks

Speaking of which, UBS’ Major recently upgraded both Canada’s Barrick and Denver-based Newmont from Neutral to Buy. “Both very much fall into that category of having a challenging recent track record,” he says. Newmont has lost 20% over the past three years while gold has gained 76%, which Major blames on difficult acquisitions and earnings shortfalls. Barrick, down 8%, has been in a dispute with Mali since 2023, when its government instituted a new mining code that gives it a greater share of profits. In recent days, authorities have shut the company’s offices in the capital city of Bamako over alleged nonpayment of taxes.

These are the sort of headaches that Krugerrands in a safe don’t produce. But Major calls expectations “adequately reset,” free cash flow attractive, and guidance achievable. Newmont, at 13 times next year’s earnings consensus, is selling assets, and Barrick, at 10 times, has healthy production growth.

Major also likes London-based, Toronto-listed Endeavour Mining, up 40% over the past three years and trading at nine times earnings, although he says it has “higher jurisdictional risk.” It is focused on West Africa, especially Burkina Faso, which had a coup d’état in 2022. You’d think the stock would be doing worse amid such political upheaval. Then again, Burkina Faso since 1966 has had eight coups, five coup attempts, and one street ousting of a president who tried to change the constitution to remain in power. That works out to an uprising every four years, on average.

Montezuma’s scatological name for gold might have been prescient, considering the sometimes-odious consequences for small countries that find it.

Read the full article HERE.

Gold rallied to a record as a fresh bout of US dollar weakness, criticism of the Federal Reserve by President Donald Trump and persistent trade war concerns underpinned haven demand.

Bullion roared above $3,400 an ounce, as the US currency fell to the lowest since late 2023. Trump has contemplated firing Fed Chair Jerome Powell, while making the case for lower interest rates. Fed Bank of Chicago President Austan Goolsbee warned against efforts to curtail the monetary authority’s independence.

“Firing Powell not only undermines the principle of central-bank independence, but risks politicizing US monetary policy in a way that markets will find unsettling,” said Christopher Wong, a strategist at Oversea-Chinese Banking Corp. If the Fed’s credibility is called into question, that could erode confidence in the dollar and accelerate flows into havens, including gold, he said.

The precious metal has soared to successive records this year as the trade conflict has unsettled markets, hurting appetite for risk assets, while accelerating a rush to havens. Holdings in bullion-backed exchange-traded funds have risen for the past 12 weeks, the longest run since 2022. Central banks have also been adding the metal to their reserves, underpinning robust worldwide demand.

On the trade front, China warned nations against striking deals with the US at the expense of Beijing’s interests. Data due this week — including revised forecasts from the International Monetary Fund — may reinforce concerns about a global slowdown.

Banks have become progressively more positive about gold’s prospects as this year’s rally has gone from strength to strength. Among them, Goldman Sachs Group Inc. has forecast the metal could hit $4,000 midway through next year.

Spot gold surged as much as 2.2% to touch $3,400.38 an ounce, and traded at $3,399.81 as of 12:40 p.m. in London. The Bloomberg Dollar Spot Index fell 0.8%. Silver reversed an early drop to push 1% higher. Platinum rose, while palladium declined.

Read the full article HERE.

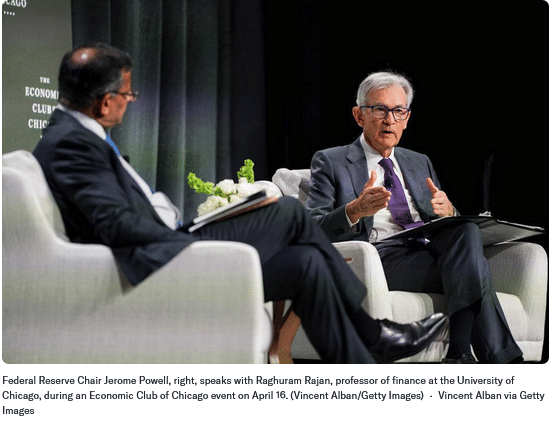

Jerome Powell delivered a clear message to markets this week: I’m not coming to the rescue.

The chair of the Federal Reserve used an appearance at the Economic Club of Chicago to say in no uncertain terms that investors shouldn’t expect changes in interest rates anytime soon or any near-term intervention in the bond market following turmoil triggered by President Trump’s tariffs.

The key moment came on Wednesday when professor Raghuram Rajan of the University of Chicago Booth School of Business asked Powell if there was a “Fed put” in the stock market.

And Powell couldn’t have been more explicit: “I’m going to say no.”

Markets are “struggling with a lot of uncertainty and that means volatility.” But his view is that markets are “are functioning kind of as you would expect them to in a period of high uncertainty.”

That seemed to pour cold water on speculation that the Fed might step in to restore some calm in the bond market if needed.

The speculation ramped up last week as yields on long-term debt soared, prompting predictions the central bank would need to provide some liquidity as investors unwound positions.

Powell said those markets remain “orderly” and chalked up the recent turmoil to “markets processing a historically unique development.” What also helped is that the bond market did settle back down this week, easing the pressure for immediate intervention.

This week Powell also disappointed investors — and a US president — hoping to hear signs he was ready to lower rates as a way of preventing a downturn or cushioning the inflationary effects of new tariffs.

The central bank will “wait for greater clarity” before considering any interest rate adjustments, he said, as he expects Trump’s tariffs to generate higher inflation and slower growth.

Powell predicted a tough decision ahead for the Fed as it weighs both sides of its mandate for stable prices and full employment, saying there is a “strong likelihood” that the economy will be moving away from both of the Fed’s goals for the “balance of the year, or at least not making much progress.”

If anything, Powell went out of his way to hint he may give preference to controlling inflation, noting that without price stability, the Fed cannot achieve a strong job market for a long period. And he made it clear he wasn’t yet sure whether the inflationary effects from tariffs would be temporary or long-lasting.

“Tariffs are highly likely to generate at least a temporary rise in inflation,” he said, but “the inflationary effects could also be more persistent.”

Powell also underscored the Fed’s obligation is to keep long-term inflation expectations well anchored and to prevent a one-time price increase associated with higher tariffs from becoming an ongoing inflation problem.

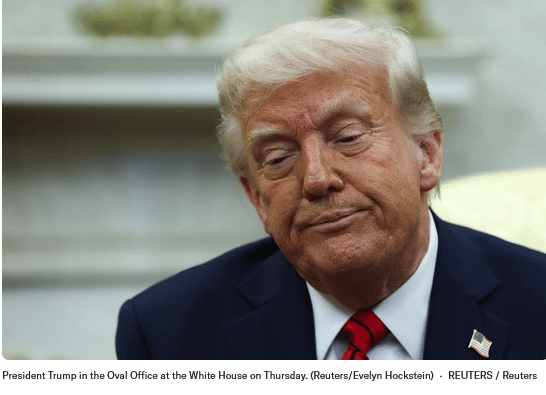

All of this seemingly hit a nerve with the president, who spent much of Thursday lashing out at Powell on social media and during a press event in the Oval Office.

“Powell’s termination cannot come fast enough!” the president wrote on Truth Social. Trump said Powell “is always TOO LATE AND WRONG” and should be cutting interest rates alongside other central banks.

At the White House later on Thursday, Trump reiterated he was “not happy” with Powell and that Powell would leave his position “if I ask him to.”

The Wall Street Journal reported Thursday that Trump has for months privately discussed firing Powell, but he hasn’t made a final decision about whether to try to oust him before his term ends in May 2026.

Powell has shown no signs of blinking. On Wednesday, he again reiterated the independence of his institution and his own job, saying it’s “a matter of law,” and pledged not to act in response to any political pressure.

Read the full article HERE.

US trade policy may create an epic buying opportunity, but much later if there is a downturn.

Recession

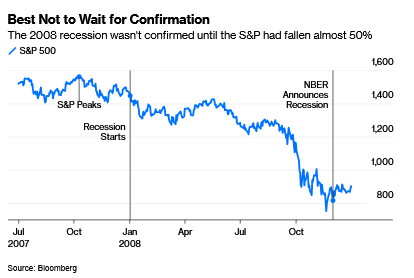

When you think a recession is coming, it generally pays to sell first and ask questions later. Waiting for confirmation that the economy is declining is just too costly. For a spectacular demonstration, look to the events of 2008, when the National Bureau of Economic Research announced that a recession had started in January of that year — but didn’t announce this until December:

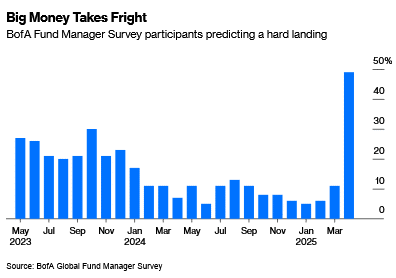

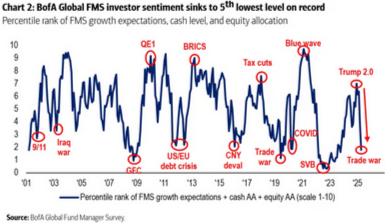

From the start of the recession to the NBER’s acknowledgement, the S&P 500 almost halved. It was better to take a judgment first. That’s why there’s particular interest in the latest survey of global fund managers by Bank of America Corp., the first since the “Liberation Day” tariffs announcement, which showed a dramatic increase in fears of an economic hard landing:

If big fund managers take fright, then their actions can guarantee a market selloff as they move their money to safety. And they’re not the only ones growing much more nervous. Odds of a recession this year have ballooned on the Polymarket betting site, and now stand at more than 50%:

Traditional indicators of market negativity show a similar trend. The total assets of State Street Global Advisors’ GLD exchange-traded fund, the biggest fund for retail investors to buy gold, topped $100 billion for the first time Wednesday, as a rising price and growing interest from small investors combined:

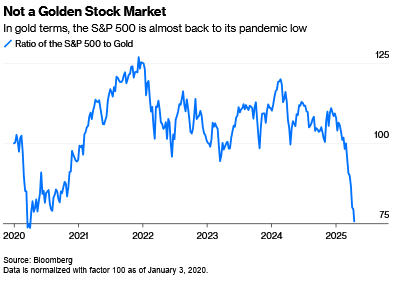

(Parenthetically, the gold rally provides vital context for the stock market. The ratio of the S&P 500 to the gold price, which effectively prices the index in gold rather than dollars, has tanked this year and is almost back to its pandemic-era low. If you choose to view the post-Covid rally as one big side effect of cheap money, this would tend to support you.)

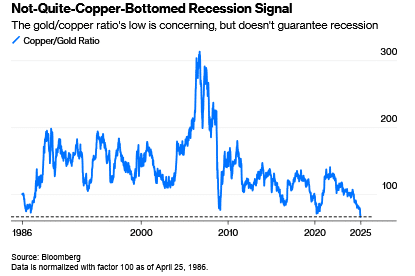

Combining gold with copper provides another alarming recession signal. The former rises when people are worried, while a gain in the latter shows that economic activity is expanding. So when copper drops to its lowest in gold terms in at least 38 years, that’s concerning (although it’s worth noting that the previous low in 1987 didn’t prefigure a recession):

There’s another problem with making a confident recession prediction. Formerly reliable market indicators have been foretelling one for so long without success that it’s getting harder to take them seriously. The New York Fed recession probability indicator is based on the bond yield curve. Over time, an inverted curve, in which long bonds yield less than shorter-term instruments, has been a surefire sign of trouble ahead. But it’s never been more confident of an oncoming recession than it was in 2022, and so far it hasn’t come to pass:

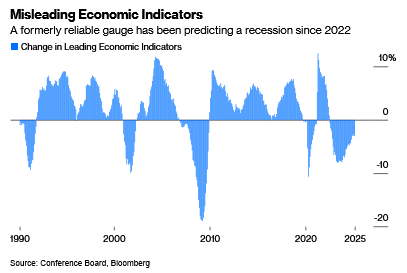

Another virtually foolproof signal comes from the Conference Board’s Leading Economic Indicators, which smooshes together various measures of the economy and market. Just like the yield curve, it successfully predicted the last four recessions, but also a fifth that still hasn’t happened:

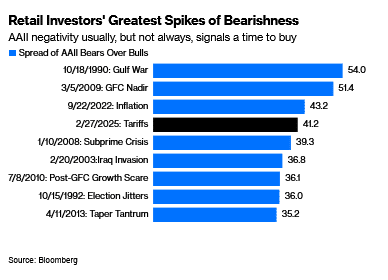

One problem with getting out of the market when everyone is scared of a recession is that this is often a great contrarian time to buy. The American Association of Individual Investors has for decades asked its members a weekly question: Are you bullish or bearish? The recent peak in the majority of bears over bulls makes this the fourth-biggest incidence of bearishness since 1987. Here it is in context:

All were either good or great times to buy, with the significant exception of the angst over subprime bankruptcies in January 2008, when a few months later investors discovered they hadn’t seen nothing yet. Similarly, BofA has a measure of sentiment based on how much cash fund managers are holding, their hopes for growth, and the amount they’ve allocated to equities. With the exception of the response to the 9/11 terrorist attacks in 2001, all the previous times when sentiment dropped this low proved decent times to buy:

A further problem: The recession fears this time around have been driven entirely by a new policy (US tariffs) that might yet be revoked. The chances are that it will create an epic buying opportunity at some point in the future. But that time to buy will come much later if there is a recession. While the uncertainty over tariffs persists, it will be hard to put together a market rally.

Words, Words, Words

It’s conventional wisdom that deeds matter more than words. That buttresses the continuing optimism over trade policy: For all his protectionist invective, Donald Trump has announced delays or retreats on most of his tariffs.

There are exceptions. The Federal Reserve often uses the power of the jawbone and what it says matters a lot. If people react to a warning, the Fed can even have its desired effect without needing to do anything. Because central bankers have to mind their words, mere choice of subject can be most significant.

For a prime example, Fed Chair Jerome Powell triggered a big afternoon selloff by talking frankly — but without saying anything anyone didn’t know — in a discussion at the Economics Club of Chicago. He admitted that there “isn’t a modern experience for how to think about this:”

Our obligation is to keep longer-term inflation expectations well-anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem. We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension

More or less everyone is alive to the risk that tariffs could both raise inflation and lower growth, and hammer both sides of the Fed’s mandate. The fact that Powell said so, however, along with the explicit assertion that higher prices due to tariffs might push up inflation expectations, was a sign that he wouldn’t resort to rate cuts at the first sign of trouble. He might easily have dropped such a hint — and many traders were furious with him for not doing so.

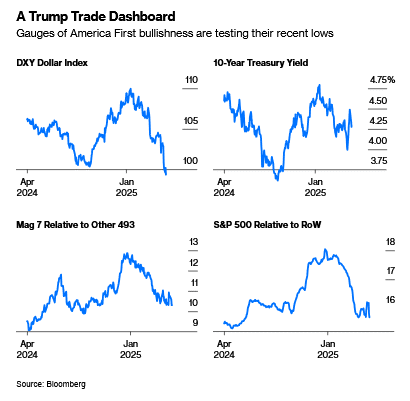

Equities, led by Big Tech, sold off after he spoke, as did the dollar. Amid much excitement, the main elements of US exceptionalism, are back to testing their post-“Liberation Day” lows — but at least Treasury yields are falling again:

Central bankers’ mere words do indeed matter. But do we need to note what politicians are saying? Normally, their deeds matter far more. There have been exceptions of late, however, particularly when coming from the mouth of US Vice-President J.D. Vance.

In February, he made an epochal speech in Munich, lacing in to European leaders to say that they were more threatening than Vladimir Putin’s Russia. Two weeks later, there was his equally famous berating of Ukrainian President Volodymyr Zelenskiy in the Oval Office. Nobody was hurt in these exchanges, but they had consequences.

After the Vance speech, Points of Return was headlined “There’s No Template for the Shock Europe Just Got” and described it as a major geopolitical event. That prompted some pushback from the US. One reader said that the column had taken on a “tilt” and added:

The intransigency of the European state appears to require strong rhetoric to even dent their narrative. They are words, Europe is overdue to act.

That’s a reasonable response, but not to the message that Vance actually delivered. He didn’t read the riot act over defense spending — which would have been reasonable — but made such a wide-ranging attack on Europe and all it stood for that his listeners decided the US could no longer be trusted as an ally. The subsequent boost to defense spending in Germany isn’t to make sure it keeps its NATO commitments, but to ensure its independence from the US. And as we’ve written at length, that’s had massive financial impacts.

The Munich speech is only the biggest example. People don’t like being insulted and hate criticism from foreigners. Describing the Chinese as peasants gifted propaganda to the US’ prime trade adversary, and helped it to muster support in its population. It’s now a Chinese condition of talks that the US shows respect, which is fair enough. If you want to make a deal with someone, don’t insult them first.

Vance’s response to the British and French proposal to send peacekeeping troops to Ukraine — dismissing the efforts of “some random country that hasn’t fought a war in thirty of forty years” — led to a furious response, particularly from his more natural supporters on the right, who have also noted that US conservatives are criticizing Winston Churchill. UK forces fought alongside the US in Kuwait, Afghanistan and Iraq. This came across as a specious insult, impeding US aims to get Europe’s powers to step forward in their own defense.

The administration has as yet done nothing to back up its interest in seizing Greenland, but Vance’s trip there appeared designed to create the greatest possible insult. Denmark’s people already felt grievously affronted. And while the Trump administration wants to add Canada as a state, the leadership’s deliberately offensive words have triggered an economic backlash.

It’s harder to grasp this from the US, but this language has done lasting self-harm. As my old colleague Katie Martin pointed out in the Financial Times, trust is lost, and the US is now open to ridicule.

It’s not often that mere words do matter. But US discourse has been so aggressive and offensive as to sunder long-lasting alliances, and forestall the possibility of a rapprochement.

Survival Tips

Happy Easter. Points of Return will be taking off for Good Friday, but for some great Easter-themed music, I recommend Puccini’s Stabat Mater, a setting of the words of Mary watching her son on the cross, conducted here with fire in his eyes by the great Carlo Maria Giulini. It’s a tad too operatic for some tastes, but it’s wonderful. Or you could try Jesus Christ Superstar, a true rock opera, in which Judas gets the best lines and stands in for doubting modern agnostics. It’s more than 50 years old and its stature grows with time. Have a great weekend everyone.

Read the full article HERE.

IRA-approved silver refers to specific types of physical silver, such as certain coins and bars, that meet the Internal Revenue Service (IRS) requirements for inclusion in a self-directed Individual Retirement Account (IRA).

For you as an investor, this means silver can serve as either an alternative to, or a complement alongside, traditional retirement assets like stocks and bonds.

In fact, when stocks plunged during the 2008 financial crisis, silver rose in value alongside gold, serving as a safe haven and a much-needed counterbalance to sharp equity declines.

That said, not just any silver qualifies. Only silver that meets the IRS’s strict criteria (more on that later) offers the protection, tax advantages, and legal compliance required for retirement accounts.

Benefits of a Silver IRA

Lower Entry Cost

Compared to gold, silver is significantly less expensive per ounce, and thus, more accessible to investors.

As of early 2025, trends show silver trading at approximately $30 per ounce and gold averaging over $2,700 per ounce — a very noticeable difference. This means you can purchase more silver for the same capital overlay.

Inflation Hedge & Diversification

Silver, like gold, has historically maintained purchasing power during inflationary periods. During the high inflation years of 1973–1980, silver prices rose from under $2 per ounce to an average of roughly $40 per ounce (even reaching a year high $50), illustrating its function as an inflation hedge.

At the same time, this event shows how silver doesn’t always move in sync with stocks, which makes it a strong diversifier (and a form of protection) for your retirement plan. If the stock market takes a hit, holding silver can help cushion the impact.

Tangible Asset

Unlike stocks or bonds, silver bullion is a physical asset with real, documented ownership, not just a digital balance that rises and falls with market swings.

Moreover, according to the World Silver Survey 2024, industrial demand for silver reached 654.4 million ounces in 2023 — an 11% increase from the previous year. This growth was largely driven by strong demand from industries like solar energy (photovoltaics), electronics, and medical technology.

This fact shows that silver isn’t just stored in vaults, but is consistently used in critical industries, adding long-term support for silver’s strength and value especially during periods of financial market stress.

Tax Advantages

Silver IRAs offer the same powerful tax benefits as traditional IRAs. That means your investment can grow without being taxed each year, allowing it to potentially build faster over time.

If you open a Traditional Silver IRA, your contributions may be tax-deductible now, and you won’t pay taxes on your gains until you withdraw them in retirement.

If you choose a Roth Silver IRA, you pay taxes upfront, but then enjoy tax-free growth and withdrawals later, as long as you follow the IRS rules.

How Does a Silver IRA Work?

Silver IRA vs Gold IRA

A Silver IRA investment is, functionally, the same as a Gold IRA. Both fall under the umbrella of self-directed IRAs (SDIRAs), which allow individuals to hold physical precious metals (gold, silver, platinum, or palladium) in tax-advantaged retirement accounts.

That means the term “Gold IRA” is mostly marketing shorthand. Silver is just as eligible an investment as gold, as long as it meets IRS standards.

Funding Your Silver IRA

The two most common methods to fund your Silver IRA are through transfers and rollovers.

Transfers

Transfers apply when an investor already has an existing IRA and wants to move those funds into a new SDIRA — in this case, a Silver IRA.

In this process, assets are moved directly from the current IRA custodian to a new custodian without the investor ever taking possession of the funds. That being said, it’s considered the simplest and safest way to fund a Silver IRA using existing retirement assets.

Rollovers

Rollovers, on the other hand, typically apply when an investor is moving funds from a qualified retirement plan — such as a 401(k), 403(b), or TSP — into a new SDIRA.

In this case, the account holder takes possession of the funds before redepositing them into the SDIRA. This can be quite tricky as it requires careful adherence to strict IRS guidelines like rollover timeframes and other eligibility criteria.

Role of Custodians and Approved Depositories

Custodians

Custodians are institutions approved by the IRS to help you set up and manage your Silver IRA. Their responsibilities include handling paperwork and logistics, complying with IRS rules, and processing transactions on your behalf.

What they are not is someone who gives investment advice or recommends specific products.

That kind of guidance — like helping you choose the right silver assets — is typically handled by a company that specializes in precious metals IRAs, like us here at Thor Metals Group. It’s just one part of the broader support we provide.

The IRS maintains a list of qualified custodians, all of whom are authorized to manage self-directed IRAs.

Approved Depositories

Approved depositories, on the other hand, are specialized storage facilities that are vetted and authorized to securely hold physical precious metals on behalf of IRA account holders.

Once the custodian completes the silver purchase, the metals are delivered to and stored in one of these depositories.

The IRS does not publish a public list of qualified depositories. It leaves the approval and oversight of depositories to the custodians. Some widely used, industry-trusted depositories include:

- Delaware Depository

- Brinks Global Services

- IDS (International Depository Services)

- CNT Depository

Criteria for Silver to Be IRA Approved

As discussed, only certain silver coins and bars meet the IRS’s strict criteria. Why is that so?

Think of it this way. If all types of silver were accepted into retirement accounts — regardless of purity, origin, or how they are stored — it would be easier for bad actors to slip in counterfeit or overvalued assets.

Below outlines specific IRS requirements under IRC Section 408 (m) to help protect your retirement savings and ensure your account stays compliant and tax-advantaged:

- Purity: Silver must be at least 99.9% pure (also referred to as .999 fine).

- Production: Coins and bars must be produced by a national government mint or by a refiner, assayer, or manufacturer that is accredited by NYMEX/COMEX, the London Bullion Market Association (LBMA), or other recognized commodity exchanges.

- Storage: All physical silver must be held in an IRS-approved depository. Home storage is prohibited under current IRS rules and may disqualify the account from tax-advantaged status.

IRA Approved Silver Coins and Bars

Some of the most common IRA eligible silver products — which are also available through Thor Metals Group — include:

- American Silver Eagle (U.S. Mint): The official silver bullion coin of the U.S., minted since 1986 with 0.999 purity, and widely considered the default choice for IRA investors

- Canadian Silver Maple Leaf (Royal Canadian Mint): Globally recognized North American bullion coin with .9999 purity, slightly higher than the American Silver Eagle.

- Australian Silver Kangaroo (Perth Mint): With .9999 purity and a design that features Australia’s iconic kangaroo, this coin has sparked strong collector interest since its debut in 2016.

- Silver Bars: A good choice for bulk investors trying to get more silver for their money, since these typically carry lower premiums than coins, regardless of condition or mint

Choosing the Right Silver for Your IRA

Coins vs. Bars

When deciding between coins and bars, think about what matters most to you. If you want liquidity and recognizability, especially when you might want to sell in the short term, silver coins are widely trusted and are generally easier to resell.

On the other hand, if your focus is on getting the most silver for your dollar and building up value over time, silver bars are a better investment as they come with lower premiums.

Differences in Ounces

Most silver held in IRAs comes in 1 oz coins or larger bars, which are considered the standard for retirement investing.

Smaller sizes like ½ oz, ¼ oz, or even 1/10 oz are available, but they’re less common in IRA portfolios due to higher premiums per ounce.

These fractional sizes are typically more appealing to collectors or to those interested in silver for smaller transactions or as a barter-ready asset in periods of economic uncertainty.

How to Invest IRA in Silver

Broadly speaking, opening a Silver IRA (or Gold IRA) involves three main steps:

- Open a self-directed IRA with an approved custodian.

- Fund your SDIRA through a transfer, rollover, or direct cash contribution.

- Work with your custodian to choose your preferred silver products and coordinate the IRS-compliant storage process. They’ll also be responsible for maintaining compliance documentation and annual reporting.

Or, you can streamline all three steps into a single, guided process by working with a reputable Gold IRA company.

As we’ve outlined earlier, setting up a Silver IRA involves several moving parts, from navigating IRS regulations to selecting compliant silver products and arranging secure storage. These details can be time-consuming and complex.

With a trusted Gold IRA company, the key advantage is having a single point of coordination. At Thor Metals Group, for instance, we handle the communication with custodians, assist with product selection, and oversee the compliance process — so investors don’t have to manage it on their own.

Pros and Cons of a Silver IRA

Pros of Silver IRA

To sum up the earlier points, below are the key advantages that come with investing in a Silver IRA.

- Diversification: Adds a non-correlated asset class to a retirement portfolio.

- Inflation Protection: Silver tends to retain value during periods of currency devaluation.

- Physical Ownership: Investors own tangible metal, not a paper claim.

- Tax Benefits: Offers the same deferral or exemption benefits as other IRA types.

- Accessibility: Lower cost per ounce compared to gold.

Cons of Silver IRA

Of course, like any other investment, silver also has its cons and tradeoffs.

Storage Rules

Silver in an IRA must be stored in an IRS-approved depository, which means you won’t be able to touch the silver, and more importantly, you will have to pay annual storage fees, the rate depending on your custodian and storage type.

However, while you can’t hold it physically, you still get documented, verifiable ownership of real, tangible silver held in your name — something no paper asset can offer.

Price Volatility

Silver can swing more sharply in price than gold or stocks in the short term. For example, in March 2020, silver dropped below $12 per ounce, then surged to $29 by August. That’s more than a 100% swing in under six months.

However, when you zoom out and look at the long term, silver has shown stability similar to gold. So while there may be short-term dips, silver has historically held its purchasing power over time.

Limited Long-Term Growth Potential

Silver’s value increases only when its price rises. This makes it less of a high-growth asset compared to more energetic investments like stocks or real estate, which can generate both capital gains and recurring income.

Silver’s strength, as mentioned, lies in value preservation rather than aggressive portfolio growth, which eventually protects your retirement savings from inflation and market downturns.

Final Thoughts: Silver is a profitable IRA investment

Silver is often overshadowed by gold in retirement discussions, but it remains a financially sound option for portfolio diversification. It’s more affordable than gold, yet has consistently shown the ability to preserve value, particularly during market downturns.

If you’d like to explore how silver could support your long-term retirement goals — or if you’re looking for a professionally guided process to open a Silver IRA — feel free to contact Thor Metals Group and speak with a member of our team.