Gold prices extended their record run on Wednesday, to breach $3,300 per ounce, as a weaker dollar and escalating U.S.-China trade tensions pushed investors towards the safe-haven asset.

Spot gold climbed 2.6% to $3,310.82 an ounce as of 08:51 a.m. ET (1251 GMT), after hitting a record high of $3,317.90 earlier in the session.

U.S. gold futures gained 2.7% to $3,326.40.

“Gold remains heavily supported by a broadly weaker dollar, uncertainty around tariff announcements and fears about a global recession,” said Lukman Otunuga, senior research analyst at FXTM.

“Beyond $3,300, it’s all about psychological levels for gold prices. Bulls may target $3,400, $3,500, and upwards. However, a bout of profit-taking or positive U.S.-China trade developments could trigger a selloff.”

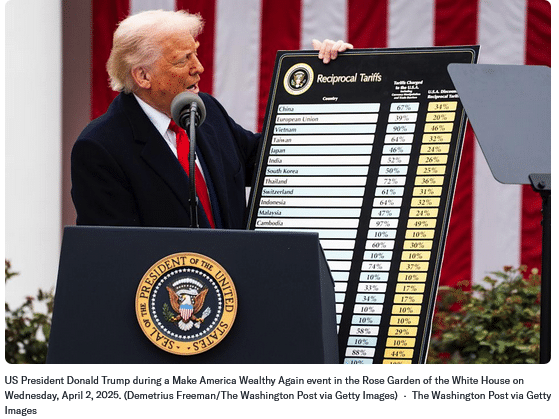

U.S. President Donald Trump on Tuesday ordered an investigation into possible tariffs on all U.S. critical minerals imports, marking another escalation in his dispute with global trade partners and an attempt to pressure industry leader China.

The latest flare-up of tensions between the world’s two largest economies dented sentiment in wider financial markets, sending investors towards safe-haven assets such as gold. [.N]

The dollar, meanwhile, slipped against its rivals to hold near a three-year low hit last week, making gold more attractive for other currency holders. [USD/]

Gold has risen nearly $700 this year, supported by tariff disputes, expectations of interest rate cuts and strong central bank buying.

“The rally has become a bit unhinged, leaving it at risk of corrections. However we have for more than a year now seen corrections to be shallow, with underlying bids waiting on any setbacks,” said Ole Hansen, head of commodity strategy at Saxo Bank

Investors await a speech from Federal Reserve Chair Jerome Powell later in the day for more clues on the direction of interest rates.

Elsewhere, spot silver rose 2.2% to $33.01 an ounce, platinum gained 0.5% to $963.76, and palladium eased 0.4% to $968.04.

Read the full article HERE.

Gold prices gained on Tuesday, helped by safe-haven demand as U.S. President Donald Trump’s tariff plans kept investors wary of trade policy, while an overall weaker dollar also lent support.

Spot gold was up 0.4% at $3,223.41 an ounce as of 09:32 a.m. ET (1332 GMT). Bullion hit a record high of $3,245.42 on Monday.

U.S. gold futures rose 0.4% to $3,238.70.

“Traders are waiting for the next major fundamental development to drive the gold market, but the charts remain bullish. There’s still safe haven demand,” said Jim Wyckoff, senior analyst at Kitco Metals.

Federal Register filings on Monday showed that the U.S. administration is advancing investigations into pharmaceutical and semiconductor imports in a bid to impose tariffs.

Trump on Sunday said he would announce the tariff rate on imported semiconductors over the next week.

Gold, used as a safe investment during times of political and financial uncertainty, has risen over 23% so far in 2025 and scaled multiple record highs.

“The rise in the gold price is also partly in line with the continuing weakness of the dollar, which points to a gradual erosion of the U.S. currency’s status as a safe asset — gold is likely to be an alternative for many USD investors,” Commerzbank said in a note.

“The short term monetary policy outlook is providing further support for gold.”

The dollar was trading near a three-year low against its rivals, making gold more attractive for other currency holders. [USD/]

Financial markets expect the U.S. central bank to resume cutting interest rates in June after pausing in January, and reduce its policy rate by 100 basis points this year.

Investors now await comments from U.S. Federal Reserve Chair Jerome Powell, who is scheduled to speak on Wednesday, for more clues on the interest rate path.

Elsewhere, spot silver eased 0.4% to $32.23 an ounce and platinum rose 1.4% to $964.80, while palladium gained 1.3% to $968.46.

Read the full article HERE.

Planning for retirement today means facing an economy that’s anything but predictable. One moment the market is stable, the next it’s reacting to interest rate hikes, inflation, or global events.

Because of this uncertainty, more Americans are exploring alternatives beyond traditional retirement investments. A Gold IRA (Individual Retirement Account) is one such option, offering a way to hold physical gold and other precious metals in a tax-advantaged retirement account.

In response to this growing interest, this article will help guide you through how a Gold IRA works, and how you can use Thor Metals Group’s Gold IRA Kit as a resource to better understand your options.

What is a Gold IRA Kit?

A Gold IRA Kit is a free informational packet offered by gold IRA companies to help potential investors understand precious metal IRAs — not only gold, but also silver, platinum, and palladium.

The point of this comprehensive kit is to help you understand how a Gold IRA works, how it can help protect your retirement savings, and how you can get started with it — basically all foundational information you need before making any commitments.

After all, you don’t want to jump in based on a quick ad or a casual recommendation from a friend.

That’s why we created our free Gold IRA Kit in the first place — to give you time and clarity to learn the basics, weigh your options, and decide whether a precious metals IRA aligns with your long-term goals.

Included in a typical gold IRA kit are as follows:

- An overview of what a Gold IRA is and how to open one

- Instructions for transferring an existing IRA or 401(k)

- Examples of IRA-approved precious metals

- Details on storage options and the custodial process

- Benefits and perks of opening a gold IRA

Benefits of a Gold IRA

Adding gold or other precious metals to your retirement account offers a number of potential advantages. These are among the most common reasons investors look into precious metal IRAs as a component of a retirement strategy.

Inflation Protection

Gold has historically maintained its value, particularly during periods of rising inflation.

- During the 2008 financial crisis, when inflation hit 3.8%, the price of gold surged from around $800 an ounce in early 2008 to over $1,100 by the end of 2009.

- In 2020, during the coronavirus pandemic, gold rose sharply as inflationary fears grew, reaching over $2,000 an ounce for the first time in history.

- As of January 2025, with inflation hovering around 3.0%, gold continues to remain strong, trading above $2,600 an ounce.

That is to say, while the dollar weakens, gold has consistently held its ground, and in many cases, even gained value.

Diversification & Risk Reduction

A traditional IRA is tied to paper assets — stocks, bonds, mutual funds. Since those paper assets are generally correlated with the broader financial markets, a market downturn can negatively impact all of them at once.

Meanwhile, precious metals move independently of those paper assets. By relying less on Wall Street’s fluctuation, you reduce overall portfolio risk and keep your retirement strategy a bit more stable.

Tangible Ownership

Unlike stocks or mutual funds, you physically own gold within a Gold IRA. That means actual gold bars or coins are bought in your name, securely stored in an approved depository, and fully accounted for.

This is verifiable, documented ownership and not just a digital balance or a share in a paper fund, like most of us are used to seeing nowadays.

More importantly, that means your retirement assets are less exposed to the risks tied to third parties, whether that’s a company’s financial performance, fund manager decisions, or broader stock market volatility.

Long-Term Store of Value

As emphasized earlier, gold tends to hold its value over time, and that makes it useful for long-term financial planning.

For someone planning ahead for retirement, that kind of dependability can help balance out more unpredictable assets. It allows you to keep part of your savings in something that isn’t tied to short-term news or market cycles.

Why Our Gold IRA Kit is the Best

Thor Metals Group’s nine-page Gold IRA Kit is designed to be read in just a few minutes — brief enough to fit into a busy schedule, yet thorough and practical in providing the guidance you need to get started today.

That clarity comes from listening, as we built this kit based on real questions from customers we’ve had the pleasure of working with. In fact, it’s a big reason why Thor Metals Group was recognized by Consumers Advocate as one of the top Gold & Silver IRA companies for 2025.

Our materials are shaped by experience, not guesswork. It reflects everything people need to know and consider before starting to invest in Gold.

What is Included in Our Gold IRA Kit?

When you request a kit from Thor Metals Group, you’ll receive:

- A digital copy of The Gold IRA Quick Start Guide

- How to begin funding your new Gold IRA, whether through fund transfers, asset rollovers, or direct cash contributions

- A list of IRS-approved precious metal products

- Clear explanations of tax benefits and implications

- List of the best depositories for a Gold IRA

- Contact information for personalized consultation with our experts

Here’s what comes along with Thor Metals Group’s personalized customer care:

- Free in-depth market reports

- Free Gold IRA setup

- Free Shipping and Insurance, and more.

How Does a Gold IRA Work?

Transferring or Rolling Over Funds

Most people fund their Gold IRA by moving money from an existing retirement account. This can be done through a transfer (moving funds between the same type of account, like IRA to IRA) or a rollover (moving funds from a 401(k) into an IRA).

You can also fund your Gold IRA with direct cash contributions, though annual limits apply based on IRS rules. This method typically results in a smaller contribution amount, which is why it’s less commonly used for funding a Gold IRA.

In either case, a reputable Gold IRA company or IRS-approved custodian can help you complete this without triggering taxes or penalties.

The Role of a Custodian and Storage

Gold IRAs must be held by an IRS-approved custodian. This financial institution is responsible for managing the account, executing transactions, and ensuring IRS rules are followed.

Once you purchase gold, it must be stored in an IRS-approved depository. These facilities are secure, insured, and regularly audited. Home storage is not allowed for metals held in an IRA, and doing so risks the account being disqualified (and taxed as a distribution).

Tax Advantages and Compliance

Gold IRAs follow similar tax rules to traditional IRAs and Roth IRAs. Contributions may be tax-deductible (traditional), or withdrawals may be tax-free (Roth), depending on which type you choose.

The IRS also sets annual contribution limits and requires minimum distributions (RMDs) starting at a certain age for traditional IRAs, as mentioned earlier.

As long as the gold meets purity standards and is properly stored, your account remains compliant and retains its tax-advantaged status.

How Your Gold IRA is Managed

Unlike traditional IRAs that typically hold mutual funds or stocks, a Gold IRA holds physical assets — coins or bars. You choose what to buy from an approved list, and your custodian arranges the purchase and storage.

Your account value fluctuates based on the market price of those metals. While you won’t earn dividends like you might with stocks, you’re holding an investment that’s historically known for preserving value over time, especially during inflation or market turmoil.

A trusted custodian or IRA provider will manage the paperwork and reporting for you so you stay in good standing with the IRS while maintaining control over your investment choices.

Are Free Gold IRA Kits Legit?

Yes, free Gold IRA kits are legitimate, especially when they come from reputable, well-established providers.

To be clear, the credibility of a Gold IRA kit is tied directly to the company offering it. Trusted providers typically operate within established legal and regulatory boundaries, including:

- Partnering with IRS-approved custodians to handle retirement accounts

- Following FTC rules for truthful and transparent advertising

- Complying with IRS rules under IRC Section 408, which allow alternative assets like gold and silver to be held in IRAs

Moreover, you can recognize well-established, trusted providers by the ratings and reviews they’ve earned from independent third-party organizations.

Thor Metals Group, for instance, holds an A rating from the Better Business Bureau (BBB) and a 5-star rating on TrustLink. Both are examples of helpful indicators to look out for when you’re weighing your options.

Does Your Free Gold IRA Kit Come with a Free Gold Bar?

Our free Gold IRA Kit includes a wealth of information, though it doesn’t come with a gold bar. That said, we do offer up to $20,000 in precious metals on qualifying purchases.

If you’d like to find out how it works — or are simply ready to diversify with physical assets — feel free to contact us and speak with a member of our team.

Advisers in Trump’s orbit have long fantasized about a cheaper currency. They’re unlikely to have wanted it at this perilous moment.

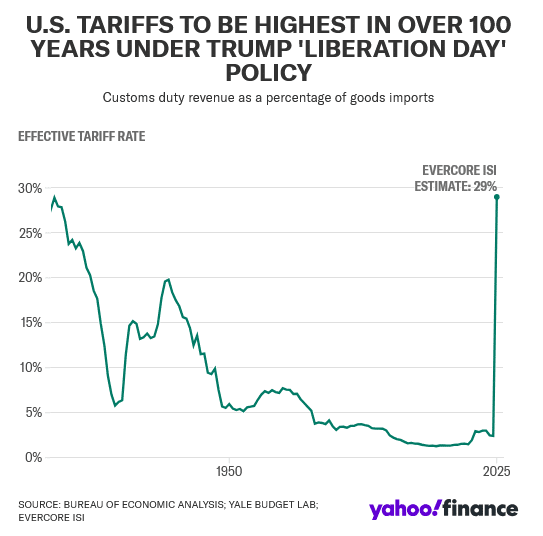

Donald Trump’s economic policy is not going according to plan. If you need more proof than the volatility in stocks, look no further than the depreciation of the dollar. While some in Trump’s orbit may have occasionally fantasized about a weaker greenback to boost domestic industry, it was never, ever supposed to happen like this — an abrupt slide at the worst possible time.

Weak-dollar Trumpism is perhaps best associated nowadays with Stephen Miran, Trump’s chair of the Council of Economic Advisers. In a speech to the Hudson Institute last week, Miran said that the dollar’s special status in global finance has “caused persistent currency distortions and contributed, along with other countries’ unfair barriers to trade, to unsustainable trade deficits.” (His diagnosis isn’t wrong, though I think it pays short shrift to the considerable benefits that accrue from the greenback’s reserve-currency status, which I’ll return to later.) Trump himself has flip-flopped about the dollar. During his first term, he grumbled about Chinese and European currency weakness and said that the US should match their tactics. Conversely, he’s also recently threatened to punish countries that move away from dollar-based trade.

But what no one wanted — and certainly not Miran — was a flash devaluation that drove fear into the hearts of market participants and could potentially exacerbate inflation and the fiscal deficit.

Yet here we are. The US Dollar Index plummeted by 0.8% on Friday, bringing its total depreciation to around 8.5% since Trump’s inauguration. The move came after the Trump administration unveiled the highest import duties in a century, triggering a violent (but somewhat predictable) selloff in the S&P 500 Index. What surprised many investors, however, was the drop in traditional “haven” investments such as Treasury notes and the buck, which hinted at a broader loss of faith in US governance — a sense of alarm about not just the administration’s strategic tariff goals but also their amateurish execution.

The Trump administration had seemingly designed the policy based on shaky math, and it only issued a course correction after being pressured to do so by Elon Musk, the world’s richest man, and investor Bill Ackman.

The Trump team seemed to further walk back the original “reciprocal tariff” policy late Friday, amending it to exempt smartphones, computers and other electronics, according to an update published by US Customs and Border Protection. Then Sunday on ABC’s This Week, Commerce Secretary Howard Lutnick appeared to walk back the walk-back, saying that, in fact, the exempted products would still be subject to a separate and forthcoming levy specific to their product category. And in an even more surreal and revisionist twist, President Trump himself posted on Truth Social late Sunday that “there was no Tariff ‘exception’ announced on Friday.” Huh? The upshot is that whiplash and uncertainty are as pervasive as ever. The weak-dollar camp in Trump world finally has the buck they’d coveted, but not in the way they’d envisioned.

Let’s dig into the unfortunate timing. In a November 2024 paper “A User’s Guide to Restructuring the Global Trading System,” Miran laid out a catalogue of options to reshape the international trading order that he cast as placing an unfair burden on the US. Tariffs are one of two that he considers, currency depreciation is the other. He assumed that the import duties would probably cause the dollar to strengthen. But he argues that intentional dollar depreciation is riskier, and the Trump government shouldn’t be too hasty about orchestrating such a maneuver. “The Administration will likely wait for more confidence that inflation and deficits are lower, to limit potentially harmful increases in long yields that could accompany a change to dollar policy,” Miran wrote. Given the economic circumstances at the moment, he said that he expected policy to be “dollar-positive before it becomes dollar negative.” So much for that.

The dollar plunge of the past few weeks has come in the context of still-elevated inflation and still-gaping fiscal deficits, which congressional Republicans may exacerbate with new tax cuts, including efforts to extend the expiring provisions of the Tax Cuts and Jobs Act of 2017.

A report Thursday showed that the core consumer price index — excluding volatile food and energy — rose 2.8% in March from a year earlier. The hike in tariff rates will likely push the number substantially higher in 2025, with a weakened currency now adding some further pressure on import prices. Perhaps more concerning still are the hints in consumer survey data from the University of Michigan that households are losing faith in the disinflation process, with inflation expectations at multi-decade highs. Economists see inflation as a self-fulfilling prophecy, and consumer psychology may well be the key to understanding the endemic inflation that everyone wants to avoid.

The fiscal backdrop is similarly ill-suited for dollar depreciation. In general, big currency moves, like the ones seen recently in the dollar, can have material adverse effects on foreign holders of bonds, if sustained.

At about 7% of gross domestic product, the government is still running deficits comparable only to those seen during major crises, and surging net interest expense is one of the biggest factors. Treasury Secretary Scott Bessent has said that he and the president would prioritize lower rates on the 10-year Treasury note, a key benchmark for borrowing costs including for corporate bonds and residential mortgages. But the recent market turmoil has upended any significant signs of progress.

To use an example similar to one Miran laid out in his “User’s Guide” essay, consider that, from the perspective of a foreign investor in our bonds, the roughly 8.5% depreciation of the dollar has already wiped out almost two years of interest payments on 10-year Treasuries note yielding 4.46% as of Friday. No wonder such moves can snowball into something that feels like market panic. Fortunately, the Treasury has still found decent demand at its regular auctions of new securities, but the perception of a risky currency can ultimately lead investors to demand higher interest rates from the US government.

Perhaps this will be remembered as a “be careful what you wish for” moment. There are no doubt challenges associated with the US being at the center of the global financial system. In normal times, the perceived safety and stability of our currency and bonds arguably leave them slightly overvalued, but that also translates into lower borrowing costs, cheaper imported consumer goods and an ability to borrow large sums of money even when wars or pandemics break out — the times we need it the most. As with everything, there are tradeoffs that come from being in that position, and I personally think the benefits justify the costs.

Others may disagree and think that the strong dollar is an albatross around the US manufacturing sector. Even those who accept their premise would admit that their vision couldn’t be playing out at a worse possible time.

Read the full story HERE.

On Wednesday, after the White House abruptly changed course on the tariffs announced a week earlier, an initial sense of relief was soon overshadowed by new questions. What was already an uncertain future for households, companies, banks, and investors suddenly became more in doubt.

High levels of uncertainty ratcheted up early last month when President Donald Trump reversed course on tariffs charged to Canadian and Mexican goods importers. Researchers at Northwestern University and Stanford University maintain an “Economic Policy Uncertainty Index” that measures news sentiment, changes in tax provisions, and disagreement among participants of the Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasters.

In March, that monthly U.S. uncertainty index reached its second highest reading since 1985, only exceeded by May 2020 levels during the heart of the Covid-19 pandemic, and higher than any month in the financial crisis. In April, the daily index is near early-pandemic highs.

Much of corporate investment in the past three decades was premised on free trade, especially with Canada, Mexico, and China, which collectively accounted for 42% of 2024 U.S. imports and 40% of exports, according to the U.S. Census Bureau. Those investment decisions have been complicated by tariffs.

This week’s temporary pause in tariff rates for most countries adds to the burden.

Customs brokers, who expedite customs including calculating the correct tariff payment, are at the tip of the spear. “There’s just no clarity, and this is what’s causing the biggest problem,” Karen Ferry, who runs Karen Ferry Customs Brokers, told Barron’s. “The exporters, the importers, everybody is just nuts.”

“This business is always crazy, but it just 100% made it more crazy because of the uncertainty and the changes every day,” she said.

The uncertainty around today’s tariffs is exacerbated by longer term questions. In four years, a new administration could change the rules again.

Uncertainty hits the economy in several ways. Households, many of whom don’t closely follow rapid shifts in policy, are met with a blizzard of news that is hard to make sense of. Many may decide to hold off on big purchases until the dust settles, while others may buy more ahead of tariffs, pushing demand forward. U.S. consumers made up over two-thirds of 2024 GDP, so spending softness will have a large effect on the economy as a whole.

“Consumers are often more nervous when they’re not sure about what to expect going forward about their jobs, about their 401ks, about their investments, about future costs,” says Scott Baker, a finance Professor at Northwestern University’s Kellogg School of Management and one minder of the Economic Policy Uncertainty Index. “It makes it much harder to plan.”

The next largest part of GDP is fixed investment in structures, equipment, and intellectual property—at 18% of the total in 2024. This brings in company decision-making. Many goods-makers have been investigating moving production to the U.S., but the latest tariff announcements complicate the process. Will tariffs on Chinese goods remain at 145%? Will North America have free borders again? Will smaller countries like Vietnam and the Philippines be able to avoid their own tariffs?

“If you’re going to invest a billion dollars in a new plant and you’re deciding where to put it, a lack of certainty about what the actual tariff coming from that country is going to be has massive implications.” Baker says. “Firms may adopt a wait-and-see attitude and say ‘we’re not going to make any sort of irrecoverable investments because the risk of losing our investment is too big.’”

Steven Davis of Stanford’s Hoover Institution, who also maintains the Economic Policy Uncertainty Index, sees an additional threat to companies. “This diverts senior leadership from thinking about other things, like how to make better products, how to improve their services, how to make sure they’re managing their workforces as best they can,” he told Barron’s.

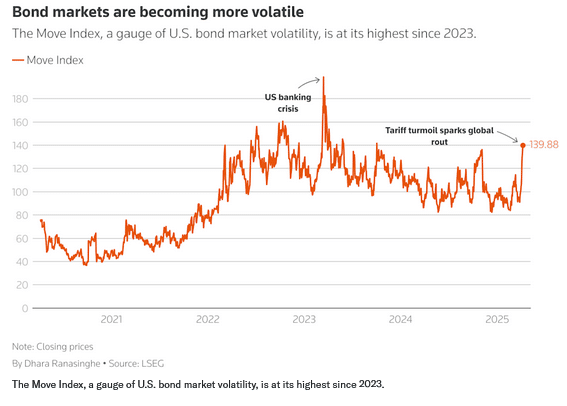

Finally, uncertainty hits banks and other lenders, especially when the largest borrower is the U.S. government, the source of the uncertainty. Along with stocks, interest rates have been unusually volatile in the past weeks because bond traders are having a hard time pricing risk.

Banks may decide to maintain a wait-and-see stance, screening borrowers more carefully, asking for higher rates, or more collateral. “Somebody that three months ago they might have extended a loan to,” Davis said, “they no longer will because the underlying economic environment is more risky.”

Read the full article HERE.

Gold rose again after posting its biggest one-day gain in 18 months, as confusion over US President Donald Trump’s tariff agenda drove investors to buy the precious metal as a haven.

Bullion climbed as much as 1.6% on Thursday and was trading less than $50 short of last week’s all-time high. That’s after it closed up 3.3% on Wednesday in a whipsaw day for markets. The precious metal has also been supported by a weaker greenback.

Gold’s initial surge in the previous session came after US tariffs on around 60 trading parters kicked in, fueling market upheavals and increasing worries about a global recession. Then Trump announced a 90-day pause to higher tariffs on 56 countries and the European Union, which will now be taxed at the 10% baseline rate.

“When you’re in a crisis and gold is selling off, that’s telling you you’ve got a liquidity problem,” Carlyle Group Inc.’s Jeff Currie told Bloomberg Television on Thursday. “Then boom, they came out with the reprieve, gold bounced back up which is telling you liquidity came back into the system,” he said.

Still, Trump also hiked duties on China to 125%, effective immediately, after Beijing announced plans to retaliate with an 84% tariff to start Thursday. Those moves are exacerbating concerns the world’s two biggest economies will become enmeshed in a crippling trade war.

Markets rallied after Trump’s tariff-pause announcement. US stocks had their best day since the financial crisis, with the S&P 500 soaring nearly 10%, after slumping to the fringe of a bear market in the past week.

The constant back-and-forth of the US administration’s tariff plan has rocked the world, as investors scramble to find direction and certainty. That’s generally been supportive for gold, which is up 19% this year. The metal has also been bolstered by hopes for more Federal Reserve monetary easing and central-bank buying.

“We remain quite positive for gold,” Dominic Schnider, head of commodities and Asia Pacific currencies at UBS Global Wealth Management, said on Bloomberg Television. “The next step is going to be, at some point, the Fed coming in — and that gives the next leg up for gold.”

Spot gold gained 1.1% to $3,117.15 an ounce as of at 11:52 a.m. in London. The Bloomberg Dollar Spot Index fell for a second day. Silver and platinum were flat, while palladium was down.

Read the full article HERE.

Investors are dumping U.S. assets they usually favour in times of turmoil as fear over the economic impact of U.S. President Donald Trump’s reciprocal tariffs shakes confidence in traditional safe-havens.

The dollar and U.S. Treasuries have taken a beating as Trump’s tariffs, plus a 104% duty on China, took effect, while China swiftly retaliated. In contrast, safe-haven favourites such as gold and the Swiss franc continue to pull in cash.

The rapid rise in U.S. Treasury yields has worried investors, who fear this could be forced selling to cover portfolio losses and a dash for cash, rekindling memories of the COVID-19 market turmoil.

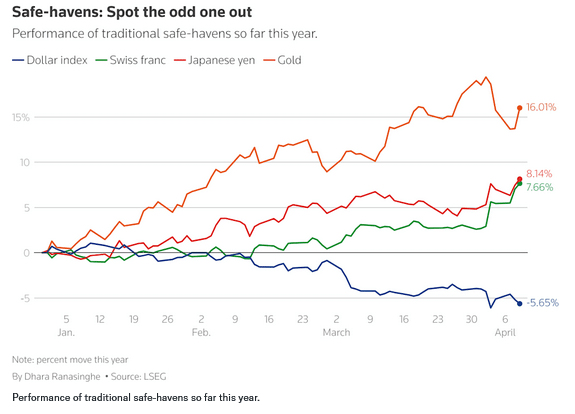

Here is a glance at how traditional safe havens have fared so far during the tariff turbulence:

Dollar takes backseat

The dollar was the first to lose its shine after Trump announced tariffs, when it dropped along with stock markets. This was an unusual move raising questions about the global standing of the U.S. currency, often dubbed “King Dollar” for its strength and dominance in global currency markets.

The dollar has shed more than 5% this year against a basket of other currencies after posting its weakest start to a year since 2016, LSEG data shows.

The dollar’s failure to benefit from rising U.S. Treasury yields has added to investors’ worries because, until now, higher returns on Treasuries relative to other bond markets had boosted the dollar’s appeal.

“The dollar not getting support from (higher) yields suggests the dollar is not a currency safe-haven,” State Street Global Markets’ head of macro strategy Michael Metcalfe said.

Bond rout

Investors initially rushed into government bonds on heightened recession risks, but that has quickly changed.

After plunging 26 basis points last week, U.S. 10-year Treasury yields have surged more than 40 basis points so far this week. Longer-dated bonds are the worst hit, with 30-year yields up nearly 50 bps, set for their biggest weekly jump since the early 1980s. Bond yields rise when prices fall.

An index of Treasury volatility has risen to its highest since late 2023.

Yields have surged even as traders price in faster U.S. Federal Reserve rate cuts, suggesting deliberate dumping of Treasuries rather than selling driven by changes in economic expectations. This is reflected in a widening gap between Treasury yields and interest rate swaps, derivatives used for hedging.

Pepperstone senior strategist Michael Brown said that pointed to a real lack of desire to hold Treasuries.

“Whether this is participants selling down Treasuries to raise cash in order to meet their liquidity needs, or a representation of how institutional confidence in the U.S. has continued to be eroded, remains to be seen.”

Investors also believe the unwinding of a widely used hedge fund arbitrage trading strategy between cash and positions in Treasury futures, known as the basis trade, is adding to these market moves.

The bond market pain is spreading. In Britain, 30-year bond yields rose to their highest since 1998, putting pressure on the country’s stretched finances.

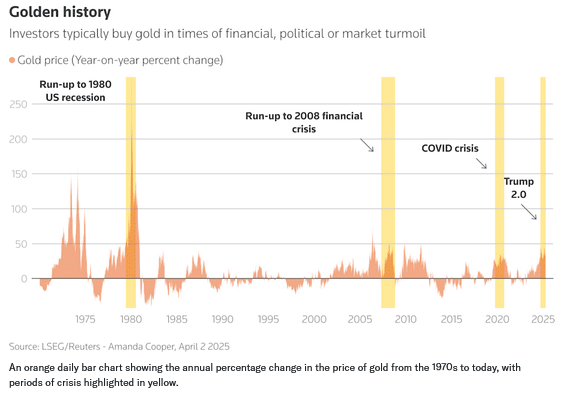

Golden Era

Gold has a long history as a safe-haven asset.

It tends to rise in a financial or political crisis. The 1970s energy crisis, the 1980 U.S. recession, the 2008 global financial crisis and the 2020 COVID-19 pandemic all triggered a rise in gold.

This time gold has surged to all-time highs above $3,000 an ounce, having almost doubled in the past 2-1/2 years. It was caught up in the broader market selling of the past week, as investors rushed to raise cash to plug losses elsewhere.

But gold was up more than 2% on Wednesday, only narrowly below its record peak at $3,167.

Central banks and investors, who scooped up gold as a hedge against the inflation spike after the COVID pandemic, have continued buying even as inflation eased. And with Trump’s isolationist trade policies playing out, more investors are buying it to protect their wealth.

Back in favour

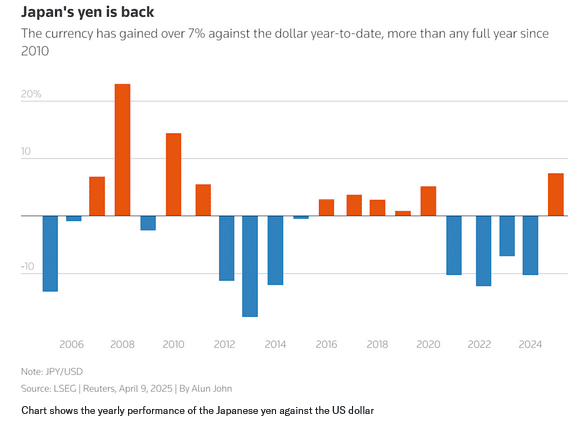

Japan’s yen is often the biggest major currency to benefit from safe-haven flows and typically performs well when stocks falter.

The yen was set for its best day against the dollar since September on Wednesday and has rallied 7.5% so far this year, while another safe-haven favourite, the Swiss franc, has strengthened just as much.

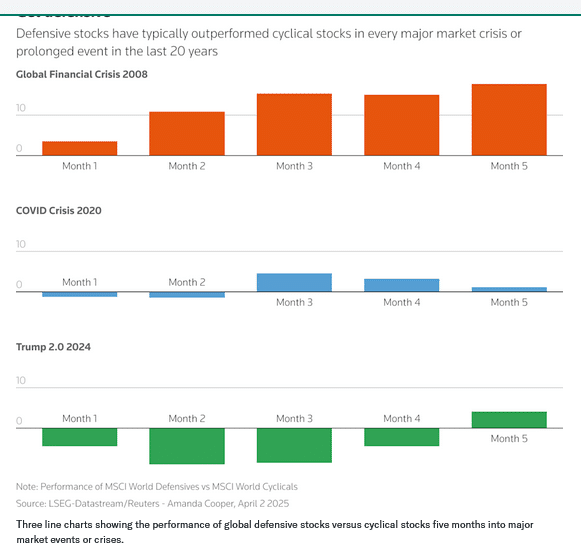

Defensive plays

Stocks are usually in the front line in recessions and financial crises. Investors take profits, yanking their cash as they run for shelter. But most cannot abandon the equity market entirely, so when trouble hits, they pile into stocks with recession-proof earnings, such as drugmakers, utilities and food and beverages.

In the last 25 years, so-called defensive stocks have consistently outperformed cyclical stocks that are most closely linked to the global economy, such as technology or mining shares.

Even though there is no sign yet of a recession, a basket of global defensive stocks has fallen less since Trump’s November election win than a basket of cyclicals, reflecting investors’ caution.

Read the full article HERE.

Wall Street just got hit hard. Main Street could be next.

President Donald Trump’s massive tariff hike last week sent markets into a sharp decline. In two days, more than $6 trillion was wiped out from equity markets.

Though a recession isn’t guaranteed at this point, the market turmoil has economists and market analysts revising their economic outlooks and boosting the risk of a downturn. The question now is how could market turbulence spill over into the economy?

Consumer spending, which accounts for nearly 70% of U.S. economic growth, and the labor market are two areas where the effects of trade strife will be critical in determining the economic outlook. So far, the economic data is showing stable conditions, but there are indicators to watch for weakness in the coming weeks.

No Spending Slowdown Yet

Half of U.S. consumer spending is driven by the highest-earning 10% of Americans —those making about $250,000 or more annually. That’s important in assessing the health of the economy, since the so-called “wealth effect” has been a driver of economic growth in recent years.

The explosion of growth in financial assets—driven by back-to-back gains of over 20% for the S&P 500 index in 2023 and 2024—and soaring real estate values have boosted consumer health.

That means a market downturn poses a risk to consumer spending. For lower-income households, tariffs will act as a tax on imported goods and drive prices higher. That will crimp household spending and business investment.

So far, consumer spending is relatively solid at the end of the first quarter. For example, the Johnson Redbook Index, a weekly proprietary retail sales index, increased by 4.8% year over year in the week ending March 29. “That is currently well-behaved, no signs of consumer spending slowing down on that front,” says Torsten Sløk, chief economist at Apollo Global Management. Debit- and credit-card spending has also been holding up. Weekly attendance at Broadway shows, which typically draws in a higher-income crowd, and hotel occupancy levels remain solid.

Other spending indicators that Slok watches, such as restaurant reservations and TSA air travel data, have been slightly weaker, but nothing too concerning.

“There are a few signs here and there that things might get a little weaker, but the core indicators used to discuss the economic outlook are still holding up quite nicely. At the moment, it’s a little bit of a storm in a teacup by markets, since the data hasn’t shown much signs of a slowdown” Slok says.

Employment Conditions Remain Key

Trump’s tariff hikes could not only spoil spending, but higher operating costs derived from the higher levies could also translate into job losses if employers pull back.

Bottom line, if people aren’t employed, they can’t spend—which could be another way economic growth will contract. So far, the so-called soft sentiment data has been negative. There has been a reversal in corporate capital expenditure plans in recent months and corporate confidence has slumped since the start of the year.

The data on employment conditions are more mixed. WARN notices—the 60-day notification of planned layoffs required of employers with more than 100 employees—have risen. According to non-seasonally adjusted data collected by Cleveland Fed researchers, there was a 19% month-to-month jump in WARN filings in February.

U.S. employers announced 275,240 job cuts in March, a 60% increase from February, according to placement firm Challenger, Gray & Christmas. Though the firm noted that most stem from Department of Government Efficiency cuts, some of which have been stalled by legal challenges.

So far, the layoff and discharge rate has remained steady since October, according to the latest data from the Job Openings and Labor Turnover Survey. And the number of Americans filing for unemployment benefits has also remained relatively unchanged.

Overall U.S. employment has been stable during the first quarter, with employers delivering blowout payroll gains of 228,000 last month, according to the latest data released by the Bureau of Labor Statistics on Friday.

But while employers may have had some momentum in March, Huntington Bank’s Chief Economist Olu Omodunbi says he will be watching the guidance that comes out of the coming earnings season that kicks off on Friday. He puts the odds of the U.S. entering a recession in 2025 at about 50%.

The downside risk to the U.S. economy is intensifying, but the size of the economic risks, at this point, depends on the duration and magnitude of this shock, Slok says.

Brian Gardner, Stifel’s chief Washington policy strategist, says that negotiations of trade deals is a “likely outcome.” But agreements with countries like Vietnam and Cambodia “won’t move the needle economically.” Instead, it will come down to how negotiations with large economies like China and Europe proceed—and that will take time, Gardner says.

In the interim, economists aren’t the only ones who will be reading the tea leaves among the incoming spending and employment indicators.

Read the full article HERE.

Jamie Dimon said he is concerned about how President Trump’s new tariffs will affect America’s long-term economic alliances, which he said have been key to the country’s “extraordinary standing in world affairs.”

In his annual letter to shareholders, the JPMorgan Chase JPM -3.25%decrease; red down pointing triangle chief executive said the tariffs are likely to drive up inflation on imported goods and domestic prices, with input costs rising.

“Whether or not the menu of tariffs causes a recession remains in question, but it will slow down growth,” Dimon wrote in the letter that touched on issues including the tax code, military security, healthcare costs and the country’s education system.

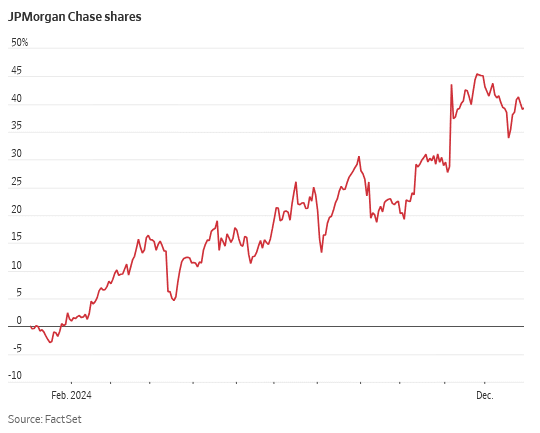

Wall Street has been reeling since Trump unveiled his sweeping tariffs on Wednesday, with the S&P 500 plunging 9.1% last week and the Nasdaq falling 10% and into a bear market. Bank stocks were among those that were slammed, with investors fearing a recession would lead to a pullback in borrowing and dealmaking.

For the past few years, Dimon has been warning about risks to the economy, from the wars in Ukraine and the Middle East, to interest rates and government debt. He has called the global geopolitical situation the most tense since World War II. On Monday, he added the tariffs to that list of simmering issues.

Dimon’s letter said there are many ongoing uncertainties around the tariffs, including retaliatory actions by other countries and the effects on corporate profits and the dollar.

“The quicker this issue is resolved, the better because some of the negative effects increase cumulatively over time and would be hard to reverse. In the short run, I see this as one large additional straw on the camel’s back,” he wrote.

After negotiations, Dimon said he hoped the long-term effect of the tariffs will bring benefits to the U.S.

Dimon’s tone on tariffs has changed with Trump’s rollout of his tariff plans. In January, he didn’t appear worried about tariffs at the World Economic Forum in Davos. “If it’s a little inflationary, but it’s good for national security, so be it. I mean, get over it,” he said in an interview with CNBC.

But by March, Dimon was expressing more concern about the effects of tariffs on companies, noting that “uncertainty is not a good thing” in an interview at a recent retirement summit.

Others on Wall Street, including hedge-fund manager Bill Ackman and investor Stan Druckenmiller, have started speaking out about tariffs as well.

Here’s what else Dimon touched on in his letter:

Taxes

Dimon took aim at tax breaks that he said primarily benefit the wealthy. “These include carried interest, the ability to deduct up to $10,000 of state and local taxes, and too many creative estate tax planning techniques.” He said the U.S. tax code should incorporate the “Buffett Rule” so that high-income earners pay a minimum tax on realized income.

“Everyone, including the wealthy, would benefit enormously from the increased growth that would follow if we amended our system the right way,” he wrote.

Stock prices

Even with the recent declines, Dimon said stock and debt prices remain high. “Markets still seem to be pricing assets with the assumption that we will continue to have a fairly soft landing. I am not so sure,” he wrote.

U.S. deficit

Dimon said America’s economic performance has been driven in part by its enormous government spending, which has led to a huge deficit. “These large deficits are not sustainable—I do not know whether it will cause a real problem in six months or six years—the sooner we deal with it, the better,” he wrote.

Management lessons

The longtime CEO also had some advice for leaders, including to treat everyone with respect and to make follow-up lists. “Take care of yourself. If you don’t take care of yourself, it doesn’t work,” he added.

Read the full article HERE.

During the AI boom, Wedbush analyst Dan Ives has become Wall Street’s most prominent tech evangelist, offering an unrelentingly bullish view on how this new technology will usher in a Fourth Industrial Revolution.

But as times change, people do too.

And in a note to clients on Friday, Ives sounded the alarm on the state of the tech trade as the reality of Trump’s shock tariff announcement on Wednesday continues to sink in across the investment world.

“The concept of taking the US back to the 1980’s ‘manufacturing days’ with these tariffs is a bad science experiment that in the process will cause an economic Armageddon in our view and crush the tech trade, AI Revolution theme, and overall industry in the process,” Ives wrote.

How Trump and his team will pull off revitalizing US manufacturing is a debate that will dominate economic policy circles for years to come.

As that years-long process plays out, however, US consumers look set to face swift and dramatic changes in the cost of some goods. Eggs have played a major role in the recent inflation discourse, and Wall Street economists on Thursday began floating the idea that the rate of inflation could double this year as a result of Trump’s actions.

But Ives has a simpler and perhaps even more tangible warning for how these tariffs will weigh on consumers: The cost of an iPhone might triple.

“The economic pain that will be brought by these tariffs are hard to describe and can essentially take the US tech industry back a decade in the process while China steamrolls ahead,” Ives wrote.

“50% China tariffs, 32% Taiwan tariffs would essentially cause a shut-off valve from the US tech landscape and in the process cause every electronic to go up 40%-50% for consumers, iPhones made in the US would cost $3,500 (vs. $1,000), and the AI Revolution trade would be significantly slowed down by these head scratching tariffs that NEED to be negotiated to realistic levels.” (Emphasis added.)

Ives also flagged an issue Nick Colas at DataTrek highlighted in a Friday morning note too: There’s a duration mismatch between US politics and Trump’s manufacturing ambitions.

“It will take many years for companies to shift production here, but Americans go to the polls every two years for Congress and four years for the presidency,” Colas wrote.

“Should newly announced trade policy cause a recession and incremental inflation, the lingering effects of both will be on voters’ minds, especially in 2028,” he added.

In Ives’s view, the cost of labor in the US makes it “unrealistic” that we could ever reshore semiconductor fabrication.

“If these tariffs went into place at current form overall tech earnings would come down 15% at least, the supply chain will be a Rubik’s Cube rivaling Covid days, and the economy would go into a recession/stagflation,” Ives wrote.

Less than an hour before Ives’ note hit the inbox, headlines crossed that China would slap 34% retaliatory tariffs on US imports.

“We assume tariff negotiations start now otherwise dark days are ahead for tech,” Ives added, “and US consumers pay the price for this … not a debate.”

Read the full article HERE.