President Donald Trump’s tariffs, if sustained, could push the U.S. and the world into a recession, according to JPMorgan.

If implemented, Trump’s tariffs — which start at a baseline of 10% and go even higher for some countries — raise the effective U.S. tariff rate to 25%, a level that would hurt the U.S. growth and inflation outlook, according to JPMorgan.

The tariff hike would account for roughly 2.2% of GDP, the firm said. Meanwhile, it would add close to 2% to the consumer price index.

“We view the full implementation of these policies as a substantial macro economic shock not currently incorporated in our forecasts,” global economist Nora Szentivanyi wrote on Thursday. “This shock will likely be magnified by its impact on sentiment and through the retaliation of countries facing significant increases in their tariff rates.”

“We thus emphasize that these policies, if sustained, would likely push the US and global economy into recession this year,” Szentivanyi added.

To be sure, the economist said she’s not immediately making any changes to her forecasts, waiting to see how the policy will be implemented in the coming days.

However, the severity of Trump’s tariffs alarmed investors Thursday morning, with the Dow Jones Industrial Average futures plunging more than 1,200 points on fears of a global trade war.

Read full article HERE.

- All eyes on tariff announcement at 4 p.m. EDT (2000 GMT)

- Spot gold hit record high of $3,148.88 per ounce on Tuesday

- US private payrolls accelerate in March

- US monthly employment report due on Friday

Gold prices rose to nearly a record high on Wednesday, supported by safe-haven demand as markets braced for details of U.S. President Donald Trump’s latest tariff plans later in the day.

Spot gold was up 0.4% to $3,123.74 an ounce as of 9:15 a.m. EDT (1315 GMT). U.S. gold futures also gained 0.4% to $3,158.70.

“You have a very unsettled economic and political environment in the world and that’s going to keep investors buying gold and keeping gold price high,” said Jeffrey Christian, managing partner of CPM Group.

Trump, who has been promoting April 2 as “Liberation Day,” is expected to introduce sweeping new tariffs on multiple countries at 4 p.m. EDT (2000 GMT) during an event at the White House.

The U.S. president said his reciprocal tariff plans aim to equalize the comparatively lower U.S. tariff rates with those imposed by other nations.

Investors are worried that Trump’s tariffs will stoke inflation and hinder economic growth and are taking refuge in safe-haven assets like gold.

“A breach of resistance at $3,147.41/$3,149.84 would bode well for a push to $3,200, and lend confidence to bullish outlooks that highlight $3,300 and $3,500,” said Peter Grant, vice president and senior metals strategist at Zaner Metals.

Gold, often used as a safe store of value during times of political and financial uncertainty, has risen more than $500 so far in 2025 and hit a record peak of $3,148.88 on Tuesday.

“If the tariffs set to take effect today are implemented, demand for safe-haven assets could rise further, as this scenario has not yet been fully priced in,” said Ricardo Evangelista, senior analyst at brokerage firm ActivTrades.

Meanwhile, the ADP National Employment Report on Wednesday showed U.S. private payrolls growth accelerated in March. The biggest jobs data this week will come on Friday with the release of the monthly U.S. employment report.

Among other metals, spot silver rose slightly to $33.76, while platinum dropped 0.4% at $975.51, and palladium was down 0.3% to $980.51.

Read the full article HERE.

Tear up every gold prediction and precious metals forecast that was made before March 1, 2025. Everything has changed with respect to the world’s favorite safe haven. If you’ve lost count of gold’s all-time highs, expert endorsements, soaring central bank demand, and the scores of analysts who are now frantically embracing the precious metal — you’re not alone. Gold seems to go “where it has never gone before” …. on A daily basis.

The Wall Street Journal has just announced that “Everyone is a Gold Bug Now!”[1] Indeed, gold is attracting more first-time buyers than ever before, and they’re not only moving money out of stocks and bonds but also cashing in crypto accounts to buy physical gold.

[1] https://www.wsj.com/finance/investing/gold-bug-investing-36268c5a

Most global experts have “upped” their gold price predictions and forecasts with targets that suggest this rally has very steady and strong legs.

Gold is in Uncharted Territory

Gold prices have now eclipsed $3100/oz. This is unprecedented for the yellow metal as we find ourselves in the midst of an historic price surge that has seen 19 all-time high records set just in 2025 alone. As of this writing, gold is up over 38% in the past year and more than 90% over the past five years.

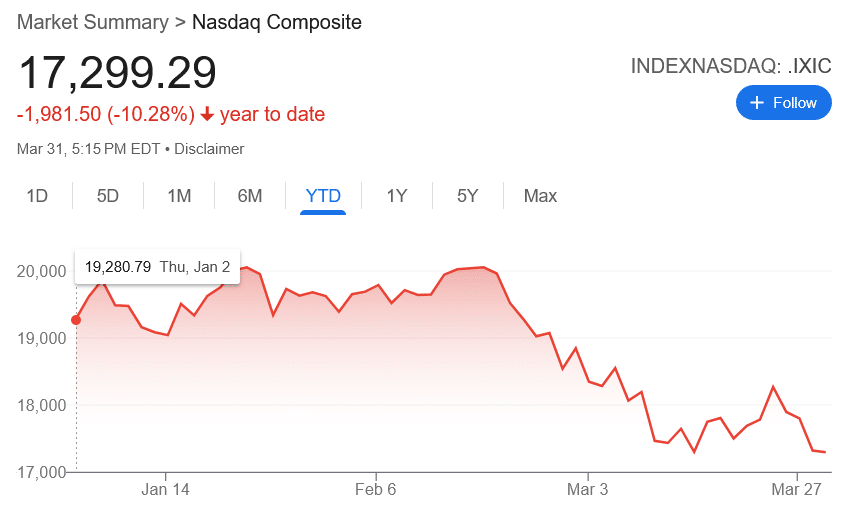

Amid gold’s historic run, stocks have faltered. The Dow Jones is down more than 450 points YTD. The Nasdaq is down well over 2000 points YTD, and the S&P 500 is down over 260 points YTD. The Nasdaq and S&P 500 also both entered into correction territory in March.

According to NerdWallet, a market correction is a fall in value of at least 10% from a recent market or indices high. At its most basic level, market corrections are triggered because investors are more motivated to “sell” than to “buy.” The reasons for a longer-term decline includes the following:

- A Slowing Economy: If the economy is slowing or entering a recession, or investors are expecting it to slow, companies will earn less, so investors bid down their stocks.

- Lack of “Animal Spirits”: This old phrase refers to the surges of investor emotion and risk-taking during a bull market. As they see the chance for profits, people jump into the market, pushing stock prices up.

- Fear: In the stock market, the opposite of greed is fear. If investors think the market is going to fall, they’ll stop buying stocks, and sellers will have to lower their prices.

- Outside Events: This miscellaneous category includes everything else that might spook the market, such as wars, attacks, oil-supply shocks, and other events that aren’t purely economic.[1]

What is Driving the Unstoppable Gold Surge?

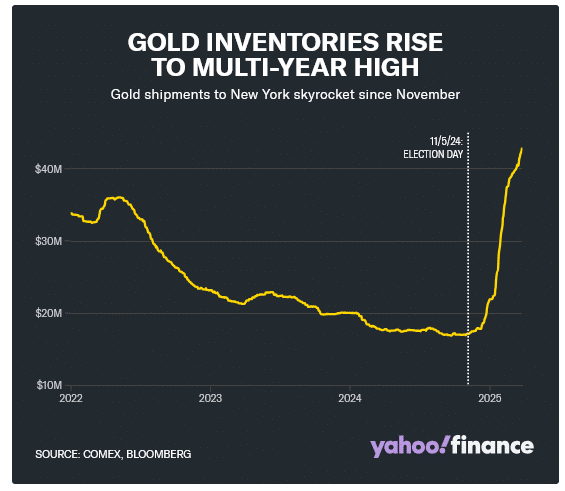

The Trump tariffs have been dominating economic headlines in 2025, and their impact on inflation, GDP, consumer sentiment, market volatility and the prospects of a recession have been actively fueling gold demand.

Worries Abound! From the fear of a broadening trade war and retaliatory tariffs — to rising consumer prices and supply chain challenges — financial uncertainty is now crippling Wall Street!

[1] https://www.nerdwallet.com/article/investing/what-is-a-stock-market-correction-and-what-happens-in-a-crash

And according to a senior analyst at online trading platform Capital.com, the stock market’s pain is gold’s gain!

“While stocks falter, gold continues to shine. The metal’s status as a safe haven has been reinforced by tightening financial conditions, falling bond yields, and a weaker US dollar. As foreign demand for US assets drops due to lower yields, the environment becomes increasingly supportive for non-yielding assets like gold.”[1]

Gold’s safe haven appeal is also being fueled by geopolitical tensions as Israel is back in Gaza and Russia continues to launch drone attacks on Ukraine. And of course, the world’s central banks have been buying at unprecedented levels.

According to the World Gold Council

“Central banks’ insatiable appetite for gold reached a significant milestone in 2024. Having added 712t in the first three quarters of the year, central banks bought a further 333t in Q4 to bring the net annual total to 1,045t. As a result, they have extended their buying streak to 15 consecutive years, and, remarkably, 2024 is the third consecutive year in which demand surpassed 1,000t – far exceeding the 473t annual average between 2010-2021, and contributing to gold’s annual performance.”[2]

And despite record-high gold prices, the central bank gold grab has been historic as the world’s reserve banks are adding to their gold reserves at the fastest pace in history.

Experts Predict an Extended Gold Bull

Economists, analysts, and most major banking giants have been scrambling to update their gold projections. Not only have Morgan Stanley, Citigroup, Goldman Sachs, and Bank of America all increased their gold price forecast — so have traders, refiners, miners, jewelry analysts and most macro models.

According to precious metals trader Heraeus Metals,

“Gold’s rally has been fueled by escalating geopolitical tensions, inflation concerns, and strong investor demand. Given the current macroeconomic environment – particularly trade war uncertainties and central bank policies – this trend appears sustainable in the near term.”[3]

[1] https://www.businessinsider.com/gold-price-record-april-tariffs-trump-economy-central-bank-etf-2025-3

[2] https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2024/central-banks#from-login=1

[3] https://www.reuters.com/markets/commodities/gold-sails-above-3100-uncharted-territory-us-tariffs-approach-2025-03-31/

Similarly, global asset management and financial services company, Macquarie Group, admits that gold’s strength took them by surprise:

“Year-to-date, gold has been running ahead of our expectations. We are raising our gold price forecast to a 3Q25 quarter average peak of $3,150 per ounce and our single point price high to $3,500 per ounce. President Trump’s rapid move to announce, if not always to enact, import tariffs has contributed to geopolitical uncertainty and boosted inflation expectations, helping push down front-end real rates and supporting gold in the face of periodic USD strength and initially reduced expectations for Fed rate cuts.”[1]

And multiple experts think $4000/oz gold is not only feasible but likely including Bloomberg Intelligence strategist Mick McGlone, Yardeni Research, and the Chief Executive Officer at DoubleLine, Jeffrey Gundlach who believes gold is experiencing a “very sharp, steep trajectory” that he does not expect to stop:

“I’d be so bold to say I think gold will make it to $4,000 … “I think that that’s in recognition of gold as a storehouse of value that’s more outside of the financial system, which seems to be in a state of flux at this point in time.”[2]

[1] https://finance.yahoo.com/news/gold-touches-new-record-as-latest-wall-street-prediction-sees-prices-reaching-3500-170903882.html

[2] https://www.marketwatch.com/story/golds-going-to-reach-4-000-says-gundlach-he-also-puts-recession-probability-at-60-36b3f772

April 2nd is “Liberation Day” — Protect Your Money!

President Trump has dubbed Wednesday, “Liberation Day” where he is promising to roll out major new tariffs and levies on goods from other countries. The president has also indicated that he will impose reciprocal tariffs on other countries to level the “trade playing field” and end unfair trade practices by other countries.

According to Barron’s, it is a ‘make or break’ moment for the stock market:

“No one, perhaps not even Trump himself knows what’s to come. There’s hope that the levies will be small and targeted in their execution, but also reports that the administration is considering placing 20% tariffs across the board … For U.S. companies, the problem starts with earnings. Estimates for this year have slipped from about $272 at the start of the year to about $268 now, but high tariffs will almost certainly raise costs and eat into margins, suggesting that earnings have a lot more room to fall.”[1]

Specifically, the president mentioned new tariffs on the EU, Brazil, South Korea, India, and other countries with unfair or unbalanced trade policies toward the United States. All of this follows the announcement of a 25% tariff on all imported passenger cars (and automotive parts) last week.

“This is the beginning of Liberation Day in America. We’re going to charge countries for doing business in our country and taking our jobs, taking our wealth, taking a lot of things that they’ve been taking over the years. They’ve taken so much out of our country, friend and foe. And, frankly, friend has been oftentimes much worse than foe.”[2]

[1] https://www.barrons.com/articles/liberation-day-stock-market-selloff-89723759

[2] https://www.cnbc.com/2025/03/30/trumps-promised-liberation-day-of-tariffs-is-coming-heres-what-it-could-mean-for-you.html

Gold prices on Monday soared above $3,100 per ounce for the first time as concerns around U.S. President Donald Trump’s tariffs and the potential economic fallout, combined with geopolitical worries, drove a fresh wave of investments into the safe-haven asset.

Spot gold prices hit a record high of $3,106.50 per ounce.

Gold prices have hit multiple record highs, gaining more than 18% so far this year – capitalising on its cachet as hedge against economic and geopolitical turbulence.

Earlier this month, it breached the psychological $3,000 per ounce mark for the first time – a significant milestone that experts say reflects growing concerns over economic instability, geopolitical tensions and inflation.

Bullion’s rally has prompted multiple banks to increase their price forecasts for gold this year.

“For now, gold’s appeal as a safe haven and inflation hedge has further strengthened in light of these geopolitical concerns and tariff uncertainty. We remain constructive on the outlook of gold amid ongoing global trade friction and uncertainty,” said analysts at OCBC.

Goldman Sachs, Bank of America and UBS have all raised their price targets for the yellow metal this month, with Goldman forecasting gold to hit $3,300/oz by the end of the year, up from $3,100. BofA expects gold to trade at $3,063/oz in 2025 and $3,350/oz in 2026 – an increase from its previous forecasts of $2,750/oz for 2025 and $2,625/oz for 2026.

Trump has floated plans for a series of new tariffs aimed at protecting U.S. industries and reducing trade deficits since he took office, including a 25% tariffs on imported cars and auto parts, as well as an additional 10% on all imports from China. He intends to announce a fresh set of reciprocal tariffs on April 2.

“Tariff issues will continue driving (gold) prices higher until there is some finality to the tit-for-tat campaign,” Marex consultant Edward Meir said.

Additional factors, like robust central bank demand and exchange-traded fund inflows, will also continue supporting gold’s stunning rally this year, analysts and investment banks say.

Read the full article HERE.

Wall Street keeps pushing up its already bullish calls on gold as the precious metal climbs to new highs.

Gold futures (GC=F) rose to $3,114 on Friday after hitting their 17th record of the year on Thursday. President Trump’s auto tariff announcement fueled trade war fears, while a weaker US dollar (DX-Y.NYB) also supported prices.

Earlier this week, analysts at Bank of America raised their price target on gold to $3,500 per ounce over the coming 18 months from $3,000 previously. The new target is based on the assumption that investments increase 10% through more buying from China and central banks and continued purchases of physically backed ETFs.

“Uncertainty around Trump administration trade policies could continue to push the USD lower, further supporting gold prices near-term. In our view, a broad rebalancing of America’s twin deficits could be bullish gold too,” wrote the analysts.

A “confluence of factors, mostly driven by the Trump administration’s economic policy mix, have pushed investors to increase their allocations to the yellow metal,” the analysts wrote.

BofA’s call follows a similar forecast from Macquarie Group, which recently predicted the precious metal will touch $3,500 in the third quarter of this year.

The precious metal’s more than 15% rally year-to-date has even prompted JPMorgan analysts to question whether a price of $4,000 is a possibility.

The firm’s researchers noted the commodity’s price move from $2,500 to $3,000 occurred in just 210 days, significantly faster than previous $500 increments, which have averaged over 1,700 days.

JPMorgan analysts asked in a client note on Wednesday, “With each $1,000 phase taking about two-thirds less time than the previous one, and considering the law of diminishing returns alongside investors’ attraction for round numbers, could the $4,000 mark be just around the corner?”

The analysts said the freezing of Russian foreign assets following the Ukraine war has “triggered a structural change in the demand for gold.” Last year, demand for the precious metal reached an all-time high as central bank purchases accelerated.

“Heading into 2025, gold remained our top bullish pick for a third consecutive year in a row,” the analysts wrote.

Read the full article HERE.

U.S. gold futures scaled a record peak on Thursday, as investors sought the safe-haven asset in response to escalating global trade tensions and tumbling equity markets following U.S. President Donald Trump’s announcement of new auto tariffs.

U.S. gold futures climbed 1.2% to $3,058.6, after hitting an all-time high of $3,065.50 earlier in the session, while spot gold rose 1% to $3,049.24 an ounce.

Gold is traditionally seen as a hedge against economic and political uncertainty and often thrives in a low-interest rate environment. Gold spot prices have hit 16 record highs this year, reaching an all-time peak of $3,057.21 on March 20.

“Looks like we’re going to see (gold futures hit) $3100 here shortly and the main catalyst is safe-haven buying,” driven by uncertainty around Trump’s tariff plans, said Bob Haberkorn, senior market strategist at RJO Futures.

Governments from Ottawa to Paris threatened retaliation after Trump unveiled a 25% tariff on imported vehicles, set to come into effect the day after he plans to announce reciprocal tariffs, aimed at the countries he says are responsible for the bulk of the U.S. trade deficit.

Global stock markets fell as shares in some of the world’s biggest carmakers tumbled.

Following the Federal Reserve’s decision last week to hold its benchmark interest rate steady, while indicating potential rate cuts later this year, investors are now awaiting the U.S. Personal Consumption Expenditures data due on Friday to gauge the trajectory for further rate cuts.

“If (the PCE data) comes out better-than-expected, it might signal more upside for gold… because the Fed would be in a better position to start cutting rates,” Haberkorn said.

Goldman Sachs on Wednesday raised its end-2025 gold price forecast to $3,300 per ounce from $3,100, citing stronger-than-expected ETF inflows and sustained central bank demand.

Spot silver rose 0.8% to $33.98 an ounce, platinum added 0.2% to $976.10 and palladium added 0.8% to $975.93

Read full article HERE.

The Congressional Budget Office warned that the federal government could run out of enough money to pay all of its bills on time as soon as August if lawmakers fail to raise or suspend the debt limit.

The Treasury Department has been using special accounting maneuvers since Jan. 21 to avoid breaching the $36.1 trillion debt ceiling, which kicked in at the start of the year. But the department has yet to offer specific guidance on when those measures will be exhausted.

“If the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will probably be exhausted in August or September 2025,” the CBO, a nonpartisan arm of the US legislature, said in a statement Wednesday. “The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections.”

The CBO also said that, “If the government’s borrowing needs are significantly greater than CBO projects, the Treasury’s resources could be exhausted in late May or sometime in June, before tax payments due in mid-June are received or before additional extraordinary measures become available on June 30.”

Going past the so-called X-date would necessitate the Treasury defaulting on “some obligation,” then-Secretary Janet Yellen said during the last congressional battle to address the debt limit, in 2023. Scott Bessent, who took the Treasury’s helm in January, told lawmakers in his confirmation hearing the US “is not going to default on its debt” with him in the job.

Congressional Wrangling

The CBO projection for X-date provides lawmakers with a rough estimate on how much time they have to raise or suspend the debt ceiling to avoid such a crisis.

House Republicans have pushed to include raising the debt limit in legislation to enact President Donald Trump’s top priority — extending his 2017 tax cuts, much of which expire at year-end. The House took one step toward that last month, passing a budget proposal that included raising the debt ceiling by $4 trillion.

Senate Majority Leader John Thune on Tuesday said there is “consensus forming” around attaching a debt-limit provision to the tax package as part of a so-called reconciliation bill, which the GOP could pass without Democratic votes. It’s not clear, however, whether there’s sufficient support among Senate Republicans for addressing the debt limit through that process.

The 2023 debt-ceiling suspension was done on a bipartisan vote.

Earlier this week, the Bipartisan Policy Center released its own X-date estimate, putting it sometime between mid-July and October. Wall Street strategists have estimated the date could fall around late-July to late-August. Some forecasts, however, put the timing as early as late May.

Much depends on tax-collection proceeds, with the April 15 filing date fast approaching. House Ways and Means Committee Chair Jason Smith warned earlier this month that a debt-ceiling breach was possible as soon as mid-May if the Treasury brings in less revenue than expected.

Read full article HERE.

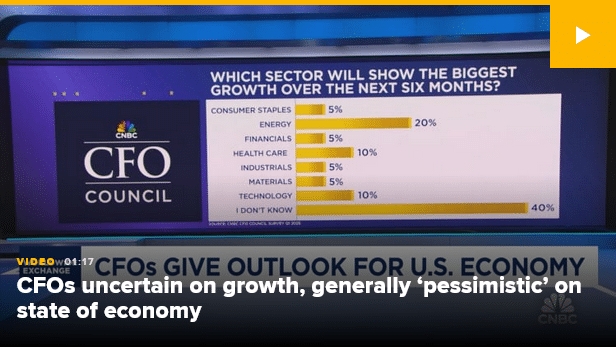

- The economy will enter a recession in the second half of 2025, according to a majority of chief financial officers responding to the quarterly CNBC CFO Council Survey.

- CFOs describe themselves as generally “pessimistic” on the overall state of the U.S. economy and uncertain about the stock market.

- 95% of CFOs said policy is impacting their ability to make business decisions, and many said while Trump is delivering on promises, his administration’s approach is too chaotic, disruptive and extreme for businesses to navigate effectively.

The stock market experienced a relief rally to start the week, and attempted to keep the comeback going on Tuesday morning, as comments from the Trump economic team over the weekend suggested a softer stance on tariffs. But within the boardroom, hope is not likely to replace caution any time soon.

Many executives in the C-suite and across the economy remain disturbed about the trade war outlook and a White House that has given every indication it is ideologically committed to a major change in global economic policy. Shifting messages from President Trump that continue to add confusion to the tariff planning process haven’t helped.

In a word, the “pessimism” has crept back in where the animal spirits had been after Trump’s election. That’s one way to sum up the results from the latest CNBC CFO Council quarterly survey for Q1 2025. While some chief financial officers said Trump is doing what he promised on the campaign trail, many CFOs said the way he is going about delivering on his agenda is not what was expected.

“Too chaotic for business to navigate effectively” was how one CFO respondent framed their view of Trump’s second term to date.

“Extreme”; “Disruptive”; “Aggressive”; “A wild ride,” were some of the other ways CFOs portrayed their current view.

It all adds up to a majority of CFOs (60%) saying they expect a recession in the second half of the year – another 15% say a recession will hit in 2026.

Just a quarter ago, when the recession question in the quarterly survey was laid on the Fed rather than Trump – in the Q4 2024 survey, we asked whether the central bank’s efforts to tame inflation would lead to an economic slump – only 7% of CFOs said they thought that was on the calendar for 2025.

In recent weeks, recession has become a more popular default setting in the market, for the first time since the Fed began aggressively raising interest rates to beat back runaway inflation in March 2022. The odds of recession are running as high as 50% at some financial firms, new “recession watch” indicators are being created, and other recent CNBC surveying, among money managers and economists, shows a spike in recession fears.

The CFO Council survey is a sampling of views from chief financial officers at large organizations across sectors of the U.S. economy, with 20 respondents included the Q1 survey conducted between March 10 and March 21.

U.S. trade policy is the primary reason for the new economic downturn base case. It is now being cited as the top external business risk by CFOs, at 30%, followed by the related risks: inflation (25%) and consumer demand (20%), with the latest reading on consumer confidence in income, business and job prospects hitting a 12-year low.

Ninety percent of CFOs say tariffs will cause “resurgent inflation,” and as CFOs worry more about prices, expectations for when the Fed can engineer it back down to 2% in keeping with its dual mandate keep getting pushed further out. Despite Fed Chair Jerome Powell himself holding out hopes that any tariffs inflation may be “transitory,” half of CFOs now say that the 2% target inflation rate will not be achieved until either the second half of 2026 or 2027.

Pressure on U.S. treasury bond yields is expected to remain, with 65% of CFOs saying the range will still be between 4% and 5% at the end of 2025 (50% of CFOs expect yields to stay within the lower end of this range, between 4% and 4.5%, where 10-year treasury are today).

As industries look to the White House for tariff exemption deals molded in their own self-interest, the general level of economic and market uncertainty among business executives across sectors was registered in one unusual way in the quarterly survey. Typically, when asked to name the stock market sector that will do the best over the next six months, CFOs choose tech, health care or energy. In the history of the survey, the responses to this question rarely deviate from those three sectors. This quarter, though, the majority CFO opinion on the sector with the best growth prospects was, “Don’t know.”

Few CFOs think the bull market will quickly resume its march upwards, with 90% of respondents saying the Dow Jones Industrial Average will retest 40,000 before ever reaching 50,000, which indicates the potential for several thousand points more in the index lost.

In a more key, core way, the cautious corporate view was evident in the change quarter over quarter with respect to spending plans, with the number of CFOs who say their firm plans to increase capex this year declining from Q4. It was not a precipitous decline (roughly 10%), but it is trending in the wrong direction. The largest share of respondents expect spending to remain in line with the recent trend at their companies (45%), and even as it declines as a budget stance, there are still more who expect an increase (35%) in spending than a decrease (20%).

Overall, 95% of CFOs said policy uncertainty is having an impact on their business decision-making.

The most acute way that rising pessimism was registered in the survey was simply by asking CFOs what they think of the economy: 75% of respondents said they are “somewhat pessimistic about the overall state of the U.S. economy” right now. And that’s despite 75% being optimistic about the state of their own industry.

The good news if a recession is in the cards? Ninety percent of CFOs think it will either be moderate (50%) or mild (40%).

But CFOs remain divided on where it is all leading, measuring a mix of diminished hopes and bleak confusion.

“I feel the current administration is seeing how far they can push before anything breaks. I am hopefully after the first 100 days that things will moderate,” said one CFO.

But another CFO responding to the survey concluded, “Complete chaos, without an end game strategy.”

Read the full article HERE.

Critics will tell a hearing on Monday that the move against commercial ships could be more disruptive for global trade than Trump’s tariffs.

For a symbol of the chaos engulfing world trade since the Trump administration walked into the White House, look no further than a pile of 16,000 metric tons of steel pipes. Stevedores in Germany should be preparing to load the first batch on a container ship bound for a massive energy project in Louisiana. Instead the cargo is sitting in a German warehouse after Washington proposed putting million-dollar levies on Chinese ships docking in the US.

Talks over the terms for shipping the pipes were put on hold until there’s more clarity, said Jose Severin, a business development manager for Mercury Group, the logistics provider for the deal. For that particular route across the Atlantic, 80% of the ship owner’s vessels were built in China, meaning a shipment would be subject to a surcharge of between $1 million and $3 million. Depending on how the measure is applied, that could amount to double or triple the current cost of shipping the steel pipes from Germany.

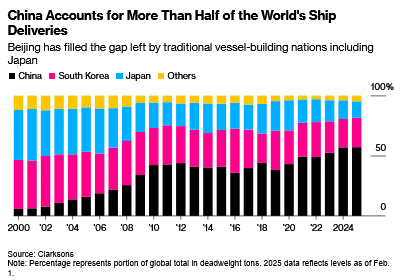

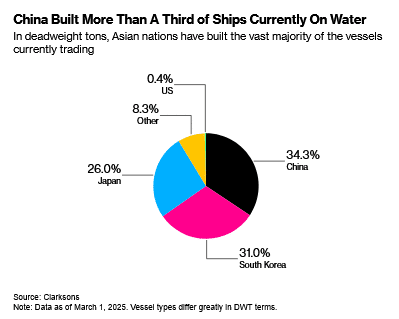

It’s one of countless deals caught in the crossfire sparked by a proposal from the Office of the US Trade Representative aimed at curbing China’s dominance of the shipbuilding, logistics and maritime industry. China now produces more than half of the world’s cargo ships by tonnage, up from just 5% in 1999, according to the USTR, with Japan and South Korea the other shipbuilding powers. Last year US shipyards built just 0.01%, and the USTR has an eye on reviving the fortunes of the long dormant US merchant shipbuilding industry.

China’s dominance gives it “market power over global supply, pricing, and access,” the USTR said on Feb. 21 when it unveiled the proposal. In response, the China State Shipbuilding Corp., which has the largest order book of any shipbuilding group in the world, described the measures as a breach of World Trade Organization rules.

The subject will be at the heart of a two-day USTR hearing in Washington that opened on Monday. The entire supply chain will be represented, from soybean growers to shippers to Chinese shipbuilders. Dozens of business owners and trade groups will explain why they fear the proposals would disrupt global trade more than President Donald Trump’s approach to tariffs.

“They see this as more of a threat than the tariffs, because of the impact it’s going to have on the supply chain,” said Jonathan Gold, vice president of supply chains and customs policy at the National Retail Federation. “Carriers have said they’re not only going to pass along the cost, but they’re going to pull out of certain rotations, so the smaller ports, Oakland, maybe Charleston, Delaware, Philly. They’re all going to suffer as a result.”

In letters to the USTR and interviews with Bloomberg News ahead of the hearing, business owners and industry officials said the proposals don’t make sense if the goal is to revive the domestic shipbuilding industry, and would potentially be devastating for the US economy. They argue it would make American goods too expensive internationally, divert trade away from US regional hubs to Canada and Mexico, overwhelm major US ports, and force up global freight rates and inflation at home.

The levies could theoretically generate between $40 billion and $52 billion for US coffers, according to Clarksons Research Services Ltd., a unit of the world’s largest shipbroker. But, already roiled by uncertainty over the escalating tariffs on Chinese goods, steel and aluminum, and with a fresh round of reciprocal measures expected on April 2, some American companies and others in the industry are anxious.

“What the USTR has proposed — a backward-looking, retrospective, multi-million dollar per port call fee — won’t work,” said Joe Kramek, chief executive officer of the World Shipping Council, who is set to testify on Monday. “It will only serve to penalize US consumers, businesses, and especially farmers, raising prices and threatening jobs.”

John McCown, a veteran of the maritime transportation industry and author of a history of cargo shipping, put it more starkly: “If you wanted to take a sledgehammer to trade this is what you would do. You take it all together — it’s like an apocalypse for trade.”

‘Make Shipping Great Again’

The USTR investigation began last year under the Biden administration after a request from five major labor unions. The resulting report, delivered just days before Trump was inaugurated in January, determined that China had targeted the global maritime sector to dominate it. It left it to the new administration to come up with ways to address Beijing’s commanding position.

The imposition of levies and additional export requirements are designed “to create leverage to obtain the elimination of China’s targeting of these sectors for dominance,” according to the initial proposals issued by the USTR on Feb. 21. Firms would be penalized using a formula based on their fleet’s existing share of Chinese-built ships, as well as others on order. Some vessels could attract fees of up to $3.5 million per port call if they are Chinese-built with a Chinese operator which also has a ship on order from a Chinese manufacturer, according to Clarksons.

An estimated 83% of container ship visits to the US last year would have been hit with fines under the proposed rules, as well as two-thirds of car-carrier calls and nearly a third of crude tankers, according to Clarksons.

The proposal also requires a share of US products — including agricultural, chemical, energy and consumer goods — to move on US-flagged, crewed, and built ships in coming years.

Many carriers and operators say they would happily buy or hire US-built merchant ships, but that it would take decades for US shipyards to meet capacity demands and there’s already a shortage of American mariners. At the same time, the port fees would punish carriers for investments they’ve already made in Chinese-built ships.

When Atlantic Container Line AB, which carries more than half of US exports of construction and agricultural equipment to Europe, needed to source “container-roll-on-roll-off” vessels in 2012, Japanese and Korean shipyards wouldn’t build just five of the specialized ships. American shipyards said they wouldn’t be able to deliver them for at least seven years, wrote CEO Andrew Abbott in a submission to the USTR. Instead ACL found ships in China, where they could get the vessels quickly and at a “competitive price.”

“The proposed action will put us out of business for a commercial decision taken 13 years ago,” wrote Abbott of the USTR proposal, “at a time when US shipyards were flush with US Navy orders and could not build our vessels, and when the Chinese shipbuilding industry was a minor player in the world.”

Many of the commenters expressed support for curbing China’s maritime might, while urging the USTR to rethink its approach. There were, however, a handful of comments in support of the proposed measures among the more than 250 submissions.

“China’s unfair production practices have made it impossible for American shipbuilders to compete on an even playing field,” said Scott Paul, president of the Alliance for American Manufacturing, who is scheduled to testify on Monday. “If fully implemented, these remedies will help to restore American economic security, push back against China’s unfair trade practices, and revitalize shipbuilding in America.”

Several industry executives believe the proposal is likely to be watered down given how disruptive it would be to world trade. Adjustments to the fees and export requirements could certainly be made. They could even be scrapped, given the mercurial character of some administration decisions. Yet, industry lobby groups insist there is good reason to think at least some of this will stick.

The idea of restoring a US shipbuilding industry to firm up US influence at sea has captivated Trump and fits with his wider push for a return to the halcyon days of US manufacturing. He has already staffed a new maritime directorate office inside the National Security Council.

Across Washington, the maritime sector is now cast as an essential pillar of national security, a shift that is still gaining momentum.

The USTR investigation echoes elements of a bipartisan bill introduced in December to address a shortage of merchant mariners using expanded training programs and tax incentives for companies looking to invest in US shipbuilding. The USTR proposal also shares some DNA with a draft executive order seen by Bloomberg that would funnel tariff or tax revenue to a fund to support the domestic shipbuilding industry.

The draft document — “Make Shipbuilding Great Again” — also suggests that the US will pressure other countries to align against China’s maritime dominance, or face retaliation. The White House didn’t respond to a request for comment about the draft executive order.

Major carriers have said they could adapt to the fees by skipping smaller ports along US routes, which might potentially damage local economies and specific industries that rely on them. Operators of container ships discharging at one port might be able to share the cost across thousands of containers, minimizing their exposure. But million-dollar plus fees for each port call could devastate smaller operators, as well as low-margin agricultural and commodities exporters reliant on smaller ports like Oakland or Charleston.

“It’s going to be immensely economically harmful,” said Philip Luck, economics director at the Center for Strategic and International Studies. “It’s not going to address the basic challenge they said they want to solve: increasing capacity of the US shipbuilding industry.”

“If it’s a pure security issue,” he added, “we should be incentivizing investment by allies like South Korea, Japan and Finland, who are very good at building ships.”

Two-Tier Shipping

The shipping sector has recent experience of the chaos that Washington’s scrutiny of China can bring. After the US Department of Defense blacklisted China’s largest shipping line Cosco Shipping Holdings Co. in January, over alleged links with the People’s Liberation Army, some shipbrokers were asked not to offer Cosco’s vessels for charter, according to people familiar with the matter. The suspension was lifted after a few days when it became clear that the blacklist would not impact charterers of Cosco’s ships financially or legally.

If the USTR implements its proposal as written, shipping executives and brokers say a gradual split of the market is likely, where China-built ships are treated differently to those constructed elsewhere. In the tanker market where China-built vessels make up a third of all ships, it already appears to be happening. Charterers are starting to shy away from leasing China-linked tankers for long-term engagements, according to shipbrokers, because they expect that the vessels will need to call at US ports in the future, exposing them to tariffs.

Shipowners keen to expand their fleet while avoiding the penalties would also find themselves in a bind. Yards are near capacity in South Korea and Japan with the next slot for new ship orders only available around 2028, shipbrokers said. But not acquiring new ships at a time when the age of the global fleet is rising means that they would be stuck with deteriorating vessels.

Jose Severin will watch the outcome of the USTR decision — which is expected in the coming weeks — closely. A lack of domestic supply means those 16,000 metric tons of steel pipes are still needed for the Louisiana project, “it still needs to happen,” he added.

Read the full article HERE.

The Federal Reserve on Wednesday painted a picture of an economy reshaped dramatically by President Donald Trump and his economic policy. It warned that tariffs could significantly dampen the economic outlook, ushering in higher inflation and slower growth. That sparked concerns about the dreaded “stagflation,” an economic curse that is hard to escape.

Eager to soothe worried investors, businesses and consumers, the Fed urged caution about getting too worked up about its forecast, noting that inflation caused by tariffs may not be long lasting. Nevertheless, there’s no cocktail a central banker hates more than high unemployment mixed with high inflation.

While Wall Street was already starting to sound the alarm about stagflation, Fed Chair Jerome Powell has remained relatively sanguine. That held true at Wednesday’s post-meeting press conference.

But many market observers felt Fed officials’ new economic forecasts nevertheless gave off whiffs of stagflation.

According to officials’ latest median estimates, the US unemployment rate may hit 4.4% by year’s end. Inflation, as measured by the Personal Consumption Expenditures price index, could rise to 2.7%.

That’s an uptick from the 4.3% unemployment rate and the 2.5% inflation rate officials projected in December. It’s also a jump from the current 4.1% unemployment rate, per the February jobs report, and 2.5% PCE inflation in January.

Additionally, US gross domestic product, Fed officials predict, will grow at an annual rate of 1.7%. In December, Fed officials projected a 2.1% pace.

In a note to clients on Wednesday, JPMorgan chief US economist Michael Feroli said the projections “were revised in a stagflationary direction.”

If the Fed’s latest forecasts manifest, though, they’ll be a far cry from stagflation.

Stagflation explained

Stagflation is the ultimate doomsday scenario for central bankers. No matter what they do, it’s all but certain to inflict pain on the economy.

Low rates of unemployment tend to compensate for some of the pain that high levels of inflation bring because businesses generally can only raise prices when people are earning enough to afford it. In contrast, when unemployment is high and people are cutting corners, businesses will have a tough time passing on higher prices to their customers, which keeps inflation low.

One of the worst bouts of stagflation happened in the 1970s after a spike in oil prices from the Arab oil embargo on the US and other countries that supported Israel in the 1973 Yom Kippur War raised the cost of living dramatically. But when the Fed tried to ease inflation by raising interest rates, the economy fell into a recession.

Then, to get the economy out of a recession, the Fed lowered interest rates. That resulted in higher inflation. Ultimately it took a painful recession without interest rate cuts to get the economy back on track.

What the economy is now experiencing, partially a result of President Donald Trump’s tariff policies dampening economic growth forecasts and renewing concerns about inflation, is unlikely to prompt Fed officials to so much as whisper stagflation to one another.

“I was around for stagflation. It was 10% unemployment. It was high single-digits inflation and very slow growth,” Powell said last May, referring to stagflation in the 1970s.

We’re nowhere near those 1970s levels now.

Read the full article HERE.