Gold Rally Doesn’t Lose Bullish Momentum

The gold (XAU/USD) price gained 0.44% on Wednesday, fuelled by the prospect of Federal Reserve (Fed) rate cuts and safe-haven buying due to trade tariffs uncertainty and geopolitical instability.

As expected, the Fed held its benchmark unchanged in the 4.25–4.5% range. However, Fed policymakers still expect the central bank to deliver two 0.25 percentage points cuts by this year’s end, matching their December projection. Jerome Powell, Fed Chairman, stated that the Trump administration’s early policies, particularly import tariffs, seem to have contributed to slower US economic growth and a temporary rise in inflation.

A confluence of factors—tariff uncertainties, the prospect of rate reductions, global central bank gold demand, and renewed tensions in the Middle East—has propelled gold to an extraordinary rally, resulting in 16 record highs in 2025, four exceeding $3,000. Still, traders should watch out for possible unexpected downward corrections.

“Given the very good performance in gold through Q1, I think a correction is not out of the question. However, so far, corrections have been relatively short-lived and well bid… $3,090–$3,100 may see some resistance”, said Nicholas Frappell, global head of institutional markets at ABC Refinery.

XAU/USD rose during the Asian and early European trading sessions. Today, more interest rate decisions are coming up. Swiss National Bank (SNB) and the Bank of England (BoE) will announce their base rates at 8:30 a.m. UTC and 12:00 p.m. UTC. In addition, the US Jobless Claims report will come out at 12:30 p.m. UTC. Lower-than-expected figures could pause the rally in XAU/USD, but such a setback will likely be short-lived. Conversely, higher-than-expected results may pull XAU/USD higher towards the $3,083.

Euro Fails to Rise Even as US Dollar Weakens

The euro (EUR/USD) lost 0.38% against the US dollar (USD) on Wednesday, even as the greenback failed to rally due to the Federal Reserve’s (Fed) dovish message. As expected, the Fed held interest rates steady but indicated that policymakers anticipate reducing borrowing costs by 0.5 percentage points by the end of this year.

The US Dollar Index (DXY) weakened after the decision but generally remained positive on the day. Fed officials revised their 2025 inflation forecast upward in response to the Donald Trump administration’s tariffs. They now expect inflation to reach 2.7%, exceeding the 2.5% projection from December and surpassing the 2% target. This US inflation outlook supported the greenback and pressured EUR/USD, which has been moving predominantly range-bound for several days.

“I think that we’re probably going to be kind of floating around here until we get some firm first-quarter GDP data that’s going to be a really big tell for traders as to whether this economic weakness that everyone’s worried about, it’s fully materialising”, said Helen Given, director of trading at Monex USA.

Meanwhile, the Eurostat statement showed that inflation in the eurozone was 2.3% in February. The figure is below the previously reported 2.4% and aligns with earlier economist estimates. However, core inflation—an indicator closely watched by policymakers, which excludes volatile food and energy costs—remained at 2.6%. It held steady even after the monthly growth rate was cut from 0.6% towards 0.5%. While the revision is significant, it’s not expected to substantially alter expectations for the European Central Bank’s (ECB) April policy meeting.

EUR/USD fell slightly during the Asian and early European trading sessions. Today, the Swiss National Bank (SNB) and the Bank of England (BOE) will announce their policy rate decisions at 8:30 a.m. UTC and 12:00 p.m. UTC. The announcements may add some volatility to EUR pairs. In addition, the US Jobless Claims report is due at 12:30 p.m. UTC. Lower-than-expected figures could push EUR/USD below 1.08750. Conversely, higher-than-expected results may pull EUR/USD towards 1.09460. Also, traders should note that several ECB policymakers, including ECB President Christine Lagarde, will give speeches later today. Their remarks, particularly regarding the current economic outlook and potential policy adjustments, might offer clues about the central bank’s upcoming decisions.

Weak Employment Report Pushes AUD Down

The Australian dollar (AUD/USD) weakened against the US dollar on Wednesday but later recovered and finished the day essentially unchanged.

Earlier today, AUD/USD started to fall again after the Australian Bureau of Statistics released a surprisingly weak Employment report. Figures showed net employment fell by 52,800 in February from January compared with the expected 30,000 rise. Annual job growth pulled back sharply from 3.5% to just 1.9%. Still, figures remain in line with long-running averages. After hitting a record high of 67.2% in January, the participation rate slumped towards 66.8%. However, the unemployment rate stayed at 4.1%, matching market expectations.

Interest rate swaps market data still implies only a small 10% chance of a rate cut by the Reserve Bank of Australia (RBA) at the April 1 meeting. Meanwhile, the chances of a rate reduction in May have risen from 70% towards 78%. The RBA cut interest rates last month for the first time in four years but cautioned that further easing isn’t guaranteed, given the surprisingly strong labour market could risk stoking inflation. Now, the labour market no longer looks strong, so investors expect the RBA to turn dovish again. These expectations put downward pressure on AUD/USD.

AUD/USD dropped below the important 100-day moving average during the Asian and early European trading sessions. Today, the focus is on two central banks’ decisions and US macro data. The Swiss National Bank (SNB) and the Bank of England (BOE) will announce their policy rate decisions at 8:30 a.m. UTC and 12:00 p.m. UTC, respectively. Also, the US Jobless Claims report will come out at 12:30 p.m. UTC. Lower-than-expected figures could push AUD/USD towards 0.63000. Conversely, higher-than-expected results may pull the pair above 0.63500.

Read the full article HERE.

The UCLA Anderson Forecast, citing substantial changes to the economy from policies of the Trump administration, issued its first-ever “recession watch” on Tuesday.

UCLA Anderson, which has been issuing forecasts since 1952, said the administration’s tariff and immigration policies and plans to reduce the federal workforce could combine to cause the economy to contract.

Its analysis was titled, “Trump Policies, If Fully Enacted, Promise a Recession.”

“While there are no signs of a recession happening yet, it is entirely possible that one could form in the near term,” said a news release from the forecaster.

U.S. recessions are only officially declared by the Business Cycle Dating Committee of the National Bureau of Economic Research. The committee employs a variety of indicators, including production, employment, income and growth to determine if the economy is contracting. At the moment, none of the specific indicators look to be near levels that would prompt the committee to declare recession.

The average respondent to the CNBC Fed Survey for March, published Tuesday, forecast a 36% recession probability in the next year, up from 23% in the prior month. But it remains well below the 50% level that prevailed from 2022 and 2023 in the wake of the pandemic and turned out to be wrong. That shows how difficult it is to predict a recession, or even determine if the economy is in one. The Fed Survey also shows that a recession is not the base case for most Wall Street forecasters, only that the concern is somewhat elevated.

Recessions occur when multiple sectors of the economy contract at the same time. The UCLA Anderson Forecast said reductions to the workforce from the administration’s immigration policies could create labor shortages, tariffs will raise prices and could lead to a contraction in the manufacturing sector while changes to federal spending will reduce employment for government workers and private contractors.

“If these and their consequent feedback into the demand for goods and services occur simultaneously, they create a recipe for a recession,” the statement from the forecaster said.

‘Stagflationary’

Administration officials, from the president to his top economic lieutenants, have not specifically pushed back against the possibility of a recession from their policies. President Donald Trump has said there would be a “period of transition,” while the Commerce secretary had said a recession will be “worth it” for the gains that will eventually come from the policies.

Recessions are often the result of unexpected shocks to the economy. The surge in optimism following the election of Trump, followed by the recent sharp drop-off in some surveys, suggest that both businesses and consumers were unprepared for the extent and even the nature of some of the policies now being pursued.

On timing, the UCLA Anderson Forecast would only say a recession could develop in the next year or two. Its report said: “Weaknesses are beginning to emerge in households’ spending patterns. And the financial sector, with elevated asset valuations and newly introduced areas of risk, is primed to amplify any downturn. What’s more, the recession could end up being stagflationary.”

Read the full article HERE.

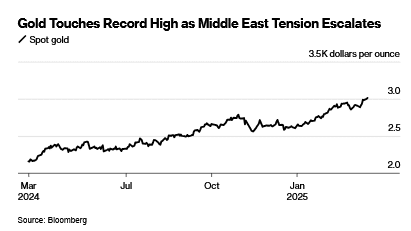

Gold rose to a record high above $3,028 an ounce as an escalation in Middle East tensions underscored its haven appeal, and investors weighed data that fueled concern the US economy is slowing down.

Bullion climbed as much as 0.9% as Israel launched military strikes on Hamas targets in Gaza, a move that threatens to undermine a shaky truce. Hamas said at least 322 people had been killed or were missing since the airstrikes began.

Traders were also digesting US retail sales data released Monday, which rose less than forecast in February. While the figures pointed to weak spending on goods, there was no sign of a severe pullback and the data did little to alter traders’ bets on expectations for Federal Reserve rate cuts.

Still, companies, investors and economists remain cautious as consumer sentiment sours and signs of financial stress mount, amid risks of escalating trade wars sparked by US President Donald Trump.

The gloomier outlook for both the US and global economy has underscored bullion’s role as a store of value in uncertain times. The metal is up 15% so far this year, extending its strong annual advance in 2024. Several major banks have hoisted their price targets for this year higher in recent weeks.

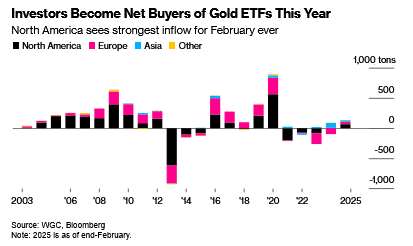

Inflows into physically-backed gold exchange-traded funds continued for a fifth consecutive day on Monday. The amount of gold held in ETFs has risen 5% this year, after dropping for the past four years, according to data compiled by Bloomberg.

While gold has further room to run, “$3,000 was a strong resistance” in the short term, said Vasu Menon, managing director of investment strategy at Oversea-Chinese Banking Corp. “Even though it’s broken marginally above this, it may not signal a decisive break,” said Menon, who sees bullion rising to $3,100 an ounce within twelve months.

Spot gold was up 0.8% to $3,023.65 an ounce as of 9:28 a.m. in London. The Bloomberg Dollar Spot Index fell 0.1%. Silver, platinum and palladium all rose.

Read the full article HERE.

Bank of America Corp., Citigroup Inc. and Macquarie Group Ltd. have been vocal cheerleaders for gold during a breakneck rally that has taken prices to record highs above $3,000 an ounce. With anxiety about the global economy growing, they see plenty of reasons to stay bullish.

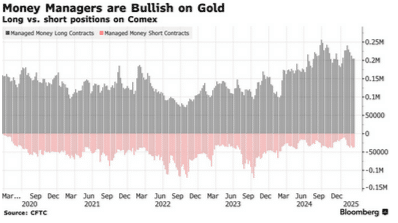

Gold has been on the charge since late 2022, with elevated central-bank purchases and a buying spree in China causing prices to almost double in a little over two years. Now, it is bullion’s time-tested status as a haven asset that’s drawing investor interest.

Prices broke through the $3,000 an ounce barrier on Friday, against a backdrop of growing angst about the economic risks arising from US President Donald Trump’s disruptive trade agenda. US consumer confidence has plunged, while inflation expectations have surged, and as the apprehension grows, many analysts have been hiking their price targets.

“We do still think there are some materially bullish developments likely to come for gold,” said Marcus Garvey, Macquarie’s head of commodities strategy, who raised the bank’s top-end price target from $3,000 to $3,500 last week. “I don’t really see things that would suggest to us that this rally is in an area that’s become frenzied or overextended.”

Here, illustrated in four charts, are the key factors that have Wall Street betting that bullion’s blistering rally has more room to run.

ETFs

Investors are net buyers of physically-backed gold exchange-traded funds this year, after selling them for the past four years. North America saw a major inflow in February, the largest in a single month since July 2020, according to the World Gold Council. That was partly helped by sentiment stemming from a worldwide rush to ship bullion into the US to capture the large price differential between New York’s Comex and the spot London market.

Concerns over a slowing economy may also prompt US households to seek to diversify their portfolios by buying gold ETFs, according to Citigroup analyst Max Layton. “That’s the big development that’s taking us that next step higher,” he said.

“While there’s been a lot of central-bank buying and evidence of high-net-worth individuals buying over the last 12-18 months as a hedge against downside risks in equities and US growth, the household hasn’t really bought yet — and they’re potentially only just starting,” Layton said.

For Matt Schwab, head of investor solutions at Quantix Commodities, whether ETF holdings can keep rising is crucial to gold’s move higher. ETFs played an important role in the precious metal’s rally to then-record highs during the pandemic.

Overcoming Headwinds

While gold tends to thrive during prolonged periods of economic weakness, analysts caution that bullion may get hit in the short run if there’s a heavy selloff in the stock market, as investors may opt to exit profitable gold positions to cover losses elsewhere.

“Sometimes it can get messy, as we’ve seen in 2008/2009 period, we’ve seen the pandemic: gold gets hit very hard along with all other asset classes as well when there is a big risk-off move,” said Bart Melek, global head of commodity strategy at TD Securities.

Michael Widmer, Bank of America’s head of metals research, agrees that gold could be set for short-term turbulence as investors take profits, but he still sees bullion rising further to $3,500 over the long run.

Buying could also reaccelerate in China this year, thanks to Bejing’s initiative to let insurers invest in precious metals, according to Widmer. The policy could create 300 tons of additional demand, equivalent to 6.5% of the annual global market, he estimates.

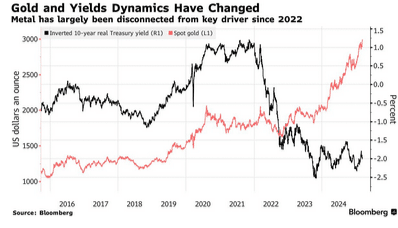

Real Rates

One striking feature of gold’s two-year bull run is that it has come despite a surge in interest rates. Typically, higher inflation-adjusted interest rates act as a headwind for gold, because bullion pays no interest, and investors can make safe and attractive returns in government bond markets.

But higher debt and deficits have meant that some investors are now pricing in an element of credit risk in some developed economy government bonds, pushing some of them to gold, according to Macquarie’s Garvey.

“Other than something like a failure to lift a debt ceiling leading to a technical default, I don’t think anyone is arguing that the US is ever going to default in dollar terms, and most countries are never going to default in local currency terms,” Garvey said.

“But if you are running an unsustainable fiscal backdrop, you are then implicitly devaluing your own currency, and gold as the hard currency really benefits from that.”

Central-Bank Buying

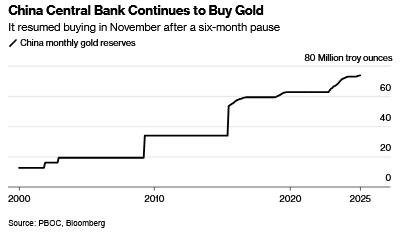

Central banks were the main driver behind gold’s ferocious run in 2024. They continued to buy the precious metal this year even as prices kept rising, with 18 tons of net purchases in January, according to the World Gold Council.

China’s central bank, which played a crucial role in gold’s spectacular rally last year, expanded its gold reserves for a fourth month in February, with total holdings at 73.61 million ounces by the end of last month.

Goldman Sachs — which raised its year-end forecast to $3,100 just last month — now sees a growing likelihood of an even bigger rally, driven by strong central bank buying and rising investor demand.

That’s “because US policy uncertainty may support investor demand, and because we believe that central bank gold buying will remain structurally higher,” Goldman analysts said in an emailed note on Friday.

Read the full article HERE.

The stock market is in a world of hurt, giving up all of its post-election gains due to worries about tariffs, trade wars, and the threat of recession. But gold continues to shine! The yellow metal is getting ever closer to $3,000 an ounce, opening up investment opportunities. Here are some to consider from top MoneyShow experts.

Sean Brodrick | Weiss Ratings Daily

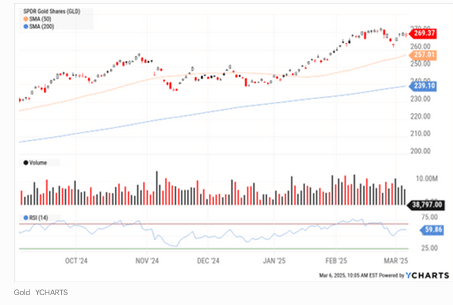

There’s something very curious going on in gold — and it says something about where the yellow metal might be headed. An easy way to play the coming move is through the SPDR Gold Shares ETF (GLD).

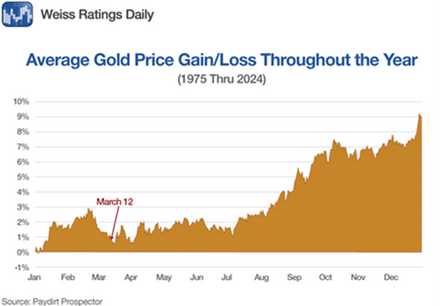

The first thing you need to know is that seasonally speaking, gold shouldn’t be rallying at all. This is the weak time of the year for gold, as you can see from this chart…

Gold usually doesn’t start making significant gains until April, if then. To be sure, this is an average, and every year is different. But this rally at this time of year is kind of a shocker!

So, what makes this year different? “Chaos as policy.”

First, I’m pretty sure President Trump and his team have set out to “break” the US government. That’s what Elon Musk’s Department of Government Efficiency, or DOGE, is all about. Their plan is to rebuild and restructure the government, only leaner. Trump says we’ll be much better off when it’s all said and done. In the short term, it’s chaos.

Meanwhile, the White House’s on-again, off-again approach to tariffs with our major trading partners is so chaotic, it can barely be called a policy. Chaos scares investors. And that is one of the major forces driving gold higher.

Second, this raises the odds of the Federal Reserve cutting benchmark interest rates this year. As recently as Feb. 12, the market was pricing in only one rate cut. While Fed Chair Powell said recently that the Fed wants to take it slow on rate cuts, the market is now pricing in three cuts in 2025, starting in June. Combined with the rate cuts that began last year, America is in a rate-cutting cycle.

Now, we don’t know exactly how much gold will run this time around. But odds are it’s going a LOT higher. If the past is a guide, gold will more than double. GLD has a Weiss Rating of “B-” and an expense ratio of just 0.4%, which is pretty cheap.

Eoin Treacy | Fuller Treacy Money

Gold has been very resilient over the last several weeks. The current range has a much narrower amplitude than those posted over the last year. There are two ways of thinking about it.

The first is the pace of the advance is picking up and traders are not willing to wait for a deeper pullback to buy. The second is the trend is still very consistent and a reaction of $200-$250 is still possible.

Of course, the other point is this is the US Dollar price of gold. The currency has fallen sharply over the last month so that has helped to support the gold price.

In British Pounds, the price of gold has pulled back £133 from its peak. The October – January range has a maximum drawdown of £160. The April-to-September range had an amplitude of £154.

The message is quite similar. The size of the current reaction is smaller than the last two. Since this has occurred against a background of an appreciating Pound, that is good news.

It’s a similar story for the Australian Dollar price. This reaction was for A$160. The last two were A$332 and A$351, respectively.

When we look at gold priced in several currencies, there is no questioning that the pace of the advance has picked up. This global surge in demand for physical gold has been driven by central banks. Political volatility has increased substantially since Donald Trump took office.

The news over the last week has been filled with talk of tariffs and war. It’s easy to get caught up in the minute details of which tariff is being increased or decreased. The bigger message is more important to gold.

The US is no longer a reliable partner. That means the status quo is no more and we are entering a new era of great power politics. That is going to have far-reaching consequences.

Gold is currently pausing below the big, psychological $3,000 level. Twenty years ago, $3,000 was considered an ambitious, far-away target. Today it is upon us and I don’t hear many people talking about a future price of $5,000 or $10,000.

I can’t tell you when those levels will be achieved, but the long-term trend of currency debasement is alive and well. That means those targets are inevitable. The only question is when.

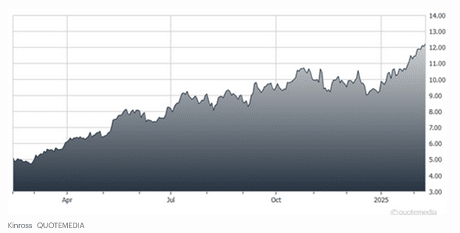

Mark Skousen | Forecasts & Strategies

Gold is over $2,900 an ounce and headed for $3,000, largely due to global uncertainty and strong central bank purchases by China and other countries. The SPDR Gold Shares ETF (GLD) is ahead nearly 11% in six weeks. I also like Kinross Gold Corp. (KGC).

Here’s a surprise: Which is up more over the past 25 years — gold or stocks? The average investor would answer stocks. But the correct answer is gold.

As the Wall Street Journal reported recently, the S&P 500 — including dividends — returned 525% between 2000 and the end of 2024. But gold increased by more than 800% over the same period, jumping from $281.63 an ounce to $2,603.01.

It remains a great inflation hedge. And mining stocks are a good way to play it. That brings me to KGC. It yields only 1%, but is now up 30% for us.

Read the full article HERE.

Signs of weakness are showing up in spending on everything from basics to luxuries

Key Points:

-Consumer spending is declining across all income levels due to concerns about tariffs, inflation and a potential recession.

-Retailers are reporting weak demand since the start of the year as consumers become more cautious about their spending.

American consumers have had a lot to fret about so far this year, between never-ending tariff headlines, stubborn inflation and most recently, fresh fears about a recession. These concerns seem to be hitting spending by both rich and poor, across necessities and luxuries, all at once.

Take low-income consumers: At an interview at the Economic Club of Chicago in late February, Walmart Chief Executive Doug McMillon said “budget-pressured” customers are showing stressed behaviors: They are buying smaller pack sizes at the end of the month because their “money runs out before the month is gone.” McDonald’s said in its most recent earnings call that the fast-food industry has had a “sluggish start” to the year, in part because of weak demand from low-income consumers. Across the U.S. fast-food industry, sales to low-income guests were down by a double-digit percentage in the fourth quarter compared with a year earlier, according to McDonald’s.

Dollar General on its earnings call on Thursday said its customers report only having enough money for basic essentials; some are having to sacrifice even on necessities. The company doesn’t expect any improvement in the economic environment this year and is watching potential changes to government entitlement programs. Dollar stores rely more heavily on food-stamp benefits, which could be on the table for budget cuts.

Things don’t look much better on the higher end. American consumers’ spending on the luxury market, which includes high-end department stores and online platforms, fell 9.3% in February from a year earlier, worse than the 5.9% decline in January, according to Citi’s analysis of its credit-card transactions data.

Costco, whose membership-fee-paying customer base skews higher-income, said last week that demand has shifted toward lower-cost proteins such as ground beef and poultry. Its members are still spending but are being “very choiceful” about where they spend, Chief Financial Officer Gary Millerchip said. He said consumers could become even pickier if they see more inflation from tariffs. Dollar General said Thursday that sales to higher-earning households, who are seeking cheaper options, accelerated in the past few weeks.

Department stores are seeing signs of penny-pinching all around, too. On Tuesday, Kohl’s CEO Ashley Buchanan said consumers making less than $50,000 a year are “pretty constrained” on discretionary spending, but added that “it’s also pretty challenging” for those making less than $100,000. The company gave a much weaker sales forecast for the full year than Wall Street expected, causing its share price to plunge 24% on Tuesday. Last week, Macy’s CEO Tony Spring said the “affluent customer that’s shopping [at] Macy’s is just as uncertain and as confused and concerned by what’s transpiring.”

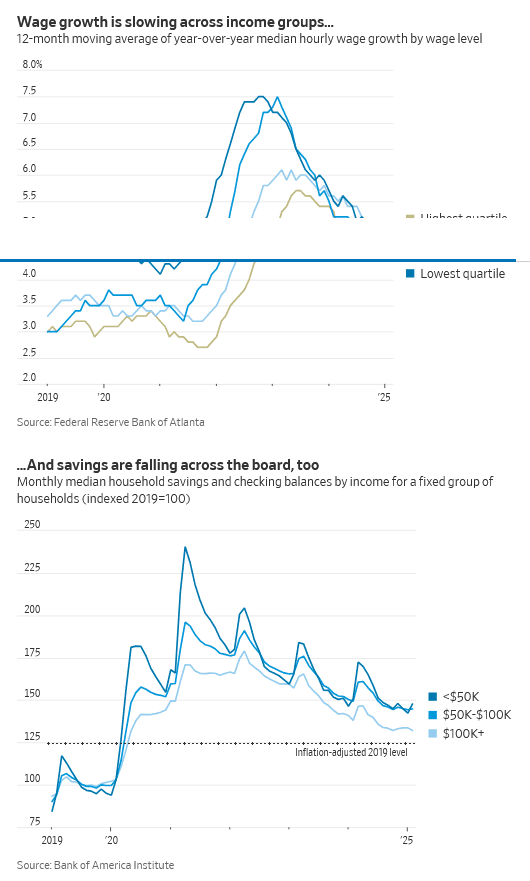

The economy has seen pockets of weakness in recent years, but nothing that suggests such widespread weakness. The period following the pandemic was dubbed by some a “Richcession” because higher earners’ wage growth lagged behind those of in-demand blue-collar workers. But poorer households’ gains have since reversed: Starting in 2023, Covid-era increases to food-stamp benefits were rolled back, and by late 2024, wage growth for the lowest-income Americas started trailing those of richer Americans, according to data from the Federal Reserve Bank of Atlanta. Several years of inflation—particularly on necessities such as groceries, rents and utility bills—have hit poorer Americans hard. But a strong stock market, buoyed by artificial-intelligence hype, kept wealthier folks spending.

Now, everyone seems to be feeling more cautious, and this spending restraint is affecting several categories. There are signs that consumers are pulling back on air travel, for example. Delta Air Lines, American Airlines and JetBlue all cut their first-quarter guidance earlier this week. Delta CEO Ed Bastian said at an industry conference on Tuesday that there was “something going on with economic sentiment, something going on with consumer confidence.”

Citi’s analysis of its U.S. credit-card data shows that spending has fallen across most retail categories. In the retail quarter to date, spending plunged 12% and 22% on apparel and athletic footwear, respectively, compared with a year earlier. But even less-discretionary categories such as food retail, aftermarket auto parts and pet retail are seeing moderate declines.

Retailers including Target, Foot Locker and Lowe’s have all reported seeing weak demand in February. Target CEO Brian Cornell said last week that consumers are thinking about the potential impact of tariffs and what it will mean for them. Foot Locker, which said last week that its consumers were “cautious and sensitive” in February, said its customer base, which skews young, is “thinking about [their] overall cost of living, plus some uncertainty about tariffs.”

This week alone, consumers have had plenty of new developments to digest. President Trump on Sunday declined to rule out a U.S. recession as a result of his economic policies, causing stocks to plummet. This was followed by yet another roller coaster of tariff threats, counter-tariffs and reversals. While Wednesday’s inflation data showed price increases slowing down slightly in February, that is cold comfort because it is too early to reflect the effects of Trump’s tariffs.

But it isn’t all about tariff fears, or even some broader sense of uncertainty. Many also have less cold hard cash on hand. Checking and savings deposit balances across all income levels have declined over the 12-month period through February and are getting closer to inflation-adjusted 2019 levels, according to card data tracked by Bank of America Institute. Wage growth for all income groups has slowed over the past year, per data from the Federal Reserve Bank of Atlanta. Americans’ inflation-adjusted debt balances are starting to surpass prepandemic levels.

What this means is that consumers generally are less able to absorb shocks, just as uncertainty is soaring. It is hard to blame them for turning cautious, even if that means the economy suffers.

Read the full article HERE.

The next generation of retirees isn’t feeling so confident about the future

Generation X, a cohort that never got quite as much attention as its baby-boomer elders or its millennial younger siblings, will begin turning 60 this year, and many are worried about their retirements.

One of the biggest reasons for that lack of confidence? They’re juggling too many financial responsibilities, such as mortgages, children’s education, and the rising cost of living, a new report from Fidelity has found. Generation X has almost become synonymous with the “sandwich generation,” taking care of aging parents and children at the same time.

Financial advisers have taken notice of the generation’s worries. “This complex web of financial obligations makes it incredibly difficult to prioritize retirement savings,” said Ashley Folkes, a certified financial planner at Farther Financial. “It’s imperative to understand that, while this stage of life presents unique challenges, it’s not insurmountable. The key is to take a holistic view of your financial situation, clearly define your values and goals, and engage in open discussions about what truly matters.”

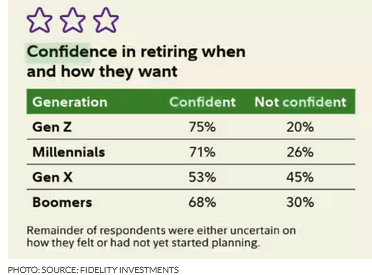

Among all workers, Generation X was the most mixed in characterizing its confidence in retiring on its own terms, according to Fidelity Investments’ latest 2025 State of Retirement Planning report. Almost half, or 45%, of Gen X said they weren’t confident, compared with 30% of baby boomers, 26% of millennials and 20% of Gen Z who said the same.

Overall, 67% of Americans in their “planning years,” as Fidelity put it, said they are confident about their retirement prospects, though that is down seven percentage points from the previous year.

Another factor contributing to retirement insecurity is that Gen X represents a tipping point in retiree reliance on 401(k) plans instead of pensions, said Rita Assaf, vice president of retirement at Fidelity. More than six in 10 respondents in their planning years, or 61%, said their own retirement accounts, including 401(k) plans, IRAs and small-business plans, will be their biggest retirement income streams, compared with about half of current retirees, the report found.

Another 62% of respondents said they’re not sure if those savings will last their lifetimes.

With the bulk of their retirement savings in self-directed investments, near-retirement Gen X–ers will only have anxiety levels heightened by stock-market volatility. The generation has weathered the tech-stock bust and the Great Recession during their working and saving years, in addition to smaller market disruptions, and Fidelity’s report comes as the U.S. stock market has been suffering declines across the board, pressured by worries about a trade war, a possible recession and declining consumer confidence.

Retiring in the midst of a down market can throw careful retirement planning into turmoil. Advisers typically suggest avoiding withdrawals from investment accounts when the market is in a downturn because it could require taking a larger chunk of the portfolio and thus potentially hurting future returns, known as sequence-of-returns risk.

Hope is not lost for Gen X–ers, advisers say. And this generation, importantly, should create a retirement plan if they haven’t already, experts said. “If you’re planning for something, you feel better,” Assaf said. “You don’t have to do it alone, especially with retirement planning. There’s a lot of help.”

A retirement plan involves assessing current finances, determining clear goals for the future and doing the math to attain those goals, Jon Ulin, a certified financial planner and managing principal of Ulin & Co. Wealth Management. “A well-structured, written plan acts as a roadmap with measurable milestones,” he said. “Rule of thumb: Understanding how much you’ll need as a lump sum to fund a multidecade retirement — while accounting for inflation and taxes — is essential for long-term financial security.”

Other tasks include boosting retirement contributions while still able to do so, paying down debts (especially high-interest debts) and planning for healthcare expenses, Ulin said. Engaging a financial adviser can help.

The financial-services industry lately has put a spotlight on annuities, which are investment products that offer guaranteed income. Investors contribute a certain amount of money with the expectation of receiving a stream of income in the future. Annuities have had an imperfect reputation in the past — and investors should scrutinize any product before taking part, regardless of where they heard the recommendation — but having these additional sources of income in retirement can help reduce anxiety.

When looking for an adviser, search for professionals who will look at the full financial picture — as opposed to just recommending investment products — and ask about fees, retirement-planning strategies, their client base and how they will communicate with you as life twists and turns into, and in, your retirement years.

Read the full article HERE.

Strategists at Citi are keen on China tech instead

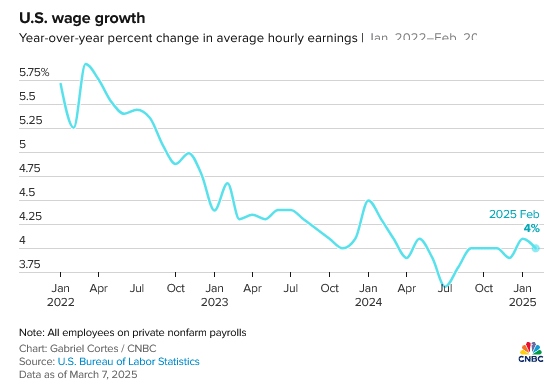

Just when investors thought it couldn’t get worse, Monday’s brutal selloff was a hold-their-beer day.

And while Tuesday is looking a bit better, speculation on whether stocks have bottomed should probably wait until a CPI update on Wednesday. Softer-than-forecast data could relay the message that there’s room for the Fed to ease, bringing some relief to stocks, but higher inflation might do the opposite, and send stocks sinking again.

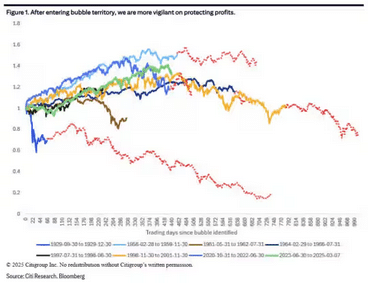

Wall Street strategists, who headed into 2025 armed with bullish forecasts are getting cautious. Citigroup has now joined that camp, as it has just downgraded U.S. equities to neutral from an overweight, or bullish, stance since Oct. 2023.

In our call of the day, a team of Citi strategists led by Dirk Willer said it’s now clear that “U.S. exceptionalism is at least pausing.” Alongside that shift, they upgraded China stocks to overweight, which in balance, now leaves their overall global equity view at neutral.

Willer and the team explained that two of their bearish signals have now been triggered for U.S. stocks. One was the S&P 500 breaking its 200-day moving average “at a time when the market is/has been extended.”

The second signal was triggered by five-straight soft sessions for four of the seven so-called “generals,” referring to the major technology stocks that have been leading the market higher for the past two years.

Already mired in a tough year, the “Magnificent Seven” grouping of large technology stocks collectively lost $759 billion in market cap on Monday, the biggest one-day loss of market cap on record.

Last week, the Citi strategists felt some of those bearish signals were close to triggering, but they were reluctant to move forward until after Friday’s payrolls data, which could have changed the market’s trajectory. However, the data not only failed to do so, but Citi’s economists believe it was likely the last strong jobs report before DOGE cuts—government reductions executed by the Department of Government Efficiency—along with voluntary resignations and a weaker economy take hold.

Willer and his team emphasized that their neutral stance on U.S. stocks is short-term, based on a three- to six-month outlook. “In the bigger picture, we doubt that the AI bubble is already fully played out, and we would expect for the U.S. to remain one of the leaders, maybe jointly with China, while the AI theme is intact,” they said.

“But for reasons mentioned above, we believe this is unlikely to be the right view for today, as we expect more negative U.S. data prints.”

As for China stocks, the strategists said those assets have been screening as attractive for some time, but they’ve been wary up to now due to tariff risks. The strategists flagged two big reasons to love China: 1) DeepSeek has “proved that China tech is at the Western technological frontier (or beyond) despite export controls and 2)President Xi Jinping has embraced the tech sector, albeit belatedly. The sector is still relatively cheap versus other global AI assets, even after a big rally.

Citi strategists prefer the Hang Seng China Enterprises Index which is up 20% year-to-date, as they said the index outperformed the Shanghai Composite during the 2018 tariff wars. The Hang Seng Tech index has climbed 33% so far this year, versus a nearly 10% drop for the Nasdaq Composite. The U.S.-listed KraneShares CSI China Internet ETF has shot up 21% this year.

The Citi strategists argued that there might be some dovish signs on the horizon, such as a report that President Trump may visit Xi in China as soon as next month. Tariffs on China, said Willer and his team, have already risen by 20% and “have had a limited impact on the market,” and in their view, the U.S. will likely be in “deal-making mode.”

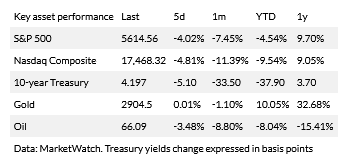

The markets

After the worst day for the S&P 500 since December, U.S. stocks. Treasury yields are steady and the dollar is dropping.

The chart

The chart from Goldman Sachs maps out where the bank sees U.S. tariffs hitting on different sectors on countries and sectors. Goldman cut its U.S. growth forecasts on Monday, not for data, but because of a more negative view on those duties.

“We now see the average U.S. tariff rate rising by 10pp [percentage points] this year, twice our previous forecast and about five times the increase seen in the first Trump administration,” said chief economist Jan Hatzius.

Read the full article HERE.

- High-grade, high-yield CDX indexes opened weaker on Monday

- Weak backdrop may force blue-chip firms to postpone bond sales

US gauges are showing their highest levels of credit risk this year Monday morning, as investors exhibit fresh concern about the state of the country’s economy in light of tariffs and cuts to the federal workforce.

As numerous investment-grade borrowers are poised to opt against issuing bonds Monday, the Markit CDX North American Investment Grade Index widened as much as 2.06 basis points to 53.54 — another 2025 high.

The gauge rises as credit risk climbs. The Markit CDX North American High Yield Index, which falls as credit risk increases, declined as much as 0.5 point to 106.4 — its lowest in six months.

Equities have opened the week with declines around the world amid worries about the US economic outlook. That after the Nasdaq 100 Index sank into correction territory on Friday, with a mixed jobs report released late last week unable to provide solace to investors.

If a US recession does materialize in 2025, which Barclays Plc sees as “improbable but no longer unthinkable,” it will be led by consumer weakness, strategists led by Bradley Rogoff and Dominique Toublan wrote in a note Friday.

“We increasingly view a large-scale pullback in spending driven by uncertainty about tariffs, DOGE layoffs and weakness in equities as a non-trivial tail risk.”

Read the full article HERE.

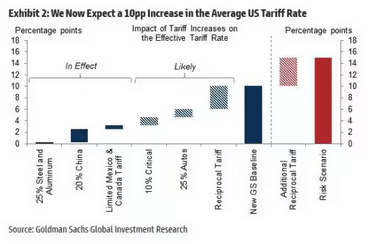

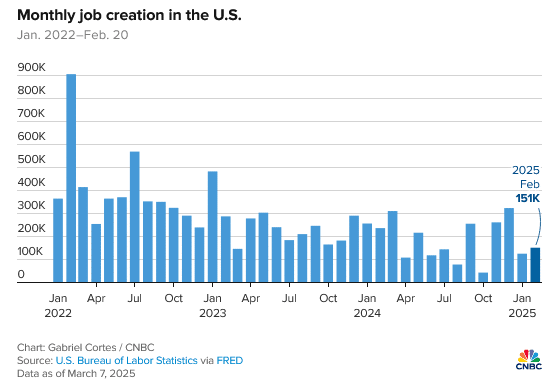

- Nonfarm payrolls increased by a seasonally adjusted 151,000 on the month, better than the downwardly revised 125,000 in January but less than the 170,000 consensus forecast.

- Federal government employment declined by 10,000 in February though government payrolls overall rose by 11,000.

- Average hourly earnings climbed 0.3%, as expected, though the annual increase of 4% was a bit softer than the 4.2% forecast.

Job growth was weaker than expected in February though still stable despite President Donald Trump’s efforts to slash the federal workforce.

Nonfarm payrolls increased by a seasonally adjusted 151,000 on the month, better than the downwardly revised 125,000 in January, but less than the 170,000 consensus forecast from Dow Jones, the Labor Department’s Bureau of Labor Statistics reported Friday. The unemployment rate edged higher to 4.1%.

The report comes amid efforts from Elon Musk’s Department of Government Efficiency to pare down the federal government, starting with buyout incentives and including mass firings that have impacted multiple departments.

Though the reductions likely won’t be felt fully until coming months, the efforts are beginning to show. Federal government employment declined by 10,000 in February though government payrolls overall increased by 11,000, the BLS said.

Many of the DOGE-related layoffs happened after the BLS survey reporting period, meaning they won’t be included until the March report. Outplacement firm Challenger, Gray & Christmas reported earlier this week that announced layoffs under Musk’s efforts totaled more than 62,000.

Health care led the way in job creation, adding 52,000 jobs, about in line with its 12-month average. Other sectors posting gains included financial activities (21,000), transportation and warehousing (18,000), and social assistance (11,000). Retail posted a decline of 6,000 workers.

On wages, average hourly earnings climbed 0.3%, as expected, though the annual increase of 4% was a bit softer than the 4.2% forecast.

Stock market futures moved higher following the report while Treasury yields were lower.

“We are not putting much stock in the jobs report at the moment,” said Byron Anderson, head of fixed income at Laffer Tengler Investments. “Today’s data was mixed at best, but we still have no clarity on the economy moving forward with the Trump turmoil. The longer we have chaos and turmoil from Trump, the higher the probability that we will eventually have data trend negative.”

Though the report indicated continued job growth, some of the details were a little less positive.

The labor force participation rate slumped to 62.4%, its lowest level since January 2023, as the labor force declined by 385,000. A broader measure of unemployment that includes discouraged workers and those holding part-time positions for economic reasons jumped half a percentage point to 8%, its highest level since October 2021.

Also, the household survey, which the BLS uses to calculate the unemployment rate, told a different story, showing a plunge of 588,000 workers. Those holding part-time jobs but wanting full-time positions swelled to 4.9 million, an increase of 460,000.

The BLS report tracks a tumultuous month for markets and the economy.

Stocks have gyrated on a daily basis since Trump has taken office, with movements depending largely on tariff news that has changed rapidly. At the same time, Musk’s efforts through DOGE have been reflected in surveys showing high levels of worker angst.

The February numbers, though, show that the labor market is stable. The December jobs count was revised up to 323,000, an increase of 16,000, while the new January figure represents a decline of 18,000 from the previous estimate.

Read the full article HERE.