Bank stocks and the Russell 2000 have slumped on growth concerns, while Treasurys and gold have rallied

Wall Street is having another growth scare.

Investors entered 2025 optimistic that an already strong U.S. economy could get an extra boost from an administration pushing market-friendly tax cuts and regulatory rollbacks. Instead, trade tensions and signs of slowing growth have driven major indexes lower in recent weeks.

The declines accelerated this week as Trump imposed 25% tariffs on the U.S.’s major trading partners—forcing investors to rethink how serious he is about pursuing a broadly protectionist agenda.

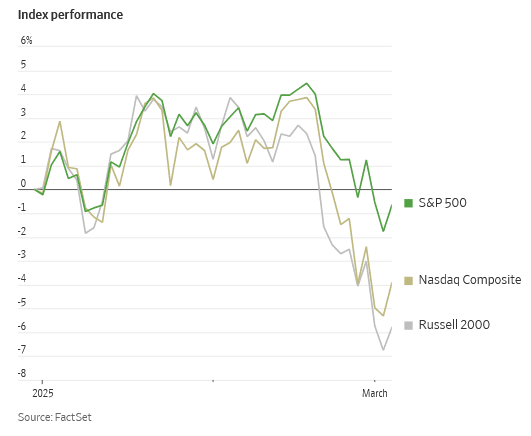

Losses have been particularly acute in sectors that investors view as sensitive to a slowdown, such as banks and smaller companies. The tech-heavy Nasdaq Composite has fallen 7.5% since mid-February. Oil prices have slipped. Havens including gold and U.S. Treasurys, meanwhile, have rallied.

“I think a lot of people were just assuming that tariffs was just a bluff, and now there’s more uncertainty around that,” said Keith Lerner, co-chief investment officer at Truist Advisory Services.

The moves show investors struggling to gauge if the conditions underpinning two straight years of near-25% stock gains have deteriorated significantly. While few analysts thought stocks could do quite that well this year, most still thought that they could keep marching higher.

Many remain confident that this latest bout of economic jitters will prove no worse than others that have popped up in recent years. The present threat strikes some as less alarming because it is driven by government policies that Trump could reverse in a moment, as he has done in the past. Stocks retraced a portion of their weekly declines Wednesday after the White House said that automakers would get a one-month exemption from the new tariffs on Canadian and Mexican imports.

Still, concerns had been building on Wall Street since the inauguration, as the new administration moved much more aggressively than expected both in pushing tariffs and laying off government workers.

So far, the worst economic reports have been largely confined to so-called soft data, such as confidence surveys.

The Conference Board’s consumer-confidence index, for example, posted its largest monthly decline in February since 2021. A survey of manufacturers, released Monday, pointed to a steep decline in new orders, along with a jump in input costs.

The survey quoted several respondents flagging tariff concerns. “The incoming tariffs are causing our products to increase in price…Inflationary pressures are a concern,” one said.

The closely followed GDPNow tracker, published by the Atlanta Fed, currently suggests that first-quarter growth is running at a minus 2.8% annualized pace—although other models still show growth.

According to most economists, a sharp increase in tariffs should slow economic activity as businesses are forced to pay more for imports and then pass on those costs to consumers.

Most economists haven’t expected that higher tariffs would go so far as to drive the economy into a contraction. In a recent report, economists at Goldman Sachs predicted that tariffs would subtract just 0.2% from U.S. growth this year—a much smaller hit than what other countries like Canada could experience.

As of Wednesday’s close, the S&P 500 was down about 5% from its last record high reached on Feb. 19, having dropped 1.9% this week. The Russell 2000 index of smaller companies is off 9.4% since late January.

Bank stocks have been among the biggest decliners. Goldman Sachs has lost 12% since hitting a record on Feb. 18. The consumer-staples sector has generally outperformed others, with Procter & Gamble—the maker of essentials such as Tide detergent and Crest toothpaste—rising 0.4% this week.

Anxieties have extended well beyond Wall Street. Thomas Cooper, a 34-year-old in Wooster, Ohio, who runs service and advertising businesses and trades daily, said he has bought more gold since Trump’s election to protect himself from volatility.

“The market is just turning against you very quickly, out of nowhere,” he said.

One bright spot for investors has been the rally in bonds, which had been battered in recent years by sticky inflation. As of Tuesday, the widely tracked Bloomberg U.S. Aggregate Bond Index had returned 2.7% this year, including price gains and interest payments.

Some analysts, though, caution that further gains could be more challenging. Inflation remains above the Federal Reserve’s 2% target, making the central bank reluctant to cut rates much more than it already has. Expectations for lower rates tend to boost demand for existing bonds, as investors try to lock in higher yields while they still can.

Brian Jacobsen, chief economist at Annex Wealth Management, is among those skeptical that bonds can keep rallying.

Jacbosen said that he still believes that Trump will use tariffs mostly as a negotiating tool but that the president clearly intends to drive a harder bargain than he had previously anticipated.

“I thought the negotiation would have taken place before the implementation,” he said. “Apparently, he would rather do: implement first, negotiate later.”

Read the full article HERE.

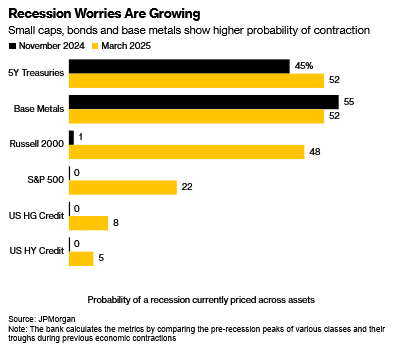

Financial markets are signaling that the risk of a recession is growing as tariff-related uncertainty and indicators of economic weakness spread fear across Wall Street.

A model from JPMorgan Chase & Co. shows that the market-implied probability of an economic downturn has climbed to 31% on Tuesday, from 17% at the end of November. Key indicators like five-year Treasuries and base metals are showing an even higher — toss-up — chance of a contraction. While it’s far from the base case, a similar model from Goldman Sachs Group Inc. also suggests recession risk is edging up, at 23% from 14% in January.

After a wild ride in markets Tuesday, economic sentiment is darkening as money managers and corporate executives struggle to cope with the volatility created by President Donald Trump’s threatened tariffs. Trump defended his plan to remake the global trading order in his address to Congress Tuesday night, acknowledging the prospect of discomfort ahead.

“With softer economic activity data in the US and already weaker business and consumer confidence in recent weeks, the tariffs that came into effect on March 4th on Canada, Mexico and China are raising the risk of an even bigger hit to business and consumer confidence going forward,” said JPMorgan strategist Nikolaos Panigirtzoglou. “In turn this raises the specter of a US recession and markets have naturally priced in higher probability.”

S&P 500 futures struggled to hold onto to gains in Wednesday trading, even after US Commerce Secretary Howard Lutnick hinted at tariff relief for Mexico and Canada.

Data this week showed US factory activity last month edging closer to stagnation as orders and employment contracted. This came after reports showing consumer confidence hitting the lowest levels since 2021, personal spending unexpectedly decreasing, and disappointing prints about the American housing market.

Mohamed A. El-Erian, the president of Queens’ College, Cambridge and a Bloomberg Opinion columnist, now sees a 25% to 30% chance of a recession, up from 10% at the beginning of the year. El-Erian is among a small but growing group of Wall Street worrywarts, focused on stubborn inflation pressures and the recent decline in consumer and business confidence.

JPMorgan calculates the prospect of a recession by comparing the pre-recession peaks of various classes and their troughs during an economic contraction. By this metric, the prices of five-year Treasuries, base metals and small stocks now suggest a recession probability of about 50%. Still, the investment-grade credit market suggests the chance remains low at 8%, though that’s higher than effectively zero at the end of November.

The Goldman model is based on multiple cross-asset indicators, including credit spreads and the Cboe Volatility Index. One metric, tracking expectations in the futures market on the Fed’s benchmark rate in 12 months time, suggests a 46% likelihood of an economic contraction.

“The largest shifts have been in the pricing of Fed cuts and the yield curve, which tends to indicate latent recession risk,” said Christian Mueller-Glissmann, head of asset allocation research for Goldman Sachs said in an email. “There has also been a pick-up in the VIX, which tends to spike around recessions and is more of a coincident indicator.”

To be clear, financial markets have struggled to price in the direction of the business cycle since the disruption caused by the pandemic. Recession bets in markets misfired in 2023 after the US consumer proved more resilient than expected to monetary tightening. This time round, stagflation fears are rising amid signs of easing growth and elevated inflation. The latest survey of economists conducted by Bloomberg shows a 25% probability of a contraction in the next year.

While US stocks have erased their gains for the year, there are plenty of bright spots in the investment and consumption cycle, not least the unemployment rate hovering around 4% and income metrics showing strength. Additionally, a lot of bad economic news has come from reports based on surveys, according to Cayla Seder, a macro multi-asset strategist at State Street Global Markets.

“It would be premature to extrapolate the soft data-weakness into meaning economic growth is rolling over, as of now,” said Seder. Still, “drivers of economic growth have become more concentrated, which means there are fewer drivers of economic growth,” she added.

Read the full article HERE.

Berkshire Hathaway’s legendary CEO Warren Buffett says that tariffs are an “act of war” that could further worsen inflation. After a blitz of information in recent weeks, it seems that the market agrees, with stocks falling again on Monday.

After the election, pundits were awash in reasons investors shouldn’t worry that President Donald Trump meant what he said. They argued instead that his administration would be marked only by growth-spurring initiatives such as regulatory rollbacks and that it would not be hamstrung by things such as trade wars. Now that it’s clear that that’s not the case with key parts of his agenda—such as tariffs—the market is back to the level it was at in early November, erasing its post-election gains.

Confirmation that the U.S. will impose 25% tariffs on Canada and Mexico on Tuesday sank the market. The Dow Jones Industrial Average fell 1.5%, the S&P 500DJIA-1.41% slid 1.8%, and the Nasdaq Composite crumpled 2.6%.

“From my lens, the Trump honeymoon period with the markets is over,” writes Rosenberg Research’s Dave Rosenberg, noting that only 8% of S&P 500 stocks are at new 52-week highs, far below the 25% that were at that peak in early November. “The major averages have now done nothing since Election Day, which is a far cry from the powerful and ongoing risk-on response at this same stage in Trump 1.0….The U.S. economy, instead of speeding up, is slowing down.”

This might not be surprising to anyone who remembers far back into the mists of time, to the year of 2018, when tariff uncertainty was a leading cause of the S&P 500’s decline during Trump’s first administration. More recently, Barron’s warned in December that stocks might struggle after Inauguration Day, when hopes met reality. It appears that the market is just coming to grips with the latter after the S&P 500 recorded a painful February.

“The apparently measured start to Trump 2.0 tariff diplomacy featuring easy wins, delayed implementation and a soft approach on China fuelled investor complacency that there would be negotiated settlements in place of the aggressive tariffs threatened during the election campaign,” notes TS Lombard’s Jon Harrison. “Last week’s, at times chaotic, tariff and trade related news flow marked an end to complacency.”

The White House’s decision to impose an additional 10% tariff on China and move forward with 25% tariffs on Mexico and Canada fully deflated hopes that there wouldn’t be much trade disruption, and it forces the market to take other levies, such as the 25% threatened against the European Union, more seriously.

Nor does it seem like there is an easy path toward concessions, particularly when it comes to China, given that Trump has also told the Committee on Foreign Investment in the United States to thoroughly scrutinize Chinese investments in certain sectors. “Other measures announced could reopen previously settled issues including adherence to accounting standards and stronger enforcement of rules on US listings for Chinese companies,” writes Harrison. “China has said it will retaliate against both these measures as well as to the tariffs.”

The upshot is that markets will have to live with the seesaw of trade talks for the foreseeable future, even as other data shake confidence in the economy.

“Continuous negotiations on Trade War 2.0 and the uncertainty alone are headwinds to the S&P 500,” argues Evercore ISI’s Julian Emanuel. So called soft-data points, such as consumer confidence, are flashing yellow as shoppers pull back in the face of persistent inflation and mass government layoffs, threatening economic growth. Meanwhile, last week’s increase in jobless claims was the “first crack in the ‘hard data’ ” about the economy’s health, Emanuel notes.

In short, factors are aligning at the worst time.

“Trade policy that creates a consumer demand shock—assuming the current threats are implemented—at a time when US economic growth is already slowing increases the odds of a negative feedback loop developing in the economy,” writes 22V Research’s Dennis DeBusschere.

Still, investors don’t necessarily need to give up on U.S. stocks entirely. Yes, it appears that volatility will remain the name of the game as long as tariff uncertainty remains, but while the S&P 500 might have further to fall in the coming months, Evercore’s Emanuel believes that it can still end the year higher, to the tune of 6,800. Barron’s, too, thinks that ultimately it will be an up year for the index.

DataTrek’s Nicholas Colas thinks it’s wise to take the longer view, too, even as he sees more choppiness to come. “[I]t is important to remember that ‘American exceptionalism’ with respect to equity price performance is a relative/longer run concept and does not assure the S&P 500 will beat all comers over any given quarter,” he writes. “Given the combination of lofty expectations and manifold policy uncertainty, US stocks are holding up remarkably well.”

That may be the case, although to borrow Buffett’s analogy, that doesn’t mean they won’t take a beating and further retrench before recovering. War—what is it good for?

Read the full article HERE

Monday’s action is looking positive, but the week could be a tough one for markets as the main event — Friday’s jobs data — looms. That’s as Wall Street has been increasingly scrutinizing the U.S. economy and the new administration’s ability to keep the stock market from coming unglued.

Within that scrutiny is our call of the day from strategists at JPMorgan, who worry investors aren’t giving enough thought to potential economic turbulence this year.

“The risk is of a broadening air pocket in activity, where more aggressive trade, immigration and fiscal consolidation policies could increase uncertainty, and ultimately affect payrolls,” said a team led by Mislav Matejka, head of global and European strategy, in a note to clients.

He and his team rattled off an ever-growing list of economic data they see as starting to wobble – consumer confidence, retail sales, and services purchasing managers surveys. In addition, they also noted a weak performance of cyclical stocks – shares of companies that tend to rise when the economy is booming and vice versa – versus defense stocks, alongside lower bond yields.

At the same time, hottish consumer prices are expected to keep the Fed on the sidelines over interest rates, though that could change, they said.

“Ultimately, the activity air pocket could lead to more forceful Fed support, drive the re-steepening of the yield curve and bullish equity market behavior, likely in the [second half] but not in the first instance,” the strategists said.

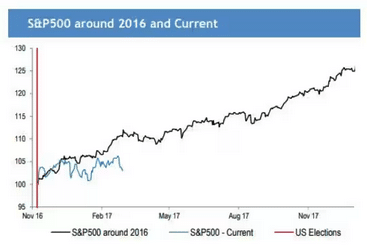

The strategists doubled down on their view that “there are clear differences to the 2017 reflation template,” referring to eight years ago when global stocks rallied on hopes that fiscal stimulus under Trump 1.0 would drive economic growth. The consolidation seen by the S&P 500 this time around has been caused for one, by uncertainty over how policy changes might play out, they said.

“It is premature to believe that tariffs uncertainty has already peaked, and interestingly, even if not much sticks, the adverse impact on sentiment could still be the end result,” JPMorgan strategists warned.

So where to invest right now? They say in the interim, before any Fed support can be seen, defensive stocks should keep performing well.

JPMorgan has a neutral position on U.S. stocks overall, as its strategists continue to worry about a heavily concentrated market with high valuations. At 22 times, they view the U.S. forward price/earnings ratio as looking “very stretched,” though they note valuation discounts seen earlier for China and eurozone equities has largely closed.

“Having said that, we do think U.S. activity will be stronger than the rest, and the U.S. market will likely benefit from animal spirits and deregulation,” said the strategists.

If trade uncertainty does escalate, that will likely be “less of a headwind for the U.S. If markets weaken, the U.S. typically held up better than other regions during risk-off periods.”

One trend likely to continue for U.S. markets, said Matejka and his team, is the rotation out of big U.S. technology and growth companies. Last summer, the bank closed out a bullish position on the growth theme and suggested a rotation from semiconductors to software.

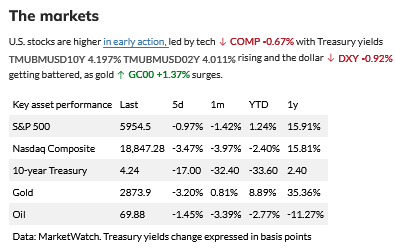

The markets

U.S. stocks are higher in early action, led by tech with Treasury yields rising and the dollar getting battered, as gold surges.

The buzz

European defense stocks like Rheinmetall following a fractious meeting between President Trump and Ukraine President Volodymyr Zelensky. Bitcoin and other cryptos including Ripple’s XRP after a surge in prices on Sunday after Trump gave details of a strategic reserve. Shares of related stocks, MicroStrategy and Coinbase are flying.

Tesla stock is up over 3%. Chief Executive Elon Musk wrote over the weekend on X that he believes a 1,000% profit gain for the EV maker over five years is possible.

Blue Ghost has become the second private spacecraft to ever land on the moon. Space-related stocks like AST SpaceMobile and Rocket Lab are climbing.

The Institute for Supply Management’s manufacturing survey is due at 10 a.m., alongside construction spending.

The Trump administration reportedly is considering exclude government spending from gross GDP reports, which could ultimately distort the picture of the economy’s health.

Read the full article HERE.

The euphoric postelection trade that swept across financial markets has turned into an uncertainty trade. What looked like a robust Trump trade in several asset classes may have fizzled until there is more clarity on policy and the economy.

The dollar, crypto, and bond yields are all off their highs after rallying into the beginning of the year on the promise of better growth. The S&P 500 +0.47% fell 4.6% from Feb. 19 through Thursday’s close. Small-caps are lagging, momentum names are sliding, tech is in decline, and defensive stocks like consumer staples and healthcare have been the best performers.

President Donald Trump said Thursday he planned to go ahead—again—with tariffs on China, Canada, and Mexico. Stocks sold off and the 10-year Treasury yield +0.32% traded just below 4.3%. Trump said tariffs of 25% would go into effect March 4 for Mexico and Canada and China would face additional tariffs of 10%.

“I think it’s a risk-off mood, which is what you would expect when there’s a growth scare,” said Marc Chandler, chief market strategist at Bannockburn Global Forex. “At first blush, people thought the tariffs were going to be inflationary, but now as they drag on, and people have more time to think about it, they’re more concerned about the slowing-down impact.”

The 10-year yield peaked at 4.8% Jan. 13 as investors worried that some Trump administration policies that would be positive for the economy would also saddle the country with more debt. The DXY dollar index DXY +0.07% hit a 52-week high on Jan. 10 and has since fallen 2%.

Optimism isn’t dead. But now markets reflect a wait-and-see posture by investors. Many are waiting to see how tariffs could impact corporate profits.

Rick Rieder, BlackRock’s global chief investment officer of fixed income, said he believes the stock market could finish the year up more than 10%. “I still think the economy is in good shape,” he said. “But I think scaling back a little of what looked like ‘off-to-the-races’ growth I think makes sense,” he said.

The trajectory of stock, bond, and currency markets are linked. The 10-year yield, before it turned lower, had neared the 5% level where stock market analysts worried it would slow stock market gains. The dollar, when on a rising trajectory, threatened to dampen corporate profits.

Treasury Secretary Scott Bessent said on Feb. 6 he is focused on keeping the 10-year yield low. That was an important signal to global investors, who keep a close eye on the 10-year Treasury yield. It affects home mortgages and many other loans.

The 10-year yield’s rise earlier in the year in part reflected the expectations that Trump’s tariff policy could be inflationary, said Ian Lyngen, BMO Capital Markets head of U.S. rate strategy. Trump campaigned on maximalist tariffs. Since taking office, he has shown a willingness to negotiate some tariffs, while others have yet to materialize. That lower yields. Yields move opposite bond prices.

But investors are still looking for clarity.

“I think the market is responding to the increase in uncertainty, and the fact of the matter is we don’t have enough information because the decisions are being made and then unmade,” said Lyngen.

Softness in other economic data has helped push yields lower.

“There are growing concerns about the direction of the employment market and therefore the broader real economy,” said Lyngen. One worrisome data point was the seven-point decline in February consumer confidence, the index’s biggest monthly decline since August 2021.

Walmart raised questions about the strength of the consumer last week when it disclosed 2026 fiscal year revenue and profit targets that were lower than Wall Street expectations.

BlackRock’s Rieder said he believes the consumer is still in good shape, and the economy is being driven by the higher end consumer.

Stocks should go higher because companies have strong balance sheets, Rieder said. “You’ve got more than a third of the market that throws off an average [return on equity] of more than 33% and buys back a huge amount of their stock,” he said.

He also said the 10-year yield could challenge 5% again, depending on the course of inflation but that it should mostly stay in a range below that level and not get much above it, but it should stay in a range.

U.S. government debt is near 100% of gross domestic product. That outsize balance is Rieder’s biggest concern, but he is encouraged by the Trump administration’s focus on the issue. Bessent recently said he would not immediately extend the term of government debt, as some of his past statements suggested he might. Rieder took that as a positive.

“The sensitivity to it [debt duration] is a big deal. Quite frankly I think the pragmatic nature is we don’t have to extend the term of the debt today until we bring inflation down and people are comfortable spending is coming down. That makes a lot of sense,” Rieder said.

“I also think the ability to create some deregulation of the financial industry to create places to hold more of the debt is a big deal. I think [Bessent’s] focus there is important,” he said.

The efforts by Elon Musk and his Department of Government Efficiency has sent a strong signal that the Trump administration is trying to curb spending by reducing head count and costs. But its aggressive strategy has drawn lawsuits and political opposition. How those public-sector cuts will affect the private employment market is also unclear.

Even with uncertainty, many strategists are betting the animal spirits from Trump’s policies will keep stocks rising this year. But to do so, the administration will need to balance its actions against the real impact they could have on inflation, confidence, and employment.

Read the full article HERE.

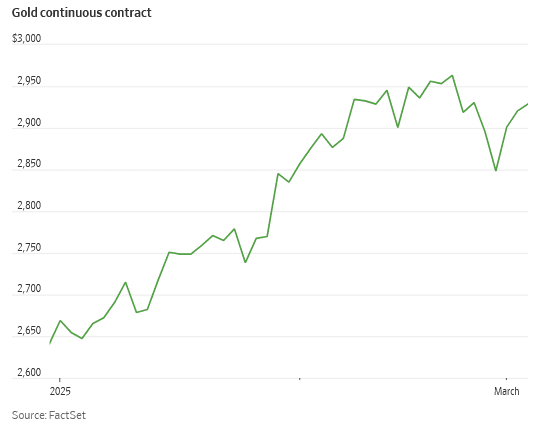

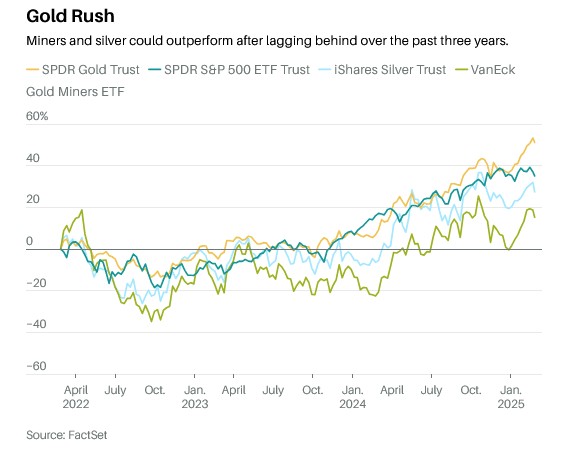

The precious metal has more than doubled the S&P 500’s return. Is silver next?

Gold’s stellar run is too shiny to ignore—and its rally could continue through 2025.

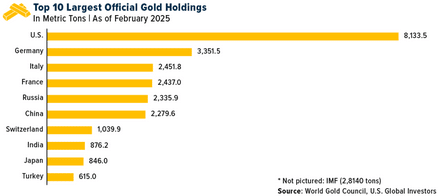

The precious metal is certainly having a moment. On Feb. 24, President Donald Trump said he was worried that someone might have stolen gold from Fort Knox, the U.S. depository in Kentucky. Worries that he might place tariffs on gold have created a flurry of activity as bars in London, where the Bank of England is home to the world’s second-biggest stockpile, have been transported to New York, where the Federal Reserve has the largest reserves. There’s even speculation that the U.S. could revalue its gold holdings to give the Treasury $750 billion more to play with.

All told, gold futures have reached $2925.10 an ounce, returning 42% over the past 12 months, more than double the S&P 500 indexSPX+0.19%’s 19% return, including reinvested dividends.

That’s not bad for a commodity that has little practical use and doesn’t produce earnings or pay interest to those that hold it. What’s more, the reasons offered for gold’s rally are often contradictory and don’t seem to hold up when investigated. It’s considered a defensive asset, but has been rising along with the stock market and as the economy chugs along. The precious metal, which is priced in dollars, should move in the opposite direction of the greenback +0.70%, but it has bucked that rule as well. Gold is often thought of as an inflation hedge, but its big gain has coincided with a deceleration of price increases.

Yet just because everything we thought we knew about gold is wrong, it doesn’t mean investors should be rushing to unload the metal. “It’s just a pet rock, but I’m not selling it,” says David Jane, a portfolio manager of Premier Miton in London, who has about 5% of the $1 billion he manages allocated to gold. “You can’t pin down its price. I’m not going to cut and run.”

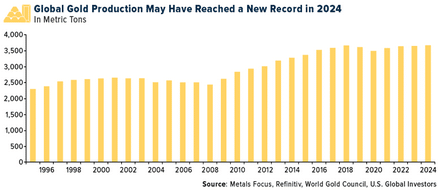

Historically, gold has been considered a store of value—and for good reason. There’s a limited supply—all of the gold in the world could be melted into a cube measuring 25 yards on each side, roughly the volume of one floor of an office building—and miners are only able to increase it by 1%-2% a year despite their best efforts, according to the World Gold Council. If supply is relatively fixed, then changes in price are all about demand.

And demand has picked up. Central banks across the world have been consistently increasing gold purchases as a way to diversify their reserves. De-dollarization isn’t new, but has taken on considerable urgency after the U.S. froze Russia’s assets in the wake of its invasion of Ukraine. Central bank purchases exceeded 1,000 tons for a third year in a row in 2024, according to the World Gold Council. China and India in particular have been snapping up gold for the past few years.

Central banks can’t entirely ignore the prices they pay for gold, but as the value of their holdings rise, it means they feel more comfortable stepping in to buy more, says Philip Newman, a founding partner of the Metals Focus consultancy, especially when prices decline. “[Gold] has a floor level of support that is strong and rising,” he explains.

There’s a decent level of retail demand for gold the world over; spending on jewelry rose 9% last year, according to the World Gold Council. China has even encouraged insurance funds to stock up on the metal, and even ordinary households in the world’s second-biggest economy may be looking to gold after the nation’s specular property crash during the Covid-19 pandemic. Others may be rushing to buy it simply because of the uncertainty created by Trump’s shake-up of the world order could be helping gold, even if stocks and the economy are booming, too.

“Gold plays well when there are tensions in the world,” says Krishan Gopaul, an analyst at the World Gold Council.

Other factors may also be contributing to the sharp rise in gold prices. The anticipation that the U.S. will levy taxes on gold imports in the near future pushed up the cost of physically delivering gold, which in turn pushed up prices for borrowing it. This created a kind of “short squeeze” in which anyone who had bet on gold prices falling suddenly had to reverse their positions, driving prices even higher, according to Gavekal Research. “This means that the fundamentals of the gold bull market are still strong and the technicals are rock solid,” Gavekal’s Louis-Vincent Gave writes.

Gold may also be benefiting from people having too much money to put to work, says Premier Miton’s Jane, creating momentum that just won’t quit. “The positive correlation between gold and equities suggests to me that it’s excess liquidity around that world that’s getting sucked into gold, just like it’s going into large-cap U.S. stocks and anything else that looks like fun at the moment,” Jane says. “This is speculation, not fear.”

The momentum should continue. While $3,000 could be an important psychological level, many analysts see the metal moving even higher. In February, Goldman Sachs and UBS raised their forecasts for 2025 to $3,100 and $3,200, respectively, while Bank of America’s Michael Widmer says gold could hit $3,500 an ounce if investment demand increases by 10%. “That’s a lot, but not impossible,” he writes. Worldwide, gold-backed exchange-traded funds attracted $3 billion in January, driven by demand from Europe, according to the World Gold Council, compared with net outflows a year earlier.

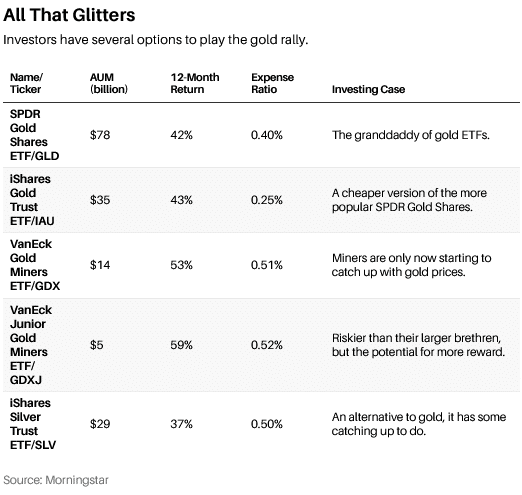

Buying gold can be very simple—as easy as heading to your local Costco or Walmart and buying a bar or coin. Those slices of gold are more souvenirs than serious investments, however, and selling them could be difficult. A better option could be to buy into a gold exchange-traded fund such as the $85 billion SPDR Gold SharesGLD-1.39% ETF, which has an expense ratio of 0.4%, or the $38 billion iShares Gold Trust, which charges 0.25%.

Mining stocks are another way in. Even though their earnings should increase more or less in line with higher gold prices, their share prices have lagged behind the metal itself over the past three years. That means they could be due for some catch-up. The $14 billion VanEck Gold Miners ETF, which owns big global miners Newmont and Barrick Gold and has an expense ratio of 0.51%, has returned 19% this year, including reinvested dividends, compared with 11% for the SPDR Gold ETF, while the $5 billion VanEck Junior Gold Miners ETF, which charges 0.52%, has returned 17%.

Among individual miners, Gold Fields, which operates in Australia, Ghana, Peru, and South Africa, is up 44% this year and could be poised to break out of a 30-year trading range, according to the Institutional View’s Andrew Addison. “Don’t want to miss this, because GFI boasts the biggest base of any gold stock,” he writes, while recommending that investors buy shares on pullbacks to $18 from a recent $19, in anticipation of a move above $20.

For those concerned that gold could lose momentum after its rally, silver might be the way to go. The two metals often trade similarly to each other, even though silver has more industrial uses than gold. But that extra use case is what has been keeping silver down, due to a slump in demand from the slowdown in Chinese manufacturing. Silver futures are up just 6.8% this year, compared with gold’s 10% rise, and could have more room to run if investors start getting more comfortable with the economy. Investors could consider the $14 billion iShares Silver Trust, which has an expense ratio of 0.5%.

“Investors aren’t focused on silver,” says Newman at Metals Focus. “But If gold gets to $3,000, you could see some switching.”

For now, though, gold is as good as, well, gold.

Read the full story HERE.

Discretionary spending represents only 16% of the federal budget. We can’t avoid entitlement reform.

Government debt has exceeded $36 trillion and continues mounting, with no end in sight. This is unsustainable absent dramatic changes in how we allocate our tax dollars.

Budget hawks have been rare in Washington since 2010, when the bipartisan Simpson-Bowles commission put forth a comprehensive plan to reduce spending and increase revenue, only to see it sink. Today, the problem is dire. Our ratio of federal debt held by the public to gross domestic product has grown from 61% in 2010 to 100% this fiscal year. Left uncorrected for another four years, we will surpass the historic high of 106% that America hit at the end of World War II.

It’s little wonder that more Republicans and Democrats are voicing concerns that American global power—backed by economic strength—is threatened by growing budget deficits. It’s time lawmakers seek solutions rather than argue about who’s to blame.

Several factors drive deficit spending, including an aging population and rapidly rising medical costs. But the major reason is reckless spending.

President Trump deserves credit for trying to make the federal bureaucracy more efficient to reduce deficits. His decision to create the Department of Government Efficiency put a much-needed brake on wasteful government spending.

We caution the president, however, against relying on tariffs to raise revenues. Tariffs engender ill will among allies and other trading partners and allow China to seize a greater global role. Further, tariffs risk domestic inflation by raising the costs of goods. As the president will remember, high prices caused political problems for Democrats last fall.

But there are many steps the administration and lawmakers can take. The nondefense discretionary spending that DOGE has focused on is only 16% of the federal budget. If DOGE reaches its goal of reducing spending by $500 billion, the budget deficit for the year will be reduced by about 26%. That’s a good start. But our leaders must also develop plans to control spending on entitlement programs, because those will be the primary source for our deficits in the coming decades.

America can’t achieve a sustainable budget without reforming Social Security, Medicare and other healthcare benefits. Together, these accounted for 49% of federal spending last year, and the share is growing over time.

Meanwhile, these programs are hurtling toward insolvency. Social Security is projected to be insolvent by 2034. Unless Congress and the White House enact reforms by then, there will be a 23% reduction in benefits. Similarly, Medicare Part A is projected to exhaust its trust fund by 2036, requiring an 11% cut in benefits.

In 1983, when one of us (Mr. Baker) helped President Ronald Reagan push through the last major Social Security reform, the program was three months away from insolvency. The final vote in Congress came two years after a commission, led by Alan Greenspan, began working for a bipartisan solution.

Then, as now, acting sooner rather than later would have reduced the cost of a solution. Acting now would require spending cuts equal to 2% of GDP, while waiting until 2033 would require 40% more in cuts. That’s a significant difference.

We’re about two presidential terms away from the Social Security and Medicare trust fund exhaustion dates. Fortunately, that’s plenty of time to identify solutions that can attract bipartisan support. Republicans and Democrats must work together to form bipartisan commissions to begin studying solutions.

Given the current political climate in Washington, it would be wise for such commissions to keep their thoughts as confidential as possible until the time comes to release a final set of recommendations. The reasoning for doing so is straightforward: Political foes are quick to use any mention of a potential solution as an immediate campaign slogan.

If America fails to act, debts will grow as deficits add up and interest payments balloon to unprecedented levels. Inflation will surge again. Such an outcome will reduce the nation’s economic vitality, impose a hardship on the least-affluent Americans most affected by inflation, and strip the U.S. of the flexibility needed to respond to economic crises and existential foreign policy challenges.

Read the full article HERE.

Gold prices surged to an all-time high of $2,940 per ounce last Thursday, pushing its market cap above $20 trillion for the first time ever, as trade tensions between the U.S. and Europe have stoked fears of a global economic slowdown. And while safe-haven demand is certainly a driver, there’s another potential catalyst that could send prices soaring even higher: the revaluation of America’s gold reserves.

As many of you are aware, the U.S. holds the most gold of any country on earth by far, with reserves totaling 8,133 metric tons. But what’s less well-known is that the stockpile’s value has remained at just $42 per ounce since 1973, putting its total value at around $11 billion.

Let’s say we were to revalue those reserves at today’s price of around $2,900, which some people are in favor of. The total value, then, would jump to a staggering $760 billion, creating a windfall of $749 billion.

This could provide the government with options to sell a portion of its gold or enhance its balance sheet by reducing debt. It could even be used to fund a Sovereign Wealth Fund, which I wrote about earlier in the month.

Treasury Secretary Scott Bessent has tried to tamp down speculation that the U.S. will go through with this process, stating that it’s “not what [he]had in mind,” but I believe the fact that we’re having this discussion highlights gold’s importance as a financial asset and geopolitical tool.

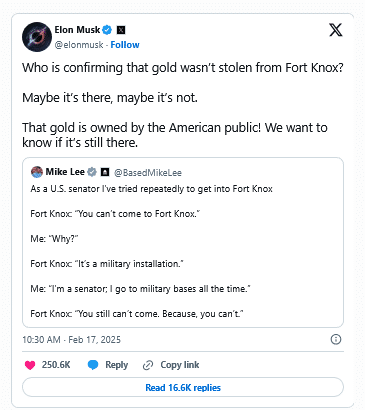

Verifying The Gold At Fort Knox

Before any revaluation can occur, though, it’s probably best to verify that the gold reserves actually exist—a concern that’s lingered for decades.

The U.S. Bullion Depository at Fort Knox, which houses the bulk of the nation’s gold, has only opened its doors to non-authorized personnel three times in history: 1) in 1943 for President Franklin D. Roosevelt, 2) in 1974 for a small group of Congress members and 3) in 2017 for a delegation including Senator Mitch McConnell and then-Treasury Secretary Steven Mnuchin.

Elon Musk has announced plans to conduct an in-person audit of Fort Knox’s gold reserves on behalf of his cost-cutting operation, the Department of Government Efficiency, or DOGE. In a tweet on February 17, Musk wrote, “Who is confirming that gold wasn’t stolen from Fort Knox?… We want to know if it’s still there.”

I don’t doubt that the gold’s where it should be, but I fully support Musk and President Trump’s efforts to provide transparency. If the audit confirms the reserves—which I believe it will—it could boost confidence in the U.S. government’s finances. Conversely, if discrepancies are found, it could send shockwaves through global markets, adding further momentum to gold prices.

Central Bank Buying And Global Market Trends

Central banks have been on a gold buying spree, having snapped up over 1,000 tons of the metal for the third consecutive year in 2024, according to the World Gold Council. The National Bank of Poland led the pack, adding 90 tons to its reserves, while the People’s Bank of China announced a fresh purchase of five tons to start 2025, bringing its total holdings to 2,285 tons.

Central banks are often considered the “smart money” in the gold market, and their sustained accumulation of gold reflects a broader strategy to diversify reserves and hedge against their very own policies. What’s more, this buying activity supports prices, creating a favorable backdrop for gold as an investment.

Peak Gold Ahead?

On the supply side, total gold production rose to a record 4,974 tons in 2024, driven by increased mine output and recycling. Initial estimates suggest mine production reached an all-time high of 3,661 tons, though final figures could revise this record. However, the long-term supply outlook is less rosy.

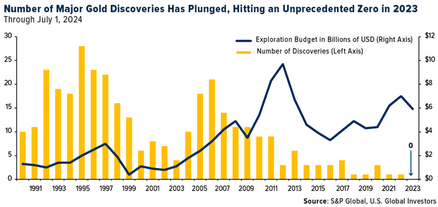

According to S&P Global’s Paul Manalo, the gold supply is expected to peak in 2026 before declining as a result of fewer new discoveries. Exploration budgets, which surged to $7 billion in 2022, have cooled off but remain higher than historical averages. This trend could support higher gold prices over the medium to long term, particularly if demand from central banks and investors remains robust.

Positioned For Growth

The high gold price environment has allowed gold mining companies to expand operations, prioritize sustainability initiatives and attract investor interest. Bank of America estimates that companies under its coverage could generate around $3 billion in free cash flow in the fourth quarter of 2024, with even more expected this year.

However, rising costs present a challenge. The average All-In Sustaining Cost for gold miners hit a record $1,456 per ounce in the third quarter of 2024, driven by higher labor costs and maintenance expenses.

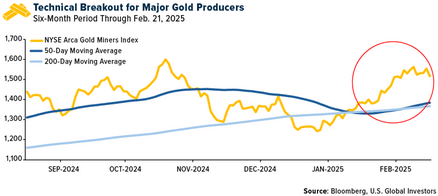

Despite these pressures, many miners remain highly undervalued, making them attractive to value investors. The NYSE Arca Gold Miners Index, which tracks major gold producers, recently made a technical breakout, with the 50-day moving average crossing above the 200-day moving average.

Strategic Takeaways

So, what does all this mean for your portfolio?

Gold remains a vital asset for diversification. I believe its role as a hedge against inflation, currency devaluation and geopolitical risks is as relevant today as ever for long-term investors.

For more tactical investors, the potential revaluation of U.S. gold reserves—or even the publicity surrounding Musk’s proposed audit—could act as a catalyst for price movements.

Meanwhile, the continued buying by central banks and supply constraints in the mining sector offer additional support for a bullish outlook on gold.

As always, I recommend a 10% weighting in gold, with 5% in physical gold (coins, bars, jewelry) and 5% in high-quality gold mining stocks, mutual funds and ETFs.

Read the full article HERE.

Much attention has been focused on US gold reserves in recent days, especially the stockpile in Fort Knox. While Treasury Secretary Scott Bessent dismissed the possibility of revaluing the stash of gold to market levels, an analyst said that would be bullish for prices, which have already been on a tear.

Revaluing US gold reserves to match current market conditions would add more momentum to prices as it would signal the precious metal isn’t an anachronistic asset, according to a Wall Street analyst.

In an interview on Bloomberg TV on Friday, Francisco Blanch, head of commodities and derivatives research at Bank of America Securities, acknowledged that repricing the gold would be an accounting exercise but still result in an increase in the Federal Reserve’s balance sheet.

“I think it would probably be bullish for the gold market because it would show that gold is no longer this barbarous relic that has been sitting in central banks and been dismissed a little bit, but now even the biggest central bank of them all is taking a renewed interest in gold,” he said.

The Fed doesn’t own gold anymore after transferring it to the Treasury Department under the Gold Reserve Act of 1934. In exchange, the Fed received gold certificates.

The US owns 261.6 million troy ounces of gold, valued at a 1970s-era rate of $42.22 an ounce, producing a book value of $11 billion. At gold’s current spot price of about $2,950 per ounce, however, the value would top $750 billion.

Treasury Secretary Scott Bessent set off speculation earlier this month that a revaluation was possible when he said, “We’re going to monetize the asset side of the U.S. balance sheet for the American people.” He later clarified that he didn’t mean repricing gold reserves.

Still, America’s stockpile of gold continues to come under extra scrutiny from elsewhere. On Saturday, President Donald Trump reiterated his intention to visit Fort Knox with Elon Musk to ensure that its gold is still being held there.

For his part, Bessent told Bloomberg on Thursday that he had no plans to visit Fort Knox, adding that “all the gold is there.”

Gold has been on a tear in recent years and has doubled in price since the COVID pandemic. More recently, it has surged since Russia invaded Ukraine in 2022, triggering Western sanctions that froze Russia’s dollar- and euro-denominated assets.

That fueled concerns among other countries that their dollar holdings may also be vulnerable one day, resulting in a shift toward gold. Now, central banks are among the biggest buyers of gold. Meanwhile, investors and consumers have also been piling into gold as a safe-haven asset as fears about the economy mount.

BofA’s Blanch pointed out that repricing gold would not contribute to the Trump administration’s top priorities of weakening the dollar, lowering energy prices to bring inflation down, and inducing Fed rate cuts.

But Secretary of State Marco Rubio signaled last week the potential for US-Russian economic cooperation, which Blanch thinks would likely involve Russian energy exports that could lower prices.

“There’s potentially an angle here, which is if Russia eventually gets sanctions relief, does that mean that we have a new stream of petrodollars flowing into the market?” he added. “And are those petrodollars potentially a source of funding for the US government down the line as we seek this constant need to fill that $2 trillion budget deficit in Washington?”

Read the full article HERE.

It’s one thing when the chairman of the Federal Reserve accuses Wall Street of “irrational exuberance,” as Alan Greenspan once did. It’s another thing when Wall Street pros are saying it about themselves.

But that’s the insane situation we’re in right now — yet another development that will test the resolve of many long-term investors.

An astonishing 89% of the world’s top fund managers now say that they think that the skyrocketing U.S. stock market, which has risen by 50% in just two years, is overvalued.

That’s the highest percentage who are warning about valuations on Wall Street since the tail end of the great millennium bubble 24 years ago.

Yet a large majority of the same professional investors nonetheless report that they are heavily overinvested in stocks, especially those overvalued U.S. stocks.

A net 35% of fund managers told BofA Securities that they were “overweight” stocks in general, meaning they held even higher levels than their benchmarks would suggest, with U.S. markets their favorite region by a clear margin.

And they have cut the cash levels in their portfolios to 3.5%, the lowest levels since 2010.

Confused? You are not alone. But welcome to the world of professional investment managers, where FOMO, or fear of missing out, leads to FOLC, or fear of losing clients. And this is far greater than FOLM, or fear of losing money.

The findings come from the latest BofA Securities survey of global fund managers. (This is the same survey I use for my semiregular Pariah Capital portfolios.) The latest survey polled 168 institutional investment managers, chief investment officers and asset allocators, who handle a total of $401 billion in assets.

The mind boggles. What in the current situation is causing professional investors to throw caution to the winds and buy stocks at prices that even they admit are crazy? Is it the peaceful global outlook? The calm, stable political situation? The robust, healthy status of the Western alliance? The overwhelming evidence that the government in Washington, D.C., is in the hands of mature, stable geniuses?

The best that can be said is that by some of these metrics, fund managers are slightly less exuberant than they were in December. And last month they warmed up slightly toward European stocks — just in time for the Ukraine crisis to boil over again, naturally.

It is hardly surprising that investors are looking at current U.S. stock prices with alarm. The S&P 500 now trades at nearly 23 times forecast per-share earnings for the next 12 months. That’s the most expensive rating for the index since 2001, other than a brief spell in 2020. The dividend yield on the index, at 1.3%, is the lowest since the peak of the great bubble in 2000.

U.S. stock indexes are also expensive by the standards of history when measured according to various other guides, such as the so-called Buffett indicator, which compares stock values with annual gross domestic product; the cyclically adjusted or Shiller price-to-earnings ratio, which compares stock prices with average per-share earnings of the past 10 years; or Tobin’s Q, which compares stock valuations with the cost of replacing companies’ assets. These various indicators are named after the investment gurus who popularized them: Berkshire Hathaway Chair Warren Buffett and Nobel Prize-winning economists Robert Shiller and James Tobin.

None of these indicators alone proves the market is in a dangerous bubble. Even when they all occur at the same time, it doesn’t prove it. But combined with this almost blind exuberance among professional fund managers, it is enough to give you pause.

It speaks volumes that while fund managers are telling their clients that “God is in his heaven, and all’s right with the world,” the price of gold — disaster insurance for thousands of years — has never been higher. Gold has risen 12% just since Jan. 1 and is near $3,000 an ounce, an all-time record.

Veteran Wall Street money manager Howard Marks, who anticipated the crash that followed 2000, came close to calling the current market a bubble a few weeks ago.

Meanwhile, it’s ironic that investors have slashed their cash balances. Cash has rarely been this appealing in recent years, with Treasury bills and short-term Treasury bonds paying 4% interest or better. Oh, and Buffett has stockpiled a record $325 billion in cash in his Berkshire Hathaway investment conglomerate. That last development might be mere coincidence, of course. Then again, it might not.

Read the full article HERE.