US and European companies are frontloading orders and weighing price hikes while Chinese factories hunt for buyers elsewhere

A two-hour drive west of Shanghai, Sunny Hu has spent almost two months since the US election rushing shipments of her company’s outdoor furniture and pavilions to American customers and racing to diversify Hangzhou Skytech Outdoor Co. Ltd. into other markets.

Meanwhile, in the heart of Germany’s Riesling belt, eighth-generation winemaker Matthias Arnold has been fielding an influx of special orders from US importers since Donald Trump’s victory. He’s rushing to fill as many as possible before the president-elect can bring back levies on European wines that he imposed in 2019 but the Biden administration suspended.

Across the world, businesses aren’t waiting until US Inauguration Day on Jan. 20 to see which countries, products or tariff rates are announced in Trump’s widely telegraphed trade wars. The mere threat of his universal tariffs is sparking a scramble that’s leaving the global trading system prone to bottlenecks, saddled with higher costs and vulnerable to disruptions should an economic shock come along.

“We’re still in the freakout period,” said Robert Krieger, president of Los Angeles-based customs brokerage and logistics advisory firm Krieger Worldwide. “There’s about to be a king tide in the supply chain.”

At California-based JLab, Chief Executive Officer Win Cramer had already shifted his supply chains away from China to dodge tariffs imposed during Trump’s first presidency. Along with a hiring freeze imposed until June amid the uncertainty, his next move would be raising prices for the company’s headphones and wireless products if a universal tariff is applied this time around.

To get ahead of the game, some firms are frontloading orders. Others are seeking new suppliers or, if that’s not possible, renegotiating terms with existing ones. A common theme: The renewed stress comes with higher costs, in the form of bigger inventories, costlier expedited shipping, or taking a chance on untested partners. Profits will suffer and expenses will be reduced elsewhere, they said. Ultimately consumers will foot the bill.

The problem is, for all the preemptive moves, there’s no guarantee that the strategies that helped some businesses endure Trump’s first trade war will work this time around. As shown by Trump’s late November threat to impose additional 10% tariffs on goods from China and 25% tariffs on all products from Mexico and Canada, both allies and adversaries are in his sights this time around.

Zipfox, an online product-sourcing platform that links US-based businesses with factories primarily in Mexico, has seen a 30% uptick in quote requests and new buyer signups since two weeks before the election, according to founder and CEO Raine Mahdi, who said inquiries spiked again after Trump threatened 100% tariffs on BRICS nations. Most of those are from importers of goods manufactured in China. Mahdi warns against complacency.

“If you wait too long, you’re going to find yourself trying to make the transition in a pinch,” Mahdi said. “This time you’re not catching the tail end of the Trump administration, you’re catching the entire thing and with a new wrath.”

The survival instincts of business leaders are already beginning to show up in high-frequency data, and central bankers are keeping a close eye given the threat that higher import taxes pose to their inflation fights.

China’s ports saw double-digit growth in container throughput in the two weeks around the election and that rose further to an almost 30% gain in the second week of December. International air freight flights have increased by at least a third each week since mid-October and economists expect that’ll continue as customers rush to frontload orders.

Across the Pacific, the busiest container gateway in the US, made up of the twin ports of Los Angeles and Long Beach, is seeing a surge of inbound shipments — not unlike the wave that accompanied Trump’s first tariff volleys at China. Both ports smashed pandemic-era records in the third quarter and volumes are expected to stay elevated into next year.

The advanced ordering started well before the US election in early November and is showing up at the docks now. At the Port of LA alone, inbound container shipments in November jumped 19% from the same period a year earlier, and 2024 is on track to be Long Beach’s busiest year ever. But the cargo crush through Southern California is unlikely to last for long and probably means a slump at some later stage.

“The surge in imports nationwide could continue into the spring of 2025,” Port of Long Beach CEO Mario Cordero told reporters in December. “Back in 2018, tariffs initiated during the first Trump administration resulted in a 20% decrease in imports from China and a 45% decrease in exports to China due to retaliatory actions.”

Tariffs aren’t the only factor at play given the typical rush ahead of China’s annual Lunar New Year holiday, which starts in late January, and the need to get ahead of potential port strikes in the US. Given that backdrop, it wouldn’t take a lot to stoke additional pressure in the global trading system, said Citigroup Inc. senior global economist Robert Sockin.

“Shipping costs may feel additional upward pressure if front-running activity picks up notably,” he said. “If front-running is particularly extensive, it could create some bottlenecks at US ports which would exacerbate supply chain pressures.” Prospects for another dockworkers’ strike just days before Trump’s inauguration only compound those concerns.

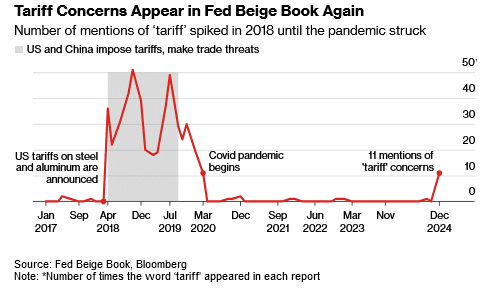

Since the US election in early November, the Federal Reserve has heard more concerns about the levies. The word “tariff” appeared 11 times — — the most since 2020 — in its latest Beige Book report, a regional survey of businesses.

An analysis of earnings-call transcripts to count mentions of tariffs by executives of S&P 500 companies jumped in November to the highest in records going back to late 2019, according to data compiled by Bloomberg. Industrial firms and in particular industrial machinery and suppliers are talking about tariffs the most.

Smaller companies are doing more than talking, though it’s too soon to measure with any precision the extent of the economic fallout.

If Lynlee Brown’s email inbox is any guide, the impact will be widespread. She’s a global trade partner at EY, the consulting giant. In the early morning hours after the US election, she had received more than 400 messages. The queries spanned the globe — from US companies that import raw materials to an Australian apparel company. “There are a lot of questions coming in from companies,” she said.

Among those looking for answers are Kim Osgood and Mike Roach, who own Paloma Clothing, a women’s clothing store in Portland, Oregon. The shop offers products that include jewelry, accessories, sweaters, scarves and rain coats. The store has already begun placing extra orders from its vendors who manufacture overseas.

“The one thing as a business owner that you absolutely abhor is uncertainty,” Roach says. “But there’s not a lot we can do.”

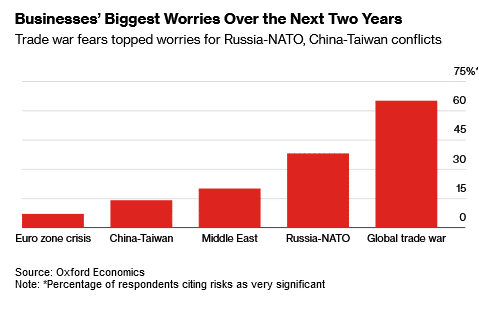

Such paralysis appears to stem from fear. According to an Oxford Economics survey of 156 businesses in the two weeks to Dec. 10, 65% of respondents said a global trade war presents a very significant risk to the global economy over the next two years, compared with 38% for a Russia-NATO showdown and 14% for a China-Taiwan conflict.

Across China’s vast manufacturing hubs, businesses are trying to maintain export sales. In Hangzhou, about 90% of Hangzhou Skytech Outdoor’s products are exported to the US, making it vulnerable to tariffs in excess of the 25% already slapped on its American exports during the first trade war in 2018-19.

The firm is considering offering its US buyers a price that incorporates both tariffs and freight, but those would need to be at least 10% to 15% higher, Hu said, depending on the new tariff level. In the meantime, the company is aiming to ship half of 2025’s expected demand before Trump is sworn in.

About three weeks after the election, when Bloomberg News reporters visited, the workshop and warehouse were piled high with boxes on pallets ready to ship as workers hurried to bend and cut metal to meet the peak demand season. After a boom in sales during the pandemic the firm decided to expand — it’s currently building a new five-story workshop and showroom which would double capacity.

Crossing the muddy construction site, Sunny’s husband, the CEO of the company, looked at the almost-finished building and noted all the uncertainty the company faces.

The unknowns are equally vexing at Carlsbad, California-based JLab. Its products were hit by tariffs in 2019 during the first Trump administration after requests for exclusions from the duties were denied. That prompted Cramer to move about 90% of his contract manufacturing from China to Vietnam, Malaysia and other countries. “We were essentially forced to rebuild our supply chain outside of China, and that’s not an easy thing to do,” he said.

Cramer said trying to build up inventories before tariffs are imposed isn’t really practical because that takes cash and with ever-changing technology, he could be stuck with obsolete inventory. And Trump might do something other than what he said he would during the campaign.

While the company didn’t raise prices after tariffs were enacted in the first Trump administration, that may not be possible this time. His top-selling product is a $24.95 wireless ear bud, and while he can absorb some additional cost from the tariff, he’ll have no choice but to pass on some of it because of his low profit margins.

“We’re designed to offer a fair product at a fair price, and when tariffs come into play, that makes it harder to do,” he said.

Many businesses that adjusted to Trump’s first round of tariffs would struggle to deal with a second blow, according to Evelyn Suarez, a customs attorney based in Washington whose clients include US manufacturing companies that import parts and components from China. “They’re at the level they could manage, but if you add on another 60% — that would be prohibitive.”

Suarez said her clients are “bracing for higher costs and that’s a real challenge because prices are going to go up.”

Arnold, with winemaker Weingut Jul. Ferd. Kimich, had to absorb about 80% of Trump’s tariffs during his first presidency to keep customers who could otherwise pivot to less expensive wines from other regions. Both Arnold and the US importer he works with want to maintain relatively steady prices for customers this time around too; the question is how the additional cost of the tariffs will be split between them.

Arnold, who exports about 10,000 bottles of wine to the US each year amounting to about 5% of his overall volume, said he’s confident he can wait out another round of tariffs, though higher-margin markets like Scandinavia start to become more attractive export destinations if the tariffs are in place longer term. Some German winemakers, however, sell as much as 40% of their product to the US. For them it will be tough, he said.

“This time the tariffs could come fast and last much longer,” Arnold worries.

Read the full article HERE.

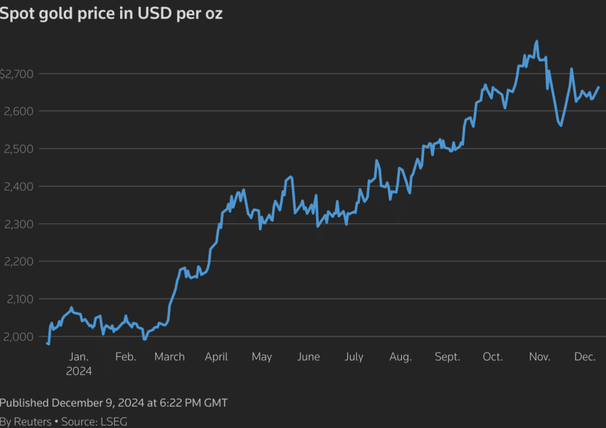

Gold has had a bumper year in 2024, climbing to new highs and setting records. However, the question among investors is can it push higher in 2025?

The precious metal has broken record after record, rising more than 30% in 2024 while hitting an all-time high of $2,748.23 in October. It is currently trading around the $2,600 mark.

Gold will rally to a record next year on central-bank buying and US interest rate cuts, according to Goldman Sachs, which listed the metal among its top commodity trades for 2025 and said prices could extend gains during Donald Trump’s presidency.

Goldman Sachs expects gold prices to jump to $3,000 per troy ounce, an increase of 19% from the current level, if concerns over US fiscal sustainability grow. The yellow metal acts as a good hedge against inflation and rising geopolitical tension.

“Go for gold,” analysts said in a note, reiterating a target of $3,000 an ounce by December 2025. The structural driver of the forecast is higher demand from central banks, while a cyclical lift would come from flows to exchange-traded funds as the Federal Reserve cuts, they said.

Gold prices have increased sharply over the previous 12 as investors have piled in, seeking to protect their portfolios.

In the view of Goldman Sachs’ analysts, this rally could now be set to continue, despite expectations of continued increases in the value of the dollar.

“We push back on the common argument that gold cannot rally to $3,000/toz by end-2025 in a world where the dollar stays stronger for longer,” Goldman Sachs’ analysts said.

Instead, Goldman’s analysts said they expect gold prices will mainly be determined by the extent to which the US Federal Reserve cuts interest rates.

“In our base case, we see a 7% boost from 125 basis points of additional Fed cuts to the end-2025 gold price,” Goldman’s analysts said.

Interest rate cuts typically drive up demand for gold by reducing the attractiveness of government bonds and other interest-yielding assets.

A stronger dollar could also encourage gold purchases by central banks from across the globe seeking to restore confidence in their own currencies, Goldman’s analysts said.

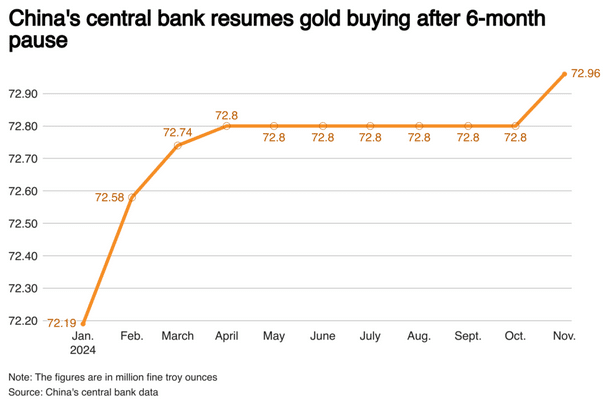

“Key buyers like China, with large dollar reserves and a long-run strategic interest in diversification, may even increase gold demand during periods of local currency weakness to boost confidence in their currency,” the analysts said.

Uncertainty related to heightened geopolitical tensions and the potential for tariffs from the US could further increase the attractiveness of gold as a safe haven, the analysts said.

“Geopolitical shocks, including tariffs, typically boost both gold and the dollar,” Goldman Sachs’ analysts said.

UBS strategists predict that gold’s value will increase heading into 2025. Since the start of 2024, gold prices have risen by 28%, outperforming the S&P 500. UBS strategists believe several factors will continue to drive prices higher in 2025, including central banks’ ongoing gold accumulation as part of their diversification strategies.

According to International Monetary Fund (IMF) data, global central banks made their largest gold purchases of the year in October. UBS now forecasts 982 metric tons of gold will be bought in 2024, up from its previous estimation of 900, and well above the post-2011 average of 500 metric tons.

There is also growing demand from investors seeking reassurance due to uncertainties like Donald Trump’s fiscal, trade, and geopolitical policies, along with ongoing conflicts in Ukraine and the Middle East. These factors are driving demand for safe-haven assets, boosting inflows into gold exchange-traded funds.

UBS forecasts gold to reach $2,900/oz by the end of 2025 and recommends a 5% allocation within a USD-based balanced portfolio for diversification.

Global gold demand swelled by about 5% in the third quarter, setting a record for the period and lifting consumption above $100bn for the first time, according to the World Gold Council.

How do I invest in gold?

Gold falls under the category of alternative investments, named after their nature as alternatives to traditional investment assets such as bonds and equities. These can be anything from art to property, hedge fund investments, gold, and gold funds, and even digital assets.

For those wanting to protect their investment portfolio from market uncertainty, it is worth considering gold. Anyone can invest in physical gold in the form of bars and coins.

However, it might be easier and cheaper to invest in gold through Exchange-traded funds (ETFs) or Exchange-traded commodity (ETC) products. Another option is to invest in shares of gold mining companies, which can yield dividends as you are investing in a business rather than just the precious metal.

Should you buy gold coins or bars?

It is probably the first image on our mind when we think about the precious metal: a gold bar or coins. If you go down this route, you are investing in the physical metal. Gold coins are a popular choice, but mostly for collectors, as you will pay a premium for the design that you might not get back. However, some coins become more desirable for collectors over time, so this gambit could pay off.

If you’re not bothered by the aesthetic value of gold, the straight way to go about it is to get a cast bar. A 500g bar will set you back £34,074.37 if you purchase it from the Royal Mint.

Rick Kanda, managing director at The Gold Bullion Company, said: “Despite coins being viewed as the obvious choice for first-time value, small and first-time investors should look into both coins and bars.

“Manufacturing costs for bars are generally lower than those for coins, resulting in lower purchase prices per gram for gold bars. This could help maximise your profits if you go on to sell at a later date.”

You can start smaller, with a 1g Britannia bar coming in at around £91. Regardless of what you get, ensure that the purity is above 99.9% for coins and 99.95% for bars so that it is VAT-free.

Gold and other precious metals are often weighed in troy ounces. At 31.1034768 grams, one troy ounce is about 10% heavier than a regular ounce.

Another thing to consider, often misunderstood, is the capital gains tax-free nature of British legal tender coins.

“The sovereign and the gold and silver Britannia have a unique place as precious metal coins with a legal tender value. This means that any profits made over the lifetime of the investment are free of CGT when sold. Many clients overlook this issue as they are so concerned about purchasing physical metal and do not think about the other side, which is relevant when they come to sell,” Paul Atkinson, co-founder at Atkinsons Bullion & Coins, told Yahoo Finance UK.

“A 500 gram gold bar would be subject to tax as much as 28% CGT when sold. The equivalent in gold Britannias or Sovereigns would not. There was an argument that a bar was cheaper when you purchase in the first place but that difference was a maximum of 1%, not 28%. In the current market you can buy coins as cheaply (low premiums) as a bar,” he added.

How to invest in gold via ETFs or ETCs

If you look at gold purely as an investment and do not want to handle things like storage or purity levels, you can choose to invest in an ETF or ETC.

These investment products are funds that consist of only one asset: gold. They trade just like a normal stock but get their value from holding “underlying assets” centred on the precious metal, such as physical gold, gold futures, or exposure to companies that mine the metal.

The main costs of investing in gold ETFs will be the ongoing charge and any platform fees. You should also pay attention to where the product trades. Most physical gold is priced in US dollars, so if an ETF or ETC operates in sterling, then the USD/GBP rate will likely play a significant role in its performance.

Looking at gold ETFs traded in the USA, the DB Gold Double Long Exchange Traded Notes has returned 53% this year.

ProShares Ultra has delivered 49% and Invesco DB Precious Metals Fund has recorded a 28% gain since January.

If you want to keep things in pounds, you some of the top gold ETFs in the UK include the Invesco Physical Gold ETC that comes with a 0.12% fee, and aims to replicate the spot price movement of gold bullion as closely as possible.

There is also the iShares Physical Gold ETC for the same fee. This product has the particularly of only accepting gold bullion that meets the Good Delivery standards set by the London Bullion Market Association (LBMA). All assets are classified as responsibly sourced, only allocating gold that was mined after 2022.

If you’d prefer a fund, Troy Trojan is on Hargreaves Lansdown’s top funds to watch in 2025 list.

Victoria Hasler, head of fund research at Hargreaves Lansdown, said that the managers of the Troy Trojan fund “manage to take advantage of the attributes of gold without putting all their eggs in one basket,”

The Troy Trojan fund had 12.6% exposure to gold-related investments as of the end of November, including its top positions in the Invesco Physical Gold and iShares Physical Gold exchange-traded commodities.

However, other major holdings in the fund include consumer goods company Unilever and tech giant Alphabet.

“Rather than trying to shoot the lights out, the fund aims to grow investors’ money steadily over the long run, while limiting losses when markets fall,” said Hasler.

Over the past year, the fund has generated a return of 8.5%, which is higher than the 3.5% increase in the UK retail price index but behind the 15.8% rise in the FTSE All-Share index.

Best gold stocks and how to invest in mining companies

Gold-oriented stocks and shares provide exposure to the commodity without the cost of buying and storing it.

You are investing in a company, just like you would do with any other listed business, but in this case, you secure exposure to gold and could potentially achieve higher returns as gold companies expand production and reduce costs, which can drive profits. As you own shares in the company, you could also be in line for dividends.

In the US, Galiano Gold, Equinox Gold or ElDorado Gold shares have a track record of delivering dividends to investors. Barrick is also a household name for gold investors.

Again, if you prefer to keep your investments UK-bound, there is Empire Metals, Serabi Gold or Resolute Mining.

As always, past performance is no guarantee of future results, and gold should be part of a diversified portfolio.

Which country is the biggest buyer of gold?

In 2023, global gold demand surged to a record 4,899 metric tonnes, with jewellery accounting for 46% of this demand, according to figures from the World Gold Council.

China emerged as the world’s leading consumer, using 959 metric tonnes of gold last year. India followed closely as the second-largest consumer, with total consumption reaching 761 metric tonnes. The US rounded out the top three, consuming 250 metric tonnes of the precious metal.

When it comes to financial reserves, the US holds the top position globally with 8,133 metric tonnes of gold. Germany follows with 3,352 metric tonnes, and Italy maintains 2,452 metric tonnes. Several countries, including Kazakhstan and Russia, have been actively increasing their gold reserves in recent years.

Read the full story HERE.

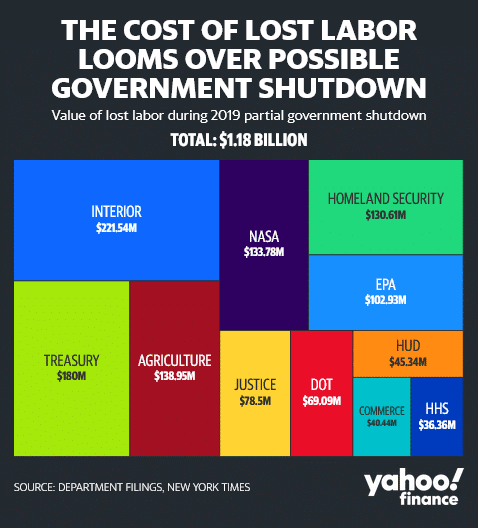

The United States government could be headed towards a shutdown this weekend after two failed attempts by House Republicans in recent days to avert a stoppage.

First, Speaker Mike Johnson and his colleagues saw one bipartisan deal fall apart amid opposition from Elon Musk and President-elect Donald Trump. Then a second GOP-negotiated deal collapsed due to 38 House Republicans joining nearly all Democrats to vote no and tank that effort.

Johnson and his colleagues are still working feverishly to resolve a complex series of disputes on issues like the debt ceiling to various funding priorities but now have only hours to act to head off an array of impacts that could be felt across the country as well as economic impacts that could grow with each passing day.

“We will regroup and we will come up with another solution so stay tuned,” was all Johnson was able to offer reporters after Thursday’s latest failed vote.

For now experts are downplaying the immediate economic effects and noting that lawmakers have intense motivation to find a deal and then get home for the holidays.

“Nobody wants the optics of shutting down the government,” Stifel Chief Washington Policy Strategist Brian Gardner noted in a Yahoo Finance Live appearance on Thursday, noting noting a shutdown would include things like temporarily unpaid military personnel.

But with few options left, what could be a growing economic question for the coming days is the length of any stoppage — especially in the middle of the holiday travel season.

TSA Administrator David Pekoske tried to assuage some concerns Thursday when he noted in a post that about 59,000 of his agency’s over 62,000 employees “are considered essential and would continue working without pay in the event of a shutdown.”

But he was quick to add a warning: “please be aware that an extended shutdown could mean longer wait times at airports.”

If a shutdown begins to drag out, the bite could begin to be directly felt on Monday morning at the beginning of the workweek.

Many America’s more than 2 million federal employees (and another 2 million military personnel) could either find themselves furloughed, be working without pay, or simply dealing with shutdown related disruptions.

The effects would be felt by individuals but also many businesses that rely on the government on a day-to-day basis.

At the same time, wide swaths of the government are set to be largely unaffected — notably Social Security and Medicare.

Money for those so-called “mandatory spending” represents a majority of the government’s budget and supports programs like Social Security and Medicare. That is set to continue no matter what happens on Capitol Hill.

Here’s a rundown of just some of what is set to remain accessible and what will be on ice if the standoff on Capitol Hill isn’t resolved.

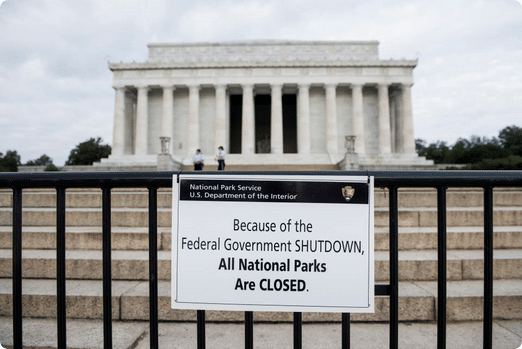

Closed: Everything from the national memorials to taxpayer assistance

The most prominent closures in any shutdown are national parks. In previous shutdowns, everything from scenic natural areas to major tourist attractions like the Lincoln Memorial in Washington have been shuttered.

A range of other government operations are also set to be rendered more difficult to access or completely inaccessible.

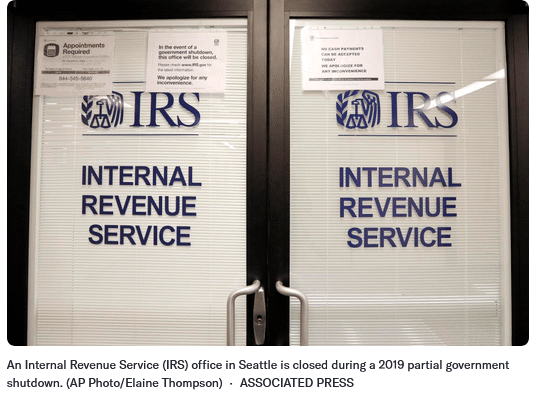

Many taxpayer services at the Internal Revenue Service are expected to be suspended.

The most recent contingency plan from the agency for the current fiscal year laid out scenarios where telephone helplines could go unanswered and Taxpayer Assistance Centers across the country would be likely to be deemed inessential and close.

But that could shift if a shutdown drags into early 2025 and the filing season draws closer.

Financial regulators overseeing financial markets like the Securities and Exchange Commission, the Commodity Futures Trading Commission, and the Federal Trade Commission will also be cut back to bare minimums with about 9 in 10 staffers there likely to be at home for the shutdown.

A recent SEC plan is to only keep on hand an “extremely limited number of staff members available to respond to emergency situations.”

Government economic data that is released from places like the Bureau of Labor Statistics is likewise expected to “completely cease” for the duration of a shutdown.

Getting something like a passports will likely still technically be possible during a shutdown, but could be more difficult with many government buildings closed.

Many areas of possible disruption — from airports to the presidential transition of power

A range of other government services may not shutter entirely but are likely to become more difficult to access, especially if the shutdown stretches for weeks.

Airports are often where Americans feel the impact of a shutdown directly and that could be especially true this time with the holiday travel season.

Past government shutdowns featured longer security lines as a shutdown means that TSA agents are not paid but are nonetheless asked to continue working. Those missed paychecks are then made up when the government reopens.

Nevertheless, past shutdowns have featured higher-than-normal unscheduled absences with a higher than normal number of workers calling in sick.

A shutdown also could cause a wide array for interruptions in the social safety net around programs like federal housing, food assistance, and healthcare for the poor.

Given the timing of this standoff, the ongoing transition of power from Joe Biden to Donald Trump could also be impacted with government employees who are currently charged with briefing their successors perhaps being furloughed.

A spokesperson for the government’s Office of Management and Budget warned Politico this week that such a lapse “would disrupt a wide range of activities associated with the orderly transition of power,” without laying out (yet at least) exactly how.

Open for business: Mandatory spending like Social Security, as well as the post office

But even amid the disruptions, huge swathes of the federal government will be largely unaffected. Mandatory spending by the government — which does not have to be approved by Congress each year — makes up about $7 of every $10 that the government spends.

Social Security and Medicare are the most prominent mandatory programs and are expected to largely continue as normal.

Social Security checks will keep flowing to seniors even as some members of the agency may face furloughs making things like customer service less available.

Likewise, Medicare payments are set to continue to doctors, hospitals, and beneficiaries while the overall Department of Health and Human Services expects to furlough about 45% of its workforce.

The nation’s public schools — funded at the local level — will also remain open, although some federally funded programs like Head Start may shutter.

Finally, the mail will still be delivered, as the US Postal Service is generally self-funded through methods like the sale of stamps and other products.

President-elect Trump has recently floated the idea of making the mail delivery service private but that issue won’t be address until 2025 if he tries to follow through once he’s in office..

Read the full article HERE.

The 25-basis-point cut to interest rates marks the Fed’s second consecutive cut of that size

The Federal Reserve on Wednesday announced its third straight interest rate cut, lowering the benchmark rate by 25 basis points amid economic data showing that inflation remains above the central bank’s target rate.

With the 25-basis-point cut, the benchmark federal funds rate will sit at a range of 4.25% to 4.5%. The Fed’s move follows a 25-basis-point cut in November and a larger-than-normal cut of 50 basis points at its September meeting, which was the first reduction in rates since March 2020 and brought them down from a range of 5.25% to 5.5% — the highest level since 2001.

The Federal Open Market Committee (FOMC), the group within the Fed responsible for setting monetary policy, said in a statement that “labor market conditions have generally eased, and the unemployment rate has moved up but remains low” and while inflation has progressed toward the 2% objective, it “remains somewhat elevated.”

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate,” the FOMC added.

One member of the FOMC, Cleveland Fed President Beth Hammack, dissented from the decision to cut rates and preferred to hold the benchmark rate at a range of 4.5% to 4.75%.

The FOMC also released a summary of economic projections, which reflected two rate cuts in 2025, two cuts in 2026 and one cut in 2027. It had previously projected four cuts in 2025 in its most recent projection from September.

The summary shows the median of the federal funds rate at 4.4% at the end of 2024, before declining to 3.9% in 2025, 3.4% in 2026 and 3.1% in 2027. Those forward-looking projections are higher than the Fed’s September projections, with the 2025 and 2026 medians each a half-point higher and the 2027 figure 0.2 percentage points higher.

It also projects that the personal consumption expenditures (PCE) index, which is the Fed’s favored inflation gauge, will finish this year at 2.4% and will be 2.5% in 2025 — up from 2.1% in the previous projection released in September. PCE would then decline to 2.1% in 2026 before reaching 2% in 2027 and over the longer run.

“Today was a closer call, but we decided that it was the right call because we thought it was the best decision to foster achievement of both of our goals, maximum employment and price stability,” Fed Chair Jerome Powell said at a press conference.

“We see the risks two-sided — moving too slowly and needlessly undermine economic activity and the labor market, or move too quickly and needlessly undermine our progress on inflation. So we’re trying to steer between those two risks, so we decided to move ahead with a further cut,” he explained.

Powell said downside risks to the labor market have diminished, but noted that the labor market is looser than it was before the pandemic and is continuing to cool, which isn’t needed to get inflation to the 2% target. He also noted that the pace of the decline in inflation has flattened over the last year in part because housing services inflation is falling at a slower pace than hoped, with some “bumpiness” in prices for goods.

“We coupled this decision today with the extent and timing language in the post-meeting statement that signals that we are at or near a point at which it will be appropriate to slow the pace of further adjustments,” Powell said.

The Fed chair responded to a question about what policymakers will consider in future rate cut decisions heading into the new year, given the signal sent by the Fed’s economic projections about fewer rate cuts in 2025 than were previously forecast.

“We’re significantly closer to neutral at 4.3% and change, we believe policy is still meaningfully restrictive, but as for additional cuts, we’re going to be looking for further progress on inflation as well as continued strength in the labor market,” he explained. “And as long as the economy and labor market are solid, we can be cautious as we consider further cuts and all of that is reflected… in the December SEP, which showed a median forecast of about two cuts next year compared to four in September.”

“The U.S. economy is just performing very, very well — substantially better than our global peer group — and there’s no reason to think a downturn is more likely than it usually is. So the outlook is pretty bright for our economy. We have to stay on task, though, and continue to have restrictive policies so that we can get inflation down to 2%. We’re also going to be looking out for the labor market pretty close to where it is,” Powell said.

The chair also discussed the impact of inflation in recent years on American consumers. Prices are roughly 20% higher than they were four years ago, despite inflation easing from a 40-year high of 9.1% in June 2022 to 2.7% in November 2024.

“What I think people are feeling right now is the effect of high prices, not high inflation. We understand very well that prices went up a great deal, and people really feel that and it’s prices of food and transportation and heating your home and things like that. So there’s tremendous pain in that burst of inflation that was very global,” Powell said.

Markets fell in response to the Fed’s decision, with the S&P 500 down over 1.7% in the final hour of trading and the Dow down over 1.4%. The probability of the Fed pausing its rate-cutting when it meets on Jan. 28-29 was largely unchanged in response to the Fed’s decision, with a 96.5% chance of rates being held at the new 4.25% to 4.5% range next month, little changed from Tuesday, according to the CME FedWatch tool.

“The Fed has been able to maneuver 100 basis points of cuts so far in this cycle, but given the trajectory of the economy and the recent uptick of inflation, it is going to be more difficult for the Fed to provide basis to continue cutting rates at the same pace,” said Charlie Ripley, senior investment strategist for Allianz Investment Management.

“The other reality is Powell and company cannot afford to be wrong on inflation again as upside risks continue to persist,” he said. “Therefore, we see the bar being raised for rate cuts going forward from here and given this Fed is operating on a data-dependent level, any meaningful upticks of inflation raise the risk that additional rate cuts, if any, will be few and far between.”

“In many ways, today’s cut and the release of updated expectations for 2025 signals a strong vote of confidence in the current state of the economy and job market. And that optimism may trickle down to business leaders waiting for a firm signal to ramp up hiring,” said Cory Stahle, economist at the Indeed Hiring Lab.

“There is still a lot of uncertainty around the impact of any new policies enacted by the incoming administration, and there is no guarantee that the current market momentum can or will endure over the medium or longer term. But absent any big surprises, the labor market looks poised to enter 2025 with solid momentum and wind in its sails,” Stahle added.

Read the full article HERE.

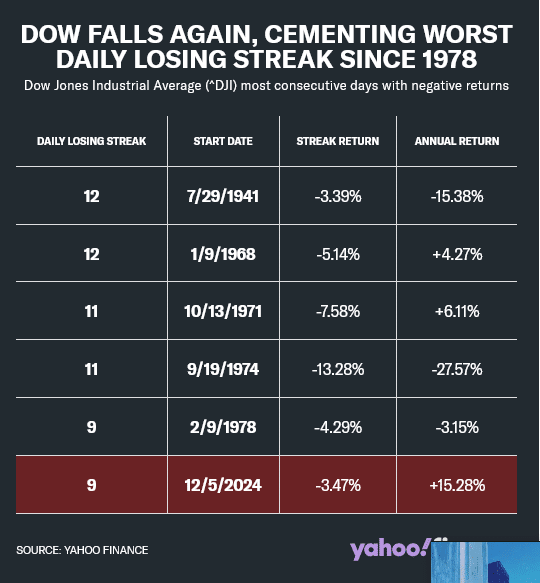

The Dow Jones Industrial Average (^DJI) is on its worst losing streak in nearly 50 years.

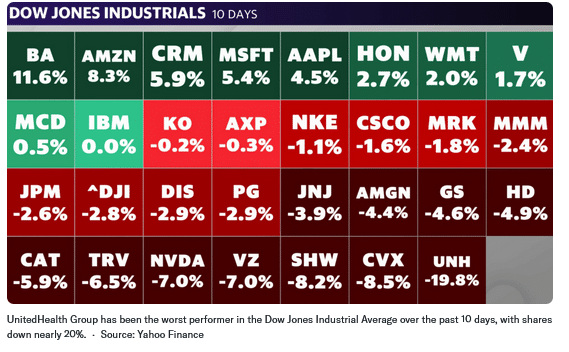

The major index has fallen for nine straight trading days, its largest stretch of consecutive declines since 1978. The move lower in the Dow comes as large-cap tech has largely been holding up the S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) throughout December.

The Dow’s losses amount to roughly 3%, or more than 1,500 points, in the past nine trading sessions. The index has fallen from a record close of 45,014 on Dec. 4 to 43,499 as of Tuesday’s close. In that same time frame, the S&P 500 is down about 0.6%, while the Nasdaq Composite is up almost 2%.

Given the Dow’s construction, it’s not benefitting from the tech rally. Of the Dow’s 30 stocks, just four — Amazon (AMZN), Microsoft (MSFT), Apple (AAPL), and Nvidia (NVDA) — are members of the “Magnificent Seven” tech stocks. This means the Dow, unlike the S&P 500 and Nasdaq, hasn’t benefitted from massive rallies in Tesla (TSLA), which is up more than 37% in the past 10 days, or Alphabet (GOOGL,GOOG), which has risen 14% in the same time period.

Instead, the Dow has been pulled down, partly due to the recent sell-off in Nvidia stock. The blue-chip index added Nvidia on Nov. 8. Since then, one of the hottest stocks in the market has cooled off, with shares down nearly 12%.

“It’s really the tech leadership versus everything else, value versus growth,” WisdomTree global chief investment officer Jeremy Schwartz told Yahoo Finance.

A sell-off in healthcare stocks has also weighed on the Dow. UnitedHealth (UNH) is down about 20% in the past 10 days following the murder of its CEO Brian Thompson on Dec. 4. Other healthcare stocks have also lagged, with Johnson & Johnson (JNJ) and Amgen (AMGN) both down more than 4% in the past 10 trading sessions.

Schwartz said the Dow’s decline hasn’t been surprising given the run-up in stocks this year, though.

“We are still optimistic for next year. We think stocks versus bonds is still [the place] to be in the markets,” he said. “But there was so much strong positioning for this rally and for this seasonal rally that it’s not actually a surprise to see this pullback.”

Read the full article HERE.

When investors are wildly optimistic, it is much harder for the market to rise and much easier for it to fall on any hint that they might be wrong

The market feels toppy. There is no science to this and readers will have to judge for themselves. But here are a bunch of things that make me think trouble might be imminent for stocks—perhaps a correction, perhaps the start of something bigger, but at least a bump in the road.

Bulls are everywhere. Bears are hard to find. This shows up in sentiment, in surveys and in the capitulation of the permabears.

Sentiment is euphoric, according to Citigroup’s Levkovich indicator. This index combines lots of measures and suggests investors have only been more positive twice, in the postpandemic SPAC/cannabis/green bubble and in the dot-com bubble of 1999-2000.

When investors are wildly optimistic, it is much harder for the market to rise—everyone’s already got a lot of stocks—and much easier for it to fall on any hint that they might be wrong. I don’t know what the trigger might be, but it doesn’t need to be much.

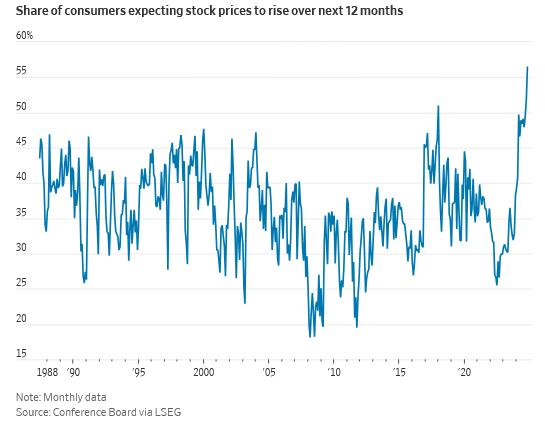

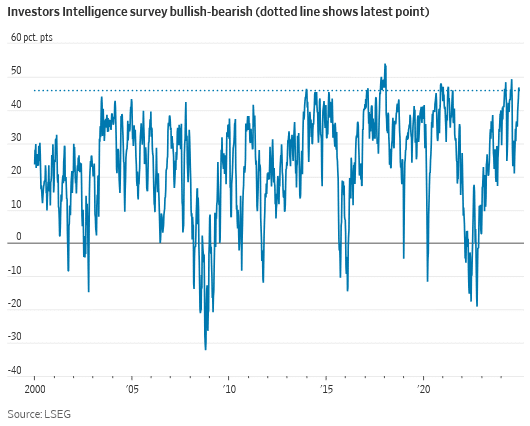

Other signs of optimism. Investment newsletter writers have rarely been more bullish or less bearish, according to the weekly survey by Investors Intelligence. Households have never been so confident that stocks will rise over the next year, according to the Conference Board’s monthly survey.

And fund managers shifted after the election to be more overweight U.S. stocks than any time since 2013, pretty much as all-in on the U.S. as they have ever been, according to Bank of America’s survey. Money is pouring into funds at an exceptionally high rate too, close to new highs.

Some of the best-known bears have given up. Economist and fund manager Nouriel Roubini used to revel in the moniker of “Dr. Doom,” but he told Bloomberg TV “I’m not Dr. Doom, I’m Dr. Realist,” while talking up the prospects for the U.S. economy. David Rosenberg of Rosenberg Research didn’t actually say the fateful words “this time is different” but he did write that “traditional valuations, at the least, are not that helpful right now.”

This time will be different. Rosenberg thinks investors have shifted away from the standard metric of price against one-year forward earnings to look further out, because of the prospects for an AI-driven productivity boom. Even those who think markets will eventually return to something like normal, such as Goldman Sachs, don’t expect issues soon.

Almost everyone agrees AI and the U.S. economy are great. Wei Li, chief investment strategist of the BlackRock Investment Institute, says spending on artificial intelligence will be “of a magnitude similar to previous industrial revolutions, but happening so much faster.” She argues that “U.S. exceptionalism has been years in the making.”

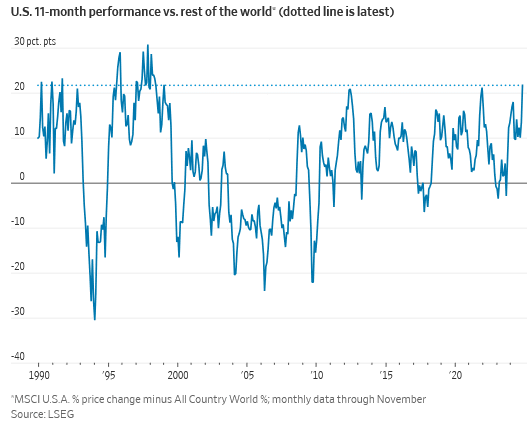

The widespread agreement shows up in prices. The biggest AI-linked stocks dominated the market this year, while the U.S. market outperformed the rest of the world by almost 22 percentage points in the year to the end of November, the most over an 11-month period since 1998.

No one cares about valuation. It isn’t just that people think AI and the U.S. will do well. They don’t seem to care about the price, even though price is the starting point for future returns. Cheap, or value, stocks have been underperforming for years, but just had their longest-ever consecutive daily decline, falling every day for the past 11 days. These are almost by definition bad companies, but the disconnect from the excitement about growth stocks is extreme.

The same goes for stocks against bonds, with the earnings yield—the inverse of the PE ratio—barely above the 10-year Treasury yield, the lowest reward on this measure for the risk of holding stocks since the aftermath of the dot-com bubble. It isn’t just that people want to buy good companies, they seem to want them at any price.

Inside trades. The one group not buying into the story are corporate executives, who ought to be best-placed to see the potential for a new golden era for American profits. They have been selling more stock than they buy, according to regulatory filings, suggesting they think prices are too high.

None of these points are proof that the market must fall, let alone that it will happen soon. None have a perfect record and on some measures—such as the American Association of Individual Investors’s survey—things aren’t so extreme. But I don’t want to be part of a crowd buying into a narrow story when prices, valuations and hope are already extremely high, and insiders aren’t willing to back it with their money.

This feels like a good time to take some money off the table.

Read the full article HERE.

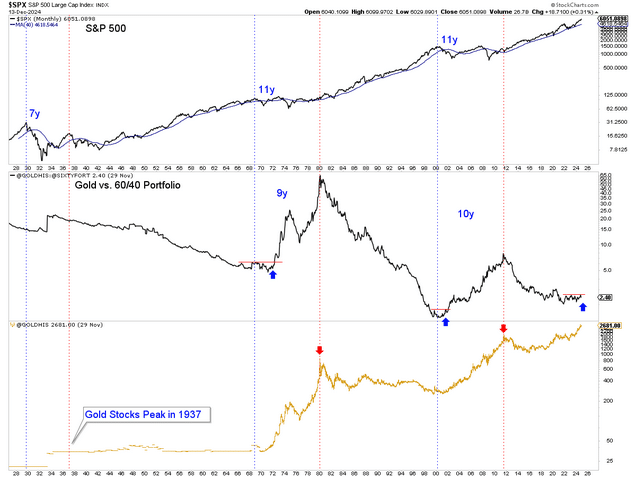

Gold’s break out of a 13-year cup and handle pattern is likely the start of a new secular bull market.

However, as we wrote last week, a new secular bull market in the entire precious metals sector cannot begin until Gold breaks out against the conventional 60/40 investment portfolio.

Some are concerned that the weak relative performance indicates the bull market is over or that precious metals are dead money forever.

The reality is the secular bull market in precious metals has yet to start.

There are two key indicators to watch.

The first is Gold breaking out against the 60/40 portfolio, while the other is the S&P 500, after years of an uptrend, losing its 40-month moving average.

We plot the S&P 500, Gold against the 60/40 portfolio, and Gold.

The last two secular bull markets in Gold and precious metals ended 11 years after the S&P 500 reached its secular peak or 10 years after the S&P 500 lost its 40-month moving average (late 1969 and 2001).

Gold and precious metals peaked 9 years and 10 years after the Gold to 60/40 Portfolio ratio began its advance to the breakout.

At present, precious metals are trending higher, as they did with the stock market in the mid 1960s. That is the best historical comparison.

Even if in 2025, we get these bullish signals for precious metals (S&P 500 peaks, Gold breaks out against the 60/40 Portfolio), the secular bull market could last midway through the next decade. If the secular bull in the stock market continues for another 13 months, we could see a precious metals peak in 2036-2037.

When Gold begins to outperform the 60/40 Portfolio and stock market in earnest, Gold, Silver, and other leveraged plays will soar as fresh capital moves into the sector.

For now, it is best to position in the quality companies that will lead in the current macro environment.

Read the full article HERE.

The “King of Bonds” sees the risk of a debt restructuring with global repercussions

IN “THE SUN ALSO RISES”, Ernest Hemingway’s first novel, Mike Campbell, a jaded war veteran and inveterate drunk, is asked how he went bankrupt. “Two ways,” he replies. “Gradually and then suddenly”. America’s government—like Mike, no stranger to serial binges and futile wars—is on its own way to bankruptcy. We have lived through the gradual part. Under the next few presidential administrations, the national debt will mushroom beyond the government’s ability to service it, perhaps even beyond the credulity of the country’s creditors. In the coming years expect dollar debasement, debt restructuring or both.

America’s sovereign-debt spiral has been building since Washington embarked on large budget deficits in the 1980s. As the tab rose from about 30% of GDP towards 100% in the 21st century, the Treasury continued to find willing creditors. The dollar still rules as the world’s reserve currency. Inflation and bond yields tracked lower for decades. And since 2008, under the anaesthetic appellation “quantitative easing”, the Federal Reserve has shown its readiness to print more dollars to monetise away government debt. So why can’t the band play on?

n interplay of forces is going to break the bank. Yields on Treasury bonds fell and fell for nearly 40 years, with the 10-year yield hitting all-time lows in 2020. America has since entered a secular environment of rising interest rates, so the costs of servicing the national debt are rising rapidly. As securities issued at interest rates as low as 0.5% mature, the principal is being rolled into the higher rates of the spot market, at the moment 3.7 percentage points higher. Higher interest expenses feed into deeper deficits, sparking more borrowing, driving heavier debt loads. This is how the debt spiral spirals—unless, that is, lower rates are engineered by the Federal Reserve, which would cause inflation. There will be no road left to kick the can down.

A recession would propel this debt spiral into crisis. The government is running annual deficits approaching $2trn, more than 6% of GDP, even with positive growth and four years of low unemployment. This breaks with the Keynesian bargain which prevailed from the end of the second world war until the middle of the past decade: run large deficits to offset economic weakness, shrink them in times of robust growth. With the deficit at recessionary levels already, the hit to tax revenues in an actual recession would drive America yet further into the red.

As in the past, a recession—or fear of it—should drive investors towards perceived safe havens, including Treasury bonds: a rate-lowering movement that may already have played out. Once confronted with a recessionary decline in tax revenue, the government’s probable reflex would be a return to money-printing. Politicians would borrow more to fund the wider gap, taking for granted debt monetisation by their central bank. The scale of money-printing, however, would dwarf that of past bouts of Fed bond buying. Yields would rise to discount repayment in a depreciated currency.

Let’s run the numbers. Projections to 2034 from the Congressional Budget Office (CBO) assume no recessions, an average primary deficit of 2.6% of GDP, plus 3.6% from debt expense (the latter assuming an effective interest rate on government debt of 3.5%). In the next ten years, under those assumptions, America’s debt-to-GDP ratio would rise from 99% to 122%.

But those assumptions are optimistic. America’s economic expansions after the second world war have lasted an average of 21.8 quarters; the current one has spanned 17. Timing economic cycles is difficult but for the sake of argument, let us accept the CBO’s recession-free outlook. The 2.6% primary-deficit premise, though, is another matter. Since the financial crisis of 2007-2009, it has averaged 4.9%. As for the effective rate, consider 3.5% a rosy view. Rates of 6% are certainly within the experience of the past 30 years; for a world breaking with past inflation norms, 9% is not unimaginable.

In either case our debt-spiral model, assuming nominal growth stays the same, shows this situation compounding into fiscal catastrophe. By 2034 debt service at 6% rates would consume 45% of all tax revenue; at 9% rates it would eat up 83%. The budget deficit would balloon from 6% of GDP to 11% or 18%, respectively. These numbers imply debt-to-GDP ratios of 147-184%. The Penn Wharton Budget Model has shown that debt loads of 175-200% would be sustainable only under the most favourable assumptions, and a belief that Washington will prevent the debt burden from rising further. “Once financial markets believe otherwise,” says the research group, “financial markets can unravel at smaller debt-GDP ratios.”

Something will surely give before such hypothetical nightmares play out. Earlier this year, the CBO itself and the International Monetary Fund issued their own explicit warnings. Phillip Swagel, the head of the CBO, even warned that the “unprecedented” escalation of America’s debt bender risked a kind of market reckoning that curtailed the government of Liz Truss, briefly Britain’s prime minister.

President-elect Donald Trump’s plan for a Department of Government Efficiency (DOGE) led by Elon Musk and Vivek Ramaswamy is the most encouraging sign I have seen of a fiscal awakening in Washington. I doubt DOGE will touch the entitlements, where much of the imbalance lies, but let us hope this begins a trend in the right direction.

When external pressure at last forces America’s leadership into hard choices, I believe the first move will be dollar debasement. Congress may one day impose taxes on assets—ineffective but gratifying to some. And there is the real possibility of a quasi-default by the Treasury, through debt restructuring beyond what today’s consensus would dare to contemplate. In the upheaval to come, few are likely to be spared.

Read the full article HERE.

–The economy is doing “exceptionally well” as President-elect Donald Trump gets ready to enter the White House, said Moody’s Analytics chief economist Mark Zandi.

–But, Zandi added, “I do think there are some potential storms coming.”

The economy is doing “exceptionally well” as President-elect Donald Trump gets ready to enter the White House, according to Moody’s Analytics chief economist Mark Zandi.

Zandi, speaking at the Consumer Federation of America’s financial services conference on Wednesday, noted some of the glowing areas: Gross domestic product has been growing at around 3%, productivity and business formation rates are strong and the stock market is up.

“The economy can weather a lot of storms,” Zandi said.

But, he added, “I do think there are some potential storms coming” next year under the new administration.

Immigration policy, tariffs could affect economy

Zandi expects Trump to act quickly on deporting immigrants and implementing tariffs, two moves that could have profound impacts on the U.S. economy.

“I believe President Trump is going to do what he said he’ll do on the campaign trail,” Zandi said. “He’s going to be quite aggressive in pursuing the policies.”

Immigration has played a big role in the economy’s strength, Zandi said.

Others agree. “Recent immigrants have flowed disproportionately into the parts of the labor force that were particularly tight in 2022, contributing to labor supply in places where it was most badly needed,” Goldman Sachs analysts wrote in a note to clients in May.

Meanwhile, tariffs create “a whole lot of uncertainty for businesses,” Zandi said. As a result, they could lead to job losses.

Tariffs are also likely to impact people’s spending, he said.

“It’s going to mean higher costs for consumers, it’s a tax increase,” Zandi said.

Trump’s universal tariff proposals could cause prices to skyrocket on clothing, toys, furniture, household appliances, footwear and travel goods, according to a recent report from the National Retail Federation.

Trump has said he would impose a 10% or 20% tariff on all imports across the board.

The NRF found that the impact of the tariffs would be “dramatic” double-digit percentage price spikes in nearly all six retail categories that the trade group examined.

For example, the cost of clothing could rise between 12.5% and 20.6%, the analysis found. That means an $80 pair of men’s jeans would instead cost between $90 and $96.

These new prices would squeeze consumer budgets, especially for low-income households that spend triple as much of their monthly budgets on apparel as high-income households spend, according to the Bureau of Labor Statistics.

Read the full article HERE.

Gold could extend its record run into 2025 as further interest rate cuts from major central banks and the prospect of a weaker dollar will boost demand for the safe-haven asset, Heraeus Precious Metals said on Tuesday.

Heraeus expects gold prices to range from $2,450 to $2,950 per ounce in 2025, influenced by continued buying by major central banks, albeit in lesser quantities than in 2024, geopolitical risks in Ukraine and the Middle East.

Gold, often used as a safe store of value during times of political and financial uncertainty, tends to appreciate on expectations of lower interest rates, which reduce the opportunity cost of holding the non-yielding asset.

“If the Chinese government’s economic stimulus measures boost the economy, China and India could provide a solid basis for gold demand in 2025,” the company said in a report.

China’s central bank resumed buying gold for its reserves in November after a six-month pause, official data by the People’s Bank of China (PBOC) showed on Saturday.

“With the return of Donald Trump as US president, there is likely to be more uncertainty regarding trade and tariffs, which should also support the gold price,” said Steffen Metzger and Stefan Staubach, who have been leading the precious metals division of Heraeus.

Gold has surged more than 29% this year and is on track for its best annual performance since 2010, driven by central bank interest rate cuts and growing geopolitical tensions.

Heraeus further noted that industrial demand for silver is expected to surge, propelled by the continued growth in solar photovoltaic demand.

The current gold-silver ratio indicates silver’s undervaluation compared to gold, suggesting that silver may outperform gold in late bull markets, with expected prices between $28 and $40 an ounce, the report said.

The platinum market is projected to remain in a deficit in 2025, the report said. Despite rising demand from the automotive and industrial sectors, Heraeus anticipates that platinum prices will remain within the $850 to $1,220 per ounce range.

However, the report underscores that demand for palladium, which is heavily dependent on the automotive industry, might decline as internal combustion engines lose market share to electric vehicles.

This shift could exert downward pressure on palladium prices, with Heraeus projecting a price range of $800 to $1,200 per ounce.

Read the full article HERE.