Dockworkers along the East and Gulf coasts have pledged to strike unless a new contract is reached by October, prompting experts to warn that higher prices and empty shelves could await consumers.

In fact, some experts say prices could rise before year’s end, impacting goods during the critical holiday season. The dire situation arose just as consumers were beginning to experience some relief from inflation.

The International Longshoremen’s Association (ILA) is negotiating on behalf of 45,000 dockworkers at three dozen U.S. ports from Maine to Texas that collectively handle about half of the country’s seaborne imports. It warned its members are prepared to stop work if they don’t have a new contract by the Oct. 1 deadline.

The Retail Industry Leaders Association (RILA) said in a statement that “retailers view this strike and its imminent disruption as a self-inflicted wound to the U.S. economy.”

JPMorgan estimated that for each day the ports are shut down, it will take roughly six days to clear the backlog. Analysts pegged the economic impact of a strike to about $5 billion per day, according to a research note published earlier this month.

Even though retailers have made contingency plans to minimize its effects, “the longer a work stoppage goes on, the harder it will be to do so,” the RILA said.

Several experts have told FOX Business that this type of disruption in shipping and supply chains often leads to product shortages, which drives up prices.

“If these strikes cause a rise in prices, it could push inflation higher, potentially delaying the Federal Reserve from cutting rates further,” Cody Moore, partner and wealth adviser of wealth management firm Wealth Enhancement & Prevention, told FOX Business. He added that “this delay could ultimately impact consumer costs for things like home mortgages, car loans and credit cards.”

SalSon Logistics CEO Jason Fisk told FOX Business that shoppers “should brace for a rise in prices for goods by the first quarter of 2025, or possibly even sooner.”

“Importers are actively implementing strategies to manage these risks, yet these solutions often come with their own high expenses, inevitably impacting consumer prices,” Fisk said.

Discretionary products, particularly luxury items and recreational goods, are expected to be most affected due to their high price elasticity, according to Fisk.

While the strike’s full impact remains unclear, Fisk says he is expecting “significant repercussions” such as “retail stockouts and plant slowdowns, especially as we approach the busy holiday season.”

Retail stockouts is an industry term for out-of-stock events, which is when a product is unavailable for purchase.

Read the full article HERE

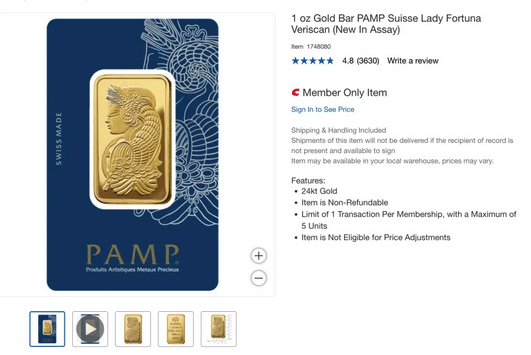

Costco (COST) is slinging a lot of gold bars as prices for the yellow metal continue to surge.

Sales of gold were up “double digits” in the most recent quarter, Costco CFO Gary Millerchip told analysts on its earnings call Thursday evening. Millerchip went on to add that gold was a “meaningful tailwind” to e-commerce sales in the quarter.

Costco began selling gold bars in the fall of 2023. Wells Fargo analysts have estimated Costco is selling $100 million to $200 million in gold bars each month.

The most recent gold performance led to a tongue-in-cheek moment as Costco’s call was nearing its end.

Veteran Evercore ISI analyst Greg Melich asked executives, “Given the nonfood, the success there, … I’m just curious, are there any plans to maybe bring Kirkland Signature into the gold bullion market?”

Kirkland Signature is Costco’s large private-label business.

“No plans at this time,” Costco CEO Ron Vachris said.

The gold rush at the warehouse club comes as futures for the metal hit (GC=F) record highs at $2,708.70 an ounce during Thursday’s trading session. Year to date, gold is up 30%, with the Fed’s decision to cut rates by a half percentage point last week giving it another boost.

Top gold stocks such as Freeport McMoRan (FCX) and Barrick Gold (GOLD) have gained a cool 22% and 18%, respectively, in 2024.

On its website, Costco sells its 1 oz gold bar for $2,679.99. You have to be a member to buy the bullion. It’s also non-refundable, and there’s a limit of five total units per membership.

IDX CIO Ben McMillan told Yahoo Finance this week that after years of gold being “sleepy,” it’s now firing on all cylinders as investors look to de-risk their portfolios.

“Gold historically has been … kind of associated with very risk-off, very flight to safety type trades like hard landing recessions,” McMillan said.

Despite the hefty sales of gold, Costco’s bread and butter is still hawking products like, well, bread and butter to cost-conscious shoppers.

Its fiscal fourth quarter same-store sales growth came in at 6.9%, compared to estimates of 6.4%. E-commerce sales jumped 19.5%, slightly lower than the 19.63% growth rate Wall Street was projecting.

Sales were powered by growth in appliances, food health and beauty aids, tires, toys, and gift cards, among other items.

Read the full article HERE.

Silver continues to shine as an attractive asset for investors, driven by a mix of favorable macroeconomic factors.

As per analysts at UBS, silver prices could see a significant rally, with a potential upside of nearly 20% over the next 12 months.

The report mentions a combination of monetary easing, industrial demand recovery, and growing investor interest through ETFs as key factors that could propel prices higher.

Currently, silver is hovering around USD 32/oz, supported by global monetary policy easing and a weaker US dollar.

The recent decision by the Federal Reserve to cut rates by 50 basis points has instilled confidence in the markets that real rates will decline further.

This environment of lower real rates is expected to bolster economic growth and fuel industrial demand for silver, which plays a critical role in sectors such as electronics, renewable energy, and medical technology.

At the same time, the weakening of the US dollar, a common consequence of falling rates, typically supports higher silver prices.

UBS forecasts that these dynamics will push silver to new highs, potentially reaching $36-38/oz by next year.

In addition to the influence of central banks, the broader recovery in global manufacturing is set to boost the demand for silver.

As production picks up across various industries, the need for silver in industrial applications will likely increase, adding further upward pressure on prices.

UBS notes that this rebound in manufacturing activity, combined with a more favorable interest rate environment, could lead to greater inflows into silver-focused exchange-traded funds.

China’s economic policies are another critical factor in the bullish outlook for silver. The Chinese government has implemented a range of stimulus measures aimed at reviving its economy, which has been under strain in recent years.

Given that China is one of the world’s largest consumers of silver, particularly for industrial use, these policies could provide a strong tailwind for silver prices.

UBS believes that if these measures are successfully implemented and followed up with additional initiatives, they could significantly bolster demand for commodities like silver.

While silver has traded within a $26-32/oz range since the second quarter of this year, UBS expects this sideways movement to give way to a broader uptrend.

The strategists foresee silver breaking out of this range and embarking on a more sustained rally, with a target price of $36-38/oz. The combination of rate cuts, monetary easing, and rising industrial demand sets the stage for silver to achieve these higher levels.

However, the analysts also caution that several risks could challenge their bullish outlook. One key risk is that the market has already priced in many of the expected rate cuts from the Federal Reserve.

Any unexpectedly strong economic data, such as a positive payroll report, could temporarily strengthen the US dollar, putting downward pressure on silver prices.

Additionally, while China has introduced numerous stimulus measures, not all have been successful in sparking a meaningful economic recovery.

If consumer demand in China does not pick up, the rally in silver and other commodities could lose momentum.

Furthermore, speculative positions in silver futures remain elevated, and a lack of positive news could prompt a pullback in these positions, dampening silver’s short-term prospects.

“For investors who are less confident of a rally in silver prices, we believe selling the downside for a yield pickup offers an alternative avenue to take silver exposure,” the analysts said.

Read the full article HERE.

Silver just hit its highest price in more than a decade, and growing demand and falling interest rates mean it could have more room to run.

On Thursday, silver hit $32.43 an ounce, its highest price since 2012. The metal is up 35% so far this year. That beats a 30% rally for gold, which has been trading at all-time highs.

Both silver and gold have benefitted from the Federal Reserve’s shifting stance on interest rates—with policy makers lowering rates earlier this month for the first time in four years. The Fed isn’t the only central bank taking action: On Wednesday, the People’s Bank of China announced its own rate cut, which helped fuel a broad rally that included metals as well as stocks Thursday morning.

While investors frequently buy gold and silver as safe-haven assets, they don’t offer any yields like Treasuries and other types of bonds. As a result, when yields decline, metals become comparatively more attractive.

Investors expect the Fed to continue cutting rates well into 2025. Futures market data suggest the federal-funds rate will hit 3.25% or below next September, down from 5.25% to 5.5% before the Fed’s half-point cut earlier this month.

One caveat for silver bulls: Investors have been expecting rate cuts all year. Given silver’s strong performance year to date, at least some gains from future rate cuts are likely baked into today’s prices.

Still, silver also stands to benefit from other tailwinds, including increasing demand. The commodity plays a significant role in the global economy’s transition to green energy, as a key component in solar panels and electric car batteries.

The Silver Institute, a trade group, forecasts industrial demand for silver will increase about 9% this year.

The market for silver is especially strong in China, says Citigroup, which estimates silver demand has increased 20% year over year in recent months, largely driven by production of electric vehicles, solar panels, and other electronics.

“China fundamental demand is booming,” wrote Citi analysts Maximilian Layton and Viswanathrao Kintali in a recent note.

One source of demand that hasn’t picked up yet—but could if prices remain elevated—is from U.S. investors. Investor flows into the iShares Silver TrustSLV+0.62% exchange-traded fund were negative for most of 2024, before ticking up sharply in the past three months when $770 million rushed into the $14 billion fund.

Still, the vast majority of the recent inflows came on just two days. That suggests bulk-buying by hedge fund traders, rather than small investors who tend to trickle in money over time. When it comes to silver, individual investors may just be starting to pay attention.

To read the full article click HERE.

The vice president is a question mark. Markets understand what to expect from Trump’s policies.

The Federal Reserve’s interest-rate cut comes as the unemployment rate is signaling a recession may be near—or even under way. If so, policy uncertainty will be a key factor driving the economy south. Economists have found that elections heighten market uncertainty dramatically when the proposals of opposing parties are especially divergent. That’s the case this time around, so expect the economy to struggle beneath the weight of uncertainty in the short term.

Kamala Harris’s evolving agenda has contributed to the uncertainty. President Trump’s first term gave markets a good idea of what he might do if re-elected. Ms. Harris, on the other hand, is anything but an open book.

In the past she endorsed myriad policies that, while popular among Democrats, would be extremely disruptive to the global economy. These include bans on fracking and offshore drilling, going carbon neutral by 2030, and killing the filibuster to pass the Green New Deal and pack the Supreme Court. She has also at one time or another expressed support for Medicare for All, a financial-transactions tax and a new form of wealth tax. Lately, however, she has reversed course on these and other progressive proposals, leaving policy analysts wondering which Ms. Harris the economy is going to get if she wins.

Among the easiest of her proposals to evaluate is her plan to raise the corporate tax rate from 21% to 28%, and to allow the 199A deduction—which grants pass-through entities the right to exclude 20% of their income from taxation—to expire.

For C corporations, the corporate-rate hike would be the largest increase enacted for any major advanced economy in at least 45 years.

A recent review by Aaron Hedlund and Michael Faulkender of the academic consensus that has emerged notes that the Tax Cuts and Jobs Act of 2017 lifted domestic investment by 20%. This coincided with a record $5,420 annual increase in real median household income in 2019. Since the original act was designed to be almost revenue neutral because of growth and the expansion of the tax base, the Harris proposal would lift the effective tax rate above what it was prior to the Trump tax reform for many forms of investment. The consequence would be a negative investment shock that would more than reverse the positive effects found in the literature.

The harm wouldn’t be limited to corporate investment. A large share of the burden of this new tax would fall directly on workers and consumers, exacerbating the affordability crisis by raising retail prices while wages decline. Firms’ demand for labor has dropped sharply and remains anemic. A tax hike would present a notable headwind to the labor market at an unusually bad time.

The second tax proposal concerns the 199A deduction, which is set to expire in 2025. According to Internal Revenue Service data, 25.9 million small businesses took advantage of this tax break in 2021. The elimination of the exclusion would add to the investment carnage of the higher corporate rate and affect every small business, not only the new startups that might benefit from Ms. Harris’s new startup incentives.

On regulatory policy, the records of the two candidates couldn’t be more different. According to a study by the University of Chicago’s Casey Mulligan, the Trump administration reduced regulatory lifetime costs by roughly $11,000 a household. New Biden-Harris administration regulations, on the other hand, have increased regulatory lifetime costs by an average of $47,000 a household. On trade, Mr. Trump and Ms. Harris are singing from the same hymnal. He relied heavily on tariffs during his first term, and the Biden-Harris team has kept most of those policies in place.

Considerable economic literature has shown that a strong rule of law is essential for a vibrant economy. Any complete economic analysis of Ms. Harris’s agenda should account for this. According to surveys that ask people if they have been victims of crime, there has been a collapse in the rule of law under the Biden-Harris administration. While violent crime fell by 17% during Mr. Trump’s four-year term, violent crime increased by 43% during the first two years of the Biden-Harris administration. This trend will likely grow worse if a Harris administration keeps faith with Biden administration policies.

Nobody knows what the future holds, but most everyone can remember what their lives were like four years ago. Mr. Trump is thus running on policies he once successfully enacted. A lively and mostly supportive academic record suggests those same policies would advance prosperity. Ms. Harris’s policies promise the opposite, causing identifiable and quantifiable harm to the economy, especially through higher taxation and heavier regulation. If the more radical policies she has supported in the past end up becoming law, the consequences would likely be a downside scenario too deep for economists’ models even to begin to simulate.

Mr. Hassett is a distinguished fellow in Economics at the Hoover Institution. He served as chairman of the White House Council of Economic Advisers, 2017-19. Mr. Clingenpeel was an economist and then senior adviser to the chairman of the council, 2018-21.

To read the full article click HERE.

Major banks expect gold to extend its record-breaking price rally into 2025 because of a revival in large inflows to exchange-traded funds (ETFs) and expectations of additional interest rate cuts from prominent central banks around the world, including the U.S. Federal Reserve.

“Strong physical demand from China and central banks supported gold prices over the past two years, but investor flow, and retail-focused ETF builds in particular, continue to hold the key to a further sustained rally over the upcoming Fed cutting cycle,” analysts at J.P. Morgan said in a note on Monday.

Non-yielding gold has gained nearly $570 an ounce, or over 27%, so far this year, putting it on track for its biggest annual rise since 2010 and positioning itself as one of the standout assets of 2024. The precious metal hit a record high of $2,639.95/oz earlier on Tuesday and has notched record highs several times this year.

“Despite reaching multiple highs this year and outperforming major stock indices, we believe gold has more room to run over the next six to 12 months,” analysts at UBS said in a note last month, adding that “key factors in our view include a revival of large inflows to exchange traded funds (ETFs) – something that has been missing since April 2022.”

The Fed began its easing cycle last week with a half-percentage-point rate cut, and forecast another 50 basis points of cuts by the end of this year and a full percentage point of cuts next year.

Zero-yielding bullion tends to be a preferred investment in a low interest rate environment and during geopolitical turmoil.

The Nov. 5 U.S. presidential election could also boost gold prices further as potential market volatility may drive investors towards safe-haven gold, analysts said.

The following is a list of the latest brokerage forecasts for 2024 and 2025 prices for gold (in $ per ounce):

Read the full article HERE.

S&P flash US services Purchasing Managers’ Index (PMI) for September came in at 55.4, slightly above economists’ expectation of 55.2. Meanwhile, the S&P flash US manufacturing PMI for September was 47.0, which was weaker than the 48.6 economists were expecting.

Citi economist Veronica Clark joins Catalysts to discuss the print and what it signals about the health of the economy as the Federal Reserve continues to ease interest rates.

Clark notes that the services measure has been “remarkably steady” over the last five months. She highlights that the employment subcomponent is still in “contractionary territory” as it sits below 50. Meanwhile, she explains that manufacturing came in weaker than expected and that the industry is slowing overall, especially as the sector saw job losses during the month of August.

Heading into the year-end, Clark believes the recession risk is “still pretty elevated.” Thus, the state of the labor market is critically important. “We do think this is a genuine weakening of the labor market, and we can see that more in data that we’re going to get next Friday. We’ll have another jobs report before we get to that November decision also. But I think both of those should show this weakening trend continuing,” she tells Yahoo Finance.

If the labor market continues to weaken, Clark believes that the Federal Reserve could cut 50 basis points in November before continuing with 25-basis-point cuts.

While she sees the risk of inflationary pressures looking “pretty muted” over the next year, she will keep a close eye on the housing market. She explains, “Where you would expect to see any reemerging signs of inflationary pressures first would be in something like the housing market if we see home prices picking up or rents picking up… we have seen mortgage rates coming down, but those mortgage applications still look very low. I think what could be happening is that the labor market is weakening, and that’s going to offset any boost you would get from the lower rates in that sector.”

For more expert insight and the latest market action, click here to watch this full episode of Catalysts.

to read the full article click HERE.

Gold prices continue to skyrocket, closing last week at another record high, as several factors help boost the precious metal which has actually outperformed the blistering stock market in 2024.

Spot gold prices ended Friday at a new record of $2,622 per troy ounce in New York, according to FactSet data, extending its year-to-date gain to 27.1%, topping the U.S. benchmark S&P 500 stock index’s balmy 20.8% return, including reinvested dividends.

Gold is on track for its best return since 2010, outpacing even 2020’s 25.1% gain as the COVID-19 pandemic accelerated doomsday investment bets.

The most recent lift to gold prices was the Federal Reserve’s Wednesday decision to institute the first interest rate cut in 4.5 years, which provides a pair of tailwinds for the metal, according to conventional wisdom, as gold prices rose 2% from Tuesday to Friday.

Lower rates of return on other non-stock assets which offer fixed payments tied to the Fed-set interest rates, like short-dated government bonds and certificates of deposit (CDs), may make gold a more popular diversification option, and gold is considered perhaps the most popular hedge against inflation, meaning if the Fed acted too swiftly and U.S. inflation gets worse again, gold prices should benefit.

But it’s not just U.S. monetary policy boosting gold, as experts tie the increased appetite for gold to geopolitical risks globally, including from the U.S. election and the ongoing wars between Russia and Ukraine and Israel and Hamas.

Surprising Fact

The volume of global central bank purchases of gold have tripled since Russia invaded Ukraine in early 2022, according to Goldman Sachs, which also named concerns over climbing U.S. federal debt and the potential for increased institutional capital into gold exchange-traded funds (ETFs) as a driver of higher gold prices.

Big Number

811%! That’s how much gold prices have soared since the turn of the millennium, dwarfing the S&P’s 517% return since Dec. 31, 1999.

Key Background

The two largest years for central bank gold purchases on record were 2022 and 2023, according to the Wall Street Journal. China was the biggest buyer of the commodity during that stretch, though the People’s Bank of China declined to bolster its gold reserves from May to August, ending an 18-month streak of gold purchases. Gold prices typically increase during times of uncertainty as investors look to clutch onto the metal which has been viewed as a source of value for centuries, outlasting countless currency changes and conflicts. Gold, which traded as low as $255 per troy ounce in 2001, has enjoyed three distinct rallies since 2000, including around the 2008 financial crisis, around the COVID-19 pandemic and the last two years’ global inflation bout. The latest rally comes as most experts believe the odds of a U.S. recession is unlikely to occur imminently, eating into gold’s historic boost from heightened downturn fears.

Read full article HERE.

Gold hit a fresh high, as concerns around inflation and the US economy linger, with bets that the precious metal could hit the $3,000 mark next year.

The spot gold price hit $2,622 per ounce on Friday, with a rise of 1.7% over the course of the week and more than 1% on Friday alone, according to Deutsche Bank. The price held steady on Monday, edging slightly higher to $2,623 per ounce, while gold futures (GC=F) were up to $2,647.

Deutsche Bank’s analysts said in a note that “with the Fed cutting rates by 50bps (basis points), there was a bit more concern about inflation again”, pushing gold prices higher.

Gold is considered a safe haven investment to hedge against the impact of inflation, as its value typically rises as the pricing power of the currency in which it is priced falls.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “Gold is predominantly traded in US dollars so falls in the currency can make the metal cheaper for buyers, helping increase demand.”

The pound continued to strengthen against the dollar (GBPUSD=X) on Monday, trading at $1.33 in the afternoon.

Streeter added that inflation remained “stubborn in some economies and there are also concerns that governments across the world continue to run up high levels of debt, which is associated with a rise in long-term inflationary expectations.”

The US Federal Reserve announced its first interest cut in four years last week, slashing its range to between 4.75% and 5%.

The Federal Open Market Committee (FOMC) said it had “gained greater confidence that inflation is moving sustainably toward 2%” but added that “the economic outlook is uncertain”.

Fed members foresee two more 25 basis point cuts this year and four more in 2025, based on projections.

Some on Wall Street considered the decision to go with a heftier 50 basis point cut, rather than 25 basis points, as an indicator that the Fed was playing catch up.

However, Fed chairman Jerome Powell said the central bank didn’t think it was “behind” on cutting rates.

Central banks have been keeping interest rates higher in a bid to slow down spending and demand enough to lower inflation back down to a widely used target level of 2%. At the the same time, rate setters are trying to avoid waiting too long to cut rates, as this risks slowing activity so much that it tips economies into a downturn.

Read full article HERE.

Spot gold prices hit a record high on Friday as a weak dollar, expectations of more U.S. interest rate cuts and tensions in the Middle East more than offset muted physical demand in Asia.

Spot gold was up 1.2% at $2,617.60 per ounce after hitting a record high of $2,617.89. U.S. gold futures rose 1.1% to $2,643.

Non-yielding gold is up 27% so far this year, heading for its biggest annual rise since 2010. It got the latest boost from the start of the Federal Reserve’s easing cycle on Wednesday.

“We expect further dollar depreciation, as the Fed catches up with other central banks who started their cutting cycles earlier. That should be gold price positive,” said WisdomTree commodity strategist Nitesh Shah.

Gold could hit $3,000 per ounce in a year amid geopolitical risks and investors hedging against a slowing economy, he added.

However, from a technical point of view, gold’s Relative Strength Index moved into “overbought” territory on Friday, at 70.9.

“Over the last few weeks gold’s inverse relationship with the US dollar, and indeed US treasury yields, has been very much reinstated,” said independent analyst Ross Norman.

“The path of least resistance for gold looks to be to continue higher and, even though it looks well overbought and much above fair value, the momentum trades are behind it and price strength looks in order,” Norman said.

Meanwhile, demand from the physical sector in Asia remains light and gold is trading there at a discount to the London price. Top consumer China did not import any gold from a major trading hub Switzerland in August, for the first time in 3-1/2 years.

In other metals, silver gained 2.0% to $31.39, platinum rose 0.5% to $993.85 and palladium was steady at $1,080.75.

Read full article HERE.