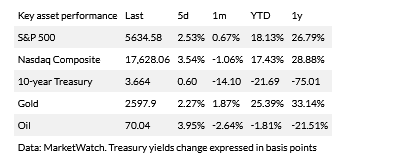

Spot gold prices hit a record high on Friday as a weak dollar, expectations of more U.S. interest rate cuts and tensions in the Middle East more than offset muted physical demand in Asia.

Spot gold was up 1.2% at $2,617.60 per ounce after hitting a record high of $2,617.89. U.S. gold futures rose 1.1% to $2,643.

Non-yielding gold is up 27% so far this year, heading for its biggest annual rise since 2010. It got the latest boost from the start of the Federal Reserve’s easing cycle on Wednesday.

“We expect further dollar depreciation, as the Fed catches up with other central banks who started their cutting cycles earlier. That should be gold price positive,” said WisdomTree commodity strategist Nitesh Shah.

Gold could hit $3,000 per ounce in a year amid geopolitical risks and investors hedging against a slowing economy, he added.

However, from a technical point of view, gold’s Relative Strength Index moved into “overbought” territory on Friday, at 70.9.

“Over the last few weeks gold’s inverse relationship with the US dollar, and indeed US treasury yields, has been very much reinstated,” said independent analyst Ross Norman.

“The path of least resistance for gold looks to be to continue higher and, even though it looks well overbought and much above fair value, the momentum trades are behind it and price strength looks in order,” Norman said.

Meanwhile, demand from the physical sector in Asia remains light and gold is trading there at a discount to the London price. Top consumer China did not import any gold from a major trading hub Switzerland in August, for the first time in 3-1/2 years.

In other metals, silver gained 2.0% to $31.39, platinum rose 0.5% to $993.85 and palladium was steady at $1,080.75.

Read full article HERE.

Gold advanced to another record high on Wednesday after the Federal Reserve announced an aggressive interest cut of half a percentage point to stimulate the US economy.

Spot gold rose as much as 1.1% to $2,600.11 per ounce, continuing its record-setting trend over recent weeks. US gold futures also had nearly the same percentage gain.

By late afternoon, however, gold had erased those gains, with spot gold down 0.4% at $2,559.15 per ounce and futures down 0.6% at $2,582.90 per ounce.

The US central bank was widely anticipated to lower interest rates at this week’s meeting after holding them at a two-decade high for more than a year, but traders were split over how much the first cut would be.

Meanwhile, gold has hit repeated records over the past weeks as investors weighed prospects that the Fed would deploy a rate reduction bigger than a quarter percentage point, which would present a significant boost to the non-yielding bullion.

Gold, Treasuries and the S&P 500 Index have all typically risen as the Fed starts lowering rates, according to a Bloomberg News analysis of the past six easing cycles going back to 1989.

Fed’s announcement on Wednesday caps a period of flux in the gold market, as some analysts have pointed to a return to more traditional trading patterns, and in particular to gold’s longstanding tendency to rise and fall in the opposite direction to real yields.

That relationship had broken down in recent years, as gold remained historically elevated even as rates soared — with prices supported instead by huge central bank purchases, as well as surging demand from investors and consumers in Asia. Gold prices have broken out dramatically this year in particular, soaring more than 25% to successive records.

In recent months, there have been signs of Western investors jumping back into the gold market too, as bets mounted that the Fed was about to pivot. Holdings in gold-backed exchange traded funds have risen for 10 of the past 12 weeks, while long-only gold positions in Comex gold futures are hovering near the highest in four years.

Read full article HERE.

Officials are hoping to prevent a gradual cooling in the labor market from turning into a deeper freeze

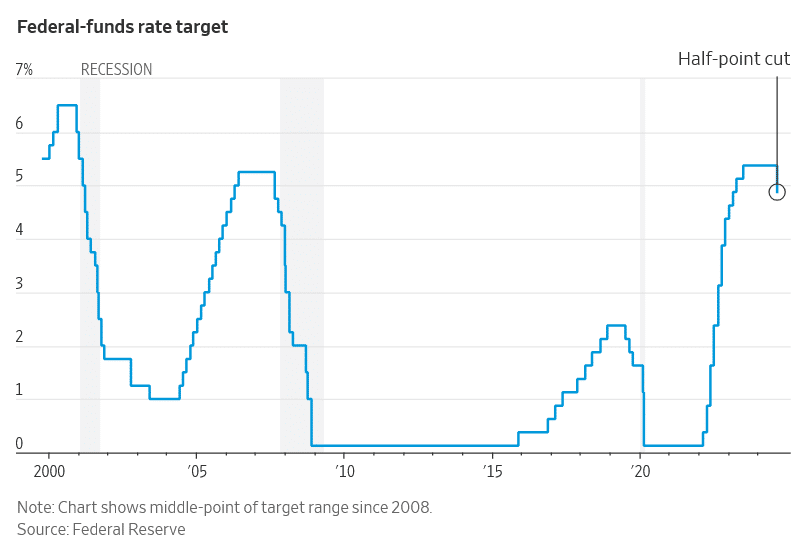

The Federal Reserve voted to lower interest rates by a half percentage point, opting for a bolder start in making its first reduction since 2020. The long-anticipated pivot followed an all-out fight against inflation the central bank launched two years ago.

Eleven of 12 Fed voters backed the cut, which will bring the benchmark federal-funds rate to a range between 4.75% and 5%. Quarterly projections released Wednesday showed a narrow majority of officials penciled in cuts that would lower rates by at least a quarter point each at meetings in November and December.

Fed Chair Jerome Powell’s decision to trim rates by a larger amount than most analysts anticipated until just a few days ago moved the central bank unwaveringly into a new phase of its inflation battle: It is now trying to prevent past rate increases, which last year took borrowing costs to a two-decade high, from further weakening the U.S. labor market.

“We are committed to maintaining our economy’s strength,” Powell said at a news conference. “This decision reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained.”

In its policy statement, the Fed said the decision reflected “greater confidence that inflation is moving sustainably toward 2%” and that the central bank “judges that the risks to achieving its employment and inflation goals are roughly in balance,” the Fed said in its policy statement Wednesday.

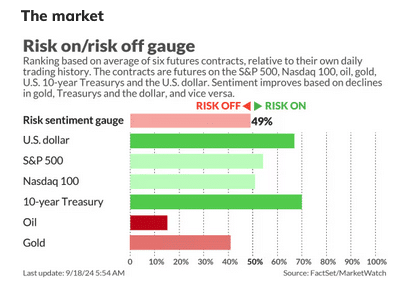

Stocks rose after the Fed announcement. Anticipation of rate cuts buoyed Wall Street in the run-up to this week’s meeting, with the Dow Jones Industrial Average hitting a new record on Monday. Yields on the 10-year Treasury note stood at 3.64% on Tuesday, ticking up slightly from a 52-week low recorded on Monday.

The decrease should provide some immediate relief to consumers with credit card balances and to small businesses with variable-rate debt. Long-term borrowing costs—on everything from mortgages to corporate debt—have already been declining in anticipation of a series of rate cuts this fall, particularly after Powell last month said reductions were on the way.

A rate cut never appeared to be in doubt this week, but analysts were uncharacteristically foggy over the size of the move. Many anticipated a smaller quarter-point cut. Fed officials have often preferred to make smaller changes in order to avoid having to reverse course if their moves prove premature.

Powell’s apparent decision to push his colleagues to make a half-point cut likely reflected so-called risk management concerns in which officials weigh the risks of various economic hazards, such as high inflation or rising joblessness, and navigate accordingly

For most of the past 2½ years, as inflation hit 7%, Powell had been single-mindedly focused on preventing inflation from becoming entrenched. Central bankers have long been haunted by the example of the 1970s, in which they took insufficient steps to constrain demand and allowed expectations of higher prices to become self-fulfilling.

But inflation has fallen over the last year, assisted by healed supply chains and a steady influx of workers to the job market. That suggests the downturn many economists once thought might be needed to tame inflation would now be overkill.

Meantime, more signs that the job market is softening have cropped up. The unemployment rate stood at 4.2% last month, up from 3.7% in January. Powell last month signaled he was shifting the Fed’s attention to preventing what for now looks like a gentle cooling in labor demand from turning into a deeper freeze.

In their projections, all Fed officials thought the unemployment rate would end the year between 4.2% and 4.5%. In June, most saw the unemployment rate settling around 4.0% at year-end.

While some Fed officials had argued in recent weeks the economy wasn’t weak enough to necessitate a half-point cut, others had concluded that labor-market cooling this summer warranted a larger reduction because the Fed was, in effect, catching up for lost time.

Fed officials entertained but opted against cutting interest rates at their previous meeting at the end of July. Two days later, hiring figures showed a sharper-than-expected slowdown in payroll growth and a bigger jump in unemployment. While central bankers don’t get mulligans, they might have opted for a cut if that data had been in front of them at the July meeting. A larger cut this week offered the chance to reset.

Some officials also feel greater urgency to cut rates because they are increasingly confident that rates are well above a so-called neutral level that neither spurs nor slows growth, and that rates will continue to be at a restrictive level even after Wednesday’s cut. With the economy closer to a healthy equilibrium, keeping conditions there could call for moving rates closer to this neutral level, which can’t be observed.

Fed governor Michelle Bowman dissented against Wednesday’s decision in favor of a smaller quarter-point cut. Bowman, who was appointed to the board by Donald Trump in 2018, became the first governor to dissent against an interest-rate decision since 2005. It was the first dissent by any voter on the rate-setting committee since June 2022.

The Fed rate cut marks just the sixth time in the past 30 years that the central bank switched from raising to lowering rates. Usually when the Fed starts cutting rates, it doesn’t know whether it will make a handful of small moves—as it did in 1995 and 1998 when the economy avoided a downturn—or whether it is the start of a longer series of reductions, as in 2001 and 2007 when the central bank cut rates a few months before the economy entered recession.

Interest-rate projections show officials penciled in the equivalent of another four cuts of a quarter point next year, assuming the unemployment rate doesn’t jump and inflation continues to decline. That would take the fed-funds rate to just below 3.5% by the end of 2025.

Officials are walking a fine balance as they attempt to engineer a soft landing that brings inflation down without a recession, all while trying to tune out crossfire from politicians ahead of the fall elections.

Three Senate Democrats, including Elizabeth Warren of Massachusetts, called on Powell this week to make a larger cut of 0.75 point, something the Fed has only done when the economy is in obvious distress.

Some Republicans are upset that a rate cut might boost sentiment ahead of the November election. The rate cut is a sign the economy is “not good. Otherwise you wouldn’t be able to do it,” Trump said at a town hall on Tuesday night. Powell has said the Fed doesn’t take political considerations into account.

Rep. Patrick McHenry (R., N.C.), who chairs the House Financial Services Committee, said in an interview Tuesday he expected the Fed to ignore political noise. “The Fed should act in the way that the data indicates they should act—period,” he said. “The outrage to me is … for instance, if you’re on the right, you say, ‘The Fed should be independent, except I think right now they should do this.’ And on the left, the same.”

The Fed slashed rates to near zero in March 2020 as the Covid-19 pandemic brought global commerce to a standstill, and officials held rates at that level for two years. In the spring of 2021, they misdiagnosed a sharp rise in inflation as likely to be short lived.

Powell pivoted at the end of 2021, first withdrawing stimulus and then lifting rates in March 2022. Inflation hit 40-year highs, and officials quickly reeled off hikes in unusual 0.5- and 0.75- point increments. It was the most rapid interval of rate increases since the early 1980s, and it took rates to a two-decade high in July 2023.

Most global central banks reacted in a similar fashion to inflation that soared in most of the world’s advanced economies, first as economies reopened from the pandemic and later as Russia’s invasion of Ukraine drove up energy and commodity prices. With Wednesday’s rate cut, the Fed joins policymakers in Canada, the European Union, and the United Kingdom, among others, in beginning to dial down interest rates.

Powell signaled at the end of last year that the Fed was probably done raising rates and was turning its attention to when to cut, but officials scrapped tentative plans to begin reducing rates this summer after a sharper-than-expected burst of inflation greeted the U.S. economy in the first quarter.

At their meeting in June, a narrow majority of officials thought the Fed would make just one quarter-point cut this year, and some officials this spring puzzled over why higher borrowing costs hadn’t done more to slow economic activity.

But in recent months, the fingerprints of tighter monetary policy have become more apparent, convincing officials they could finally ease off the brake pedal. While layoffs are low, hiring has slowed. There were fewer than 1.1 job vacancies for every worker counted as unemployed in July, down from 1.25 before the pandemic and from a peak of 2 when the Fed began raising rates in March 2022.

Interest-sensitive manufacturing and real estate sectors have been soft. Corporate America has increasingly warned that low- and middle-income consumers are resisting higher prices, leading to more promotions and discounts.

Inflation receded to 2.5% in July from around 5.5% in January 2023. Wage growth has slowed in recent months, and oil prices are down 19% since April.

Economists are also divided over whether rate cuts will help avert a sharper slowdown in the months ahead. Unlike 2001 and 2007, when the Fed initiated rate cuts with a larger half-point reduction, the economy isn’t suffering from evident financial-market stress or deflating asset bubbles.

On the other hand, modest rate cuts might be of little help to corporate borrowers who locked in much lower fixed borrowing costs before 2022 and who need to refinance over the next year at rates that could still be high, even as the Fed dials rates down.

It’s also unclear how much marginal declines in rates will stoke housing activity given serious affordability challenges. While mortgage rates have fallen meaningfully in recent weeks, there haven’t yet been notable signs of increased demand. Applications for home purchase loans last week were no higher than their level one year ago, even though mortgage rates are down sharply. Rates fell to 6.2% last week, the lowest level in more than a year and a half.

Just as Fed officials and private-sector economists misjudged how the transmission of higher rates to the economy two years ago had been dulled by households and businesses that locked in low rates, “there’s a risk the easing cycle will see some similar challenges,” said Rebecca Patterson, former chief investment strategist at Bridgewater Associates.

Bond investors are anticipating another 2 percentage points in rate cuts over the next 1½ years, while stock valuations suggest investors see healthy earnings growth over the next year. “For all of that to transpire, you need to see Fed easing have that supporting effect on consumer and business activity,” said Patterson. “The channels can’t get clogged.”

See full article HERE

Gold has surged despite macroeconomic headwinds, primarily due to central bank purchasing and geopolitical tensions. Could the rally see another gear after lower interest rates and a weaker dollar?

John Reade of the World Gold Council has seen gold rally to record highs of about $2,575 an ounce despite a strengthening dollar and rising interest rates in Europe and the U.S.

Now, he’s looking to the yellow metal to see how it performs when those headwinds are removed.

“Gold has been able to ignore some of the classic macro drivers,” he told Investing News Network. “But that may be changing now. … I think it’s going to be Western macroeconomic factors that probably take the lead in determining gold’s direction for the balance of this year and into 2025.

“Gold typically performs pretty well when rates are cut, and if those rate cuts lead to weakness in the U.S. dollar, which they certainly might, that could be a double tailwind helping the metal from here.”

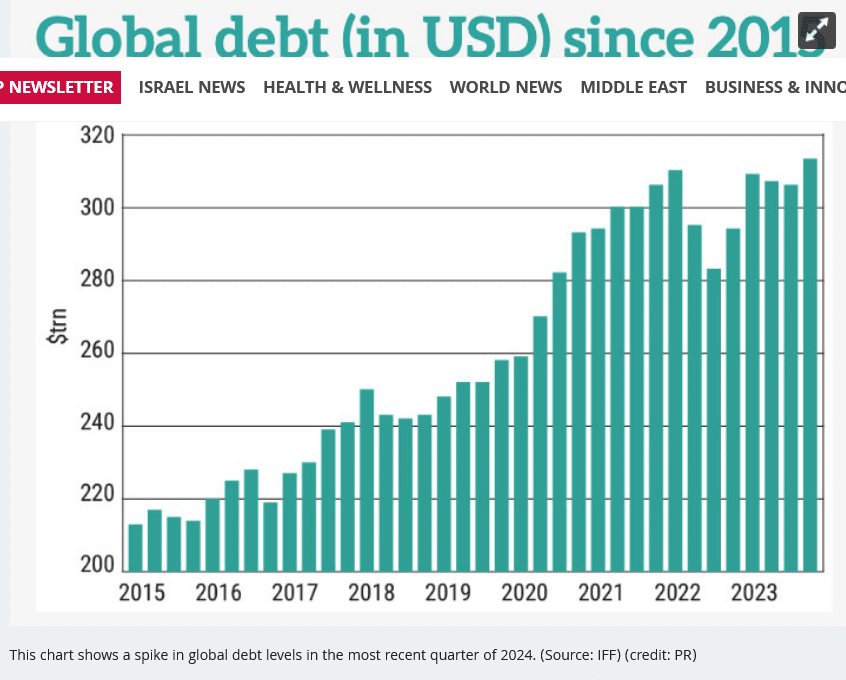

Global debt levels continue to rise

Global debt recently hit an all-time high after three consecutive quarterly reductions, which should turn investors to gold, according to Jupiter Asian Income manager Jason Pidcock.

“Fiscal policy globally is very loose, and that is a concern,” he told Portfolio Adviser. “Budget deficits — even when economies have supposedly been strong — have been way too high, and that’s why we’re invested in gold mines.”

Pidcock said Jupiter Asian Income is speculating a reduction in value among fiat currencies, which should lead to a rise in commodities prices.

“Everyone should have some exposure to gold, whether it’s as an insurance policy or just sensible diversification,” he said.

See full article HERE

Happy Fed day, in what will be a momentous decision not just for the fact that it will herald the beginning of an interest rate-cutting cycle but for the uncertainty over the magnitude of the reduction.

The last time the interest rate for a Fed decision was set more than 10 basis points away from market expectations was March 3, 2020 — the emergency cut at the beginning of the COVID pandemic, points out Michael Brown, senior research strategist at Pepperstone. That gives the interest-rate cycle a symmetry — uncertainty on the way up, and uncertainty on the way down.

But it may be a puzzle as to why the Fed is cutting rates at all when the economy is far from recession — the Atlanta Fed’s GDPNow estimate of third-quarter growth is a healthy 3% — and inflation is still above target.

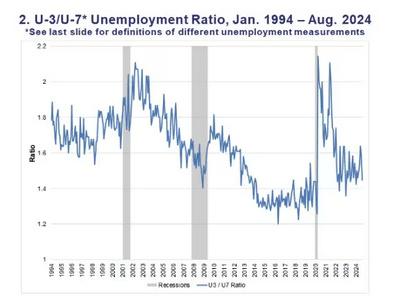

David Kotok, the chief investment officer of Cumberland Advisors who hosts an annual summer gathering in Maine of investors and other financial market participants, points to a warning from an employment measure that doesn’t officially exist. It’s called U-7, invented by David Blanchflower, the Dartmouth labor economist who served on the Bank of England’s monetary policy committee.

U-7 is actually not hard to compile — it’s a simple calculation involving two measures of underemployment that the Labor Department produces each month. It yields the number of part-time workers who want full-time jobs as a percentage of the workforce.

Kotok says the idea behind U-7 is that it isolates the most fragile element of the workforce. He says the way to use the number is to compare it with the main unemployment rate, which the Labor Department calls U-3. When the U-3 rises faster than the U-7, that’s a recession warning.

Blanchflower himself in a paper he co-authored said the U-7 segment also is key to understanding wage pressure. The idea is that it’s an indicator of the weak bargaining power of the full-timers. When there’s a bigger pool of underemployed, that naturally leads to less bargaining power for the fully employed.

U.S. stock index futures ES00-0.09%, NQ00-0.06% edged higher early Wednesday, following the fourth highest close on record for the S&P 500 SPX-0.08% . Oil CL00-2.19% was trading below $70 per barrel. Gold GC000.16% was hovering around $2,600 an ounce.

The buzz

The Fed decision is due at 2 p.m. Eastern, with the market leaning toward a half percentage point, rather than 25 basis point, reduction. Jerome Powell’s press conference starts 30 minutes later.

Mortgage activity, and in particular refis, soared heading into the Fed decision, according to Mortgage Bankers Association data. Housing starts also rose, topping forecasts.

See the full article HERE.

By Andrew Addison

My work turned bullish long-term on gold GC00 -0.78% almost two years ago when the precious metal closed above $1680 an ounce in November 2022. Its most recent cyclical advance began with its liftoff gap last October at $1845. Then, in March, gold said goodbye to 13 years of resistance in the $2100 area when it broke out decisively. And now with last week’s record close at $2610, gold is beginning to advance with “escape velocity,” which projects substantially higher prices.

Let’s check the charts to see why.

The daily chart (above) illustrates the resistance trendline that had repelled gold starting in April. Despite many false starts and bearish reversals (yellow arrows), gold consolidated for a month at resistance before breaking out last Thursday.

Next, the weekly chart (above) shows that after false starts (yellow arrow), gold formed two “bull flags” (pink). Quick advances were followed by sideways price action and sharp advances to new highs. With a decisive hurdling of final resistance, gold launched escape velocity.

On the monthly chart, you can see the gigantic 13-year base. From 2020 to 2023, gold formed a series of high-level consolidations. Each high-level consolidation was higher and shorter than the previous one—indicating weakening selling pressure on each probe to the top of the base.

With last month’s breakout, gold overcame final resistance to begin “escape velocity” that my work projects to $3000-plus. Consider all pullbacks as opportunities to buy or add to positions.

See full article HERE.

The investment bank’s models show the average calendar-year return for the S&P 500 could shrink to 5.7%, roughly half the level since World War II.

Millennials and Generation Z might not enjoy the robust returns from U.S. stocks that helped swell the retirement accounts of their parents and grandparents, according to a team of equity analysts at J.P. Morgan Securities.

Over the next decade, the average calendar-year return of the S&P 500

SPX-0.14% could shrink to 5.7%, based on the models maintained by a team of strategists at JPMorgan focused on long-term market performance. That is roughly half the pace of returns seen since the end of World War II.

The basis for their argument was mostly mathematical. Current stock-market valuations are high relative to history, largely due to the performance of a handful of megacap stocks like the members of the Magnificent Seven.

Reams of historical data suggest that, over the long term, valuations should return to the mean, which should translate to lower stock-market returns in the years ahead.

With a current trailing price-to-earnings ratio of 23.7 times, the S&P 500 is about 25% more expensive relative to its 35-year average of 19 times. Robert Shiller’s Cyclically Adjusted PE ratio, another valuation metric used by the team, showed stocks are even more richly valued currently.

But as is often the case in markets, models rarely tell the whole story. So the JPM team theorized some fundamental factors that could weigh on stock-market returns going forward.

The most obvious, according to them, is the pace at which the U.S. population — and indeed, much of the global population — is aging. Older investors tend to shirk stocks in favor of more conservative investments, like bonds.

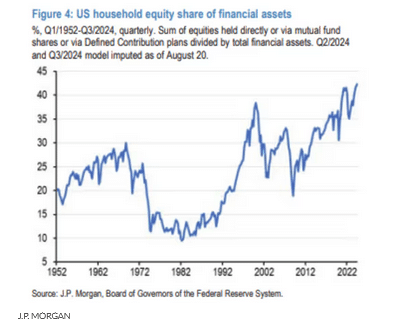

This could help to weigh on the average household allocation to stocks as more baby boomers and older members of Generation X reach retirement age. Currently, that allocation is at record highs, as the chart below shows.

“Multiples could come down because aging induces the growing cohort of elderly baby boomers to lower their equity allocations, currently at record highs, in line with their shrinking investment horizons,” said strategist Jan Loeys and Alexander Wise said in a report.

But there are other issues out there that could weigh on stock-market returns ahead. The team also questioned whether corporations could can continue to expand after reaching record highs during the COVID-19 pandemic.

Globalization and growing market concentration had helped profits grow more quickly than the economy since the early 1990s, as did generous corporate tax cuts. But tax rates could rise as the U.S. scrambles to reduce its budget deficits.

And although there is not a ton of evidence yet that taking on the biggest companies could yield gains for politicians, the team noted that antitrust actions by the U.S. government have picked up over the past few years.

If they progress, antitrust efforts by the government could help shake the dominance of some of the largest Big Tech firms, potentially dimming their already exorbitant (relative to recent history) valuations.

Increasing U.S. political instability and dedollarization could also emerge to diminish equity returns over the long run, the strategists said. Although, so far, neither has had much of a discernible impact on markets.

In fact, U.S. markets have proven remarkably resilient to rising government budget deficits, the team said. But that could change over the next five or 10 years, as foreign investors become less enthusiastic about dollar-denominated assets.

The team concluded their analysis with a caveat: their observations are only useful over the long run. They shouldn’t be applied with the purpose of trying to time the market.

“Valuations…are great at informing us about returns over long holding periods but are quite poor at giving us a clean direction, up or down, over the near term,” the team said.

The S&P 500, Nasdaq Composite COMP0.04% and Dow Jones Industrial Average DJIA-0.15% tallied their worst calendar-year performance since 2008 in 2022, but since then, all three have made a remarkable comeback.

The S&P 500 rose by more than 24% last year, and is up more than 18.5% so far in 2024, according to FactSet data. The index was on the cusp of a fresh record closing high on Tuesday as traders awaited the latest interest-rate decision from the Federal Reserve. And the Dow was poised for another record close of its own.

The Nasdaq was also trading higher on Tuesday, but remained well below its July record high.

Read the full article HERE.

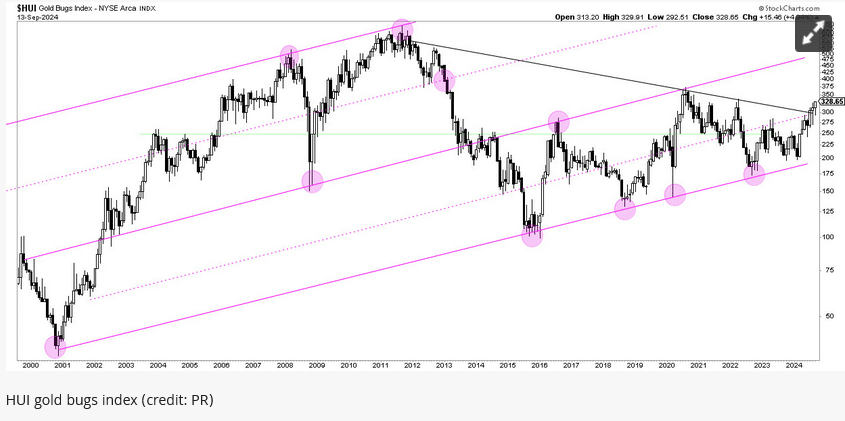

As we head into 2025, the gold market is witnessing a remarkable sequence of ‘events.’

There is no gold bull market without participation of gold miners.

Admittedly, gold miners have been lagging, tremendously in fact. But that’s changing ‘as we speak’ because gold miners are now staging epic secular breakouts.

In this article, we repeat the fundamental drivers underpinning this gold bull market. We also look at gold miners which are coming to life and will amplify the gold bull market.

Dominant Gold Price Drivers

Rising inflation expectations

Inflation expectations have proven to be a dominant market dynamic driving gold prices higher in this new gold bull market.

As inflation is stabilizing, globally, inflation expectations are on a steady path higher. Investors are increasingly turning to gold as a hedge against normalizing inflation.

Essentially, what happened in 2022 is that aggressive disinflationary policies introduced by policy makers pushed the real inflation rate lower. This, in turn, affected the gold price.

Historical data reveals that gold performs exceptionally well when inflation expectations are on the rise, as explained in great detail in Gold Price Drivers Remain Very Bullish Ahead Of 2025.

This trend is particularly relevant today, as inflationary pressures are pushing gold to new levels. The current economic environment, characterized by dominant dynamics around inflation and geopolitical tensions, is setting the stage for a continued rise in gold prices.

As we approach 2025, the rise in inflation expectations is expected to maintain momentum. This trend highlights the strength of gold as an investment asset, emphasizing its role as a key asset for smart and diversified investors.

Central bank purchasing: A supportive yet secondary dynamic

While central bank purchases of gold have certainly contributed to the bullish trend, they are secondary to the primary driver of rising inflation expectations. Central banks have been actively increasing their gold reserves, providing a supportive backdrop for gold prices.

Recent data from July 2024 indicates a substantial increase in central bank gold purchases, reaching 37 tons. This represents a notable rise in demand and helps support gold prices. However, it is important to recognize that the main catalyst for gold’s current bullish trend remains the growing concerns about inflation.

Central bank buying is an important component of the overall gold market dynamics. Primary and secondary price influencers for price of gold are nicely explained in this well researched gold price prediction.

Gold Miners: From Lagging to Leading

Gold mining stocks have faced a challenging period over the past 18 months. If anything, they have been lagging significantly behind the performance of bullion prices. This underperformance has been a divergence from the strong gains in gold itself.

However, the tide is turning for gold miners. Moreover, it has happening NOW.

One key factor driving the recent turnaround in gold mining stocks is the decline in crude oil prices. Lower oil prices reduce operational costs for mining companies, which is a significant advantage in an industry where energy expenses are a major component of overall costs.

Additionally, the surge in bullion prices is providing a strong incentive for mining companies to push their production up, affecting their revenue and profit margins.

These positive changes in market conditions are creating a perfect storm for gold miners, setting the stage for a potential breakout.

What makes this breakout so exceptional is that it’s occurring on a secular timeframe, marking a significant shift in the long-term trend. This is a major milestone in the gold mining sector. Surprisingly, this pivotal development has largely gone unnoticed by mainstream financial media. However, JPost.com is spotlighting this decisive evolution and is eager to share this important news with its readers.

Gold Miners’ secular breakouts happening now

The HUI Gold Bug Index, a leading benchmark for gold mining stocks, is showing a dramatic bullish breakout.

This chart breakout is particularly noteworthy given the index’s previous period of underperformance.

The recent uptrend suggests that gold mining stocks are set for a significant recovery and could experience substantial gains (in the quarters and years to come) for as long as gold prices continue to rise.

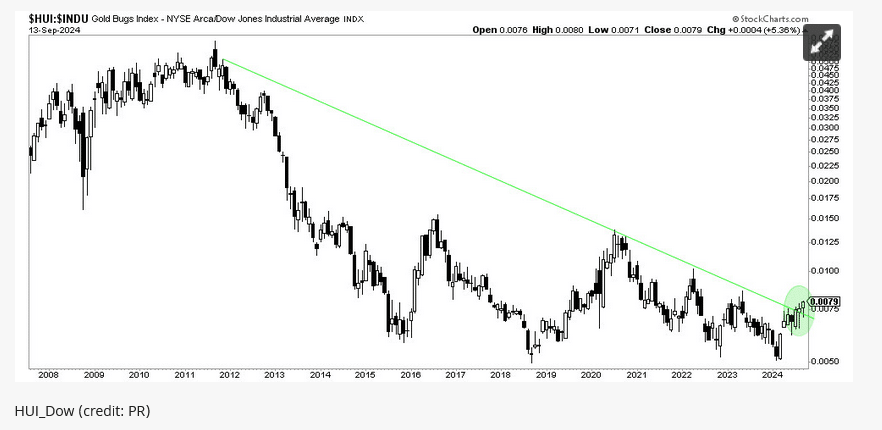

Furthermore, we look at a ratio chart. What’s interesting and insightful about ratio charts is that they express the value of a market segment expressed in another leading segment.

In particular, we like the HUI/Dow ratio a lot. It compares gold mining stocks to the defensive segment of the market represented by the Dow Jones Index.

As seen below, the HUI/Dow ratio has a chart pattern that exhibits a breakout out from a 12-year downtrend. This indicates that gold miners are gaining relative strength and suggests a promising outlook for the sector.

Opportunities and Considerations

The bullish development in the gold mining space represents a compelling investment opportunity. With gold prices driven by rising inflation expectations and favorable market conditions, gold mining stocks are likely to see considerable upside.

More importantly, gold miners are likely to fuel the gold bull market by improving even more bullish sentiment.

However, it is essential to remain mindful of potential risks. Gold miners are traditionally very volatile, and individual stocks come with individual risks. For investors seeking some safety, it is safe to consider either the leading gold mining ETFs and/or the large cap gold miners.

Conclusion

The gold market is entering a new phase as we head into 2025. This environment which is very favorable for gold is now having an impact on gold miners. They are finally emerging from a period of underperformance.

With favorable conditions, including high bullion prices and declining crude oil costs, gold mining stocks are set for a rebalancing act.

Read full article HERE.

Gold prices charged to a record high on Monday as a weaker dollar and the prospects of aggressive U.S. monetary policy easing boosted non-yielding bullion’s appeal.

Spot gold was up 0.4% at $2,586.04 an ounce by 0914 GMT after touching a record peak of $2,589.59. U.S. gold futures edged up by 0.1% to $2,613.40.

The dollar index eased 0.4%, making gold more attractive to other currency holders.

This week’s key event is the Federal Reserve interest rate decision due on Wednesday. Trader expectations are for a 59% chance of a cut of 50 basis points.

The first U.S. rate cut is getting closer and will be followed by more, supporting gold, said UBS analyst Giovanni Staunovo.

“Any change to the Fed dot plot is likely to result in near-term volatility, but I believe we are still on the path of higher prices over the coming months,” he said.

Bullion becomes generally a more attractive investment in periods of lower interest rates and is considered a safe asset in times of turmoil.

Macroeconomic and geopolitical concerns, U.S. elections and a likely increase in equity market volatility also make a compelling case for increasing investment in gold, ANZ analysts said in a note.

“We expect gold prices to move towards $2,700 in the short term and reach a high of $2,900 by the end of 2025,” the note added.

The FBI said that Republican presidential candidate Donald Trump was the subject of a second assassination attempt on Sunday.

Spot silver gained 1% to $30.95 an ounce, hitting its highest in two months earlier in the session.

Platinum shed 0.2% to $993.70 and palladium was up 0.2% at $1,070.70.

Data from China over the weekend showed industrial output growth slowed to a five-month low in August while retail sales and new home prices weakened further.

See full article HERE.

- With the Federal Reserve holding benchmark rates at their highest in 23 years, the government has laid out $1.049 trillion on debt service, up 30% from the same period a year ago.

- The jump in debt service costs came as the U.S. budget deficit surged in August, edging closer to $2 trillion for the full year.

The U.S. government for the first time has spent more than $1 trillion this year on interest payments for its $35.3 trillion national debt, the Treasury Department reported Thursday.

With the Federal Reserve holding benchmark rates at their highest in 23 years, the government has laid out $1.049 trillion on debt service, up 30% from the same period a year ago and part of a projected $1.158 trillion in payments for the full year.

Subtracting the interest the government earns on its investments, net interest payments have totaled $843 billion, higher than any other category except Social Security and Medicare.

The jump in debt service costs came as the U.S. budget deficit surged in August, edging closer to $2 trillion for the full year.

With one month left in the federal government’s fiscal year, the August shortfall popped by $380 billion, a dramatic reversal from the $89 billion surplus for the same month a year prior that was due largely to accounting maneuvers involving student debt forgiveness.

That took the 2024 deficit to just shy of $1.9 trillion, or a 24% increase from the same point a year ago.

The Fed is widely expected to lower rates next week, but just by a quarter percentage point. However, in anticipation of additional moves in future months, Treasury yields have tumbled in recent weeks.

The benchmark 10-year note last yielded about 3.7%, down more than three-quarters of a percentage point since early July.

See full article HERE.