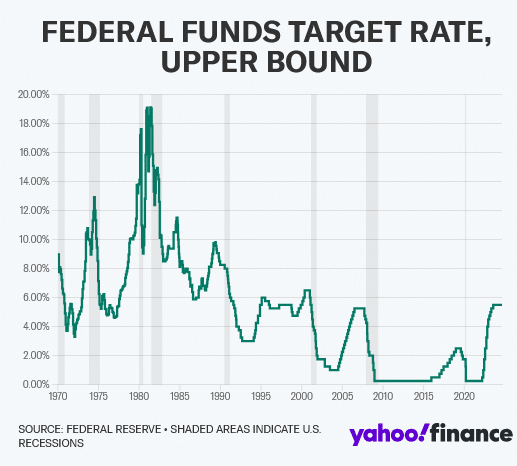

The Federal Reserve is nearing the end of an era as the central bank looks to cut interest rates for the first time in four years.

If the Fed eases monetary policy at its next meeting on Sept. 18 as expected, it will officially mark the termination of the most aggressive inflation-fighting campaign since the 1980s. Its benchmark rate is currently at 5.25% to 5.5%, a 23-year high.

The central bank’s new era of easy money is expected to last through 2025 and 2026. That shift will ripple through the US economy by making it cheaper for Americans to borrow what they need to buy houses and cars or credit card purchases.

Businesses will also have an easier time taking out loans to fund their operations. “We’re starting this rate cut cycle, it looks like, in September at a place that fed funds hasn’t been in more than 20 years,” WisdomTree head of fixed income strategy Kevin Flanagan told Yahoo Finance.

“You have a whole generation of investors who have never experienced rate cuts at these levels of interest rates.” For Fed Chair Jerome Powell, this inflection point may allow him to claim an accomplishment that eluded many of his predecessors, including his inflation-fighting idol Paul Volcker.

Powell has said how much he admires Volcker, who hiked interest rates to an eye-popping 22% in the 1980s in an effort to get inflation under control. But Volcker wasn’t able to avoid a recession as his high rates took a toll on millions of Americans and businesses.

Powell had his own Volcker moment in 2022 when he promised “pain” as the Fed took its own rate-hiking campaign into overdrive. He then experienced a banking crisis in the spring of 2023 that tested the central bank as it worked to ease panic among bank depositors across the US.

But the goal that is now within his reach is the ever-so-rare “soft landing,” in which inflation falls back to the Fed’s 2% target without forcing the US economy into a painful downturn.

Esther George, former Kansas City Fed president, said the Fed will not have finished its job until it secures its 2% inflation target.

“They may be on the golden path, but for me, [it’s] too soon to say we know the path we’re on,” George said. “The Fed’s credibility of achieving 2% is coming into better focus, but we’re not there yet.”

There is still the danger that a cooling labor market could worsen, which has the potential to drag down the US economy and force the Fed to lower rates more aggressively.

That’s the debate that will likely define the coming days as the Fed prepares for its next meeting.

Powell made clear in his last speech that the central bank is poised to begin its rate-cutting cycle, saying in Jackson Hole, Wyo., that “the time has come for policy to adjust.”

But he was silent on how big the first cut could be and whether it would definitely happen at the September meeting.

Atlanta Fed president Raphael Bostic told Yahoo Finance that September or November is “definitely in play” and that an initial 25 basis point reduction “could be the most appropriate way forward.”

Philadelphia Fed president Patrick Harker told Yahoo Finance in another interview that he expects the central bank to start with a 25 basis point cut, but he would be open to a larger cut if the labor market deteriorates suddenly.

For now, traders are betting on a small cut to start. The odds of a 25 basis point reduction in September are now at roughly 65%.

Playing catch up

The Fed’s multiyear fight against inflation began with what many consider a misstep and included plenty of ups and downs along the way.

The misstep was believing that inflation would be “transitory.” That was the belief for much of 2021 as Fed policymakers watched prices move higher due to pandemic dislocations and supply chain disruptions caused by the COVID-19 health crisis.

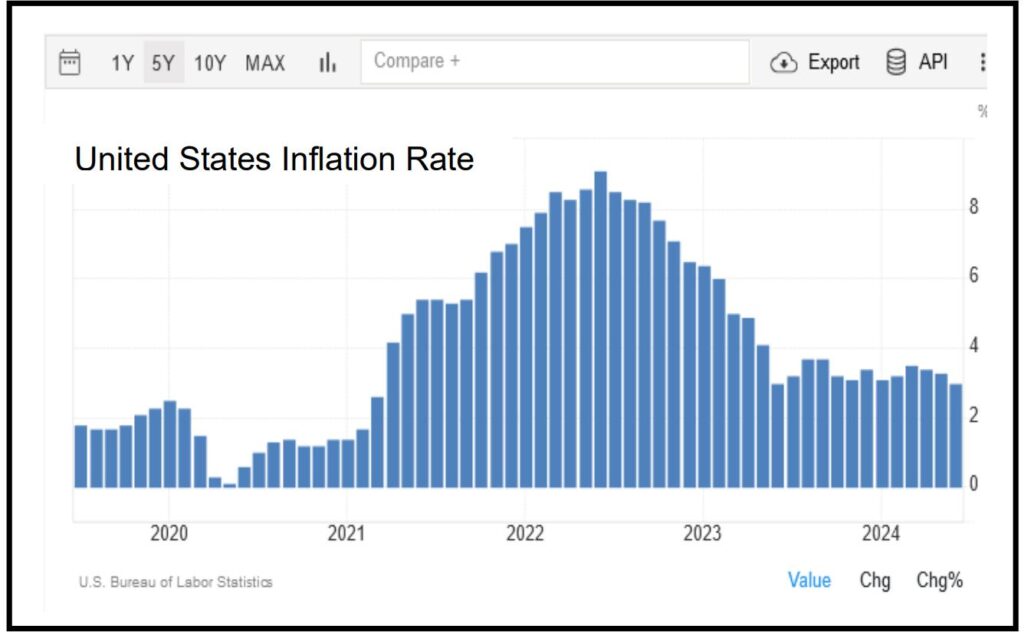

But when price increases spread to a broader range of goods and services, it was clear that inflation was proving to be more persistent than previously thought — especially as oil prices spiked following the start of Russia’s war in Ukraine.

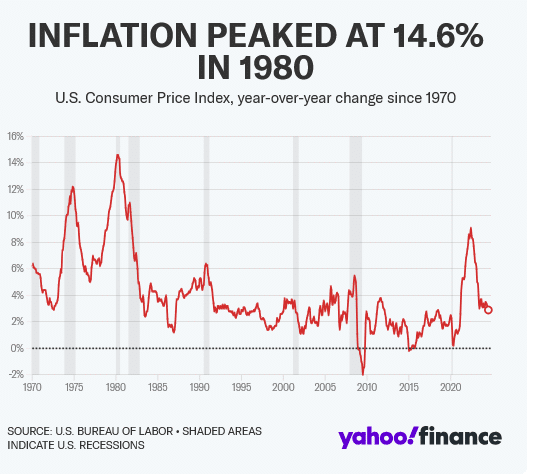

In March 2022 the annual change in inflation as measured by the Consumer Price Index hit 8.5%, the highest mark in 40 years. Even excluding food and energy, the rise was still 6.5%, unacceptably high when compared with the Fed’s 2% target.

That month, the Fed decided at its policy meeting to raise rates for the first time since 2018, starting with a small quarter-percentage-point cut.

“As I looked around the table at today’s meeting, I saw a committee that’s acutely aware of the need to return the economy to price stability and determined to use our tools to do exactly that,” Powell told reporters after that meeting.

But inflation kept heating up. The annual rise in CPI accelerated to 8.6% in May and 9.1% in June.

The Fed then switched into catch-up mode, pulling the trigger on a 0.75% rate hike, the largest in more than a quarter century. It would be the first of four 0.75% hikes in a row.

As Powell became more aggressive, he sent the markets plunging with an August 2022 speech in which he warned that the Fed’s “overarching focus right now is to bring inflation back down to our 2% goal” and that this will cause “some pain to households and businesses.”

“Failure to restore price stability would mean far greater pain,” he added.

The Fed went back to quarter-point hikes in early 2023, defying some predictions that a regional banking crisis roiling the financial world at that time might stop the Fed from tightening further.

The last hike came in July 2023, settling the fed funds rate at a 22-year high of 5.25% to 5.5%. It has been at that level ever since.

‘Things look pretty good’

Investors began 2024 thinking the Fed’s inflation-fighting campaign was done and hoping for six cuts over the course of the year.

That immediately led to tension between the Fed and Wall Street. Fed officials repeatedly pushed back on those expectations, saying they needed to see more progress on inflation before they would be ready to stop raising rates.

Their caution appeared to be warranted when inflation heated back up in the first quarter, causing policymakers to revise their own predictions for multiple cuts to just one for all of 2024.

But as inflation resumed its downward crawl in the second quarter and unemployment started to tick higher, some Fed critics reemerged.

They argued the central bank had held rates too high for too long and risked upending the possibility of a soft landing.

Alan Blinder, former vice chair of the Federal Reserve and professor of economics at Princeton University, is among those who argued the Fed could have started cutting rates in July.

The Fed, he told Yahoo Finance, is a “little behind the curve.”

Blinder doesn’t think the chances for a recession have increased, noting that the economic data doesn’t look much different now than it did in July. But the job market can’t cool “too much more” without a recession, he said.

“[The unemployment rate] has been going up smoothly — a tenth of a point. You don’t want to keep that up for a year. If you do that, you’re up 1.2% points,” he added in an interview.

When asked if the labor market can cool without tipping the economy into a recession, the Atlanta Fed’s Bostic said, “It can, and we will have to see whether it does.”

But a recession, he added, “is not in my outlook.”

Former Cleveland Fed president Loretta Mester said the central bank now has a “good shot” at achieving a soft landing.

The Philadelphia Fed’s Harker agreed.

“Right now things look pretty good,” he said.

“Do you like green eggs and ham?”

Some have called the iconic Dr. Seuss children’s book “Green Eggs and Ham” the world’s best sales manual — and its use of persistence, doggedness, and the assumptive close is not lost on the White House. It is about a relentless little fellow named Sam, (“Sam-I-Am”) who peddles green eggs and green ham to a main character who has no interest in consuming them. “I do not like them Sam-I-Am,” says the nameless protagonist.

Alas, Sam is insistent and hounds his beleaguered friend begging him to try the unappetizing combo in a variety of different places and scenarios … in a house, in a box, with a mouse, with a fox, with a car, in a tree, on a train, in the dark, in the rain, with a goat, and on a boat.

The shaggy, top-hatted narrator is adamant, however, “I do not like green eggs and ham. I do not like them anywhere!”

In the current economy, eggs and ham have become very green, indeed. Yahoo Finance states that “eggs represent morning, rebirth, and the continuity of life.” And their skyrocketing price is the embodiment of consumer “sacrifice” since they’re used in countless American meals, foods, and baked goods.[1]

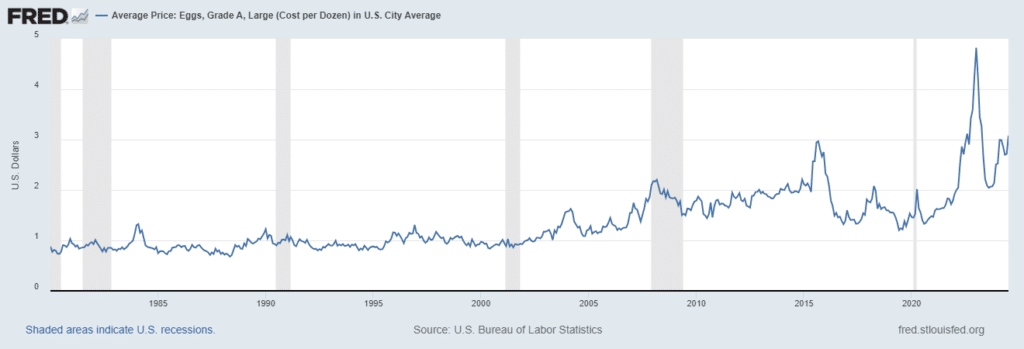

According to data from the Federal Reserve Bank of St. Louis, egg prices were about $1.35/dozen back in August of 2020. Prices rose as high as $4.82/dozen in January of this year before dropping to $3.08/dozen in July.

While the Biden-Harris administration has been quick to tout the 36% drop in egg prices from their January highs, it fails to point out that eggs are still 128% higher than they were in 2020.

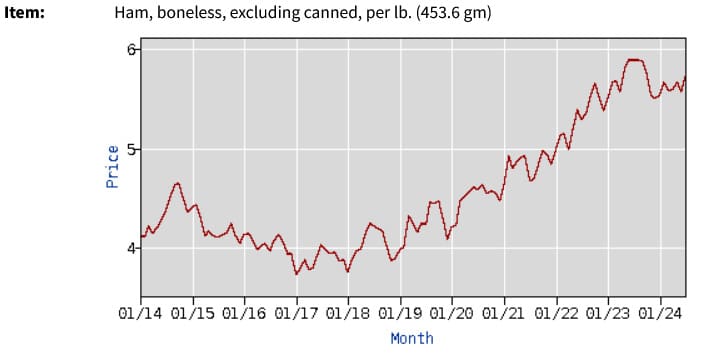

The price of ham has also risen dramatically. Historical data from the Bureau of Labor Statistics indicates that ham prices are up 9.6% just since last year.[2] Likewise, the price of pork chops and bacon are up 8.3% and 3.5%, respectively since July of 2023.

Despite the administration’s attempts to justify and qualify the high-price of eggs and ham, U.S. consumers are feeling the pain.

“For the third year in a row, the percentage of Americans naming inflation or the high cost of living as the most important financial problem facing their family has reached a new high. The 41% naming the issue this year is up slightly from 35% a year ago and 32% in 2022. Before 2022, the highest percentage mentioning inflation was 18% in 2008.”[3]

The current inflation rate is 2.9%, (which is the annual inflation rate for the 12 months ending July 2024), but prices are still more than 20% higher than before the pandemic and according to BankRate “just 6% of the nearly 400 items that the Bureau of Labor Statistics tracks are cheaper today.”[4]

“Would you like them here or there?” Much like Sam-I-am, the administration continues to serve up inflation data in different forms and different contexts to convince us that prices have come down, and we should feel good about it. “No president’s had the run we’ve had in terms of creating jobs and bringing down inflation. It was 9% percent when I came to office, 9%,” Biden recently stated.

The inflation rate when Biden was inaugurated in January of 2021 was actually 1.4%. It hit 9% in June of 2022 after Biden and Harris has been in office for more than 16 months.

The official White House website further claims:

“Bidenomics is already delivering for the American people. Our economy has added more than 13 million jobs—including nearly 800,000 manufacturing jobs—and we’ve unleashed a manufacturing and clean energy boom … America has seen the strongest growth since the pandemic of any leading economy in the world. Inflation has fallen for 11 straight months and has come down by more than half. And we have done it all while responsibly reducing the deficit.”[5]

“Would you eat them in a box? Would you eat them with a fox? On August 21, 2024 the Labor Department issued revised jobs figures for the 12 months through March of 2024 showing that the US economy added 818,000 fewer jobs than originally reported.

“The U.S. Bureau of Labor Statistics on Wednesday revised down its estimate of total employment in March 2024 by 818,000, the largest such downgrade in 15 years. That effectively means there were 818,000 fewer job gains than first believed from April 2023 through March 2024.”[6]

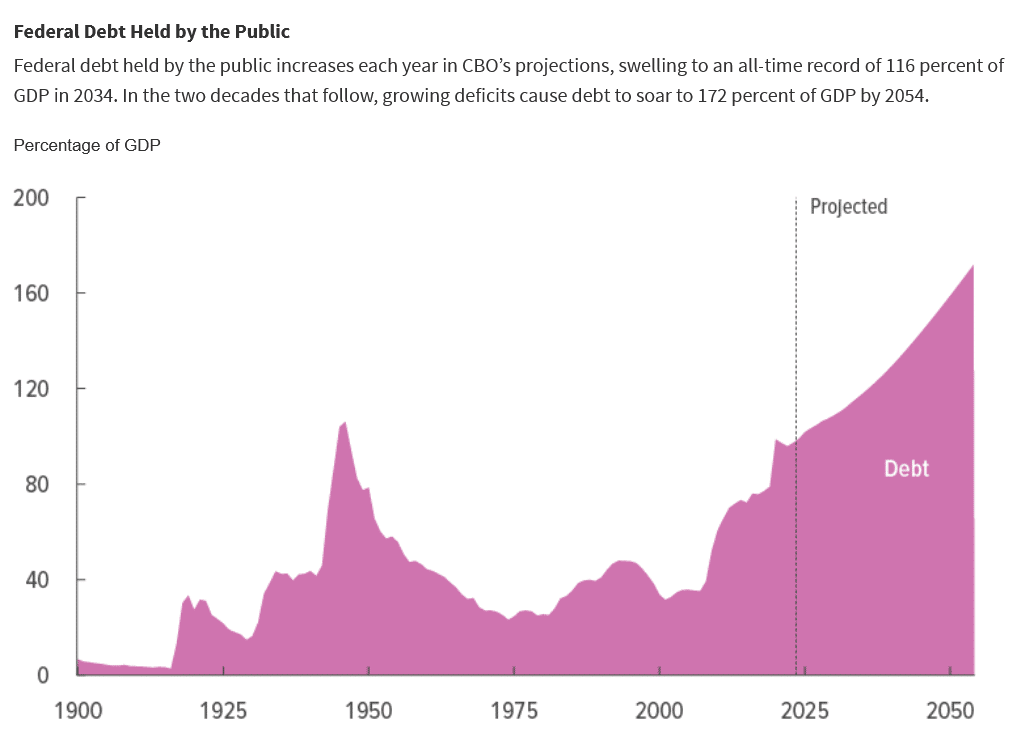

According to the Congressional Budget Office’s June report, the deficit projection for 2024 is actually 27% larger than the agency’s February projection and the cumulative deficit from 2025-2034 is projected to increase by 10% or $2.1 trillion. The largest increase was attributed to legislation providing aid to Ukraine, Israel, and other countries in the Indo-Pacific region.[7]

In order to finance deficits, the government must borrow and the projected federal debt according to the CBO explodes through 2050.

“You do not like them. So, you say. Try them! Try them! And you may. Taking a page from Sam-I-Am’s playbook, the Biden-Harris administration believes that if they say that things are getting better often enough and push high-priced “green eggs and ham” at us hard enough, we’ll eventually accept it. And as everyday Americans scrape to pay bills, the White House dismisses their misery as being misinformed and being unable to grasp the true state of the economy. According to Liz Peek of The Hill, this is downright offensive:

“Being told repeatedly that everything is great, when you can’t make ends meet, is deeply unsettling. It’s also insulting — the corollary implication is that you just don’t understand your own situation.”[8]

To justify the high price of eggs and ham, the White House is actively recalibrating price data and rewriting economic history. And their hope is, as in the case of Sam-I-Am, that U.S. consumers will finally relent, “Sam, if you will let me be, I will try them. You will see!”

But Americans give the administration low marks on the economy and continue to worry about inflation, the value of the dollar, Wall Street volatility, and their retirement accounts.

And in an environment of high prices and economic uncertainty, they’re doing something else. They’re buying gold. Gold has risen almost 30% in 2024, 10% higher than a dozen “green” eggs and more than 27% higher than a pound of “green” ham.

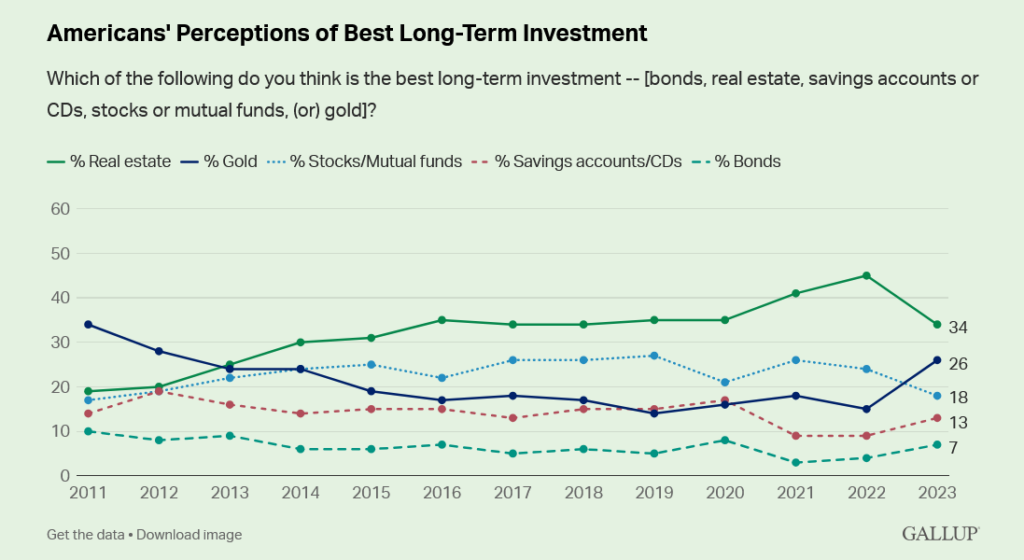

According to a recent Gallup poll, Americans now list real estate and gold as the best long-term investments, and real estate is quickly losing ground to the yellow metal.

“The 34% of Americans choosing real estate this year is down sharply from last year’s record-high 45% … before housing prices skyrocketed during the pandemic. Higher interest rates over the past year have cooled the housing market, dampening consumer exuberance about real estate as an investment. Meanwhile, the perception that gold is best has nearly doubled, rising from 15% in 2022 to 26% today.”

Despite its historically high price, the 2024 Q1 Demand Trends from The World Gold Council indicate that central banks continue to buy gold at a brisk pace. This combined with robust over-the-counter buying by investors pushed gold demand up 3% year-over-year. [9]

And as the precious metal hovers near a record $2530/oz, Bank of America strategist Michael Hartnett urges Americans to “do what central banks are doing” and buy more gold — since it is now the only asset outperforming tech shares.[10]

Gold offers portfolio diversification and protection from Wall Street’s wild price swings along with the security of a physical asset with intrinsic and universal value. And as we head into an uncertain election season, rising recession fears, and exploding geopolitical tensions across the globe — it has become the safe haven of choice for 2024.

Sam-I-am relentlessly pushed “green eggs and ham” more than a dozen times in the Dr. Seuss classic. The White House has been pushing them for three and a half years. But the 36 million Americans who own gold, don’t have to be pushed at all. They understand gold’s long history as a symbol of wealth and royalty —and its role as a monetary standard and a timeless store of value.

[1] https://finance.yahoo.com/news/egg-prices-nearly-doubled-since-171357774.html

[2] https://www.bls.gov/regions/mid-atlantic/data/averageretailfoodandenergyprices_usandmidwest_table.htm

[3] https://news.gallup.com/poll/644690/americans-continue-name-inflation-top-financial-problem.aspx

[4] https://www.bankrate.com/banking/federal-reserve/latest-inflation-statistics/

[5] https://www.whitehouse.gov/briefing-room/statements-releases/2023/06/28/bidenomics-is-working-the-presidents-plan-grows-the-economy-from-the-middle-out-and-bottom-up-not-the-top-down/

[6] https://www.usatoday.com/story/money/2024/08/21/jobs-report-revision-growth-lower/74886965007/

[7] https://www.cbo.gov/publication/60039

[8] https://thehill.com/opinion/finance/4682020-thehill-com-opinion-finance-4682020-biden-economy-inflation-jobs-cost-of-living-spin-machine/

[9] https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2024

[10] https://markets.businessinsider.com/news/commodities/gold-price-prediction-buy-record-highs-central-banks-pile-in-2024-8

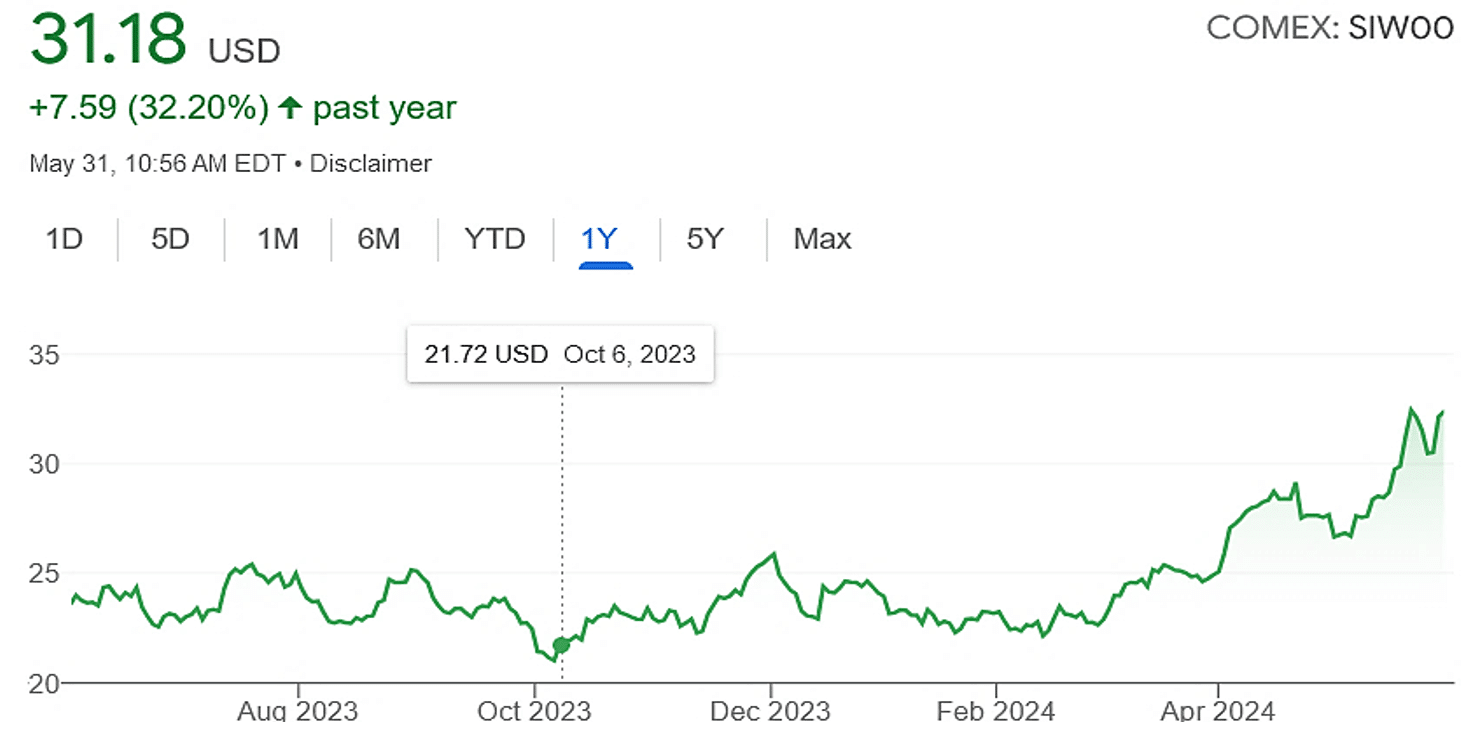

Silver prices are poised for further gains in the coming months, driven by a combination of favorable macroeconomic factors and robust demand fundamentals, as per analysts at UBS in a note dated Monday.

A weaker U.S. dollar, improving sentiment across financial markets, and record-high gold prices have all contributed to a recent modest rebound in silver prices.

UBS analysts suggest that long-term investors should consider increasing their exposure to silver, with a target price range of $36-38 per ounce.

The recent weakening of the U.S. dollar and a shift towards a more risk-on environment among investors have provided a supportive backdrop for silver.

Read the full story HERE.

Pink Floyd’s 1979 song “Comfortably Numb” opens with the following lines, “Hello, hello, hello. Is anybody in there? Just nod if you can hear me. Is there anyone home?” The song was released as part of “The Wall” album and according to music and lifestyle platform Neon Music, it has become “an anthem for emotional detachment and the struggle to maintain a sense of self in an overwhelming world.”[1]

The world of 1979 was volatile as the Iranian Revolution created oil price shock, advanced economies slowed, the U.S. dollar struggled, American hostages were seized in Tehran, The Soviet Union invaded Afghanistan, there was a nuclear disaster at Three-Mile-Island and consumer prices in America skyrocketed.

The U.S. Treasury Department summed up the economic challenges as follows:

“By 1979, inflation had moved up to a double-digit pace and threatened to spiral higher. The economy was showing signs of weakness, and many were predicting recession and rising unemployment. The mood in financial markets was becoming one of deep gloom, as the dollar was sinking and interest rates were soaring.”[2]

Pink Floyd’s lyrics underscore the detachment and dispassion of those trying to navigate a difficult moment in history: “Your lips move but I can’t hear what you’re saying” …. “The dream is gone. I have become comfortably numb.” Indeed, 1979 was social and economic chaos, but today the threats are far more severe.

The Worst Pandemic in 100 Years

It has now been a little more than a year since the official end of the Covid-19 pandemic — which the World Health Organization declared was no longer a public health emergency on May 5th of last year. Now ranked among history’s deadliest plagues, it’s easy to conclude that those of us who survived, have become “numb” to the sheer magnitude of the event.

The impact of SARS-CoV-2 was both deeply psychological and economic — lest we forget the quarantines, mandatory masking, travel restrictions, stay-at-home orders, school closures, and vaccine mandates — along with the very real fear of dying from a virus that killed over 7 million people worldwide. The financial toll of Covid has also been staggering. In April of 2020, an International Monetary Fund Blog entitled, The Great Lockdown: Worst Economic Downturn Since the Great Depression stated that “the magnitude and speed of collapse in activity that has followed is unlike anything experienced in our lifetimes.”[3]

A recent paper published by the National Library of Medicine states that “the COVID-19 pandemic has caused a considerable threat to the economics of patients, health systems, and society.” The authors cite the direct and indirect costs of the virus, healthcare expenditures, preventative measures, absenteeism, and a macroeconomic impact in the trillions of dollars with quarantine costs alone that exceeded 9% of global GDP.[4]

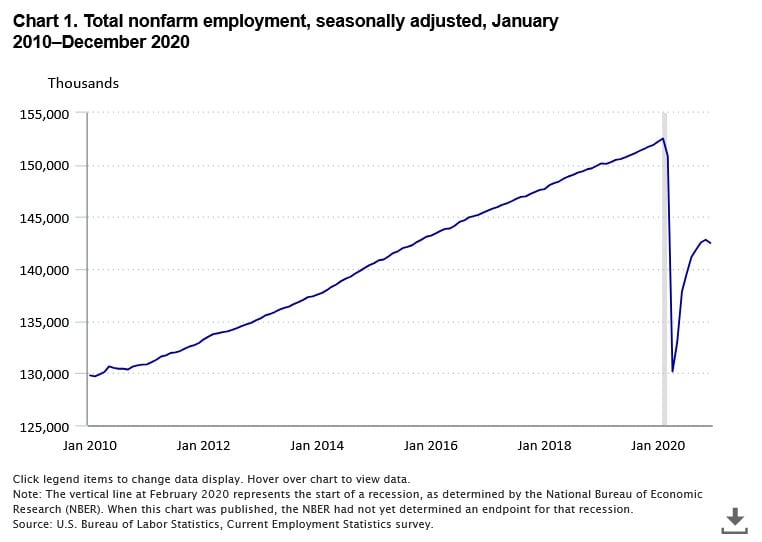

According to data from the Bureau of Labor Statistics (BLS) Current Employment Statistics (CES) survey, non-farm payroll employment in the U.S. declined by 9.4 million in 2020 the largest calendar-year decline in the history of the CES employment series. “As with virtually all economic activity in 2020, this decline was due to the coronavirus disease 2019 (COVID-19) pandemic, including pandemic-driven social and behavioral changes and government restrictions on business activity.”[5]

Critical supply chain disruptions during the pandemic coupled with high demand for goods contributed to soaring inflation in 2021 and 2022. This prompted the Fed to hike interest rates at the fastest pace in 40 years resulting in sky-high borrowing costs. And according to Liberty Street Economics and the Federal Reserve Bank of New York, not everyone has recovered.

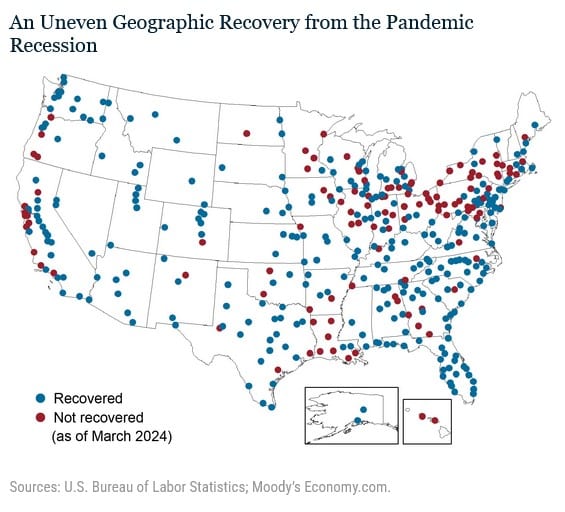

“The recovery has been uneven and remains incomplete in many places. Indeed, while most metro areas have recouped the jobs that were lost during the recession (shown as blue dots), more than 25 percent still have not (shown as red dots). Most of these areas are concentrated in the Rust Belt along the Great Lakes, though clusters are present in parts of the South—Louisiana in particular—as well as in California, Oregon, and Hawaii. In fact, employment is still more than 5 percent below pre-pandemic levels in New Orleans, and more than 3 percent below in Honolulu and San Francisco. Likewise, sizable job shortfalls remain in Cleveland, Detroit, and Pittsburgh.”

Analysts warn that the economy is still adapting to the dramatic effects of the pandemic and has not yet processed the full impact on commercial real estate, healthcare, global trade, tight credit conditions, slowing economic growth and an underlying sense of altered destiny and grievance that we still don’t quite fully understand.

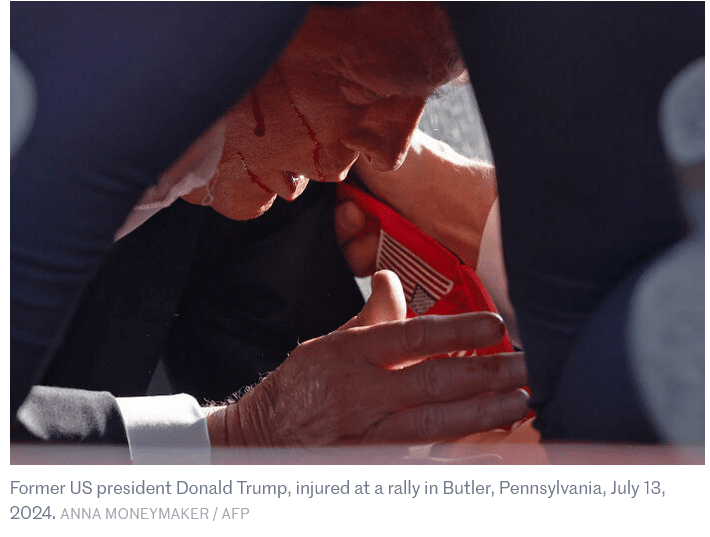

The First Presidential Candidate Shot in 56 Years

On a sunny, summer afternoon at a recent outdoor campaign event in Western Pennsylvania, a would-be assassin attempted to kill former President Donald Trump, the presumptive nominee of the Republican Party in the upcoming 2024 Presidential election. The gunman fired eight shots from the unsecured rooftop of an adjacent warehouse, hitting Trump in the right ear, killing one man in the crowd, and wounding two others.

It was a surreal moment for the nation and reminiscent of Bobby Kennedy’s assassination in 1968 at the Ambassador Hotel in Los Angeles. Kennedy was one of the leading contenders for the Democratic nomination in the 1968 Presidential Election. After celebrating a victory in the California Primary and addressing supporters in the hotel ballroom, he was shot while exiting through the hotel kitchen. Ironically, the fatal shot hit Kennedy behind his right ear.

The recent Trump shooting has raised serious questions about Secret Service protocols, site preparation, and overall competency. The Associated Press reported on some of the pressing questions surrounding the tragedy:

“The U.S. Secret Service is investigating how a gunman armed with an AR-style rifle was able to get close enough to shoot and injure former President Donald Trump at a rally Saturday in Pennsylvania, in a devastating failure of one of the agency’s core duties … The gunman, who officials said was killed by Secret Service personnel, fired multiple shots at the stage from an ‘elevated position outside of the rally venue,’ the agency said.”[6]

The entire nation witnessed countless viral video clips of rally goers yelling that there was “a man on roof with a gun.” There were other clips of the shooter suspiciously walking the grounds behind attendees, and additional reports that local police had seen and even encountered the suspect up to an hour before the shooting started.

According to Spotlight PA an independent Pennsylvania news service:

“The Trump rally shooting that day, which killed one man and injured three others, including the former president, has been called the largest security failure in 40 years. It has led to the resignation of the Secret Service director, a congressional investigation, and questions from lawmakers about how such a lapse could have occurred.”[7]

The shooting is symbolic of the dangerous uptick in political rhetoric, violence, and polarization in America. Trump has been the target of multiple impeachments, investigations, prosecutions, and a name-calling campaign i.e. fascist, racist, Hitler — that has dehumanized him to the point that a deranged individual might very well have climbed a roof with an AR-15 seeking to remove the “threat to democracy” that he believed Trump represents.

Regardless of the motivation, the attempt on Trump’s life elicits memories of other difficult ‘American moments’ as the French publication Le Monde outlined:

“The attack immediately joined the country’s collective consciousness, especially since it was filmed live. Although the former president escaped safely, the white roof on which the gunman stood is likely to be long remembered, like Dealey Plaza, in Dallas, Texas, where President John F. Kennedy was killed on November 22, 1963, by a gunman ambushed from the top floor of the school book depository. Similarly, there is the balcony of the Lorraine Motel in Memphis, Tennessee, where Martin Luther King was shot dead on April 4, 1968, by a right-wing extremist. Or the kitchen of the Ambassador Hotel in Los Angeles, through which Robert F. Kennedy was walking on June 5, 1968, after a victory speech in the California Democratic primary, where a Palestinian-Jordanian man opened fire. Or the Hilton Hotel in Washington, where Ronald Reagan was shot and seriously injured on March 30, 1981, 90 days after his inauguration.”[8]

July 13, 2024 is another dark chapter in American political history and reflects a country clearly on edge and gripped by radical dissent and ideological extremes.

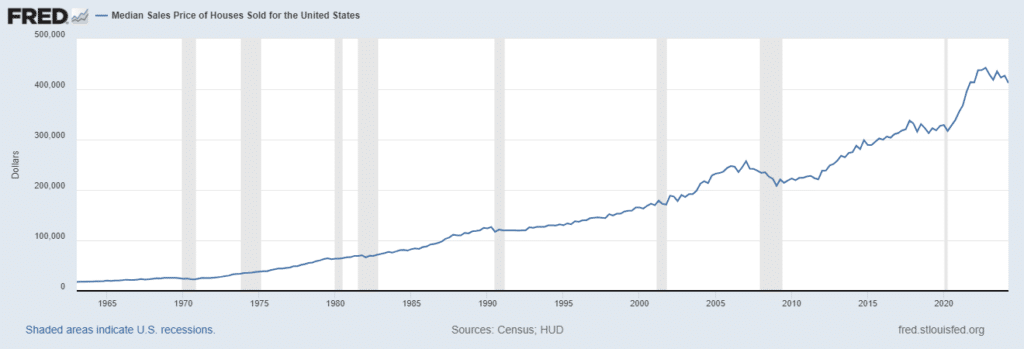

The Largest Housing Bubble since 2007

On top of our post-Covid economic angst and rising political uncertainty is another pain point that strikes at the heart of the American Dream — home prices and home affordability. The United States is sitting in a massive housing bubble. Home prices have risen an astonishing 47.1% since the start of 2020.

According to Fox Business … “Home price growth so far this decade is on the verge of surpassing all the growth seen in the 2000s. During that time period, housing prices skyrocketed 47.3%, including an 80% spike before the 2007 housing market crash.”[9]

Prices are being driven by a variety of factors including low inventory, high mortgage rates, an undersupply of new homes, a spike in the cost of building materials, and the powerful “locked in effect” of the many homeowners who “locked in” historically low interest rates during the pandemic creating a disincentive to sell, move, downgrade or upgrade.

According to the non-profit civic group Strong Towns, home prices have also been manipulated as “decades of housing subsidies, down payment assistance, artificially low interest rates, money printing and endless bank support have turned the American home into a financial product first and a place of shelter second.”[10]

The question on everyone’s mind is will there be a price crash that crushes the economy and triggers the next Great Recession? The answer depends on who you ask. Bank of America maintains that home prices will remain high into 2026 but housing experts warn that if demand suddenly drops and there’s a rapid oversupply of homes — the housing market could nosedive. A large percentage of Americans now believe that is possible and according to Lending Tree, some are even hoping for it … “44% of Americans believe that the housing market could crash this year, and more than one third say they want the market to crash, believing it’s their only way to be able to afford a home.”[11]

We must be careful what we wish for. The subprime mortgage crisis of 2007-2009 triggered a punishing global financial crisis that resulted in the worst economic disaster since the Great Depression as U.S. GDP collapsed by 4.3%, home prices sank by 30%, and unemployment doubled.[12] And according to one prominent economist, that is precisely where we’re headed right now. Chris Vermeulen, the founder of The Technical Traders believes that both the US residential and commercial real estate markets are on the cusp of collapse and will see price drops of as much as 30%.

“A lot of people are struggling financially, and this is really the tip of the iceberg. Give it another two or three years — that’s when the real-estate market gets hit the most. People are starting to get laid off as unemployment rises. People have burned through their savings, and inflation is crazy higher. Eventually, people aren’t going to be able to pay their mortgages … [and] are going to have to start to sell their homes.”[13]

Hello. Hello. Hello.

Is anybody in there? Just nod if you can hear me. Is there anyone home? So much has gone on over the past few years socially, economically, and politically that experts fear we’ve erected a metaphysical wall to collectively coddle ourselves. These once-in-a-generation events have left us desensitized and nonreactive — and that’s not only dangerous for our psyche, but it could be disastrous for our finances.

In his book, “The Fourth Industrial Revolution” Klaus Schwab, Executive Chairman of the World Economic Forum, addresses the increasingly blurred lines between the physical and the digital, the fusion of humans and machines, the high connectivity, and the dangerous detachment of living in this place and time. “The changes are so profound that, from the perspective of human history, there has never been a time of greater promise or potential peril.”

The “peril” is apparent in a news cycle dominated by geopolitical conflicts, protests, inflation, interest rates, market volatility, Fed policy, debt, layoffs, and political warfare — making the notion of being “comfortably numb” as tempting now as it was in 1979. And just like 45 years ago, it’s critical to have a plan to protect our savings and preserve our wealth from the volatility of a dramatically changing and far more unpredictable world.

This essay is brought to you by Thor Metals Group. For more information about preserving wealth with precious metals call 1-844-944-THOR.

[1] https://neonmusic.co.uk/unravelling-the-mystery-the-profound-meaning-behind-pink-floyds-comfortably-numb/

[2] https://home.treasury.gov/news/press-releases/js2001

[3] https://www.imf.org/en/Blogs/Articles/2020/04/14/blog-weo-the-great-lockdown-worst-economic-downturn-since-the-great-depression

[4] https://pubmed.ncbi.nlm.nih.gov/38365735/

[5] https://www.bls.gov/opub/mlr/2021/article/covid-19-ends-longest-employment-expansion-in-ces-history.htm

[6] https://apnews.com/article/secret-service-trump-rally-4e3415b1461f5acefbc8e1fadad0375b

[7] https://www.spotlightpa.org/news/2024/08/trump-assassination-attempt-secret-service-flaws-failures/

[8] https://www.lemonde.fr/en/international/article/2024/07/15/trump-assassination-attempt-political-violence-an-american-plague_6684742_4.html

[9] https://www.foxbusiness.com/economy/us-home-prices-have-surged-47-since-start-2020

[10] https://www.strongtowns.org/journal/2024/8/19/the-housing-market-is-a-bubble-full-of-fraud-and-its-going-to-pop

[11] https://www.businessinsider.com/personal-finance/mortgages/when-will-the-housing-market-crash

[12] https://www.forbes.com/advisor/investing/great-recession/

[13] https://www.dailymail.co.uk/yourmoney/article-13608961/economist-stark-warning-united-states-property-market.html

The Global ‘Carry Trade’ is Unwinding, Leaving Broken Markets in its Wake

For the past 15 years, Japan maintained its interest rates at or near 0%. This prolonged period of exceptionally low rates led investors to borrow trillions of yen, and invest these funds in stronger currencies and assets.

This strategy, known as the “yen carry trade,” essentially constituted a bet that the yen would continue to depreciate in relative value. The strategy proved highly effective until last Wednesday.

In a notable shift, Japan’s central bank raised its interest rates slightly to 0.25%. While this rate remains remarkably low, it triggered a significant appreciation of the yen, which surged by 7.5% against the US dollar. This sudden spike in the yen’s value forced investors to cover their short positions, resulting in enormous losses totaling billions of dollars. This chain of events precipitated a substantial global sell-off as investors sought liquidity by offloading other performing assets.

The end of the yen carry trade this week has had far-reaching consequences for global markets. Many investors might be perplexed by the sudden downturn in their portfolios, and this development largely explains the recent turbulence.

An additional bearish factor contributing to this situation, which has not been widely discussed, is Japan’s reliance on oil imports. Japan produces approximately 2 million barrels of oil per day but consumes double that amount or more, necessitating substantial oil imports.

Current geopolitical tensions are exacerbating an already volatile oil import market. Iran has threatened a significant strike against Israel in response to a surprise attack on Tehran last week. This retaliatory strike is anticipated imminently, possibly even today. If such an event unfolds, it could prompt Israel and the United States to take military action against Iran. In retaliation, Iran might close the Strait of Hormuz, a critical choke point through which 20 million barrels of oil pass daily.

The closure of the Strait of Hormuz would cause a dramatic increase in global oil prices, severely impacting Japan’s economy due to its heavy reliance on oil imports.

In summary, these interlinked developments underscore the precariousness of the global economic situation. The sudden end of the yen carry trade and the potential for escalated conflict in the Middle East are formidable challenges. It is crucial for all parties involved to exercise restraint and seek diplomatic solutions to avoid a broader conflict with Iran, as the stability of the global economy likely hinges on such efforts.

Wall Street, they say, has finally caught up with Main Street. For years, the latter has been warning that all is not well with the American economy.

Consumers Felt it First

US consumers have been feeling stressed and stretched since inflation started rising in the Summer of 2020 impacting the price of groceries, clothing, housing, and even fast food. For consumers, $15 Big Macs and a dozen eggs approaching $5.00 — have become real-life symbols of economic hardship.1

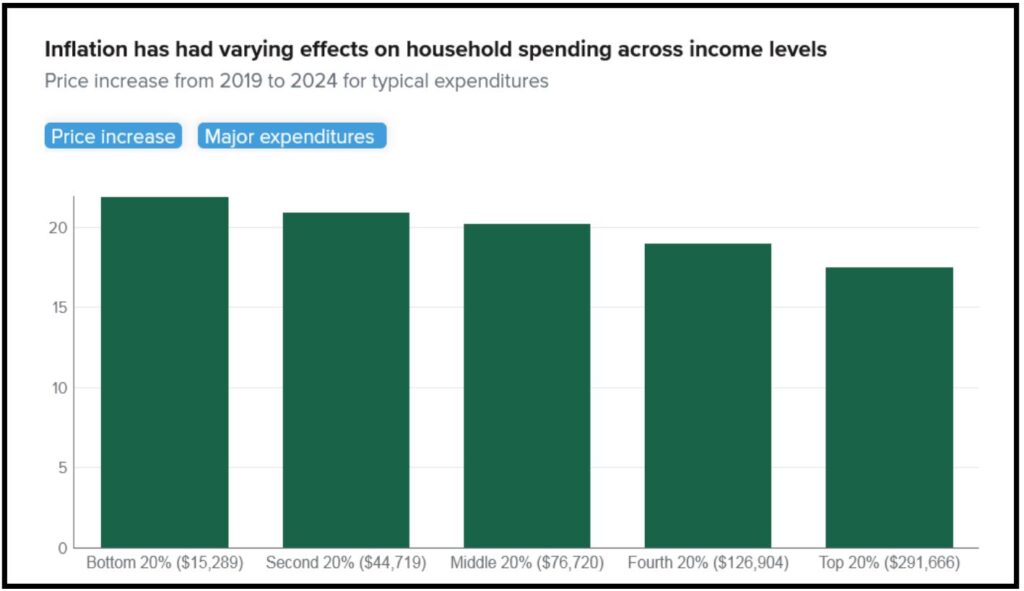

The impact of inflation hits lower income households hardest, since they spend the bulk of their money on necessities. California’s Public Policy Institute examined the impact of rising prices on various income levels:

“Food prices are up 27% compared to April 2019, and gasoline is up 29%. While expenditures on these goods and services make up large portions of most household budgets, lower-income households spend almost all of their resources (83%) on food, housing, transportation (including gasoline), and health care. Middle-income families spend 75% on these necessities, and high-income families spend 64%. Inflation has hit lower income Californians hardest … the same set of necessities would cost low income households 22% more today than in 2018–19. By comparison, middle-income households would spend 20% more, and high-income households would pay 17.5% more.”

While prices have come down, the PPIC concludes that the prolonged period of severe inflation has left economic “scars,” particularly on families and households making less. In July, the Index of Consumer Sentiment, a consumer confidence survey published monthly by the University of Michigan, dropped 7.1% year over year. Similarly, the Current Index of Economic Conditions was down 18% year over year.2

Jobs Seekers Knew Months Ago

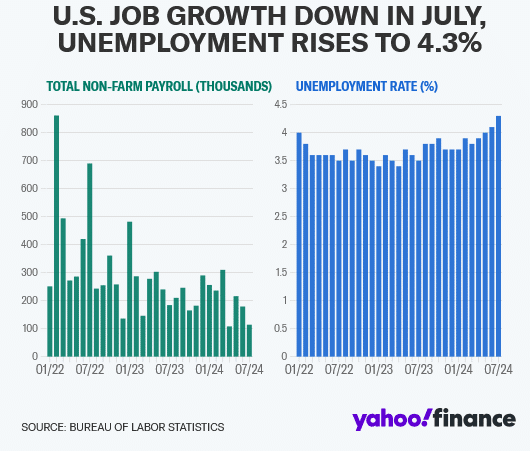

American jobseekers knew that jobs were getting harder to find and keep long before the weak June jobs report showed that the economy added just 114,000 new jobs far short of the projected 185,000. In addition, unemployment rose to a worrisome 4.3%. Employers are grappling with inflation, political uncertainty, and higher interest rates — while workers are confronting a cooling labor market, rising layoffs, the impact of AI, and growing economic uncertainty.

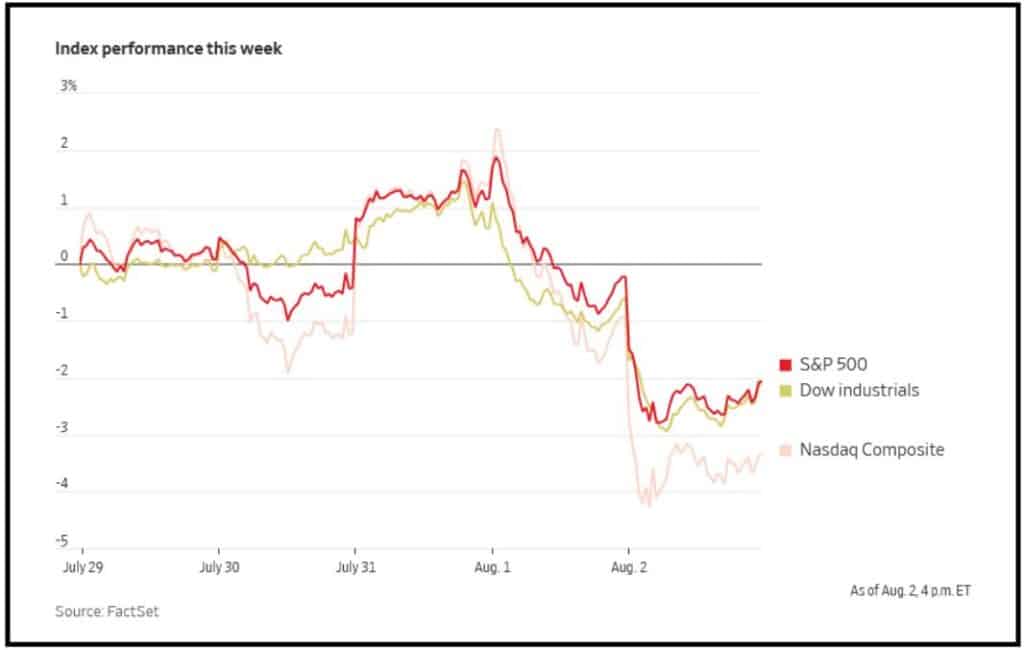

The report sent the financial markets into a tailspin and left some questioning whether the Fed has waited to long to cut rates as reported by the Wall Street Journal:

“In stocks, a broad-based selloff hammered the tech-heavy Nasdaq, which fell 2.4% and entered correction territory, down at least 10% from its recent high … For months, the economy seemed to be in a sweet spot, with inflation falling and growth humming along. Investors piled into the most economically sensitive corners of the market, wagering that the expansion had room to run. This week’s data has punctured some of those hopes and raised questions about whether the Federal Reserve has waited too long to trim interest rates … ‘Maybe things weren’t as rosy as we thought they were,’ said Eric Merlis, co-head of global markets at Citizens Financial Group.3

The pressure on Fed Chair Powell to cut rates has increased as the market turmoil continues and there has even been calls for emergency rate cuts sooner than September.

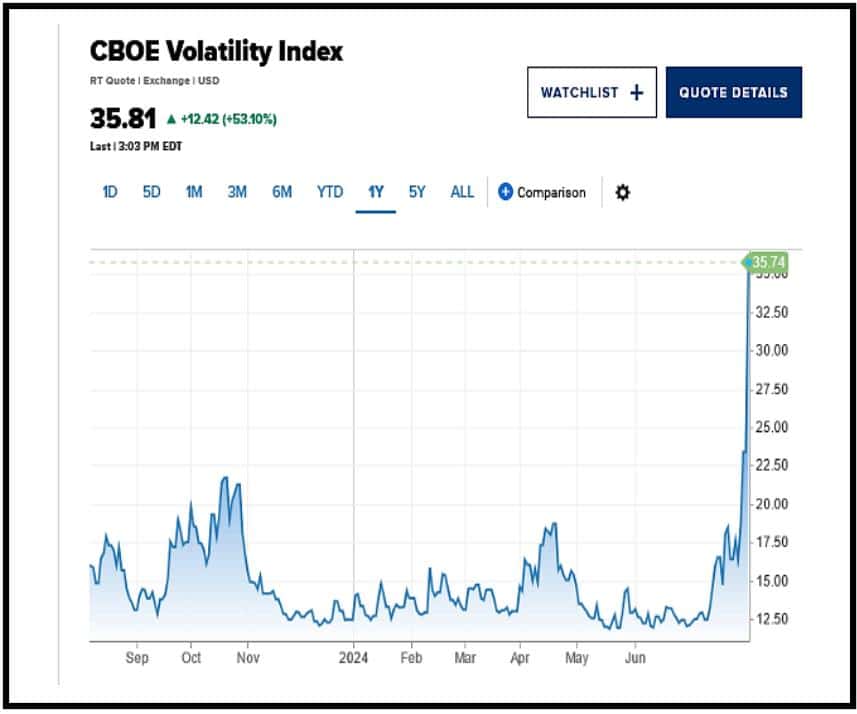

The Volatility Index Has Known for a While

The CBOE (Chicago Board Options Exchange) Volatility Index which measures the market’s expected volatility, started making noise last Fall. On Monday, it spiked to the highest level since the depths of the Covid-19 pandemic when the U.S. economy was in complete shutdown and at one point, it did something it has not done since the 2008 financial crisis.

“Earlier on Monday, the VIX was up 134% at 55, surpassing a 115% increase from Feb. 5, 2018, on a closing basis. On that day, the VIX more than doubled as several short-volatility exchange-traded products were forced to bid up VIX futures, sending a shudder through the broader market … For a brief period, the spread between the spot VIX and its second-month futures contract reached a deeply negative 30 points, exceeding its most recent lows reached during the depths of the COVID-19 selloff. On a closing basis, this would have been the widest level since October 2008.4

The VIX is a serious indicator that has been around for over three decades. It specifically tracks volatility in the S&P 500. According to Investopedia, “the VIX is calculated using a formula to derive expected volatility by averaging the weighted prices of out-of-the-money puts and calls.”5 The index reflects volatility expectations over the next 30 days and in that sense is a gauge of market risk. As a general rule, VIX readings below 20 indicate a low-risk environment while anything above 20 suggests a more volatile outlook.

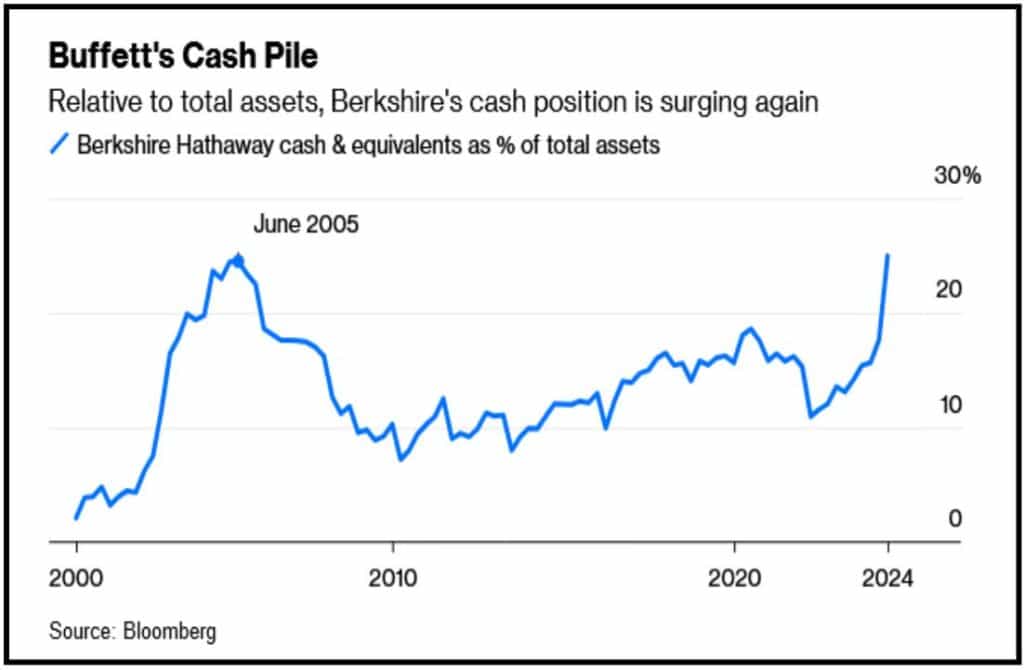

Warren Buffet Knows All Too Well

Warren Buffett’s Berkshire Hathway has apparently sold over $75 billion in stocks to boost its cash reserves. The multinational conglomerate’s stock dump includes almost half of its shares of Apple worth about $20 billion and $3.8 billion worth of Bank of America. This has prompted Elon Musk to suggest that Buffett knows a correction is coming.

Buffet is famous for saying, “Be fearful when others are greedy, and be greedy when others are fearful” which suggests that he may be accruing billions in cash to pick up bargain buys in the event of a recession. The move should not go unnoticed and is a clear wake-up-call for what has been an expensive and irrationally exuberant market.

Bloomberg calls Buffett’s move a clear warning that harkens back to the financial crisis of 2007-2009:

“The Berkshire news comes at a point of particular vulnerability in markets and the economy. Together with excess savings and low unemployment, high asset prices — sustained in part by elevated US large-cap valuations — have been one of the three pillars of US consumption in recent years. Excess savings have been dwindling for some time, but personal wealth and the labor market seemed to be holding up well until last week. Now, suddenly, the consumption story feels unstable. Two days after the Federal Reserve forwent an opportunity to cut policy rates, a Bureau of Labor Statistics report Friday showed that the unemployment rate rose to a nearly three-year high, starting the selloff that Buffett helped continue.6

Buffett’s cash pile has not looked this flush since June of 2005, just 18 months before the start of the Great Recession. The current stock rout was driven by Friday’s disappointing jobs report and mounting U.S. recession fears which triggered a global selloff just weeks after indices reached record highs. Since the start of the month, the Dow has lost over 1645 points, the S&P 500 has lost almost 260 points, and the Nasdaq has lost over 987 points. Apple, Amazon, and Google all declined sharply as did Nvidia and Microsoft which also raises concerns about the overall viability of the AI market boom.

Wall Street Doesn’t Want You to Know

Wall street has many secrets — from hidden fees and market manipulation, to cooking the books, and shameless stock promotion. Back in 2002, Bloomberg touched upon some of these in an article entitled: “How Corrupt is Wall Street?”

“Wall Street has always struggled with conflicts of interest. Indeed, an investment bank is a business built on them. The same institution serves two masters: the companies for which it sells stock, issues bonds, or executes mergers; and the investors whom it advises. While companies want high prices for their newly issued stocks and low interest rates on their bonds, investors want low prices and high rates. In between, the bank gets fees from both and trades stocks and bonds on its own behalf as well, potentially putting its own interests at odds with those of all its customers.7

While Wall Street’s big investment banks are mum about these conflicts, they’re also quiet about the behavioral economists they use to influence trades.

“Behavioral economists used to be guardians of America’s 95 million Main Street investors, with an aura of integrity, professionals with a fiduciary responsibility. No more. They’re the investors’ enemy, working for Wall Street banks, for Washington politicians, operating in the shadows, like the NSA, developing tools and technologies to secretly control data, manipulate the brains of savers, voters, taxpayers, and investors.8

And that’s not all. New structured investments create a false sense of security as outlined by the Wall Street Journal earlier this year.

“It might seem strange that volatility is so low when inflation, monetary policy and geopolitical conflicts make the global economy more uncertain than ever. Here is the problem: Structured products might themselves be what is lowering it … the Bank for International Settlements pointed out that the banks selling all these notes have been forced to take the other side of their clients’ bets. To hedge the risk, trading desks have been leaning against swings in stocks, selling them when they go up and buying large drops—a practice known as delta hedging. This has pulled down long-term volatility.9

These structured products have created a feedback loop reminiscent of 2017 and 2018 which resulted in an eventual explosion of volatility and a subsequent equities free fall.

So, it seems that Wall Street insiders not only knew about the coming volatility, in many respects, they orchestrated it by inflating values and manipulating market sentiment to the point of meltdown.

Whether poaching fees from nest eggs, funneling public pension plans into private equity conglomerates, or ignoring economic data — investment banks often put savers, retirees, and everyday investors at great risk. Lest we forget, it was predatory lending and subprime interest-only loans that contributed to the 2008 financial crisis and the subsequent housing crash.

Gold is a Hedge for the Unknown

On September 23, 2007 the Sunday New York Times read: “Gold, Again, Becomes a Shield Against the Unknown”10 as it urged a return to gold just months before one of the worst financial meltdowns in American history. To the victor go the spoils and while so many lost so much — those who listened emerged from the Great Recession with a commodity that nearly doubled in value.

Gold performs well in the face of financial mayhem. It is a physical asset driven by supply and demand making it fairly invulnerable to manipulation by big banks and big government. It is considered a critical commodity to hold in times of crisis due to its liquidity and longstanding reputation as a store of value.

There’s a famous saying, “stocks take the stairs up and the elevator down.” Gold does neither. It is a safe haven investment whose value remains fairly stable providing critical diversification for portfolios confronting inflation, uncertainty, volatility, and the many things we simply do not know about — until it is far too late.

Call Thor Metals Group at 1-844-944-THOR for more information about acquiring gold.

- https://tradingeconomics.com/united-states/inflation-cpi ↩︎

- http://www.sca.isr.umich.edu/ ↩︎

- https://www.wsj.com/livecoverage/stock-market-today-jobs-report-live-08-02-2024 ↩︎

- https://www.marketwatch.com/story/the-vix-just-did-something-it-hasnt done-since-2008-heres-why-this-could-be-a-buying-opportunity-for-stocks-c6c89d6b ↩︎

- https://www.investopedia.com/articles/active-trading/070213/tracking-volatility-how-vix-calculated.asp ↩︎

- https://www.bloomberg.com/opinion/articles/2024-08-05/warren-buffett-s-277-billion-hoard-after-unloading-apple-is-a-warning ↩︎

- https://www.bloomberg.com/news/articles/2002-05-12/how-corrupt-is-wall-street ↩︎

- https://www.marketwatch.com/story/why-investors-are-helpless-against-wall-streets-secret-brainwashing-machine-2015-05-29 ↩︎

- https://www.wsj.com/finance/investing/markets-are-lulling-themselves-into-a-false-sense-of-security-4e7f48eb ↩︎

- https://www.nytimes.com/2007/09/23/business/yourmoney/23gold.html ↩︎

This has truly been gold’s “amazing year.” The precious metal continues to rally after hitting multiple all-time highs. Central banks and the world’s leading monetary authorities continue to stockpile gold bullion and investors have once again turned to gold’s safe haven properties as wars rage across Eastern Europe and the Middle East. The prospect of rate cuts has added to gold’s allure particularly as inflation wanes. And political uncertainty across the globe including the future of U.S. leadership presents yet another gold price trigger. If you have not yet made a move into gold, here are key reasons to do so before the election in November.

1) Market Concentration Risk

There is no denying that Wall Street’s market gains have been largely concentrated among just a handful of stocks.1

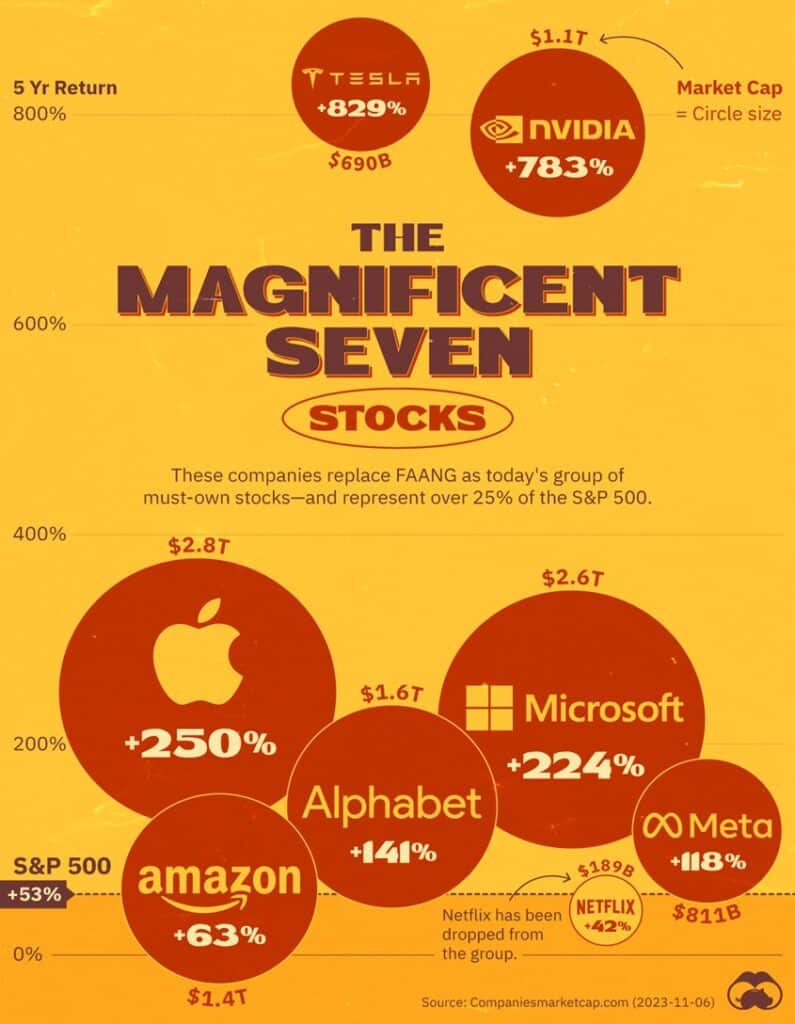

The infamous “Magnificent Seven” — Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla gained 107% in 2023, pushing the S&P 500 up 24%.2 All seven of these companies essentially belong to the same technology sector representing a degree of market concentration that is replete with risk. With fewer companies driving the market, an earnings shift or sector reversal increases the odds of a market correction.

The 10 largest U.S. companies accounted for just 14% of the S&P 500 stock index a decade ago. Today, they account for more than 27%, nearly double. According to Morgan Stanley, the pace of market concentration is the most rapid since 1950, giving just a handful of companies with overlapping business models undue influence on investment portfolios.3

Gold is a Powerful Stock Market Hedge

2) The New Real Estate Crisis

Real Estate in America currently sits at the lowest affordability levels since the 1980s. According to U.S. News & World Report, millions of homeowners are experiencing “golden handcuffs” as they locked in very low, pandemic era fixed-rate mortgages prior to rates skyrocketing giving them little incentive to sell:

“In the past, when mortgage rates rose, home prices would decline to maintain affordability. Today, however, with so many existing homeowners locked into their existing low mortgage rates of 4% to 5% or below, there have not been sufficient incentives to move elsewhere, keeping home inventory low and prices high – for now.”

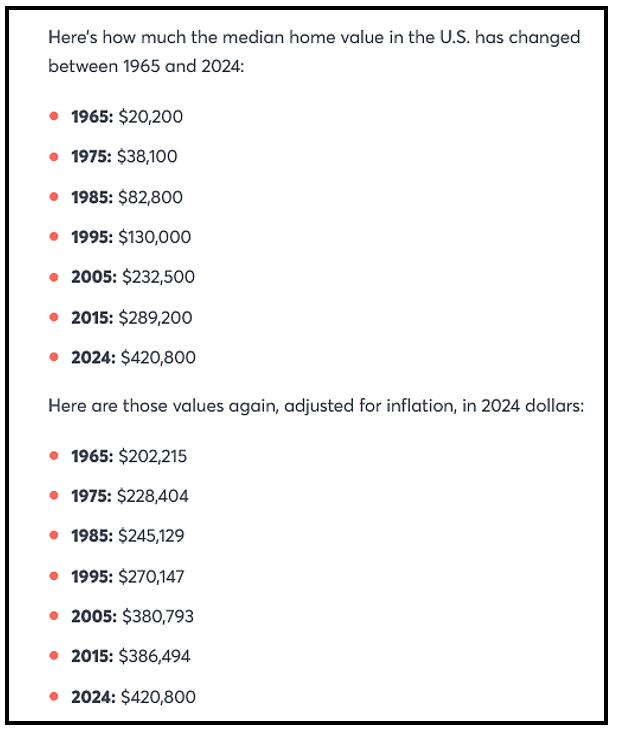

According to US Census Data, homebuyers are spending more than double to buy a home in 2024 as opposed to back in 1965 when a home cost about $202,000 — less than half of the over $420,000 it costs today when adjusted for inflation.4

Long-time investment strategist, Chris Vermeulen of The Technical Traders, believes the property market is due for a significant correction and both commercial and residential properties could plunge as much as 30%.

“People are going to have to start to sell their homes. What we’re starting to see is people starting to realize they can’t afford their mortgages, or they need to downgrade. A lot of people are struggling financially, and this is really the tip of the iceberg. Give it another two or three years — that’s when the realestate market gets hit the most.” 5

Gold Hit Record Highs During the 2008 Subprime Real Estate Crisis

3) The Trump Tariffs

If he prevails in the 2024 Presidential Election, Donald Trump has made no secret of his intention to take a tougher stance on America’s trading partners. He has proposed an acrossthe-board 10% tariff on all imported goods and floated a 60% tariff on all Chinese imports.

“I’m a big believer in tariffs,” the former President proclaimed in March. “I fully believe in them economically when you’re being taken advantage of by other countries. Beyond the economics, it gives you power in dealing with other countries.” 6

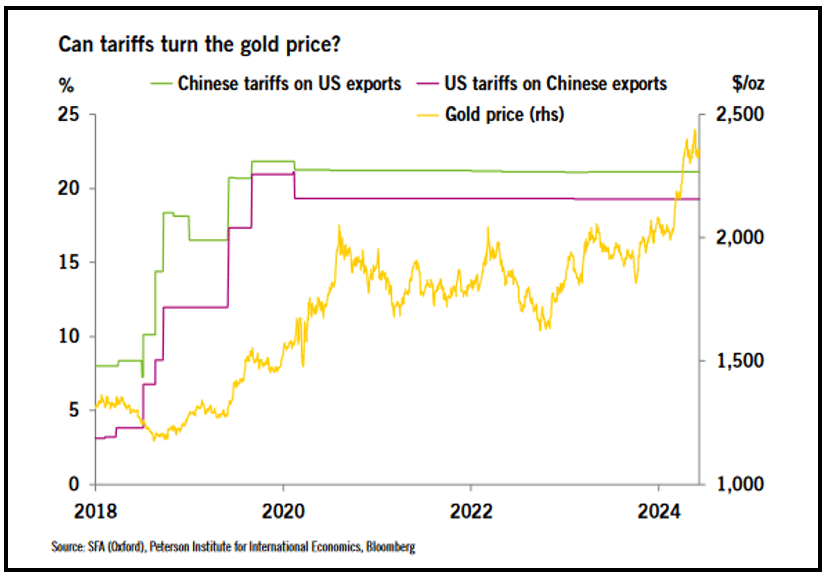

Some experts worry, however, that the Trump Tariffs could prove economically disruptive and even inflationary. German technology group Heraeus, one of the world’s largest refiners of precious metals points out that Trump last trade war with China from 2018-2020, coincided with dramatically rising gold prices.

“The US-China trade war between 2018 and 2020 coincided with a rising gold price. Gold surged during this period as the prolonged negotiations, coupled with tariff and geopolitical escalations, drove investors to seek gold as a safehaven asset despite a rate-hiking environment until mid-2019. Gold’s appreciation closely correlated with the tariff increases which served as a meaningful indicator of US China tensions.” 7

Trump’s Return to the White House Could Drive Investors to Gold

4) Fed Rate Cuts

The latest Consumer Price Index for June, indicates that inflation fell 0.1% from May, marking the first monthly decline in prices since May of 2020. Prior to this reading, Fed Chair Jerome Powell had already indicated that inflation doesn’t need to be below 2% for the Fed to cut rates.

“You don’t want to wait until inflation gets all the way down to 2%. If you waited that long you probably waited too long because inflation will be moving downward and would go well below 2%, which we don’t want.”8

According to the Wall Street Journal, Powell made an even more important shift toward lower rates when he expressed concern about the US labor market during his Senate Banking Committee testimony on June 9th.

“Elevated inflation is not the only risk we face. We’ve seen that the labor market has cooled really significantly across so many measures.” 9

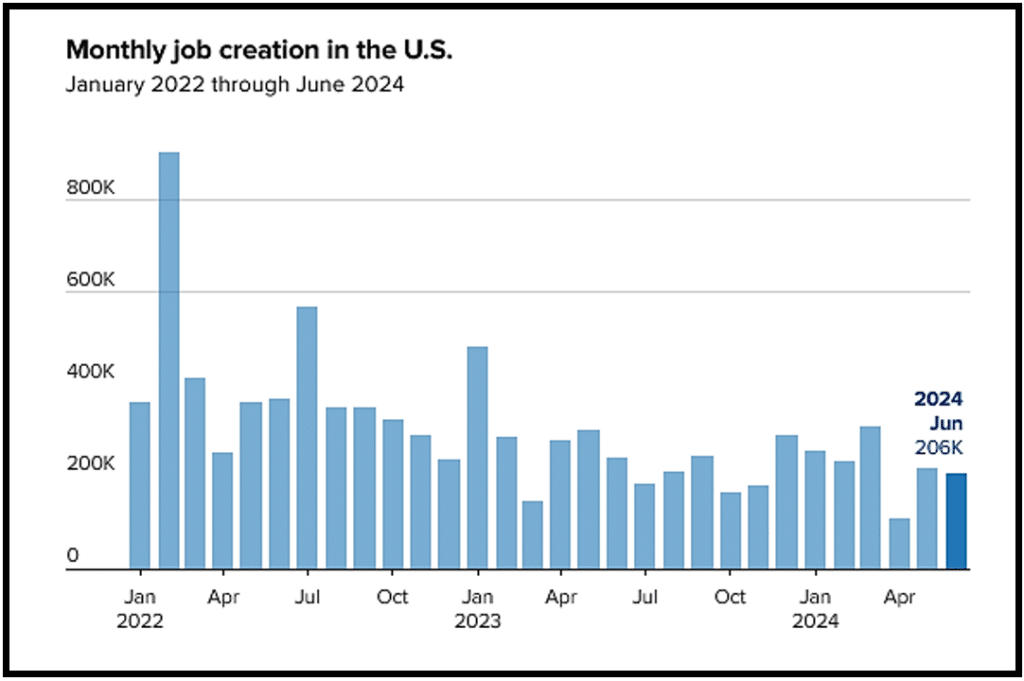

The June jobs report showed employers adding 206,000 jobs, down from 218,000 in May. In addition, the unemployment rate tick up to 4.1%, the highest level since late 2021. The latest inflation readings and soft jobs data have significantly raised the odds that the Fed will start cutting rates in September and continue to do so in subsequent meetings.

Gold has Historically Delivered Positive Returns during Rate Cut Cycles

5) An Imminent Economic Downturn

There are a host of financial experts now expressing concern about a looming economic crisis driven by a number of factors including a cooling labor market, rising unemployment, slowing GDP growth, geopolitical fragility, skyrocketing consumer debt, decreased consumer spending, a real estate crash and a sharp downturn in U.S. business investment.

Economist David Rosenberg believes there is an 85% chance that the U.S. economy will enter a recession this year based on models from the National Bureau of Economic Research including financial conditions indexes, the debtservice ratio, foreign term spreads, and the level of the yield curve. Rosenberg says the recession model is displaying the highest probability since the financial crisis of 2008. 10

Peter Berezin, chief global strategist at BCA Research, recently predicted that a recession will hit the US economy later this year or in early 2025 accompanied by a 32% stock crash. 11

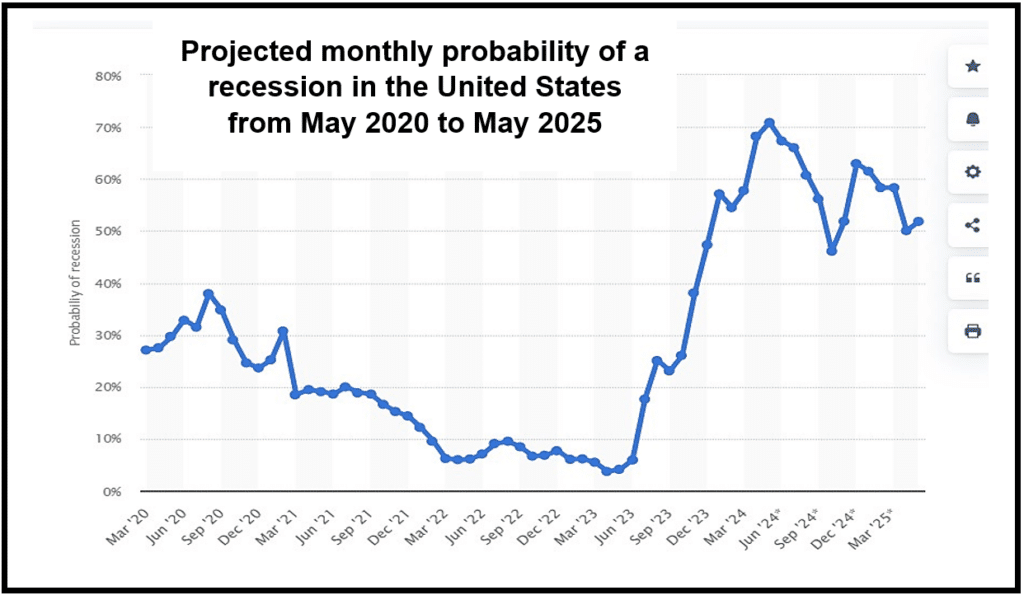

Data platform Statista is projecting an almost 52% probability that the U.S. will fall into an economic recession in less than a year or by May of 2025. 12

And top economist and founder of the Economic Cycle Research Institute, Lakshman Achuthan, also believe the US economy is flashing a recession warning based on a model that has only shown a false positive once in the last century. The ECRI’s Cyclical Labor Conditions index has plunged nearly 50%. That steep decline mirrors falls seen prior to the 2001, 2008, and pandemic-era recession. 13

Gold has Proven to be a Reliable Safe Haven during Economic Crisis

This report is courtesy of Thor Metals Group. 1-844-944-THOR www.ThorMetalsGroup.com

- https://www.visualcapitalist.com/magnificent-seven-stocks/ ↩︎

- https://www.forbes.com/sites/danirvine/2024/03/20/magnificent-7-momentum-is-slowing-signals-caution/ ↩︎

- https://www.cnbc.com/2024/07/01/how-magnificent-7-affects-sp-500-stock-market-concentration.html ↩︎

- https://www.cnbc.com/2024/05/13/how-much-more-expensive-homes-are-since-1965.html ↩︎

- https://www.businessinsider.com/real-estate-crash-home-prices-correction-foreclosures-mortgage-defaults-2024-7 ↩︎

- https://www.cnbc.com/2024/03/11/trump-pledges-to-get-tough-with-tariffs-again-if-elected.html ↩︎

- https://www.heraeus.com/media/media/hpm/doc_hpm/precious_metal_update/en_6/Appraisal_20240701.pdf ↩︎

- https://www.marketwatch.com/livecoverage/powell-testimony-day-two-house-hearing-will-give-fed-chief-more-scope-to-talk-about-rates ↩︎

- https://www.wsj.com/economy/central-banking/jerome-powell-senate-testimony-july-b7805d54 ↩︎

- https://finance.yahoo.com/news/us-now-85-chance-recession-022705048.html ↩︎

- https://markets.businessinsider.com/news/stocks/stock-market-crash-prediction-2025-decline-fed-fails-avoid-recession-2024-7 ↩︎

- https://www.statista.com/statistics/1239080/us-monthly-projected-recession-probability/ ↩︎

- https://www.statista.com/statistics/1239080/us-monthly-projected-recession-probability/ ↩︎

And Why So Many Investors Are Setting One Up

A Gold IRA is much like it sounds, an individual retirement account that expressly allows individuals to hold approved precious metals like gold and simultaneously reap key benefits that the IRS has carved out for traditional retirement arrangements: “IRAs allow you to make tax-deferred investments to provide financial security when you retire.”1 The Gold IRA, however, is a special type of retirement account that permits a wider selection of assets, and for many this not only provides greater control — but the protection of a more diversified portfolio.

The Power of Choice

To put gold into an IRA, you must set up a Self-Directed Individual Retirement Account (SDIRA).

Investopedia defines this type of account as follows:

“A self-directed individual retirement account (SDIRA) is a type of individual retirement account (IRA) that can hold various alternative investments normally prohibited from regular IRAs. Although a custodian or trustee administers the account, it’s directly managed by the account holder, which is why it’s called self-directed.”2

SDIRA’s are available either in the form of traditional IRAs where your money grows tax deferred or as a Roth IRA where you contribute after tax dollars and your money grows tax free. This type of account permits account holders to invest in alternative assets like gold and other approved precious metals but also cryptocurrencies, private equity, real estate, and even promissory notes.

According to financial counseling group Ramsey Solutions, “the self directed IRA … gives investors the power of choice… whether it’s having a closet full of different wardrobes or dozens of flavors to choose from at your favorite ice cream shop, we like having options.”3

Gold is a Self-Directed IRA Favorite

Gold is one of the more popular alternative assets held in an SDIRA. A Gold IRA combines the powerful and timeless benefits of gold with the tax and savings advantages of an IRS approved retirement account.

Gold is widely considered to an effective inflation hedge. It also tends to have an inverse relationship with the dollar and dollar-dominated investments like stocks and bonds. This means when the markets or the dollar fall, gold tends to rise and/or maintain its value. This characteristic has given it a reputation as crisis insurance and the go-to asset during times of economic volatility.

The Economic Observatory, an academic research and policy institute, recently summed up gold’s safe haven benefits as follows:

“The value of gold is stable. It provides protection from inflation; it can diversify investors’ portfolios; and it is typically resilient to financial and economic crises. There has always been strong demand for gold. These characteristics make gold a safe asset. Indeed, fueled by geopolitical unrest and higher inflation around the world, gold prices have recently reached an all-time high.”4

The world central banks all hold gold and set gold buying records in 2023 as well as in the first quarter of 2024. The world’s leading monetary authorities buy gold for the same reason private investors do — to mitigate investment risk, to diversify their assets and as a hedge against global economic chaos.

How to Set-up a Gold IRA

There are essentially three main steps to setting up a Gold IRA.

- The first step is to choose a custodian for your metals. A precious metals custodian is an IRS-approved institution that specializes in safe guarding and securing alternative assets. According to Investopedia, custodians can manage customers’ accounts, the settlement of financial transactions, report on the status of assets, and ensure compliance with tax regulations. 5

- The next step is to fund your account. According to online education resource, LendEDU, there several ways of doing this. The first is with cash, payable by check or wire. The second is to rollover funds by withdrawing them from an existing traditional IRA or 401(k) and then depositing them (within 60 days) into your new self-directed IRA. The third option is to do a direct transfer (with no cash taken out) from your current IRA directly into your new gold IRA account. 6

- The last step is to select your portfolio of metals. In the case of gold, you must hold only IRS approved gold bars, rounds, and coins. According to custodian Strata Trust Company, the gold must be:

- 99.5% pure.

- Produced by a manufacturer certified by NYMEX, COMEX, NYSE/Liffe, LME, LBMA, LPPM, TOCOM, ISO 9000 or a national government mint.

- Proof coins must be in excellent condition, in original mint packaging, and include a certificate of authenticity.

- Small bullion bars must be manufactured to precise weight specification.

- Non-proof coins must be in brilliant and in uncirculated condition.

Some examples of IRS approved coins that may be included in a Gold IRA are: American Eagle bullion and proof coins, Canadian Maple Leaf coins, Chinese Panda coins, and British Britannia coins (2013 and newer).7

A Gold Backed Retirement

Holding physical gold in a retirement account provides key benefits critical to preserving and protecting wealth. Gold’s time-tested attributes can help combat the mounting threats posed by inflation, federal debt, political polarization, fed policy, and the fallout of global wars. Above all, a gold backed retirement provides peace of mind by virtue of its design and its inherent benefits which include:

1) Portfolio Balance via Strategic Asset Diversification

2) The Tax Advantages of an IRS-approved Account

3) A Hedge Against Inflation and/or Economic Uncertainty

4) Chaos Insurance in the event of a Financial Downturn

5) The Peace of Mind of tangible Asset Ownership

Gold has long been heralded for preserving purchasing power and wealth and this is rooted in both history and long-term market data as outlined by State Street Advisors:

“Gold has demonstrated a low and negative historical correlation to many financial indices over time, potentially helping to smooth out volatility and preserve wealth. For example, gold has shown a 0.01 and 0.09 monthly correlation to the S&P 500 Index and Bloomberg US Aggregate Bond Index, respectively, since the 1970s. 1 This persistent and historically low correlation to many other financial assets is rooted in gold’s diverse sources of demand — both cyclical and countercyclical — which is illustrated during different phases of a full economic cycle.”8

- https://www.irs.gov/retirement-plans/individual-retirement-arrangements-iras ↩︎

- https://www.investopedia.com/terms/s/self-directed-ira.asp ↩︎

- https://www.ramseysolutions.com/retirement/self-directed-ira ↩︎

- https://www.economicsobservatory.com/is-gold-a-safe-haven-for-investors ↩︎

- https://www.investopedia.com/terms/c/custodian.asp ↩︎

- https://lendedu.com/blog/transfer-ira-to-gold/ ↩︎

- https://www.stratatrust.com/self-directed-iras/investment-options/gold-precious-metals/ira-allowable-precious-metals/ ↩︎

- https://www.ssga.com/us/en/intermediary/etfs/insights/gold-as-a-strategic-asset-class ↩︎

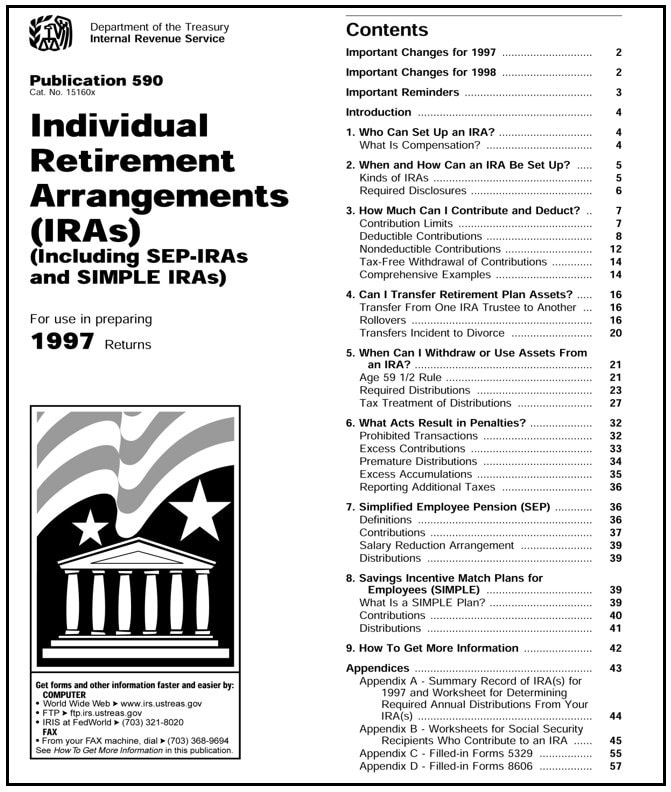

Diversifying with precious metals via an Individual Retirement Account wasn’t always an option in America. When the IRA was established back in 1974 by virtue of the Employee Retirement Income Security Act (ERISA), precious metals were not allowed. But in 1997, Congress passed the Taxpayer Relief Act which changed the rules of self-directed IRAs and in Title III: Savings and Investment Incentives, Section 304, it states: “Permits the investment of IRA assets in certain bullion.”1

The legislation specifically permits self-directed IRAs to hold certain precious metals including gold, silver, platinum, and palladium classified as investments as opposed to collectibles. The distinction between “investments” and “collectibles” is particularly important and constitutes an exception to existing Tax Code.

The accounting firm PKF Mueller describes the exception as follows:

“As a general rule, an IRA investment in any metal or coin counts as the acquisition of a collectible item … In effect, this general rule prohibits IRAs from investing in precious metals or coins made from precious metals. However, the Tax Code supplies an important statutory exception: IRAs can invest in 1) certain gold, silver, and platinum coins and 2) gold, silver, platinum, and palladium bullion that meets applicable purity standards. However, the coins or bullion must be held by the IRA trustee or custodian rather than by the IRA owner. These rules apply equally to traditional IRAs, Roth IRAs, SEP accounts and SIMPLE-IRAs.”2

So, what are the “purity standards” and “certain” coins that constitute the statuary exceptions referenced above? To be eligible for investment in an IRA — gold, platinum, and palladium must be 99.5% pure and silver must be 99.9% pure meaning that only the remaining .5% and .1% can be an alloy (or a combination of other metals).

Online financial educator LendEDU outlines the other minimum fineness requirements as follows3:

Coins:

- Proof coins must be encapsulated, in mint condition, and require a certificate of authenticity.

- Non-proof coins must be brilliant and uncirculated.

Bars and Rounds:

- Must be produced by an accredited/certified source or a national government mint and meet fineness requirements.

- Small bullion bars must be manufactured to exact weight specifications.

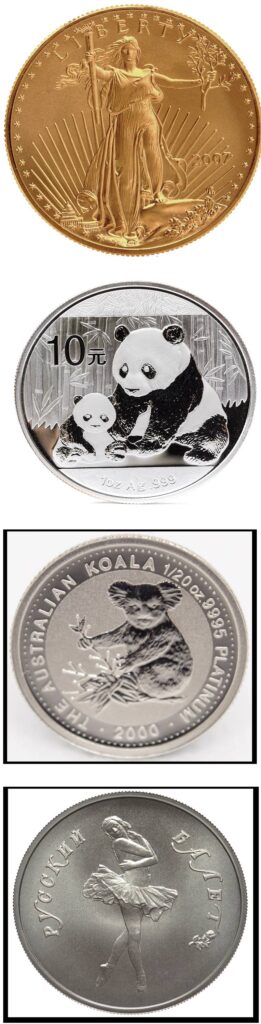

Here are some popular IRA-approved precious metals:

GOLD

- American Eagle Bullion and Proof Coins

- Canadian Maple Leaf Coins

- Chinese Panda Coins

- Credit Suisse Pamp Bars

- Austrian Philharmonic Bullion Coins

SILVER

- American Eagle Bullion and Proof Coins

- Canadian Maple Leaf Coins

- Chinese Panda Coins

- Australian Kookaburra Coins

- Mexican Libertad Bullion Coins

PLATINUM

- American Eagle Bullion and Proof Coins

- Australian Koala Bullion Coins

- Canadian Maple Leaf Coins

- Isle of Man Noble Bullion Coins

PALLADIUM

- American Eagle Bullion and Proof Coins

- Canadian Maple Leaf Coins

- Russian Ballerina Coins

- 1 ounce Palladium Bar

Three, Key Benefits of holding Gold and other Approved Metals in an IRA

Diversification – When held as part of a self-directed Individual Retirement Account, precious metals can help reduce portfolio volatility since they tend to be negatively correlated to paper assets like stocks and bonds. Negative correction means that precious metals tend to either increase in value or maintain their value when weakness or volatility strikes Wall Street, the bond market, and the U.S. dollar.

Tax Deferred Growth – Precious metals placed in a pre-tax IRA enjoy the same tax benefits as a standard IRA, meaning contributions are often tax deductible (in the year they are made) effectively reducing taxable income. In addition, precious metals IRAs appreciate tax deferred until the time of withdrawal. In the case of a qualified Roth Precious Metals IRA, gains are tax-free.

Store of Value – Gold has long been considered a store of value meaning it retains its value over the long term. Traditional assets held in an IRA tend to rise and fall over time, sometimes quite dramatically. Gold, however, has intrinsic value due to its rarity, supply and demand factors, its acquisition by central banks, and its longstanding historical significance.

At a recent US News Investment Experts Roundtable, financial consultant Julie Pinkerton, (CLU, ChFC, LUTCF), stated the following about gold’s appeal in particular:

“Many gold enthusiasts still remember the 1970s, a trifecta of recession, double-digit inflation and soaring oil prices. Long lines at the gas station are etched into their memories. As an investment, gold performs best when conditions are at their worst. Now, it’s easy to pick up any newspaper, watch any TV or hear one’s tech device chime with another notification of current turmoil – multiple global wars and instability, persistently elevated inflation, social unrest on college campuses and political upheaval in a contentious election year. For many, physical gold can be comforting. They can see it, touch it and have a general idea of how it will behave as an investment in these circumstances.” 4

Suffice to say whether you decide to put American Eagle gold bullion coins or pure palladium bars into a precious metals IRA, doing so will help reduce your portfolio risk, protect your retirement dollars, hedge against inflationary forces, and add a critical layer of safety to your accumulated wealth.

- https://www.congress.gov/bill/105th-congress/house-bill/2014 ↩︎

- https://www.pkfmueller.com/newsletters/tax-implications-of-holding-precious-metal-assets-in-your-ira ↩︎

- https://lendedu.com/blog/what-does-ira-eligible-gold-mean ↩︎

- https://money.usnews.com/investing/articles/is-gold-a-good-investment ↩︎

While gold has been grabbing world headlines as it has set repeated price records, silver has quietly rallied to an 11-year high, shattering the $30/oz mark this month. It is one of the year’s best performing commodities and yet in relative terms, silver is cheap. It currently takes about 80 ounces of silver to buy 1 ounce of gold, compared with the 20-year average of 68.1

Silver’s story is steeped in history as the jewelry, food vessels, objets d’art, and coins of the ancients were all made from silver.

But it is also a metal with one foot firmly in modernity as a highly conductive catalyst that plays a critical role in the green revolution and the global transition to clean energy.

According to the U.S. Geological Survey, “of all the metals, pure silver has the whitest color, the highest optical reflectivity, and the highest thermal and electrical conductivity.”2

Could Silver Double or Even Triple?

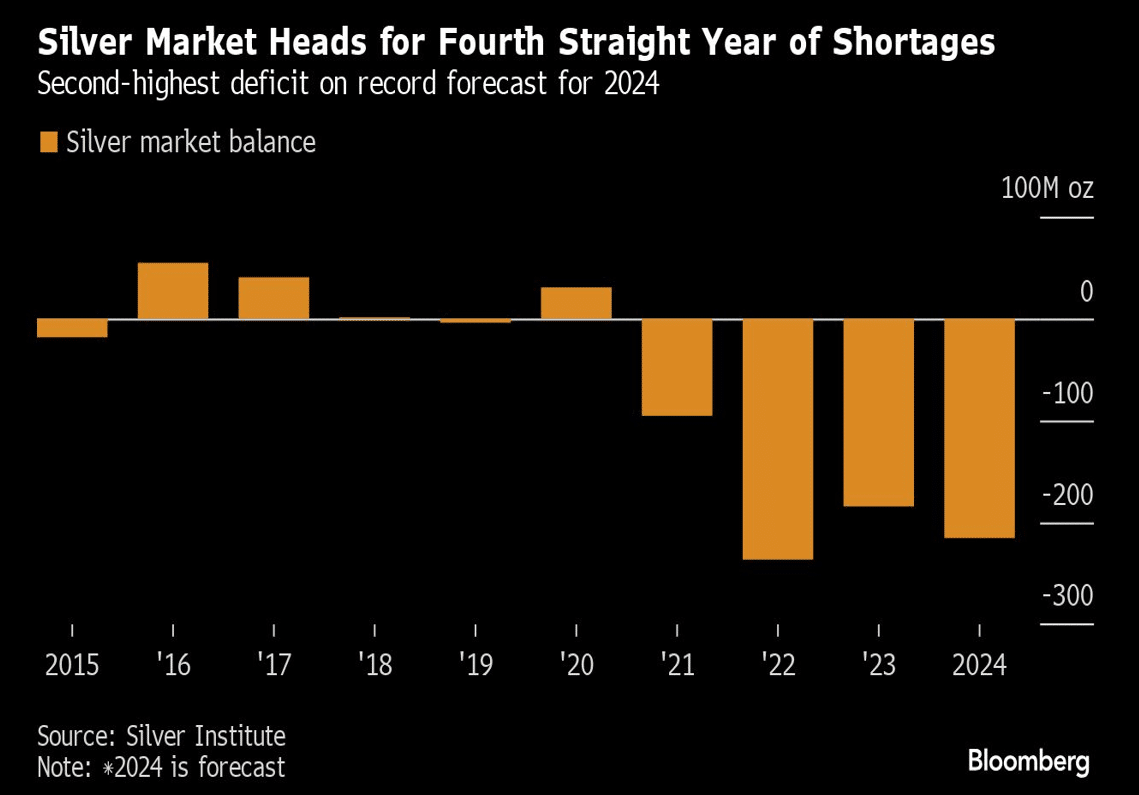

Silver’s latest price forecasts range from $34-$35/oz to as high as $50/oz with some outlier predictions for a price surge of up to $100/oz based on rising industrial demand, growing supply deficits, and limited above ground stock. From 2021 to 2023, the Silver Institute estimates there was a cumulative deficit of 474 million ounces of silver, equivalent to 14,743 tons of the white metal.

According to MarketWatch

“Forecasts pointing to a fourth straight yearly deficit in global supplies and a rise in demand to its second-highest level on record raise the potential for silver prices to rally, and even roughly double before the end of 2024.”3

Supply Challenges Keep Silver Undervalued

Most experts consider silver to be grossly undervalued based upon inherent and uncorrectable supply deficits. As mentioned, silver demand has outpaced supply for the past three years, and according to commodities research group CPM, silver supply is currently in a structural decline that cannot easily be reversed.

“The main issue is the deterioration in mine production, although scrap sources are falling as well. This is important because much of the bullion you and I buy comes from newly-mined silver. Secondary sales (bullion products that have been previously bought and sold) will always have a place in the industry, but to be prepared … mine production will need to be healthy and rising. It is neither of those things.”4

It’s important to remember that silver is rarely found in its pure form and excavating silver from the earth is a complex process of extracting and sifting mineral-rich rock and sediment (ore) via open pits and deep underground mines. Silver-bearing ores like copper, lead and zinc must then be crushed, ground, separated and chemically processed to derive pure silver.

This inherently arduous, expensive, and often inefficient process will only become more taxing since most of the silver that’s easiest to mine has already been reached. So, amid the greatest demand pressure in history, silver reserves are dwindling and that should drive silver prices higher well into the foreseeable future.

Investing News recently summarized the silver supply and demand challenges as follows:

“The thinning inventories that contributed to silver’s price gains through Q1 have been driven by the white metal’s increasing demand from industrial sectors. The biggest contributing sectors have come from the energy transition, particularly the production of photovoltaics and electric vehicles.”5

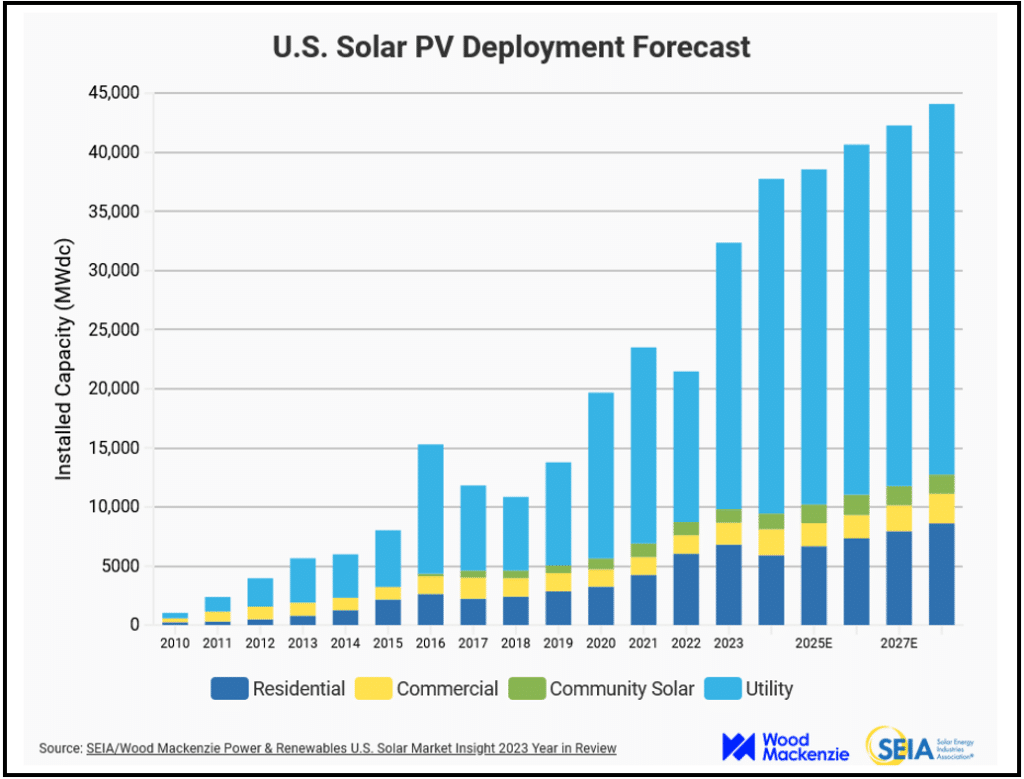

The Unstoppable Solar Army

So where does silver go from here? In terms of green energy needs, demand looks elevated well into the end of the decade. Solar energy continues to boom, particularly in the U.S. The Solar Energy Industries Association predicts nothing but silver rooftops and sunshine ahead.

“The total US solar fleet is expected to quadruple over the next decade to 673 GW, as the Inflation Reduction Act provides key tax incentives and long-term certainty that will spark demand for solar and storage and accelerate the transition to renewable energy.”6

Breaking Price Barriers and Resistance Levels

Andrew Addison of Barron’s who has been charting silver’s price barriers, resistance levels and upsides for years, believes silver is ready for a dramatic breakout. “Once silver has a monthly close above $31, then my work would confirm upside projections to $45-$55.”7

He’s not alone. FX Empire recently stated that, “historically speaking, once we get above the $30 level, it [silver] is a market that tends to just take off to the upside.” And Forbes Advisor Benjamin Curry offers this advice, “It makes sense to invest in silver under certain market conditions. When supply and demand are out of balance is the right time to invest in silver.”

And with silver supply critically constrained and silver demand being inexhaustibly driven by expanding 5G networks, photovoltaics, and consumer electronics — the right time to buy appears to be right now.

AI Demand and Beyond

Global silver demand is expected to reach 1.2 billion ounces this year, the second highest level in recorded history, and there seems no end in sight for silver’s role in industry, manufacturing, renewable energy and beyond.

According to the Silver Institute’s April 2024 Newsletter, “Silver has many exciting new demand opportunities beyond its traditional applications and expanding role in the energy transition. For example, silver will become an indispensable material as artificial intelligence (AI) rises. End uses expected to incorporate silver in AI include transportation, nanotechnology, biotechnology, healthcare, consumer wearables, computing, and energy in data centers.”8

Contact Thor Metals Group at 844-944-THOR for information on Investment-Grade Silver

- https://www.mining.com/web/hot-commodity-silver-sets-pace-as-demand-and-deficit-drive-rally ↩︎

- https://www.usgs.gov/centers/national-minerals-information-center/silver-statistics-and-information ↩︎

- https://www.marketwatch.com/story/it-may-be-silvers-turn-to-shine-after-the-gold-rush-to-record-high-prices-e119b3ec ↩︎

- https://cpmgroup.com/update-new-silver-supply-is-drying-up-faster-than-death-valley ↩︎

- https://investingnews.com/daily/resource-investing/precious-metals-investing/silver-investing/silver-forecast ↩︎

- https://www.seia.org/solar-industry-research-data ↩︎

- https://www.barrons.com/articles/silver-breakout-what-to-watch-cf9872ac ↩︎

- https://www.silverinstitute.org/wp-content/uploads/2024/05/SNApr2024.pdf ↩︎