US consumer sentiment fell in November to one of the lowest levels on record as Americans’ views of their personal finances soured.

The final November sentiment index dropped to 51 from 53.6 in October, according to the University of Michigan. The figure was only slightly better than the preliminary figure.

The current conditions gauge slid 7.5 points to a record low of 51.1. Views of personal finances were the dimmest since 2009.

“Consumers remain frustrated about the persistence of high prices and weakening incomes,” Joanne Hsu, director of the survey, said in a statement.

Consumers expect prices to rise at an annual rate of 4.5% over the next year, easing for a third month, data released Friday showed. They saw costs rising at an annual rate of 3.4% over the next five to 10 years, compared to 3.9% in October.

While Americans’ inflation worries have ebbed, they remain anxious about the high cost of living and job security. The report showed the probability of personal job loss climbed to the highest since July 2020.

Continuing claims for unemployment insurance — a proxy for those receiving benefits — rose early this month to a four-year high, suggesting jobless Americans are finding it harder to land new jobs.

The University of Michigan report touched on the growing divide between wealthier consumers and those with less income.

“The wealthiest consumers appear equipped to continue spending, while the financial positions of non-stockholders are deteriorating,” Hsu said. “These trends indicate that aggregate economic statistics can obscure vulnerabilities within certain parts of the population.”

Consumers became slightly more downbeat about the near-term economic outlook despite the end of the longest government shutdown in US history. Buying conditions for big-ticket goods dropped to the lowest on record.

The survey was conducted from Nov. 3 to Nov. 17.

Read the full article HERE.

Having surged nearly 80% in 2025, platinum has become one of the best-performing commodities. The latest report from the World Platinum Investment Council (WPIC) indicates that although the market may move towards balance in 2026, fragile supply chains, volatile investment demand, and intense competition for physical metal between the US and China are pushing the platinum market into an unprecedented period of high volatility.

The core issue in the current platinum market is a persistent structural supply shortage. WPIC data shows that the global platinum market is expected to see a supply deficit of 692,000 ounces in 2025. Although this is slightly narrower than previous estimates, the tight situation remains severe.

South Africa, the world’s largest platinum producer, is plagued by soaring costs and operational disruptions, leading to a 5% year-on-year decline in global mine supply, which is 10% below the pre-pandemic five-year average. Despite a 7% increase in recycling supply to 1.619 million ounces, it still cannot compensate for the shortfall in primary supply.

On the demand side, while automotive sector demand (accounting for about one-third of the total) remains stable due to resilience in the fuel-powered vehicle market, industrial demand is expected to fall sharply by 22%. However, investment demand has emerged as a key variable driving prices, forecast to grow 6% to 742,000 ounces in 2025.

A new variable in the platinum market in 2025 stems from the competition for platinum between the US and China, which is reshaping the global supply chain and exacerbating market tightness. Tariff threats and the inclusion of platinum on the US critical minerals list have prompted large flows of platinum into US warehouses. In just the last three weeks, New York warehouses absorbed nearly 290,000 ounces of the metal. This phenomenon of “inventory transfer” rather than “inventory increase” has led to physical shortages in traditional trading hubs like London and Zurich.

As the world’s largest platinum consumer, China’s imports hit a record of 1.2 million ounces in the second quarter, consistently exceeding estimates of domestic consumption. The imminent launch of platinum futures on the Guangzhou Futures Exchange, which will for the first time publish inventory data, will enhance transparency in the Chinese market and could also strengthen China’s influence over international pricing.

Analysts point out that the tightness in the platinum market is most evident in lease rates. The recent one-month implied lease rate remains above 10%, down from a peak of 35% in July but still far above the normal level near zero. These “crazy lease rates” have sharply increased costs for industrial users, even causing market liquidity to dry up at times. Tim Murray of Johnson Matthey admitted that in his 36-year career, he has never seen such sustained tightness in the platinum market.

The WPIC forecasts that the platinum market will achieve a small surplus of 20,000 ounces in 2026, but this “balance” is actually very fragile. Firstly, if global trade tensions ease, an estimated 150,000 ounces of platinum is expected to flow back from US warehouses to London, creating an illusion of balance without solving the fundamental supply shortage. Secondly, prices need to rise significantly further to stimulate new production. Craig Miller, CEO of Valterra Platinum, stated that while about 90% of mines are now profitable, prices would still need to increase by about 50% to incentivize new project investment.

In conclusion, the platinum market is at a crossroads of structural transformation. On one hand, years of underinvestment and production challenges in South Africa limit supply elasticity. On the other hand, US-China geopolitical competition is distorting inventory distribution and amplifying physical tightness. Even if the market statistically moves towards balance in 2026, the fragility of the supply chain and the major powers’ scramble for strategic resources will likely keep platinum prices trading at elevated levels.

Read the full article HERE.

Key Points:

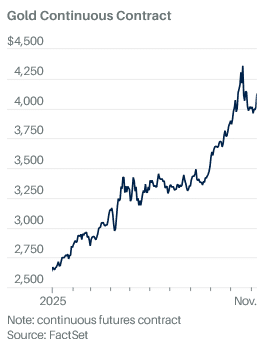

- Goldman Sachs forecasts gold prices to reach $4,900 by the end of 2026, a 21% gain from Tuesday’s price.

- Gold has fallen approximately 6% to $4,062 an ounce since reaching an all-time high of $4,336 on October 30.

- The U.S. dollar’s strengthening and a decreased likelihood of a December interest-rate cut have impacted gold prices.

Gold is having a bad month. The struggles will likely turn out to be a blip rather than the start of a sustained downturn, Goldman Sachs says.

All in all it has been a great year for gold, with the precious metal up nearly 75%. Starting about a month ago, however, investors began to show some doubts. Gold reached a record high of $4,336 an ounce on Oct. 30. Since then, it’s tumbled about 6% to $4,062 on Tuesday.

One culprit has been a strengthening U.S. dollar. Since gold is priced in dollars, a stronger dollar makes gold more expensive for global buyers who need to swap out of local currencies to acquire the metal.

A separate, but related, factor is the outlook for U.S. interest rates. A month ago, markets were all but certain the Federal Reserve would issue another interest-rate cut in December. In the past few weeks, those odds have fallen below 50%. Higher U.S. interest rates help strengthen the dollar and make gold, which doesn’t pay any interest, comparatively less attractive than Treasuries.

The question weighing on gold investors: Is this just a bull market gut check, or the start of a bigger selloff?

Put Goldman Sachs clearly in the blip camp.

On Monday, the investment bank forecast gold prices would hit $4,900 by the end of 2026, representing a gain of about 21% on Tuesday’s price. The metal could go even higher, according to Goldman analyst Lina Thomas. She sees “significant upside if the private investors diversification theme were to gain more traction”—a reference to more U.S. and international investors buying gold to complement their stock-and-bond portfolios.

What’s behind all the bullishness? The current gold rally has been driven by heavy buying from two key sources—central banks and private investors, such as retirement savers, investment funds and more. Goldman doesn’t see either one changing their behavior.

Central banks began buying gold to move away from dollar-denominated assets in 2022, after the U.S. froze Russian assets in response to the country’s invasion of Ukraine. That rationale hasn’t changed, notes Goldman, which says central banks’ purchases appear to have ticked up in September, the latest month for which it has data.

Gold buying by investors, such as Main Street retirement savers, also appears to be on the rise. So far this year, investors have poured more than $41 billion into SPDR Gold Shares and other exchange-traded funds. While ETF investors have pulled some money out in the past month, the turnaround hasn’t been dramatic, with the funds seeing outflows of only around $1.2 billion. Thomas expects ETF investors, alongside ultrahigh net worth individuals who buy physical gold, to continue accumulating the metal.

Goldman isn’t the only one that remains bullish despite the pullback. Last week, strategists at UBS predicted gold could hit $5,000 in 2026 or 2027.

Read the full article HERE.

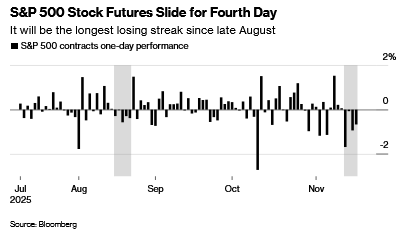

- The S&P 500 was set for its longest losing streak since August, as a six-month rally shows signs of cracking following a $1.2 trillion selloff in cryptocurrencies and fears around stretched artificial intelligence valuations.

- Futures tracking the S&P 500 were down 0.4% at 8:26 a.m. in New York, putting the benchmark on course for a fourth day of declines as investors reconsider their optimistic expectations for Federal Reserve interest-rate cuts.

- The chorus of warnings about a possible AI bubble grew louder after JPMorgan Chase & Co. Vice Chairman Daniel Pinto warned that valuations in the industry could be due for a correction.

The S&P 500 was set for its longest losing streak since August, as a six-month rally shows signs of cracking following a $1.2 trillion selloff in cryptocurrencies and fears around stretched artificial intelligence valuations.

Futures tracking the S&P 500 were down 0.4% at 8:26 a.m. in New York after earlier dropping as much as 0.8%, putting the benchmark on course for a fourth day of declines as investors reconsider their optimistic expectations for Federal Reserve interest-rate cuts. Futures on the technology-heavy Nasdaq 100 Index also slipped 0.5%.

Asian and European stock indexes fell, while Bitcoin briefly dropped below $90,000 for the first time in seven months. Meanwhile, a Bank of America Corp. survey showed that fund managers’ cash holdings have fallen to low levels that have triggered a sell signal in the past.

“Appetite for AI is under pressure from circularity worries and bubble fears,” said Ipek Ozkardeskaya, a senior analyst at Swissquote. “The bad news is that some of the more bullish vibes — AI enthusiasm, massive government stimulus, dovish central-bank expectations — are starting to fade.”

The chorus of warnings about a possible AI bubble grew even louder on Tuesday after JPMorgan Chase & Co. Vice Chairman Daniel Pinto warned that valuations in the industry could be due for a correction. “That correction will also create a correction in the rest of the segment, the S&P and in the industry,” Pinto said at the Bloomberg Africa Business Summit in Johannesburg.

US stocks have come under pressure this month as investors worried the AI-led rally has run too hot. The S&P 500 is trading at about 22 times forward earnings, above its 10-year average of 19. Concerns are also rising about the economic impact of the longest US government shutdown.

Cryptocurrencies, meanwhile. have slumped, with many smaller coins nursing losses in excess of 50% for this year. Digital tokens have lost a combined $1.2 trillion of market value since Bitcoin peaked in October, figures from CoinGecko show.

Dip Buyers

Investors have so far been keen to buy the dip given underlying optimism about US economic growth. On Friday, the S&P 500 reversed losses of as much as 1.4% to end the day little changed and a similar swing looked possible on Tuesday too, as futures rebounded off their session lows.

“We tend to treat market retrenchments as a buying opportunity,” said Marija Veitmane, head of equity research at State Street Global Markets. “The economy is strong enough to support robust earnings growth and yet weak enough to warrant rate cuts.”

Still, results from Home Depot Inc. offered a warning to investors about the strength of US consumers after the world’s largest home-improvement retailer cut its full-year earnings outlook. There’s also higher demand for bearish bets on technology stocks, suggesting faltering confidence in a sustainable rally.

Heavy spending on AI is also raising worries about companies’ capacity to finance such bills. Credit spreads for Oracle Corp. have soared to the highest in nearly three years. In a further sign of growing worries about the space, Microsoft Corp. and Amazon.com, Inc. were both downgraded to neutral from buy at Rothschild & Co Redburn, which said the bull case for generative AI is no longer clear.

BofA’s warning of a potential sell signal came as fund managers’ average cash holdings fell to 3.7%, something that has only occurred 20 times since 2002. Stocks fell and Treasuries outperformed in the following one to three months each time that has happened in the past, BofA strategists said in a note. The survey also showed that for the first time in 20 years, investors said companies are overinvesting.

Nvidia Test

The S&P 500 is now about 3% below its October peak. On Monday, the benchmark index closed below its 50-day moving average for the first time since April. Market breadth has also weakened, with only 54% of S&P 500 constituents trading above their 200-day moving average, according to data compiled by Bloomberg.

All eyes are now on AI bellwether Nvidia Corp.’s quarterly earnings report due Wednesday. Meanwhile, swaps traders have pared bets on the possibility of a Fed rate cut in December.

For Matt Britzman, senior equity analyst at Hargreaves Lansdown, the longer-term outlook for stocks remains intact.

“Pullbacks are never fun but are often healthy, especially in a market that’s showing signs of frothiness,” he said.

Here’s what other market participants are saying about the outlook for US stocks:

Homin Lee, a senior macro strategist at Lombard Odier

“We believe that the nervousness will persist until the September employment report provides greater clarity. At the current juncture, a soft US labor market data or a large beat in Nvidia earnings could help.”

Ulrich Urbahn, head of multi-asset strategy and research at Berenberg

“Crypto market turmoil has increased equity volatility, while the Fed’s mixed signals on rates keep investors wary. AI remains a key growth driver, but concerns over potential earnings disappointments and valuation pressures persist. Overall, stocks face a delicate balance between positive AI momentum and macroeconomic caution as the year closes. We remain cautiously optimistic though, given likely strong buyback and flow support over coming weeks.”

Mary-Sol Michel, a director a Swiss Life Gestion Privée in Paris

“We were expecting a drawback to occur but a bit earlier earlier than this. We had therefore already cut some positions, notably on ASML and Alphabet. The selling isn’t usual in terms of seasonality as typically at this time of the year people are expecting a year-end rally. We’re staying invested in tech, but we decided to take profits to secure our performance this year. There’s a lot of nervousness in the tech segment.”

Eric Bleines, a fund manager at SwissLife Gestion Privée

“The question is whether the selloff will continue after Nvidia’s results: this will make the difference between the market just taking a breather or going for a correction.”

Joachim Klement, a strategist at Panmure Liberum

“Stock markets in the US and UK are still underpinned by solid fundamentals and in the US, weaker jobs data for September could revive the bets for a December rate cut by the Fed. US stocks will be supported by Fed rate cuts, though these will benefit US value stocks more than the expensive tech sector.”

Read the full article HERE.

Stocks have experienced only brief downturns over the past 16 years, creating dangerous complacency

“How bad do you think it’s gonna be?”

When Michael Corleone asks Clemenza in “The Godfather” about the mob war he’s about to start, he gets the sort of reassurance that comes with experience. “These things gotta happen every five years or so, ten years. Helps to get rid of the bad blood…been ten years since the last one.”

There’s no saying when the next major bear market will send Americans to the mattresses—maybe through the collapse of AI mania, or possibly just a garden-variety recession. There have only been minor scrapes the past 16 years, and that’s actually a problem.

A downturn like 2007-09 when U.S. stocks fell by more than half can be both awful and therapeutic. It took 66 months for the S&P 500 to regain its previous high. Investors with a long-term perspective pounced on what in hindsight were solid, boring bargains near the bottom.

The five brief downturns since then that met the unofficial definition of a bear market taught the opposite lesson. Momentarily terrifying, they encouraged investors to “buy the dip” quickly and recklessly—the junkier the stocks, the better.

Remember the summer of 2020 when Nikola, the fraudulent hydrogen-truck company, became worth more than Ford, or when bankrupt Hertz’s shares were touted on social media and soared?

This year’s Liberation Day swoon felt similar: It took just 4.3 months for the S&P 500 to reach a fresh high. The advance was led by the theme du jour, artificial intelligence, plus many unproven, unprofitable companies.

Long bear markets accompanied by a recession discredit the last boom’s wildest themes and its cheerleaders. They also remind us of what capital markets are for: matching mostly good businesses with patient savers’ nest eggs.

In the past century, there have been 26 bear markets, including some that barely met the definition, such as this year’s swoon.

The average time to reach the previous high when a bear market was accompanied by a recession was 81 months. It took just 21 without a recession. Over the past 16 years, downturns have lasted less than eight months before the old high was reached.

The model for buying the dip was set in the summer of 1998, after Russia defaulted and hedge fund Long-Term Capital Management collapsed. The Federal Reserve stepped in and the effect was electric, sending stocks back to a new high by that November.

The tech-heavy Nasdaq composite would go on to rally 255% over 17 months. In 1999 and 2000 combined, there were 631 technology initial public offerings, according to Jay Ritter, a University of Florida finance professor. Their average multiple of price-to-sales was nearly 50 when they began trading. Multiples of two to six are more typical.

That rewarding bounce made the tech bubble wilder, as did the fact that few people in the market in the late 1990s had personally experienced a really nasty, long downturn.

Sort of like today: Hardly anyone younger than 40 now even had a 401(k) during the 2007-09 wipeout. Most Wall Street pros hadn’t graduated from college yet.

Bear markets are educational, but the tuition is a doozy.

Read the full article HERE.

Key Points:

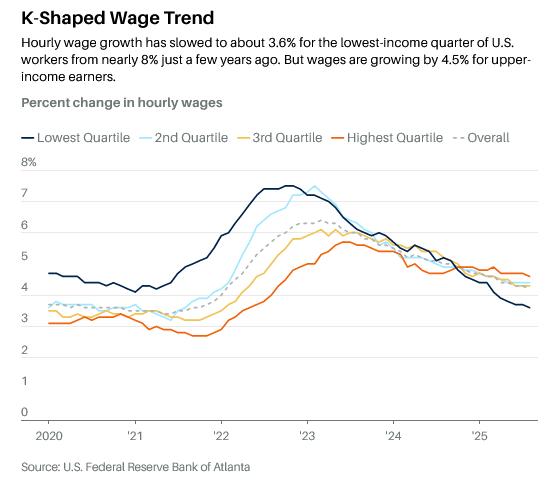

- Wages for the top 25% of the U.S. workforce are rising by 4.6% annually, while the lowest quarter sees only 3.6% annual gains.

- Financial stress is increasing for lower-income households, with 29% living paycheck to paycheck and a record 6.7% of subprime auto loans delinquent.

- The economy’s growth is increasingly reliant on affluent households, as lower-income consumers face rising costs and reduced spending capacity.

After years of narrowing wage inequality, the workplace has become a tale of two economies again. This time, unlike in the postpandemic period, trends favor the top 25% of the U.S. workforce, whose wages are rising by 4.6% a year. That compares with annual wage gains of only 3.6% a year for the lowest quarter of the workforce, or roughly half the pace in 2022, according to the Federal Reserve Bank of Atlanta.

The reversal in fortunes has popularized the notion of a K-shaped economy, in which, like the letter, the upper arm rises while the lower arm droops. Fresh data about wages, spending, and credit conditions from banks, economists, and the Fed show the divergence widening this year. The U.S. economy is still expanding—gross domestic product is expected to grow by about 1.7% in 2025—but its health depends increasingly on more affluent households.

Bank of America data show that 29% of lower-income households are now living paycheck to paycheck, up from 27% in 2023. “Wages for lower-income earners have been easing relative to their higher-income counterparts since the beginning of 2025,” says Joe Wadford, a Bank of America economist.

Financial stress is also mounting among the less well off. Cox Automotive reported 1.7 million vehicle repossessions in 2024, up 43% from two years earlier and the highest level since 2009. This year is likely to be worse: The number of subprime borrowers at least 60 days behind on their auto loans rose to nearly 6.7% in October, the highest level on record, according to Fitch Ratings data.

TransUnion reports that more borrowers now cluster at credit score extremes: either superprime, with scores above 780, or subprime, below 600. “We are seeing a divergence in consumer credit risk, with more individuals moving toward either end of the credit-risk spectrum,” says Jason Laky, TransUnion’s executive vice president and head of financial services.

Mark Zandi, Moody’s chief economist, says spending among the bottom 80% of households, those earning less than $175,000, has kept pace with inflation since the pandemic. But the top 20% have done far better, and the wealthiest 3% “much, much, much better.”

Those high-income consumers are now powering growth. “As long as they keep spending, the economy should avoid recession,” Zandi wrote. “But if they turn more cautious, for whatever reason, the economy has a big problem.”

In a recent speech, Federal Reserve Governor Christopher Waller put more numbers around the growing imbalance. The top 10% of households account for 22% of all personal consumption, and the top 20% contribute 35%, he said in October citing Fed and Bureau of Labor Statistics data. The bottom 60% represent 45% of consumption. “This group has been affected by higher prices this year and is already changing its spending plans to find better value,” he said.

The K-shaped pattern changes the economy’s resilience. When wage gains cluster in the top income strata, growth becomes more sensitive to changes in the financial markets and less anchored to ordinary income.

Affluent households, which also control the greatest share of wealth, may keep spending, but their behavior is likely to swing with asset prices, exposing the economic expansion to greater volatility. According to Jared Bernstein, chair of the Council of Economic Advisers under President Joe Biden, the decline of a dollar in stock market wealth translates to two to three cents less in spending.

An increasingly unbalanced economy also changes the way economic weakness is reflected in data. Growing stress among lower-income households manifests in rising delinquency rates, shrinking buffers, and reductions in discretionary spending, which then hurt businesses that depend on widespread demand rather than high-margin customers. While the economy can continue to grow for some time while its foundations erode, policymakers are left with a clouded picture of its underlying condition.

Inflation is a particular drag for lower-income households, even if headline inflation has fallen to 3% or so from a high of around 9% in June 2022, as measured by the consumer price index. Joe Brusuelas, an economist at RSM, notes that shelter costs have risen 3.6% over the past year, utilities 5.8%, and beef nearly 15%.

Bank of America has found that inflation is outpacing after-tax wage growth for both middle- and lower-income earners. Tariffs are compounding the problem: Yale’s Budget Lab estimates an average effective tariff rate of 17.9%, the highest since 1934, which has lifted prices about 1.3% and cost the typical household $1,800 so far.

Federal Reserve officials have begun to speak more openly about the K-shaped economy, even if they don’t invoke the alphabet to describe it. Philadelphia Fed President Anna Paulson has said that nearly all net job growth this year has come from healthcare and social assistance. With lower-income consumers under strain, she warned, the economy is increasingly reliant on spending by affluent consumers, much of it tied to a narrow stock market rally driven by AI-linked companies.

“The relatively narrow base of support for the labor market, the importance of high-income consumers, together with the prominence of the narrative around AI for equities, adds up to a relatively narrow base of support for growth,” Paulson said. “Indeed, some business contacts are wondering where future demand will come from. This is something to watch closely.”

Fed Chair Jerome Powell has also expressed worries. “If you listen to the earnings calls or the reports of big, public consumer-facing companies, many of them are saying that there’s a bifurcated economy,” Powell said after last month’s Fed policy meeting. “Consumers at the lower end are struggling and buying less and shifting to lower-cost products. But at the top, people are spending.”

Business leaders are taking note. “We continue to see a bifurcated consumer base,” said McDonald’s CEO Christopher Kempczinski on the company’s most recent earnings call.

Traffic from lower-income consumers declined by nearly double digits in the third quarter, he said, “a trend that’s persisted for nearly two years.” Traffic growth among higher-income consumers, in contrast, “remained strong, increasing nearly double digits in the quarter,” he said.

Henrique Braun, chief operating officer of Coca-Cola, said on a recent analyst call that the company had leaned into “mini-cans” to appeal to cash-strapped consumers. “When we look from a consumer point of view, we continue to see divergency in spending between the income groups,” he said. “The pressure on middle- and low-end income consumers is still there.”

The bifurcation creates policy challenges for the Fed, which faces conflicting signals. The softening labor market argues for continued rate cuts to prevent further deterioration, while inflation that has run consistently above the central bank’s 2% annual target for the past five years argues for caution.

The Fed’s tool kit isn’t designed to address distributional problems. It can try to support the labor market broadly, but it can’t target specific wage groups. It can ease financial conditions, but that primarily benefits asset owners.

Brusuelas described September’s CPI report, which showed prices rising by a less-than-expected 3% on an annual basis, as “the perfect depiction of the K-shaped economy.”

Beneath the headline numbers, he said, “middle-class and down-market households experiencing slowing wage growth are having difficulty adjusting to persisting increases in the cost of living. For those households, it is about food, fuel, and utilities.”

Households exposed to assets will continue to prosper as rate cuts bolster equity prices, he wrote. Upper-income households with rising incomes and appreciating assets can capitalize on current conditions. “The upper spur of the Big K is a good place to be,” he wrote.

But the “Big K” itself is a troubling look for the broader U.S. economy.

Read the full article HERE.

Gold rose as traders weighed the US fiscal outlook following the end of the longest government shutdown in history.

Bullion climbed for a fifth session to trade near $4,230 an ounce, after US President Donald Trump signed legislation to end the longest government shutdown on record. However, the White House has warned that official jobs and inflation data for October are unlikely to be released.

The data void throughout the shutdown has caused investors to fly blind or rely on private statistics for a temperature check on the world’s largest economy. Gold has rallied in that environment, boosted by a string of weak private data releases. The October jobs and consumer price index reports may well never be published, even after the government shutdown.

“This data ‘blackout’ should continue to boost demand for safe haven assets like Treasuries and precious metals,” analysts at BMO Capital Markets wrote in a note.

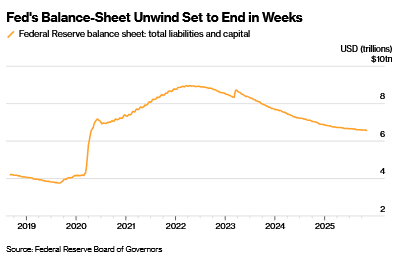

There’s also the prospect of the Federal Reserve injecting further liquidity into the financial system, and a pivot to looser monetary policy that could benefit precious metals. The US central bank “won’t have to wait long” before purchasing assets to sustain desired liquidity levels, the Federal Reserve Bank of New York’s Roberto Perli said on Wednesday.

Last month, Fed officials announced they would stop shrinking their balance sheet — which drains liquidity — starting Dec. 1, amid volatility in short-term funding markets.

Combined with elevated US fiscal deficits, and further spending suggestions from President Donald Trump, that could bolster the so-called “debasement trade” theme — the retreat from sovereign debt and the currencies they are denominated in — over fears their value will be eroded over time.

That concern has helped power gold’s 60% rally this year, as investors and central banks step up purchases to hedge against growing fiscal unease in some of the world’s biggest economies. The precious metal remains on track for its best annual performance since 1979.

Though gold has yet to regain last month’s record above $4,380, several investors are forecasting another advance to $5,000 and beyond next year. China has been a leader among central-bank buyers, supporting its aim of building a world less dependent on US-centric financial markets.

Gold rose 0.8% to $4,227.96 an ounce as of 11:09 a.m. London time. The Bloomberg Dollar Spot Index fell 0.2%. Silver climbed toward a record high, while platinum and palladium also rallied.

Read the full article HERE.

Professional forecasters learned to sleep past 5 a.m. and ask their plumber for clues about the U.S. economy; ‘It’s a little sad.’

This past Friday, labor economist Guy Berger got to sleep in for the second month in a row. He wasn’t happy about it.

The government shutdown meant there was no jobs report from the Bureau of Labor Statistics. So instead of waking in the dark at 5 a.m. in California to be ready for the release of the report, Berger got up a few hours later and spent the morning drinking coffee and eating yogurt.

“It’s a little sad,” Berger said of the missing jobs data. “I will be very happy when the BLS data comes back.”

He may get his wish soon. Senators on Monday passed a spending package to end the record-long government shutdown. The package now moves to the House for a final vote as soon as Wednesday.

For the past six weeks, Berger and his peers have searched for meaning wherever they could find it. For some, that’s meant tracking obscure metrics like visits to the Statue of Liberty. Others used the shutdown to dust off esoteric research projects. One economist said he asked his plumber how tariffs are affecting his business when he came to do work in his home.

Economists have long planned their professional and personal lives around the regular morning government data releases that occur throughout a typical month. Though private-sector economists have continued to be paid as usual, unlike the federal workers who missed paychecks, they say it’s been hard to decipher the direction of the economy.

“My assembly line of data that comes through just is getting thinner and thinner. So that’s why in desperation, I have gone out and looked at indicators that I would not normally spend too much time on,” said Torsten Slok, chief economist at Apollo Global Management.

It’s not just the monthly jobs report they’ve been missing. The government puts out regular data on everything from exports of excavating machinery to sales at shoe stores.

“The data dogs are howling because we’re not getting our usual supply of information,” Chicago Fed President Austan Goolsbee, who has used the canine term to refer to himself in the past, said in a radio interview that aired Oct. 1.

Like others, Goolsbee has looked for new sources. “One of the key rules of the data dogs is, sniff every piece of data that hits the floor, because it might be food,” he said. The Chicago Fed continued to publish its own labor market data during the shutdown. Economists have also long followed some private sources of data like payroll firm ADP’s jobs figures.

Fed Chair Jerome Powell said in late October that the dearth of comprehensive statistics—along with piecemeal surveys and anecdotes showing no major deterioration in the outlook—could make the central bank more cautious about further rate cuts. “What do you do if you’re driving in the fog? You slow down.” he said.

A few days after the government closed, Slok and two colleagues sent clients a 75-page document titled “Alternative Data During the Shutdown.” It included slides on visits to the Statue of Liberty and Broadway show attendance, metrics they believe could reflect discretionary spending. There’s a slide on movie attendance sourced to Boxofficemojo.com.

“It is like circumstantial evidence in a Sherlock Holmes mystery,” said Slok. “I do not know whether things have been getting better or not, but I have a lot of small pieces of evidence that I find on my way as I walk forward.”

Economist Don Rissmiller of Strategas hasn’t missed an inflation or jobs report in nearly three decades. He closely follows the other, more minor releases, too. “You have a hole between 6:30 a.m. and 10:30 a.m. every day. It’s hard to fill completely,” Rissmiller said.

He’s wary of turning to anecdotal data, like his own personal observations or even the Fed’s Beige Book that compiles feedback from local businesses and others. “You’re at the mall, does it look busy? You’re asking the taxi driver, ‘Is there anything going on in town?’” he said. “It’s easy to get carried away with a few negative anecdotes.”

His team has been dusting off some research that they may not have gotten to without the shutdown. His colleague Maria Cabella sent clients a note about stablecoins that began with a Latin proverb and a first-person recollection about her college roommate.

Much of the data for the September jobs report was collected before the shutdown, so it could be released relatively quickly if the government reopens, Berger said.

Even if the government reopens soon, the jobs report may not go back to normal until the December report, scheduled for release in early January. The data were never collected for the October report—and an important portion of the data for the November report was supposed to be collected this week. The shutdown itself could skew the employment figures too.

The bill headed to the House would fund the government through Jan 30. “Assuming nothing crazy happens, by early January we’ll have a pretty good idea about the job market. Then there’s the question of if we’ll have another shutdown,” Berger said.

Read the full article HERE.

Key Points

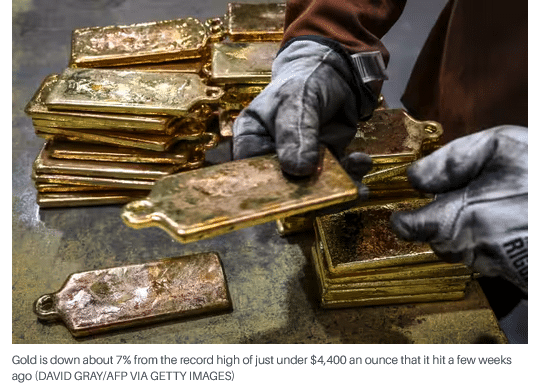

- Gold prices rebounded to around $4,100 an ounce after falling below $4,000, though they are still down 7% from a record high of nearly $4,400.

- UBS strategists predict gold could reach a new all-time high of $5,000 in 2026 or 2027, citing its growing role as a strategic asset.

- Factors like central-bank diversification, retail investor interest, a weakening dollar, and falling real yields are expected to support gold’s continued rise.

The recent correction in gold may not be the start of a deeper bear market for the shiny yellow metal. In fact, some on Wall Street see even brighter days ahead.

Gold prices have already rebounded to back above $4,100 an ounce after falling below $4,000 in late October. Gold is still down about 5% from the record high of just under $4,350 an ounce that it hit a few weeks ago. But strategists at UBS said in a report Monday that they think gold could hit a new all-time high of $5,000 at some point in 2026 or 2027.

“Core positions are becoming more resilient. Gold is increasingly viewed as a long-term strategic asset and a core part of asset allocation,” the UBS strategists wrote.

They argue that “there has been an acceleration in the broadening of gold’s investor base,” adding that “gold stands to benefit from a growing number of investors reallocating” from stocks, bonds, the dollar and other assets and that, “given the relative size of the gold market

to other asset classes, even a small shift can have a large impact if it is broad-based.”

The combination of more gold-buying by central banks looking to diversify their holdings away from the U.S. dollar, and a flock of retail investors buying the metal through exchange-traded funds, could catapult gold even higher again.

Jeff Jacobson, managing director and head of derivatives strategy for 22V Research, said in a report last week that he’s still bullish on gold as well.

He pointed to the fact that the metal has remained above its 50-day moving average, a key technical level, despite its recent slide. That’s a good sign.

“The fact that even after such a sharp decline gold remains in a very clear uptrend suggests you want to continue to add on such pullbacks,” Jacobson wrote.

He also noted that recent moves higher in both the U.S. dollar and long-term bond yields appear to have stalled. Jacobson expects the greenback and 10-year U.S. Treasury to slip back again. That should boost gold, which tends to do better during times of dollar weakness and lower interest rates.

Strategists at Pictet Asset Management also think that not much has changed for gold in the past few weeks—other than its price. Many of the bullish arguments that have lifted gold prices by more than 55% this year remain just as compelling today.

“Though we note the precious metal’s steep climb takes its valuation to lofty levels, the fundamentals continue to be supportive: real yields are coming down, the dollar continues to weaken and there’s the real risk of significant expansions in public sector deficits across the developed world,” the Pictet team wrote.

The rebound in gold—the price was up 2.8% at around $4112 in late afternoon trading Monday—is good news for gold mining stocks, too. Just look at some of the leading miners. Newmont Mining, one of the top-performing stocks in the S&P 500 this year and a recent Barron’s stock pick, is up nearly 15% since Oct. 27 on the back of gold’s comeback. Another miner, Barrick Mining, soared more than 5% Monday after reporting earnings and announcing that it was boosting its dividend and share-buyback program.

Yes, gold will likely continue to be volatile in the near term. Austin Pickle, an investment strategy analyst with the Wells Fargo Investment Institute, said in a report Monday that “gold was historically stretched” and that “the most recent pullback has been a much needed and healthy consolidation.” He conceded that it could take some time for some of the excesses in the market to be wrung out and that gold could be choppy over the next few months.

But it looks like conditions are in place to push it on toward the next milestone of $5,000 an ounce before long.

Read the full article HERE.

Student loan delinquencies hit 9.4% as lower-income Americans face mounting financial pressure

American households’ debt burdens increased to the highest level on record in the third quarter of 2025, according to a new report by the Federal Reserve Bank of New York.

The New York Fed’s Center for Microeconomic Data released its quarterly report on household debt and credit this week, which showed that household debt rose by $197 billion in the third quarter to a record of $18.59 trillion.

Mortgage balances grew by $137 billion in the quarter to a total of $13.07 trillion at the end of September, while credit card balances rose $24 billion to a total of $1.23 trillion at the end of the quarter. Auto loan balances were steady at $1.66 trillion, while student loan balances increased $15 billion to a total of $1.65 trillion.

“Household debt balances are growing at a moderate pace, with delinquency rates stabilizing,” said Donghoon Lee, economic research advisor at the New York Fed. “The relatively low mortgage delinquency rates reflect the housing market’s resilience, driven by ample home equity and tight underwriting standards.”

Overall delinquency rates remained elevated in the third quarter of 2025, with 4.5% of outstanding debt in some stage of delinquency.

The New York Fed noted that transitions into early delinquency were mixed with credit card debt and student loans increasing, while all other debt types saw decreases.

Transitions into serious delinquencies, defined as 90 days or more delinquent, were largely stable for auto loans, credit cards and mortgages. Overall debt flow into serious delinquency was 3.03% in the third quarter of 2025, up from 1.68% in the same quarter last year.

Missed payments on federal student loans weren’t reported to credit bureaus from the second quarter of 2020 to the four quarter of 2024, and the resumption of those reports caused student delinquencies to rise sharply in the first half of 2025.

The New York Fed found that in the third quarter of 2025, 9.4% of aggregate student debt was reported as 90+ days delinquent or in default, compared with 7.8% in the first quarter and 10.2% in the second quarter.

The Federal Reserve cut interest rates for the second consecutive meeting in October despite elevated inflation amid signs of a weakening labor market.

Policymakers have cautioned that while economic growth has been solid overall, there are signs it’s being driven by higher income consumers while less affluent households are struggling.

Federal Reserve Chairman Jerome Powell said at his press conference following the rate cut decision that there is a “bifurcated economy” and that “consumers at the lower end are struggling and buying less and shifting to lower-cost products, but that at the top, people are spending at the higher end of income and wealth.”

Read the full article HERE.