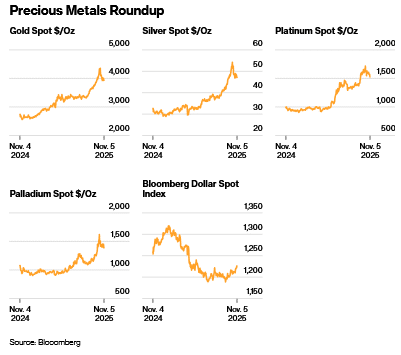

Gold prices nudged higher Friday, supported by a softer U.S. dollar and growing bets on another Federal Reserve rate cut.

At 08:15 ET (13:15 GMT), Spot gold was up 0.5% at $3,996.56 an ounce and U.S. Gold Futures edged 0.3% higher to $4,003.87 per ounce.

Softer dollar, Fed easing bets support gold prices

The US Dollar Index fell 0.5% on Thursday and stayed subdued on Friday, making bullion cheaper for holders of other currencies.

The prolonged U.S. government shutdown — which has now entered its second month — has delayed the release of key economic reports, including employment and inflation data, leaving markets with limited official guidance.

The data vacuum has heightened uncertainty and prompted investors to rely on private-sector surveys for economic signals.

A private jobs report on Thursday showed signs of weakness in the labor market, adding to expectations that the Fed could ease policy rates again sooner than previously thought.

“The absence of official data is clouding the situation, but business surveys suggest the Federal Reserve will likely cut rates further despite recent hawkish messaging,” ING analysts said in a note.

Futures pricing now indicates about a 70% chance of a rate cut in December, up from roughly 60% a day ago. Lower interest rates tend to support gold, which yields no interest.

Global equity markets, meanwhile, extended sharp losses this week, with technology shares leading the slide amid renewed concerns over lofty valuations.

The broader rout pushed investors toward safer assets, such as gold and U.S. Treasuries.

Gold has long-term appeal – BCA

Gold has retreated from the all-time highs seen late last month, but BCA Research still sees it delivering strong long-term returns.

After a 10% pullback following this year’s sharp rally, BCA strategists said the correction in gold is “mostly behind us,” while maintaining that its long-term appeal remains intact.

“The network effect that has made gold the physical insurance asset of choice will generate long-term outperformance versus other commodities,” a team led by Dhaval Joshi wrote in a report released Thursday.

Gold’s value, they said, stems from its role as an “insurance asset” in the fiat money system—a function reinforced by collective investor belief and central bank behavior.

“The true value of gold comes from the network effect that makes gold the go-to insurance asset in a fiat monetary regime,” the strategists said.

The research house identified three main drivers of gold’s long-term value: global wealth levels, the share of wealth allocated to insurance assets, and the availability of alternatives.

Metal markets edge higher; Chinese exports fall unexpectedly in Oct

Other precious and industrial metals traded modestly higher on Friday as a weak dollar lent support.

Silver Futures rose 1% to $48.425 per ounce and Platinum Futures advanced 1.6% to $1,562.10/oz.

Benchmark Copper Futures on the London Metal Exchange gained 0.6% to $10,743.20 a ton, while U.S. Copper Futures were up 0.6% to $4.9955 a pound.

Data on Friday showed that Chinese exports unexpectedly shrank in October for the first time in 18 months, amid continued pressure from high U.S. trade tariffs and cooling overseas demand.

Imports also weakened, leading to a decline in the country’s trade balance.

Read the full article HERE.

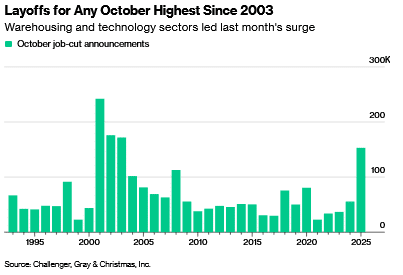

US companies announced the most job cuts for any October in more than two decades as artificial intelligence reshapes industries and cost-cutting accelerates, according to data from outplacement firm Challenger, Gray & Christmas Inc.

Companies announced 153,074 job cuts last month, almost triple the number during the same month last year and driven by the technology and warehousing sectors. It’s the most for any October since 2003, when the advent of cellphones was similarly disruptive, said Andy Challenger, the company’s chief revenue officer.

“Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes,” Challenger said in the report. “Those laid off now are finding it harder to quickly secure new roles, which could further loosen the labor market.”

The numbers are weak no matter how they’re spliced. Year-to-date job cuts have exceeded 1 million, the most since the pandemic. In the same period, US-based employers have announced the fewest hiring plans since 2011. Seasonal hiring plans through October are the lowest since Challenger started tracking them in 2012.

“It’s possible with rate cuts and a strong showing in November, companies may make a late season push for employees, but at this point, we do not expect a strong seasonal hiring environment in 2025,” said Challenger.

In recent weeks, Target Corp. announced plans to eliminate 1,800 roles, or about 8% of corporate jobs in its first major restructuring in years. Amazon.com Inc. said it would slash 14,000 corporate jobs — following a warning from its CEO that AI will shrink the company’s workforce — while Paramount Skydance Corp. axed 1,000 workers. Other companies cutting corporate jobs include Starbucks Corp., Delta Air Lines Inc., CarMax Inc., Rivian Automotive Inc. and Molson Coors Beverage Co., which cut about 9% of its salaried workforce.

The companies’ reasons vary. United Parcel Service Inc. said last month that it has culled its operational workforce — which includes delivery drivers and package car handlers — by 34,000, about 70% more than it previously projected earlier this year. The package handler cited increased use of automation, which has driven up productivity.

Others are focused on removing layers of management, reducing the hangover from the pandemic-fueled hiring bloat and protecting profit margins from the added costs of tariffs. While many expected increased levies to drive up prices, many employers have absorbed the price increases and instead chosen to cut costs from labor and other parts of their businesses.

Mounting job-cut announcements risk fueling concerns about the health of the labor market just as newly unemployed Americans are facing a diminished hiring environment. The figures could also be viewed at odds with Federal Reserve Chair Jerome Powell’s recent characterization that there’s only a “very gradual cooling” in the job market.

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon echoed Powell’s sentiment. He said headcount at the largest US bank will probably remain steady or rise as it continues to roll out artificial intelligence, if “we do a good job.” Dimon said the bank would redeploy workers whose jobs were impacted by the technology. AI will reduce human workloads in many roles, but “it will also create jobs,” he said in a recent interview with CNN.

Payrolls at US companies increased by 42,000 in October after two straight months of declines, signaling some stabilization while consistent with a general softening in labor demand, ADP Research data showed Wednesday.

Separate data out Thursday from Revelio Labs showed US overall employment fell about 9,000 in October, largely reflecting a decline in the government sector. Smaller decreases were noted at manufacturers, retailers and wholesalers, while education and health services led those industries increasing employment.

Data from the workforce intelligence firm also showed an increase in the number of employees who were issued layoff notices last month. Those figures are drawn from so-called WARN notices that require companies with at least 100 workers to issue advance notice of plans to lay off at least 50 employees.

Read the full article HERE.

- Gold rebounded as investors sought safety following a slump in global stocks due to concerns around elevated valuations.

- Spot bullion rose toward $4,000 an ounce, after falling almost 2% in the previous session as the US dollar strengthened.

- Gold rose 0.8% to $3,965.04 an ounce as of 10:28 a.m. in London.

Gold rebounded as investors sought safety following a slump in global stocks due to concerns around elevated valuations.

Spot bullion rose toward $4,000 an ounce, after falling almost 2% in the previous session as the US dollar strengthened. Treasuries also rallied, while global stocks extended their steepest drop in nearly a month in the previous session.

Gold’s drop on Tuesday came as a trio of Federal Reserve policymakers stopped short of supporting an additional interest-rate cut in December as they weighed competing risks from inflation and a softer labor market. Investors will have an opportunity to hear more viewpoints this week, including from St. Louis Fed President Alberto Musalem. Lower borrowing costs boost the appeal of gold relative to interest-bearing assets like bonds.

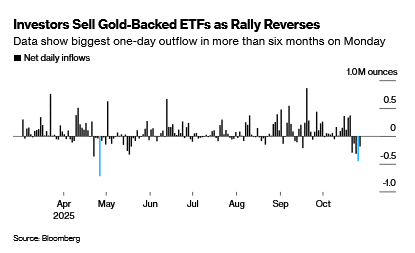

Gold is about 50% higher year-to-date, after prices touched a record last month before retracing some gains. The pullback — which followed a slew of signals that the ascent had been too rapid — was accompanied by withdrawals from bullion-backed exchange-traded funds. Traders are now trying to assess whether the metal’s drop has run its course.

“It should not be a big surprise to see the yellow metal consolidate in a lower, $3,800-to-$4,050-an-ounce trading range,” TD Securities strategist Bart Melek said in a note, citing factors including ambiguities over the outlook for Federal Reserve rate cuts, as well as concerns over retail buying in China.

Still, the factors that contributed to gold’s gains this year are still mostly intact, and elevated buying by global central banks and strong demand from private investors should send prices back up after the consolidation phase, he added.

“The tone during this time has shifted from exuberance to reflection, with traders reassessing how much of the 2025 narrative — rate cuts, fiscal stress, geopolitical hedging, and central bank demand — has already been priced in,” Ole Hansen, commodities strategist at Saxo Bank A/S wrote in a note.

Gold rose 0.8% to $3,965.04 an ounce as of 10:28 a.m. in London. The Bloomberg Dollar Spot Index was steady after closing at the highest level since mid-May. Silver was up 1.2%%, platinum was little changed, while palladium edged higher.

Read the full article HERE.

Key Points

- Cantor Fitzgerald analysts project the four major cloud providers will collectively spend $520 billion annually by the end of next year.

- Bank of America data indicates that capital spending by hyperscalers is consuming nearly all cash generated from their existing operations.

- Meta Platforms used a special-purpose vehicle to raise approximately $30 billion, mostly debt, for a Louisiana data center.

One of the many great scenes in The Big Short, which fictionalizes famed investor Michael Burry’s bet against the U.S. housing market, involves a tower of wooden blocks.

During a client pitch, a trader illustrating the risk of collateralized debt obligations unveils a Jenga tower that represents the mortgage bonds stuffed inside a CDO. It inevitably collapses, of course, both on screen and in real life.

A lot of skeptical investors are waiting for a similar implosion of the artificial-intelligence investment boom. The market value of the biggest tech stocks has reached eye-watering levels. The titanic levels of spending being committed to data-center projects simply aren’t generating revenue, let alone profits, in the earliest stage of the cycle.

Cantor Fitzgerald analysts estimate collective annual spending from the four major cloud providers: Microsoft, Google, Amazon.com and Oracle will reach $520 billion by the end of next year.

Bank of America data, meanwhile, suggests capital-spending plans of the biggest tech companies, the so-called hyperscalers, are now swallowing up nearly all of the cash their existing operations produce.

That could suggest AI companies “collectively may be reaching a limit on how much AI capex they are willing to fund purely from cash flows,” said BofA analyst Yuri Seliger.

And that could be why we are seeing a new development in AI financing that bears a striking resemblance to tools used to house a lot of the CDOs that brought the global financial system to its knees in the late 2000s: so-called special purpose vehicles.

SPVs effectively kept billions worth of housing debt off the balance sheets of the country’s biggest banks during the pre-crisis housing boom. That made it harder for investors to understand the risks involved, leaving them with little warning when it all went bad.

In October, Meta Platforms used an SPV called Beignet Investor LLC to raise around $30 billion, most of it debt, that will be used to build a data center in Louisiana. That keeps the debt raised off Meta’s balance sheet, but effectively tied to its broader business prospects.

The company didn’t immediately respond to a request for comment.

Elon Musk’s xAI is reportedly looking to raise $20 billion through an SPV-structured deal that will buy Nvidia processors and lease them back to the AI start-up. Nvidia CEO Jensen Huang said he was “delighted” to be a part of the project.

Cash flow might have been a consideration for Meta, given that around 65% of its current tally is going toward capital spending. The parent of Facebook told investors last week that it would see a “notably larger” capex increase in 2026.

Alphabet, on the other hand, reported third-quarter capex of around $24 billion, which was just under half of its operating cash flow for the period.

That healthy mix likely allowed the Google parent to tap the U.S. bond market for $15 billion on Monday. A portion of the sale matures in 50 years. A further $7 billion will be raised in Europe’s corporate debt market.

Meta has also been able to sell large amounts of debt in the traditional corporate bond market, and raised around $30 billion in October with the fifth-largest issue on record. Oracle sold $18 billion of debt in late September. Both sales drew solid demand from investors.

Dave Novosel, senior analyst at Gimme Credit, thinks the use of SPVs is likely more a reflection of the market having to cope with a big increase in new debt than concern over the health of big-tech balance sheets.

“The hyperscalers and other huge issuers of debt have incredibly strong credit profiles and therefore can easily borrow in the capital markets,” he told Barron’s.

Using an SPV, he said, not only keeps the debt separate but also isolates the risk of a particular project. It gives investors more choices in terms of where they can lend their money.

But it can also raise questions about transparency and market liquidity, given that the market for SPVS is far less active than traditional corporate bonds. Those issues appear more striking when paired with increasing concerns over megacap tech’s dominance of the equity markets, and the increasingly circular nature of AI spending among a handful of players.

OpenAI underscored the latter when it signed a $38 billion deal with Amazon to provide Nvidia chips for its computing needs on Monday.

The ChatGPT creator has now committed to spending around $1.5 trillion over the next decade. Its own estimates peg 2030 revenue at just under $175 billion.

If OpenAI opts to use off-balance sheet tools, as well as traditional debt markets, to fill that gap in financing, investors might start peeking under the hood of these vehicles to find out just how special they are.

And whether we have another Jenga tower to deal with.

Read the full article HERE.

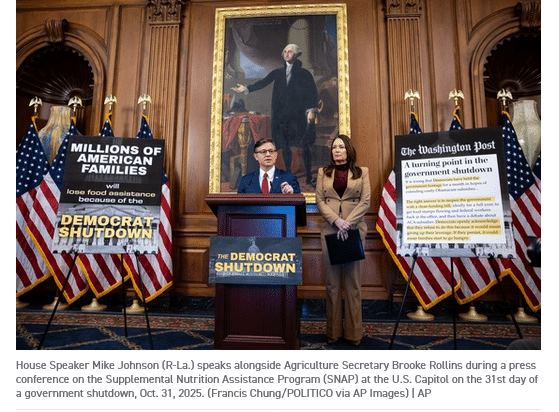

There’s no chance for Congress to resolve the shutdown and reopen the government before crossing the historic threshold Tuesday.

Congress is on track this week to break an unflattering record: presiding over the longest government shutdown in U.S. history.

The ongoing funding lapse will hit the 35-day mark Tuesday night, eclipsing the partial shutdown that ended in early 2019 and also occurred under President Donald Trump.

Bipartisan talks among rank-and-file senators are underway, which could thaw the weekslong freeze between the two parties. Lawmakers over the weekend were confronted with the grim reality that millions of Americans could lose SNAP food aid — as well as more closures of early education centers, shortages of air traffic controllers and first glimpses of higher health care premiums as Obamacare subsidies are set to expire.

But there’s little chance members of Congress will be able to cobble together a deal to reopen the government before their partisan stalemate clears a new milestone. Even if an agreement quickly materializes in the Senate, lawmakers aren’t scheduled to return to the Capitol until Monday night, and Speaker Mike Johnson has told House members they will get 48 hours notice before they need to be back in Washington to vote on any bill.

“Shameful, utterly shameful, that the Democrats are making history in this way,” Johnson said in an interview Friday. “I honestly did not believe they would have the audacity to inflict this much pain on the people and show no regard for it whatsoever.”

Tuesday is also Election Day in several states, with both parties closely watching the outcomes in the gubernatorial races in Virginia and New Jersey, as well as the mayoral contest in New York City and a congressional redistricting referendum in California. Some Republicans are betting their Democratic colleagues will be more willing to vote for a funding patch once those major political events are behind them.

“They’re going to wait till after the election on Tuesday and get their guy in New York elected — they’re going to get New Jersey. And then they’re looking for an exit ramp,” Sen. Markwayne Mullin (R-Okla.) told reporters last week. He was referring to Zohran Mamdani, the democratic socialist vying to run New York City, and Rep. Mikie Sherrill (D-N.J.), on the ballot to be New Jersey’s governor.

“They’re going to show they put up a good fight. They don’t want to do it before Tuesday. Because if they do it before Tuesday, then their base may not show up because it looks like they caved,” Mullin added.

Senate Majority Leader John Thune agreed: “Tuesday, that seems to be another inflection point and hopefully that frees some people up to be able to vote ‘yes.’”

Democrats reject the premise that they are holding out on a deal based on a political calculation.

“Over the last 30 days, we’ve said the same thing over and over and over again: We’ll sit down with Republicans anytime, anyplace, anywhere in order to reopen the government and act on a spending agreement that actually meets the needs of the American people,” House Minority Leader Hakeem Jeffries said at a news conference last week.

But Democrats have been increasingly in the hot seat during this standoff, forced to reckon with the blowback they got from their base back in March when Senate Minority Leader Chuck Schumer led a handful of his members in advancing GOP-backed legislation to avoid a shutdown. Schumer and others are now seeking a deal on health care and a path to a bipartisan funding framework before lending their votes to reopen the government.

Many Republican lawmakers are not convinced the shutdown will end so quickly.

“What I see is no off-ramp,” Sen. John Kennedy (R-La.) said late last week. “And I’ve heard all the rhetoric and the Democrats are getting restless and they’re going to crack any minute. … Chuck’s not going to let them agree on jack shit.”

Rep. Mark Takano (D-Calif.) said in an interview that Trump will play a pivotal role in what comes next in shutdown talks.

“The Republicans all take their cue from [Trump]. And ultimately, he’s got to say, ‘I want a deal.’ So a lot’s on him to bring people together,” Takano said. “He’s got to be part of the off-ramp.”

But Trump was overseas last week, only to return to the U.S. and immediately throw a wrench into fragile member-level discussions by posting a message on Truth Social demanding Senate Republicans eliminate the legislative filibuster to bypass Democratic opposition to the House-passed funding patch.

Trump’s recommendation for ending the shutdown wasn’t the type of involvement lawmakers of either party had in mind for the president. The Senate GOP likely doesn’t currently have the votes to change the chamber’s rules.

Setting the shutdown record is likely to become another talking point for each party to scorn the other with, but it’s a superlative that neither party wants to own, which could motivate lawmakers to hasten their pursuit of a deal.

Rep. Josh Gottheimer (D-N.J.) raised some eyebrows in his caucus last week by suggesting in a television interview that Thune offered Democrats a “fair deal” in saying he would allow a vote to extend expiring Affordable Care Act subsidies if the minority party voted to end the shutdown. And Rep. Adam Smith (D-Wash.) said Friday his party might need to “recalibrate” its position if Republicans remained unmoved.

“The point of this was not to blackmail the Republicans or to score political points on one issue or another. The point of this was to get to better policy. And if what we are doing with the shutdown isn’t getting us to better policy, then yeah, we recalibrate and we have a conversation,” Smith, the top Democrat on the House Armed Services Committee, said at a Council on Foreign Relations event.

This shutdown is also proving to be more painful than past ones — not only because of its length but because Congress didn’t get any full-year spending bills signed into law before thrusting the federal government into crisis.

In late 2018, when the last record-breaking shutdown began over whether to fund Trump’s border wall, lawmakers had already locked in funding for a number of agencies, including the Pentagon. That allowed some parts of the government to operate normally and limited the full impact of a lapse in appropriations.

In the coming days, lawmakers will have to weigh the full implications of allowing the shutdown to continue. While last week was filled with warnings of pain points ahead, some members of Congress believe this is the week where reality could set in.

Rep. Glenn Ivey (D-Md.) predicted a potential lapse in SNAP benefits could be a turning point.

“I think our expectation is that things are going to blow up one way or the other,” Ivey said. “When people get up and check their EBT card, it’s got zeros on it. I don’t know, it’s unbelievable.”

Read the full story HERE.

Summary

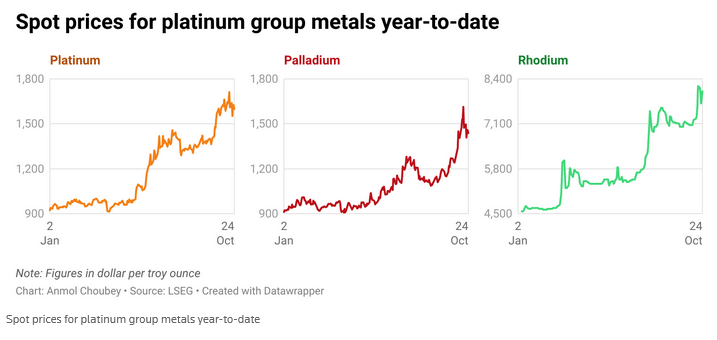

- Platinum seen averaging $1,249.50/oz in 2025, $1,550/oz in 2026

- Palladium seen averaging $1,106/oz in 2025, $1,262.50 in 2026

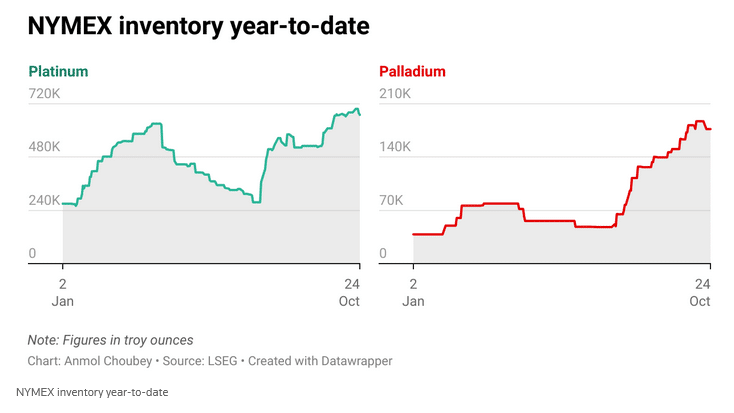

Analysts have sharply raised their price forecasts for platinum and palladium in 2026, citing tight mine supply, tariff uncertainty and rotation from investment demand for gold, as platinum nears its best yearly performance and palladium marks its best year since 2017.

Spot prices for platinum and its sister metal palladium are up about 76% and 56%, respectively, so far this year, as broader support from gold’s record-breaking rally coincided with outflows to U.S. stocks.

“We continue to expect platinum prices to test higher highs and remain deeply undersupplied in 2026,” said Standard Chartered analyst Suki Cooper.

The main factors for platinum were the potential launch of a futures contract in China, still-muted jewellery demand after Chinese fabricators increased their platinum stock, and outflows from platinum-backed exchange-traded funds helping to ease tight spot supply during periods of profit-taking, she added.

The median forecast from a survey of 30 analysts and traders was for platinum to average $1,550 a troy ounce in 2026, up from $1,272 predicted in a poll three months ago and an expected 2025 average price of $1,249.50.

Uncertainty about U.S. import tariffs have been a driver for platinum group metals this year, although more clarity is expected from a U.S. probe into potential new tariffs on imports of critical minerals, which the market is awaiting this month.

Palladium has another layer of worries, which are likely to extend to 2026, due to calls in the U.S. to consider a tariff on imports from major producer Russia.

For palladium, the median 2026 forecast in the Reuters’ poll was $1,262.50 an ounce, up from $1,100 in the previous poll and the 2025 expected average of $1,106.

Palladium prices had fallen for the previous four years on expectations that electric-vehicle takeup would reduce demand for the metal which is mainly used to clean exhausts in gasoline vehicles.

“Although there is some pushback in the uptake of electric vehicles, there is still a Damoclean sword hanging over this market,” StoneX analyst Rhona O’Connell said, referring to the possibility of the opposite still happening.

Read the full article HERE.

Key Points

- By a 10-2 vote, the central bank’s Federal Open Market Committee lowered its benchmark overnight borrowing rate to a range of 3.75%-4%.

- In addition to the rate move, the Fed announced that it would be ending the reduction of its asset purchases – a process known as quantitative tightening – on Dec 1.

- The statement reiterated concerns that policymakers have over the labor market, saying that “downside risks to employment rose in recent months.”

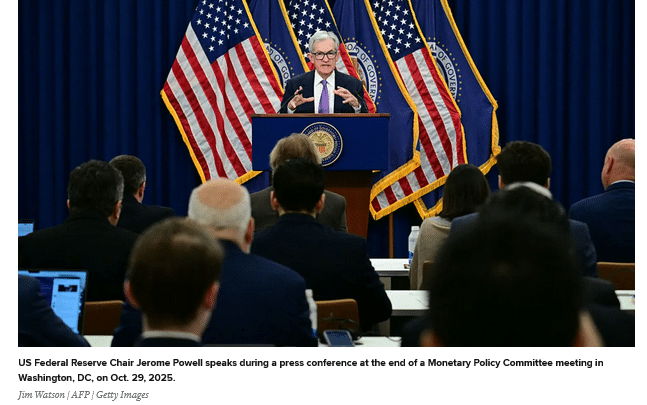

The Federal Reserve on Wednesday approved its second straight interest rate cut, though Chair Jerome Powell rattled markets when he threw doubt on whether another reduction is coming in December.

By a 10-2 vote, the central bank’s Federal Open Market Committee lowered its benchmark overnight borrowing rate to a range of 3.75%-4%. In addition to the rate move, the Fed announced that it would be ending the reduction of its asset purchases – a process known as quantitative tightening – on Dec 1.

Governor Stephen Miran again cast a dissenting vote, preferring the Fed move more quickly with a half-point cut. Kansas City Fed President Jeffrey Schmid joined Miran in dissenting but for the opposite reason – he preferred the Fed not cut at all. Miran is an appointee of President Donald Trump, who has pushed hard on the committee to lower rates quickly.

The rate also sets a benchmark for a variety of consumer products such as auto loans, mortgages and credit cards.

The post-meeting statement did not provide any direction on what the committee’s plans are for December. At the September meeting, officials indicated the likelihood of three total cuts this year. The Fed meets once more in December.

Powell, however, cautioned against assuming that a rate cut is a sure thing at the next meeting.

“In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December,” Powell said during his post-meeting news conference. “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

He later added that there is “a growing chorus” among the 19 Fed officials to “at least wait a cycle” before cutting again. Traders lowered odds for a December cut to 67% from 90% a day ago, according to the CME Group’s FedWatch.

Stocks, which had been higher after the initial decision was released, turned lower on the chair’s comments. Major averages slowly came back during the session with reporters.

The reduction came even though the Fed essentially has been flying blind lately on economic data.

Other than the consumer price index release last week, the government has suspended all data collection and reports, meaning such key measures as nonfarm payrolls, retail sales and a plethora of other macro data is unavailable.

In the post-meeting statement, the committee acknowledged the uncertainty accompanying the lack of data, qualifying the way it categorized broad economic conditions.

“Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments,” the statement said. “Inflation has moved up since earlier in the year and remains somewhat elevated.”

Each of those characterizations represented tweaks from the September statement. The most significant change was the view on broad economic activity. In September, the FOMC said activity had moderated.

The statement reiterated concerns that policymakers have over the labor market, saying that “downside risks to employment rose in recent months.”

Even before the shutdown, evidence had begun to build that while layoffs have been contained, the pace of hiring had flattened. At the same time, inflation has held considerably above the Fed’s 2% annual goal. The CPI report last week, released because of its importance to Social Security cost-of-living adjustments, showed the annual rate at 3%, pushed by higher energy costs as well as several items with direct or indirect links to Trump’s tariffs.

The Fed tries to strike a balance between full employment and stable prices. Officials lately, though, have said they see a slightly higher risk posed by the jobs picture. Along with the interest rate decision, the Fed said its process of reducing the amount of bonds it holds on the central bank’s $6.6 trillion balance sheet will end.

The program, also known as QT, had shaved some $2.3 trillion off the Fed’s portfolio of Treasurys and mortgage-backed securities. Instead of reinvesting maturing proceeds from the securities, the Fed has been allowing them to roll off the balance sheet at a limited level each month. However, recent signs of some tightening in short-term lending markets have raised concern that the roll-off has gone far enough.

An implementation note accompanying the decision indicated the Fed will be rolling proceeds from maturing mortgage securities into shorter-term bills.

Markets recently had begun anticipating that the Fed would end QT either in October or by the end of the year. The Fed expanded its holdings during the Covid crisis, pushing the balance sheet from just over $4 trillion to close to $9 trillion. Powell has said that while the Fed found it necessary to shrink its holdings, he did not foresee a return to pre-pandemic levels.

In fact, Evercore ISI analyst Krishna Guha said he could foresee a scenario where the Fed actually restarts the purchases early in 2026 for “organic growth purposes” as market conditions shift. The Fed rarely eases monetary policy during economic expansions and bull markets in stocks. Major averages, though volatile, have been posting a series of record highs, boosted by further gains in Big Tech stocks and a robust earnings season.

History has shown that the market continues to rise when the Fed does cut under such circumstances. However, easier policy also poses the risk of higher inflation, a condition that forced the Fed into a series of aggressive rate hikes.

Read the full article HERE.

- Gold staged a partial recovery after a three-day selloff, with dip-buyers returning ahead of an expected interest-rate cut by the Federal Reserve.

- Investors are penciling in a 25-basis-point reduction, although Fed Chair Jerome Powell is unlikely to offer much forward guidance, and lower borrowing costs tend to benefit non-interest bearing precious metals.

- Gold is still up about 50% this year, supported by central-bank buying and the so-called debasement trade, in which investors avoid sovereign debt and currencies to protect themselves from runaway budget deficits.

Gold staged a partial recovery after a three-day selloff, with dip-buyers returning ahead of an expected interest-rate cut by the Federal Reserve.

Bullion advanced toward $4,000 an ounce, having lost more than 4% over the previous three sessions. Investors are penciling in a 25-basis-point reduction, although Fed Chair Jerome Powell is unlikely to offer much forward guidance. Lower borrowing costs tend to benefit non-interest bearing precious metals.

Gold has retreated sharply following a torrid rally that drove prices to a record above $4,380 an ounce last week. Technical indicators had shown the ascent had run too far, too fast — a move that coincided with reduced demand for havens amid signs of progress in US-China trade relations.

With Donald Trump and Chinese counterpart Xi Jinping due to meet on Thursday, the US president talked up the prospects for their summit, telling reporters he expects that there will be “a very good outcome for our country and for the world.”

Even after gold’s recent pullback, the metal is still up about 50% this year, supported by central-bank buying and the so-called debasement trade, in which investors avoid sovereign debt and currencies to protect themselves from runaway budget deficits.

The surge had drawn institutional and retail buyers to gold-backed exchange-traded funds — although outflows this week have dented some of that support. Investors withdrew a net $1 billion from State Street’s SPDR Gold Shares on Monday, the most since April, according to data compiled by Bloomberg. The outflow came as total investor holdings of gold ETFs fell the most in six months.

“Gold’s role as a portfolio hedge against fiscal and policy uncertainty remains undiminished, though short-term exuberance has clearly given way to consolidation,” said Christopher Wong, a currency strategist at Oversea-Chinese Banking Corp. “If we manage to consolidate in this range of $3,920-$4,020 an ounce, then it may set the stage for base-building before the next leg higher.”

Gold’s rapid rise — and recent retreat — was a hot topic at the London Bullion Market Association’s precious metals conference in Kyoto, Japan, this week. The overall mood remained buoyant, with a survey of 106 attendees projecting that gold would trade at nearly $5,000 an ounce in a year’s time.

Spot gold rose 1.1% to $3,996.90 an ounce as of 7:22 a.m. in London. The Bloomberg Dollar Spot Index was up 0.1%. Silver increased almost 2%, while platinum and palladium advanced.

Read the full article HERE.

The Federal Reserve faces a pivotal moment. With a divided committee and an economic landscape transformed by postpandemic shifts, artificial intelligence, and political forces, its traditional guideposts to the economy have become unreliable.

The neutral rate—the interest rate at which monetary policy neither stimulates nor restrains economic growth—is one such indicator that is becoming more and more elusive and irrelevant. Rather than remain fixated on it, the Fed should prioritize “doing no harm”: setting policy that avoids stalling growth or reigniting inflation.

The neutral rate, or r*, is the real (inflation-adjusted) interest rate where inflation is at target and monetary policy is neither expansionary nor contractionary. Swedish economist Knut Wicksell introduced the concept in the early 20th century to explain the business cycle. He argued that market rates below the neutral rate would expand credit and asset prices, eventually reversing as returns fell below capital costs.

In 1993, John B. Taylor formalized that concept with the “Taylor rule,” which posited that policy rates below the neutral rate would spur inflation, signaling the Fed to hike rates.

Before the global financial crisis, the Fed believed that inflation would clearly signal that the policy rate was below neutral. This is one reason for the Fed’s nonchalance toward housing market risks in the early 2000s. Price levels were muted heading into the crisis.

The Fed’s views evolved postcrisis. They returned to Wicksell’s original interpretation that the financial markets would do a better job than inflation in assessing whether policy was restrictive. This explains the central bank’s abrupt 75 basis-point cut in 2019, following a steep stock market selloff in the late 2018, as well as its aggressive actions during Covid-19.

Financial conditions historically helped gauge policy restrictiveness. But today, these correlations have broken down. Large tech stocks and AI enthusiasm drive U.S. market performance more than interest rates. Hyperscalers’ AI investment will continue—regardless of whether rates are 2% or 5%—making the S&P 500 less indicative of the economic cycle.

Inflation is also no longer a clear signal. The outlook for prices depends on a complex mix of monetary policy, money supply, tariffs, currency movements, immigration, housing supply, deregulation, government spending, and productivity. The combined effect is nearly impossible to predict. High policy rates have affected unemployment by slowing labor demand. Going forward, however, AI-driven job losses may have a greater impact than rates, and near-term employment prospects hinge on immigration policy, which is beyond the Fed’s control.

Given these uncertainties, Fed Chair Jerome Powell advocates for a data-dependent approach. He also wants more focus on inflation, which remains further from the Fed’s target than employment does. Yet, a “wait and see” approach risks a late response to slowing growth or increasing inflation.

The newest Fed governor, Stephen Miran, on the other hand, argues the administration’s policies will lower the neutral rate, justifying a more aggressive cutting cycle.

At its September meeting, Powell, Miran, and the rest of the Federal Open Market Committee members disagreed on the path for interest rates. The divergence stemmed from differing views on how restrictive current policy is. Powell described rates as “modestly restrictive,” while Miran called them “very restrictive.” In the end, Miran strayed from the group and voted for a larger cut of 50 basis points.

Underlying their disagreement is the debate over the neutral rate. But with the neutral rate so difficult to estimate these days, basing policy on it is too risky.

A third path is needed: The Fed should keep interest rates at the lowest real level that supports both stable inflation and maximum employment. This means reducing policy rates, which are dampening hiring from small businesses reliant on funding tied to short-term rates.

Cuts should be measured, however. Aggressive reductions could further ignite asset prices and stall the Fed’s already slow progress on bringing down inflation. The wealth effect from high asset prices has contributed to sticky services inflation, with nearly half of consumption driven by the top 10% income bracket. Continued upward pressure on prices could further profligacy from wealthy consumers.

Ironically, the inflation spike from 2021 to early 2023 may explain why the Fed’s median policy rate and inflation forecasts already align with a “do no harm” approach. The rate is forecast to be 3.4% at the end of 2026, with core inflation at 2.6%. That implies just 75 basis points of cuts over the next 15 months. Investors have crowded into short-dated credit securities, betting on more aggressive easing and strong equity momentum. If the Fed cuts more gradually than markets expect, these investors may be disappointed.

Monetary policy is always uncertain. But AI and government policies are further complicating the signals the Fed uses to judge restrictiveness. Rather than trying to pinpoint the “right” neutral rate, the Fed should set its policy rate to minimize harm—supporting growth and employment, without reigniting inflation.

Read the full article HERE.

- The question of whether we are in an AI bubble is overshadowed by the concern of low credit spreads, which suggest a low-risk environment despite market uncertainty.

- Low credit spreads may indicate that markets are underpricing risk, which could lead to a debt crisis where payments aren’t made and firms go bankrupt.

- The demand for risky bonds is currently high, but this can change, and when it does, the price of risk will adjust, potentially leading to a crisis.

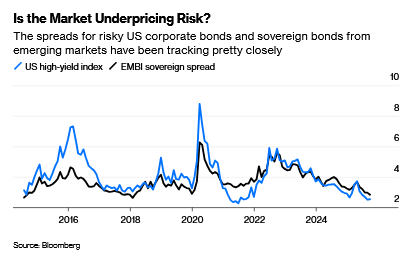

The question of the moment in markets is whether we are in an AI bubble, as stocks seem awfully expensive amid hopes that artificial intelligence will transform the economy. But there is another curiosity that is far more concerning: low credit spreads. That suggests a low-risk environment — which describes precisely nothing about this market.

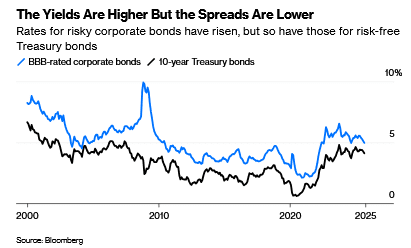

The credit spread is a measure of the difference in yield between high- and low-risk bonds. Risky debt is normally low-rated corporate or emerging-market bonds. Both tend to trade at a much higher rate because there is a higher risk of default or future volatility. And yet spreads on risky corporate debt are low by historic standards.

That means one of two things: Either these bonds aren’t so risky — or markets are underpricing risk. That second scenario never ends well.

To be sure, there are reasons not to worry, or to worry for a different reason. The yields on these bonds are higher than they were several years ago; it’s the difference between them and the low-risk bonds that is smaller. And that’s because risk-free bond yields, such as a 10-year Treasury, are much higher.

This could be because risk-free bonds aren’t looking so safe anymore. Not only is the US government taking on a lot of debt, but the future of trade, inflation and the dollar looks uncertain. All of that increases bond yields. It’s also possible that the difference between risky and risk-free just isn’t as meaningful as it used to be, so the credit spread isn’t the measure of risk that it once was.

Another potential explanation for the low credit spread is the rise of private credit. As credit-cycle finance guru Edward Altman has noted, the growing size of the private credit market means that much more capital is chasing risky bonds, which is a factor in decreasing spreads. It could also be that firms that are less well suited for public markets may be seeking credit from private lenders, leaving relatively stronger borrowers. A big influx of foreign buyers of debt, seeking higher yields, has also added to demand.

Yet none of this is entirely reassuring. First, while spreads may be low, firms face a higher cost of borrowing, and many borrowers have not yet had to refinance. When their debt reaches maturity in the next two to three years, they will face higher debt payments. Weaker firms will have a harder time servicing their debt and risk bankruptcy.

In fact, bankruptcy rates and leverage are already rising. Some companies with private loans can’t make their debt payments and are rolling them into their principal. The market will eventually have to come to terms with the fact that the rates of the 2010s aren’t coming back, possibly triggering more bankruptcies.

Another indicator is that credit spreads and the VIX, a measure of stock risk, have slightly diverged recently. The VIX is now increasing more than spreads.

All this suggests that risk may be underpriced — and all things considered, underpriced risk in debt markets is more dangerous than a stock-market bubble. When equities crash, people lose money. In a debt crisis, payments aren’t made, collateral becomes worthless, and firms go bankrupt.

A big reason that spreads are so low is the same reason that the price of gold went up: There is a lot of demand and a limited supply. As long as that is true, the price of risk will continue not to make sense, encouraging even more leverage.

This can go on for a while — but not forever. One day the demand for risky bonds will fall, perhaps because dollar-denominated assets become less attractive, or a wave of bankruptcies scares investors. And then things will get pretty gnarly pretty fast.

Read the full article HERE.