Companies are freezing hiring and investment to deal with shifting tariff policies. ‘Even Trump doesn’t know what Trump will do next.’

Key Points

- U.S. economy faces uncertainty because of shifting trade policies and tariffs, affecting business planning and investments.

- Despite steady job growth and low unemployment, businesses express concerns over trade policy uncertainty.

- Consumer spending and potential financial-market shocks are key factors determining if the U.S. economy bends or breaks.

The U.S. economy, which weathered false recession alarms in 2023 and 2024, is entering another uncomfortable summer.

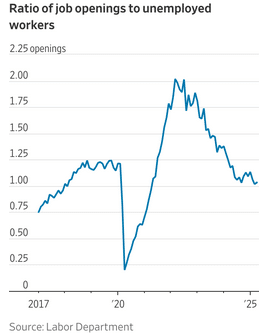

Job growth held steady in May, with the economy adding 139,000 jobs. The unemployment rate has stayed in a tight range, between 4% and 4.2%, over the past year.

But there are cracks beneath the surface. Businesses are warning that constantly shifting trade policies are interfering with their ability to plan for the future, leading to hiring and investment freezes.

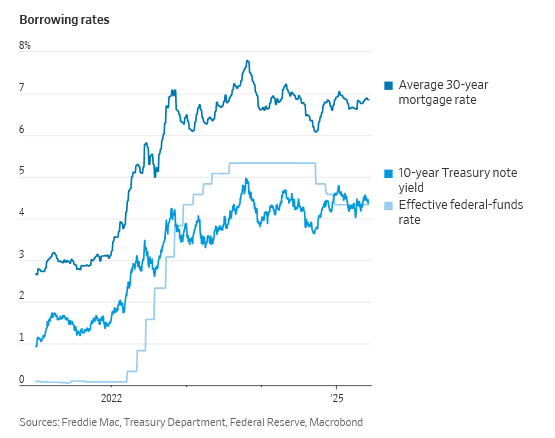

Policy uncertainty has unfolded against the backdrop of an economy with slower job growth and a cooling housing market. Compared with last year, the Federal Reserve is more reluctant to cut interest rates because officials are worried about new inflation risks.

John Starr, the owner of UltraSource, an importer and manufacturer of meat-processing technology in Kansas City, Mo., said he is hunkering down—no hiring, no more capital spending—until he has clarity on tariffs.

The company is waiting for suppliers in Europe to finish work on $20 million in orders it placed before 10% tariffs took effect on April 9. That means he faces a $2 million levy if tariffs stay at that level.

“How am I supposed to pay this?” said Starr, a third-generation owner of the company. “That could wipe out profits for a year.”

Whether the economy again bends, rather than breaks, turns on how the U.S. consumer handles the latest curveball—this time from President Trump’s desire to reorder America’s trading relationships and reduce reliance on imported goods. For months, the president has announced one large tariff increase after another, at times wavering from escalation to temporary resolution.

“Where this goes all depends on what Trump decides to do next, and candidly, even Trump doesn’t know what Trump will do next,” said Christopher Thornberg, founding partner at Beacon Economics in Los Angeles. “So it’s almost impossible to see where this thing is heading.”

Economists largely agree that for the U.S. economy to slide into recession, the American consumer needs to falter.

“As long as the consumer is doing OK, it’s not going to change our world,” said Ric Campo, chief executive of Camden Property Trust, a Houston-based developer and owner of 58,000 apartment homes.

Most economists think the prospects of a recession are higher than they were at the beginning of the year but lower than in April and early May, when tariffs on China had been increased by 145%.

The U.S. agreed to roll back the tariff increase to 30% last month. Most other nations face 10% tariff increases, with higher rates on dozens of countries paused until early July.

Three risks loom large.

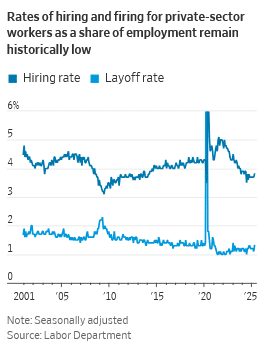

• First, the U.S. labor market has been in an uneasy equilibrium where companies aren’t hiring but are reluctant to fire workers that they hustled to find three or four years ago. Like a beach ball that shoots skyward after being held underwater, joblessness can quickly jump once companies decide demand is too soft to keep those workers.

“It starts with one large firm. Then competitors might say, ‘Well, listen, we have to do the same,’ ” said Gregory Daco, chief economist at consulting firm EY.

Bill Hutton, president of Titan Steel, a Baltimore-based distributor and processor of mostly imported steel for products such as paint cans, said he is going to “err on the side of caution” when it comes to reducing the size of his workforce. Having worked so hard to staff up, he said, he is “very, very leery of making assumptions that, ‘Oh, we can dial up or down our workforce at a moment’s notice.’ ”

• Second, consumers could finally push back against rising costs, forcing companies to tighten their belts.

Delinquency rates on consumer debt have been on the rise for a year, raising fears that deteriorating finances for low-income borrowers could lead to a more pronounced slowdown in consumer spending.

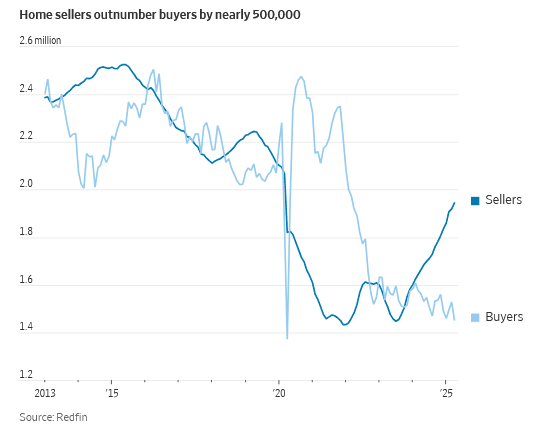

For the housing market, the spring sales season has been a bust. The U.S. market now has nearly 500,000 more sellers than buyers, according to real-estate brokerage Redfin. That is the largest gap since its tally began in 2013. Home prices could fall 1% this year, said Redfin economist Chen Zhao.

“The market has been at rock bottom for the last 2½ years and there was some hope that we’d get a little bit of a turnaround this year. And it’s just actually been worse than expected,” said Zhao.

• Third, financial-market shocks or abrupt sentiment changes remain a wild card. The Fed reduced short-term interest rates by 1 percentage point last year, providing a measure of relief to borrowers with credit cards or variable-rate bank loans.

Officials hit pause on rate cuts this year amid concerns that tariffs might create new inflation risks. Longer-term borrowing rates, which aren’t set by the Fed and which influence many borrowing costs such as mortgages, have been elevated as investors around the world pay more attention to how governments will finance rising deficits in the years to come.

Any sudden and sustained rise in borrowing costs could spill over to the stock market, hurting companies’ earnings and making stocks less attractive. Lofty asset prices have supported business investment and high-income consumer spending.

For many companies, the uncertainty triggered by Trump’s sudden and seemingly arbitrary announcements of tariffs has upended the outlook for sales this year.

Starr, at UltraSource, orders equipment that has a lead time measured in months. Because those products are made to each customer’s specifications, Starr can’t resell them if clients refuse to eat the cost of the tariff.

“I have to take action now,” Starr said. “We’re going to be very careful about any cash expenditure just because we need that cash to pay the tariff.”

White House officials have said they are confident the president’s approach will lead to better trading relationships. “In order to get another country to eat the burden of the tariffs, we have to have a credible threat to move our supply chains across the border…It can take some time to make that threat credible,” Stephen Miran, chairman of the president’s Council of Economic Advisers, said in an interview.

Miran said he couldn’t produce a forecast for inflation this year because “we’re still waiting for policy details to be fully fleshed out right now.” He also said businesses would benefit from a tax-cut package moving through Congress.

Starr, who said he has already racked up $300,000 in unanticipated expenses because of tariffs, said the prospect of business tax cuts is of little use if his profits are zeroed out from tariffs. He said he doesn’t object to paying a 20% tariff on prospective orders as long as he has certainty the duty won’t suddenly change after he has negotiated purchase orders with customers and vendors.

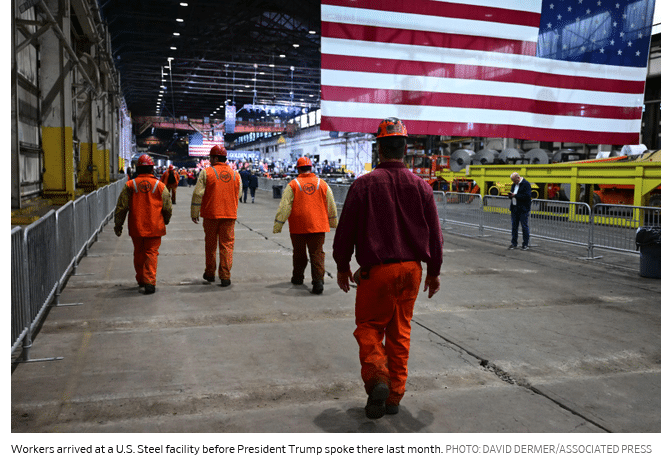

Steel and aluminum tariffs, which Trump this past week raised to 50% from 25%, could boost domestic metal producers while squeezing profits for carmakers, can manufacturers, and companies such as Titan Steel. Hutton, the steel company’s president, said customers have been understanding about accepting some price increases because his competitors have also had to raise prices.

“It feels like we’re muddling through,” he said. “Nobody—neither us, nor our customers, nor our overseas supplier—is in any position to do any long-term thinking.”

The Fed aggressively raised rates in 2022 and 2023 to combat inflation. But the U.S. economy was insulated because many households and businesses had already refinanced at ultralow rates during the pandemic. Later, the economy benefited from an unexpected boom in capital spending on artificial intelligence.

Any pullback could be abrupt. “It’s very rare that you have a technology shock of this sort that doesn’t lead to overbuilding,” said Jason Thomas, chief economist at private-equity manager Carlyle Group.

Some companies have held back from raising prices now until they can see how tariffs settle out. “They just said, ‘We cannot take the risk of souring relations with our customers, with our suppliers, over a policy that in two months’ time may not even be in place,’” Thomas said.

He expects businesses eventually will have to pass along some cost increases, however, because they will have depleted inventories acquired at pretariff rates.

One tailwind—recent declines in energy prices—could help offset some of the inflationary impulses from tariffs.

While the president often gets undue credit for what goes right or wrong in the economy, this time could be an exception.

“The economy has a lot of momentum, and so if Trump truly backs off on tariffs and just calms down, you could see this expansion going another two, three years, honestly,” said Thornberg of Beacon Economics. “Then again, if he keeps rocking the boat, you can blow it up by the beginning of next year.”

Read the full article HERE.

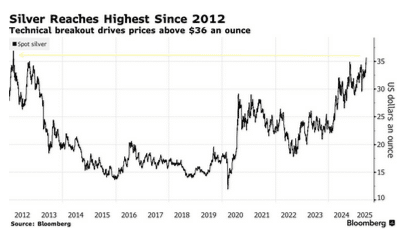

Silver extended gains to 13-year highs and platinum reached the highest since early 2022, signaling growing investor appetite for precious metals used in key industries.

Spot prices for both metals continued to rally on Friday after spikes of more than 4% in the previous session. Gold edged higher at a slower pace.

The metals were aided by technical momentum as well as improving fundamentals, with a strong appetite for physical silver in India and resurgent Chinese platinum demand reinforcing the rallies, according to a note by Nicky Shiels, head of metals strategy at Geneva-based MKS PAMP SA.

Silver and platinum tend to trade in tandem with gold, which is seen as a haven in times of geopolitical uncertainty. Gold is up 28% this year as an expanding US-led tariff war boosted its safety appeal and central banks maintained elevated levels of buying.

Silver and platinum had been lagging behind, but they are now catching up, with year-to-date gains of 25% and 28%, respectively. Both are driven by the ebbs and flows of industrial demand.

Silver is a key input into photovoltaic solar panels, while platinum is used in catalytic converters in combustion engines and laboratory equipment. Both markets are heading for a deficit this year, following several years where demand outstripped supply.

Holding above $35 an ounce remains a “critical inflection point” for silver and, if sustained, should reignite retail interest, Shiels said. Meanwhile, a potential renewal in demand for platinum-backed exchange-traded funds could produce a speculative rally, given sticky and elevated lease rates indicate the market is tightening, she said.

Platinum ETF holdings are showing signs of picking up, and have expanded more than 3% since mid-May, according to data compiled by Bloomberg. Inflows into silver-backed ETFs have continued to grow since early February, with holdings up 8%.

Palladium also benefited from growing positive sentiment across the precious metals complex, climbing as much as 2% on Friday.

Spot silver rose 1.6% to $36.22 an ounce as of 9:50 a.m. in London. Platinum gained 2.1%, while gold edged 0.4% higher. The Bloomberg Dollar Spot Index was little changed.

Investors are looking ahead to a key US jobs report due later on Friday, following an unexpected jump in unemployment claims that boosted bets the Federal Reserve will cut rates at least twice this year. Lower borrowing costs tend to benefit gold and other precious metals, as they don’t pay interest.

Read the full article HERE.

Gold held its ground on Thursday as investors looked forward to U.S. non-farm payrolls data due later this week to assess the U.S. interest rate path, while silver prices rose above the key $35 per ounce level for the first time since October 2012.

“I would say that the path of least resistance remains to the upside, despite today’s sort of flat mode for gold trading. But I think this is more due to traders being in wait-and-see mode ahead of non-farm payrolls,” said Ricardo Evangelista, senior analyst at brokerage firm ActivTrades.

Wednesday’s ADP National Employment Report revealed U.S. private payrolls increased far less than expected in May. U.S. President Donald Trump on Wednesday called for Fed Chair Jerome Powell to lower interest rates.

“I think that a weakening in the U.S. labor market will increase bets on a dovish Fed, so on the Fed cutting interest rates, (which) would be positive for gold,” Evangelista added.

Gold, a safe-haven asset during times of political and economic uncertainty, tends to thrive in a low-interest-rate environment.

Meanwhile, spot silver jumped 2.5% to $35.83 per ounce, its highest level since February 2012.

Silver’s “recent underperformance against gold because of economic concerns, given that 70% of silver usage is industrial, it looks that there could be some ratio trading going on now that it has dipped below the 100 level,” StoneX analyst Rhona O’Connell said.

The gold-silver ratio, denoting how many ounces of silver one ounce of gold can buy, is used by the market to gauge future trends as it indicates silver’s current performance against its historical correlation with gold.

Platinum rose 3.6% to $1,123.88, its highest level since March 2022, and palladium was up 1.8% at $1,018.38.

“Tangible assets with limited supply such as gold, silver, platinum and copper should be part of a broad portfolio in order to mitigate any economic fallout from geopolitical events, government mismanagement of debt and rising inflation threat” said Ole Hansen, head of commodity strategy at Saxo Bank.

Trump on Wednesday said the nation’s debt ceiling should be eliminated, saying he agreed with Democratic Senator Elizabeth Warren’s view on the subject.

Read the full article HERE.

If the US dollar is no longer a cast-iron reserve asset, then where can you turn?

The remonetisation of gold

When I last wrote about gold about six weeks ago, I noted that it could probably do with a breather, having burst through the $3,300 an ounce level.

It promptly went on to $3,400 an ounce — twice — then went back down to below $3,200 as investors grew a bit more optimistic about the staying power of Trump’s tariffs, what with him doing a deal with the UK.

However, gold has since rebounded pretty sharply and looks like it may challenge $3,400 again. This cannot yet be described as a breather or a lull.

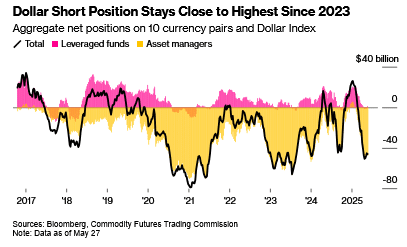

So what’s going on now? There’s a bit of US dollar weakness in there — the dollar had a bit of a rally in early May but (as measured by the Bloomberg dollar spot index) is now near the weakest it’s been since 2023.

But it’s not just dollar weakness. Silver, gold miners, and platinum (a precious, but not monetary, metal) have all started to play catch-up with gold in the last month or so. If anything, it feels as if the theme is broadening out, rather than calming down.

When the Covid-era inflation peaked around 2022 and central banks were furiously jacking up interest rates, slamming the stable doors shut while the horses galloped gaily around the paddocks, theory suggested that the good times were over for gold.

Gold doesn’t like rising “real” interest rates, was the basic argument, and one that had been a decent explanation for gold’s behaviour throughout the post-2008 period.

However, that’s not really what happened. Gold did hit a bottom in 2022, but it had a pretty punchy 2023, and then a stellar 2024, which has basically carried on into 2025. This is not because retail investors have been piling in.

Gold is Becoming a Vital Reserve Asset Again

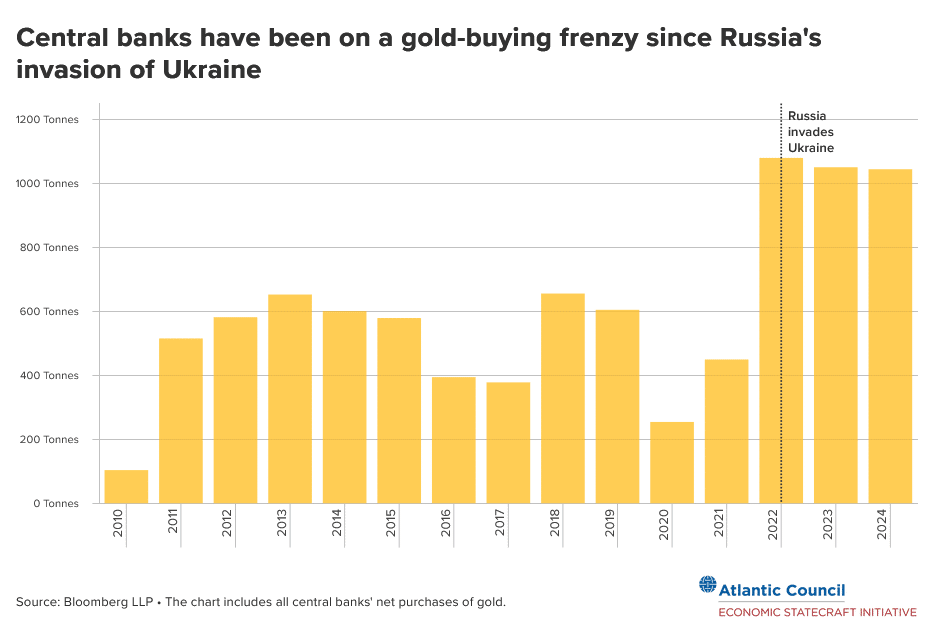

No, the main culprit then — and as it turns out, now — appears to be central banks. Analysts at Goldman Sachs Group Inc. reckon they are buying about 80 metric tons of the stuff every month, mostly in secret (for more, see this Bloomberg report).

Why? Here’s a quote from the same piece that sums it up. “Gold is the safest reserve asset,” said Adam Glapinski, governor of the National Bank of Poland. “It is free from direct links to the economic policy of any country, resistant to crises and retains its real value in the long term.”

The idea of gold regaining its place as not just a respectable, but a desirable, reserve asset among central banks is a shift. And it’s an understandable one.

The US dollar standard replaced the gold standard because it had the advantage of being reliable. Broadly speaking, the US made the rules, but it would treat all dollar users in the same way.

That has changed. Use of and access to the US dollar system is now contingent on a number of things, the most obvious of which is, you can’t be an enemy of the US. The overt weaponization of the US dollar is a relatively recent phenomenon which became far more obvious with Russia’s invasion of Ukraine.

The problem is, it’s not just US enemies who need to be wary. Under Donald Trump, the US is also taking its allies to task. Issuing the world’s reserve currency might be an “exorbitant privilege” but it’s not cost-free, and as far as Trump’s concerned, it’s time to call in the bill.

Increasingly, US political policy seems to be similar to the business strategy of a maturing tech company. Having built a network of customers by offering a decent service at a negligible or non-existent price, it’s putting up its subscription fee on the assumption that there is no other alternative. That’s a bold bet, to put it one way.

Gold: “Hot But Not Red Hot”

Note by the way that the quote above is from the central bank of Poland. It’s not a major world central bank, but nor is it the central bank of a country which is ever likely to find itself on the wrong side of the global world order (not the current one, anyway).

It’s just another sign that the concern about how welcome foreign capital is in the US, is real. And that’s before we see whether the latest “revenge tax” passes the Senate or not.

Charlie Morris at ByteTree tends to be my first port of call for a sober yet non-sceptical voice on all things precious metal and crypto related. As far as he’s concerned (or at least was two weeks ago when his most recent gold report came out), gold is “hot but not red hot”.

“This will be over when gold is widely owned by investors, budgets are balanced, and there is an outbreak of geopolitical stability.” So not any day soon, it appears.

Read the full article HERE.

President Donald Trump’s rapid tariff rollout has slowed U.S. imports to a trickle, weighed on global growth prospects, and rekindled inflation concerns.

It has also, in part, led to the worst start to the year for the U.S. dollar on record, according to Dow Jones Market Data.

The 8.4% slump over the first five months of the year, in fact, has the U.S. dollar index which tracks the greenback against a basket of six global currencies, trading near to the lowest levels since the spring of 2022.

Bank of America calls foreign exchange rates the most important price in an open economy, noting they act as both an asset class as well as a “powerful transmission mechanism of macro policies.”

The signal currently emanating from that particular tower, however, has the potential to undermine the greenback even further.

Buried deep within the federal tax and spending bill passed last week by House lawmakers and currently being marked-up by the Senate, is section 899. Dubbed the “revenge tax,” the new rule would allow the government to apply new taxes on foreign investment from countries deemed to have unfair or discriminatory tax schedules of their own.

That could put investors from Europe, for example, at risk of having to pay extra fees when repatriating capital gains, dividends, or U.S. Treasury bond coupon payments. Europe’s digital services taxes on U.S. tech giants has been a keen focus of the Trump administration’s ire and an oft-cited example of the bloc’s non-tariff barriers.

“This potential power play against foreign holdings of US-based assets could eventually slow interest in recycling surpluses into U.S. capital markets,” said John Hardy, global head of macro strategy at Saxo Bank. “That’s obviously dollar-negative in flow terms on major players looking for alternatives to U.S. assets.”

Some of those players are already on the move. The euro, the heaviest weight against the dollar in global foreign exchange markets, is up 11% against the greenback this year. That is despite a much weaker economy and a central bank that has cut rates twice this year, and will likely do so again Thursday in Frankfurt.

Japan’s yen +0.83%, which pays virtually no interest on short-term investments, has gained 9%. The British poundGBPUSD-0.33%, despite Bank of England rate cuts and a slowing economy, is up 8%.

Trump’s latest moves on tariffs, which include a steepened 50% levy on steel and aluminum imports and a fresh attack on China’s alleged violation of a trade truce reached in Geneva last month, are also heaping renewed pressure on the bruised greenback.

“A shift to a more confrontational stance on trade between the U.S. and China (and) any early end to the deal, which lasts until Aug. 12, would hit risk assets and the dollar again,” said ING’s global head of markets Chris Turner.

U.S. exporters might enjoy the added advantage of a weaker dollar, and companies with overseas profits will find them cheaper to repatriate as the greenback slides. But the broader effect could be chilling.

America’s global trade deficit is also responsible for attracting billions in domestic investment from overseas, driving stock prices higher, Treasury bond yields lower and providing longer-term support for the greenback.

And when the country’s fiscal position is weakening and its overall debt levels are forecast by the Congressional Budget Office to top $50 trillion by the middle of the next decade, keeping those investments flowing is crucial.

Read the full article HERE.

Wall Street banks are reinforcing their calls that the dollar will weaken further, hit by interest-rate cuts, slowing economic growth and President Donald Trump’s trade and tax policies.

Morgan Stanley said the greenback will tumble to levels last seen during the Covid-19 pandemic by the middle of next year, while JPMorgan Chase & Co. remains bearish on the US currency. Goldman Sachs Group Inc. said Washington’s efforts to explore alternative revenue sources — should tariffs be impeded — may be even more negative for the dollar.

The dollar fell against all its Group-of-10 peers on Monday amid a flare-up in global trade tensions. The Bloomberg Dollar Spot Index dropped 0.5%, extending its decline since the start of April and nearing its weakest level since July 2023.

“We think rates and currency markets have embarked on sizeable trends that will be sustained — taking the US dollar much lower and yield curves much steeper — after two years of swing trading within wide ranges,” Morgan Stanley strategists including Matthew Hornbach wrote in a May 31 note.

The bank forecasts the US Dollar Index will fall about 9% to hit 91 by around this time next year.

Trump’s trade policies have dented sentiment on US assets and triggered a re-think on the world’s reliance on the greenback. Still, the bearishness is far from historical extremes, underscoring the potential for more dollar weakness ahead, Commodity Futures Trading Commission data showed.

JPMorgan strategists led by Meera Chandan reinforced their negative view for the dollar last week, instead recommending bets on the yen, euro and Australian dollar. Morgan Stanley also listed the euro and the yen among the biggest winners from the greenback’s slide, along with the Swiss franc.

The euro climbed to a more than five-week high at $1.1437 on Monday and Morgan Stanley sees it rising to around $1.25 next year. The bank also said the pound may advance from $1.35 to $1.45, aided by “high carry” — the return investors can get from holding the currency — and the UK’s low trade tension risks. The yen may strengthen to 130 from 143, the analysts added.

Morgan Stanley also said the 10-year US Treasury yield will reach 4% by the end of this year, and stage a much larger decline next year as the Federal Reserve delivers 175 basis points of interest-rate cuts. The yield was up four basis points on Monday to 4.44%.

Investors are looking to a slew of US labor-market indicators this week, including the May employment report, for help in determining the next shifts in Fed policy and its implications for the dollar. They will also closely follow any developments on trade negotiations after China and the US accused each other of violating a deal concluded last month.

Tax Risk

For Goldman Sachs, investors are particularly focused on a potential change to US tax rates on foreign individuals and companies. The measure is buried deep in the tax-and-spending bill that Trump is muscling through Congress, and it calls for, among other things, higher taxes on passive income — such as interest and dividends — earned by investors who are potentially sitting on trillions in American assets.

“Even if the application is relatively narrow, such a tool would exacerbate concerns about risks of US investments, at a time when investors are already looking at shifting cross-asset correlations as a reason to seek greater diversification away from US assets,” strategists including Kamakshya Trivedi and Michael Cahill wrote in a note.

In a separate report, Goldman Sachs strategists said their models suggest the dollar is about 15% overvalued and therefore it has further to fall. The decline will likely be driven by reallocation and repricing of global assets, they added.

Read the full article HERE.

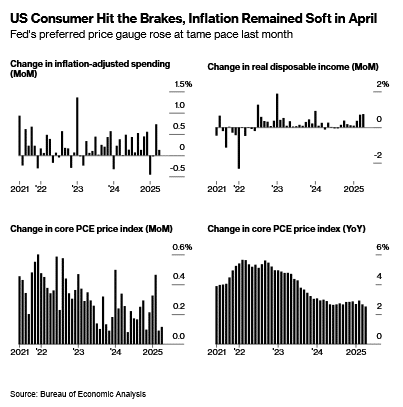

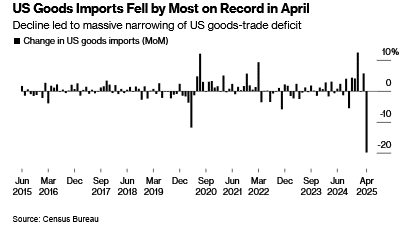

US consumers hit the brakes in April while goods imports plummeted by a record as companies adjusted to higher tariffs.

Inflation-adjusted personal spending rose 0.1% after rising 0.7% a month earlier, Bureau of Economic Analysis data showed Friday. Separate data showed an almost 20% slump in imports, leading to a massive narrowing in the US merchandise-trade deficit in April.

Meanwhile, the Federal Reserve’s preferred price gauge remained tame. The personal consumption expenditures price index, excluding food and energy, increased 0.1% from a month earlier. Compared with a year earlier, the so-called core inflation gauge rose 2.5% from April 2024 — the smallest annual advance in more than four years.

The data offer a snapshot of the economy during a month when the Trump administration raised tariffs on China goods to 145%, roiling stock markets and prompting companies to halt orders for imported goods. The figures reflect an undercurrent of anxiety among many American consumers about the economy after the weakest quarter for spending in nearly two years. Higher duties on imports had yet to show up more broadly in higher goods prices, as sentiment slumped and the outlook for personal finances stood at a record low.

Levies have since come down after the US and China agreed to a temporary drop in tariffs on their respective goods while the two countries negotiate a deal. It may have led some importers to resume shipments in May, but the constant state of flux in trade policy has since fueled further uncertainty. This week a US court issued a ruling that blocks many of the import taxes, and on Friday President Donald Trump accused China of violating an agreement with the US to ease tariffs, ratcheting up tensions between the world’s two largest economies.

Meanwhile, Fed policymakers will likely keep interest rates unchanged for the foreseeable future until they get more clarity on the impact of tariffs not only on prices but also on other pillars of the economy like the labor market and consumer spending.

The modest rise in April spending reflected an increase in services that more than offset a decline in durable goods outlays.

Economists are paying close attention to the degree to which companies are passing through higher import duties to consumers. A measure of goods inflation that excludes food and energy climbed 0.3%.

While many companies have so far been absorbing or offsetting much of the hit from tariffs, retailers including Walmart Inc. and Macy’s Inc. have indicated Americans will start seeing price hikes soon.

Services Costs

Core services prices — a closely watched category that strips out housing and energy — were little changed. That was the tamest in five years.

According to minutes of the Fed’s May meeting, released earlier this week, central bank staffers marked down their expectations for economic growth in 2025 and 2026, reflecting the announced trade policies.

And while job growth has shifted into a lower gear since last year, the labor market remains the main engine fueling consumer spending. Real disposable income increased 0.7% for a second month, fueled by government transfer payments, according to the BEA.

Excluding government transfers, personal income still advanced at a healthy pace. Nominal wages and salaries rose 0.5% for a third straight month. The saving rate increased to 4.9%, the highest in nearly a year.

Read the full article HERE.

Goldman Sachs Group Inc. touted gold and oil as hedges against inflation in long-term portfolios, citing the appeal of bullion as a haven amid concerns over US institutional credibility and crude’s ability to protect against supply shocks.

Analysts including Daan Struyven said investors with so-called 60/40 portfolios — an investment strategy of allocating to equities and bonds — have historically been able to maintain average annual returns while reducing risk by adding long-term allocations of the two commodities.

“Following the recent failure of US bonds to protect against equity downside and the rapid rise in US borrowing costs, investors seek protection for equity-bond portfolios,” the analysts said in a note on Wednesday. “During any 12-month period when real returns were negative for both stocks and bonds, either oil or gold have delivered positive real returns.”

The analysts recommended a higher-than-usual allocation to bullion and a lower-than-usual — but still positive — weighting to crude, calling the commodities “critical” hedges against inflation shocks that tend to hurt bond and equity portfolios.

The popular 60/40 approach has been challenged in recent years as its underlying mechanism broke down, with US stocks and bonds moving in lockstep rather than offsetting each other. The strategy has seen fresh setbacks as long bonds have slumped in recent months, driven by investors’ growing reluctance to hold long-term US sovereign securities amid spiraling debt and deficits.

That wariness underscores the potential risk that markets could lose faith in the credibility of US institutions. Such a scenario — which would likely boost bullion’s allure as a haven asset — could trigger a sustained selloff in both US bonds and equities, according to Goldman.

The analysts, citing historical data, said 60/40 portfolio holders targeting an average annual return of 8.7% have been able to reduce risk from about 10% to just under 7% through adding gold and oil.

Meanwhile, US President Donald Trump’s contentious relationship with the Federal Reserve has also added to worries, following several comments indicating his desire to oust Chair Jerome Powell from his position. Reduced central bank independence has historically led to higher inflation, they added, again pointing to bullion as a hedge in a higher price environment.

If concerns about the US fiscal position and Fed independence intensify, a flight into gold by private investors could drive prices well beyond the bank’s current forecast of $3,700 an ounce by year-end and $4,000 an ounce by mid-2026.

Given the bullion market is small relative to other major asset classes, “even a small diversification step out of US fixed income or risk assets could cause the next giant leap for gold prices,” the analysts said. Robust central bank purchases for at least another three years should also underpin the metal’s strength, they added.

Oil is also a positive for Goldman, with energy disruptions difficult to predict and a likely sharp slowdown in non-OPEC supply growth from 2028 raising the chance of a supply shock. Still, high spare capacity limits the upside for now, the analysts said.

Read full article HERE.

President Donald Trump loves gold. He uses it to adorn his properties. So it is perhaps fitting that gold is experiencing a tremendous bull run during his second term.

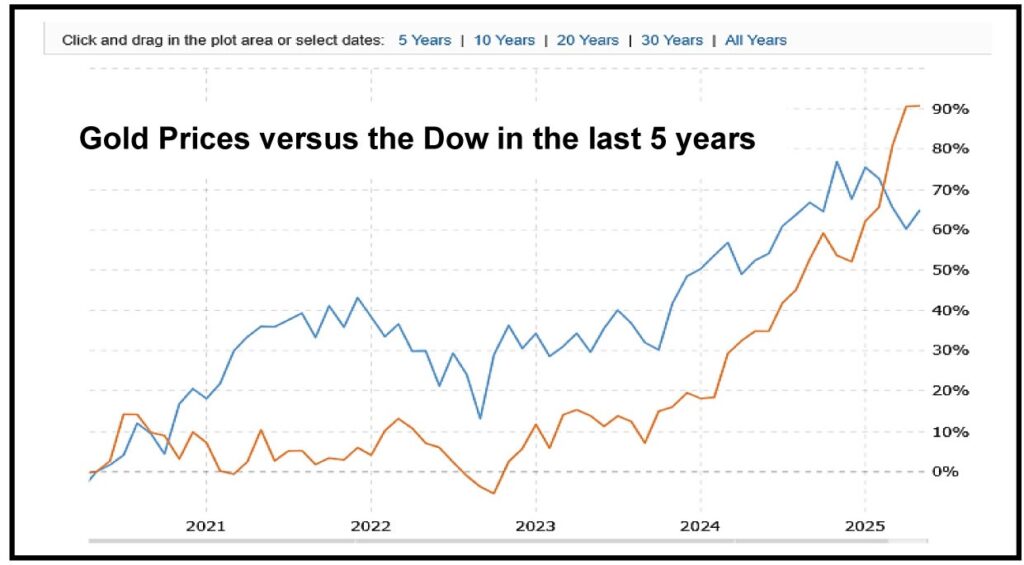

The SPDR Gold Shares exchange-traded fund (ticker: GLD) is up about 28% this year, compared with a 0.15% decline for the S&P 500 indexSPX-0.08%. A day seldom passes without bullish gold news for the precious metal.

Unfortunately, gold is popular for reasons that likely annoy the president. As the preeminent feel-good asset in times of economic distress—and paranoia—its allure is stronger now as investors struggle to understand Trump’s master plan for remaking the U.S. and global economy.

Gold’s extraordinary price performance suggests that investors are undecided about Trump’s bold idea to use tariffs against trading partners to enrich the U.S. and liberate Americans from income taxes.

Much remains unsettled. Trump’s “big, beautiful bill” passed the House and now awaits the Senate. If approved, it would increase the deficit to about 125% of the economy’s output, which would, according to traditional thinking, hobble America with economic problems and financial risks if the tariff plan fails to produce.

To a real estate tycoon like Trump, who has often used debt as a tool to unlock asset values, deficits probably aren’t as concerning as to those who consider massive government debt to be the economic equivalent of the Covid virus.

If the president is right, the world will pay to access American consumers—perhaps the world’s greatest purchasing force—and the deficit and income taxes will cease to be problematic.

Trump’s approach is revolutionary, and potentially catastrophic, which should support gold’s continued advance. Goldman Sachs has told clients that it sees gold rising to $3,700 a troy ounce by the end of 2025, up from $3,326 on May 23.

All of this enriches investors who own gold, while creating challenges for those who have enviously watched the rally. Few canny investors like chasing hot stocks, as the risk of a price reversal is high.

In this case, gold’s price momentum can be harnessed with a so-called bull spread using call options, which limits money at risk while still allowing for potentially astronomical returns.

Aggressive investors who are intrigued could buy the gold ETF’s September $310 call and sell the September $330 call. This spread cost about $6.35 when GLD was at $304.50. One hundred shares of the ETF would cost about $30,450, much more than the options that control the same number of shares.

The spread’s maximum profit is $13.65 if GLD is at $330 at expiration. During the past 52 weeks, the ETF has ranged from $211.54 to $317.63.

We selected a September expiration for a recent stock market hedge, and are suggesting it again in deference to the challenges that define the rest of 2025.

An extraordinary number of economic reports will challenge stock and bond prices, and options volatility, as investors try evaluating the impact of tariffs—and the outcome of three Federal Reserve rate-setting meetings.

The Fed is expected to lower interest rates in September. Until then, any hint of economic weakness should prompt more investors to buy gold and flee stocks—and maybe even bonds.

Though gold’s preeminence in chaotic times is assured, recent trading activity reveals increasingly volatile intraday price swings. This suggests investors are actively arguing about the sustainability of gold’s price.

If there were more agreement, there would be less price volatility and intraday moves would be narrower. The disagreements reinforce the merit of managing risk while positioning for further gains.

Read the full article HERE.

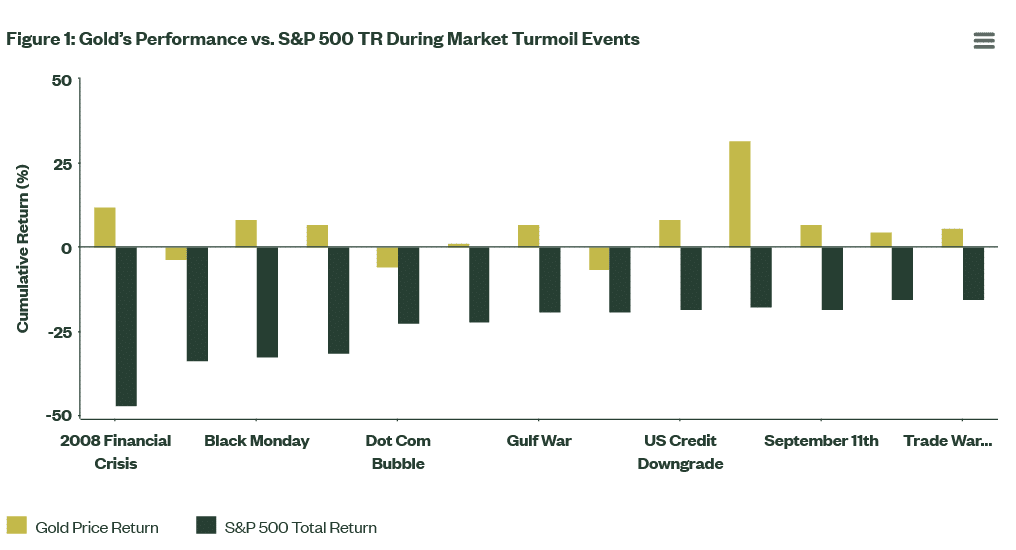

New Reasons to Hold Gold

Investors typically turn to gold during times of economic crisis, market volatility, and the fear of an impending recession. Gold’s robust performance during the 2008 subprime crisis, the Dot Com bubble, and the September 11th attacks — is indicative of a reliable safe haven asset. Gold prices also tend to rise in response to a weakening U.S. dollar, lower interest rates, and an unstable labor market.

In 2025, however, gold has gained over 23% despite a recovering dollar, an elevated Federal Funds rate, and a relatively healthy job market.

Gold’s steady performance amid traditional headwinds suggests that it is no longer a mere crisis commodity but has become a strategic global asset with long term appeal.

A market insight from Blackrock back in February stated the following:

“Gold’s continued advance has occurred despite both the dollar and U.S. interest rates spiking higher. Since late September the dollar (DXY Index) has risen by nearly 10%, while long-term rates have climbed by almost a full percentage point. The fact that neither trend has disrupted gold’s performance speaks to the changing rationale for holding the metal, with central bank demand and U.S. deficits serving as support.”[1]

This sentiment has been echoed by both traditional and alternative asset experts who see gold evolving into a tactical investment that not only serves as a safe haven but can outperform stocks, bonds, cryptos, cash and even real estate with respect to liquidity. Investors are no longer buying gold just for portfolio diversification, they are also acquiring it as a profit asset capable of delivering significant returns in an increasingly dollar adverse world.

FTSE Russell recently declared that “gold is reasserting its role as a strategic asset in a fragmented, multipolar world — favoured by central banks seeking alternatives to the US dollar amid geopolitical and monetary shifts.”[2]

The ‘Incurable Defects’ Propelling Gold Prices

An ‘incurable defect’ is most commonly associated with real estate. It is used to describe a property with an inherent problem that cannot be reasonably remedied. A piece of land, for instance, that is close to an airport, near a busy intersection, or in the vicinity of a hazardous waste site is considered inherently flawed since it cannot be physically moved or improved upon with respect to its location.

Similarly, there are incurable defects within the financial landscape that have been driving gold prices to record levels, and they have no easy or apparent remedy.

The Waning U.S. Dollar

The world’s central banks have dramatically increased their gold purchases since 2019. While a host of factors are driving gold demand, a desire to reduce reliance on the dollar is among the leading triggers. Central banks are acquiring gold to diversify away from the buck in an effort to mitigate the risk of holding a single currency, particularly a declining U.S. Dollar.

According to London Investment management firm, The Man Group:

“As the geopolitical landscape fractures, central banks are ramping up bullion purchases to diversify reserves, driven by growing concerns over reliance on the US dollar … The US dollar served as the foundation of an open global trading system, backed by the economic and military strength of the US government. This framework allowed the US to sustain both fiscal and current account deficits for decades. However, the impartiality of the US dollar has been eroding in recent years. While US president Donald Trump’s recent trade policies have drawn significant attention, the weaponisation of the US dollar has been a bipartisan strategy, pursued across multiple presidential administrations.”[3]

Central Banks perceive the dollar as increasingly unstable. With U.S. debt and deficits on a record-breaking trajectory, concerns about America’s ability to pay its bills are growing. And as confidence in the greenback continues to erode, the world’s monetary authorities will continue to boost their gold reserves to protect their economies from financial risk.

The World Will Always be Risky

Among the top geopolitical risks of 2025 are the regional conflicts in the Middle East and Eastern Europe. The death toll in Gaza has now topped 50,000 while Russian and Ukrainian casualties are purported to be well into the hundreds of thousands. There are also ongoing tensions between the U.S. and China, the West and Iran, India and Pakistan — and conflicts raging in Africa particularly in Sudan and Myanmar.

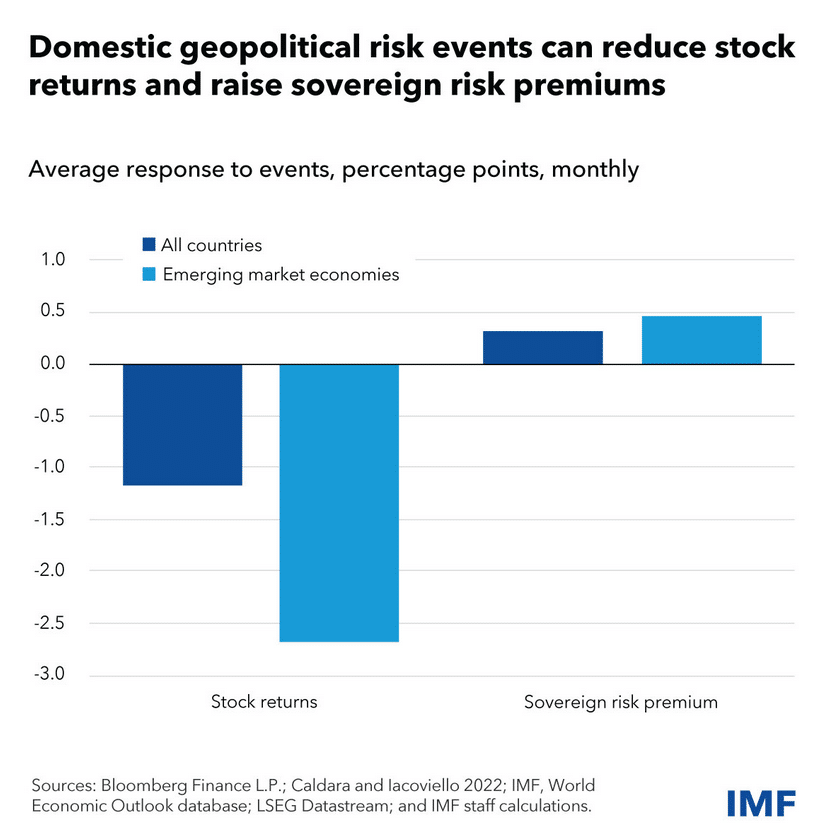

According to the International Monetary Fund these types of territorial disputes heighten financial risk:

“Global geopolitical risks remain elevated, raising concerns about their potential impact on economic and financial stability. Shocks such as wars, diplomatic tensions, or terrorism can disrupt cross-border trade and investment. This can hurt asset prices, affect financial institutions, and curtail lending to the private sector, weighing on economic activity and posing a threat to financial stability. Such risks are challenging for investors to price due to their unique nature, rare occurrence, and uncertain duration and scope. This can lead to sharp market reactions when geopolitical shocks materialize.”[4]

In 2025, there are the added threats posed by cyber-attacks, the rise of AI, an aging population, and falling birth rates. But border incursions, global discord, and existential threats are not exclusive to our era — these types of risks are the bane of every generation.

Back in the 1970’s investors grappled with the Oil Crisis, the collapse of Bretton Woods, and rampant stagflation. The Cold War, the rise of Islam, and the emerging threat of nuclear war confronted Ronald Reagan and the economy of the 1980’s. The 1990’s saw the Soviet Union collapse, China emerge as an economic power, and global terrorism go mainstream with the rise of international extremist groups.

The reality is, the world will always be dangerous and investors will continue to look to gold as a reliable safe haven and store of value.

Finite Supply amid Chinese and Indian Demand

Gold has long been a symbol of wealth, prosperity and status — but perhaps to no greater extent than in China and India. Both countries revere gold as a financial asset and a commodity of societal importance.

The Chinese have as strong connection with gold and the reasons are inherently economic as well as deeply cultural according to the Smithsonian:

“In Chinese culture, gold is associated with power, wealth, longevity, and happiness. It is considered the most valuable and significant gift one can give, and is included in many celebrations, such as weddings, the birth of a child, the New Year, and other important occasions. Historically, gold’s importance made it a valuable ingredient in the ‘elixir of immortality.’ It was also important in rituals and ceremonies associated with unsolvable problems or unexplainable natural phenomena.”[5]

Gold also has deep cultural and religious significance in India. It is similarly tied to ceremonies, festivals, and gift giving but Indians are also renowned for their use of gold in adornment and for their iconic gold jewelry.

According to Vummidi Bangaru jewelers in Tamil Nadu, Southern India:

“Indian jewellery has always been renowned for its intricate designs, craftsmanship, and the cultural stories it tells. From the Mughal courts to the temples of South India, Indian jewellery is a blend of history, tradition, and artistry … The evolution of Indian jewellery is a story that spans thousands of years, reflecting the changes in human society, culture, and technology. From the earliest shell beads worn by our ancestors to the elaborate gold and diamond creations of today, jewellery has always been a way for us to express our identity, status, and beliefs.”[6]

Aside from heavy gold purchases by the central banks of China and India, gold sits at the very heart of the heritage and traditions of both countries. Its role in their customs dates back thousands of years. And its rarity and limited supply will continue to prop up gold prices amid steady demand from both nations — which are among the world’s fastest growing economies.

The Bullish Gold Outlook for 2025-2026

Most experts expect gold prices to continue to rise throughout this year and into next. Goldman Sachs cites central bank buying as well as renewed interest from investors as propelling gold to new record highs:

“Since March, investors have been increasing their holdings of gold, driven by concerns about the health of the economy and market volatility. Longer term, Goldman Sachs Research expects prices to be propelled by multi-year demand from central banks. Our analysts’ gold price prediction is for these two factors to push the metal to new record highs.”[7]

Meanwhile, JP Morgan sees gold prices surpassing $4000/oz by Q2 2026 and asset management firm Incrementum has a “forecast corridor” of $4,800 to $8,900 declaring that the role of gold has changed into is a portfolio outperformer:

“The growing gap between gold and the S&P 500 since the beginning of the year points to fundamental changes. Capital is increasingly flowing from US markets into the safe haven of gold – but also increasingly into Europe and selected emerging markets. If this trend is confirmed, it would be a clear signal of a sectoral and geographical rotation with far-reaching consequences … In other words, we are witnessing capital outflows from a once immensely popular and widely held sector into performance gold, an asset that has lingered in the shadows for nearly a decade.”[8]

We are indeed witnessing a fundamental shift both in the perception of gold, its sources of physical demand, and its performance expectations versus other assets. This is a turning point for a rare commodity once deemed outdated and which John Maynard Keynes referred to in 1924 as a “barbarous relic.” Just four years after his declaration, America would witness the greatest stock collapse in its history with the Dow Jones losing almost 90% of its value.

We are, as President Trump has declared, living in the new “golden age” — and we’re reminded that it is not necessarily a new awareness of the world’s most valuable precious metal — but more of a strategic reawakening.

This article was brought to you by Thor Metals Group. Our representatives are standing by to discuss adding gold to your portfolio. We’re currently offering a percentage of free metals matched to every dollar of gold you purchase.

Call 844-944-THOR (8467) to speak to an expert right now. Or fill out our online form, and we’ll reach back out to you.

[1] https://www.blackrock.com/us/individual/insights/stay-long-gold

[2] https://www.lseg.com/en/ftse-russell/research/gold-in-a-fragmented-world-safe-haven-and-strategic-asset

[3] https://www.man.com/insights/views-from-the-floor-2025-april-29

[4] https://www.imf.org/en/Blogs/Articles/2025/04/14/how-rising-geopolitical-risks-weigh-on-asset-prices

[5] https://library.si.edu/es/donate/adopt-a-book/ancient-chinese-gold

[6] https://www.vummidi.com/blog/history-of-indian-jewellery/

[7] https://www.goldmansachs.com/insights/articles/why-gold-prices-are-forecast-to-rise-to-new-record-highs

[8] https://ingoldwetrust.report/wp-content/uploads/2025/05/In-Gold-We-Trust-Report-2025-Compact-Version-english.pdf