U.S. stocks are extending their scorching spring rally into the close of the second quarter, with the S&P 500 probing record levels as investors ride bets on Federal Reserve rate cuts, fading tariff risks, and stimulative tax and spending plans from Capitol Hill.

Now, the question is whether companies’ performances justify that second-quarter surge. With corporate earnings reports starting on July 15 with an update from JPMorgan Chase, some investors are worried that expensive stock valuations and subdued levels of market risk could suggest markets are pricing in more profit growth and a better economic performance than is likely over the coming year.

“The U.S. market remains the clear global leader, buoyed by strong earnings momentum, macro resilience, and AI-driven enthusiasm (and) reignited conversations about whether the “Buy America’ trade is making a comeback,” said Charu Chanana, chief investment strategist at Saxo Bank.

“However, with stretched valuations, this earnings season needs to confirm the second-half rebound story—or risk a market rethink.”

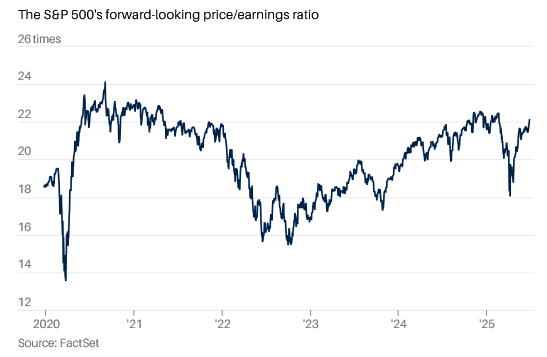

The S&P 500SPX-0.13%, which closed at a record high of 6201 points on Monday, is now trading at 22.8 times the collective earnings its constituents are expected to generate over the next 12 months.

That is not only historically expensive, according to data from Goldman Sachs Global Investment Research, but it also means the benchmark is more highly valued than the Nasdaq 100 and the Russell 2000RUT-0.18%.

“There’s clearly a bit of pull forward of earnings expectations,” said Louis Navellier of Navellier Calculated Investing. “There’s also a desire to get in front of the Fed beginning to cut rates.”

“Clearly, the geopolitical risks are being discounted as having little impact on growth prospects, as are the prospects of tariffs either having little impact on inflation or never actually becoming real,” he said. “As always, there are many fewer questions about bull markets than bear markets.”

Collective second-quarter earnings for the index are forecast to rise 5.9% from last year to around $529 billion, according to LSEG data, but that growth rate is only around half of the 10% gain the benchmark has recorded since the end of March.

Nearly half of the benchmark’s 11 subsectors, meanwhile, aren’t expected to see any earnings growth at all. Of the six sectors that will generate higher profits, around 82% of the increase will come from just two: communications services and information technology.

LSEG data point to earnings growth of 8.5% for the year. That implies that stocks are valued at 23.4 times earnings, compared with their current 22.8 times, even though that 8.5% is well below the 14% increase in profits expected at the start of the year.

And investors don’t seem to be demanding much extra return regardless of the risk implied by those high valuations. Calculations from WisdomTree indicate the so-called equity risk premium—the extra return investors can get by being in stocks rather than safe Treasury debt—is just 2.4 percentage points, the lowest since the early 2000s.

Measures of volatility are near the lowest levels of the year. The Cboe Group’s VIX index, priced at 16.62, suggests traders expect daily swings of around 65 points for the S&P 500 over July. That compares to a peak of around 105 points in early April.

Though Clark Bellin, president and chief investment officer at Bellwether Wealth in Lincoln, Neb., isn’t sure that the market can remain this complacent, he doesn’t see it as a worry.

“While stocks trading at record highs naturally leads many to believe that a pullback is imminent, that’s actually not usually the case, as new highs often beget new highs,” he said. “The positive momentum can continue for some time,” though volatility is always possible.

“The big conundrum facing investors for the second half of 2025 is how to deploy new cash, especially for investors who did not put new money to work during the April market pullback.”

Read the full article HERE.

- The dollar is under siege—from Trump’s Fed pressure to trillion-dollar deficits.

- With DXY testing key support, all eyes now turn to jobs data and Powell’s next move.

- Until then, markets remain stuck between political noise and policy uncertainty.

Confidence in the US dollar remains low in global markets. The dollar index (DXY), hovering around 97, is very close to its lowest level in the past three years. Domestic political uncertainties and signals of possible monetary policy intervention have played a key role in this decline. In particular, President Donald Trump’s increasing pressure on the Fed, and his open desire to replace Jerome Powell with a more dovish chair, have raised concerns in the markets about the Fed’s independence.

Political Pressure on the Fed: Monetary Policy Independence Back on the Agenda

Trump’s remarks on Fox News regarding interest rates—stating that the Fed should cut its policy rate to 1–2%—and his explicit wish to replace Powell have increased speculation about a “politically motivated monetary policy.” Reports last week that Trump may soon announce Powell’s successor have added to fears that he could speed up the process. This has brought the Fed’s independence back into question and is seen as a factor contributing to the medium-term structural weakening of the dollar.

Market pricing for the Fed’s next moves is also being shaped by this backdrop. Fed Chair Powell’s remarks in Congress, suggesting a rate cut was on the table if inflation does not rise significantly during the summer, were interpreted by markets as a clear dovish signal. According to market expectations, the probability of a 25 basis point rate cut in September has risen to 91.5%. While some analysts believe the market is pricing in too much, the underlying pressures on the dollar remain intact.

Trump’s Giant Budget Deficit Plan Also Challenges the Dollar

Another major factor undermining the dollar’s strength is concern over the Trump administration’s economic policies. The Congressional Budget Office (CBO) estimates that Trump’s $4.2 trillion tax cut and spending package—recently passed by the Senate—could widen the budget deficit by $3.3 trillion between 2025 and 2034. This could strain the U.S. debt outlook and weigh on the dollar’s long-term status as a reserve currency.

Trump’s aggressive rhetoric toward Iran and renewed trade tensions with Canada over the digital services tax are also dampening global risk appetite and reducing demand for the dollar. Although Canada has since reversed the tax and resumed talks with the U.S. and China, the threat of new tariffs after July 9 is reintroducing market anxiety.

On the macroeconomic side, May core PCE data in the U.S. came in above expectations at 2.7% year-over-year. This triggered a rise in bond yields but still indicated that inflation expectations remain anchored. The decline in University of Michigan inflation expectations supports this view.

However, the key data point this week will be the nonfarm payrolls report. If a labor market slowdown materializes as expected, the Fed may move more quickly toward a rate cut. If not, the optimism surrounding dovish expectations could fade. As such, data flow may lead to increased volatility this week.

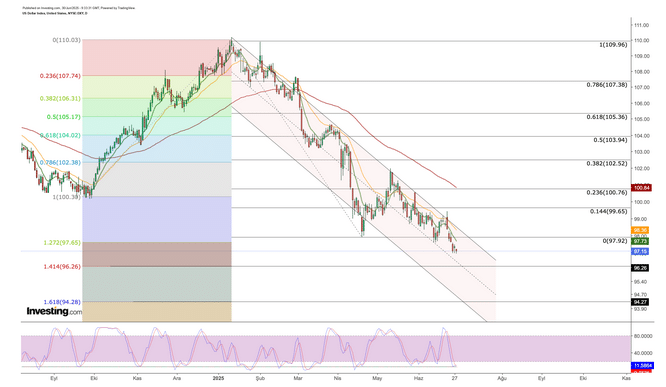

XY Technical Outlook: Monitoring Critical Support Zone

The dollar index has recently fallen as low as 97, breaking below the support level at the Fib 1.272 extension—around 97.65—amid recent declines. This marks a move into the Fibonacci expansion zone from a technical standpoint.

The next support level in the DXY, which continues to move within a descending channel, stands at 96.25. If the intermediate support at the 97 level fails during the week’s volatility, we may see the index drop toward the 96 region. Conversely, if the 97 level holds, then 97.65 becomes the next immediate resistance. A break above that could trigger a move toward 98. Such a move would also represent an upward breakout from the descending channel. Should the DXY remain above 98 during the week on any rebound, this could establish a neutral outlook in the 98–100 band going forward. However, current developments suggest continued weakness in the dollar is more likely for now.

Trump’s strong criticism of the Fed, aggressive fiscal policies that widen the budget deficit, and lingering trade uncertainties continue to weigh on the dollar in both structural and short-term contexts. Expectations for a rate cut by September remain high and will likely support further downward pressure on the DXY. In the coming period, employment data, inflation readings, and Trump’s statements following July 9 will remain key drivers of the dollar index. In conclusion, while the DXY remains under pressure in the short term, Fed policy and macroeconomic data will play a decisive role in determining its medium-term direction.

Read the full article HERE.

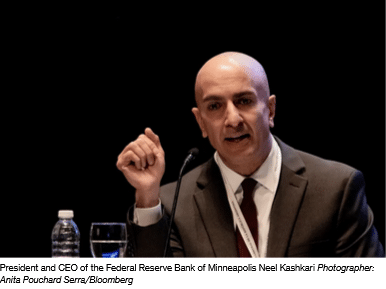

- Federal Reserve Bank of Minneapolis President Neel Kashkari sees two interest-rate cuts as likely this year, with the first potentially in September.

- Kashkari warns that tariffs could have a delayed impact on inflation and policymakers should remain flexible.

- Kashkari praises the economy’s resilience in the face of higher-than-expected tariff announcements in April and notes that the labor market has “cooled gently.”

Federal Reserve Bank of Minneapolis President Neel Kashkari said he sees two interest-rate cuts as likely this year — with the first potentially in September — but warned that tariffs could have a delayed impact on inflation and policymakers should remain flexible.

“While we gather more evidence on the true tariff shock affecting the economy, I believe we should put more emphasis on the actual inflation and real economic data that we are seeing without committing to an easing policy path in case the effects of tariffs are merely delayed,” Kashkari wrote in an essay published Friday on his bank’s website.

Kashari said he has left his rate projections for 2025 unchanged since December. At that point, Fed policymakers had delivered a full percentage point of cuts, all in the final four months of the year, as price pressures cooled and the labor market showed signs of weakness. He expected just two cuts then because he was unsure inflation would continue to fall in this year, he wrote.

He kept that projection in March amid heightened tariff uncertainty and little further progress on inflation. Now, though there hasn’t been much evidence of a hit to prices from tariffs, he worries that may still materialize later this year.

Kashkari said his forecast for two rate cuts implies the first would come in September.

Fed officials left rates unchanged when they met last week. Since then, two Fed governors, Christopher Waller and Michelle Bowman, have signaled they might back lowering rates as early as next month. But most policymakers who spoke this week, including Kashkari, made clear they aren’t seriously considering a move in July.

President Donald Trump has repeatedly lashed out at Federal Reserve Chair Jerome Powell over over the bank’s position to hold interest rates steady.

In the essay, the Minneapolis Fed chief also said that the US central bank shouldn’t be bound to a particular policy path even if it resumes lowering rates in September.

“If the data called for it, we could hold the policy rate at the new level until we gained greater confidence that inflation was headed back to our target,” Kashkari wrote.

Kashkari praised the economy’s resilience in the face of higher-than-expected tariff announcements in April and said the labor market has “cooled gently.”

He said business leaders he’s spoken with have expressed a reluctance to pass tariff costs on to customers, but that if trade deals aren’t struck and tariff rates remain high, they might have to do so. Kashkari also pointed to the time required to ship goods to the US from Asia as another reason the tariff effect may materialize later.

Read the full article HERE.

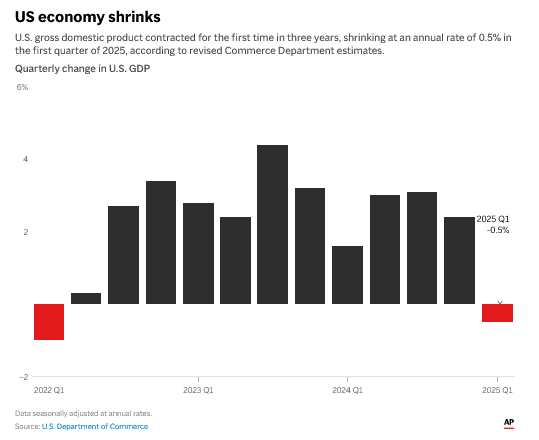

The U.S. economy shrank at a 0.5% annual pace from January through March as President Donald Trump’s trade wars disrupted business, the Commerce Department reported Thursday in an unexpected deterioration of earlier estimates.

First-quarter growth was weighed down by a surge of imports as U.S. companies, and households, rushed to buy foreign goods before Trump could impose tariffs on them. The Commerce Department previously estimated that the economy fell 0.2% in the first quarter. Economists had forecast no change in the department’s third and final estimate.

US economy shrinks

U.S. gross domestic product contracted for the first time in three years, shrinking at an annual rate of 0.5% in the first quarter of 2025, according to revised Commerce Department estimates.

Quarterly change in U.S. GDP

The January-March drop in gross domestic product — the nation’s output of goods and services — reversed a 2.4% increase in the last three months of 2024 and marked the first time in three years that the economy contracted. Imports expanded 37.9%, fastest since 2020, and pushed GDP down by nearly 4.7 percentage points.

Consumer spending also slowed sharply, expanding just 0.5%, down from a robust 4% in fourth-quarter 2024 and sharp downgrade from the Commerce Department’s previous estimate.

A category within the GDP data that measures the economy’s underlying strength rose at a 1.9% annual rate from January through March. It’s a decent number, but down from 2.9% in the fourth quarter of 2024 and from the Commerce Department’s previous estimate of 2.5% January-March growth.

This category includes consumer spending and private investment but excludes volatile items like exports, inventories and government spending. Ryan Sweet of Oxford Economics called the downgrade in that figure “troubling,″ though he doesn’t expect to make a significant change to his near-term economic forecast.

And federal government spending fell at a 4.6% annual pace, the biggest drop since 2022.

Trade deficits reduce GDP. But that’s just a matter of mathematics. GDP is supposed to count only what’s produced domestically, not stuff that comes in from abroad. So imports — which show up in the GDP report as consumer spending or business investment — have to be subtracted out to keep them from artificially inflating domestic production.

The first-quarter import influx likely won’t be repeated in the April-June quarter and therefore shouldn’t weigh on GDP. In fact, economists expect second-quarter growth to bounce back to 3% in the second quarter, according to a survey of forecasters by the data firm FactSet.

The first look at April-June GDP growth is due July 30.

Read the full article HERE.

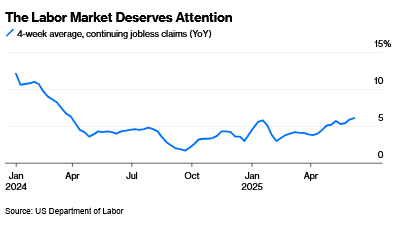

Downside risks to the labor market are becoming more of a concern for Fed policymakers, with some open to a July interest rate cut.

It’s been three years now since people began worrying that high interest rates would push the US economy into recession, so some skepticism is in order whenever a spell of soft economic data draws fresh concerns. A growing body of evidence, however, suggests that this time really is different. The unusual supports that held up the labor market following the pandemic are now largely gone, inviting more typical recessionary risks if the economy weakens from here.

The most concerning recent trend is the uptick in the number of people collecting unemployment benefits, which has accelerated over the past couple of months at the quickest pace since early 2024. This, combined with the softening in underlying inflation, has prompted a rethink from some members of the Federal Reserve’s rate-setting committee on how quickly to resume policy easing to support the labor market.

Over the past week, two Fed governors — Christopher Waller and Michelle Bowman — have said that downside risks to the labor market are a concern that may warrant an interest rate reduction as soon as the central bank’s July meeting. Chair Jerome Powell did not endorse that specific scenario in testimony to Congress on Tuesday, but he said that it was one of many possible outcomes. Markets are now priced for around a 20% chance of a cut next month.

With Powell leaving his options open, Waller’s comments are significant given he correctly argued against recession fears in the summer of 2022, when the number of job openings relative to the number of unemployed workers was at nearly double its pre-pandemic level. That left room for a cooling without unemployment rising much. Now, however, the job openings-to-unemployment ratio is back at levels last seen in late 2018. Data such as the increasing unemployment among college graduates are “starting to make me a little worried,” Waller said in a CNBC interview last week, adding:

I’m all in favor of saying maybe we should start thinking about cutting the policy rate at the next meeting, because we don’t want to wait till the job market tanks before we start cutting the policy rate.

The labor market for young and white-collar workers has been sluggish since at least the latter part of 2023, driven by a normalization after the over-hiring of the pandemic boom. More recently, companies have begun looking for ways to use artificial intelligence rather than hiring to drive growth. There seems to be a growing sense among companies large and small that what’s impressive and innovative to investors now is using AI to scale teams and companies with as few workers as possible. The extent to which this is feasible remains to be seen, but the vibe shift suggests we’re unlikely to see a corporate hiring boom in the near-term despite the hundreds of billions of dollars being pumped into AI.

We got the latest evidence of this with news that Microsoft Corp. plans to cut 6,000 jobs on the heels of a prior round of 6,000 layoffs. It’s notable that Microsoft is making these changes as executives plan for the next fiscal year, which begins July 1 for the company. As I’ve written previously, there’s a reasonable possibility that the typical fiscal year-end of Dec. 31 brings further waves of layoffs when companies go through their annual planning cycles.

Housing and government also pose risks to employment now in a way that they didn’t a year ago. Rising resale housing inventory in the South and West is putting downward pressure on construction activity and homebuilder profit margins, often a prelude to layoffs. Government employment, an important source of job growth in 2023 and 2024, has been flat since January given the Trump administration’s efficiency drive and budget crunches at the state and local government level.

These emergent but inconclusive labor market risks pose a challenge for the Fed, which is dealing with multiple sources of inflation uncertainty, too, from tariffs to the tax legislation going through Congress and conflicts in energy-producing regions. It’s no surprise then that Powell on Tuesday reminded senators of the need for caution with consumers still hurting from their recent experience with inflation. “We haven’t fully restored price stability, and another shock, we have to be careful if there’s a meaningfully large and sustained inflation shock,” he said.

Ultimately, though, it’s downside risks from the labor and housing markets that are likely to be what’s more persistent. The Conference Board’s gauge of confidence unexpectedly declined in June, according to data Tuesday, with the share of consumers that said jobs were plentiful dropping to the smallest in more than four years. Also on Tuesday, the S&P CoreLogic Case-Shiller home price indices showed a second month of declines in April for the 20 metros tracked from the previous month.

It’s understandable that Fed policymakers want a little more time to get their arms around these short-term inflation risks, but they can’t allow the labor market to deteriorate much more than it already has.

Read the full article HERE.

The U.S. current account deficit widened to a record high in the first quarter as businesses front-loaded imports to avoid President Donald Trump’s hefty tariffs on imported goods.

The Commerce Department’s Bureau of Economic Analysis said on Tuesday the current account deficit, which measures the flow of goods, services and investments into and out of the country, jumped $138.2 billion, or 44.3%, to an all-time high of $450.2 billion. Data for the fourth quarter was revised to show the gap at $312.0 billion instead of $303.9 billion as previously reported.

Economists polled by Reuters had forecast the current account deficit increasing to $443.3 billion last quarter.

The deficit represented 6.0% of gross domestic product, the highest since the third quarter of 2006 when it peaked at 6.3%. That was up from 4.2% in the October-December quarter.

Economists have warned that the widening current account gap and ballooning federal government budget deficit could pose a risk to the dollar in the long term. Trump’s sweeping tariffs have taken some of the shine off the dollar’s safe haven status.

Imports of goods surged $158.2 billion to a record $1.00 trillion, driven by nonmonetary gold and consumer goods, mostly medicinal, dental and pharmaceutical products. Imports of services dropped $1.8 billion to $217.8 billion, weighed down by declines in charges for the use of intellectual property such as licenses for the use of outcomes of research and development.

Goods exports increased $21.1 billion to $539.0 billion, the highest since the third quarter of 2022, lifted by capital goods, mainly civilian aircraft and computer accessories, peripherals and parts.

Exports of services decreased $4.4 billion to $293.2 billion, pulled down by declines in government goods and services like military units and agencies. Personal travel also decreased as did professional and management consulting services.

The goods trade deficit widened to a record $466.0 billion from $328.9 billion in the fourth quarter. The import flood has, however, since subsided as the front-running of merchandise ran its course. Goods imports slumped by a record 19.9% to $277.9 billion in April, the government reported this month.

Receipts of primary income decreased $22.9 billion to $355.1 billion last quarter. Payments of primary income also fell $13.7 billion to $362.7 billion. Receipts and payments of primary income were both restrained by declines in direct investment income, mostly earnings.

Receipts of secondary income increased $2.3 billion to $49.6 billion, lifted by fines and penalties. Payments of secondary income dropped $8.4 billion to $101.5 billion amid decreases in government transfers.

Read the full article HERE.

Analysts at Bank of America see gold prices reaching $4,000 an ounce — an 18% jump above current levels — within the next year due to a ballooning US fiscal debt.

Gold — traditionally viewed as a safe haven during times of uncertainty — has risen by nearly 30% this year, driven by high global trade tensions and rising geopolitical risks.

In April, the yellow metal soared to an all-time high of $3,500 as an unprecedented tariff war ignited by the US rocked the global markets. A dragged-out US-Ukraine deal also did little to assuage investor concerns.

Contrary to popular opinion, another potential rally to $4,000 may have less to do with these factors, but more to do with US debt, BofA analysts say.

In a note published Friday, the analysts explained that wars and geopolitical conflicts typically “aren’t long-term growth drivers” for gold prices, pointing to the 2% dip in the metal’s prices since Israel began its airstrikes on Iran a week ago.

According to the bank’s analysts, the Israel-Iran conflict has drawn attention away from US President Donald Trump’s sprawling tax-and-spending bill that’s making its way through Congress. If passed, the bill is expected to add trillions of dollars in deficits in the coming years, raising concerns about the sustainability of US debts and the future status of the dollar.

“While the war between Israel and Iran can always escalate, conflicts are not usually a sustained bullish price driver,” they wrote. “As such, the trajectory of the US budget negotiations will be critical, and if fiscal shortfalls don’t decline, the fallout from that plus market volatility may end up attracting more buyers.”

De-dollarization

The BofA analysts also pointed to the growing trend of global central banks shifting away from US assets (Treasuries and dollar) in their reserves and holding more gold. They estimate that central banks’ gold holdings represent about 18% of the outstanding US public debt, up from 13% a decade ago.

“That tally should be a warning for US policymakers. Ongoing apprehension over trade and US fiscal deficits may well divert more central bank purchases away from US Treasuries to gold,” they warned.

A study by the European Central Bank revealed that bullion has risen up the ranks of official reserve assets, surpassing the euro and only behind the dollar. By the end of 2024, it is estimated that gold accounted for 20% of the world’s total reserve holdings. The dollar, while maintaining a lead at 46%, continued to decline.

Similarly, a recent survey by the World Gold Council showed that most central banks are expecting to accumulate more gold and less dollar over the next 12 months.

Read the full article HERE.

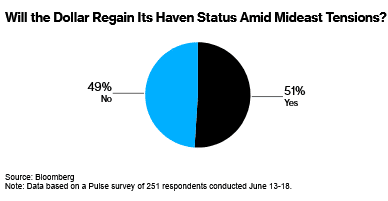

- The escalating Middle East conflict is likely to help the dollar hold on to its haven role, with a little more than half of respondents thinking the US currency will regain its status as a safe asset.

- Despite this, the Bloomberg Dollar Spot Index is expected to fall over the next month, and sentiment toward the US currency remains overwhelmingly bearish, with the dollar having lost over 11% against the euro and 8% against the Japanese yen this year.

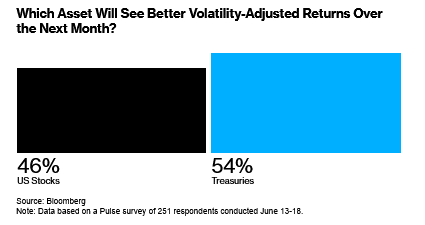

- The appeal of Treasuries in times of turmoil is clear, with 54% of respondents favoring bonds over US stocks for better volatility-adjusted returns over the next month.

The escalating Middle East conflict is likely to help the dollar hold on to its haven role — but only just, the latest Bloomberg Pulse survey shows.

A little more than half of 251 respondents think the US currency will regain its status as a safe asset as Iran and Israel continue to carry out attacks on each other. Yet participants also see the Bloomberg Dollar Spot Index falling over the next month, according to the poll conducted June 13-18.

“While we expect further dollar weakness, investors now perceive more two-way risks,” Goldman Sachs Group Inc. strategists including Christian Mueller-Glissmann and Michael Cahill wrote in a note to clients. “Some argue the depreciation may be overdone, especially given resilient US asset returns.”

The divergence underscores a shift in perceptions of the greenback, as global investors grow more averse to President Donald Trump’s policies. While geopolitical tensions in the past week have limited its decline, sentiment toward the US currency remains overwhelmingly bearish.

The share of respondents expecting Bloomberg’s dollar gauge to fall over the next month is the smallest since February, according to Pulse survey data. The index was set for its first weekly gain since May.

Beyond the revival of haven demand, the greenback also received support from a Federal Reserve policy decision on Wednesday, where Chair Jerome Powell warned of the inflationary impact of tariffs and said policymakers don’t have great conviction in their outlook for lower rates.

All the same, this week’s advance barely dents the greenback’s battering this year. It has lost more than 11% against the euro and about 8% against the Japanese yen so far this year.

A weaker dollar is here to stay, according to Invesco Ltd. Senior Portfolio Manager Kristina Campmany. Recent shakeups in US policy mean that there’s now a premium for holding the currency, Campmany said earlier this month at Bloomberg’s Money & Macro: An Evening with Markets Live event in New York.

As for Treasuries, higher oil prices resulting from the Middle East conflict will add to price pressures that will temper the bond rally — that’s according to 49% of survey respondents. About a third said the crude spike will have no effect on US debt.

The appeal of Treasuries in times of turmoil was clear. When asked which asset will deliver better volatility-adjusted returns over the next month, 54% of respondents favored bonds over US stocks.

Read the full article HERE.

The Federal Reserve left interest rates unchanged at its June policy meeting on Wednesday and maintained its forecast for two rate cuts in 2025. But Chair Jerome Powell was adamant about one point: Tariffs will likely push inflation higher in the months ahead.

Powell, speaking at a press conference following the Federal Open Market Committee’s rate decision, emphasized the high level of uncertainty facing the economy but was much more certain about this specific inflation risk.

“Everyone that I know is forecasting a meaningful increase in inflation in coming months from tariffs,” he said, citing early signs of price pressures and business plans to pass along higher costs. “We have to take that into account.”

The Fed’s updated Summary of Economic Projections, or SEP, also released on Wednesday, reflects that view. The SEP includes quarterly forecasts from policymakers for inflation, growth, unemployment and interest rates. It also features a closely watched dot plot, a chart showing each official’s individual projection for where the federal-funds rate will end the year.

These projections aren’t policy promises but they do offer a window into the Fed’s collective thinking, and how much internal consensus exists.

The median forecast for core PCE inflation, the Fed’s preferred measure, rose to 3.1% in 2025, up from 2.8% in March. At the same time, officials expect economic growth to slow and the unemployment rate to rise slightly. The combination edges toward a stagflationary setup—where economic growth slows and prices increase. Powell pushed back against that framing, saying he wasn’t necessarily expecting an economic slowdown in the back half of the year.

The dot plot continues to show two cuts this year, but the internal distribution has shifted. More officials now expect just one cut or none at all, than in March. The median holds, but narrowly. Economists sometimes refer to this situation as a soft median, vulnerable to slipping lower with just one or two more hawkish dots.

Powell acknowledged that fragility on Wednesday afternoon. “No one holds these rate paths with a great deal of conviction,” he said. When asked how to interpret the SEP, he turned the question back on the reporter. “What would you write down?” he asked. “It’s not easy to do that with confidence.”

Analysts echoed Powell’s point. Seven of 19 Fed policymakers are forecasting no cuts at all this year, but “in the great scheme of things these forecasts are pretty meaningless as there is so much economic and political uncertainty and the outlook for policy could change very rapidly,” wrote economists at ING in a note Wednesday.

The Fed appears to be biding its time while balancing near-term inflation risks with the markets’ desire for more dovish policy. “A policy geared toward being all things to all people cannot endure for long,” wrote Joe Brusuelas, chief economist at RSM. “Either inflation via the trade channel proves transitory and the FOMC can cut rates, or the central bank will need to signal to market participants and the White House that rates are going to remain on hold, with the possibility of a rate hike.”

For now, the economy gives the Fed some room to wait and see. Unemployment remains low at 4.2%, real wages are rising, and recent data suggest consumer demand and business investment remain resilient. Powell called it a “solid economy,” and one that allows policymakers to absorb new information before making a move.

Inflation expectations are well-anchored for now, but Powell acknowledged that confidence isn’t synonymous with certainty. “We have to be humble,” he said, referring to forecasting the pass-through of tariffs. If inflation fails to materialize and the Fed continues holding on the basis of a forecast that never arrives, pressure to pivot more decisively could build quickly.

For now the Fed is standing still. The pause holds, but only just.

Read the full article HERE.

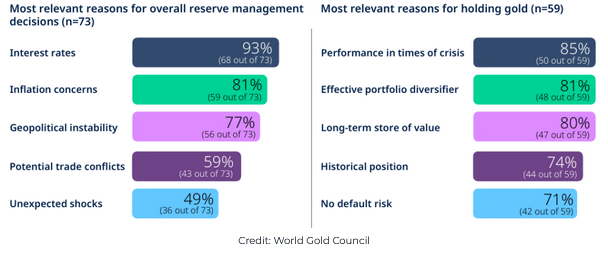

Central banks around the world continue to hold favourable expectations for gold, with most looking to add to their reserves over the coming months and even years, an annual survey by the World Gold Council (WGC) showed.

Central banks have been aggressively buying gold, accumulating over 1,000 tonnes in each of the past three years versus an average of 400-500 tonnes in the preceding decade.

These purchases coincided with a blistering gold rally during that period, which saw prices nearly doubling from around $1,800/oz. to the current $3,400 level. This year alone, gold has gained more than 26% and set multiple records, including a new high of $3,500 in mid-April.

Driving the acceleration in central bank purchases and soaring gold prices was an unstable geopolitical landscape — beginning with Russia’s invasion of Ukraine in 2022 — that clouded the overall economic outlook.

Geopolitics a recurring theme

The new WGC survey sheds light on central banks’ decision-making process during turbulent times.

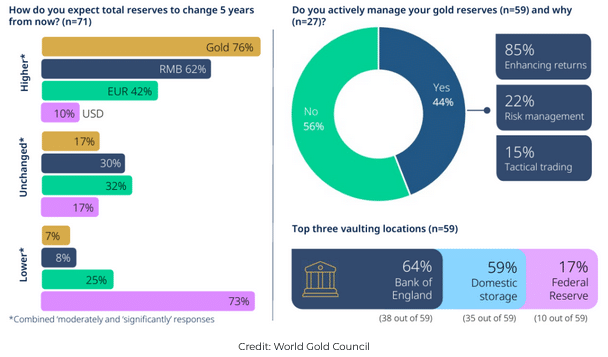

The 2025 edition of the Central Bank Gold Reserves (CBGR) survey drew a total of 73 respondents, the most since the Council began the survey eight years ago. The survey also saw a record-high number of respondents who actively manage their gold reserves at 44%.

According to the survey results, central banks continue to view economic and geopolitical uncertainty as a key factor influencing their decision to accumulate gold, just behind interest rate levels and inflation concerns. Also high on the banks’ list of considerations are tariffs and unexpected shocks.

Most of the respondents cited the precious metal’s performance during times of crisis, alongside its role as a store of value, as the main reasons for adding more gold, the survey showed.

“Gold’s performance during times of crisis, portfolio diversification and inflation hedging are some key themes driving plans to accumulate more gold over the coming year,” the WGC stated.

More gold buying ahead

With that in mind, an overwhelming number of central banks (95%) said they see official gold reserves continuing to rise over the next 12 months, compared to 81% the last survey. Importantly, nearly half (43%) of them now believe their own gold reserves will also increase over the same period, more than any in previous surveys.

Over a longer horizon, about three-quarters of the banks (76%) expect their gold holdings to be higher in five years, an increase from 69% seen last year.

At the same time, about the same number of banks (73%) are prepared to see moderate or significantly lower US dollar holdings within their global reserves.

In terms of vaulting locations, the Bank of England remains the most popular amongst respondents (64%).

“The trends uncovered in our survey suggest that central banks continue to recognize the benefits of an allocation to gold, and indicate that their demand for gold will likely remain healthy for the foreseeable future,” the Council said.

Read the full article HERE.