Retailer has weathered the trade war but says the full impact of tariffs on consumers has yet to come

Key Points

Walmart plans to raise prices this month and early this summer due to tariff-affected merchandise.

- Sales rose steadily as shoppers sought deals and fast shipping, but the trade war’s impact has yet to come.

- Walmart didn’t share a profit forecast for the current quarter and may absorb some tariff costs to keep prices lower.

Higher prices are coming to Walmart’s shelves.

The retailer said Thursday that it plans to raise prices this month and early this summer, passing along some of the cost as tariff-affected merchandise hits store shelves.

“The magnitude and speed at which these prices are coming to us is somewhat unprecedented in history,” Walmart Chief Financial Officer John David Rainey said in an interview. He said sales rose steadily in the latest quarter as shoppers flocked to deals and fast shipping, but the full impact of the trade war on consumers has yet to come.

“It’s a dynamic and fluid environment,” said Rainey. Walmart didn’t share a profit forecast for the current quarter because the company may absorb some tariff costs to keep prices lower than competitors, Rainey said.

Walmart is already raising some prices as its suppliers pass through higher costs. For example, tariffs drove up the price of bananas, one of the most frequently purchased items at Walmart, to 54 cents a pound, up from 50 cents, he said.

Earlier this week, the U.S. agreed to temporarily lower tariffs on Chinese imports to 30% from 145%. A 30% tariff on Chinese goods is better than 145%, but still means a meaningful price increase for most consumers, Rainey said.

In March and April, stock markets gyrated and consumer sentiment plummeted, but Walmart’s sales grew. The company’s U.S. comparable sales, those from stores and digital channels operating for at least 12 months, rose 4.5% in the three months ended May 2, beating investors’ expectations.

Unlike many other companies, Walmart left its sales and profit forecasts for the full year unchanged. Previously Walmart had set cautious expectations for its financial performance this year, in part because of the unpredictability of tariffs. Walmart is likely to be a relative winner in a time of economic uncertainty, Rainey said. “We tend to gain share, come out stronger.”

Walmart shares rose around 2% in premarket trading.

Walmart grew steadily through the pandemic and the period of steep inflation that followed. The Trump administration’s on-and-off-again tariffs have created a new challenge for retailers. Some of those impacts have yet to hit retailers’ shelves, in part because many companies stockpiled goods ahead of the tariffs or postponed shipments from China. So far, the economic impact of tariffs has been muted in the U.S., with unemployment and inflation holding steady.

Walmart said its consumers in the latest quarter continued to shop cautiously, as they have for the past few years because of inflation on essentials such as groceries and child care. That has been a boon to Walmart.

Walmart Thursday said more high-income households in the U.S. chose the retailer for groceries, and shoppers embraced its low-price store brand and “rollbacks,” or temporary deals. Overall inflation ticked slightly higher in the latest quarter, primarily due to the price of eggs, the company said. Walmart’s global e-commerce business grew 22% in the quarter.

Read the full article HERE.

When and how much prices will rise depends on the product, and on the ripple effects of the tariff regime, said Paul Donovan, chief economist at UBS Global Wealth Management.

President Donald Trump’s tariffs are already increasing prices on consumer goods. More price hikes could be ahead. But when and how much prices will rise depends on the product and the knock-on effects of the tariff regime, Paul Donovan, chief economist at UBS Global Wealth Management, said Wednesday. Of course, it also depends on how long the tariffs stay in place and at what level, which is in flux.

Trump’s announced levies on trade so far have cumulatively lifted the effective tariff rate to roughly 25% from 2.5% at the start of the year, but are expected to be negotiated down from here. Donovan estimates that a 10% increase in tariffs could raise price levels by about 1.1%. He doesn’t expect companies would raise prices gradually over time, but would instead opt for one-time increases to compensate for the hit to their profits.

However, second order effects, including price-led inflation, could persist at the retail level, he said on the call with members of the media. “If consumers believe prices are increasing, then retailers can push through price increases because their customers are expecting it as a concept.”

The behavioral component, meaning how businesses and consumers react to both price hikes and the anticipation of further increases, makes it hard to judge risks, he said.

Delayed impact. The impacts will begin showing up in economic releases in the coming weeks, Donovan said. “On average I would expect something to show up in June price inflation data,” he said. “But the perception is already shifting.”

When prices move depends on product shelf life, which varies widely, and that affects how soon companies have to react to tariffs. Some companies stockpiled inventory in advance of tariffs. Many consumer items are shipped overseas and the supply chain takes weeks. In contrast, “The life span of a head of lettuce is a matter of days,” Donovan said.

Donovan notes that recent consumer surveys show higher inflation expectations and a gloomy economic outlook. Some surveys also show a partisan split with Democrats and independents anticipating higher rates of inflation than their Republican peers.

The University of Michigan’s consumer sentiment index for April showed that Americans anticipate inflation for the year ahead to jump to 6.5%. That’s the highest reading since 1981.

Donovan said that he doesn’t expect tariffs to remain at significant levels for a prolonged period, but if they did, the impact would be initially inflationary, but then disinflationary because economic growth would slow.

Federal budget impact. While tariffs, like other tax increases, will increase revenue to the U.S. government, the impact on consumer prices may be larger than the benefit to federal coffers, Goldman Sachs economists explain.

“[P]rohibitively high tariff rates on imports from China will shift import demand away from China toward countries with higher production costs but lower U.S. tariff rates,” Goldman Sachs researchers led by Chief Economist Jan Hatzius wrote in a May 7 note. “This was true in the last trade war as well, but the tariff differential is now vastly larger—145% for China versus just 10% for most other countries. That shift will also raise U.S. prices, but without a commensurate increase in the effective tariff rate.”

Economic outlook weakens. Worsening economic forecasts by many Wall Street economists are a sharp contrast to the beginning of the year when the economy was on strong footing, inflation had declined substantially, and businesses were projecting confidence about economic expansion.

Some companies have already begun raising prices. For instance, Ford Motor is increasing prices on several 2025 models, Microsoft is increasing Xbox prices, and Mattel has indicated toy prices will go up. Several luxury brands have announced they would be hiking prices.

Other companies, even those not directly affected by tariffs, have suspended earnings guidance due to the significant economic uncertainty wrought by trade policy changes. For example, Southwest Airlines, American Airlines and Alaska Air pulled their 2025 guidance.

Read the full article HERE.

- US consumer price index increased 0.2% last month

- Markets expect Fed to resume policy easing in September

- US and China on Monday agreed to pause trade war

Gold prices rose on Tuesday on bargain-hunting after a sharp loss in the previous day, while softer-than-expected inflation data from the U.S. also lent support.

Spot gold rose 0.2% to $3,241.16 an ounce as of 0938 ET (13:38 GMT), after falling as low as $3,207.30 on Monday. U.S. gold futures were up 0.6% at $3,245.50.

“We had a big correction in gold on Monday on the news that there is a deal made between the U.S. and China,” Bart Melek, head of commodity strategies at TD Securities, said.

“However, tariffs (on China) are still 30%, which is quite negative for the economy.”

The U.S. and China on Monday said they would pause their tariffs for 90 days. Following the talks in Geneva over the weekend, the U.S. said it will cut tariffs on Chinese imports to 30% from 145% while China said it would cut duties on U.S. imports to 10% from 125%.

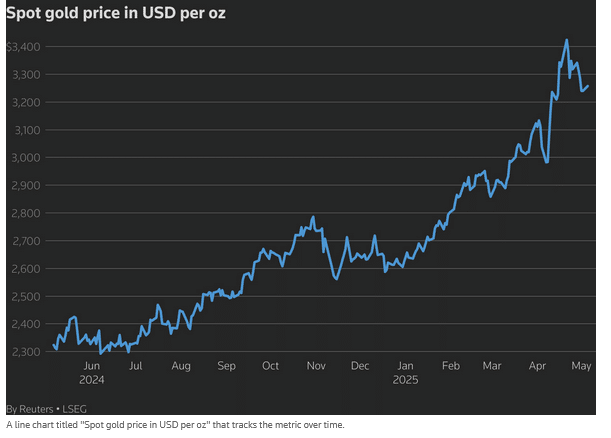

Bullion had shattered multiple record highs in 2025, owing to concerns over economic slowdown following U.S. President Donald Trump’s sweeping tariffs, strong central bank buying, geopolitical tensions and increased flow into gold-backed exchange-traded funds.

Elsewhere, U.S. consumer price index increased 0.2% last month, the Labor Department’s Bureau of Labor Statistics said on Tuesday. Economists polled by Reuters had forecast the CPI would rise 0.3%.

“The report does lean slightly friendly for the precious metals markets because it’s not a problematic inflation report that would give the Federal Reserve pause on cutting interest rates,” Jim Wyckoff, senior analyst at Kitco Metals, wrote in a note.

Financial markets expect the central bank to resume its policy easing in September.

Lower interest rates increase non-yielding bullion’s appeal.

Spot silver added 0.1% to $32.62 an ounce, platinum climbed 1.4% to $989.95 and palladium gained 0.2% to $947.24.

Read the full article HERE.

Tariff reductions are bigger than expected and Bessent says ‘neither side wants to decouple’

Key Points

- US and China agree to de-escalate trade war, unwinding most tariffs imposed since April.

- Both countries will lower reciprocal tariffs to 10% for 90 days to allow trade talks.

- Other tariffs remain, including 20% levy related to fentanyl; US seeks lasting trade deal

A few days ago, it would have seemed almost impossible. But on Monday, to the surprise of global investors and everyday businesses fearing a trade war, the U.S. and China agreed to a truce.

The world’s two biggest economies unwound for now most of the tariffs they had imposed on each other since April in a tit-for-tat battle that was threatening to stoke U.S. inflation, crash China’s export engine and upend the global economy.

Stock markets in the U.S. and elsewhere surged on the news. The dollar and bond yields rose, reflecting expectations of faster U.S. growth as trade tensions recede.

Investors and analysts said the outcome was much better for the global economy than they had expected on Saturday when U.S. and Chinese negotiators started two days of intensive talks at the Geneva residence of the Swiss ambassador to the United Nations.

The U.S. agreed to lower the base level of tariffs on most Chinese goods to 30%, from 145%, while China said it would cut its levies on U.S. products to 10% from 125%. The 30% rate imposed by the U.S. includes a levy related to China’s alleged role in the fentanyl crisis plaguing the U.S., an issue in the weekend’s talks.

The U.S. tariff on many Chinese products will be higher than 30%. U.S. duties on steel, aluminum and autos remain in place, as do some earlier tariffs on certain Chinese goods imposed during President Trump’s first term in office and that of former President Joe Biden.

Washington and Beijing agreed to keep the new tariff levels in place for 90 days, with the goal of working toward a broader deal on trade in further talks.

China said it would cancel or suspend some nontariff trade measures it had imposed to hit back at the U.S., potentially including easing export restrictions on critical minerals used in batteries and other high-tech applications.

Speaking at a news conference in Geneva, Treasury Secretary Scott Bessent said the U.S. was seeking “a long-lasting and durable trade deal” with China. He said a clear break between the two economies wasn’t desirable and “neither side wants to decouple.”

Bessent said the U.S. still had grave concerns about its unbalanced trading relationship with China. He cited issues such as China’s management of its currency and its subsidies for manufacturing, which Washington believes are a major factor driving factory-job losses in the U.S. Those and other issues will be discussed in talks over the next 90 days, he said.

The outcome forestalls for now what was shaping up to be a destructive clash between the world’s two biggest economies, with potential ripple effects across the globe.

Retailers in the U.S. were warning of empty shelves if they couldn’t get Chinese products, and some small businesses were worried they would go under without easy access to China’s vast factory floor. Economists warned higher prices and shortages risked reigniting inflation.

For China, an unrestrained trade clash with the U.S. would threaten millions of jobs tied to serving U.S. consumers and potentially worsen trade tensions with other countries wary of a surge in Chinese imports. China was also worried about losing access to some U.S. products it still needs, such as Boeing planes, aircraft parts and certain chips.

Prices for goods leaving Chinese factories have been falling for more than two years as production outstrips demand—a deflationary trend that would only get worse if trade barriers rose further.

Dan Ives, an analyst at Wedbush Securities, said the scale of the tariff reduction was “a dream scenario.” Trump had suggested just days ago that an 80% tariff on Chinese goods “seems right.”

“The tariff pause offers a reprieve from what had begun to resemble a bilateral trade embargo,” said Robin Xing, chief China economist at Morgan Stanley in Hong Kong. He said a surge in trade between the U.S. and China was likely during the 90-day window as both sides rush to take advantage of the lower tariffs, a repeat of frontloading that occurred earlier in the year.

Bessent said the two sides agreed to a framework to keep talks progressing, which he said should help avoid any future tit-for-tat escalation of the kind that followed Trump’s April 2 tariff announcement. At the time, Trump imposed an additional 34% tariff on China as part of his global tariff plan affecting most U.S. trading partners, and the figure kept rising as Beijing and Washington traded rounds of retaliation.

Though the sides didn’t come to agreement over the fentanyl tariffs, the U.S. made clear in private meetings its views on the importance of combating the deadly drug. Trump has accused China of playing a role in the illicit fentanyl trade, something Beijing denies.

In a private meeting on Saturday, Bessent picked up a bit of sugar out of a dish on the table and told Chinese officials that the amount he was holding could kill a person if it were fentanyl, said a person with direct knowledge of the exchange. Bessent picked up a little more sugar and said that amount could kill people across Geneva. Then he picked up more and said that much could kill people across Switzerland.

In a briefing with a small group of reporters, Bessent said that although fentanyl wasn’t the main focus of the trade talks, the Chinese delegation included China’s minister of public security, Wang Xiaohong, who was able to discuss the issue in detail with U.S. officials. Such an official isn’t usually part of a trade team, Bessent said, and that “shows their responsiveness to our concerns,” he said.

Since the start of his second term, Trump has been adamant about the need to raise tariffs on China, sticking to his position even when markets were taking a hit. He said China had been ripping off the U.S. for decades and it was time to put pressure on Beijing.

But in recent weeks, Bessent had focused on the potential downside of an extended trade war with China. He repeatedly said the situation with China was unsustainable.

In the same social-media post suggesting an 80% tariff on China, Trump also named his Treasury secretary as the person to make the call. He said the rate was “up to Scott B.”

Bessent said during the briefing that Trump was given updates after each of the two days of meetings in Geneva.

Read full article HERE.

Banks and brokers are seeing rising demand for currency derivatives that bypass the dollar, as trade tensions add a sense of urgency to a years-long shift away from the greenback.

Firms are receiving more requests for transactions including hedges that sidestep the dollar and involve currencies such as the yuan, the Hong Kong dollar, the Emirati dirham and the euro. There’s also demand for yuan-denominated loans, and a bank in Indonesia is setting up a desk for the Chinese currency.

The vast majority of foreign-exchange trades use the dollar even if they’re transferring money between two local currencies. For example, an Egyptian company wanting Philippine pesos will typically transfer its local currency into the greenback before buying pesos with the dollars it receives. But companies are increasingly looking at strategies that skip the dollar’s role as a go-between.

The attempt to find alternatives is another sign that companies and investors are turning their backs on the world’s reserve currency, which was hit with a wave of selling this week amid shifting bets on trade deals. Stephen Jen, a high-profile strategist known for his work on the “dollar smile” theory, has warned of a potential $2.5 trillion “avalanche” of dollar selling that could derail the currency’s long-term appeal.

The greenback’s tumble this week reflected short-term anxieties about trade tensions that are now dominating sentiment. But structural changes in how the greenback is used — and by whom — point to a longer term trend of de-dollarization.

“The increase in transactions between non-US currencies is largely due to technological development and increased liquidity,” said Gene Ma, head of China research at the Institute of International Finance. “The trading parties feel that the price may not be worse than using the US dollar, so transactions naturally pick up.”

Peak Dollar

The attempt to bypass the dollar is picking up steam, based on conversations with employees of companies and financial institutions across Asia, who asked not to be identified as they aren’t allowed to comment publicly.

Financial institutions from Europe and elsewhere are increasingly pitching yuan derivatives that cut out the US currency, said a person at a commodities trading firm in Singapore. Closer commercial ties between mainland China, Indonesia and the Gulf are spurring demand for non-dollar hedges, several people said.

European carmakers are driving up demand for euro-yuan hedges, said a trader at a financial institution in Singapore. In Indonesia, a foreign bank is due to set up a dedicated team in Jakarta this year to meet growing demand from local clients to facilitate rupiah-yuan transactions, according to an executive at the firm.

The gradual shift away from the dollar erodes one of the building blocks of global trade. For decades, it has been ubiquitous in everything from emerging market debt financing to trade settlement. The use of the dollar as a go-between currency accounts for around 13% of its daily trading volumes, according to a recent estimate.

But global use of the dollar was under threat even before US President Donald Trump’s unpredictable approach to trade forced a radical rethink about the greenback’s place in the world.

China has for years been trying to promote international use of its own currency, signing currency settlement agreements with Brazil, Indonesia and others and promoting the global use of the yuan. The BRICS group of emerging-market nations has discussed de-dollarization. Russia’s invasion of Ukraine in 2022 spurred interest among some countries in shifting away from the dollar, after sanctions on Moscow raised questions about whether the currency had become weaponized.

To be sure, few market participants doubt that a move away from the dollar will be anything but a gradual shift. For one thing, there are no realistic candidates to replace it. The use of the euro in global transactions has fallen over the past two years, according to data from data from global payments company Swift, while China’s currency remains a novelty for trade not directly involving the world’s second-largest economy.

China’s Trade Anchor

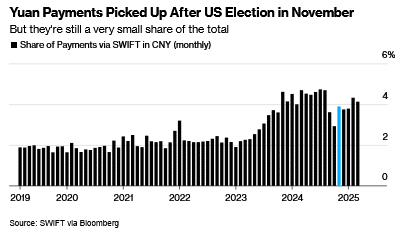

China’s yuan was used in around 4.1% of global payments in March, according to data from global payments company Swift, a far cry from the dollar’s 49% global use. But some of China’s payments are being done through its own system, which is growing rapidly.

Annual volumes through the Cross-Border Interbank Payment System reached around 175 trillion yuan ($24 trillion) in 2024, a more than 40% year-on-year growth rate, according to its own data.

Chinese investors and trading companies used the yuan in a record percentage of their cross-border activities in March. The country’s exporters are also speeding up the exchange of dollars into yuan, reversing a previous trend of exporters sitting on dollar revenues amid fears the yuan would weaken.

Chinese exports to Southeast Asia have grown more than 80% in the five years to March 2025, while those to the United Arab Emirates and Saudi Arabia more than doubled, according to Bloomberg-compiled data. That far exceeds the rate of growth for the country’s exports to the US and the European Union.

While yuan-based hedges are often more expensive than those based on the dollar, low interest rates on underlying yuan loans can mean the total cost is still attractive for borrowers.

“You can fund yourself at a third of the cost that you would fund yourself in dollars,” said Alicia Garcia Herrero, chief Asia Pacific economist at Natixis. Still, “the renminbi has limitations because there’s not a lot of liquidity offshore.”

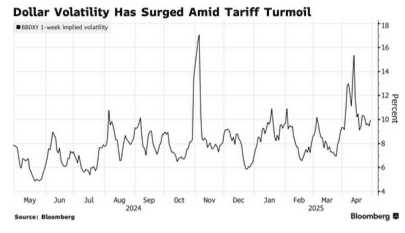

The cost of hedging the dollar against major currencies has increased over the past year, with spikes just before the US presidential election in November and again in April. Demand among options traders for hedges against dollar declines has surged. A Bloomberg gauge of the dollar has lost around 6% this year as anxiety about trade tensions have loomed large.

The tariff-related dollar swings make clear that it’s not just China and other major economies that are chipping away at the dollar’s place in the world. Trump has sent mixed signals about the currency, but he has complained about dollar strength and has given a top job to Stephen Miran, an economist who has written about a radical shake-up of the dollar-based world order.

Trump’s approach to trade, his apparent willingness to jettison longstanding practices and his repeated criticisms of the Federal Reserve have all added to a sense that the dollar’s dominant role in the global economy is facing its biggest threat in decades.

“Given the dollar’s remarkable staying power, it would appear to require truly epochal shifts in the international environment to displace it,” wrote Deutsche Bank analysts including Oliver Harvey in a recent note. “But there are growing risks that just such shifts are taking place.”

Read the full article HERE.

The Federal Reserve’s next move on interest-rate policy depends on the Trump administration’s next move—or series of moves—on trade policy.

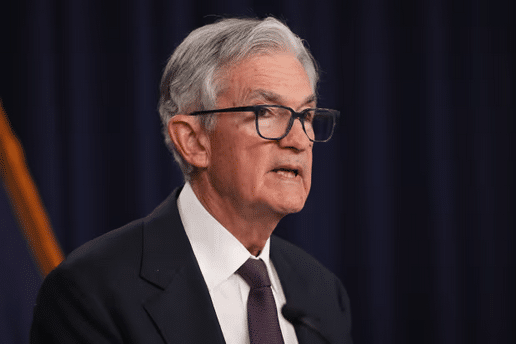

In a statement released Wednesday after the Fed’s May policy meeting, and in Fed Chair Jerome Powell’s comments at a postmeeting press conference, the message was clear: President Donald Trump’s sweeping tariffs have clouded the central bank’s economic outlook, making it nearly impossible to forecast whether inflation or unemployment will prove to be the more urgent threat.

The scale of the White House’s “Liberation Day” tariffs “was significantly larger than anticipated,” Powell said.

That leaves the Fed, which held the federal-funds rate target range steady at 4.25%-4.50%, in wait-and-see mode, so much so that Powell referenced “waiting” more than 20 times during a nearly hourlong press conference. Rick Rieder, chief investment officer of global fixed income at BlackRock, called the Fed’s stance “assertive inaction” in a client note.

The Fed’s dual mandate stipulates that it must foster price stability and full employment. Yet, as the FOMC statement stated, and as Powell’s comments later reinforced, Fed officials judged that “the risks of higher unemployment and higher inflation have risen,” largely due to uncertainty surrounding tariffs.

The economy remains solid enough to justify patience with regard to any monetary policy changes, Powell said, while emphasizing that the cost of waiting to make changes is relatively low. The Fed, Powell said, is in a “good place” to wait and see what happens.

By Thursday morning, futures traders were pricing in about 17% odds of a quarter-percentage-point cut in the fed-funds rate at the June policy meeting, down from 30.5% on Tuesday and 63% a week ago, based on the CME FedWatch tool.

The market’s attention has now shifted to the policy meeting ending July 30. Odds of a rate cut of the same magnitude at that meeting were 59% late Wednesday, up from 35% a week ago.

Much will depend on the scope and duration of tariffs, and whether they result in a one-time bump in prices or more persistent inflation, none of which is clear right now, Powell said. That’s a change in tone from the Fed’s messaging after the March meeting, when officials emphasized the transitory nature of trade policy-induced price hikes.

“We’re going to need to see how this evolves,” Powell said on Wednesday.

Not everyone agrees with the Fed’s current posture. Neil Dutta, head of economics at Renaissance Macro Research, said in a note that Powell’s labor-market views were outdated.

“Powell’s views on unemployment seem very stale, in my view,” he wrote on Wednesday. “Labor market conditions are said to be solid even though labor demand continues to cool, hiring rates are low, and average hourly earnings have slowed. What makes the Fed assume this stabilizes on its own? It can’t and won’t, which means a policy response will ultimately be required.”

In recent months, the unemployment rate has been “moving sideways,” but at 4.2% it is still within the range of maximum unemployment, Powell said.

Powell conceded that a wait-and-see policy means the Fed won’t be able to take pre-emptive action ahead of a potential economic slowdown. “It’s not a situation where we can be pre-emptive because we actually don’t know what the right response to the data will be until we see more data,” he said.

Powell also pushed back at the press conference on recent political and public criticism of the Fed. In response to a question, he said Trump’s public pressure to cut interest rates “doesn’t affect our doing our job at all.”

He added, “We’re always going to only consider economic data, the outlook, and the balance of risks. That’s it.”

Although previous presidents have routinely met with Fed chairs, he confirmed that Trump hasn’t requested a meeting during this presidential term. “I’ve never asked for a meeting and I never will,” Powell said. “It always comes the other way.”

Powell also responded to recent criticism from former Fed Gov. Kevin Warsh, who is widely believed to be Trump’s next pick for Fed head. In a keynote speech last month, Warsh accused the central bank of mission creep and overreach.

“We did things on an emergency footing during the pandemic,” said Powell. “We knew we wouldn’t get everything perfect.”

He acknowledged that the Fed could have done a better job explaining quantitative easing, its strategy of buying assets such as government debt to increase financial-system liquidity, but defended the central bank’s independence and scope.

On climate-related efforts, the Fed’s role is “very, very narrow,” he said, adding that suggestions to the contrary are exaggerated.

The main message of the Fed’s May meeting, however, was pervasive economic uncertainty, and the central bank’s decision to stay the course, watch, and wait.

Read the full article HERE.

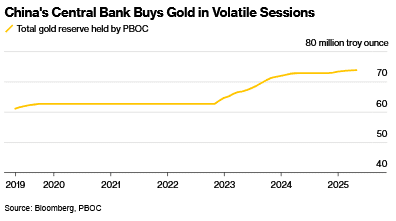

China expanded its gold reserves for a sixth straight month in April, underlining its push to boost holdings of the precious metal as prices trade near a record and the trade war rumbles on.

Bullion held by the People’s Bank of China rose by about 70,000 troy ounces last month, according to data on Wednesday. In the latest six-month span, volumes have climbed by close to 1 million ounces, or about 30 tons.

Gold has rallied to successive records this year, supported by concerted central-bank buying as authorities seek to diversify holdings away from the US dollar. Bullion’s upswing — with prices up nearly 30% higher this year — has also been aided by rising investment demand as the US-led trade war unsettles financial markets, raises concern about US assets, and drives haven demand.

In China, there have been signs investors are piling into gold, with volumes on the Shanghai Futures Exchange surging to a record in recent weeks. The voracious onshore appetite has also seen the PBOC issuing fresh quotas for commercial banks to import bullion.

At the same time, the Chinese authorities have moved to shore up support for the economy, and set the stage for trade talks with senior US officials later this week. On Wednesday, Beijing reduced its policy rate and lowered the amount of cash lenders must keep in reserve, highlighting efforts to buttress growth.

Central banks have increased their gold purchases roughly five-fold since 2022, after a freeze on Russian reserves, according to Goldman Sachs Group Inc., which has been among the most vocal bullion bulls in recent months. The trend is likely “a structural shift in reserve-management behavior, and we do not expect a near-term reversal,” analysts said in a March note.

At that time, the bank estimated that the PBOC held around 8% of its reserves in gold, below the global average of about 20%, and also far lower than the elevated share seen in some developed economies. If Beijing were targeting an allocation of 20%, and maintained an average pace of about 40 tons a month, it would take about three years to reach a that level, the analysts said.

“The modest volumes bought over the last few months suggest that while they are buyers, they will only do so if the price is attractive,” said Ross Norman, chief executive officer at Metals Daily. “Likely we will see ongoing purchases of gold by PBoC, as they scale back on US dollar denominated assets such as Treasuries.”

Read the full article HERE.

The sharp moves higher in the Taiwanese dollar and other Asian currencies against the U.S. dollar in the past couple of days are giving global investors flashbacks of the late 1990s Asian currency crisis, adding to concerns that investors are rethinking their appetite for U.S. assets.

These moves have made the dollar weaker, with the U.S. Dollar Index down 8% so far this year. That runs counter to the conventional wisdom that the dollar strengthens on the back of tariffs, which make foreign goods more expensive for U.S. currencies and theoretically narrow the trade deficit and reduce the amount of dollars going abroad.

However, some of the tamest currencies in Asia are seeing wild swings higher. Take the Taiwanese dollar which strengthened against the U.S. dollar 4.4% in a single session and 5.8% for the week for its biggest single-day and one-week gains in history. It strengthened another 4% on Monday, and Taiwan’s central bank urged calm overnight.

Other Asian currencies have also been volatile, with the Korean won strengthening 2.5% Friday; and up another 1.5% Monday. The Singaporean dollar SGDUSD+0.10% is up and Japanese yen USDJPY-0.80% also climbing.

Initially chalked up to low volumes due to a holiday for Buddha’s birthday on Friday, the strength of these currencies versus the dollar again on Monday “points to an important shift in policy,” Louis Gave, head of Gavekal Research, wrote in a note to clients.

Others agree. Jens Nordvig, founder of macro research consulting firm Exante Data, writes in a social media post Monday that these “aren’t tactical shifts” but strategic ones, imploring investors to manage their risk accordingly.

Another data point that sticks out to Nordvig: risk reversals—the difference in pricing for dollar-denominated puts versus calls—are “suddenly in a new regime” and back to levels not seen in the post-global financial crisis period.

Such sharp moves in typically tame currency markets raises concerns of trouble among those who own a lot of dollar-oriented assets, like Taiwanese insurers, and the prospects they sell dollars to deal with the pain. That in turn could roil the U.S. bond market.

From a bigger picture view, these shifts add to the notion that foreign investors are rethinking their hefty allocation to U.S. assets in the wake of Donald Trump’s efforts to reorder global trade and alliances.

Global strategists are also paying close attention to past comments from the likes of Treasury Secretary Scott Bessent that floated the idea Asian countries voluntarily revalue their currencies in some new version of the Bretton Woods agreement.

With many Asian currencies “seriously undervalued,” Gave says that made sense in theory though could be painful in practice, especially as Taiwan already is seeing weak tourism, and a 10% revaluation in its currency would hurt domestic producers’ profitability.

But global investors see parallels to the late 1990s currency crisis, which was sparked by Thailand’s devaluation. Gave says there is the possibility of a “reverse Asian crisis” where the currencies strengthen instead of tumble against the dollar as they did in the 1990s.

Taiwan and South Korea’s dependence on the U.S. for security could make them more willing to revalue their currencies. However, it’s unclear if Japan, southeast Asian currencies or China would follow, he says. Overnight, the Taiwanese central bank pushed back against speculation the U.S. had asked them to revalue their currency.

Read the full article HERE.

- Fed’s interest rate decision due on Wed

- Dollar down 0.4% against its rivals

- US stock futures fall after Trump’s new tariffs

May 5 (Reuters) – Gold prices rose more than 2% on Monday, helped by a weaker dollar and safe-haven inflows after new tariffs from U.S. President Donald Trump reignited worries about the effects of a global trade war.

Spot gold was up 2.3% at $3,313.21 an ounce, as of 1144 GMT. U.S. gold futures climbed 2.4% to $3,322.

The dollar index was down 0.4% against its rivals, making gold more attractive for other currency holders.

On Sunday, Trump announced a 100% tariff on movies produced outside the U.S. but offered little clarity on how the levies would be implemented.

“The U.S. dollar is slowing down and that is a positive for gold, more investors are betting that the Fed will cut rates relatively soon after last week’s U.S. GDP data came below expectation and now with what’s going on with oil,” said Carlo Alberto De Casa, external analyst at Swissquote.

Although the U.S. Federal Reserve is widely expected to leave rates steady on Wednesday, market focus will be on economic projections, clarity on future rate cuts and Chair Jerome Powell’s remarks.

Trump said he will not remove Powell as Fed Board Chairman before his term ends in May 2026, while reiterating his call for the central bank to cut interest rates.

Non-yielding gold acts as a hedge against global uncertainty and inflation and tends to thrive in a low-interest-rate environment.

Trump on Sunday said the U.S. was meeting with many countries, including China, on trade deals, and his main priority with China was to secure a fair trade deal.

“With Chinese solar production now slowing amid oversupply, high U.S. recession risk and central bank gold buying remaining strong in 2025, we expect gold to continue outglittering silver,” Goldman Sachs said in a note.

Elsewhere, spot silver rose 1.3% to $32.38 an ounce, platinum was up 0.1% to $961.41 and palladium gained 0.7% to $960.13.

Read the full article HERE.

Big Money pros are more anxious now than during the bursting of the dot-com bubble, the 2008-09 financial crisis, and the Covid-19 pandemic.

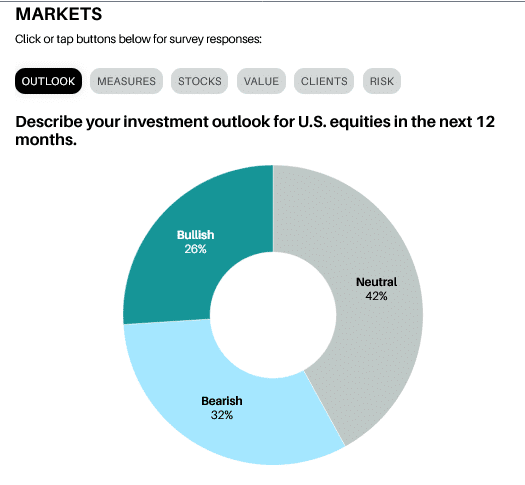

America’s money managers are more bearish today than they have been in nearly 30 years. Barron’s latest Big Money poll of professional investors finds 32% of respondents bearish on the outlook for stocks over the next 12 months—the highest percentage since at least 1997.

Just think about all the crises investors have weathered since then: the bursting of the dot-com bubble, the 9/11 terrorist attacks, the collapse of Lehman Brothers and the 2008-09 financial crisis, the Covid-19 pandemic. And yet the Big Money pros are more anxious now than during any of those painful points for the financial markets, the economy, and the country.

The bulls’ ranks also stand at historic levels in our spring survey—historically low, that is. Just 26% of respondents call themselves bullish on the market’s prospects, the smallest percentage since 1997.

A full 50% of managers were bullish last fall, while only 18% were bearish. The change in sentiment largely reflects worries about the potential impact of the Trump administration’s tariffs on corporate earnings and the economy. Although President Donald Trump has softened his stance since announcing tariff hikes on April 2, and has shown a willingness to make deals with both traditional allies and China, the managers remain concerned about the possibility of a global trade war.

“Trump may have overplayed his hand on tariffs,” says Harris Nydick, managing member and co-founder of CFS Investment Advisory Services in Totowa, N.J. “This is one of the top five times in my career for fog and murkiness. There are so many unknowns.”

The S&P 500 index has fallen about 4% this year after two years of double-digit gains. Tariff worries are only partly to blame, however. Equity valuations were unsustainably high at the start of the year, and investors’ concentrated bets on beneficiaries of artificial-intelligence technology were rocked in late January when China’s DeepSeek revealed an AI model built more efficiently, and at far lower cost, than U.S. models.

Although stocks have rebounded from the lows reached after Trump’s tariff announcement, the Big Money managers think more selling may be in store. Some 58% say the stock market is overvalued, while 38% call stocks fairly priced. Only 4% say the market is undervalued.

The managers’ clients are even more pessimistic than the pros; 56% say their clients are bearish.

Bill Smead, founder and chief investment officer of Smead Capital Management in Phoenix, calls this “one of the craziest junctures for the markets” that he has ever seen. “We needed to unwind growth-stock mania,” he says, but adds that the tariff news led investors to “slaughter things that should do better,” namely industrial and consumer stocks that have been hit hard by trade-war concerns.

Barron’s conducts the Big Money poll twice a year, in the spring and fall, with the help of Erdos Media Research in Ramsey, N.J. The latest poll was mailed out in late March, with supplementary tariff-related questions added in early April. The spring survey drew 119 respondents.

The optimists expect the Dow Jones Industrial Average, S&P 500, and Nasdaq CompositeCOMP+1.11% to end the year about 4% to 7% above recent levels, based on their mean forecasts. But the bears see a 7% decline for the Dow and low-double-digit losses for the S&P 500 and Nasdaq. Forty-two percent of respondents describe themselves as neutral in the latest poll.

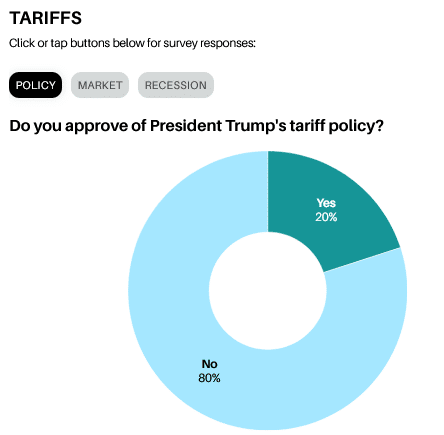

Only 20% of Big Money managers indicate they approve of Team Trump’s tariff policy, while about 80% put the odds of a tariff-related recession at 40% or higher. Still, 60% consider the market’s tariff-related tempest a buying opportunity.

Several respondents lamented the fact that the White House isn’t focusing on policies that might spur more immediate growth. “I hope the administration begins to take a look at the process of deregulation,” says John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, based in New York.

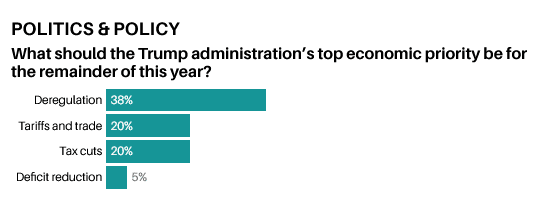

He isn’t alone: 38% of poll respondents say deregulation ought to be the administration’s top economic priority this year.

Simply put, much of the optimism about a second Trump administration unleashing animal spirits on Wall Street has evaporated since stocks surged shortly after Trump defeated former Vice President Kamala Harris in November.

“Companies are frozen; CEOs are wondering if they should play the long game or short game,” says Matthew Neyland, chief investment officer at SK Wealth Management in Providence, R.I. “There are things that could be done to make the mergers and acquisitions process easier that would help.”

Neyland says banks might be willing to lend more if they had more flexibility with regard to capital requirements. At the same time, “burdensome reporting” regulations make it more complicated for public companies to do business and have led more companies to stay private, he says.

Deregulation and tax-cut extensions may be coming, but Trump has given the market “the spinach first,” says Eric Green, chief investment officer at Penn Capital Management in Philadelphia. Green says he expects “more shoes to drop” before the market selloff is over.

He also expects a rebound in M&A activity, but notes that companies don’t want to announce major transactions until there is more clarity about tariffs. “They’ve been overwhelmed by tariffs,” he says of the White House and Congress. “Everything else might be happening, but slowly. It’s a matter of time.”

What is the biggest risk the stock market will face in the next six months? Among survey respondents, 24% cite an economic slowdown, 19% say a recession, and 14% say political turmoil in the U.S. Carter Randolph, CEO of the Randolph Company in Cincinnati, is the sole poll participant who sees no chance of a recession in the next year. Although investor and business sentiment hasn’t been good, consumer spending has held up, he says, adding that “sentiment isn’t a good investment tool.”

But others aren’t as dismissive of widespread worry on Wall Street and Main Street. Joe Gilbert, a portfolio manager at Integrity Asset Management in Rocky River, Ohio, says the economy looks to be headed toward a downturn. “Tariffs have caused things to come to a standstill,” he says. “It makes it tough to have confidence, and confidence is fuel for the economy, so a recession is more likely than not.”

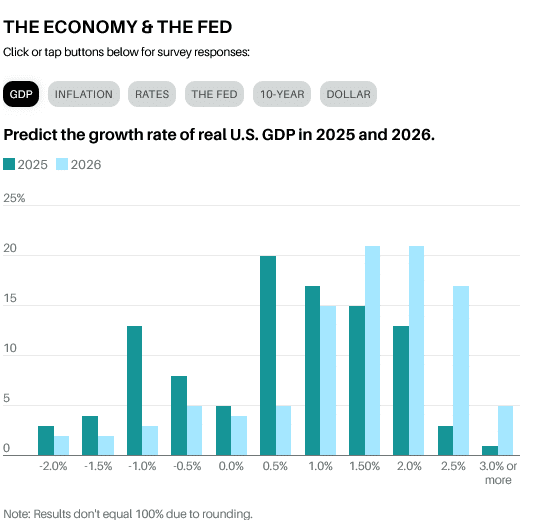

The Bureau of Economic Analysis reported on Wednesday that gross domestic product, adjusted for inflation, fell at an annualized rate of 0.3% in the first quarter, largely due to a surge in imports ahead of the implementation of tariffs. Real GDP grew 2.4% in last year’s fourth quarter.

Economic concerns are a big reason for gold’s record-breaking rally this year. Bullion has gained almost 27% year to date, to a recent $3,312 an ounce. Gold is often viewed as a defensive holding, a commodity with currency-like qualities that performs well when the dollar is weakening. The Big Money managers are fans: 58% say they are bullish on gold.

Oppenheimer’s Stoltzfus says he thinks it’s fine for investors to own a little gold, noting the price has gotten a boost largely due to buying by the central banks of China, India, and other emerging markets seeking to diversify beyond the dollar. But Tom Forester, manager of the Forester Value fund, says gold miners might be a better play.

Forester’s fund owns Agnico Eagle Mines and Alamos Gold. Both are trading below their five-year average forward price/earnings multiples, he says, and are benefiting from lower oil prices, which reduces costs. Both are Canadian companies.

Many Big Money participants say they are looking beyond the U.S. for better values this year, with 70% calling themselves bullish on non-U. S. stocks. Charles Zhang, founder and president of Zhang Financial in Portage, Mich., tells Barron’s that he likes both developed and emerging market stocks, and favors the iShares MSCI EAFE Value exchange-traded fund and the Vanguard FTSE Emerging Markets ETF. “The U.S. dollar is weaker; that and a stronger euro are helping international stocks,” he says.

Zhang, No. 1 in the Barron’s ranking of independent advisors, also sees potential for Chinese stocks to keep rising, noting that Alibaba Group Holding and other leading Chinese stocks still look reasonably priced. Alibaba is up more than 40% year to date but trades for just 13 times the next 12 months’ expected earnings.

Better prices elsewhere, coupled with frustration about U.S. trade policies, have led some investors to throw in the towel on U.S. assets. “Some clients are apoplectic,” says Sandra S. Martin, managing director of Martin Investment Management, which has offices in Palm Beach Gardens, Fla., and Evanston, Ill. She says some of the firm’s Asian clients are now focusing more on international stocks.

It isn’t all doom and gloom in the investment world. A volatile start to 2025 has created better buying opportunities in some stocks that had become too rich. “The average investor needs to think for the long term,” says Joseph Parnes, president of Technomart Investment Advisors in Baltimore. He calls himself a contrarian, and bullish. “You should take advantage of downturns, and within two to three years we should see solid growth,” he says.

Sharon Hill, a senior portfolio manager at Vanguard, likes dividend-paying stocks, particularly in the banking and pharmaceutical industries, and especially as bond yields retreat. “High-yielding stocks are already more attractive as a safety play,” Hill says.

She expects volatility in the bond market to make them even more so.

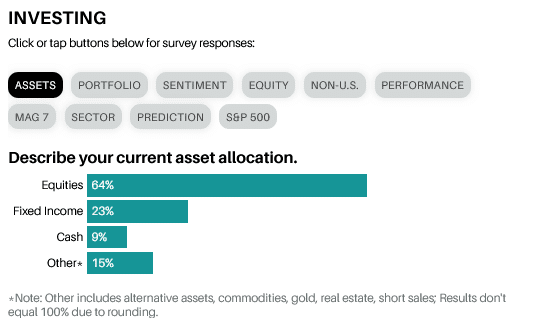

Many Big Money men and women are upbeat about the outlook for bonds. Nearly 75% of the survey participants say their weighting in fixed-income assets is higher than six months ago, while 70% say they are bullish on bonds. “There is still value in bonds,” says Erica Snyder, CEO of Hunter Associates, with offices in Pittsburgh and Salem, Ohio. “We see the Federal Reserve stepping in to cut interest rates a little bit a few times this summer.”

Rate cuts could put more downward pressure on the 10-year Treasury yield, which has fallen in recent months to a current 4.17%. Sixty-two percent of Big Money respondents expect the 10-year yield to be 4% or lower a year from now.

Lower bond yields are a boon to risk assets, prominently including equities. Jose Medeiros, a managing partner at Stonerise Capital Partners in San Francisco, likes the prospects for Meta Platforms, Amazon.com, and Alphabet. “Tech isn’t a fad; it is a growing part of the global economy, and that isn’t going to change,” he says. “Tech companies are growing earnings at a much faster rate than the broader market, with much higher margins and better cash-flow generation. Tech stocks should trade at higher multiples on that alone.”

John Maffei, chief investment officer at MFM Capital Management in Orlando, Fla., says he has been “looking to scoop up values,” particularly dividend payers, as the market has fallen. “The selloff in some stocks has been overdone with this market volatility,” he says, adding that his clients aren’t panicking.

Still, 2025 is likely to remain a year of surprises. And if subsequent quarters mirror the first, investors could be in for a tumultuous ride. “It is a difficult market,” says Ken Laudan, manager of the Buffalo Blue Chip Growth fund. “You have to be comfortable being very uncomfortable.”

If the Big Money managers are preparing for more market turbulence, the rest of us should be, too.

Read the full story HERE.