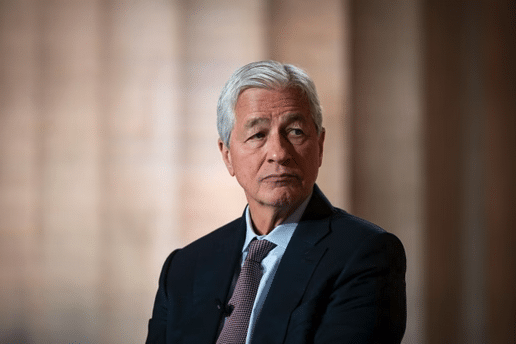

Jamie Dimon said he is concerned about how President Trump’s new tariffs will affect America’s long-term economic alliances, which he said have been key to the country’s “extraordinary standing in world affairs.”

In his annual letter to shareholders, the JPMorgan Chase JPM -3.25%decrease; red down pointing triangle chief executive said the tariffs are likely to drive up inflation on imported goods and domestic prices, with input costs rising.

“Whether or not the menu of tariffs causes a recession remains in question, but it will slow down growth,” Dimon wrote in the letter that touched on issues including the tax code, military security, healthcare costs and the country’s education system.

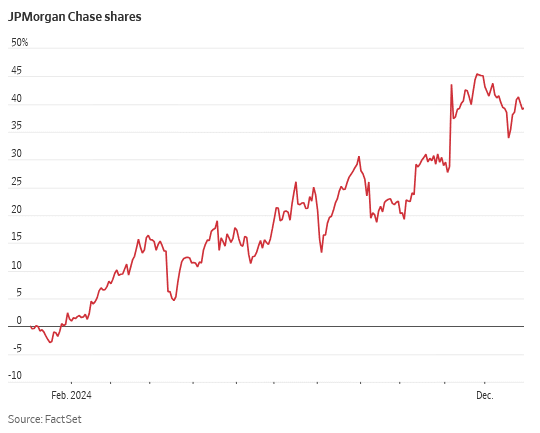

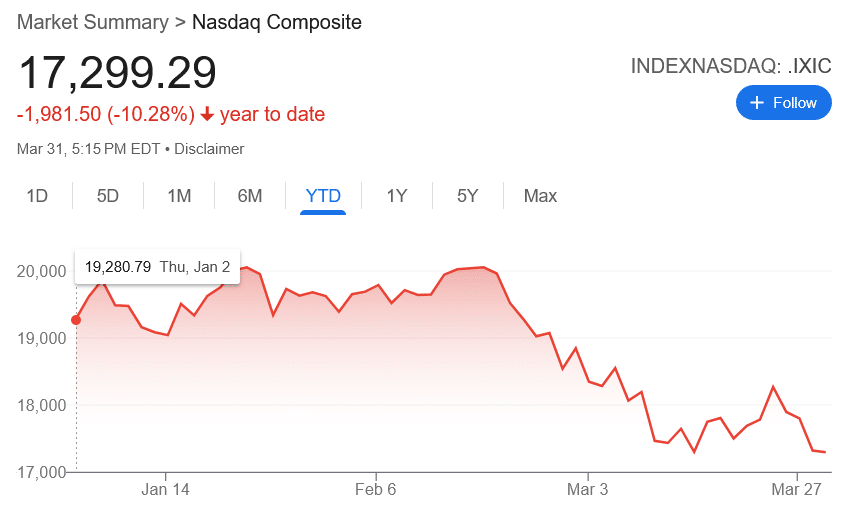

Wall Street has been reeling since Trump unveiled his sweeping tariffs on Wednesday, with the S&P 500 plunging 9.1% last week and the Nasdaq falling 10% and into a bear market. Bank stocks were among those that were slammed, with investors fearing a recession would lead to a pullback in borrowing and dealmaking.

For the past few years, Dimon has been warning about risks to the economy, from the wars in Ukraine and the Middle East, to interest rates and government debt. He has called the global geopolitical situation the most tense since World War II. On Monday, he added the tariffs to that list of simmering issues.

Dimon’s letter said there are many ongoing uncertainties around the tariffs, including retaliatory actions by other countries and the effects on corporate profits and the dollar.

“The quicker this issue is resolved, the better because some of the negative effects increase cumulatively over time and would be hard to reverse. In the short run, I see this as one large additional straw on the camel’s back,” he wrote.

After negotiations, Dimon said he hoped the long-term effect of the tariffs will bring benefits to the U.S.

Dimon’s tone on tariffs has changed with Trump’s rollout of his tariff plans. In January, he didn’t appear worried about tariffs at the World Economic Forum in Davos. “If it’s a little inflationary, but it’s good for national security, so be it. I mean, get over it,” he said in an interview with CNBC.

But by March, Dimon was expressing more concern about the effects of tariffs on companies, noting that “uncertainty is not a good thing” in an interview at a recent retirement summit.

Others on Wall Street, including hedge-fund manager Bill Ackman and investor Stan Druckenmiller, have started speaking out about tariffs as well.

Here’s what else Dimon touched on in his letter:

Taxes

Dimon took aim at tax breaks that he said primarily benefit the wealthy. “These include carried interest, the ability to deduct up to $10,000 of state and local taxes, and too many creative estate tax planning techniques.” He said the U.S. tax code should incorporate the “Buffett Rule” so that high-income earners pay a minimum tax on realized income.

“Everyone, including the wealthy, would benefit enormously from the increased growth that would follow if we amended our system the right way,” he wrote.

Stock prices

Even with the recent declines, Dimon said stock and debt prices remain high. “Markets still seem to be pricing assets with the assumption that we will continue to have a fairly soft landing. I am not so sure,” he wrote.

U.S. deficit

Dimon said America’s economic performance has been driven in part by its enormous government spending, which has led to a huge deficit. “These large deficits are not sustainable—I do not know whether it will cause a real problem in six months or six years—the sooner we deal with it, the better,” he wrote.

Management lessons

The longtime CEO also had some advice for leaders, including to treat everyone with respect and to make follow-up lists. “Take care of yourself. If you don’t take care of yourself, it doesn’t work,” he added.

Read the full article HERE.

During the AI boom, Wedbush analyst Dan Ives has become Wall Street’s most prominent tech evangelist, offering an unrelentingly bullish view on how this new technology will usher in a Fourth Industrial Revolution.

But as times change, people do too.

And in a note to clients on Friday, Ives sounded the alarm on the state of the tech trade as the reality of Trump’s shock tariff announcement on Wednesday continues to sink in across the investment world.

“The concept of taking the US back to the 1980’s ‘manufacturing days’ with these tariffs is a bad science experiment that in the process will cause an economic Armageddon in our view and crush the tech trade, AI Revolution theme, and overall industry in the process,” Ives wrote.

How Trump and his team will pull off revitalizing US manufacturing is a debate that will dominate economic policy circles for years to come.

As that years-long process plays out, however, US consumers look set to face swift and dramatic changes in the cost of some goods. Eggs have played a major role in the recent inflation discourse, and Wall Street economists on Thursday began floating the idea that the rate of inflation could double this year as a result of Trump’s actions.

But Ives has a simpler and perhaps even more tangible warning for how these tariffs will weigh on consumers: The cost of an iPhone might triple.

“The economic pain that will be brought by these tariffs are hard to describe and can essentially take the US tech industry back a decade in the process while China steamrolls ahead,” Ives wrote.

“50% China tariffs, 32% Taiwan tariffs would essentially cause a shut-off valve from the US tech landscape and in the process cause every electronic to go up 40%-50% for consumers, iPhones made in the US would cost $3,500 (vs. $1,000), and the AI Revolution trade would be significantly slowed down by these head scratching tariffs that NEED to be negotiated to realistic levels.” (Emphasis added.)

Ives also flagged an issue Nick Colas at DataTrek highlighted in a Friday morning note too: There’s a duration mismatch between US politics and Trump’s manufacturing ambitions.

“It will take many years for companies to shift production here, but Americans go to the polls every two years for Congress and four years for the presidency,” Colas wrote.

“Should newly announced trade policy cause a recession and incremental inflation, the lingering effects of both will be on voters’ minds, especially in 2028,” he added.

In Ives’s view, the cost of labor in the US makes it “unrealistic” that we could ever reshore semiconductor fabrication.

“If these tariffs went into place at current form overall tech earnings would come down 15% at least, the supply chain will be a Rubik’s Cube rivaling Covid days, and the economy would go into a recession/stagflation,” Ives wrote.

Less than an hour before Ives’ note hit the inbox, headlines crossed that China would slap 34% retaliatory tariffs on US imports.

“We assume tariff negotiations start now otherwise dark days are ahead for tech,” Ives added, “and US consumers pay the price for this … not a debate.”

Read the full article HERE.

President Donald Trump’s tariffs, if sustained, could push the U.S. and the world into a recession, according to JPMorgan.

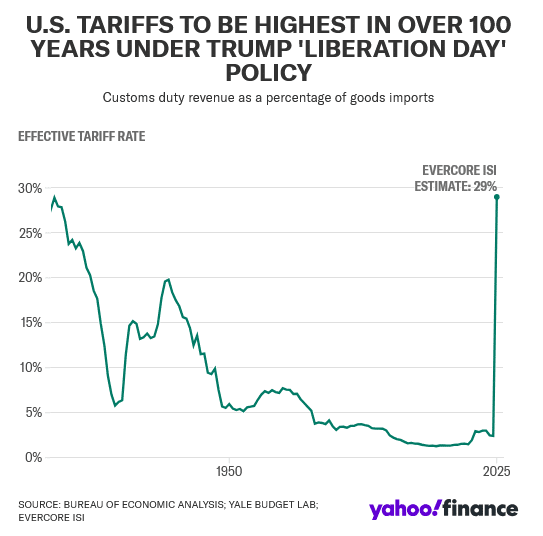

If implemented, Trump’s tariffs — which start at a baseline of 10% and go even higher for some countries — raise the effective U.S. tariff rate to 25%, a level that would hurt the U.S. growth and inflation outlook, according to JPMorgan.

The tariff hike would account for roughly 2.2% of GDP, the firm said. Meanwhile, it would add close to 2% to the consumer price index.

“We view the full implementation of these policies as a substantial macro economic shock not currently incorporated in our forecasts,” global economist Nora Szentivanyi wrote on Thursday. “This shock will likely be magnified by its impact on sentiment and through the retaliation of countries facing significant increases in their tariff rates.”

“We thus emphasize that these policies, if sustained, would likely push the US and global economy into recession this year,” Szentivanyi added.

To be sure, the economist said she’s not immediately making any changes to her forecasts, waiting to see how the policy will be implemented in the coming days.

However, the severity of Trump’s tariffs alarmed investors Thursday morning, with the Dow Jones Industrial Average futures plunging more than 1,200 points on fears of a global trade war.

Read full article HERE.

- All eyes on tariff announcement at 4 p.m. EDT (2000 GMT)

- Spot gold hit record high of $3,148.88 per ounce on Tuesday

- US private payrolls accelerate in March

- US monthly employment report due on Friday

Gold prices rose to nearly a record high on Wednesday, supported by safe-haven demand as markets braced for details of U.S. President Donald Trump’s latest tariff plans later in the day.

Spot gold was up 0.4% to $3,123.74 an ounce as of 9:15 a.m. EDT (1315 GMT). U.S. gold futures also gained 0.4% to $3,158.70.

“You have a very unsettled economic and political environment in the world and that’s going to keep investors buying gold and keeping gold price high,” said Jeffrey Christian, managing partner of CPM Group.

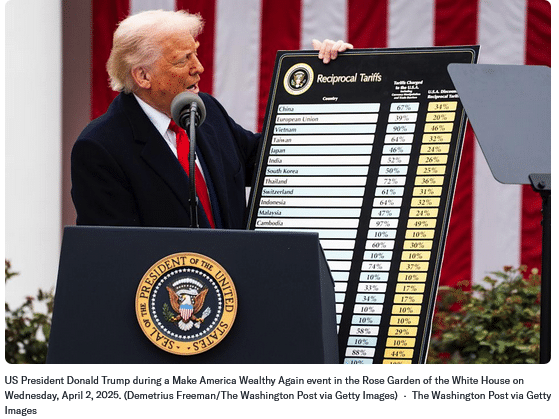

Trump, who has been promoting April 2 as “Liberation Day,” is expected to introduce sweeping new tariffs on multiple countries at 4 p.m. EDT (2000 GMT) during an event at the White House.

The U.S. president said his reciprocal tariff plans aim to equalize the comparatively lower U.S. tariff rates with those imposed by other nations.

Investors are worried that Trump’s tariffs will stoke inflation and hinder economic growth and are taking refuge in safe-haven assets like gold.

“A breach of resistance at $3,147.41/$3,149.84 would bode well for a push to $3,200, and lend confidence to bullish outlooks that highlight $3,300 and $3,500,” said Peter Grant, vice president and senior metals strategist at Zaner Metals.

Gold, often used as a safe store of value during times of political and financial uncertainty, has risen more than $500 so far in 2025 and hit a record peak of $3,148.88 on Tuesday.

“If the tariffs set to take effect today are implemented, demand for safe-haven assets could rise further, as this scenario has not yet been fully priced in,” said Ricardo Evangelista, senior analyst at brokerage firm ActivTrades.

Meanwhile, the ADP National Employment Report on Wednesday showed U.S. private payrolls growth accelerated in March. The biggest jobs data this week will come on Friday with the release of the monthly U.S. employment report.

Among other metals, spot silver rose slightly to $33.76, while platinum dropped 0.4% at $975.51, and palladium was down 0.3% to $980.51.

Read the full article HERE.

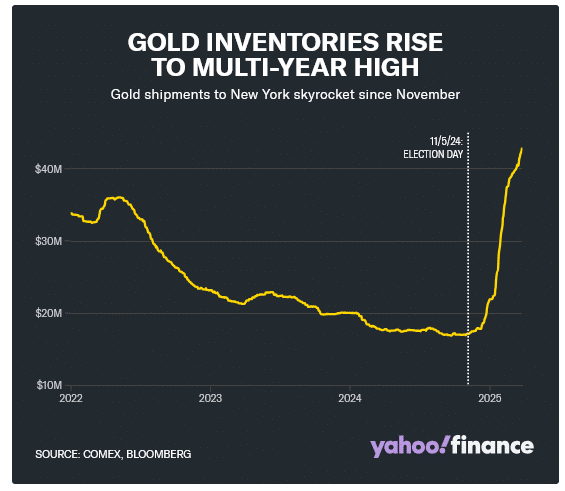

Tear up every gold prediction and precious metals forecast that was made before March 1, 2025. Everything has changed with respect to the world’s favorite safe haven. If you’ve lost count of gold’s all-time highs, expert endorsements, soaring central bank demand, and the scores of analysts who are now frantically embracing the precious metal — you’re not alone. Gold seems to go “where it has never gone before” …. on A daily basis.

The Wall Street Journal has just announced that “Everyone is a Gold Bug Now!”[1] Indeed, gold is attracting more first-time buyers than ever before, and they’re not only moving money out of stocks and bonds but also cashing in crypto accounts to buy physical gold.

[1] https://www.wsj.com/finance/investing/gold-bug-investing-36268c5a

Most global experts have “upped” their gold price predictions and forecasts with targets that suggest this rally has very steady and strong legs.

Gold is in Uncharted Territory

Gold prices have now eclipsed $3100/oz. This is unprecedented for the yellow metal as we find ourselves in the midst of an historic price surge that has seen 19 all-time high records set just in 2025 alone. As of this writing, gold is up over 38% in the past year and more than 90% over the past five years.

Amid gold’s historic run, stocks have faltered. The Dow Jones is down more than 450 points YTD. The Nasdaq is down well over 2000 points YTD, and the S&P 500 is down over 260 points YTD. The Nasdaq and S&P 500 also both entered into correction territory in March.

According to NerdWallet, a market correction is a fall in value of at least 10% from a recent market or indices high. At its most basic level, market corrections are triggered because investors are more motivated to “sell” than to “buy.” The reasons for a longer-term decline includes the following:

- A Slowing Economy: If the economy is slowing or entering a recession, or investors are expecting it to slow, companies will earn less, so investors bid down their stocks.

- Lack of “Animal Spirits”: This old phrase refers to the surges of investor emotion and risk-taking during a bull market. As they see the chance for profits, people jump into the market, pushing stock prices up.

- Fear: In the stock market, the opposite of greed is fear. If investors think the market is going to fall, they’ll stop buying stocks, and sellers will have to lower their prices.

- Outside Events: This miscellaneous category includes everything else that might spook the market, such as wars, attacks, oil-supply shocks, and other events that aren’t purely economic.[1]

What is Driving the Unstoppable Gold Surge?

The Trump tariffs have been dominating economic headlines in 2025, and their impact on inflation, GDP, consumer sentiment, market volatility and the prospects of a recession have been actively fueling gold demand.

Worries Abound! From the fear of a broadening trade war and retaliatory tariffs — to rising consumer prices and supply chain challenges — financial uncertainty is now crippling Wall Street!

[1] https://www.nerdwallet.com/article/investing/what-is-a-stock-market-correction-and-what-happens-in-a-crash

And according to a senior analyst at online trading platform Capital.com, the stock market’s pain is gold’s gain!

“While stocks falter, gold continues to shine. The metal’s status as a safe haven has been reinforced by tightening financial conditions, falling bond yields, and a weaker US dollar. As foreign demand for US assets drops due to lower yields, the environment becomes increasingly supportive for non-yielding assets like gold.”[1]

Gold’s safe haven appeal is also being fueled by geopolitical tensions as Israel is back in Gaza and Russia continues to launch drone attacks on Ukraine. And of course, the world’s central banks have been buying at unprecedented levels.

According to the World Gold Council

“Central banks’ insatiable appetite for gold reached a significant milestone in 2024. Having added 712t in the first three quarters of the year, central banks bought a further 333t in Q4 to bring the net annual total to 1,045t. As a result, they have extended their buying streak to 15 consecutive years, and, remarkably, 2024 is the third consecutive year in which demand surpassed 1,000t – far exceeding the 473t annual average between 2010-2021, and contributing to gold’s annual performance.”[2]

And despite record-high gold prices, the central bank gold grab has been historic as the world’s reserve banks are adding to their gold reserves at the fastest pace in history.

Experts Predict an Extended Gold Bull

Economists, analysts, and most major banking giants have been scrambling to update their gold projections. Not only have Morgan Stanley, Citigroup, Goldman Sachs, and Bank of America all increased their gold price forecast — so have traders, refiners, miners, jewelry analysts and most macro models.

According to precious metals trader Heraeus Metals,

“Gold’s rally has been fueled by escalating geopolitical tensions, inflation concerns, and strong investor demand. Given the current macroeconomic environment – particularly trade war uncertainties and central bank policies – this trend appears sustainable in the near term.”[3]

[1] https://www.businessinsider.com/gold-price-record-april-tariffs-trump-economy-central-bank-etf-2025-3

[2] https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2024/central-banks#from-login=1

[3] https://www.reuters.com/markets/commodities/gold-sails-above-3100-uncharted-territory-us-tariffs-approach-2025-03-31/

Similarly, global asset management and financial services company, Macquarie Group, admits that gold’s strength took them by surprise:

“Year-to-date, gold has been running ahead of our expectations. We are raising our gold price forecast to a 3Q25 quarter average peak of $3,150 per ounce and our single point price high to $3,500 per ounce. President Trump’s rapid move to announce, if not always to enact, import tariffs has contributed to geopolitical uncertainty and boosted inflation expectations, helping push down front-end real rates and supporting gold in the face of periodic USD strength and initially reduced expectations for Fed rate cuts.”[1]

And multiple experts think $4000/oz gold is not only feasible but likely including Bloomberg Intelligence strategist Mick McGlone, Yardeni Research, and the Chief Executive Officer at DoubleLine, Jeffrey Gundlach who believes gold is experiencing a “very sharp, steep trajectory” that he does not expect to stop:

“I’d be so bold to say I think gold will make it to $4,000 … “I think that that’s in recognition of gold as a storehouse of value that’s more outside of the financial system, which seems to be in a state of flux at this point in time.”[2]

[1] https://finance.yahoo.com/news/gold-touches-new-record-as-latest-wall-street-prediction-sees-prices-reaching-3500-170903882.html

[2] https://www.marketwatch.com/story/golds-going-to-reach-4-000-says-gundlach-he-also-puts-recession-probability-at-60-36b3f772

April 2nd is “Liberation Day” — Protect Your Money!

President Trump has dubbed Wednesday, “Liberation Day” where he is promising to roll out major new tariffs and levies on goods from other countries. The president has also indicated that he will impose reciprocal tariffs on other countries to level the “trade playing field” and end unfair trade practices by other countries.

According to Barron’s, it is a ‘make or break’ moment for the stock market:

“No one, perhaps not even Trump himself knows what’s to come. There’s hope that the levies will be small and targeted in their execution, but also reports that the administration is considering placing 20% tariffs across the board … For U.S. companies, the problem starts with earnings. Estimates for this year have slipped from about $272 at the start of the year to about $268 now, but high tariffs will almost certainly raise costs and eat into margins, suggesting that earnings have a lot more room to fall.”[1]

Specifically, the president mentioned new tariffs on the EU, Brazil, South Korea, India, and other countries with unfair or unbalanced trade policies toward the United States. All of this follows the announcement of a 25% tariff on all imported passenger cars (and automotive parts) last week.

“This is the beginning of Liberation Day in America. We’re going to charge countries for doing business in our country and taking our jobs, taking our wealth, taking a lot of things that they’ve been taking over the years. They’ve taken so much out of our country, friend and foe. And, frankly, friend has been oftentimes much worse than foe.”[2]

[1] https://www.barrons.com/articles/liberation-day-stock-market-selloff-89723759

[2] https://www.cnbc.com/2025/03/30/trumps-promised-liberation-day-of-tariffs-is-coming-heres-what-it-could-mean-for-you.html

Gold prices on Monday soared above $3,100 per ounce for the first time as concerns around U.S. President Donald Trump’s tariffs and the potential economic fallout, combined with geopolitical worries, drove a fresh wave of investments into the safe-haven asset.

Spot gold prices hit a record high of $3,106.50 per ounce.

Gold prices have hit multiple record highs, gaining more than 18% so far this year – capitalising on its cachet as hedge against economic and geopolitical turbulence.

Earlier this month, it breached the psychological $3,000 per ounce mark for the first time – a significant milestone that experts say reflects growing concerns over economic instability, geopolitical tensions and inflation.

Bullion’s rally has prompted multiple banks to increase their price forecasts for gold this year.

“For now, gold’s appeal as a safe haven and inflation hedge has further strengthened in light of these geopolitical concerns and tariff uncertainty. We remain constructive on the outlook of gold amid ongoing global trade friction and uncertainty,” said analysts at OCBC.

Goldman Sachs, Bank of America and UBS have all raised their price targets for the yellow metal this month, with Goldman forecasting gold to hit $3,300/oz by the end of the year, up from $3,100. BofA expects gold to trade at $3,063/oz in 2025 and $3,350/oz in 2026 – an increase from its previous forecasts of $2,750/oz for 2025 and $2,625/oz for 2026.

Trump has floated plans for a series of new tariffs aimed at protecting U.S. industries and reducing trade deficits since he took office, including a 25% tariffs on imported cars and auto parts, as well as an additional 10% on all imports from China. He intends to announce a fresh set of reciprocal tariffs on April 2.

“Tariff issues will continue driving (gold) prices higher until there is some finality to the tit-for-tat campaign,” Marex consultant Edward Meir said.

Additional factors, like robust central bank demand and exchange-traded fund inflows, will also continue supporting gold’s stunning rally this year, analysts and investment banks say.

Read the full article HERE.

Wall Street keeps pushing up its already bullish calls on gold as the precious metal climbs to new highs.

Gold futures (GC=F) rose to $3,114 on Friday after hitting their 17th record of the year on Thursday. President Trump’s auto tariff announcement fueled trade war fears, while a weaker US dollar (DX-Y.NYB) also supported prices.

Earlier this week, analysts at Bank of America raised their price target on gold to $3,500 per ounce over the coming 18 months from $3,000 previously. The new target is based on the assumption that investments increase 10% through more buying from China and central banks and continued purchases of physically backed ETFs.

“Uncertainty around Trump administration trade policies could continue to push the USD lower, further supporting gold prices near-term. In our view, a broad rebalancing of America’s twin deficits could be bullish gold too,” wrote the analysts.

A “confluence of factors, mostly driven by the Trump administration’s economic policy mix, have pushed investors to increase their allocations to the yellow metal,” the analysts wrote.

BofA’s call follows a similar forecast from Macquarie Group, which recently predicted the precious metal will touch $3,500 in the third quarter of this year.

The precious metal’s more than 15% rally year-to-date has even prompted JPMorgan analysts to question whether a price of $4,000 is a possibility.

The firm’s researchers noted the commodity’s price move from $2,500 to $3,000 occurred in just 210 days, significantly faster than previous $500 increments, which have averaged over 1,700 days.

JPMorgan analysts asked in a client note on Wednesday, “With each $1,000 phase taking about two-thirds less time than the previous one, and considering the law of diminishing returns alongside investors’ attraction for round numbers, could the $4,000 mark be just around the corner?”

The analysts said the freezing of Russian foreign assets following the Ukraine war has “triggered a structural change in the demand for gold.” Last year, demand for the precious metal reached an all-time high as central bank purchases accelerated.

“Heading into 2025, gold remained our top bullish pick for a third consecutive year in a row,” the analysts wrote.

Read the full article HERE.

U.S. gold futures scaled a record peak on Thursday, as investors sought the safe-haven asset in response to escalating global trade tensions and tumbling equity markets following U.S. President Donald Trump’s announcement of new auto tariffs.

U.S. gold futures climbed 1.2% to $3,058.6, after hitting an all-time high of $3,065.50 earlier in the session, while spot gold rose 1% to $3,049.24 an ounce.

Gold is traditionally seen as a hedge against economic and political uncertainty and often thrives in a low-interest rate environment. Gold spot prices have hit 16 record highs this year, reaching an all-time peak of $3,057.21 on March 20.

“Looks like we’re going to see (gold futures hit) $3100 here shortly and the main catalyst is safe-haven buying,” driven by uncertainty around Trump’s tariff plans, said Bob Haberkorn, senior market strategist at RJO Futures.

Governments from Ottawa to Paris threatened retaliation after Trump unveiled a 25% tariff on imported vehicles, set to come into effect the day after he plans to announce reciprocal tariffs, aimed at the countries he says are responsible for the bulk of the U.S. trade deficit.

Global stock markets fell as shares in some of the world’s biggest carmakers tumbled.

Following the Federal Reserve’s decision last week to hold its benchmark interest rate steady, while indicating potential rate cuts later this year, investors are now awaiting the U.S. Personal Consumption Expenditures data due on Friday to gauge the trajectory for further rate cuts.

“If (the PCE data) comes out better-than-expected, it might signal more upside for gold… because the Fed would be in a better position to start cutting rates,” Haberkorn said.

Goldman Sachs on Wednesday raised its end-2025 gold price forecast to $3,300 per ounce from $3,100, citing stronger-than-expected ETF inflows and sustained central bank demand.

Spot silver rose 0.8% to $33.98 an ounce, platinum added 0.2% to $976.10 and palladium added 0.8% to $975.93

Read full article HERE.

The Congressional Budget Office warned that the federal government could run out of enough money to pay all of its bills on time as soon as August if lawmakers fail to raise or suspend the debt limit.

The Treasury Department has been using special accounting maneuvers since Jan. 21 to avoid breaching the $36.1 trillion debt ceiling, which kicked in at the start of the year. But the department has yet to offer specific guidance on when those measures will be exhausted.

“If the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will probably be exhausted in August or September 2025,” the CBO, a nonpartisan arm of the US legislature, said in a statement Wednesday. “The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections.”

The CBO also said that, “If the government’s borrowing needs are significantly greater than CBO projects, the Treasury’s resources could be exhausted in late May or sometime in June, before tax payments due in mid-June are received or before additional extraordinary measures become available on June 30.”

Going past the so-called X-date would necessitate the Treasury defaulting on “some obligation,” then-Secretary Janet Yellen said during the last congressional battle to address the debt limit, in 2023. Scott Bessent, who took the Treasury’s helm in January, told lawmakers in his confirmation hearing the US “is not going to default on its debt” with him in the job.

Congressional Wrangling

The CBO projection for X-date provides lawmakers with a rough estimate on how much time they have to raise or suspend the debt ceiling to avoid such a crisis.

House Republicans have pushed to include raising the debt limit in legislation to enact President Donald Trump’s top priority — extending his 2017 tax cuts, much of which expire at year-end. The House took one step toward that last month, passing a budget proposal that included raising the debt ceiling by $4 trillion.

Senate Majority Leader John Thune on Tuesday said there is “consensus forming” around attaching a debt-limit provision to the tax package as part of a so-called reconciliation bill, which the GOP could pass without Democratic votes. It’s not clear, however, whether there’s sufficient support among Senate Republicans for addressing the debt limit through that process.

The 2023 debt-ceiling suspension was done on a bipartisan vote.

Earlier this week, the Bipartisan Policy Center released its own X-date estimate, putting it sometime between mid-July and October. Wall Street strategists have estimated the date could fall around late-July to late-August. Some forecasts, however, put the timing as early as late May.

Much depends on tax-collection proceeds, with the April 15 filing date fast approaching. House Ways and Means Committee Chair Jason Smith warned earlier this month that a debt-ceiling breach was possible as soon as mid-May if the Treasury brings in less revenue than expected.

Read full article HERE.

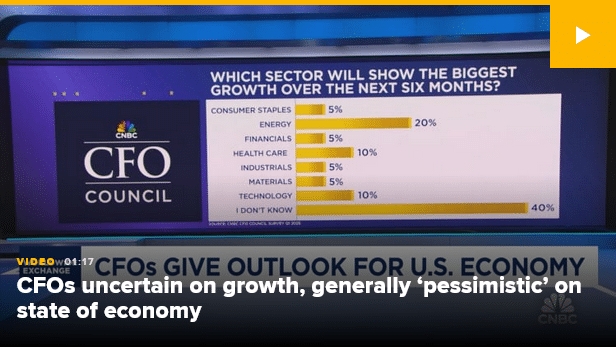

- The economy will enter a recession in the second half of 2025, according to a majority of chief financial officers responding to the quarterly CNBC CFO Council Survey.

- CFOs describe themselves as generally “pessimistic” on the overall state of the U.S. economy and uncertain about the stock market.

- 95% of CFOs said policy is impacting their ability to make business decisions, and many said while Trump is delivering on promises, his administration’s approach is too chaotic, disruptive and extreme for businesses to navigate effectively.

The stock market experienced a relief rally to start the week, and attempted to keep the comeback going on Tuesday morning, as comments from the Trump economic team over the weekend suggested a softer stance on tariffs. But within the boardroom, hope is not likely to replace caution any time soon.

Many executives in the C-suite and across the economy remain disturbed about the trade war outlook and a White House that has given every indication it is ideologically committed to a major change in global economic policy. Shifting messages from President Trump that continue to add confusion to the tariff planning process haven’t helped.

In a word, the “pessimism” has crept back in where the animal spirits had been after Trump’s election. That’s one way to sum up the results from the latest CNBC CFO Council quarterly survey for Q1 2025. While some chief financial officers said Trump is doing what he promised on the campaign trail, many CFOs said the way he is going about delivering on his agenda is not what was expected.

“Too chaotic for business to navigate effectively” was how one CFO respondent framed their view of Trump’s second term to date.

“Extreme”; “Disruptive”; “Aggressive”; “A wild ride,” were some of the other ways CFOs portrayed their current view.

It all adds up to a majority of CFOs (60%) saying they expect a recession in the second half of the year – another 15% say a recession will hit in 2026.

Just a quarter ago, when the recession question in the quarterly survey was laid on the Fed rather than Trump – in the Q4 2024 survey, we asked whether the central bank’s efforts to tame inflation would lead to an economic slump – only 7% of CFOs said they thought that was on the calendar for 2025.

In recent weeks, recession has become a more popular default setting in the market, for the first time since the Fed began aggressively raising interest rates to beat back runaway inflation in March 2022. The odds of recession are running as high as 50% at some financial firms, new “recession watch” indicators are being created, and other recent CNBC surveying, among money managers and economists, shows a spike in recession fears.

The CFO Council survey is a sampling of views from chief financial officers at large organizations across sectors of the U.S. economy, with 20 respondents included the Q1 survey conducted between March 10 and March 21.

U.S. trade policy is the primary reason for the new economic downturn base case. It is now being cited as the top external business risk by CFOs, at 30%, followed by the related risks: inflation (25%) and consumer demand (20%), with the latest reading on consumer confidence in income, business and job prospects hitting a 12-year low.

Ninety percent of CFOs say tariffs will cause “resurgent inflation,” and as CFOs worry more about prices, expectations for when the Fed can engineer it back down to 2% in keeping with its dual mandate keep getting pushed further out. Despite Fed Chair Jerome Powell himself holding out hopes that any tariffs inflation may be “transitory,” half of CFOs now say that the 2% target inflation rate will not be achieved until either the second half of 2026 or 2027.

Pressure on U.S. treasury bond yields is expected to remain, with 65% of CFOs saying the range will still be between 4% and 5% at the end of 2025 (50% of CFOs expect yields to stay within the lower end of this range, between 4% and 4.5%, where 10-year treasury are today).

As industries look to the White House for tariff exemption deals molded in their own self-interest, the general level of economic and market uncertainty among business executives across sectors was registered in one unusual way in the quarterly survey. Typically, when asked to name the stock market sector that will do the best over the next six months, CFOs choose tech, health care or energy. In the history of the survey, the responses to this question rarely deviate from those three sectors. This quarter, though, the majority CFO opinion on the sector with the best growth prospects was, “Don’t know.”

Few CFOs think the bull market will quickly resume its march upwards, with 90% of respondents saying the Dow Jones Industrial Average will retest 40,000 before ever reaching 50,000, which indicates the potential for several thousand points more in the index lost.

In a more key, core way, the cautious corporate view was evident in the change quarter over quarter with respect to spending plans, with the number of CFOs who say their firm plans to increase capex this year declining from Q4. It was not a precipitous decline (roughly 10%), but it is trending in the wrong direction. The largest share of respondents expect spending to remain in line with the recent trend at their companies (45%), and even as it declines as a budget stance, there are still more who expect an increase (35%) in spending than a decrease (20%).

Overall, 95% of CFOs said policy uncertainty is having an impact on their business decision-making.

The most acute way that rising pessimism was registered in the survey was simply by asking CFOs what they think of the economy: 75% of respondents said they are “somewhat pessimistic about the overall state of the U.S. economy” right now. And that’s despite 75% being optimistic about the state of their own industry.

The good news if a recession is in the cards? Ninety percent of CFOs think it will either be moderate (50%) or mild (40%).

But CFOs remain divided on where it is all leading, measuring a mix of diminished hopes and bleak confusion.

“I feel the current administration is seeing how far they can push before anything breaks. I am hopefully after the first 100 days that things will moderate,” said one CFO.

But another CFO responding to the survey concluded, “Complete chaos, without an end game strategy.”

Read the full article HERE.