- Trump to announce 25% steel and aluminium tariffs

- New tariffs reflect more uncertainty in global trade -analyst

- Bullion hits a record high of $2,910.99 per ounce

- US CPI, PPI due later this week

Gold prices continued their record rally on Monday and broke through the key $2,900 level for the first time, driven by safe-haven demand as U.S. President Donald Trump’s new tariff threats amplified trade war and inflation concerns.

Spot gold surged 1.6% to $2,905.25 per ounce, as of 09:43 a.m. ET (1443 GMT), after hitting a record high of $2,910.99 earlier in the session. U.S. gold futures jumped 1.5% to $2,930.90.

“Obviously the tariff war is behind the rise; it just reflects more uncertainty and more tension in the global trade situation,” said Marex analyst Edward Meir.

Trump announced plans on Sunday to impose an additional 25% tariff on all steel and aluminium imports. He also said he would announce reciprocal tariffs this week, matching rates imposed by other countries and applying them immediately.

Tariffs may exacerbate U.S. inflation, with investors awaiting U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) data due later in the week.

If the CPI and PPI data surprise on the downside, it may weigh on the dollar and inflate gold prices, while an upside surprise could push up U.S. yields and strain gold, albeit mildly due to the market’s resilience and buyer interest during dips, Meir said.

Federal Reserve Chair Jerome Powell is also due to testify before Congress on Tuesday and Wednesday.

Bullion has already hit its seventh record high this year, driven by Trump’s tariff threats, which have fueled uncertainty over global growth, trade wars, and high inflation, prompting investors turn to gold as a safe-haven asset.

Phillip Streible, chief market strategist at Blue Line Futures, said gold’s 45-degree rally since December might create a self-fulfilling prophecy of further price increases, potentially leading it to raise its forecast to around $3,250 or $3,500.

Spot silver rose 1% to $32.12 per ounce after hitting a three-month high on Friday.

Platinum added 1.1% to $986.80 and palladium gained 2.2% to $985.50.

Read the full article HERE.

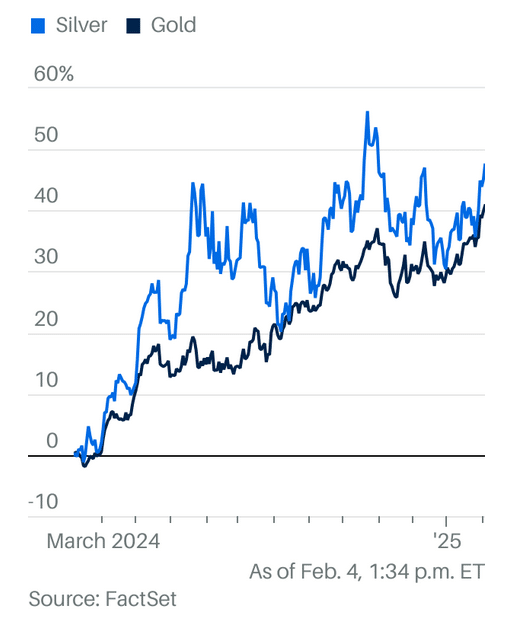

For the past several years, gold prices have staged a historic rally while silver has largely struggled to keep up. For investors, that could mean a buying opportunity.

It has been a great time to invest in gold which outperformed the S&P 500SPX-0.27% in 2024, and continued to shine in 2025. It hit a new high of $2,893 an ounce Wednesday but slipped to $2,876 on Thursday afternoon.

Silver has also performed for investors, but not quite as well. It returned 12% a year on average for the past three years, compared with 16% for gold.

On Thursday, silver traded at $32.65 an ounce, about 7% below its 12-month high of $35.04, reached Oct. 22, according to Dow Jones Market Data. Given that the two metals’ prices typically move together, that could mean silver is poised for a rally.

“While gold has broken out and continues to act well, silver remains below the highs hit in October,” wrote Jeff Jacobson, head of derivative strategy at 22V Research, in a note Wednesday.

Gold’s strength has widened the price differential between the two metals, he added, potentially setting the stage for a silver “catch-up” rally. We “have seen silver stage sharp rallies on both an absolute basis, as well as relative to gold, the last two times the silver/gold spread has gotten to these levels,” he wrote.

There are also fundamental reasons to be bullish on silver.

The supply of silver has been largely stagnant for the past decade. A big reason: Unlike gold which is mined directly, about three-fourths of silver is produced as a byproduct of other metals, such as lead, zinc, and copper. Prices for many of these base metals have been soft lately, giving miners less reason to dig them up.

As a result, the global supply of silver is expected to increase just 3% in 2025, forecasts the Silver Institute, a trade group. “Silver may be rallying, but miners are not getting the signal to increase activity” because their financial incentives are elsewhere, said Nitesh Shah, head of commodities research at WisdomTree.

At the same time, demand has been increasing steadily, largely thanks to a surge in interest in solar panels, an important industrial use for the metal. President Donald Trump’s election hit U.S. solar companies hard. But the U.S. is a relative sideshow when it comes to the global solar picture. China produces about 80% of the world’s solar panels, and the country has no plans to let up on its green energy push.

Solar’s share of global energy capacity is expected to surge to about 13% by 2028 from 5%, wrote Imaru Casanova, a portfolio manager at Van Eck, in a recent note. “The implications for silver are clear,” she said.

Read the full article HERE.

Strategists at Citi and UBS hiked their gold price forecasts on Thursday, predicting that the bull market for the precious metal will continue.

UBS has lifted its 12-month gold forecast to $3,000 per ounce as the bullion’s price surpassed its long-standing prediction of $2,850 per ounce.

This surge in gold prices, reaching new all-time highs and trading at approximately $2,870 per ounce, is attributed to concerns over tariffs and a more hawkish Federal Reserve stance since mid-December.

“While we acknowledge the current spot price of $2,870/oz is above our fair-value estimate, gold’s enduring appeal as a store of value and hedge against uncertainty has again proven itself,” UBS strategists led by Mark Haefele said in a note.

They anticipate that gold will maintain its upward momentum throughout the year, supported by an extended global rate-cutting cycle, persistent uncertainty, and strong demand from investors and central banks.

Citi has also adjusted its gold price outlook, upgrading its short-term target to $3,000 per ounce and increasing its average forecast for 2025 to $2,900 per ounce from $2,800.

The Wall Street firm cites the continuation of the gold bull market under the Trump administration, with trade wars, geopolitical concerns, and global growth concerns expected to drive demand from exchange-traded funds (ETFs) and over-the-counter (OTC) investments.

“The gold bull market looks set to continue under Trump 2.0 with trade wars and geopolitical tensions reinforcing the reserve diversification/de-dollarization trend and supporting emerging market (EM) official sector gold demand,” Citi’s note states.

The bank’s analysis suggests that, despite the possibility of a Russia/Ukraine peace deal and the unknown status of gold in potential broad tariffs, the metal’s price is likely to remain robust.

Citi does not foresee gold being included in any blanket tariffs in the second quarter of 2025, as it is considered a financial asset and, in the case of US gold coins, legal tender. However, they acknowledge the risk of a spike in US premiums if initial communications about potential broad tariffs do not explicitly exempt gold, or if it is indeed subjected to such tariffs.

As of February 5, gold trading markets estimate approximately a 20% chance of President Trump including gold in a 10% blanket tariff on all US imports, which is significantly lower than the probabilities implied for other metals like copper, silver, and platinum.

Read the full article HERE.

Take your retirement BEYOND stocks and bonds! This is the definitive guide for opening a tax-deferred, IRS-approved retirement account to hold physical metals.

The yellow metal is trading just below $2,900 an ounce. Miner stocks are rallying too. Geopolitical turmoil is boosting gold.

Worries about tariffs are spooking many investors. But not gold bulls. Fans of the yellow metal are probably relishing all the uncertainty that President Donald Trump’s tariff threats are creating.

Gold prices are up about 8.5% already this year. At just under $2,900 an ounce, the yellow metal is at a record high. And that follows a nearly 30% gain for gold in 2024.

Investors in mining stocks are doing even better. The VanEck Gold Miners exchange-traded fund, which has big stakes in Newmont Corp. , Agnico Eagle Mines and Barrick Gold , has soared more than 18% so far in 2025.

Should investors be a little wary after such a big run this year on top of 2024’s enormous gains? Of course. That would be prudent. But it’s worth noting that the mining stocks could have more room to run if gold prices keep climbing. And that seems very plausible.

It appears that both foreign central banks and retail investors are fueling the rally. Poland, Turkey, India, and China have been big buyers, according to data from late last year from the World Gold Council.

“Emerging market banks are very committed to gold and well positioned to purchase more. Strategically, they will continue to be buyers,” said Joe Cavatoni, senior markets strategist with the World Gold Council, in an interview with Barron’s.

The World Gold Council said in a report Wednesday that demand for gold in the fourth quarter rose to a new quarterly high and that the outlook for 2025 was bright.

“Central banks and ETF investors [are] likely to drive demand with economic uncertainty supporting gold’s role as a risk hedge,” the WGC said.

It’s all about the Trump trade war. The continued surge in gold is a bit unusual since it’s happening at a time when the U.S. dollar is also strengthening.

Frank Watson, a markets analyst for Kinesis Money, pointed out that a surging greenback is “normally a bearish element for dollar-denominated gold prices,” but he added that “gold’s safe haven appeal remains undiminished amid uncertainty over the economic and inflationary effects of expected US trade tariffs.” In other words, Trump’s trade policies may trump the usual impact a strong dollar has on gold.

Silver prices have been climbing too, rising about 14% so far this year. Alex Ebkarian, chief operating officer of physical precious metals dealer Allegiance Gold, said in an email to Barron’s that the prices of both metals should keep climbing due to the market uncertainty.

“In a high-risk environment, the appeal of physical gold and silver becomes even more pronounced, as they eliminate counterparty risk and provide a reliable store of value,” he said, adding that a recent move by JPMorgan Chase to deliver about $4 billion worth in gold futures is “an apparent hedge against potential trade disruptions.”

So how much higher could gold go? Michael Arone, chief investment strategist for State Street’s SPDR Business, thinks gold could top $3,000 an ounce sometime this year due to all that is happening on the worldwide landscape.

“Geopolitical risks and structural transitions in monetary and fiscal policies should also boost the prospects for gold,” Arone wrote. “Central bank purchases throughout the year will likely continue to support gold’s price. All that could finally unleash some pent up investment demand from investors chasing last year’s record gold prices.”

That should be good news as well for the mining stocks, which despite their big run already this year, remain reasonably valued. The VanEck Gold Miners ETF is trading for just 12 times 2025 earnings estimates, lower than its 5-year average of 15. It’s also trading at about a price-to-earnings ratio that is 45% below the S&P 500, much steeper than its usual 20% discount to the broader market.

So how much higher could gold go? Michael Arone, chief investment strategist for State Street’s SPDR Business, thinks gold could top $3,000 an ounce sometime this year due to all that is happening on the worldwide landscape.

“Geopolitical risks and structural transitions in monetary and fiscal policies should also boost the prospects for gold,” Arone wrote. “Central bank purchases throughout the year will likely continue to support gold’s price. All that could finally unleash some pent up investment demand from investors chasing last year’s record gold prices.”

That should be good news as well for the mining stocks, which despite their big run already this year, remain reasonably valued. The VanEck Gold Miners ETF is trading for just 12 times 2025 earnings estimates, lower than its 5-year average of 15. It’s also trading at about a price-to-earnings ratio that is 45% below the S&P 500, much steeper than its usual 20% discount to the broader market.

Read the full article HERE.

European leaders call for cooperation with Trump but say they are ready to fight

European leaders, bracing for a fight with President Trump over the world’s most valuable trading relationship, said they are ready to strike back but prefer cooperation.

Trump over the weekend announced punishing tariffs on Canada and Mexico and made clear that U.S. allies across the Atlantic were high on his target list. He later agreed to pause tariffs on Canada and Mexico for one month.

“It will definitely happen with the European Union,” Trump said of his tariff plans. “They’ve really taken advantage of us.”

European Union leaders assembling in Brussels on Monday for a planned meeting to discuss military spending—another hot-button issue for Trump—mostly played down prospects of tit-for-tat duties or similar retaliatory measures. But the 27-country bloc, which is at heart a free-trade zone, has for months been preparing potential responses to Trump tariffs.

“If we’re attacked on trade, Europe, as an enduring power, must command respect and respond,” said French President Emmanuel Macron.

The stakes are hard to overstate. According to the Office of the U.S. Trade Representative, the U.S.-Europe trade and investment relationship “is the largest and most complex in the world.”

Trump on Sunday renewed his focus on a trade surplus that Europe has long run with the U.S., which he said was more than $300 billion. The U.S. Census Bureau said the goods deficit with the EU was $214 billion last year, on U.S. goods exports to the EU valued at $342 billion.

“They don’t take our cars, they don’t take our farm products, they take almost nothing, and we take everything from them,” Trump said. “It’s an atrocity what they’ve done,” he said.

The U.S. ran a surplus of about $77 billion in services exported to the EU in 2023, which the Commerce Department valued at $262 billion.

Trade volumes pale in comparison to the value of trans-Atlantic investment. Each side accounts for more than 60% of all foreign direct investment in the other economy, far surpassing the significance of any other economy’s investments, according to U.S. government data analyzed by the American Chamber of Commerce to the EU.

Sales by U.S. companies operating in Europe, at over $3.8 trillion in 2022, are more than four times the value of U.S. exports of goods and services to Europe, according to AmCham EU. For European companies operating in the U.S., the figures and proportion are almost as high.

Trump’s pressure comes at a particularly difficult time for Europe. The EU economy grew by only 0.8% last year, according to a preliminary estimate by the bloc’s statistical office. The U.S. economy grew by 2.8% last year, according to the Commerce Department. Leaders of the EU’s biggest countries, including Germany, France and Poland, are constrained by political infighting and elections.

Top EU officials have signaled to Trump their willingness to cooperate with him on countering China economically and geostrategically. Europeans have grown much warier of China than they were during Trump’s first term.

“What is clear is that there are no winners in trade wars,” said EU foreign-policy chief Kaja Kallas. If the U.S. starts a trade war with Europe, she said, “then the one laughing on the side is China.”

Officials within the EU, which generally advocates free trade, have spent months drawing up options for responding to U.S. tariff threats, including with duties that could target products from politically sensitive U.S. states. Such a response might mirror the kinds of retaliatory tariffs Canada threatened in recent days, as well as the EU’s retaliation to Trump’s steel and aluminum tariffs during his first term.

European officials have also held talks with their counterparts in Canada, which has a free-trade agreement with the EU, and recently announced a revamped trade deal with Mexico. On Sunday, Canadian Prime Minister Justin Trudeau spoke with the EU’s António Costa, who leads the grouping of EU national leaders, the European Council, seeking ways to cooperate against U.S. pressure

“We are prepared,” said Finnish Prime Minister Petteri Orpo on Monday, declining to elaborate on preparations. “I’m not going to start a war. I want to start negotiations,” he said.

Whether Trump wants negotiations is a question weighing on Europe. EU leaders have suggested they could buy more liquefied natural gas from the U.S., but so far the overture has elicited no public reply. Some officials say buying more military equipment might help.

The EU’s long-running trade surplus in goods has angered Trump since before his first term, as has low European military spending. Most European members of the North Atlantic Treaty Organization perennially lagged behind alliance spending targets, though many have recently boosted outlays in response to pressure from Trump and Russia’s invasion of Ukraine.

But just after European NATO members on aggregate reached the alliance’s target of spending 2% of gross domestic product on defense last year and started talks about raising that threshold toward 3%, Trump recently said the level should be 5%—a level few, if any, EU countries can afford.

Trump also has repeatedly said that he wants the U.S. to buy Greenland from Denmark, a demand the country’s prime minister and other European leaders rejected. “It’s not for sale,” said Mette Frederiksen on Monday. She said Europe “absolutely” needs to increase military spending beyond 2%.

“If this is about securing our part of the world, we can find a way forward,” she said of Greenland and the Arctic region. “I will never support the idea of fighting allies,” she said. “But of course if the U.S. puts tough tariffs on Europe, we need a collective and robust response.”

Read full article HERE

Investors didn’t take President Donald Trump at his word, and now markets are selling off in reaction to his move to impose hefty tariffs on Canada, Mexico, and China.

In early trading, the tech-heavy Nasdaq Composite (^IXIC) sank nearly 2% while the S&P 500 (^GSPC) dropped 1.5%. Meanwhile, the Dow Jones Industrial Average (^DJI) shed more than 1%, or roughly 500 points.

“While we have not had tariffs baked into our own US equity market outlook, we have been concerned that many financial market participants have been underpricing the risk that they were more than a negotiation tool,” RBC Capital Markets head of US equity strategy Lori Calvasina wrote in a note to clients on Sunday.

While Trump has been clear since his first day in office that he would slap 25% tariffs on both Canada and Mexico, markets and economists appeared not to take the president at face value. The White House also said Friday that the administration planned to enact a 10% tariff on China.

“My sense is tariffs are coming, but I don’t think they’ll be quite on the same scale that the president has talked about,” Capital Economics Group chief economist Neil Shearing told Yahoo Finance on Thursday, adding, “for obvious reasons, and that is that it would tank the market.”

Even betting markets, which many believe were a leading indicator during the recent presidential election, weren’t pricing in high odds of tariffs. As of Jan. 29, Polymarket, a popular online betting offering, was pricing in just 20% odds that Trump imposed 25% tariffs on Canada and Mexico.

Now it appears the market consensus was offsides and investors are facing a repricing of potential risks. The US dollar shot up to 109, near its highest level in two years. Retail and auto stocks that could be impacted by tariffs also sold off.

“Full implemented tariffs with staying power don’t appear to be in the price of key markets,” a team of Morgan Stanley equity strategists and economists wrote on Sunday.

They added, “US equities may come under pressure, and services should outperform consumer goods.”

To be clear, there is still a path in which the widespread tariffs do not hold. The duties on all three countries will be fully in force by Tuesday, Feb. 4, and ongoing negotiations between the countries could continue.

Even still, the weekend tariff surprise for markets could be an early insight into the state of markets over the near-term as investors keep attempting to decipher Trump’s trade policy.

“Even if tariffs are called off [Monday], the increase in policy uncertainty will be hard to put back in the bottle,” JPMorgan chief US economist Michael Feroli wrote in a note to clients on Sunday. “For the Fed, the weekend’s developments will likely reinforce their inclination to sit on the sidelines and to remain below the radar as much as possible.”

In a Sunday note to clients, Goldman Sachs’ David Kostin noted that the tariff announcements have come “as a shock to many investors who expected tariffs would only be imposed if trade negotiations failed.”

Kostin added that large tariffs pose “downside risk” to his team’s S&P 500 earnings forecast. Combined with increased policy uncertainty, Kostin argued the S&P 500’s fair value could see near-term downside of roughly 5% if the market prices “sustained implementation of the newly-announced tariffs.”

To Kostin, the key for markets remains whether or not investors truly believe the tariffs will be implemented for an extended period of time.

“To the extent investors believe the tariffs will be a short-lived step toward a negotiated settlement, the equity market impact would be smaller,” Kostin said. “In contrast, equities would fall further if investors view the latest tariff announcements as signals increasing the probability of additional escalation.”

Read the full article HERE.

The Yellow Metal’s Unstoppable Bullish Momentum!

The yellow metal’s unstoppable bullish momentum has spilled over into 2025 – sending prices skyrocketing to new all-time highs as traders piled into the safe haven asset to capitalize on the famous “Trump Trade”.

Gold topped $2,805 an ounce for the first time ever on Friday – surpassing its October record and taking its gains to 7% this year, as trader’s hedge against President Donald Trump’s tariffs.

Put another way, that’s Gold’s biggest monthly gain since March 2024 – and by the time this month is over, that figure could very easily be a lot higher.

Trump’s Tariffs and Market Reactions

Following his inauguration, President Trump the self-proclaimed “Tariff Man” announced plans to impose 25% tariffs on Mexico and Canada by February 1. He also threatened to launch an economic war on the rest of the world with across-the-board tariffs – triggering concerns in the market that sweeping tariffs could apply to Gold, which has historically been exempt from import duties.

Whether or not that becomes a reality remains to be seen. However, savvy traders have not been waiting around to find out.

Gold Stockpiling and the COMEX Surge

Since President Trump’s inauguration, traders and financial institutions have been amassing stockpiles of Gold on COMEX – The New York Commodity Exchange, while in return created a shortage in London.

London is home to the world’s largest over-the-counter Gold trading hub, where major market participants trade directly with each other rather than via an exchange.

The surge into New York has seen Gold inventories on COMEX soar over 75% – posting the largest inflows since 2020. The significance of this cannot be understated. Right now, traders in London can’t get their hands on Gold because so much has been shipped to the United States – and the rest is stuck in the queue ready to join it in the bulging vaults of the COMEX Commodity Exchange.

The Impact on Gold Prices and Future Outlook

As of Friday, the value of Gold bullion stockpiles held in COMEX vaults rose to $85 billion – representing almost 31 million troy ounces, based on data tracked by GSC Commodity Intelligence. However, the total amount of Gold flows into the U.S could be far greater than reported due to additional shipments going into private vaults, which are a lot harder to track.

This historic and market-moving rush for Gold has depleted stocks of readily available bullion in London, which according to analysts at GSC Commodity Intelligence “will continue to drive Gold prices a lot higher in the coming months”.

Ultimately, everyone from leading economists to the world’s most powerful Wall Street institutions agree, that Trump’s tariffs will lead to a multitude of bullish tailwinds including higher inflation, global trade wars and heightened volatility – adding further fuel to the current Supercycle in Gold.

Read the full article HERE

Gold hit a new all-time high as the dollar declined after the latest US economic data showed softer-than-expected growth at the end of last year.

Inflation-adjusted gross domestic product increased an annualized 2.3% in the fourth quarter after rising 3.1% in the prior three-month period, according to the government’s initial estimate published Thursday. The median forecast in a Bloomberg survey of economists called for a 2.6% growth.

The greenback declined after the report, sending bullion as much as 1.1% higher to $2,790.19 an ounce — surpassing its previous all-time high set in October. A weaker dollar makes bullion more appealing for investors holding other currencies as it’s priced in the US currency.

The precious metal’s latest attempt to score a new high “most certainly occurred after the softer than expected GDP print which has softened the dollar further,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. “If softer growth and lower prices can be maintained, the door for additional cuts will be left wide open.” Lower rates typically benefit gold as it pays no interest.

Policymakers held rates steady at the conclusion of their first meeting of the year Wednesday, with Federal Reserve Chair Jerome Powell saying that officials won’t rush to lower rates as they are waiting to see further progress on inflation.

Spot gold rose 1% to $2,788.86 an ounce as of 10:19 a.m. in New York.

Read the full article HERE.

Investors aren’t expecting many surprises at the end of the Federal Reserve’s Wednesday FOMC policy meeting, where central bank officials are widely expected to hold interest rates steady following three consecutive cuts at the end of 2024.

There is considerably more uncertainty surrounding how Fed Chair Jerome Powell will use his afternoon press conference to address the new elephant in the room: the effect that Donald Trump could have on the future path of monetary policy.

The US president is threatening to impose tariffs on Mexico, Canada, and China as early as this Saturday, a stance that some economists predict will put upward pressure on inflation at a time when the central bank is trying to ensure that issue is finally under control.

What makes things more complicated is that Trump is making it clear he wants policymakers to cut rates further. He hinted last week at a coming clash with Powell on that subject, saying he wants rates to come down “a lot” and that he expects to talk directly with the Fed chair “at the right time.”

JPMorgan chief economist Michael Feroli expects Powell will adopt a “duck and cover” approach at his press conference following the Fed meeting.

Feroli said he expects Powell will indicate that each Fed member is using his or her own conditioning assumptions on what trade policies are ultimately adopted while making it clear that “the only thing decided at the meeting was the monetary policy statement” released by the Fed’s rate-setting committee.

In December, officials changed language in their policy statement to say that the Fed would consider “the extent and timing” of additional adjustments to rates based on the data and changing outlook — showing a less committed form than earlier in their 2024 rate-cutting campaign.

At that December meeting, almost all Federal Reserve officials agreed that “upside risks to the inflation outlook had increased” due in part to the “likely effects” of expected changes in trade and immigration policies, according to minutes from that meeting. Some officials had begun working those assumptions into their outlook for policy.

In recent weeks, many Fed officials have made clear they are increasingly concerned about signs of persistent inflation, citing that as a reason to move cautiously in 2025. In December they predicted just two rate cuts for all of 2025, down from a prior estimate of four.

The latest reading on inflation for the month of December, as measured by the Consumer Price Index (CPI), showed slight progress after three months of holding steady.

On a “core” basis, which eliminates the more volatile costs of food and gas, CPI climbed 0.2% over the prior month, a deceleration from November’s 0.3% monthly gain.

On an annual basis, prices rose 3.2%, dropping slightly after three months of being stuck at 3.3%.

The next reading of the Fed’s preferred inflation gauge — the Personal Consumption Expenditures (PCE) index — is out Friday.

Economists expect annual “core” PCE to have clocked in at 2.8% in December, unchanged from November. Over the prior month, economists project “core” PCE rose 0.2%, faster than the 0.1% seen in November.

Some watchers of the US economy are now raising the possibility that the Fed could even be forced to raise rates this year — a move that would surely invite Trump’s wrath.

Harvard economist Ken Rogoff told Yahoo Finance he doesn’t think the Fed will fire off the two cuts predicted.

“I think the odds of a hike are the same as the odds of a cut,” he said, pointing to the potential for higher deficits and investments in AI driving the economy.

The Fed’s policy decision is due out at 2 p.m. ET followed by Powell’s press conference at 2:30 p.m. ET.

Read full article HERE.