The chances of a recession hitting the U.S. economy was the hot topic this time last year, but entering 2025 the issue has almost entirely disappeared. That may sound comforting but it’s also cause for alarm.

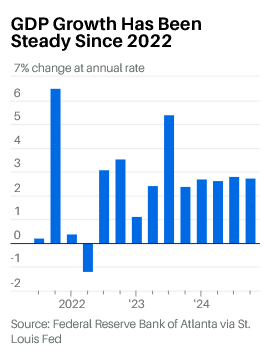

It’s easy to see why recession talk has vanished, as there are very few signs of impending collapse—GDP growth has topped 2% in eight of the last nine quarters. Seasoned investors could see an overwhelming consensus for ever-more growth as a red flag, and if the worst does happen, it means markets may swing more violently because of the unforeseen risk.

If the outlook does change, these are the warnings to watch for:

Jobs Jolt

The textbook first sign of a recession is an increase in unemployment. That leads to weaker consumer spending, which hurts company profits, which then leads to more job losses. Jawad Mian, the founder of Stray Reflections, a macro advisory for institutional investors, sees several factors that could lead to a downturn.

It may not start with high unemployment—while the jobless rate has been rising slowly, it remains historically low. Still, sticky inflation could mean real incomes are soon getting pinched again, Mian told Barron’s. There could also be a negative wealth effect if stocks and property prices stop rising so precipitously, which would hurt consumer confidence. And the labor market might weaken on its own after years of strong job growth—there’s a natural limit to how much the labor market can expand, especially if immigration is pushed down.

Trump Trauma

Which leads to the elephant in the room—President-elect Donald Trump, who has vowed to reduce immigration, slash government spending, cut taxes, and place tariffs on imports. Investors have mostly focused on his promises to reduce regulation and make it easier for U.S. firms to do business.

“The biggest risk right now is a failure to imagine the downsides,” said Mian. “We’ve reached a point of constraint in the economy.”

However, other economists have tried to put numbers on the impact of the net effect of Trump’s proposals. The National Institute of Economic and Social Research (Niesr), a London-based think tank, reckons that expelling immigrants and raising tariffs will knock 1.25% off growth from gross domestic product in the first year. In addition, it will lead to inflation in years to come—especially if Trump is able to increase the president’s influence on the Federal Reserve.

“These negative effects, which hurt consumption, investment and exports, more than offset benefits from supply-side policies, such as easing regulation, even in the medium term,” said Niesr economist Paul Mortimer-Lee. If Trump also radically reduces government spending, the usual cushions against a downturn would be undermined, and “the economy would likely enter recession,” he added.

Market Misery

For investors, one key thing to remember is that the economy and the stock market aren’t the same thing. While they do feed off each other, the stock market can perform well even without strong economic growth. It’s also the case that the economy can keep growing without stocks continuing to do well. Goldman Sachs which sees slim odds of recession, predicts a “lost decade” for stocks with returns after inflation of 3% or less on average.

At the beginning of 2024 there were more than a handful of forecasts for an economic contraction. The year before that, at the end of 2022, respected commentators including Bloomberg Economics and Deutsche BankDBK+2.51% predicted it was almost certain that the U.S., in the near future, would enter recession. Even the Federal Reserve, which was raising interest rates at the fastest pace in a generation, had a recession in its staff forecasts as late as July 2023.

Cursed Curve

The yield curve has always been an important indicator. One of the market’s favorite harbingers of recession—whether it is two quarters of contraction, or a year-over-year drop in output, or just a sustained economic downturn—is when the two-year government note yield is higher than the 10-year yield. It was inverted from mid-2022 through September of last year. But since then, the longer-term rates have pushed substantially higher.

In a FactSet survey of 85 institutions, none of them predicts an economic contraction in 2025. Goldman Sachs reduced the odds of a recession—it now sees the chances at about 15%. The Fed upgraded its forecast for gross domestic product to rise 2.1% next year.

The bottom line is that—perhaps more so than in the past two years when the market has gone from strength to strength—it’s always important to keep your wits about you.

“We are in this strange backdrop where investors believe that there is no recession risk, no risk of earnings disappointments,” said David Rosenberg, founder of Rosenberg Research. “We are in a once-in-a-lifetime situation where the concept of risk has been totally distorted—an investment world where there is no more differentiation between what has traditionally been risky and what is riskless.”

A recession may not be in the cards for 2025. But there is likely more risk out there than most people are mitigating for.

Read the full article HERE.

Baby Boomers may have hit the jackpot money-wise, but many attribute their wealth to financial planning and professional advice rather than good timing.

Millions of Baby Boomers are rapidly reaching retirement age in a “silver tsunami” that is placing a renewed focus on how this generation feels about their finances. According to Charles Schwab’s Modern Wealth Survey, 66% of Boomers believe they are in a better position to reach their financial goals than previous generations.

How did this generation find themselves to be so well positioned financially?

A majority of Boomers feel they have a positive relationship with money, which gives this generation a strong financial foundation. In addition, more than 3 in 5 Boomers (63%) are actively investing today, and they overwhelmingly expressed confidence in their investment strategy and ability to reach their financial goals. Boomers attribute this confidence to having more ways to build wealth (68%), more investment options (64%), and more accessibility to investing in general (58%). Financial confidence doesn’t always come easily, but we hear common themes from those who share it.

1. Do your research and seek professional advice

In today’s world, there is an overwhelming amount of information online, and it can be difficult to discern what financial advice is trustworthy. While “finfluencers” may be gaining traction among younger generations, Boomers are most likely to use a financial professional/institution (such as a financial adviser, investment firm, or accountant) for financial advice. They noted the top reasons for trusting these professional sources are their proven track record of success (53%) and the proper financial certifications and credentials (45%).

A financial adviser can help you navigate the complex world of investing, but it’s important to carefully determine which professional resource is right for you and best meets your needs. Are you seeking help with budgeting and savings goals or more complex guidance around financial planning, wealth management and tax planning? If you are seeking assistance with financial decisions, you will want to understand the different designations you encounter and create a list of questions to ask a potential adviser to find the right fit.

2. Have a financial plan

When it comes to managing your finances and preparing for retirement, the quote “if you fail to plan, you plan to fail” could not be more true. A financial plan is essentially a roadmap to attain your goals. It is easier and more affordable to get a financial plan today than it’s ever been before, whether you get started with a do-it-yourself digital financial plan or have an in-depth conversation with a professional.

Boomers noted that once they created a financial plan, they felt more in control of their finances and in turn more confident they would reach their financial goals.

While more than one-third of Boomers have taken the necessary steps to document their financial plan (38%), another third (34%) have only thought about their financial goals. It’s important that you discuss your financial goals and ensure you have a plan in place for your situation. Many firms, including Schwab, offer free online tools and education and employ Certified Financial Planners® that you can meet with on a one-time or ongoing basis.

3. Have an investment strategy

An investment strategy goes hand-in-hand with a financial plan. In fact, Schwab’s first investing principle is to establish a financial plan based on your goals, as these will help guide how conservative or aggressive your strategy should be. Are you saving for a dream trip, a second home, or a child’s education? Knowing your goals will help you determine if you need a strategy focused on growth or stability.

The next step is to build a diversified portfolio based on both your capacity to take on and tolerate risk. While most firms offer you the option to invest on your own, consulting a financial adviser can help simplify the process of identifying the products and services that best meet your needs.

4. Stay engaged

Having a clear vision of your financial goals is important, but equally crucial is ensuring you stay on track. Asset classes perform differently, and it’s nearly impossible to predict which ones will perform best in a given year. That’s why regularly reviewing how your investments are performing and how your assets are allocated is important. The market’s fluctuations can shift your portfolio’s balance, so periodic adjustments may be necessary. Saving for retirement is one of the most crucial goals for many investors, so it’s important to make time for ongoing reviews to ensure your strategy aligns with your evolving goals and financial circumstances.

Remember, growth is not always linear, and even during times of market uncertainty it is important to keep your eyes on the prize. This is a great time to be an investor, especially as more people recognize that investing at any stage of life is about taking ownership of your financial life and achieving your financial dreams and goals.

Read the full article HERE.

Gold prices rebounded on Friday as uncertainty surrounding the incoming Trump administration’s policies lifted safe-haven appeal, even as a stronger-than-expected U.S. employment data reinforced expectations the Federal Reserve might not cut interest rates as aggressively this year.

Spot gold was up 0.6% to $2,685.38 per ounce as of 9:40 a.m. EST (1440 GMT), while U.S. gold futures rose 1.3% to $2,726.10.

Gold prices briefly slipped to $2,663.09 an ounce after data showed the U.S. added 256,000 jobs last month, compared with economists’ estimate of a rise of 160,000. The unemployment rate stood at 4.1%, compared with a forecast of 4.2%.

Bullion prices, however, quickly rebounded and are now trading near their highest levels since Dec. 13, poised for a weekly gain of more than 1%.

“Gold’s price action points to a lack of committed sellers of the metal; a diffidence well-learned from last year’s remarkable rise,” said Tai Wong, an independent metals trader.

“The momentum from the knee-jerk reaction faded quickly and the short-term traders and programs that sold reversed quickly.”

The dollar rallied while U.S. stock futures fell sharply after the jobs data. Markets show traders now expect the Fed to cut interest rates by just 30 basis points over the course of this year, compared with cuts worth about 45 basis points before the data.

“Gold is still acting resilient in the face of a much stronger-than-expected jobs report … One of the factors that’s been supporting gold is this uncertainty that we’ve seen going into the (U.S. presidential) inauguration,” said David Meger, director of metals trading at High Ridge Futures.

As President-elect Donald Trump’s Jan. 20 inauguration approaches, investors are anxious about his vow to impose tariffs on a wide range of imports, fearing they could fuel inflation and further limit the Fed’s ability to lower rates.

While bullion is prized as a safeguard against inflation, high interest rates dull its allure as a non-yielding asset.

Spot silver gained 1% to $30.43 per ounce, platinum firmed 0.7% to $964.90 and palladium added 2.5% to $949.25. All three metals were headed for weekly gains.

Read the full article HERE.

The fundamental message is that we’re close to the limits of growth

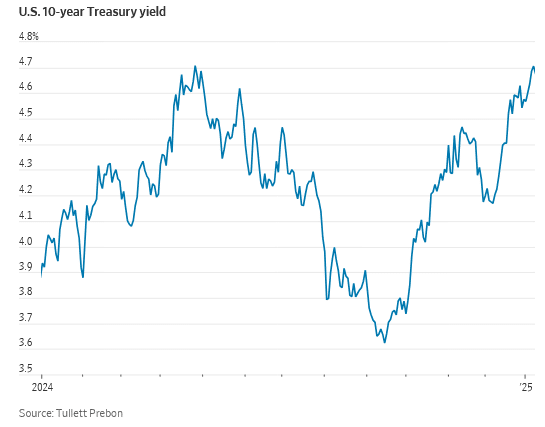

The 10-year bond yield came within a whisker of its high from last April on Wednesday morning, and stocks, especially smaller stocks, didn’t like it one bit.

It is part of a switcheroo by investors over the past month. They have shifted from thinking that higher Treasury yields are just an unwelcome side effect of the stronger growth promised by president-elect Donald Trump, to worrying that higher borrowing costs might end up being very important. If the concern is right, get ready for a bumpy ride in 2025.

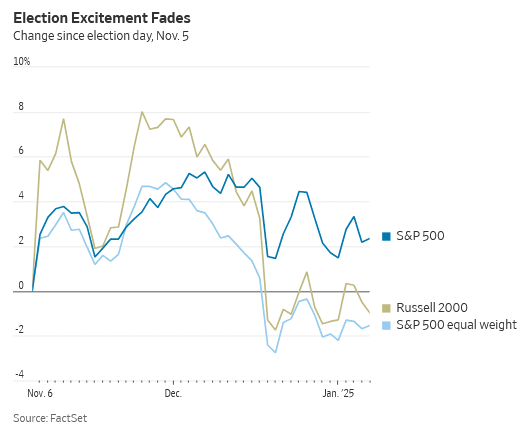

The story really starts with the excitement in the run up to, and shortly after, the election. Stocks and bond yields both soared, as investors anticipated a ton of good stuff from a new Trump administration: deregulation and lower taxes to boost growth and tariffs to extract concessions from other countries. Higher bond yields didn’t matter with so much good stuff to dream about.

It took only a few weeks for reality to kick in. Trump might not do only the good stuff, with promised deportations and permanent, rather than negotiable, tariffs pushing growth down and inflation up.

Just as bad, the risk is growing that the economy can’t cope with much of the good stuff. When the economy grows faster than is sustainable the result is either inflation or higher interest rates, or both. Bond yields rose in anticipation.

By Christmas smaller stocks and the equal-weighted version of the S&P 500—which treats pipsqueaks the same as the Big Tech stocks that dominate the normal index—were both below pre-election levels. Meanwhile Treasury yields leapt, on their way to the 4.7% they hit this week.

The big question: Did stocks suffer because bond yields are so high, or merely because they rose very fast in a short space of time? If it is the level of yields that matters, equity markets have a problem. If it is the pace of change, the drop in stocks is merely a matter of indigestion and investors can wait it out.

I think stocks are suffering because of the fundamental message from bonds, not the speed of change. But it is true these are hard to tease apart.

The fundamental message is that we’re close to the limits of growth. Instead of making everyone better off, when the economy runs too hot, it merely generates inflation, and the Federal Reserve has to cool it down with higher interest rates. To be clear, we’re not there yet: Futures traders still price in one Fed cut this year as the most likely outcome. But they think there is only a 16% chance of more than two cuts, while in early December that was seen as more likely than not. More fund managers predict no cuts this year.

Making things worse for stocks, there is also a supply problem. If the Trump Treasury shifts away from Treasury Secretary Janet Yellen’s focus on shorter-term borrowing, more bonds will have to be issued, even if the deficit doesn’t rise. Companies have been borrowing heavily, too, as they refinance maturing pandemic-era debt.

Higher yields caused by stronger growth are usually fine for stocks, because stronger growth means higher profit. But higher yields without more growth just mean pain.

Iain Stealey, international CIO for fixed income at J.P. Morgan Asset Management, said bonds are starting to look attractive both for their yield and their protective qualities in a downturn. That is despite stickier-than-expected inflation and possible inflationary policies from the new administration. But he hasn’t loaded up on bonds yet. Yields might still rise further. “The momentum definitely feels toward higher yields in the near term,” he said.

If yields keep rising, stocks could have a big drop, as they did when yields jumped toward 5% in October 2023. “When does it start to bite?” asked Guy Miller, chief market strategist at Zurich Insurance Group. “I suspect it’s a bit higher than where we are today, maybe another 50bp [half a percentage point] on 10-year yields.”

Investors who, like me, worry about high valuations and investors crowded into hot stocks might want to buy bonds now. Sure, higher near-term yields would bring immediate losses. But as Christian Mueller-Glissmann, head of Goldman Sachs’s asset allocation research, points out, even the price losses from a rise to a 5% yield on a bond bought today would be covered by less than six months of income from the bonds.

Investors who stick to stocks should have their fingers crossed that yields ease off again.

Read the full article HERE.

Here are some of the best reasons why you should include at least a little gold in your portfolio.

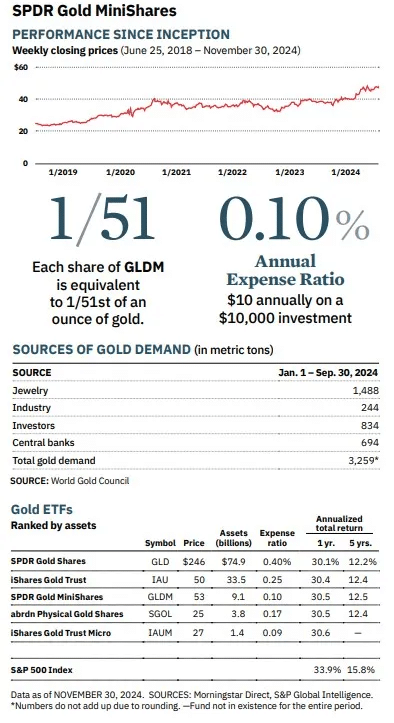

Costco shoppers have been clearing shelves of the retailer’s one-ounce gold bars. U.S. investors have poured almost $2 billion over the past 12 months into exchange-traded funds (ETFs) that hold gold bullion. And central bankers around the world have been snapping up 67% more gold bricks so far this year than they did as recently as 2021.

There are plenty of reasons investors should include at least a little gold in their portfolios. Although gold prices can be volatile, over the long sweep of history, the precious metal has maintained value.

Giovanni Staunovo, a commodities analyst at UBS Securities, says persistent inflation in the U.S. and wars in Ukraine and the Middle East have been key reasons gold prices have more than doubled in the past decade, to more than $2,600 an ounce.

He expects gold prices to reach $2,900 in 2025 thanks to continuing demand from central banks and interest-rate cuts that are likely to weaken the U.S. dollar, which typically moves inversely to gold prices. For many investors, a 5% allocation to gold strikes the right balance of risk and return, he says.

It may be fun to jingle an ounce of gold in your pocket, but ETFs have other advantages. You don’t have to worry about storage, and you can turn your gold fund into money with the click of a button.

The SPDR Gold MiniShares (GLDM) is one of the largest and fastest-growing gold ETFs. The fund has garnered more than $1 billion in net inflows over the past year, bringing assets to $9.1 billion. With an expense ratio of 0.1%, it is a lower-priced clone of the SPDR Gold Shares (GLD), which has more than $74 billion in assets and charges 0.4% in annual expenses.

The mini fund has slightly higher returns than its larger counterpart thanks to a lower expense ratio, but because it is smaller, it trades a bit less efficiently.

Read the full article HERE.

- Markets are gearing up for a heavy debt issuance this week with a US 10-year and 30-year bond auction.

- Fed interest rate projections see a cut in January out of the cards at the moment, the ECB faces challenges after hot European inflatin numbers.

- Gold price is moving within a pennant technical formation, respecting both upside and downside.

Gold’s price (XAU/USD) is coming alive on Tuesday, sprinting higher alongside with US bonds. Traders are starting to get concerned with two very chunky debt issuances set to take place this week with a 10-year bond and a 30-year bond allocation. Markets remain on edge as well meanwhile over the recent string of comments and headlines about the US tariff plans that President-elect Donald Trump wants to impose.

For a brief moment, there was a sigh of relief on Monday after the Washington Post shared a piece claiming that Trump was considering imposing a simple universal tariff on critical imports. After President-elect Trump quickly pushed back against those headlines, Gold’s price returned to levels where it opened the week.

This Tuesday does not seem any different, with the price of Gold at similar levels. Meanwhile, more risk-bearing assets are surging, with Bitcoin back above $101,000. US yields are also surging, with the 10-year benchmark at 4.62%, nearly a fresh eight-month high.

Daily digest market movers: Bond auctions on the forefront

- Inflation data from several European countries and the overall Eurozone shows that the European disinflation path is being broken up, with monthly gauges tied back up with inflation. This could throw a spanner in the works for the European Central Bank (ECB), which is foreseen to cut its policy rate by 25 basis points on January 30.

- The US 10-year yield rallied to 4.64% last week, a fresh seven-month high and not far off an eight-month high of 4.65%. This Tuesday, it is settling down near 4.62%.

- The CME Fedwatch tool is currently only showing a small 10% chance for a 25 basis points (bps) interest rate cut in January. Further on, expectations are for the Fed to remain data-dependent with uncertainties that could influence the inflation path once President-elect Donald Trump takes office on January 20.

- In the runup to the US Employment report on Friday, the JOLTS Job Openings for November are due at 15:00 GMT on Tuesday. The Institute for Supply Management (ISM) will also issue its December Purchasing Managers Index (PMI)report on the Services sector.

- The US Treasury will allocate a 3-year bond this Tuesday near 18:00 GMT. The very important 10-year bond auction is foreseen for Wednesday around 18:00 GMT.

Technical Analysis: Clawing back

It seems that the Gold price is sitting on the bench for now. Traders look to be very happy where the precious metal is currently trading. The weaker US Dollar (USD), together with the elevated tensions on tariffs and other geopolitical events, is not triggering any refugees into the safe-haven commodity. Should a clearer pattern emerge, expect a catch-up move in Gold prices.

On the downside, the 100-day Simple Moving Average (SMA) at $2,628 is holding again after a false break on Monday. Further down, the ascending trend line of the pennant pattern should provide support around $2,608 as it did in the past three occasions. In case that support line snaps, a quick decline to $2,531 (August 20, 2024, high) could come back into play as support level.

On the upside, the 55-day SMA at $2,656 is the first level to beat. It will not be an easy task as it was already proved twice last week as a firm resistance. In case it breaks through, $2,688 will be the ultimate upside level in the form of the descending trendline in the pennant formation.

In order to focus on what will be important in determining gold prices in 2025, we first need to lay out three important points that help frame New York-based CPM Group’s outlook for gold prices this year.

First, the single most important set of factors in setting the price levels and directions of gold prices are the levels and trends in investment demand for physical gold. That demand in turn is determined by a myriad of economic, financial, and political concerns and uncertainties that cause investors to think they need to own more or less gold.

Investment demand drives prices. Prices drive mine production, secondary recovery from scrap, and fabrication demand.

Second, CPM Group issued a long-term gold buy recommendation in releasing its Gold Survey in November 2000. We laid out the case that there was about to be an upward shift in the investment demand curve: More investors and more types of investors in more parts of the world would want to buy more gold for a longer period of time than ever before.

The result of this gold renaissance would be that gold prices, then around $260 per oz., would rise far beyond the 1980 record $850 and stay there for decades.

Historic trends

Prior to 1980, hostile economic and political trends would cause investors to buy more gold for a year or two. After such a period, conditions would improve and investors would buy less gold. Gold prices would subside until the next one or two-year set of crises would start the cycle again.

In 2000, CPM stated that the next cycle would see investors buying more gold for decades, not years.

Finally, there have been major shifts in the international and national political contexts around the world. One of the more significant ones is the imminent return of Donald Trump as president of the United States.

His return to power this month could dramatically alter the economic and political fortunes and landscape. It is not clear what his presidency will mean and do to the world, given the internal inconsistencies of his stated plans, but they are likely to be negative for world growth. It is too early to tell.

With these underlying realities in mind, the outlook for gold in 2025 suggests further price increases.

Gold prices have risen sharply since the middle of 2019. In 2024, gold averaged $2,370 per oz. as of Nov. 26, 21% higher than the 2023 average of $1,952.

CPM expects that gold prices might rise further in December, yielding an approximately 23% rise in the annual average gold price for all of 2024. We’re now projecting another 13% increase to an average price around $2,730 per oz. in 2025.

Prices may rise in the first quarter, and calm down a bit in the second quarter of this year, before beginning to rise again, depending on how the economic and political environments evolve.

Recession threats?

CPM has been projecting a recession at some point, perhaps most likely in 2025 or 2026. If the US government slashes its spending and pursues hostile postures toward any number of countries, a recession could arrive sooner and be more severe.

Trump often considers imposing tariffs. This raises the spectre of a deeper recession sooner.

Republican president Herbert Hoover and Congress sought to combat the Great Depression by enacting the Tariff Act of 1930, known as the Smoot–Hawley Act.

It raised tariffs on more than 20,000 imported goods mostly by 40% to 60%. Smoot-Hawley and the retaliatory tariffs in other nations caused a 67% decline in US trade, imports and exports, deepening and prolonging the severity of the Great Depression.

Rising output

Regarding gold market fundamentals, CPM projects around a 1.5% increase in global mine production in 2025 to around 88.6 million ounces. This would follow an increase of around 0.5% in 2024.

Mining share prices are likely to continue to lag gold metal prices, reflecting long-term shifts in investor attitudes and distinctions between gold bullion and mining equities.

Secondary supply, or recycled gold, in 2025 is projected to rise around 10% to about 40.9 million oz. due to the higher gold prices and anticipated worsening consumer economics in many parts of the world.

Total supply of newly refined gold is projected to be around 136.9 million oz., adding in around 7.4 million oz. from transitional economy exports. This would be up around 3.8% in 2025 from 2024.

Banks skittish

Central banks are projected to continue to be net buyers of around 8 million oz. in 2025, roughly unchanged to a bit lower than in 2024. Monetary authorities tend to be more price sensitive than private investors.

Central banks pulled back from buying as much gold as they had been buying since gold prices broke above $2,200 at the end of last March. This hesitancy is expected to continue in 2025, since prices are expected to stay strong and rise further.

One big risk is that a politically and economically collapsing Russia might sell several million ounces of its 75 million oz. of monetary reserves.

Investors bought 24 to 26 million oz. of gold on a net basis annually from 2021 through 2023. They are estimated to have bought around 32 million oz. in 2024. CPM is projecting investors will buy around 44 million oz. in 2025 as political and economic conditions elevate investor concerns.

A range of economic and political issues seem likely to keep investors interested in adding gold to their portfolios. That should keep gold prices high and most likely drive them to new record prices over the course of 2025.

Read full article HERE.

Gold prices inched higher in Asian trading on Friday, on track for a weekly gain as a slight pullback in the dollar provided support, though the greenback remained close to its two-year peak, keeping pressure on bullion.

Spot Gold rose 0.2% to $2,662.94 per ounce, while gold futures expiring in February gained 0.3% to $2,677.70 an ounce by 00:05 ET (05:05 GMT).

Gold set for weekly gain, strong dollar limits gains

The yellow metal was set to gain nearly 2% this week, its best weekly gain since November 17. It had declined in the previous two weeks.

The US Dollar Index fell 0.2% in Asia hours on Friday but remained near a two-year high it hit last month. The US Dollar Index Futures were also lower.

A weaker dollar typically drives gold prices higher because it makes the metal cheaper for buyers using other currencies.

Markets are cautious at the start of 2025, as the U.S. Federal Reserve has signaled only two more interest rate cuts this year.

High interest rates typically pressure gold prices lower, as they increase the opportunity cost of holding non-yielding assets like gold while making interest-bearing investments more attractive.

Other precious saw gains on Friday. Platinum Futures rose 0.5% $929.70 an ounce, while Silver Futures gained 0.4% to $30.30 an ounce.

Copper remains under pressure, markets await fresh China stimulus

Among industrial metals, copper prices were subdued as a strong dollar weighed, while Chinese factory activity data released a day earlier failed to provide support.

Chinese manufacturing activity grew in December but at a slower-than-anticipated pace, data released on Thursday showed.

The data suggests that the impact of recent stimulus measures is waning. Markets are holding out for more clarity on Beijing’s plans for stimulus measures this year.

The People’s Bank of China said it will cut interest rates from the current level of 1.5% “at an appropriate time” in 2025, the Financial Times reported on Friday.

Benchmark Copper Futures on the London Metal Exchange inched 0.2% higher to $8,815.50 a ton, while February Copper Futures were 0.2% lower at $4.0260 a pound.

Read full article HERE

Yellow metal expected to continue to benefit from buying by global central banks

The price of gold is set to rise further in 2025, say Wall Street analysts, although the pace of gains is likely to slow after last year’s bumper 27 per cent rally.

Gold is expected to climb to about $2,795 per troy ounce by the end of the year, according to the average forecast by banks and refiners surveyed by the Financial Times. That is about 7 per cent above current levels.

The yellow metal is expected to continue to benefit from buying by global central banks, which have been diversifying away from the dollar since the US imposed sanctions on Russia following its 2022 full-scale invasion of Ukraine.

Interest rate cuts by the US Federal Reserve, concerns about growing US government debt levels under president-elect Donald Trump and conflicts in the Middle East and Ukraine are also forecast to lift prices. Such factors were behind bullion’s biggest annual gain since 2010 last year.

“We think central bank interest will be a strong base for the buying next year,” said Henrik Marx, global head of trading at Heraeus Precious Metals, which forecast that gold could touch highs of $2,950 per troy ounce this year.

He added that Trump’s second presidential term was also likely to be supportive for gold prices. “Whatever he announces will increase debt, leading to a weaker dollar and increased inflation. That is usually a nice mixture for gold.”

The World Gold Council said in a report that this year’s growth would be “positive but much more modest”.

The most bullish call among those surveyed is from Goldman Sachs, which expects prices to reach $3,000 by the end of 2025. The bank cites central bank demand and expected rate cuts by the Fed.The most bearish forecasts were from Barclays and Macquarie, which both expect gold to sink to about $2,500 per troy ounce by the end of the year — a roughly 4 per cent drop from current levels.

“Our base case into 2025 is for gold to initially face ongoing pressure from US dollar strength, but be supported by improved physical buying and steady official sector demand,” wrote Macquarie analysts in their year-end outlook.

Global central banks bought 694 tonnes of gold during the first nine months of 2024. The People’s Bank of China announced in November that it was resuming gold purchases after a six-month hiatus.

Falling US interest rates have contributed to gold’s rally in the second half of last year, and the pace of further cuts could be crucial to the outlook for the yellow metal. Gold prices pulled back slightly after the Fed lowered rates in December but indicated that borrowing costs will fall more slowly than previously expected in 2025.

Because gold is a non-yielding asset, it typically benefits from lower interest rates, because the opportunity cost of holding it is less.

Trump’s election win in November has provided one of the most favourable scenarios for gold, due to the likelihood of elevated US fiscal spending and increased geopolitical uncertainty, said Michael Haigh, head of commodities research at Société Générale.

“Momentum is taking back over, combined with geopolitical tensions, which is going to add more fuel to the fire,” said Haigh, who expected gold prices to rise to $2,900 per troy ounce at the end of 2025.

Read the full article HERE.

Strategist Jim Paulsen sees lots of economic hurdles ahead

The end of 2024 is nigh, and can’t come soon enough for investors seeing anything but a Santa Rally lately.

Some may blame the Federal Reserve’s rollback of expectations for interest rate cuts, as it worries strong U.S. growth may reignite inflation. Our call of the day from Jim Paulsen, chief investment strategist of The Leuthold Group, sees things differently.

“Although policy officials and investors appear increasingly anxious about the potential for overheated economic growth, I think the more likely outcome for 2025 is an unexpected economic slowdown,” Paulsen says in his Paulsen Perspective blog, where he cautions such a surprise could ultimately lead to a pullback in the stock market of at least 10%.

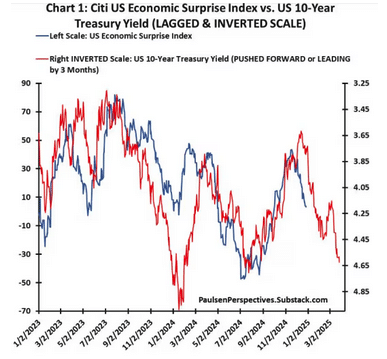

He offers up several examples of weakening growth, such as the Citi Economic Surprise Index—a rise means economic reports have come in stronger than expected, and declines mean economic momentum is trending below expectations. Paulsen’s chart compares that index with the 10-year Treasury yield lagged behind or pushed forward by three months:

Based on history going back to 2003, movements in bond yields have often led to economic surprises, and declining yields have meant an improving economy three months out, and vice versa, he notes. But bond yields, hovering near 4.6%—they hit 4.63% last week—suggest to him the economic surprise index will slow to -35 in the first quarter, slowing GDP as well.

While Paulsen says healthy business and household sectors will likely keep a recession at bay next year, if real GDP slows from a current 2.7% pace to 2% or less, recession fears will dominate financial discussions, drive down profit forecasts and feed through to stocks.

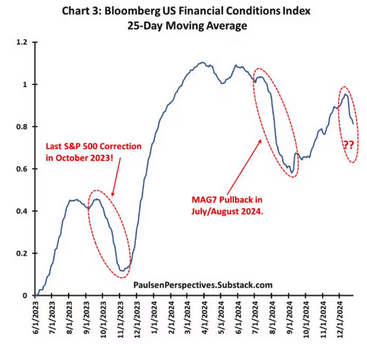

He also looked at the U.S. Financial Conditions Index, which has been worsening since early December. “As illustrated, two other times during the last 18 months, even modest declines in this index led to significant stock market events,” he said, pointing to stock pullbacks of October 2023 and last summer’s rare “Magnificent 7” slump.

“The most recent decline in financial conditions is not yet nearly as pronounced as the last two but it wouldn’t be surprising if financial conditions continue worsening somewhat as economic growth slows further in the new year,” he said.

Paulsen rattled off a number of concerning issues where stocks are concerned, such as deteriorating breadth, where the number of U.S.-listed stocks climbing relative to the number falling has dropping since early October. His read from that is investors are increasingly cautious, noting also underperformance by cyclical and more aggressive stocks since mid-November.

“Since most currently believe the economy is healthy, if not too strong, any meaningful slowdown will come as a surprise. And a ‘surprising slowdown’ which heightens fears could pause the stock market run if not possibly produce a 10% to 15% correction,” cautions Paulsen.

But given corrections are tough to call, he says “most should stay invested since the bull market seems likely to continue during 2025 even if it experiences a bump or two along the way.” That said, a small shift away from cyclical and other “traditionally aggressive investments” toward more defensive ones, may make sense, he says.

The likelihood of a correction and how deep it goes depends much on how technology sector favorites perform in 2025, says Paulsen. If that strength continues, a correction can be avoided, with any slowdown for those stocks a risk. In the below chart he overlays the relative performance of the S&P 500 tech sector with the U.S. financial conditions index:

The last four years have seen obvious close correlation, and in the past a worsening of financial conditions has led to tech underperformance that infects the entire market, Paulsen notes. “So, the primary question for investors in 2025 may be how much will financial conditions deteriorate as the economy slows next year, and how much will this impact technology stocks?”

Read the full article HERE.