Trumponomics tees off

CRITICS ACCUSE Donald Trump of being too chaotic to get much done. The speed of his first appointments should disabuse them. The next administration means business.

Stock and corporate-bond markets are broadly delighted with the prospect of deregulation and tax cuts in a second Trump term. The Economist, by contrast, has warned of a risk that mass deportation and a global trade war would do real harm. The appointments themselves attest to Mr Trump’s desire for disruption, a hard line on China and absolute loyalty . With such a concatenation of signals, you may wonder what is about to hit the world economy.

The answer comes in three instalments, beginning with Mr Trump’s intentions. His commitment to deregulation may be good for growth. Elon Musk, the world’s richest man, and Vivek Ramaswamy, an entrepreneur-politician, have been named heads of a new outfit grandly named the Department of Government Efficiency, or DOGE. A pledge to cut $2trn from the government’s annual budget is patently absurd, but judicious liberalisation could be benign. On day one the new administration could speed up legislation on permitting that is already in Congress. Mr Trump has also promised to free up artificial intelligence. The technology is immensely power-hungry. Just imagine if easier planning rules helped unleash a revolution.

Unfortunately, Mr Trump also wants to deport millions of irregular migrants and impose tariffs of up to 60% on China and 10-20% on the rest of the world. All of these would be bad for growth. For example, the costs of mass deportation could, by one estimate, run to hundreds of billions of dollars. That does not include the economic burden of labour shortages and spiralling consumer prices. Roughly half of the workers on America’s farms have no legal status.

A second part of the answer is that the tensions in Mr Trump’s agenda will be resolved by necessity, as the hyperbole of stump speeches comes into contact with the messy reality of governing. Policies take so much effort to enact that his administration will simply be unable to do everything all at once.

Imposing universal tariffs will take time, because they would need approval from Congress or the use of untested presidential powers. But free-trade Republican lawmakers could recoil at tariffs on America’s close allies. And the use of existing law to impose a universal tariff on national-security grounds would probably be challenged in the courts. Likewise, apprehending, detaining and processing millions of people will be a logistical nightmare. Federal agencies would need to turn to state authorities for help, many of which will refuse.

The third part of the answer is that, mixed in with the intentions and priorities is the mercurial temperament of Mr Trump himself. He has a fondness for picking favourites and then dumping them. He is also beholden to nobody. In spite of his appointment to the White House of Stephen Miller, a longtime loyalist and a hardliner on immigration, Mr Trump may put growth first by making a furious noise about deportation, but limiting its real-world effect. It is the same with Mr Musk, whom markets sense may receive special favours. But will the bromance last? The only discipline on a president who has succeeded so spectacularly by defying the experts around him will be those same markets. Mr Trump has an old-fashioned regard for share prices as a barometer of success.

The conclusion markets seem to be drawing is that things will work out just fine. Although they are alive to risks of inflation and cronyism, investors are betting that tariffs and deportations will do little damage. Instead, the tax cuts will produce a sugar rush that boosts corporate profits and deregulation will bring about lasting growth.

Even if that prediction proves correct about America—a fairly big if—it is too rosy for the rest of the world. As America borrows, raises tariffs and grows, the dollar will strengthen. That will dampen trade. It will also lead to higher interest rates and greater dollar-debt burden in developing countries.

Some governments will be in the line of fire, especially if the threat to extend tariffs beyond the universal rate becomes a Trumpian negotiating tool. Most vulnerable is Mexico, which will be a target both of Mr Trump’s immigration policy, because many illegal migrants cross its border with the United States, and of his trade policy, because Mexico is home to factories that send their exports north under the United States-Mexico-Canada Agreement.

Mr Trump appears to have a special animus against the snooty leaders of the European Union. Many Republicans allege that, by footing the bill for American troops in Europe as part of NATO, America is in effect paying for European welfare. For Mr Trump, the EU’s huge trade surplus with America rubs salt in the wound. Europe can expect to pay.

The main target of a hostile economic policy will be China. Marco Rubio, at the State Department, and Mike Waltz, as national security adviser, both want the rivalry between the world’s two biggest economies to be at the heart of American policy. As firms move supply chains out of China, a few countries may benefit. Others may strike up a friendship with Mr Trump. As a rule, though, the separation of the American and Chinese economies would be highly disruptive.

Fore!

Countries would do well to prepare for what is coming. The eu has said that it will steer tens of billions of euros’ worth of spending to defence. But it has fallen badly behind in AI and has put off strengthening its own internal market for too long. China is in a better position, but it has foolishly delayed the stimulation of domestic demand.

If Mr Trump unleashes a salvo of tariffs, retaliation will exert a seductive pull, not least as a show of strength. It would, however, be an act of self-harm. Few countries are more insulated against trade shocks than America, with its large domestic market. Better to take the positive side of Trumponomics, and deregulate. If Mr Trump wants to tilt the playing-field, the best way to cope will be to become more competitive.

Read the full article HERE.

The 2024 presidential race is over, and Donald Trump is back in the White House. The Dow and S&P are celebrating, suggesting investors are optimistic about Trump’s effect on Wall Street.

But, for all the fanfare, we still face an ominous challenge: The nation’s unsustainable debt and deficit. Regardless of who won, with the path we are on, we are all in trouble, unless something changes.

America’s debt recently surpassed $35.88 trillion, a sum so large it’s almost incomprehensible. That is a stack of hundred dollar bills about the same size as the Earth’s circumference — over 24 thousand miles tall. The federal deficit alone for 2024 topped $1.83 trillion.

Year after year, we’ve operated on what feels like a limitless credit card, passing the bill onto future generations, spending like drunken sailors with limitless credit lines leaving future generations to wake up to the hangover of our reckless binge.

Oddly enough, back in 1999, it was Donald Trump who talked about solving this very problem. In his book “The America We Deserve,” Trump offered ideas for putting the U.S. on a more sustainable path.

Granted, his proposals weren’t great (they were actually kind of bad, in my opinion). But Trump’s message then was a rare acknowledgment from a public figure that our fiscal policy was reckless and needed reform. And, to be clear, that was back when the national debt was less than $6 trillion and we were headed into a couple years of deficit surpluses.

Now, he has a unique opportunity to confront the debt crisis head-on. Trump’s second term frees him from the usual political pressures. He doesn’t personally have to worry about re-election, pleasing donors, or maneuvering through the usual political calculus. This means he can make the hard choices that others might shy away from.

Trump can do what he claims he excels at — taking actions that those raised in the swamp refuse to. If he steps up, he could genuinely save America from what may be one of its most severe long-term threats.

This will require sacrifices. He can help push Congress toward making changes that will put the nation on more secure fiscal footing. This will require changing the tax code, cutting spending in ways that will be painful, reforming entitlement programs, etc. — everything should be on the table.

Many of these changes will be unpopular. In today’s polarized political environment, these actions are so divisive that they’re rarely even discussed by politicians. But this is precisely why Trump might be able to pull them off. He has never shied away from controversy or backlash. If ever we needed someone who is divisive and willing to break golden calves, it’s now. Trump might be exactly the kind of person willing the slaughter the cows sacred to both sides and put the nation on a more sustainable path.

Trump’s electoral victory will be much less meaningful if he leaves office in four years without addressing our debt and deficit problems. Without bold action now, we’re on a path toward economic instability. Trump has the opportunity — and the responsibility — to help us pivot away from this cliff. Here’s hoping he’s willing to take the leap.

Read the full article HERE.

Risk of financial sanctions prompts Beijing to rethink where it parks its massive foreign exchange reserves

Ever since the US dollar cemented its role as the backbone of the global financial system following the second world war, it has been a weapon of choice for American presidents waging economic warfare.

But as the United States’ use of sanctions has proliferated in recent years, concerns have grown in China and elsewhere over whether the US dollar can remain a safe haven currency.

Now, following Donald Trump’s victory in Tuesday’s US presidential election, a fresh wave of uncertainties looms over the US dollar and US dollar-denominated assets.

“We’re still a safe haven – [offering] flight to safety in a messy dangerous world – and that’s a huge benefit,” former US treasury secretary Timothy Geithner told Bloomberg News in July.

He then cautioned that “people in policy have to understand: that position the dollar enjoys, there’s no entitlement to that. It’s not like a guarantee”.

When the governments of the world’s most-advanced economies, led by the US, froze nearly half of the Bank of Russia’s foreign reserves following Russia’s invasion of Ukraine in February 2022, it was a stark reminder to China that its foreign exchange reserves, the world’s largest, could also be affected by US sanctions.

The probability of a worsening financial relationship between China and the US is “high” now that Trump is heading back to the White House, according to Yang Siyao, a researcher at Tsinghua University’s PBC School of Finance.

It will mean bigger risks for China in holding US dollar-denominated assets, Yang said, adding that China should be prepared for the “worst case scenario”.

“For example, the risk of a forced sale or freezing of related [US] assets also needs to be considered,” Yang said.

Trump started a trade war with China in 2018, a year into his first term as US president, and promoted American “decoupling” from the world’s second-largest economy.

At a campaign rally in September, he threatened to slap 100 per cent tariffs on countries that shun the US dollar – a move seen as part of his plans to protect the currency’s dominant role in the global financial system.

The US dollar serves as the primary currency for international trade, central bank reserves and global debt issuance. And bonds, bills and notes issued by the US Treasury – held by central banks and institutions around the globe as marketable securities – have been viewed as a safe haven asset.

China’s foreign exchange reserves started to grow in the 1990s as part of its transition towards a more open economy. The 1997 Asian financial crisis, when Asian currencies were devalued, prompted Beijing to build a financial war chest to protect against external shocks.

Its foreign exchange reserves increased as its international trade and foreign direct investment expanded over the years, with State Administration of Foreign Exchange data showing they totalled US$3.261 trillion last month, down from US$3.316 trillion in September.

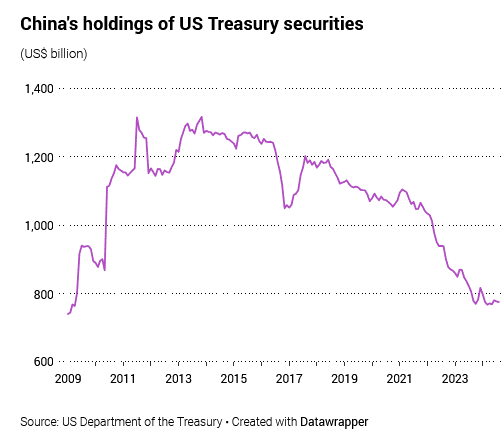

While China does not disclose where it parks its money, a significant proportion is invested in US government debt, according to official US data. As of August, China’s holdings of US treasury securities totalled US$774.6 billion, making it the second-largest foreign holder of US government debt behind Japan’s US$1.13 trillion.

But the rising risk of sanctions means questions have long been asked in China about whether Beijing should continue to invest in US treasuries.

Yu Yongding, a former adviser to China’s central bank, has urged Beijing to curb its investment in them, warning about the growing risks of a US debt crisis and the “weaponisation” of the US dollar in international trade amid geopolitical tensions.

The US’ worsening debt problems could trigger a crisis of confidence in the US government’s creditworthiness, Yu said. The US government sells US treasuries to finance its deficit.

US President Joe Biden’s administration racked up a budget deficit topping US$1.8 trillion in the financial year that ended in September, up more than 8 per cent from the previous year and the third-highest on record, the US Treasury Department said on October 18.

The banking system is another concern for China when it comes to relying on the US dollar, following repeated threats from Washington that it will kick Chinese banks out of the Society for Worldwide Interbank Financial Telecommunication – the formal name for the Swift messaging system that facilitates rapid cross-border payments – if they deal with Russian entities that have been subjected to sanctions.

US Treasury Department data shows that China began cutting its holdings of US government bonds around 2014, after they peaked at over US$1.3 trillion in 2013. In 2022, China’s holdings of US treasuries fell below US$1 trillion for the first time since 2010.

Brad Setser, former US Treasury Department economist and a senior fellow at the Council on Foreign Relations, said China could also be holding US treasuries through the use of custodians outside the US, which would not be listed as Chinese holdings in the department’s data.

“But in the last couple of months of data, China’s reported US holdings have been steady or increased just a bit – so there isn’t even a fall in the headline numbers right now in any meaningful sense,” Setser said.

In addition to its reported foreign reserves, China has maintained a substantial exposure to US dollar denominated assets through its large state commercial banks, the state policy banks, and its sovereign wealth fund, China Investment Corporation (CIC).

China launched CIC in 2007 to better manage its ballooning reserves and diversify investments beyond US dollar holdings, targeting higher-yielding opportunities abroad .

CIC said its total assets were valued at US$1.33 trillion at the end of last year, up 7.46 per cent year on year, with nearly 50 per cent of its overseas portfolio invested in alternative assets such as hedge funds and property, and a third invested in stocks – 60.29 per cent of them US-listed, up from 59.18 per cent in 2022.

Robert Greene, a vice-president at financial services consultancy Patomak Global Partners, said China is likely to maintain “very large holdings” of US dollar assets in the near term.

“China’s monetary policy approach and trade imbalances inherently bring about Chinese demand for foreign currency assets,” said Greene, who is also a non-resident scholar at the Carnegie Endowment for International Peace.

“Moreover, China’s foreign exchange reserves are so sizeable that there are structural impediments to meaningfully reducing the dollar’s share of these reserves while holding the level of reserves relatively constant.”

The Official Monetary and Financial Institutions Forum (OMFIF), a London-based finance think tank, has predicted that the US dollar’s share in world currency reserves could decline to 40 to 45 per cent by 2050 from around 60 per cent at present. It said emerging economies could become more aggressive in promoting the use of non-dollar currencies amid questions over the US’ persistent budget and current account deficits and their impact on the sustainability of US debt.

According to the US Treasury Department, America’s national debt stood at US$35.46 trillion at the end of September, giving it a debt to gross domestic product ratio of 124 per cent.

Vitor Gaspar, director of the International Monetary Fund’s fiscal affairs department, told a news conference on October 23 that while the US’ debt has grown steadily, it is still sustainable.

“We do believe that the situation in the United States is sustainable because the policymakers in the United States have access to many combinations of policy instruments that enable them to put the path of public debt under control,” Gaspar said.

For China, there are other things to consider when it comes to US treasuries, apart from their role as safe haven assets, Wu Guoding, an associate researcher at Chinese Academy of Social Sciences, wrote in an article in Shijie Zhishi, a semi-official foreign affairs magazine, in September.

“In addition to the economic significance, holding a certain amount of US debt also has certain political significance for China,” Wu wrote.

“Given the importance of US debt to the US, China can maintain its influence on the US capital market and even on US politics by holding US debt, making the US cautious in dealing with China-US relations.”

Zerlina Zeng, head of Asia strategy at CreditSights, which conducts research on credit markets, said China was likely to promote the use of the yuan – also known as renminbi – globally to reduce its reliance on the US dollar.

She said it is already promoting the use of the Chinese currency in trade and financial transaction settlement to further its internationalisation.

“In the offshore debt market, Chinese state-owned enterprises and the Chinese government are increasingly using offshore yuan, non-dollar G3 [the euro and Japanese yen], or even emerging currencies for refinancing and new debt,” Zeng said.

“We expect these trends to continue post the US election.”

Read the full article HERE

Gold prices’ slide in response to Tuesday’s election results could be a head fake. From inflation to geopolitical uncertainty, the prospect of a second Donald Trump presidency only makes the investment case look stronger.

The price of gold fell nearly 3% following the vote, after rallying this year. It hit a record high as recently as Oct. 30.

One reason for the reversal is that Trump’s clear-cut win removed uncertainty hanging over U.S. markets and politics, weakening the case for haven assets. A bigger factor, however, was a spike in interest rates that came as markets digested the prospect a second Trump term could lead to higher inflation. Many investors buy gold as an alternative to bonds, and when bond yields rise, gold becomes comparatively less attractive.

By Friday, yields on 10-year Treasury debt had eased, and gold regained some of its losses. Front-month gold futures closed at $2,688 an ounce, according to Dow Jones Markets Data. That was up from the low of $2,668 following the election result, but still below the recent record of $2,788.

Most of the arguments gold bulls make—and have been making throughout 2024—look stronger after Trump’s win.

“We are still relatively constructive on gold,” says Taylor Krystkowiak, investment strategist at Themes ETFs. “Why does gold go up? It’s geopolitical uncertainty, it’s deficit spending, and it’s inflation. Right now all those stars are aligned.”

The inflation argument might seem counterintuitive, given that over the past few days, gold has appeared to sell off due to worry over inflation sending bond yields higher. But inflation’s relationship to gold is complicated and can push both ways.

In fact, most investors regard inflation worries as a classic reason to buy, not sell gold. It is no accident that two of gold’s biggest rallies on record—the current one and a surge in the late 1970s—have come when inflation was a critical issue on investors’ minds.

Why is Wall Street so worried Trump’s win will spur more inflation? There are several reasons.

During the campaign, Trump promised a 10% tariff on all imports and a 60% levy on those coming from China. While that proposal may well be watered down, whatever import duties Trump does put in place would almost certainly push up prices for U.S. consumers. Trump’s plans to deport undocumented workers would push up labor costs for many U.S. companies.

His tax plans also pose risks. Trump pledged to extend his signature 2017 Tax Cuts and Jobs Act to spur growth. But the law’s tax cuts aren’t offset by tax increases elsewhere, so they would add more than $4 trillion to the national debt, according to one independent analysis—another potential inflation driver.

In addition to higher prices and budget deficits, the Trump political brand, built on unpredictability and the promise of fundamental change to U.S. institutions, could add political and market anxiety. That might benefit gold, often seen as the best place to take shelter when markets get rough.

Trump’s potential to inject uncertainty into markets was on display Wednesday when Fed Chairman Jerome Powell was forced to respond to Trump criticism by reminding reporters Trump didn’t have the power to fire him. Trump has called for curtailing the Federal Reserve’s political independence. Any battle over the powers of the U.S. central bank would be bound to roil markets.

Trump’s helter-skelter image is one he has deliberately fostered. When asked last month if he would use force to deter China’s leader Xi Jinping from moving against Taiwan, Trump responded: “I wouldn’t have to, because he respects me and he knows I’m f— crazy.”

In other words, like him or not, Trump’s win will keep markets on edge. “It’s a little bit of a chaos grenade,” says Krystkowiak.

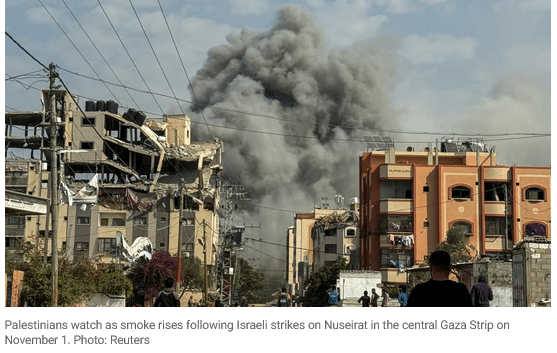

Analysts warn both sides are likely to ‘take even more risks’ in the dying days of the Biden administration

With the Middle East teetering on the brink, the re-election of Donald Trump to the US presidency has raised fears of a renewed clash between Israel and Iran in the 10-week period leading up to his inauguration – despite him promising in his victory speech to “stop wars”.

Analysts warn that Israeli Prime Minister Benjamin Netanyahu, emboldened by the electoral success of his staunch ally Trump, may be tempted to act decisively against Tehran during the dying days of the Biden administration.

Shortly after the US election result became apparent, Trump and Netanyahu discussed “the Iranian threat” on a phone call alongside the need to enhance Israel’s security, according to a statement from the Israeli prime minister’s office.

The US president-elect wants the wars in the region “to end as soon as possible … with a decisive victory” for Israel, Trump campaign spokeswoman Elizabeth Pipko said in an interview with Israeli broadcaster Keshet 12 on Wednesday.

Netanyahu’s recent dismissal of Defence Minister Yoav Gallant, on the eve of Trump’s electoral win, only made the situation “even more precarious”, according to Mairav Zonszein, a senior Israel analyst at the New York-based Crisis Group risk consultancy.

“The chances that both sides will take even more risks” during the final weeks of outgoing President Joe Biden’s administration have increased, she said in a post on X.

“I think it’s safe to say that between Trump and Netanyahu, we are squarely going into the ‘escalation towards de-escalation’ paradigm.”

While Trump’s unpredictability remains a factor, he is likely to “urge Israel to wind up” its wars in Gaza and Lebanon before he officially takes office in late January, said Barbara Slavin, a distinguished Middle East fellow at the Stimson Centre think tank in Washington, citing remarks Trump made on the campaign trail.

Analysts believe Netanyahu is confident any agreements on ending the Gaza war which are reached post-inauguration will not compromise his long-standing goal of preventing Palestinian statehood.

On Tuesday, as Americans cast their votes, the Israeli Defence Forces announced that the division of northern Gaza into two parts had been completed.

“This time there is no intention to allow the residents of the northern Gaza Strip to return to their homes and that humanitarian aid will regularly enter the southern Gaza Strip – since there are no more civilians left north of Gaza City,” it said in a statement.

Slavin told This Week in Asia that Trump “will let Israel continue to occupy Gaza” and is likely to care “even less about Palestinian lives than Biden”.

She speculated that he might also give Israel a green light “to annex the West Bank or try to revive his ‘Deal of the Century’”, proposed in 2020, which would grant Israel 87 per cent of the occupied Palestinian territories while offering a disarmed Palestinian state US$50 billion in development funds over the span of a decade.

Palestinian analyst Ahmed Fouad al-Khatib, a senior fellow at the Atlantic Council think tank’s Scowcroft Security Initiative in Washington, said Trump may “very well succeed” in ending the war in Gaza.

“But the price he’ll offer Bibi, immediately or in the near term, will be the annexation of the West Bank, forever killing the possibility of a Palestinian state”, he said, referring to Netanyahu by a popular nickname.

Zonszein noted that Trump’s former ambassador to Israel, David Friedman, had recently published a book “which is effectively a blueprint for how Israel should annex the West Bank, perfectly aligned with the far-right in the Netanyahu government”.

She described the book, One Jewish State: The Last Best Hope to Resolve the Israeli-Palestinian Conflict, as a “window into what Trump … may help Israel do”.

Normalisation redux?

Faced with public outrage over the ongoing conflicts in Gaza and Lebanon, Arab leaders are expected to tread cautiously in their dealings with a second Trump administration, even as they continue to pursue improved relations with Iran.

The Saudi foreign ministry quickly congratulated Trump following his electoral victory, with Crown Prince Mohammed bin Salman – alongside Netanyahu – being among the first world leaders to call him.

During the call, Saudi Arabia’s de facto leader “expressed the kingdom’s aspiration to strengthen the historical and strategic relations” with the US, according to an official statement released later that made no mention of the wider crisis in the Middle East.

Independent Saudi analyst Aziz al-Ghashian interpreted this response as a sign that Riyadh will be “keen but measured” in its cooperation with the new administration.

Despite recent declarations from Saudi Foreign Minister Prince Faisal bin Farhan that normalisation with Israel is “off the table until we have a resolution to a Palestinian state”, Stimson Centre’s Slavin expects Trump will try to add Saudi Arabia to the 2020 Abraham Accords – under which Bahrain, Morocco and the United Arab Emirates established diplomatic relations with Israel – using “massive bribes of weapons and nuclear technology”.

However, analysts warn that continued Israeli aggression towards Palestinians could destabilise the already fragile pro-US regimes in the region – concerns that leaders such as Egypt’s President Abdel Fatah el-Sisi and Jordan’s King Abdullah, who already enjoy a personal rapport with Trump, are expected to communicate to him.

Trump’s incoming administration is also unlikely to pursue a peace deal with Iran, despite his recent comments suggesting openness to negotiations. His team is filled with anti-Iran hawks, and reports of Iranian plots against Trump – stemming from his order to assassinate Qassem Soleimani – have likely “further antagonised” the incoming US president against Iran, according to Farzan Sabet, a senior research associate of the Global Governance Centre, a Geneva think tank.

The overall security landscape in the Middle East suggests that Trump’s administration will adopt a hardline stance against Iran, Sabet said.

The US and Iran “are more firmly on the path to direct conflict than at any time” since the end of the Iran-Iraq War in the 1980s, he said.

In response to Trump’s election, Iranian foreign ministry spokesman Esmaeil Baghaei said on Thursday that it presents an opportunity to “review previous wrong policies”. reflecting the bitter experiences with past US administrations.

“We have very bitter experiences with the policies and approaches of different US governments in the past,” he added.

While Slavin believes that Trump does “not want a war with Iran and so will restrain Israel from starting one that drags the US in”, she cast doubts over his ability to negotiate a favourable deal.

Much will depend on whether Iranian Vice-President Javad Zarif and other officials in Tehran can devise an agreement “that makes Trump look good, without making Iran look like it’s caving completely”, she said.

Read the complete article HERE.

Price falls as investors take profits from earlier gains, but longer-term prospects are bullish due to trade and inflation uncertainties

Demand for gold will continue to rise following Donald Trump’s victory in Tuesday’s US presidential election, which will increase trade tensions and uncertainties for the US dollar and US dollar-denominated assets, analysts said, predicting that gold prices will hit fresh highs despite a recent fall.

According to GF Securities, so-called “Trump deals” since the start of October took many expectations into account, leading to a strong US dollar, rising gold prices, falling oil prices, falling copper prices, and volatile US stocks, and the market was likely to trade in the opposite direction in the short term.

Shen Jianguang, chief economist at JD.com, said that in response to Trump’s election “virtual assets such as bitcoin and US bonds have risen sharply” and the price of gold would also climb in the longer term.

Shen said that reflected a broader decline in trust in the US dollar among governments and investors around the world.

“For many regions, particularly those with tense geopolitical relations with the United States, the status of gold, serving as a reliable safe-haven … store of value, is growing,” he said.

Gold has long been regarded as a hedge against economic and political uncertainty, particularly in a low-interest-rate environment. The price of gold hit a record high of US$2769.25 an ounce on October 29, having risen nearly 35 per cent this year. On Wednesday, spot gold dropped 3.1 per cent to end at US$2,659.24 an ounce.

In a report released last week, UBS forecast the price of gold would reach US$2,900 an ounce by the end of the third quarter next year, with a Trump victory to accelerate that climb given his views on tariffs, government spending, taxes and interest rates.

Many international investors have been nervous about chasing gold prices higher, Goldman Sachs Research analyst Lina Thomas wrote in a report last week.

She said the price is set to rise to US$3,000 an ounce by the end of next year.

Shen said gold will reach new highs in the long term, due to the impact of the US central bank’s increasingly lax monetary discipline on the US dollar’s global standing.

“First, the Federal Reserve’s quantitative easing in recent years has expanded its balance sheet to US$8 trillion; second, the US government has used the US dollar and tariffs as a tool for financial sanctions, causing many countries’ central banks to actively or passively dedollarise and turn to gold and virtual currencies,” he said.

Shen said Trump’s tariff policies would have an impact on global trade, especially for China. The yuan had already depreciated a bit in response, making gold more attractive for Chinese investors as a hedge against exchange rate and yuan asset uncertainty.

In the first three quarters of this year, gold consumption in China fell by 11 per cent year on year to 742 tonnes, according to the China Gold Association, which said high prices had put off consumers. Chinese consumers bought 400 tonnes of gold jewellery, a year-on-year decrease of 27.53 per cent, but they purchased 282.721 tonnes of gold bars and gold coins, up 27.14 per cent year on year, the council said.

Wendy He, the administration director of a private company in Guangzhou, said she bought gold bullion worth 50,000 yuan (US$6,979) through online banking while watching television coverage of presidential election votes being counted in Pennsylvania, a key swing state that pushed Trump closer to victory. She had already bought gold bullion worth 200,000 yuan the same way last month.

Read the full article HERE.

President-elect plans tariffs and tax cuts, as in his first term. There are risks with both, but also lots of caveats.

Key Points

- Trump’s second-term economic agenda includes higher tariffs and lower taxes, potentially leading to higher inflation and interest rates.

- Tariffs could pose a greater inflation risk than in Trump’s first term.

- Tax cuts may provide a temporary economic boost but could also increase the deficit and put upward pressure on interest rates.

Voters have re-elected Donald Trump in great part out of dissatisfaction with the economy under President Biden and nostalgia for the low inflation and prepandemic conditions of the former president’s first term.

To fulfill those voters’ hopes, Trump’s main economic tools will be the same as in that first term: tariffs and tax cuts. But there’s a difference. The tariffs he’s planning will be broader and higher, and the tax cuts more narrowly targeted.

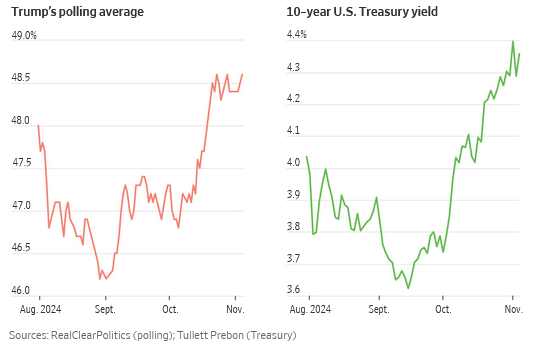

The consensus of economists and investors is that tariffs will put upward pressure on inflation while tax cuts could spur growth and add to deficits, together tending to nudge interest rates higher. And indeed, long-term Treasury bond yields had risen recently on strong economic data and Trump’s improved polling, and shot up early Wednesday, along with stock-index futures, as Trump’s victory became apparent.

The first years of Trump’s first term were better for the economy than many expected on election night in 2016, and expectations could be similarly miscalibrated now. For one thing, he inherits a relatively benign outlook. Growth has been surprisingly strong while inflation has fallen substantially from its peaks, although prices are still high. The Federal Reserve is set to trim interest rates Thursday for the second time this year. This should keep recession risks to a minimum.

As for Trump’s own plans, he may not raise tariffs as much as threatened, opting for negotiations over trade war. Congress may water down his tax plans. Finally, presidents are seldom the main driver of economic performance. Trump’s policies may have less to do with how the economy performs over the next four years than larger forces and unexpected events, such as a crisis, a war or a boom driven by new technology.

Trade comes first

His first opportunity to make a mark will likely be on tariffs, where he can act without asking Congress’s permission. Even so, administrative procedures and negotiations could delay implementation. In his first term, 11 months elapsed between initiation of the case against China and imposition of tariffs. Tariffs may also be rolled into broader negotiations on extending the 2017 tax cut.

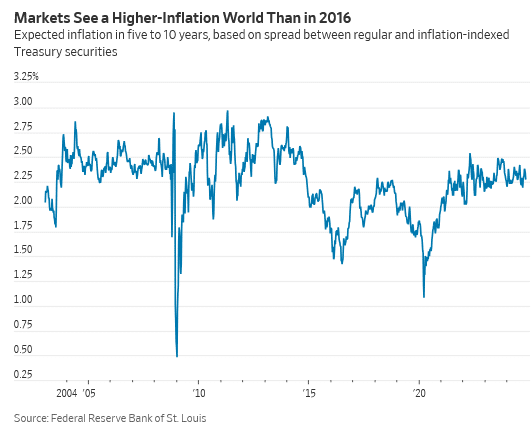

Trump’s first-term tariffs had no noticeable effect on inflation because they were relatively modest, and globally subdued demand and investment and slack labor markets were pushing in the opposite direction. On the eve of his election, wages were rising just 2.4% a year. Bond investors expected future inflation to average 1.8%, below the Fed’s 2% target.

This time Trump has proposed much higher tariffs—at least 60% on China, and 10% to 20% on everyone else. Such a combination would lift U.S. tariff rates to their highest since the 1930s. And it would come when demand is brisk, supply chains are vulnerable to geopolitical conflict, and memories of inflation are fresh. Wages are growing 3.8% a year, and bonds see future inflation at 2.3%.

This suggests tariffs could pose more of an inflation risk than in his first term. Morgan Stanley estimates Trump’s 60% and 10% plan would raise U.S. consumer prices 0.9%. That’s a one-off effect: Eventually, inflation should fall back to its underlying trend.

But other factors could result in a smaller impact. Importers could absorb more of the tariff into their margins. The dollar could rise, offsetting higher import prices. Most important, some advisers say Trump is using tariffs as a negotiating tactic to lower other countries’ trade barriers, so actual tariff increases will be less than he has threatened. And if Trump sees tariff fears hurting stocks or pushing up interest rates, he may compromise.

Goldman Sachs economists think Trump would raise tariffs on China by 20, not 60, percentage points, and will not impose an across-the-board tariff on other countries. In that scenario they think inflation excluding food and energy, using the Fed’s preferred price index, would fall from 2.7% now to 2.3% in a year, instead of 2% in their baseline forecast. That difference won’t stop the Fed from cutting interest rates, they conclude. Inflation at that level would still be lower than for most of the past three years.

Then come taxes

Portions of the tax law that Trump and congressional Republicans passed in 2017, such as for lower rates for individuals and businesses who pay their taxes on their individual returns, expire at the end of 2025 and they have given priority to extending the law. That would cost about $5 trillion over 10 years, the Committee for a Responsible Federal Budget estimates. The process is likely to consume a lot of next year.

Full extension shouldn’t have much effect on growth or interest rates because that’s already built into the behavior of investors and the public.

Not so with Trump’s other proposals, which have at times included lower corporate tax rates; exempting tips, Social Security benefits and overtime pay from taxes; and deductions for car loan interest and state and local taxes. These proposals would, the CRFB estimates, add about $4 trillion to the deficit over 10 years.

Tariff revenue would reduce that cost somewhat as would spending cuts, though Trump also plans some spending increases.

The 2017 tax law was good for long-term growth because it simplified the tax system by lowering rates on income, profits and investment and narrowing tax breaks, said Kyle Pomerleau, an economist at the American Enterprise Institute. Trump’s new proposals won’t have the same benefit because they add back complexity via new tax breaks, he said.

Still, lower taxes should provide some boost. Deutsche Bank estimates that a unified Republican government would boost growth by 0.5 percentage point in 2025 and 0.4 in 2026 without higher tariffs. With a 60% tariff on China and 10% on everyone else, Deutsche estimates the net effect on growth becomes negative.

Tax cuts would also add to the deficit and put upward pressure on interest rates. John Barry, rates strategist at JP Morgan, estimates Treasury’s current schedule of debt auctions is enough to fund next year’s deficit, but would fall $3.3 trillion short from 2026 through 2029, without extension of the 2017 tax cut. The shortfall would be even larger if the tax cut is extended and Trump’s plans are enacted.

If the Treasury starts upping auction sizes to finance larger deficits, that is likely to put upward pressure on yields. Barry estimates a unified Republican government would raise 10-year yields by 0.4 percentage point, of which the market had already built in 0.15 point through Friday.

But with the last fiscal year’s budget deficit at $1.8 trillion, triple the level of eight years earlier, even a Republican Congress may not give Trump all he wants.

“A Republican Congress is not going to bend over backward to exempt Social Security benefits or overtime pay from tax, both on the merits of those ideas, and the cost,” said Don Schneider, a former Republican congressional aide now at Piper Sandler. “There simply are not the votes to do that.”

Still, Trump’s sway over Republican legislators has grown since his first term, and he has shown he can muscle through his priorities.

Regulations

Trump has proposed lighter regulation, for example of mergers and of the oil-and-gas industry. These ought to boost growth and business confidence and hold down inflation. But economists think the effects are too difficult to identify in the broader economy. For example, U.S. oil production and gasoline prices are driven mostly by global prices, which are in turn heavily influenced by OPEC, sanctions, Middle East conflict and Chinese economic growth.

Similarly, while Trump’s plan to deport unauthorized migrants could, at the margin, raise wage and price pressure, the impact may not be noticeable given the size of the U.S. labor market.

Trump’s economic agenda isn’t just about growth but also trying to restore the good jobs and healthy communities manufacturing once made possible while reducing dependence on China, a geopolitical adversary. “Yes, there’s a cost. In many cases, I think it is worth it,” said Scott Paul, president of the Alliance for American Manufacturing.

“Globalization produces disruption, dislocation, and destruction,” Robert Lighthizer, who was trade ambassador in Trump’s first term and will likely return in some role in the second, wrote last year. “Conservatives by contrast seek to defend traditional values and institutions, preserve the social fabric, and ensure the conditions for families and communities to flourish.”

Unlike GDP or inflation, these benchmarks for a Trump economy defy easy measurement. They are no less important.

Read the full article HERE.

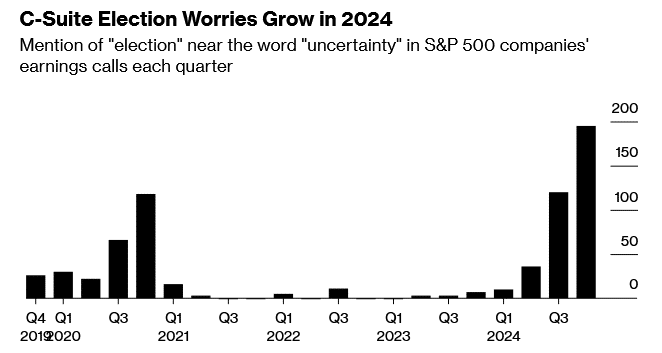

- ‘Uncertainty’ mentions by executives are higher than in 2020

- ‘Nobody knows what actually is going to happen’: Snap-On’s CEO

Company executives can’t stop talking about the US election.

Earnings calls in recent weeks have been filled with talk of uncertainty about the aftermath of Tuesday’s election, which has delayed spending as potential policy changes loom large.

And things are more intense in this presidential election cycle. Mentions of “election” near the word “uncertainty” on S&P 500 companies’ quarterly earnings calls this year are markedly higher than they were before the 2020 election.

C-Suite Election Worries Grow in 2024

Mention of “election” near the word “uncertainty” in S&P 500 companies’ earnings calls each quarter

“Welcome to the Mad Hatter’s tea party,” Nicholas Pinchuk, tool maker Snap-On Inc.’s chief executive officer, said on the company’s Oct. 17 third-quarter earnings call. “Nobody knows what actually is going to happen, so you can’t even make a pronouncement.”

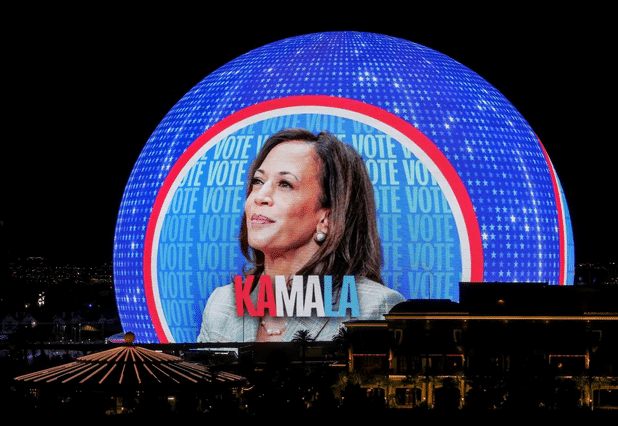

Much of the C-suite angst is over the risk of additional tariffs, particularly if Republican Donald Trump wins another term. Business leaders say new fees on imported goods could increase costs up and down the supply chain, and force some companies to rethink manufacturing and sourcing. Democratic candidate Kamala Harris’ support for higher corporate tax rates is also a source of concern.

It’s not just companies hitting the pause button until voters decide which party will control the White House and Congress.

A recent survey by research firm Circana found that 16% of US consumers said they would wait until after the election to start their holiday shopping, and 17% said they would spend more or less depending on who won.

Etsy Inc. CEO Josh Silverman said last week that the nonstop political noise is “an incredibly distracting mind-share event.”

House builder D.R. Horton Inc. said it wasn’t just higher interest rates holding back potential home purchasers. “The volatility of rates combined with general uncertainty during the election season is causing some buyers to stay on the sidelines in the near term,” CEO Paul Romanowski told analysts.

Car parts retailer O’Reilly Automotive Inc., mattress-maker Sleep Number Corp. and indoor-cycling specialist Peloton Interactive Inc. also cautioned about election-related sales sluggishness on their latest analyst calls.

Fewer people are traveling around the election, impacting airlines and hotel chains. Park Hotels and Resorts Inc., expects bookings to be down about 13% on election week and another 11% the following week as people stay close to home.

Bombarded by Campaign Ads

Companies are also finding it harder to get their messages across through the relentless campaign advertising.

“Media is more expensive,” Jim McCann, CEO of 1-800-Flowers.com, said on his company’s latest call. “The election does have a big, big impact on what we pay for things both digitally and in traditional media.”

The US political future also weighed on the minds of analysts monitoring earnings calls.

Chris McNally of Evercore asked on the General Motors Co.’s call about future electric vehicle losses, adding: “It’s sort of my way of asking the election question without asking the election question.”

CEO Mary Barra answered that later by saying GM — which has invested billions of dollars in EVs favored by one candidate and loathed by the other — is prepared to deal with any eventuality.

At least one chief executive is brimming with confidence no matter what the outcome.

“Both presidential candidates are now courting the crypto voter,” digital exchange Coinbase Global Inc. CEO Brian Armstrong said on his company’s third-quarter earnings call. “No matter what happens in this election, it’s going to be the most pro-crypto Congress ever.”

Read the full article HERE.

Higher interest rates mean that the next president, whoever it is, will find it much harder to reduce taxes and increase spending.

For all the bold talk of tariffs and price controls, the economic legacy of the next president will mostly depend on something far more mundane: the tax code — specifically, the 2017 Tax Cut and Jobs Act, much of which will expire next year. Whoever is in the White House, working with whichever party controls Congress, will need to decide whether to extend it, change it or let it expire.

Given that Donald Trump favors extending all of it, and Kamala Harris most of it, odds are that the TCJA will survive and most voters will keep their lower tax rates. If so, it may well be the last gasp of the free-lunch era — the delusion the US can cut taxes, increase spending, and never pay the consequences.

But America’s fiscal reality is catching up with its political reality. By the end of the next president’s tenure, if not sooner, politicians will have to start dealing with budget constraints again.

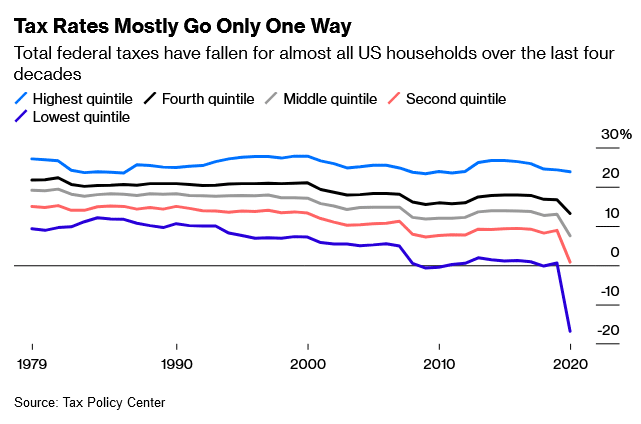

Ever since George H.W. Bush’s presidency, increasing taxes on anyone but the richest Americans has been unthinkable. This may explain why taxes rates have fallen for most Americans over the last several decades, even as the size of government has increased.

This also helps explain why it is so unlikely that either candidate will allow the TCJA to expire. Harris has promised to not increase taxes on anyone who earns less than $400,000, which suggests she will keep all the provisions from the law that apply those earners, who make up about 98% of the working population. Trump plans to make all the provisions of TCJA permanent. Both candidates are also promising tax cuts beyond those in that law, proposing to expand the earned income tax credit and the child tax credit (Harris), eliminate taxes on overtime or Social Security benefits (Trump), or end taxes on tips (both Harris and Trump).

On the spending side, Harris wants to add a new entitlement by having Medicare offer long-term care. She would increase some taxes for high earners as well as the corporate tax rate, and perhaps tax higher earners’ wealth, too.

Overall, Harris’ plan is considered more fiscally responsible — because it increases the primary deficit by only $2 trillion. Trump’s would increase it by $4.1 trillion.

These are both silly numbers, and the fact that the Harris number is less silly should not give voters or bond markets much comfort. Both parties suffer from their own delusions: Republicans that tax cuts and higher tariffs pay for themselves, Democrats that government growth can be funded entirely by higher taxes on rich people.

The question is how long markets will continue to indulge these fantasies. The inflation of the early 2020s, which was caused in part by excess stimulus spending, was a reminder of how reality can intrude. Another reminder may come in the form of rising term premiums as the election nears. Interest rates may fall a bit after the election, but historically speaking, big debt tends to increase rates.

Of course, some people argue that this time is different — but really, it’s the last 20 years that were different. Washington was able to keep spending because investors and foreign governments bought US debt no matter how expensive it got. That may be changing. Foreign appetite for Treasuries is waning both because of other nations face their own economic challenges, and because less trade overall means less need for US Treasuries. Now buyers tend to be investors seeking higher-yielding assets, which suggests that the government may not be able to count on selling its debt and offering such low rates for much longer.

It is possible that faster growth will pay for the debt. But that is a big gamble, especially in a less global and higher-rate environment. Another constraint on policy will be higher inflation, which is more likely with an older population and a more protectionist trade regime. The latest bout of inflation may also have made expectations less stable, pushing up term premiums. On the upside, higher inflation will erode the debt, but at what political cost? Recent history suggests it will be great.

A near zero-rate environment propped up the delusion that profligate fiscal policy was virtually cost-free to taxpayers and politicians alike. In a higher-rate environment, that delusion is harder to sustain. The CBO projects interest payments will take up nearly 4% of GDP in the next 10 years, and eventually exceed 6%. That assumes the 10-year bond rate stays at about 4%. If rates go to 5% or 6%, debt becomes an even bigger burden on the budget. At that level, simply rolling it over pushes up rates and starts to crowd out private investment.

Next year’s debate about the Tax Cut and Jobs Act may be the last one in which each side competes to be more reckless. The US is entering a higher-rate environment, with spending increasing and unfunded entitlements coming due, and demand for debt is changing. Something has to give: Everyone will have to pay higher taxes, or the government will have to spend less.

My bet is on the former. Either way, it’s the end of an era. In fiscal and monetary policy, as in an increasing number of corporate cafeterias, there’s no such thing as a free lunch.

Read the full article HERE.

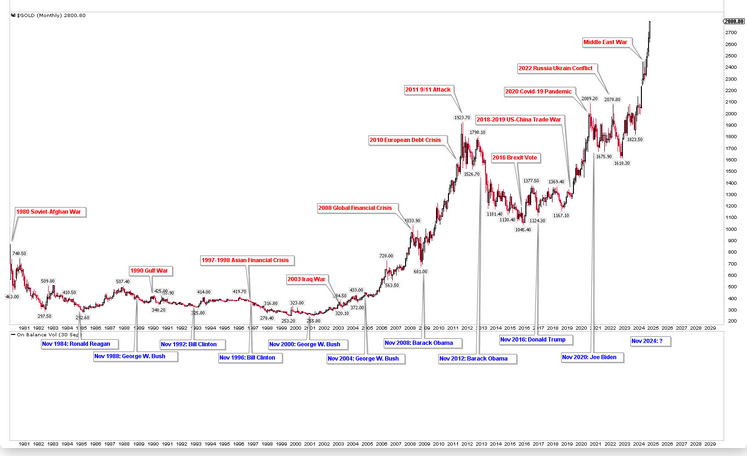

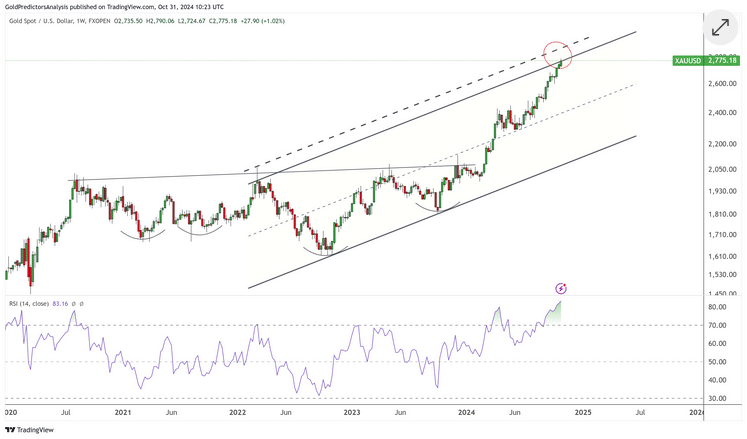

The US presidential election is approaching, and the race between Kamala Harris and Donald Trump remains tight. The election outcome will significantly impact the gold (XAU) market, with key economic and geopolitical factors in the balance. Gold trades at historic highs, peaking at $2,790 on October 31, 2024. This article presents the movements in gold prices during historical events and discusses how these events may impact the gold price outlook. The price remains strong due to the US election and geopolitical uncertainty, and there are no signs of reversal in the short-term direction.

Gold Safe-Haven Status During Political Uncertainty

Investors have recognized gold as a reliable and safe-haven asset during political uncertainty. Its status as a store of value becomes more pronounced when global events introduce instability. In the context of US elections, policy shifts, and international tensions, investors turn to gold to protect their wealth from the potential devaluation of currencies and market volatility. The upcoming US presidential election on November 5, 2024, features a closely contested race between Kamala Harris and Donald Trump. Investors expect policy changes and geopolitical strategies that could ripple through the financial markets.

Gold Price Movements During US Election

The impact of political uncertainty on gold prices has been evident throughout history. Each administration’s decisions play a crucial role, from trade wars and changes in foreign policy to debates over energy investment and tariffs.

These decisions can influence the market’s perception of risk. During the current election cycle, uncertainty emerges from both candidates’ platforms. Trump focuses on aggressive trade measures, while Harris emphasizes domestic economic support and international alliances. This has contributed to maintaining gold’s appeal. Gold will likely remain attractive if questions about future policies and global stability persist. Investors will continue seeking it to mitigate risks in an unpredictable political landscape.

The monthly gold chart illustrates the impact of US presidential elections over the past four decades. It also highlights the geopolitical events that have contributed to significant gold surges during this period. The chart shows that gold price movements have generally been positive. However, the emergence of these events has triggered intense volatility in the gold market.

Key Historical Events Shaping Gold Prices

The major historical events that have triggered the gold rallies are discussed below.

1980 – Soviet-Afghan War & High US Interest Rates

Cold war tensions escalated with the Soviet invasion of Afghanistan. This war created geopolitical uncertainty. At the same time, high interest rates in the US impacted gold demand, and prices surged.

1990 – Gulf War

Iraq’s invasion of Kuwait created instability in the Middle East. This instability resulted in a peak in oil prices and boosted gold demand due to rising geopolitical risks.

1997-1998 – Asian Financial Crisis

The Asian financial crisis started with the collapse of the Thai baht. This crisis destabilized Southeast Asian economies, increasing gold’s appeal as a safe-haven asset.

2001 – 9/11 Terrorist Attacks

The September 11 attacks led to a surge in safe-haven demand for gold as global markets reacted to heightened uncertainty. Gold prices bottomed and started to surge.

2003 – Iraq War

The US invasion of Iraq fuelled concerns over Middle Eastern stability, adding to gold’s safe-haven appeal during heightened geopolitical tensions.

2008 – Global Financial Crisis

Triggered by the collapse of Lehman Brothers, this period saw massive economic fallout, and gold surged as investors sought stability amid market turmoil.

2010 – European Debt Crisis

Sovereign debt concerns in Greece, Spain, and other Eurozone countries led to a spike in gold demand as a hedge against currency instability.

2016 – Brexit Vote

The UK’s decision to leave the European Union introduced economic uncertainty, driving demand for gold as a safe haven amid fears of financial instability.

2018-2019 – US-China Trade War

The increased tariffs and trade tensions created volatility in global markets, and gold prices rose as investors turned to safe-haven assets.

2020 – COVID-19 Pandemic

The pandemic led to global economic shutdowns, extensive fiscal stimulus, and market volatility, which propelled gold demand.

2022 – Russia-Ukraine Conflict

Russia’s invasion of Ukraine destabilized markets, triggering a rush to gold due to concerns over global stability and economic sanctions on Russia.

Gold Trends Under Different Presidencies and 2024 US Election Outlook

Harris and Trump present competing visions that could drive distinct economic and geopolitical scenarios. Harris emphasized economic support for first-time homebuyers, families, small businesses, investments in renewable energy and continued backing of domestic oil production. Her commitment to supporting US allies in the context of the Russia-Ukraine conflict adds another layer of potential geopolitical impact. On the other hand, Trump focuses on policing, immigration, and boosting tariffs on Chinese goods, along with pledging to end the Russia-Ukraine war through diplomatic measures. The platforms of both candidates are starkly different. Key areas of focus include trade relations, energy investments, and the strength of the US dollar.

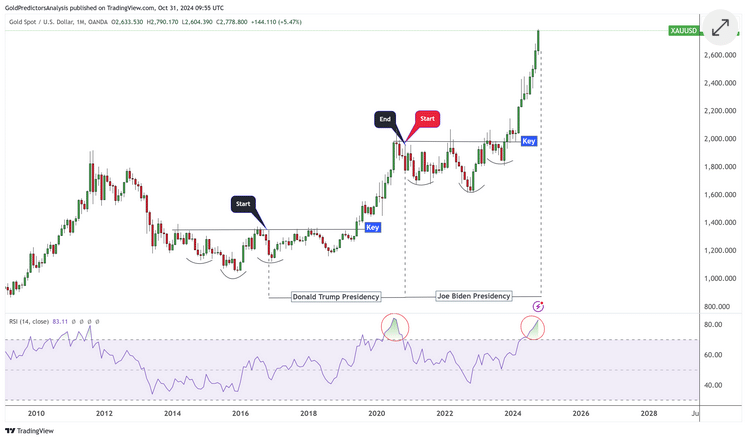

The chart below shows the gold price patterns during Donald Trump’s and Joe Biden’s presidencies. Donald Trump’s announcement as president drove the gold price sharply upward, breaking above the key level of $1,350. An inverted head-and-shoulders pattern determined this level, completed after his announcement. The gold value reached a record level of $2,075 just before the 2020 election.

On the other hand, the gold price consolidated below the key level of $2,075 during Joe Biden’s presidency. The price broke above $2,075 and initiated the next surge higher during the last year of Biden’s term. The market is now approaching the same overbought region observed just before the previous presidential election, as indicated by the RSI on the monthly chart.

Major Drivers of Gold Prices During Donald Trump’s Presidency

During Donald Trump’s presidency (2017-2021), gold prices experienced significant volatility and sharp increases due to geopolitical and economic events. Uncertainty arose from his administration’s aggressive stance on international trade, particularly the U.S.-China trade war. Tariffs on Chinese goods and countermeasures sparked fears of a global economic slowdown. Investors turned to gold as a safe haven against potential inflation and currency devaluation. Trump’s “America First” policy raised geopolitical isolation concerns, further driving gold demand. His economic policies, including tax cuts and extensive government spending, fueled worries about a growing federal deficit and long-term inflation. The Federal Reserve responded with rate cuts to stabilize markets. The COVID-19 pandemic in 2020 intensified these trends, as large stimulus packages increased inflation fears and pushed gold prices higher as a store of value.

Major Drivers of Gold Prices During Joe Biden’s Presidency

Economic policies and global geopolitical factors influenced gold prices during Biden’s presidency. The administration implemented the large-scale fiscal stimulus of the $1.9 trillion American Rescue Plan to aid economic recovery from COVID-19. This increased money supply and inflation fears prompted investors to turn to gold as a hedge against currency devaluation. The Federal Reserve kept interest rates low during the early presidency years, making gold more attractive. The Russia-Ukraine conflict boosted demand for gold as a safe haven. Moreover, U.S.-China relations and debt ceiling debates added further uncertainty. The inflation reached multi-decade highs in 2022, sustaining gold’s appeal even as the Fed raised interest rates to control inflation.

Gold Market Levels Tied to Trump and Harris Policies

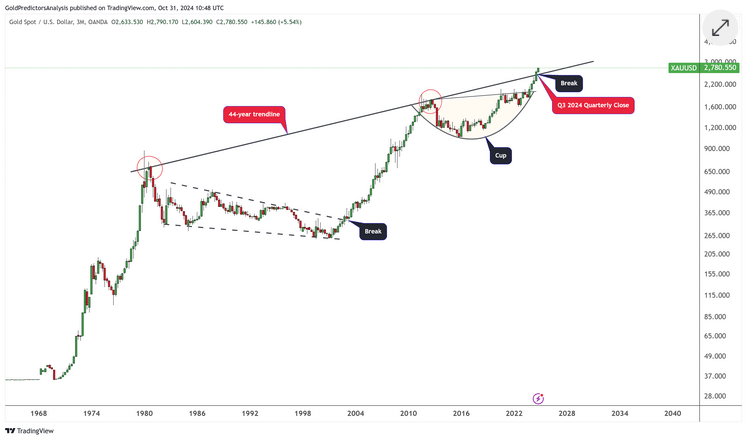

As the US election approaches, the gold price surges above a 44-year trendline on the quarterly log chart. The price closed Q3 2024 above this trendline, indicating a significant breakout. This breakout followed strong bullish patterns, including the cup formation, which was broken at the key level of $2,075.

Continuing the bullish trend after the strong quarterly close suggests that 2024 could be a strong year during the last months. Moreover, Q3 2024 was the biggest quarter in gold’s history regarding price gains in US dollars per ounce. The price may experience significant volatility as the election results approach, potentially pushing it back below this trendline or causing it to surge higher, depending on the election outcome.

The price has hit strong resistance on the weekly chart, defined by the trendline of the ascending channel pattern. Moreover, the RSI is extremely overbought, signalling a potential correction. The black dotted trendline runs parallel to the ascending channel, indicating the extension of this resistance on the weekly chart. The price range of $2,800 to $3,000 highlights the strong resistance on the weekly chart.

How Trump and Harris Policies Influence Gold Prices?

If Kamala Harris wins the election, gold prices may experience a decline in the weeks following the outcome. This decline can be validated by the strong long-term resistance observed on the weekly chart, including the market overbought conditions. Her presidency is anticipated to be less inflationary than Trump’s, reducing the urgency of investors using gold as an inflation hedge. Harris’s administration would also likely uphold economic stability similar to that of the Biden administration, which could reduce gold’s appeal as a safe-haven asset. Nevertheless, should gold prices dip initially, they are projected to rise again in 2025 if US interest-rate cuts continue, enhancing gold’s long-term attractiveness. Furthermore, strong resistance on the weekly chart suggests that gold may encounter resistance around the $2,800-$3,000 levels, potentially triggering a significant correction.

On the other hand, if Donald Trump wins the election, gold prices are expected to climb due to increased inflationary pressures and heightened uncertainty. In this case, the price can break the resistance and continue to rise in a parabolic fashion. Trump’s policies, such as higher tariffs and a more aggressive stance on trade, could lead to greater market unpredictability and inflation. These dynamics boost gold’s appeal as a safe haven. His economic plan includes removing subsidies for electric vehicles and altering vehicle emission standards, which could raise oil demand and fuel inflation. These factors and the geopolitical risks tied to Trump’s unpredictable foreign policy would make gold an attractive investment as a safe-haven asset and a hedge against rising prices.

Final Words

In conclusion, the US presidential election between Kamala Harris and Donald Trump introduces significant potential for shifts in the gold market. Each candidate’s policies are likely to drive unique economic and geopolitical scenarios. Harris’s presidency could initially lead to decreased gold prices due to expectations of reduced inflationary pressure and a more stable economic outlook. However, long-term price increases may follow if interest rates are cut.

On the other hand, a Trump presidency is expected to increase inflation and geopolitical uncertainty, making gold a more attractive safe-haven investment. Investors must consider these dynamics and prepare for heightened volatility, as the election outcome will shape gold’s trajectory in conjunction with other economic indicators and Federal Reserve actions.

From a technical perspective, the gold market is at the intersection of strong, key long-term resistance, where a Trump presidency could push prices higher in a parabolic fashion. However, the price may experience a significant correction before the next upward move. Moreover, geopolitical uncertainties from the Middle East keep gold elevated, serving as a primary driver for recent rallies. The strong resistance in the gold market is $2800 to $3,000, and the next move will depend on the election outcome.

Read the full article HERE.