Adam Hamilton, the founder of Zeal Intelligence, a financial consulting company, predicts that gold prices will rise as American investors turn to gold, fleeing from traditional stocks and the burst of the artificial intelligence (AI) bubble. Hamilton explained that gold experienced this price upswing without this main demand factor, stressing that it was a very bullish circumstance.

Gold might still have the strength to keep climbing in the current geopolitical and economic situation. According to Adam Hamilton, the founder of Zeal Intelligence, gold prices are poised to keep climbing as Americans dive into precious metals as the stock market and artificial intelligence (AI) bubbles burst.

In an article published on Mining.com, Hamilton states that gold prices reached this level, rising 38.7% in less than 11 months, registering several all-time highs without the usual suspects behind this surge during this period.

He pointed out that this gold bull market has been powered mainly by Chinese investors and central banks, with the participation of gold futures speculators. He explained that demand is unlikely to slow in the short term as stock markets rout while yuan gold keeps surging.

Gold’s popularity is also related to the pessimistic forecasts for the U.S. dollar. Hamilton declared:

With out-of-control US-government spending still ramping the mind-boggling US debt while Treasury interest expenses soar, the US dollar’s fundamental outlook is dismally-bearish. Nothing beats gold for weathering globally-rampant fiat-currency inflation and debasement.

This, and the comeback of the demand from American investors, can potentially take gold to over $2,950 if $100 billion – what Hamilton calls “pocket change” – from the stock market drips to gold alternatives. However, Hamilton states that the bull market gains will be even higher as stock investors will need “many months if not years” to reestablish even trivial 1% gold allocations.

Other analysts and banks have also predicted increases in gold prices. Goldman Sachs analysts recently stated that they had the highest conviction that gold would reach $2,700 per ounce as soon as next year.

Read the full story HERE.

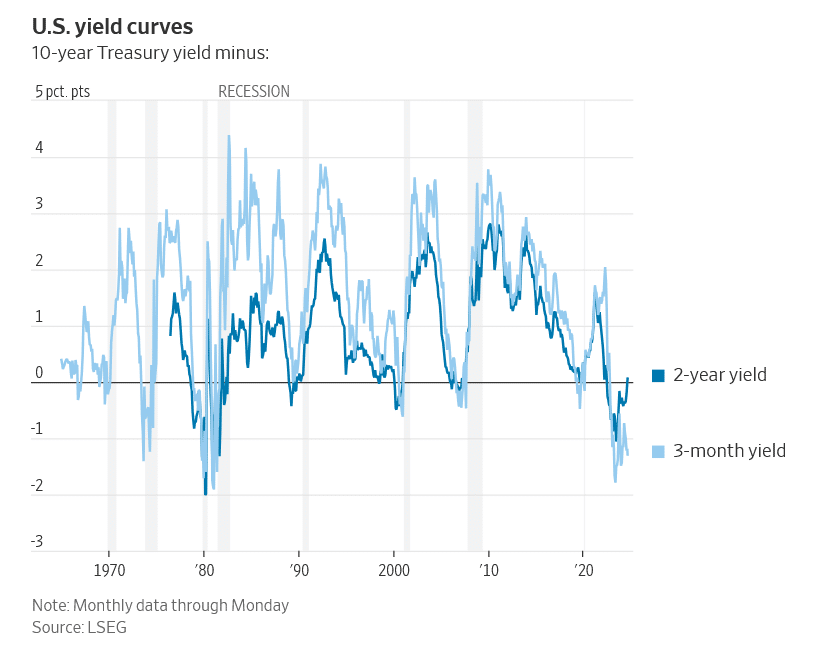

When the yield curve turns positive, the country is usually about to plunge into recession. Hope this time relies on a few historical exceptions.

Two years ago, the inversion of the yield curve—shorter-dated Treasurys yielding more than longer-dated bonds—was taken by investors as a surefire sign of recession. Now Wall Street worriers have a new concern: The yield curve is back to normal, a surefire sign of recession.

It might seem odd, but both yield-curve moves are indeed good signs of recession, though not foolproof ones. What really matters is why Treasurys move as they do, and in this case it comes down to the Federal Reserve.

The Fed is expected to embark on a series of interest-rate cuts starting next week, which is why short-dated bond yields have fallen fast, uninverting the yield curve when measured as the 10-year minus two-year yield. If those cuts are purely because inflation has dropped back close to target, that is the ideal of a soft landing for the economy, and absolutely not a sign of imminent recession.

But for most of modern history, deep rate cuts by the Fed have been a sign that the country is about to plunge into recession, or is already in one that economists missed.

The yield curve is rather a crude representation of this problem. The inversion of the past two years tells us that investors thought the Fed had rates temporarily high and they would be lower in the long run. It doesn’t tell us why.

Look at recent market action and you see investors are vacillating between the reasons for rate cuts. Some days they think a weaker economy, particularly a weaker jobs market, will push the Fed to try to boost growth with rate cuts. That is bad news for stocks, because weaker growth might turn into a recession.

Other days, they think growth is fine but lower inflation will allow the Fed to cut rates anyway. That is good for stocks, because it means cheaper financing combined with decent after-inflation profits.

History tells us that in the past when the Fed raised rates a lot, it almost always caused a recession. History also tells us that when the Fed embarked on a big series of rate cuts, it was almost always because of a recession.

The combination gives us the oddity that inverted yields curves appear to predict recession, since they typically result from the Fed raising rates a lot, and uninverting yield curves appear to predict recession since they typically result from the Fed cutting rates a lot. At the moment, futures traders are pricing in 2.5 percentage points or more of rate cuts by the end of next year, which is a lot to cut without a recession.

Hope this time rests on the historical exceptions. There were soft landings in the mid-1960s, mid-1980s and mid-1990s despite big rate rises. In the mid-1960s and very briefly in the mid-1990s, at least some measures of the yield curve inverted, although nowhere near as long or as deeply as in the past couple of years. In the mid-1980s, there was a soft landing without an inverted yield curve after big rate rises turned into rate cuts as large as the markets are predicting by the end of next year.

There is also the question of which yield curve to choose. Economists prefer to compare the 10-year yield with the three-month yield, which captures only impending rate cuts and has a better track record than the two-year used by many investors. The 10-year minus three-month curve is still a long way from uninverting, confusing the picture still further.

None of the historical examples involved both an inverted curve and such rapid predicted cuts. This is where the market might have things wrong. There are good reasons to think investors might be overdoing it in pricing in such deep cuts combined with a soft landing, given the upward pressures on long-term rates from huge and apparently permanent fiscal deficits, increased protectionism and the need for higher defense and energy spending globally.

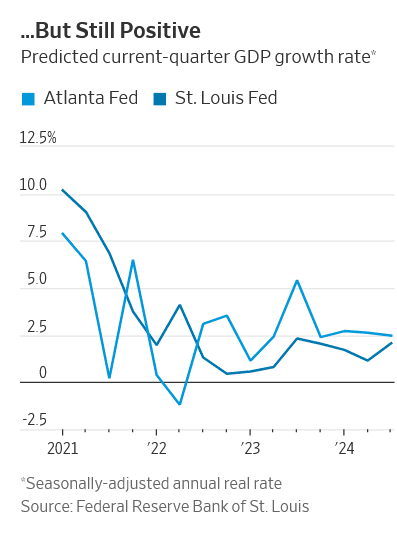

Yet, if inflation stabilizes close to the Fed’s 2% target, interest rates of 3% are perfectly conceivable for a while. Which takes us back to the deep problem that investors have to wrestle with. Is the slowdown in the economy the start of a slide into recession or a return to normal after the bust-boom cycle of the pandemic?

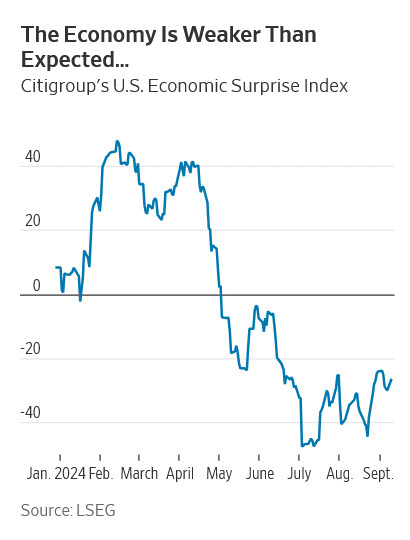

The economic data have undoubtedly been disappointing, but on the plus side they don’t suggest the economy is in trouble at the moment.

Unfortunately, if a recession is on the way, even quite aggressive rate cuts might not stop it. True, higher rates have held back some corporate investment, hit poorer and younger borrowers and made it more difficult for indebted businesses when fixed-rate debt matures.

But the economy as a whole is much less sensitive to rates than it used to be because so much debt is fixed at low rates for long periods, both for mortgages and big companies. Companies have been pouring money into building new factories despite the Fed thanks to government subsidies. And rate cuts take time to affect the economy anyway.

Investors should be careful about taking too much from the yield curve. Right now it tells us what we already know—that the Fed is about to cut rates—without telling us what we really want to know: whether a recession is imminent.

Read the Full Article HERE.

The selloff caused by a levy on unrealized capital gains would devastate ordinary investors and 401(k)s.

Kamala Harris has doubled down on her support for a radical new tax on the unrealized capital gains of the ultrarich. She calls it the “billionaire minimum tax,” but it would be better to call it the “capital markets death tax.” It would crush the U.S. stock market, grind initial-public offerings to a halt, and hit you in the 401(k).Federal capital-gains taxes have historically applied only when an asset is sold and income from the sale is realized. In recent years the left has been looking for a way to increase levies on the wealthiest Americans by taxing the appreciation of their assets, even if their assets aren’t sold and income isn’t realized. Sen. Ron Wyden (D., Ore.) proposed such a tax in 2021. President Biden offered his support in his 2024 State of the Union address and 2025 budget, which Ms. Harris has now endorsed.

The Biden-Harris wealth tax would apply a minimum annual 25% tax on the income and unrealized capital gains of Americans worth more than $100 million. Mr. Biden’s 2025 budget estimates without justification that this tax would generate $500 billion in new tax revenue over the next 10 years. He proposes using that windfall to expand social programs for U.S. households in need.

Yet the Biden-Harris wealth tax would send public markets into a tailspin and hurt all investors, not only the wealthiest. Billionaires alone own more than $5 trillion in stock, or 7% of the entire stock market. Public stock represents 66% of their wealth, so they would need to sell hundreds of billions of dollars worth of stock to fund their wealth-tax payments. These sales would drive down stock prices and, therefore, returns for all investors. The largest, most innovative and fastest-growing U.S. tech companies would be hit the hardest. Unrealized capital gains are concentrated in these companies.

This wouldn’t be a one-time problem. Stock sales would need to continue each year to pay the annual wealth tax. This would be a long-term drag on the returns of all investors, while also reducing the skin in the game of the innovative founders who built these companies. The wealthiest Americans would be entitled to tax refunds in future years if the value of their remaining stock holdings goes down, but that wouldn’t diminish the effect of the tax on capital markets.

U.S. taxpayers with assets of more than $100 million hold approximately $4 trillion in unrealized capital gains in the shares of private companies. Selling these investments to cover a tax bill is even more difficult than selling stock in public companies. Private companies generally don’t have active trading markets, so finding a buyer can be difficult and the cost of selling high. These sales can also disrupt the growth of private companies, which are often managed by their owners.

The Biden-Harris tax therefore includes an exemption from the proposed wealth tax for ultrarich investors who have 80% of their wealth in nontradable illiquid assets, such as investments in private companies. This would create a major incentive for the wealthiest Americans either to delist the public companies that they control or to keep their private companies from going public in the first place. If the ultrarich respond this way, it would reduce projected tax revenue and hurt all investors by shrinking the size of public markets.

Public markets are already small and getting smaller. In 1996 there were more than 8,000 public companies in the U.S. Today there are fewer than 5,000. Private markets are increasingly able to support the capital needs of large companies. There are now more than 700 private companies worth more than $1 billion and more than 40 private companies worth more than $10 billion. The most innovative and fastest-growing U.S. companies are private. Some are worth more than $100 billion, including OpenAI and SpaceX. Will Sam Altman and Elon Musk take these companies public if doing so comes with a multibillion-dollar tax bill?

Billionaire founders also have voting control over many large public companies through dual-class share structures and can therefore potentially force a delisting of their public companies to save billions in taxes. Perhaps the trillion-dollar megacap technology stocks are too large to take private, but investors in these companies will suffer too as their billionaire founders shift their attention to private companies where they can better reap the returns of their innovations.

The shrinkage of public markets is a big deal for anyone with a 401(k), as 90% of U.S. investors don’t meet the minimum wealth and income requirements to invest in private markets. If Ms. Harris has her way, it could do irreparable harm to Americans’ ability to pay for their retirements. The left’s desire to punish the ultrarich for their success will end up hurting the rest of us.

See full story HERE.

Gold prices held firm above the $2,500 level on Tuesday as market participants positioned themselves ahead of U.S. inflation data for further clues on the depth of interest rate cuts by the Federal Reserve next week.

Spot gold rose 0.3% to $2,513.07 per ounce by 9:10 a.m. ET (1310 GMT). U.S. gold futures were up 0.4% at $2,542.10.

“Gold prices are trading in an extremely tight range, waiting for the next catalyst, which are likely to be both the U.S. presidential debate tonight, followed shortly by inflation data tomorrow,” said Daniel Ghali, commodity strategist at TD Securities.

The investors will closely scan through U.S. Consumer Price Index data on Wednesday and the Producer Price Index reading on Thursday.

The CPI for August is expected to have risen by 0.2% month-over-month, unchanged from the previous month, according to a Reuters poll.

“Spot gold remains supported above the psychological $2,500 level, and any post-CPI forays below that big, round number should see bulls buying the dip once more, as they have consistently done since mid-August,” said Han Tan, chief market analyst at Exinity Group.

So far this year, gold has gained over 21%, hitting an all-time high of $2,531.60 on Aug. 20.

Lower interest rates reduce the opportunity cost of holding zero-yield bullion.

Markets are currently pricing in a 73% chance of a 25 basis point U.S. rate cut at the Fed’s Sept. 17-18 meeting, and a 27% chance of a 50 bps cut, the CME FedWatch tool showed.

Spot silver rose 0.3% to $28.43 per ounce.

Platinum gained 0.9% to $946.75 and palladium was up by 1.2% to $957.58.

The World Platinum Investment Council said the global platinum deficit in 2024 will be twice as high as previously expected due to inflows to exchange traded funds and purchases of large bars in China.

“We remain convinced that the platinum price has considerable upside potential,” Commerzbank said in a note.

See the full story HERE.

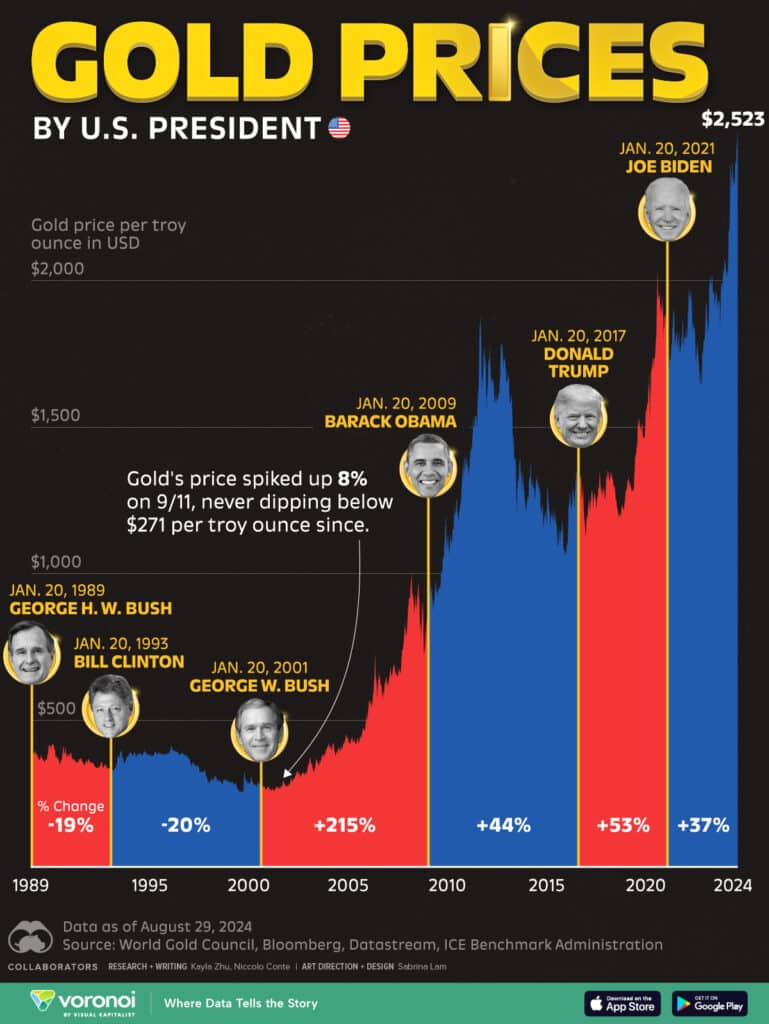

See the price performance of gold by president over the last 35 years — since George H.W. Bush.

See full page HERE

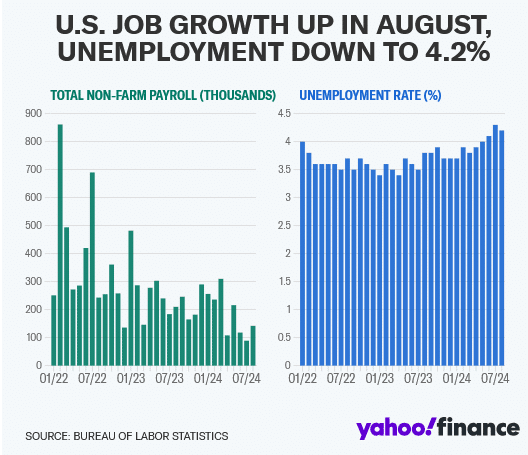

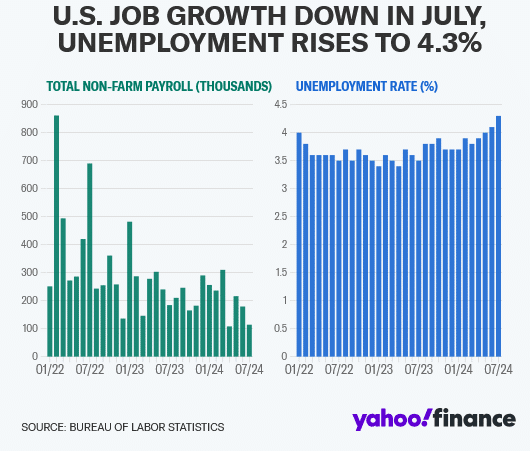

The US economy added fewer jobs than expected in August while the unemployment rate ticked lower.

Data from the Bureau of Labor Statistics released Friday showed the labor market added 142,000 nonfarm payroll jobs in August, fewer additions than the 165,000 expected by economists.

Meanwhile, the unemployment rate fell to 4.2%, from 4.3% in July. August job additions came in higher than the revised 89,000 added in July. Overall, revisions to the June and July labor reports showed the US economy added 86,000 fewer jobs than initially reported in those months.

Wage growth, an important measure for gauging inflation pressures, rose to 3.8% year-over-year, up from a 3.6% annual gain in July. On a monthly basis, wages increased 0.4%, higher than the 0.2% seen the month prior.

Capital Economics chief North America economist wrote in a note to clients that the August jobs report is “still consistent with an economy experiencing a soft landing rather than plummeting into recession.”

Friday’s report comes amid an ongoing debate over how severely the Fed should cut interest rates at its meeting later this month. During a late August speech, Federal Reserve Chair Jerome Powell said the cooling in the labor market has been “unmistakeable” and added that the central bank does not “seek or welcome further cooling in labor market conditions.”

Data released earlier this week indicated further signs of slowing in the job market. ADP’s National Employment Report for August showed private payrolls in the US added 99,000 jobs during the month, well below economists’ estimates for 145,000 and fewer than the 122,000 jobs added in July. The August data marked the fifth straight month payroll additions had slowed from the month prior. Meanwhile, data out Wednesday showed July ended with the lowest amount of job openings in the US labor market since January 2021.

Still, some economists argue that signs of strength within Friday’s jobs report are enough to prompt the Fed to cut interest rates by 25 basis points at its upcoming September meeting rather than making a larger 50 basis point cut.

“The overall solid gain in August payrolls, the retreat in the unemployment rate, and pop in average hourly earnings are not likely enough for Fed officials to start the rate cutting cycle with 50bps reduction on September 18,” Nationwide chief economist Kathy Bostjancic wrote in a note to clients on Friday.

But Bostjancic added that the downward revisions to payroll additions in prior months, as well as current job gains coming from a narrow group of sectors, “underscore that the labor market is losing steam rather quickly.” This, Boistjancic argues, could open the door for the Fed to cut rates by 50 basis points at one of its meetings this year.

The market agrees, with traders pricing in more than 100 basis points of cuts from the Fed this year, per Bloomberg data. As of Friday morning, markets were pricing in a 45% chance the Fed cuts rates by 50 basis points by the end of its September meeting, up from a 30% chance seen a week prior per the CME FedWatch Tool.

Gold (XAU/USD) and silver (XAG/USD) prices remained resilient on Thursday, with gold holding near $2,506 and silver trading around $28.31. Weaker-than-expected U.S. economic data boosted safe-haven demand for precious metals, as investors reconsidered the likelihood of an imminent Federal Reserve rate cut.

Gold’s Upward Momentum

Gold’s rally is driven by weak U.S. labor data and increasing expectations of a Federal Reserve rate cut. Job openings dropped to 7.673 million in July, the lowest since January 2021, with June’s figures also revised downward. Additionally, the Fed’s Beige Book highlighted reduced economic activity across multiple regions, amplifying speculation of a 50 basis-point rate cut in September.

In a recent tweet, the Minneapolis Fed noted:

“In our latest #BeigeBook recap video, @ErickGarciaLuna and @RonWirtz report where the Ninth District economy is slowing down, and also where we are seeing some brighter spots.” Watch the full report.

Lower interest rates generally enhance gold’s appeal by reducing the opportunity cost of holding non-yielding assets, further supporting the precious metal’s bullish trend.

.Geopolitical Tensions Boost Safe-Haven Demand

The escalating Israeli-Palestinian conflict is adding to gold’s appeal as a safe-haven asset. Recent violence in Gaza has fueled global uncertainty, pushing investors toward gold as a stable store of value during times of crisis.

Silver Faces Pressure Amid China’s Economic Slowdown

Unlike gold, silver faces downward pressure due to China’s economic challenges. Bank of America Global Research recently lowered China’s 2024 GDP growth forecast from 5.0% to 4.8%, signaling reduced industrial demand for silver. As one of the world’s largest silver exporters, China’s slowdown has contributed to silver’s drop to $28.27, with an intra-day low of $28.21.

However, not everyone is convinced by these marginal GDP adjustments. Nassim Nicholas Taleb tweeted:

“Some idiot in an investment bank lowered China’s forecast GDP from 5% to… 4.8%. Noise is +-2% for GDP growth in China, including accounting tricks.”

Taleb highlights the statistical insignificance of such minor revisions, suggesting that a 0.2% change may be less impactful than market reactions indicate. Nonetheless, China’s broader economic struggles still weigh on silver’s outlook, especially with reduced industrial demand potentially affecting global silver prices.

Key Data Impacting Precious Metals

- ADP Non-Farm Employment Change: The report showed only 99,000 jobs added in August, well below the forecast of 144,000, reflecting a significant slowdown in the private sector labor market.

- Unemployment Claims: The number of claims slightly dropped to 227,000, from the expected 231,000, indicating a marginally stable labor market, but not enough to ease economic concerns.

- Final Services PMI: The PMI came in stronger at 55.7, exceeding the forecast of 55.0, signaling growth in the services sector. However, this was offset by weaker labor data.

- ISM Services PMI: The ISM Services PMI posted 51.5, above expectations of 51.3, showing mild expansion but confirming a cooling trend.

Market Implications and Fed Outlook

Weaker-than-expected labor figures, particularly the ADP miss, have raised expectations of a dovish Fed stance at its next meeting. While the services sector remains strong, weaker employment data may push the Fed toward a rate cut, supporting higher gold and silver prices.

What’s Next: Nonfarm Payrolls In Highlights

Friday will see several critical U.S. economic reports that could impact gold and silver prices:

- Average Hourly Earnings (m/m): Expected to rise by 0.3%, up from the previous 0.2%. Strong wage growth could hint at inflation, potentially influencing Federal Reserve rate decisions.

- Non-Farm Employment Change: Forecasted at 164,000 new jobs, up from 114,000. A stronger-than-expected result could strengthen the dollar, applying pressure on gold and silver prices.

- Unemployment Rate: Expected to increase slightly to 4.3%, from 4.2%. A higher unemployment rate may raise concerns about U.S. economic growth, favoring safe-haven assets like gold.

Additionally, remarks from FOMC Members Williams and Waller could offer further clues on the Fed’s rate outlook. These events will provide key insights into the U.S. labor market and could guide future moves in precious metals prices.

Conclusion

Weaker labor data has reinforced demand for gold and silver as safe-haven assets. While the services sector shows resilience, softer employment numbers are increasing the likelihood of Fed easing, which could support higher prices for gold and silver in the near term. Traders should closely watch Friday’s NFP report, which could significantly impact market sentiment.

READ THE FULL ARTICLE HERE.

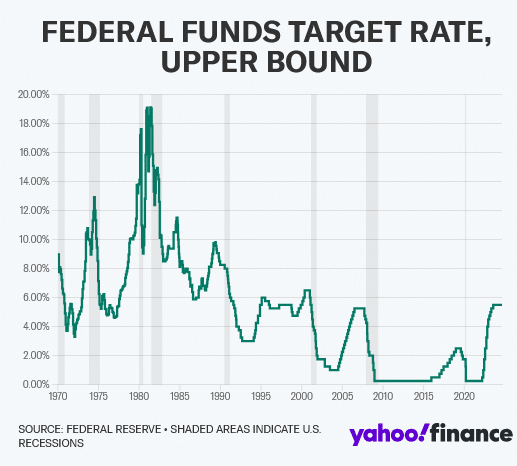

The Federal Reserve is nearing the end of an era as the central bank looks to cut interest rates for the first time in four years.

If the Fed eases monetary policy at its next meeting on Sept. 18 as expected, it will officially mark the termination of the most aggressive inflation-fighting campaign since the 1980s. Its benchmark rate is currently at 5.25% to 5.5%, a 23-year high.

The central bank’s new era of easy money is expected to last through 2025 and 2026. That shift will ripple through the US economy by making it cheaper for Americans to borrow what they need to buy houses and cars or credit card purchases.

Businesses will also have an easier time taking out loans to fund their operations. “We’re starting this rate cut cycle, it looks like, in September at a place that fed funds hasn’t been in more than 20 years,” WisdomTree head of fixed income strategy Kevin Flanagan told Yahoo Finance.

“You have a whole generation of investors who have never experienced rate cuts at these levels of interest rates.” For Fed Chair Jerome Powell, this inflection point may allow him to claim an accomplishment that eluded many of his predecessors, including his inflation-fighting idol Paul Volcker.

Powell has said how much he admires Volcker, who hiked interest rates to an eye-popping 22% in the 1980s in an effort to get inflation under control. But Volcker wasn’t able to avoid a recession as his high rates took a toll on millions of Americans and businesses.

Powell had his own Volcker moment in 2022 when he promised “pain” as the Fed took its own rate-hiking campaign into overdrive. He then experienced a banking crisis in the spring of 2023 that tested the central bank as it worked to ease panic among bank depositors across the US.

But the goal that is now within his reach is the ever-so-rare “soft landing,” in which inflation falls back to the Fed’s 2% target without forcing the US economy into a painful downturn.

Esther George, former Kansas City Fed president, said the Fed will not have finished its job until it secures its 2% inflation target.

“They may be on the golden path, but for me, [it’s] too soon to say we know the path we’re on,” George said. “The Fed’s credibility of achieving 2% is coming into better focus, but we’re not there yet.”

There is still the danger that a cooling labor market could worsen, which has the potential to drag down the US economy and force the Fed to lower rates more aggressively.

That’s the debate that will likely define the coming days as the Fed prepares for its next meeting.

Powell made clear in his last speech that the central bank is poised to begin its rate-cutting cycle, saying in Jackson Hole, Wyo., that “the time has come for policy to adjust.”

But he was silent on how big the first cut could be and whether it would definitely happen at the September meeting.

Atlanta Fed president Raphael Bostic told Yahoo Finance that September or November is “definitely in play” and that an initial 25 basis point reduction “could be the most appropriate way forward.”

Philadelphia Fed president Patrick Harker told Yahoo Finance in another interview that he expects the central bank to start with a 25 basis point cut, but he would be open to a larger cut if the labor market deteriorates suddenly.

For now, traders are betting on a small cut to start. The odds of a 25 basis point reduction in September are now at roughly 65%.

Playing catch up

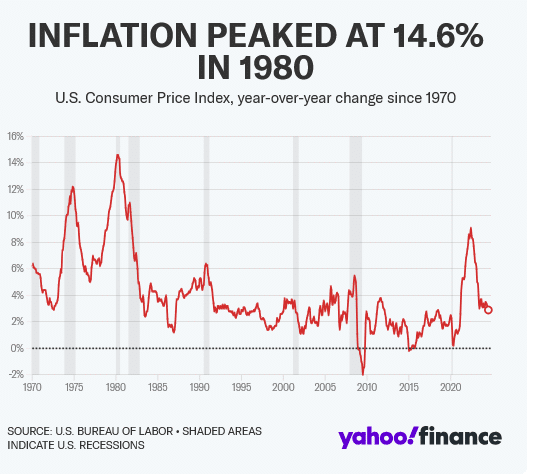

The Fed’s multiyear fight against inflation began with what many consider a misstep and included plenty of ups and downs along the way.

The misstep was believing that inflation would be “transitory.” That was the belief for much of 2021 as Fed policymakers watched prices move higher due to pandemic dislocations and supply chain disruptions caused by the COVID-19 health crisis.

But when price increases spread to a broader range of goods and services, it was clear that inflation was proving to be more persistent than previously thought — especially as oil prices spiked following the start of Russia’s war in Ukraine.

In March 2022 the annual change in inflation as measured by the Consumer Price Index hit 8.5%, the highest mark in 40 years. Even excluding food and energy, the rise was still 6.5%, unacceptably high when compared with the Fed’s 2% target.

That month, the Fed decided at its policy meeting to raise rates for the first time since 2018, starting with a small quarter-percentage-point cut.

“As I looked around the table at today’s meeting, I saw a committee that’s acutely aware of the need to return the economy to price stability and determined to use our tools to do exactly that,” Powell told reporters after that meeting.

But inflation kept heating up. The annual rise in CPI accelerated to 8.6% in May and 9.1% in June.

The Fed then switched into catch-up mode, pulling the trigger on a 0.75% rate hike, the largest in more than a quarter century. It would be the first of four 0.75% hikes in a row.

As Powell became more aggressive, he sent the markets plunging with an August 2022 speech in which he warned that the Fed’s “overarching focus right now is to bring inflation back down to our 2% goal” and that this will cause “some pain to households and businesses.”

“Failure to restore price stability would mean far greater pain,” he added.

The Fed went back to quarter-point hikes in early 2023, defying some predictions that a regional banking crisis roiling the financial world at that time might stop the Fed from tightening further.

The last hike came in July 2023, settling the fed funds rate at a 22-year high of 5.25% to 5.5%. It has been at that level ever since.

‘Things look pretty good’

Investors began 2024 thinking the Fed’s inflation-fighting campaign was done and hoping for six cuts over the course of the year.

That immediately led to tension between the Fed and Wall Street. Fed officials repeatedly pushed back on those expectations, saying they needed to see more progress on inflation before they would be ready to stop raising rates.

Their caution appeared to be warranted when inflation heated back up in the first quarter, causing policymakers to revise their own predictions for multiple cuts to just one for all of 2024.

But as inflation resumed its downward crawl in the second quarter and unemployment started to tick higher, some Fed critics reemerged.

They argued the central bank had held rates too high for too long and risked upending the possibility of a soft landing.

Alan Blinder, former vice chair of the Federal Reserve and professor of economics at Princeton University, is among those who argued the Fed could have started cutting rates in July.

The Fed, he told Yahoo Finance, is a “little behind the curve.”

Blinder doesn’t think the chances for a recession have increased, noting that the economic data doesn’t look much different now than it did in July. But the job market can’t cool “too much more” without a recession, he said.

“[The unemployment rate] has been going up smoothly — a tenth of a point. You don’t want to keep that up for a year. If you do that, you’re up 1.2% points,” he added in an interview.

When asked if the labor market can cool without tipping the economy into a recession, the Atlanta Fed’s Bostic said, “It can, and we will have to see whether it does.”

But a recession, he added, “is not in my outlook.”

Former Cleveland Fed president Loretta Mester said the central bank now has a “good shot” at achieving a soft landing.

The Philadelphia Fed’s Harker agreed.

“Right now things look pretty good,” he said.

“Do you like green eggs and ham?”

Some have called the iconic Dr. Seuss children’s book “Green Eggs and Ham” the world’s best sales manual — and its use of persistence, doggedness, and the assumptive close is not lost on the White House. It is about a relentless little fellow named Sam, (“Sam-I-Am”) who peddles green eggs and green ham to a main character who has no interest in consuming them. “I do not like them Sam-I-Am,” says the nameless protagonist.

Alas, Sam is insistent and hounds his beleaguered friend begging him to try the unappetizing combo in a variety of different places and scenarios … in a house, in a box, with a mouse, with a fox, with a car, in a tree, on a train, in the dark, in the rain, with a goat, and on a boat.

The shaggy, top-hatted narrator is adamant, however, “I do not like green eggs and ham. I do not like them anywhere!”

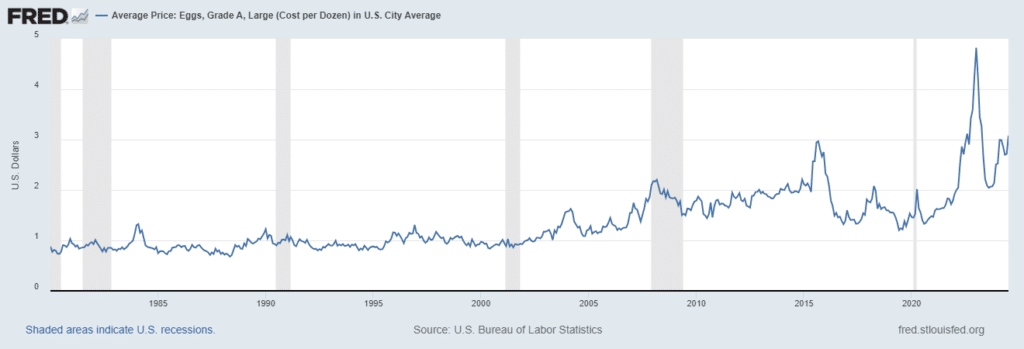

In the current economy, eggs and ham have become very green, indeed. Yahoo Finance states that “eggs represent morning, rebirth, and the continuity of life.” And their skyrocketing price is the embodiment of consumer “sacrifice” since they’re used in countless American meals, foods, and baked goods.[1]

According to data from the Federal Reserve Bank of St. Louis, egg prices were about $1.35/dozen back in August of 2020. Prices rose as high as $4.82/dozen in January of this year before dropping to $3.08/dozen in July.

While the Biden-Harris administration has been quick to tout the 36% drop in egg prices from their January highs, it fails to point out that eggs are still 128% higher than they were in 2020.

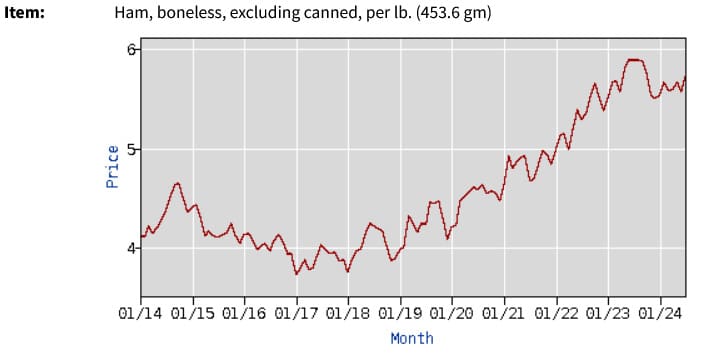

The price of ham has also risen dramatically. Historical data from the Bureau of Labor Statistics indicates that ham prices are up 9.6% just since last year.[2] Likewise, the price of pork chops and bacon are up 8.3% and 3.5%, respectively since July of 2023.

Despite the administration’s attempts to justify and qualify the high-price of eggs and ham, U.S. consumers are feeling the pain.

“For the third year in a row, the percentage of Americans naming inflation or the high cost of living as the most important financial problem facing their family has reached a new high. The 41% naming the issue this year is up slightly from 35% a year ago and 32% in 2022. Before 2022, the highest percentage mentioning inflation was 18% in 2008.”[3]

The current inflation rate is 2.9%, (which is the annual inflation rate for the 12 months ending July 2024), but prices are still more than 20% higher than before the pandemic and according to BankRate “just 6% of the nearly 400 items that the Bureau of Labor Statistics tracks are cheaper today.”[4]

“Would you like them here or there?” Much like Sam-I-am, the administration continues to serve up inflation data in different forms and different contexts to convince us that prices have come down, and we should feel good about it. “No president’s had the run we’ve had in terms of creating jobs and bringing down inflation. It was 9% percent when I came to office, 9%,” Biden recently stated.

The inflation rate when Biden was inaugurated in January of 2021 was actually 1.4%. It hit 9% in June of 2022 after Biden and Harris has been in office for more than 16 months.

The official White House website further claims:

“Bidenomics is already delivering for the American people. Our economy has added more than 13 million jobs—including nearly 800,000 manufacturing jobs—and we’ve unleashed a manufacturing and clean energy boom … America has seen the strongest growth since the pandemic of any leading economy in the world. Inflation has fallen for 11 straight months and has come down by more than half. And we have done it all while responsibly reducing the deficit.”[5]

“Would you eat them in a box? Would you eat them with a fox? On August 21, 2024 the Labor Department issued revised jobs figures for the 12 months through March of 2024 showing that the US economy added 818,000 fewer jobs than originally reported.

“The U.S. Bureau of Labor Statistics on Wednesday revised down its estimate of total employment in March 2024 by 818,000, the largest such downgrade in 15 years. That effectively means there were 818,000 fewer job gains than first believed from April 2023 through March 2024.”[6]

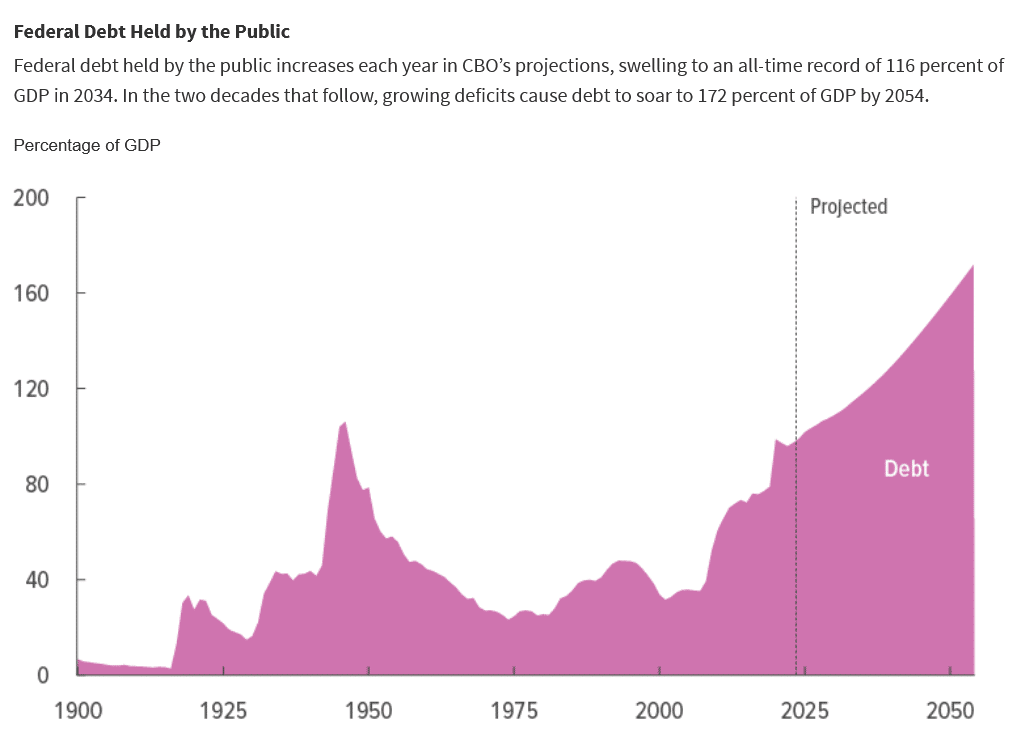

According to the Congressional Budget Office’s June report, the deficit projection for 2024 is actually 27% larger than the agency’s February projection and the cumulative deficit from 2025-2034 is projected to increase by 10% or $2.1 trillion. The largest increase was attributed to legislation providing aid to Ukraine, Israel, and other countries in the Indo-Pacific region.[7]

In order to finance deficits, the government must borrow and the projected federal debt according to the CBO explodes through 2050.

“You do not like them. So, you say. Try them! Try them! And you may. Taking a page from Sam-I-Am’s playbook, the Biden-Harris administration believes that if they say that things are getting better often enough and push high-priced “green eggs and ham” at us hard enough, we’ll eventually accept it. And as everyday Americans scrape to pay bills, the White House dismisses their misery as being misinformed and being unable to grasp the true state of the economy. According to Liz Peek of The Hill, this is downright offensive:

“Being told repeatedly that everything is great, when you can’t make ends meet, is deeply unsettling. It’s also insulting — the corollary implication is that you just don’t understand your own situation.”[8]

To justify the high price of eggs and ham, the White House is actively recalibrating price data and rewriting economic history. And their hope is, as in the case of Sam-I-Am, that U.S. consumers will finally relent, “Sam, if you will let me be, I will try them. You will see!”

But Americans give the administration low marks on the economy and continue to worry about inflation, the value of the dollar, Wall Street volatility, and their retirement accounts.

And in an environment of high prices and economic uncertainty, they’re doing something else. They’re buying gold. Gold has risen almost 30% in 2024, 10% higher than a dozen “green” eggs and more than 27% higher than a pound of “green” ham.

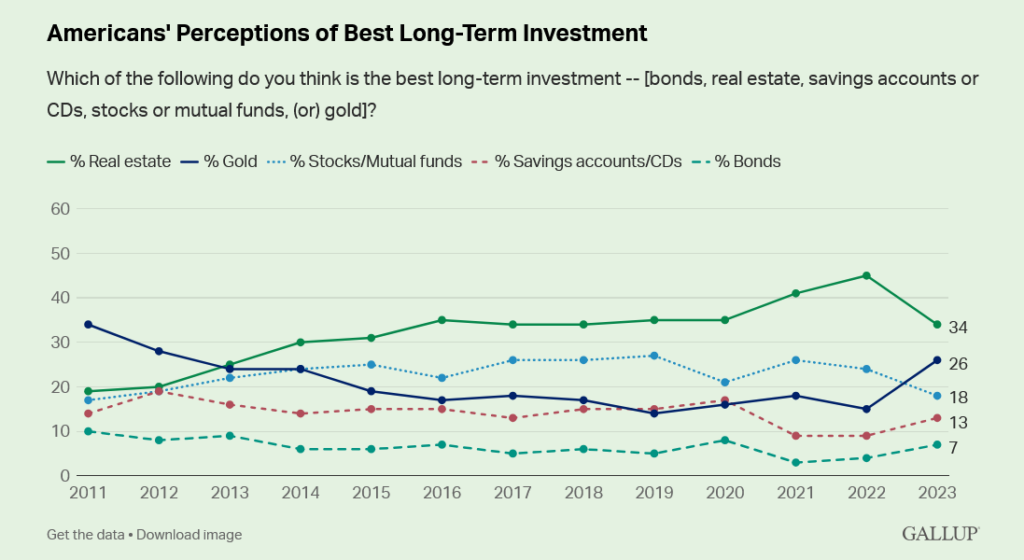

According to a recent Gallup poll, Americans now list real estate and gold as the best long-term investments, and real estate is quickly losing ground to the yellow metal.

“The 34% of Americans choosing real estate this year is down sharply from last year’s record-high 45% … before housing prices skyrocketed during the pandemic. Higher interest rates over the past year have cooled the housing market, dampening consumer exuberance about real estate as an investment. Meanwhile, the perception that gold is best has nearly doubled, rising from 15% in 2022 to 26% today.”

Despite its historically high price, the 2024 Q1 Demand Trends from The World Gold Council indicate that central banks continue to buy gold at a brisk pace. This combined with robust over-the-counter buying by investors pushed gold demand up 3% year-over-year. [9]

And as the precious metal hovers near a record $2530/oz, Bank of America strategist Michael Hartnett urges Americans to “do what central banks are doing” and buy more gold — since it is now the only asset outperforming tech shares.[10]

Gold offers portfolio diversification and protection from Wall Street’s wild price swings along with the security of a physical asset with intrinsic and universal value. And as we head into an uncertain election season, rising recession fears, and exploding geopolitical tensions across the globe — it has become the safe haven of choice for 2024.

Sam-I-am relentlessly pushed “green eggs and ham” more than a dozen times in the Dr. Seuss classic. The White House has been pushing them for three and a half years. But the 36 million Americans who own gold, don’t have to be pushed at all. They understand gold’s long history as a symbol of wealth and royalty —and its role as a monetary standard and a timeless store of value.

[1] https://finance.yahoo.com/news/egg-prices-nearly-doubled-since-171357774.html

[2] https://www.bls.gov/regions/mid-atlantic/data/averageretailfoodandenergyprices_usandmidwest_table.htm

[3] https://news.gallup.com/poll/644690/americans-continue-name-inflation-top-financial-problem.aspx

[4] https://www.bankrate.com/banking/federal-reserve/latest-inflation-statistics/

[5] https://www.whitehouse.gov/briefing-room/statements-releases/2023/06/28/bidenomics-is-working-the-presidents-plan-grows-the-economy-from-the-middle-out-and-bottom-up-not-the-top-down/

[6] https://www.usatoday.com/story/money/2024/08/21/jobs-report-revision-growth-lower/74886965007/

[7] https://www.cbo.gov/publication/60039

[8] https://thehill.com/opinion/finance/4682020-thehill-com-opinion-finance-4682020-biden-economy-inflation-jobs-cost-of-living-spin-machine/

[9] https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2024

[10] https://markets.businessinsider.com/news/commodities/gold-price-prediction-buy-record-highs-central-banks-pile-in-2024-8

Silver prices are poised for further gains in the coming months, driven by a combination of favorable macroeconomic factors and robust demand fundamentals, as per analysts at UBS in a note dated Monday.

A weaker U.S. dollar, improving sentiment across financial markets, and record-high gold prices have all contributed to a recent modest rebound in silver prices.

UBS analysts suggest that long-term investors should consider increasing their exposure to silver, with a target price range of $36-38 per ounce.

The recent weakening of the U.S. dollar and a shift towards a more risk-on environment among investors have provided a supportive backdrop for silver.

Read the full story HERE.