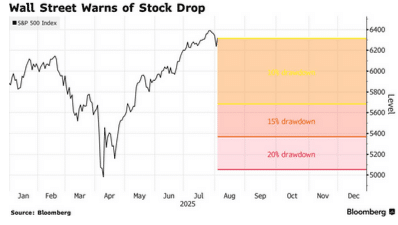

- A chorus of stock market prognosticators at some of Wall Street’s biggest firms is warning clients to prepare for a pullback as sky-high equity valuations slam into souring economic data.

- Morgan Stanley strategist Mike Wilson, Evercore’s Julian Emanuel, and a team at Deutsche Bank led by Parag Thatte all cautioned that the S&P 500 Index is due for a near-term drop in the weeks and months ahead.

- Despite the near-term concerns, the warnings come with a big bullish caveat: In the event of a dip, buy it, with strategists emphasizing that the long-term bull market in stocks is still intact.

A chorus of stock market prognosticators at some of Wall Street’s biggest firms is warning clients to prepare for a pullback as sky-high equity valuations slam into souring economic data.

On Monday, Morgan Stanley, Deutsche Bank AG and Evercore ISI all cautioned that the S&P 500 Index is due for a near-term drop in the weeks and months ahead. The predictions come after a furious rally from April’s lows that propelled the gauge to levels it has never seen before.

Morgan Stanley strategist Mike Wilson sees a correction of up to 10% this quarter as tariffs hit consumers and corporate balance sheets. Evercore’s Julian Emanuel is expecting a more substantial decline of as much as 15%. And a team at Deutsche Bank led by Parag Thatte notes that a small drawdown in equities is overdue considering they’ve been on a tear for over three months.

“Over the last couple of weeks, we have noted that investors should expect a modest pullback in the third quarter,” Wilson said in his note to clients.

The calls are coming amid mounting concerns about the US economy after data last week showed an uptick in inflation as well as weakening job growth and consumer spending. In addition, stocks are entering what’s usually their weakest time of the year. Over the past three decades, the S&P 500 has performed the worst in August and September, losing 0.7% on average in each month, compared with a 1.1% gain on average across other months, according to data compiled by Bloomberg.

In addition, stocks have gotten expensive. The S&P 500’s 14-day relative strength index topped 76 last week — its highest point since July 2024 before US stocks briefly peaked last summer and above the 70 level that market technicians view as a sign of overheating.

Options trading is also showing the fear of a downturn, as hedging against another rout becomes more expensive. Contracts protecting against a 10% decline in the SPDR S&P 500 ETF Trust (SPY) over the next 60 days compared to the cost of contracts hedging against a similar rally is hovering around levels not seen since the regional banking crisis in May 2023.

Still, despite the near-term concerns, the warnings come with a big bullish caveat: In the event of a dip, buy it.

At Evercore, Emanuel emphasizes that the long-term bull market in stocks is still intact despite expectations for volatility, and he advises clients to stay invested, particularly in companies capitalizing on the artificial intelligence boom. Deutsche’s Thatte points out that historically the S&P 500 experiences small pullbacks of around 3% every one-and-a-half-to-two months on average, and larger ones of 5% or more every three-to-four months.

“We’re buyers of dips,” Wilson told clients.

So far, traders are heeding the advice. The S&P 500 and Nasdaq 100 Index are both up more than 1% on Monday after Friday’s selloff on optimism that the Federal Reserve will cut interest rates soon.

Read the full article HERE.

Last week’s economic data caught up with the kind of economy that company executives and consumers have long described this year: flashing some warning signs.

Employment numbers released Friday painted a much weaker picture of the labor market than previously reported. Inflation-adjusted consumer spending — which accounts for about two-thirds of US economic activity — fell in the first half of the year, while the Federal Reserve’s preferred price gauge picked up in June.

The US economy is “struggling to maintain its footing,” said Sarah House, a senior economist at Wells Fargo & Co.

“Businesses and consumers have been facing a whirlwind of economic policy changes, elevated inflation and monetary policy that remains somewhat restrictive,” she said. “The loss of momentum feared by this mix is unfortunately beginning to bear out.”

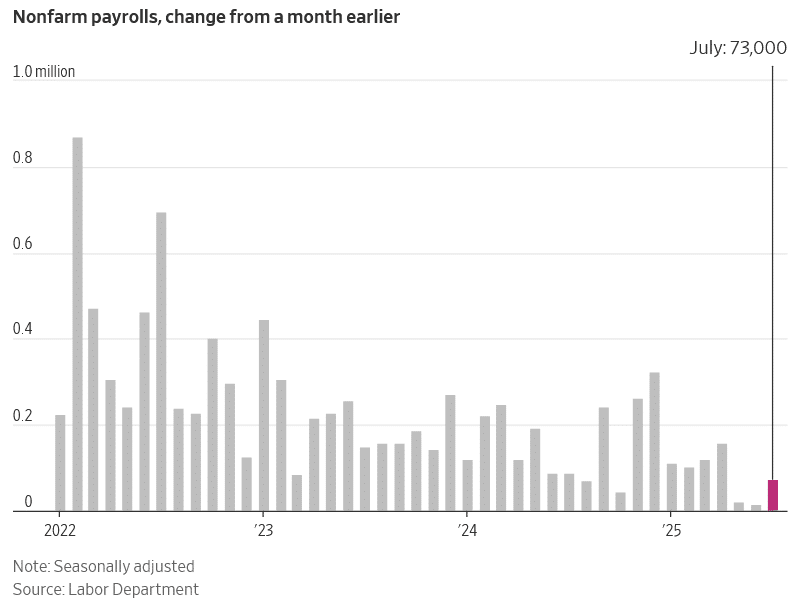

The employment data out Friday, including revisions that shaved off nearly 260,000 jobs from the May and June figures, jolted markets and upended the perception that the labor market had been solid heading into summer. Employment growth averaged just 35,000 over the past three months — the worst since the pandemic.

The Bureau of Labor Statistics report called into question the Fed’s decision to hold interest rates just a few days earlier. It also got caught in the political maelstrom after its publication, with President Donald Trump telling officials to fire the BLS commissioner — and reiterating his call on the Fed and Chair Jerome Powell to lower rates.

Then later Friday came the surprise announcement that Fed Governor Adriana Kugler will resign from her role, offering Trump a sooner-than-anticipated opportunity to install a policymaker that aligns with that vision.

Many firms have put investment and hiring on ice as they try to figure out what the impact from Trump’s economic policies — chief of them tariffs — will be. The housing market just experienced its worst spring season in 13 years. And consumers, facing mounting debt, have cut back on non-essential items.

“This struggle is likely to continue as prices rise and businesses and consumers find it more and more difficult to spend and invest,” said Gregory Daco, chief economist at EY-Parthenon.

That said, the US economy is expected to continue to plow ahead, albeit at a slower pace than in years past. Forecasters anticipate the economy to grow 1.5% this year and 1.7% in 2026, based on the latest survey conducted by Bloomberg News.

At Grata Thai Cuisine in Midtown Manhattan, owner Philip Sirikuptamas sees the slowdown first-hand. He is dealing with the double blow of higher prices and fewer consumers coming into his restaurant. The costs of imported products like coconut milk have gone up substantially, he said, while chicken prices have almost tripled. At the same time, he’s wary of raising prices and scaring away consumers.

“The customers spend less because they are struggling to make money,” said Sirikuptamas, 66. “Same as we are.”

Consumers Pull Back

Companies from Chipotle Mexican Grill Inc. to Procter & Gamble Co. have noted the economic uncertainty is weighing on demand.

“We see consumption trends consistently decelerating, not significantly, but we see a deceleration in the US,” P&G Chief Financial Officer Andre Schulten said during the company’s quarterly earnings call. “The volatility the consumer is seeing, I think is maybe not necessarily grounded in their current reality, but more on what to expect for the future.”

At the same time, June data showed a pickup in prices of goods that are often imported — like furniture and appliances — an indication that some companies are starting to pass the cost of higher duties onto consumers.

Even after the Trump administration reached trade deals with key partners, tariffs announced last week will boost the average US rate on goods from across the world. Many economists expect import levies to push up prices in the coming months.

Fed officials, who have a dual mandate of taming inflation and keeping unemployment low, now face even more pressure to lower interest rates before the economy cools too much.

Chair Powell pointed to downside risks in the labor market at his press briefing on Wednesday, while still characterizing it as “solid.” He also nodded at the slowdown in spending.

“Consumer spending had been very, very strong for the last couple of years and had — repeatedly, forecasters, not just us, had been forecasting it would slow down,” Powell said. “Now maybe it finally has.”

The housing market, constrained by high prices and elevated borrowing costs, continues to be a drag on economic growth. Combined outlays for homebuilding and nonresidential projects dropped 2.9% in June from a year ago, one of the worst annual declines since early 2019.

Massive Revisions

Revisions to government data like payrolls are routine, and they don’t usually catch much attention. But the size of Friday’s revisions, which showed 258,000 fewer jobs were added in May and June than previously thought, transformed the job market picture from solid to near-stalling.

Two-year Treasury bonds – which are tightly linked to short-term Fed rates – soared following the data, while the S&P 500 slumped.

“When corporations are nervous around the future, they tighten their belts. And the first place they tighten their belts is on hiring,” Mark Begor, chief executive officer of Equifax Inc., said on a July 22 earnings call.

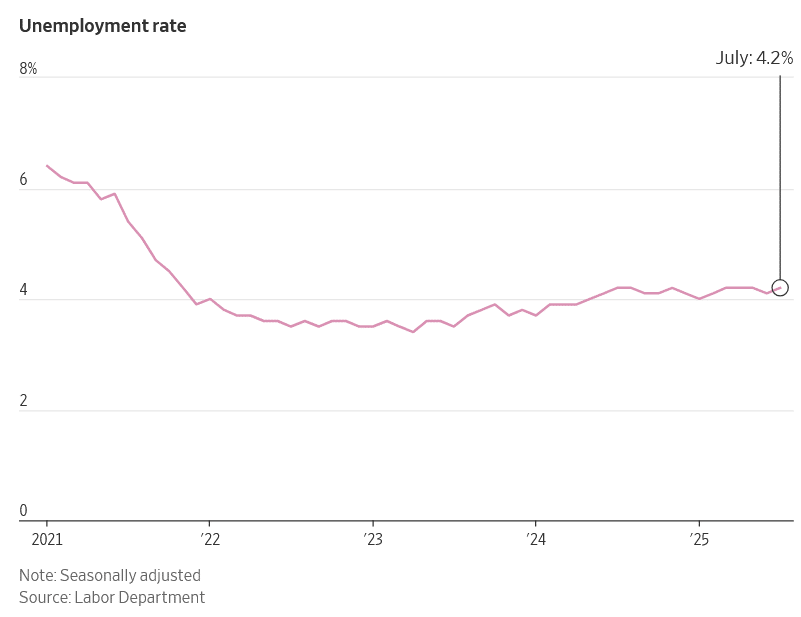

Despite the slowdown in hiring, most businesses have refrained from layoffs. The July unemployment rate remained relatively low even after ticking up to 4.2%. That said, the figures underscore the increasing struggle for out-of-work people.

Scar Winter Kelsey, a 30-year-old data analyst, has been actively looking for employment since March, without any luck.

“I was looking up unemployment statistics the other day, actually, and I was surprised — I believe last time I saw the number was at 4%,” said Kelsey, who previously researched LGBTQ issues at Northwestern University for more than four years.

“Everyone I talk to is either without a job or lucky that they have a job and worry that they are going to be on the chopping block tomorrow,” Kelsey said.

Read the full article HERE.

Jobs numbers for May and June are revised down sharply, while July’s figures fall short of expectations

U.S. job growth slowed in July, a signal that pockets of weakness that had been marring the labor market are starting to take hold.

The U.S. added a seasonally adjusted 73,000 jobs in July, the Labor Department reported Friday, below the gain of 100,000 jobs economists polled by The Wall Street Journal had expected to see.

The unemployment rate rose slightly to 4.2% from 4.1%.

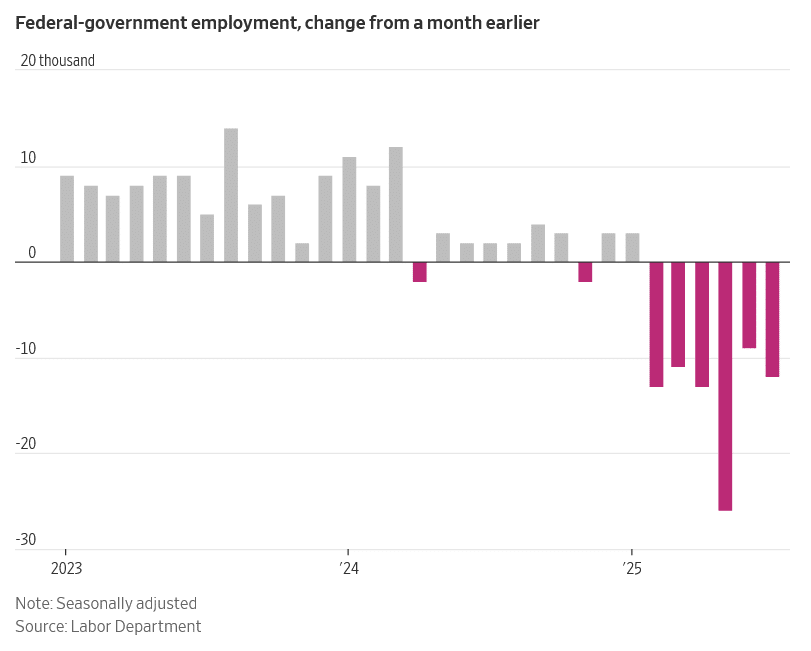

The health care and social assistance sectors accounted for a large share of the new jobs. Those sectors tend to do well no matter how the economy is doing. Federal-government layoffs continued to drag on payrolls, with that sector losing 12,000 jobs.

Hiring in May and June was much weaker than previously reported. Revisions showed employers added a combined 258,000 fewer jobs in those months than previously estimated.

Stock futures were down fell ahead of the report, after President Trump raised tariffs on scores of countries Thursday. They remained in the red afterward. The weak jobs data is likely to fuel bets on Federal Reserve rate cuts.

July’s report comes as economists and policymakers are trying to figure out which of two competing narratives about the economy is more true.

One view is that of surprising resilience. Tariff threats, though they have started to seep into some prices, have yet to translate into pronounced inflation. Consumers, after holding back earlier in the year, are feeling a bit more confident.

The other perspective is that cracks are starting to appear and could deepen. Some companies, such as Procter & Gamble and Chipotle Mexican Grill, are reporting that customers are becoming more sensitive to prices. Young consumers in particular are cutting back on discretionary spending, and much of the economy’s growth is being driven by the wealthiest Americans.

“Everyone is trying to understand what direction the economy is taking,” said Jonathan Pingle, chief U.S. economist at UBS.

Guy Berger, senior fellow at labor-market think tank Burning Glass Institute, is of the opinion that the economy is still stable.

“You look at almost every major indicator,” Berger said, “and they have all been pretty steady since last fall.”

One factor that hasn’t been steady, though, is the policy backdrop. “I would not bet a lot of money on things staying stable going forward,” Berger said, citing tariffs, restrictions on immigration and a big new tax bill.

Economists are paying particular attention to changes in the supply of workers. A dramatic decrease in border crossings is constraining the number of people from abroad coming into the labor force. High-profile immigration raids are keeping many workers at home. Meanwhile, the U.S. is aging, boosting retirements and limiting the number of younger people joining the workforce.

A year and a half ago, the economy needed to add 166,000 jobs a month to keep the labor market steady, according to Peterson Institute for International Economics senior fellow Jed Kolko. As of June, Kolko said, the needed number was only 86,000.

“It’s fallen so much because this immigration surge has ended,” Kolko said. In other words, a job creation number that might have looked lackluster a year and a half ago might actually be strong today.

Recently, the number of jobs created each month has been slowing, but the unemployment rate has risen only slightly.

“People are going to have to get used to employment gains that are meh that will not tell us on their own that the job market is weak,” said Berger. “That is a weird thing for people to get used to.”

Read the full article HERE.

The economy grew 3%, but mainly because imports collapsed. Alas, investment fell too.

If you think President Trump’s tariff ructions don’t affect the economy, take a gander at Wednesday’s report for second quarter gross domestic product. The economy grew 3% on an annual basis, but largely because imports collapsed.

This may be the weirdest GDP report ever. The top line growth number looks good, and the White House naturally touted it. This reverses the 0.5% decline in GDP in the first quarter, which was largely explained by a surge of imports as businesses tried to front-run the anticipated tariff barrage. Growth in the first half was a mediocre 1.2%.

Most striking are the second quarter report’s wild internal details. Net exports (exports minus imports) added a remarkable 4.99% to GDP as imports fell 30.3%. Imports subtract from growth in the national accounts because GDP measures domestic production. Imports are produced overseas. But imports are still crucial to U.S. economic well-being because consumers buy them and businesses use them as inputs for what they produce—and often export.

The crazy swing in imports shows how much Mr. Trump’s up-and-down trade policies have disrupted business decisions and left companies scrambling to adapt. This seems to have had a negative effect on private domestic investment, which fell 15.6% in the second quarter after a surge in the first.

Nonresidential business investment contributed only 0.27% to GDP, as businesses rapidly drew down their inventories. Chalk this up as another result of the uncertainty caused by on-again, off-again, on-again tariffs.

The doughty U.S. consumer was less affected, contributing 0.98% to GDP—decent if hardly bullish. But it’s notable that final sales to private domestic purchasers, a key measure of demand, rose only 1.2%. That’s the lowest since the fourth quarter of 2022

The best news in the report concerned prices. The price index for domestic purchases rose 1.9% in the quarter, a big drop from the 3.4% increase in the first. The personal consumption expenditures index excluding food and energy—the inflation measure watched most closely by the Federal Reserve—rose 2.5% versus 3.5% in the first quarter.

That’s not far from the Fed’s 2% target, as Fed Chair Jerome Powell pointed out Wednesday after the central bank’s latest monetary policy discussion. The Fed stood pat on interest rates, albeit with two dissenters on the Open Market Committee who wanted a 25-basis point cut.

Stock and bond prices moved down as investors seemed disappointed that Mr. Powell wasn’t clearer about a rate cut in September, but financial conditions hardly seem overly restrictive. Mr. Trump probably hurt his case for a rate cut with his Fed-bashing.

What does this bode for the rest of the year? The second quarter was all but over before the passage of the tax and budget bill with its new incentives for business investment. Full and immediate expensing for business is likely to boost investment in the second half, and it had better to offset the impact of willy-nilly trade policy. The One Big Beautiful Bill Act could save the Trump economy.

The other GDP message to Mr. Trump is to finish his trade deals with the world so companies can finally figure out how to adjust their supply chains and what their future costs will be. This may be a forlorn hope given that Mr. Trump views tariffs as an all-purpose diplomatic tool. (See his 50% tariff on Brazil because it is prosecuting his friend.)

There’s no recession signal in the second-quarter numbers, but there’s no boom either. The best path to a real golden age is to calm trade and migrant deportation uncertainty, ease regulatory bottlenecks, and unleash American business to invest and create jobs.

Read the full article HERE.

Gold could hit $4,000 an ounce by the end of next year as the Federal Reserve cuts rates to cushion the US economy, the dollar drops, and central banks keep adding holdings, according to Fidelity International.

Multi-asset fund manager Ian Samson said the firm remained bullish on the precious metal, with some cross-asset portfolios recently increasing holdings as prices eased from an all-time high above $3,500 an ounce in April.

“The rationale for that was that we saw a clearer path to a more dovish Federal Reserve,” Samson said in an interview, adding that some funds had as much as doubled their 5% allocation over the past year. Also, August is often slightly weaker for markets, so more diversification “makes sense,” he said.

Gold is up by more than a quarter this year, as uncertainty around President Donald Trump’s aggressive attempts to reshape global trade, conflicts in the Middle East and Ukraine, and central-bank accumulation buttressed gains. Still, the metal has traded within a tight range over the past few months, with demand for havens cooling a little as some progress in US trade talks eased fears about worst-case-scenarios for the global economy.

“Perhaps you’re going to avoid the doomsday scenarios that were painted earlier in the year, but ultimately we’re heading to a 15%-or-so tax on about 11% of the US economy — which is imports,” said Samson, referring to Trump’s tariffs. “You’d expect it to slow the economy.”

Fidelity’s bullish outlook for gold is similar to that from Goldman Sachs Group Inc., which has made the case in recent quarters for an eventual rally to as much as $4,000 an ounce. Still, others are cautious, including Citigroup Inc., which forecasts weaker prices. Spot bullion was last near $3,315.

Fed officials are due to gather this week to set policy. While no change is expected, Chair Jerome Powell may face dissents from officials who want to provide support to a slowing labor market, potentially from Governor Christopher Waller and Vice Chair for Supervision Michelle Bowman.

A US slowdown would likely see the dovish camp gain more influence in guiding policy, with the dollar tending to soften in environments of weaker growth, Samson said. In addition, Powell — whose term as Fed chair ends next May — will probably be replaced by someone “more amenable” to lower borrowing costs as Trump continues to lobby for interest-rate cuts, he said.

Non-yielding bullion typically benefits when the greenback softens and interest-rates ease.

Elsewhere, the world’s central bank are likely to go on buying gold, he added, while growing fiscal deficits — particularly in the US — would continue to reinforce the precious metal’s appeal as a hard asset.

“Sure, gold has come a long way, but if you look at when gold’s been in a bull market — like 2001 to 2011 — it annualized 20% per annum,” he said. “From 2021 to today, it’s also annualizing 20% a year. So it’s not necessarily, in the context of a bull run, massively overstretched.”

Read the full article HERE.

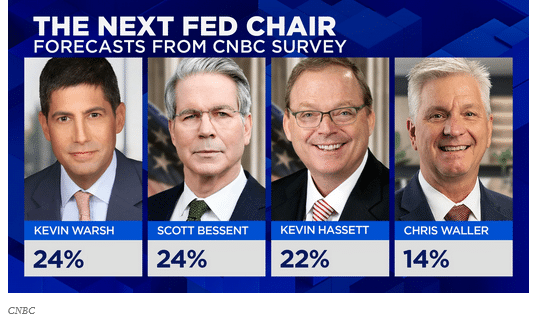

- The CNBC Fed Survey found the leading contenders to succeed Jerome Powell as Fed Chair are Treasury Secretary Scott Bessent, former Fed Governor Kevin Warsh and Kevin Hassett, the National Economic Council director.

- The probability of a recession in the next year has fallen to 31% from 38% in June and 53% in May after the president announced sharply higher “reciprocal” tariffs.

- Unemployment is seen rising only slightly from the current rate of 4.1% to 4.4% this year and remaining stable at that level in 2026.

It’s a virtual three-way tie to replace Fed Chair Jerome Powell as Fed chair when his term expires.

The CNBC Fed Survey found 24% of respondents saying President Donald Trump will replace Powell with Treasury Secretary Scott Bessent and 24% saying it will be former Fed Governor Kevin Warsh.

Close behind is Kevin Hassett, director of the president’s National Economic Council with 22%. More distant is current Fed Governor Chris Waller at 14%.

Trump repeatedly has called for Powell’s resignation, saying he’s been late to cut interest rates, and has considered firing him.

He’s also accused the Fed chair of mismanaging a $2.5 billion renovation of its headquarters and a separate building, a charge Powell has denied and for which the president has provided no evidence beyond the cost overruns.

After a recent visit to the construction site, the president appeared to ease off on his criticism of the project and the Fed’s monetary policy and suggested he would not fire Powell. Powell’s term as chair concludes in May 2026 though he can stay on as governor if he wishes until 2028.

In the survey, 84% said the president would not fire Powell before his term ends in May. The 37 respondents include fund managers, economists and strategists.

“With the jockeying going on to become the next Fed chair already appearing inside the Fed, it is clear the Fed’s independence has already been compromised,” economist Joel Naroff wrote. “This has elevated long rates and weakened the dollar. There is little to believe that would change, especially given the expectation that the next Fed chair will be a Trump loyalist.”

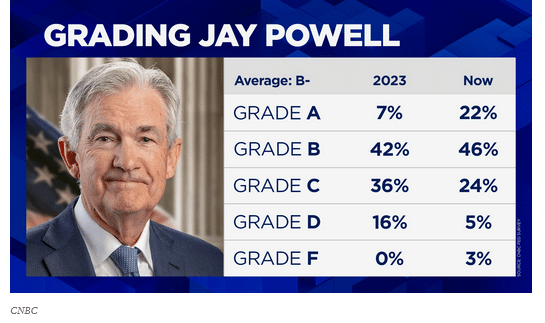

Overall, respondents gave Powell a grade of B -, up from C+ when CNBC last asked the question in 2023. He received solid B’s on leadership, transparency, market knowledge and communication, but a C- on economic forecasting (up from a D in 2023). Respondents graded Powell with a B- on economic and regulatory expertise.

Former Fed Chair Ben Bernanke left office with a final grade of B and Janet Yellen’s final grade was a B+.

Policy outlook

The president’s pressure on the Fed to cut rate is believed by some respondents to be having the opposite effect.

While 56% say it’s having no impact on policy, 42% believe it makes rate cuts less likely. Just 3% say it makes cuts more likely. No respondent forecasts a rate cut at this meeting, although 27% believe the Fed should cut.

There could be two dissents at the meeting as two Trump-appointed governors have said they supported lower rates in July. But survey respondents see those cuts coming, with 65% expected one in September and another one likely before year end. That would bring the funds rate down to about 3.9%.

Further cuts are forecast for 2026, with the average respondent putting the funds rate at 3.5%, though that will remain above the average neutral rate of 3.3%.

Tariff uncertainty remains the No. 1 threat to the expansion, followed by overall uncertainty about the president’s policy and continued high inflation. But overall, some of the uncertainty sparked by administration’s policies have eased.

Uncertainty around the economic impact of tariffs fell to 62% from 71% in June. And 65% expect a trade deal with China, up from 54%. A 51% majority now believes tariffs will result in only one-time price increases, rather than broader inflation, an 8-point gain from June.

“Trumpian uncertainties on the economy and policies are settling down,” wrote Allen Sinai, chief global economist/strategist at Decision Economics. “That is clarifying and very positive for equities. But there are still big, big societal, political, geopolitical, and non-economic uncertainties.”

Along with less uncertainty has come a modest boost in the economic outlook.

The probability of a recession in the next year has fallen to 31% from 38% in June and 53% in May after the president announced sharply higher “reciprocal” tariffs. GDP is forecast to rise 1.4%, up from 1.1% in June, though still below the more optimistic 2.4% in January.

The outlook remains for a recovery next year with an average 2.2% GDP forecast in 2026.

Troubles in the labor market

Unemployment is seen rising only slightly from the current rate of 4.1% to 4.4% this year and remaining stable at that level in 2026. But there are widespread concerns about the labor market slowing.

“Employment is not as good as some believe,” said Drew T. Matus, chief market strategist, MetLife Investment Management. “This, combined with housing issues and ongoing volatility, is likely to prompt a significant slowing in activity as we approach year-end.”

For most respondents, employment looks to be the key to whether Fed is in the right place.

“The labor market is slowing, and the housing market is deflating. Ultimately this will force the Fed to cut interest rates,” said Troy Ludtka, senior US economist at SMBC Nikko Securities Americas.

But Jack Kleinhenz, chief economist, National Retail Federation, wrote, “A relatively balanced labor market, the recent rise in the [personal consumption expenditures price index], and the potential for tariffs to push up inflation in the coming months justifies the cautious pace by the Federal Reserve. Even though uncertainty continues, the economy is expected to grow.”

Despite better growth and less uncertainty, respondents are cautious about the stock market this year.

The average respondent puts the year-end S&P 500 level at 6,344, below the close on Monday. It’s forecast to rise to 6,936 next year, a 9% increase.

But there’s also greater concern about overvaluation, as 84% see stocks as somewhat or extremely overvalued, up from 58% in June, and the highest in a year.

Read the full article HERE.

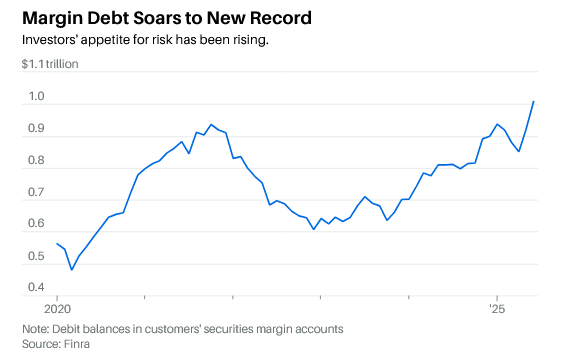

The rapid acceleration in investors’ use of margin debt in trading calls to mind the meme stock frenzy and dot-com bubble.

Investors are trading on margin like it’s 1999. Debt balances in investors’ margin accounts topped $1 trillion in June, a new record, according to data from Finra the brokerage industry’s self-regulatory organization.

The figure surpasses the previous high of $937 billion in February and is a sign that investors’ appetite for risk dramatically increased in May and June following a sharp selloff in U.S. stocks in April when President Donald Trump unveiled sweeping tariffs.

Margin trading can amplify returns and losses because investors borrow funds from their broker to buy shares. Investors’ use of margin tends to parallel moves in stock markets, and the S&P 500 and Nasdaq have risen considerably since April.

Investors’ use of margin has surpassed the level seen during the pandemic (before this year the record was in October 2021) when many first-time investors downloaded commission-free apps, such as Robinhood, to buy GameStop and other so-called meme stocks.

Risk signal. Use of margin signals increased investor appetite for risk and can be a sign that a bubble is building. Strategists at Deutsche Bank warn that we may be entering worrisome territory, noting that the 18% increase in margin usage is among the fastest increases since the tech bubble of the late 1990s. The fastest two-month increase in margin debt—24.6%—was recorded in December 1999, according to Deutsche Bank. The second fastest—20.3%—was notched in May 2007.

“We care about margin debt, as it is a useful gauge of when market sentiment is on the verge of going from ‘red-hot’ to ‘white-hot’,” credit strategists led by Steve Caprio write in a July 24 research note. “We have tracked this indicator for years now, but only have written on it today, given that the rate of increase is starting to flag as ‘too hot” by our metrics. And while there is still room for market euphoria to potentially grow, we are ultimately getting closer to that point where market euphoria is becoming too hot to handle.”

Caprio and colleagues, who focus on investment-grade and high-yield corporate bonds, say that the current run-rate of margin debt growth is consistent with U.S. high-yield credit spreads widening between 80 to 120 basis points over the next 12 months. A basis point is one one-hundredth of a percentage point and credit spreads widening is another way of saying high yield bonds fall in value relative to Treasuries. High-yield bonds falling in price can correlate with risk-off behavior among investors more broadly.

How long investor euphoria—and appetite for risk—lasts is hard to say, and Caprio acknowledges that unexpected market catalysts could emerge, such as tariff rate reductions or a dovish Fed. “But in all scenarios, we would not lose sight of the broader theme; namely that the level and pace of margin debt growth today suggests market sentiment is starting to run too hot.”

Read the full article HERE.

- The risk of a bubble in stock markets is rising as monetary policy loosens alongside an easing in financial regulation, according to Bank of America Corp. strategists.

- The world policy rate has fallen to 4.4% from 4.8% in the past year and is forecast to drop further to 3.9% in the coming 12 months, according to Michael Hartnett.

- Michael Hartnett said “Bigger retail, bigger liquidity, bigger volatility, bigger bubble” in a note, warning of the potential for a bubble in the stock market.

The risk of a bubble in stock markets is rising as monetary policy loosens alongside an easing in financial regulation, according to Bank of America Corp. strategists.

The team led by Michael Hartnett said the world policy rate has fallen to 4.4% from 4.8% in the past year as central banks in the US, UK, Europe and China slashed borrowing costs. The rate is forecast to drop further to 3.9% in the coming 12 months, he said.

At the same time, policymakers are considering regulatory changes to boost the share of retail investors in the US. “Bigger retail, bigger liquidity, bigger volatility, bigger bubble,” Hartnett wrote in a note.

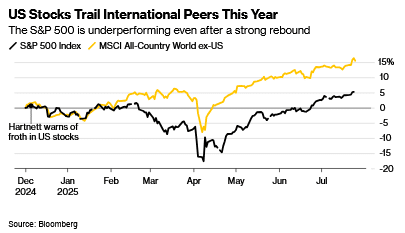

US stocks have rallied to record highs on optimism around resilient economic growth and corporate profits even in the face of higher tariffs. Some market forecasters such as Morgan Stanley’s Michael Wilson have said there’s reason to remain bullish given positive earnings momentum, robust operating leverage and cash tax savings.

However, strategists at JPMorgan Chase & Co. and UBS Group AG have warned the market may be getting too complacent about lingering trade risks. S&P 500 futures were little changed on Friday, as investors held off from making big bets ahead of the Federal Reserve’s policy meeting next week.

BofA’s Hartnett correctly forecast that international stocks would outperform the US this year. He had warned in December that equities were beginning to look frothy after a strong rally in 2024. The S&P 500 Index sank as much as 18% after he issued that call, before rebounding in early April.

The strategist said again in June that stocks could end up in a bubble on the back of expected rate cuts.

Read the full article HERE.

Tariffs may have dominated the headlines, but they haven’t hit most consumers’ finances—yet. That could change with the coming deadline for deals, and retirees are particularly vulnerable to price increases and market swings.

The White House is working to strike agreements with countries ahead of its self-imposed Aug. 1 deadline for country-specific tariffs to go into effect. In some instances, these are on top of sector-oriented tariffs, like 50% on aluminum and steel—and a spate of tariffs on pharmaceuticals, semiconductors, and critical minerals are still pending. Uncertainty continues, as grounds for some of the levies will be contested in court later this month.

To date, U.S. retailers have borne the brunt of the tariffs already in place. Many retailers front-loaded imports early in the year, stockpiling inventory ahead of the new policies. But that inventory is running low, and that, plus the expected new tariffs, will start to reach consumers in the form of higher prices and market volatility, experts say.

The impact of all this year’s tariffs would amount to an average per household income loss of $2,800 in 2025, according to an estimate by the Budget Lab at Yale as of July 13.

“I fear we have been lulled into a false sense of security,” says Mary Clements Evans, the author of Emotionally Invested: Outsmart Your Anxiety for Fearless Retirement Plannin g. “We’re going to experience significant inflation now, because of the tariffs.”

White House spokesman Kush Desai disputes that tariffs could spike inflation and cause a recession. “President Trump’s tariffs have been a key part of an economic agenda that has delivered cool inflation, robust jobs reports, stock and bond market rallies, trillions in investment commitments, historic tariff revenue, and trade deals that dramatically expand access for American exports,” he told Barron’s.

Over the next couple of months, higher inflation data could fuel market volatility, strategists say. While that can be scary, it pays to stick with your diversified mix of stocks and bonds.

“Market timing generally is hard to do,” says Janet Yang Rohr, director of multi-asset and alternative strategies for Morningstar. People who sold out of equities during the extreme turbulence following President Donald Trump’s “Liberation Day” announcement in early April now regret it, as the stock market has recovered and notched new highs.

Treasury inflation-protected securities, or TIPS, are generally considered a good inflation hedge, but they might not shine in the current environment, says John Canally Jr., chief portfolio strategist at TIAA Wealth Management. TIPS perform best when inflation exceeds the market’s expectations, but the market is already pricing in healthy price increases. Instead, consider a small allocation—no more than about 7% of your fixed-income portfolio—to emerging market bonds, which are having a good year, Canally says.

While retirees should stand pat on their portfolios, price increases could warrant some changes in spending. To determine how to respond, it helps to know where you stand, Evans says. A financial advisor can help you determine whether your money is likely to last for your expected life span under a range of stock market scenarios.

If you have an adequate cushion, don’t let sticker shock deter you from going on a bucket-list trip or otherwise enjoying your retirement, Evans says. A financial advisor can run the numbers and, if warranted, give you permission to spend.

To be sure, lower-income retirees will have less wiggle room. Some have already turned to credit cards to cope with steadily climbing prices on essentials from groceries to medical care. Older adults age 70-plus are the fastest group of borrowers, with debt rising 4.2% year over year and 36.2% over the past five years, according to a recent report from the Kaplan Group, a commercial collection agency.

One way to lower your interest costs is to transfer high-interest debt to a credit card with a 0% introductory interest rate. These so-called balance transfer cards can buy you time to pay off what you owe, as long as you’re mindful of when the introductory rate expires.

Read the full article HERE.

The U.S. economy is headed into a period of noticeably slower growth thanks to the tariff impact on inflation and, by consequence, consumer spending, according to Goldman Sachs.

Economists at the Wall Street firm expect gross domestic product to rise at just a 1.1% annual pace through 2025 “as the growing real income drag from tariff-related price increases offsets the boost from easier financial conditions,” Goldman’s chief economist, Jan Hatzius, said in a note to clients.

“Even a one-time price increase will eat into real income, at a time when consumer spending trends already look shaky,” Hatzius said. Though retail sales numbers recently have been solid, the Goldman economist expects that spending on balance stagnated for the first six months, which “rarely happens outside of recession.”

GDP fell at a 0.5% annualized pace in the first quarter, with consumer spending up just 0.5%.

The call for lowered growth comes at an uncertain juncture for the economy, with hiring slowing but still positive, consumer sentiment on the rebound from earlier lows and inflation relatively in check though still above the Federal Reserve’s 2% goal.

However, the biggest wild card is President Donald Trump’s tariffs, with Goldman gaming out multiple scenarios depending on how negotiations progress.

In the most likely case, Hatzius said so-called reciprocal tariffs likely will hit an effective rate of 15%, up from the previous forecast of 10%, taking the average effective tariff rate up 14 percentage points this year and another 3 percentage points in 2026.

As a result, Goldman sees inflation as measured by the Fed’s preferred personal consumption expenditures price index to hit 3.3% for 2025, falling to 2.7% next year and 2.4% in 2027.

Those assumptions help put the firm’s projected recession risk at 30%, about double the normal level.

From the Fed’s perspective, Goldman expects policymakers to continue their wait-and-see approach if larger tariffs come into place. At the same time, the threat to employment and supply chains from larger-than-expected tariffs “would likely warrant more aggressive rate cuts than we currently expect,” Goldman economists said in a separate note.

To be sure, some indicators are showing the economy is still solid.

Consumer sentiment as measured by the University of Michigan is off the lows it hit around the time Trump first announced his tariffs on April 2. Similarly, inflation fears have fallen back to levels seen before that “liberation day” announcement.

The Atlanta Fed’s tracking model for GDP is putting second-quarter growth at an annual rate of 2.4%.

Read the full article HERE.