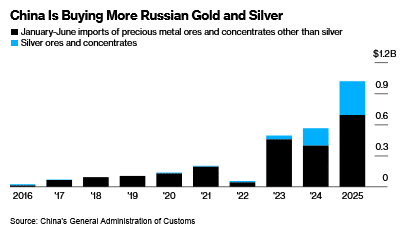

Russian precious metals exports to China almost doubled in the first half of the year, as record gold prices boost revenue.

Chinese imports of Russian precious metal ores and concentrates, including gold and silver, jumped 80% to $1 billion from the same period a year earlier, according to data from Trade Data Monitor, which sources information from China’s customs office. Bullion prices have climbed about 28% this year, boosted by heightened geopolitical risks and trade tensions, alongside buying by central banks and exchange-traded funds.

Russia, the world’s second-largest gold producer with annual output of more than 300 tons, has been shut out of Western trading hubs like London and New York since its full-scale invasion of Ukraine in 2022. The Bank of Russia, formerly the world’s largest central bank gold buyer, has not resumed large-scale purchases, leaving China as one of the country’s few remaining major markets.

Gold miners in Russia have also been buoyed by growing domestic retail demand, which reached a record high in 2024 as Russians turned to precious metals to safeguard their savings.

Russia’s MMC Norilsk Nickel PJSC, one of the world’s top producers of palladium and platinum, has ramped up exports to China this year. Prices for the two metals jumped 38% and 59%, respectively, this year.

Read the full article HERE.

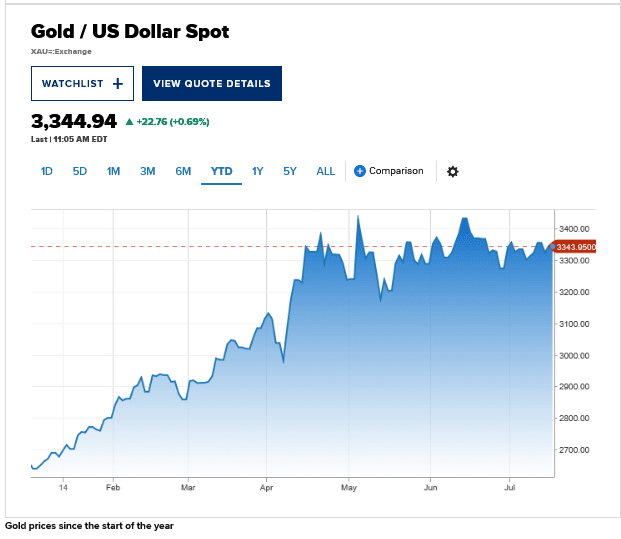

- Gold prices are up about 25% this year as investors seek a safe haven from trade war anxieties and geopolitical tensions.

- High-net-worth Americans are increasingly turning to physical gold to diversify from the depreciating U.S. dollar, according to Stephen Jury of J.P. Morgan Private Bank.

- While paranoid gold investors may be tempted to keep their bullions at home, there are more secure — and pricier — options, such as vaults in the Swiss Alps.

With gold prices up roughly 25% this year, the precious metal is in such demand that Costco has capped how many gold bars shoppers can buy in a day. A recent HSBC survey of affluent investors found that gold allocations had more than doubled this year from 5% to 11%.

High-net-worth individuals are getting in on the action too, bankers to the wealthy told CNBC, even if they aren’t buying gold bars along with rotisserie chickens. HSBC’s James Steel said the asset’s safe-haven appeal has been bolstered by trade war anxieties and geopolitical tensions.

“Gold is a friend of uncertainty,” said the chief precious metals analyst.

Investors in Asia and the Middle East have long invested in physical gold due to currency fluctuations, high inflation and cultural affinities. Edmund Shing, global chief investment officer at BNP Paribas Wealth Management, said overseas family offices have allocations as high as 5% to 10% in physical gold or gold-backed investments.

However, J.P. Morgan Private Bank’s Stephen Jury said there has been a noticeable uptick among high-net-worth U.S. clients who want to diversify from the depreciating U.S. dollar.

“If you’re buying euros or yen and you need to buy an underlying security with that currency, that starts to get a little bit more complex for most clients,” said Jury, the private bank’s global commodity strategist. On the other hand, investing in gold is “easier to get their head around,” he said.

For short-term gold trading, futures are a popular option, according to Steel. Investing in physical gold or ETFs is more attractive to investors who plan to buy and hold, he said. Since investing in bars and bullions usually comes with insurance and storage fees, it takes a higher allocation to make it worth your while, he added.

There are a slew of options, some more expensive than others. Jury recommended private bank clients invest in unallocated gold held in a J.P. Morgan vault, meaning they have a claim to the gold’s value but do not own a specific bar and can’t take it. It comes with lower fees than ETFs or allocated bars. Clients can buy a fraction of an unallocated bar for $250,000, whereas buying an allocated bar of 400 ounces costs about $1 million and incurs insurance and storage fees.

However, the more paranoid gold investors aren’t deterred by fees and higher minimums, according to Jury.

“Some clients don’t like to do that because they think the world’s coming to an end, and they want to hold the gold and know that it’s their bar that belongs to them, and they can take delivery of that bar at any time,” he said. “As people get wealthier and get older, they get a little more cautious, and that’s putting it diplomatically.”

Some clients want to keep their gold bars with them, with one telling Jury that she planned to bury it in her garden.

“I said, ‘Please don’t tell me that, and please don’t tell anyone else that,’” he recalled.

Banks advise against keeping gold at home due to security risks and the difficulty of selling gold on the open market. They take numerous precautions, such as not disclosing vault locations and running background checks on clients who request to visit, Steel said.

Jury said only clients with very large gold holdings, likely in the range of $100 million, can tour J.P. Morgan’s vault in London.

“It would have to be a good reason for us to stop and show somebody their metal,” he said. “But it can be done, as in all things, if the amounts are large enough.”

Investors seeking the utmost security can opt for military bunkers turned vaults. Swiss Gold Safe has two such vaults deep in the Swiss Alps, according to COO Ludwig Karl. Many clients choose to diversify their gold holdings across multiple countries, including Singapore. Some go as far as doing their own audits on gold held at Swiss Gold Safe, he said.

“Most of our clients are from first-world countries,” Karl said. “However, our clients have lower trust in government or financial systems or are trying to build a backup or insurance plan by holding precious metals outside of the banking system in a neutral and safe country.”

Steel said to get more investors to flock to gold as a safe haven they would have to be even more worried.

“If you look at geopolitics and economic policy uncertainty as being drivers, then we would have to have an even higher geopolitical risk thermometer than we have now,” he said. “It would have to be pretty darn high.”

Read the full article HERE.

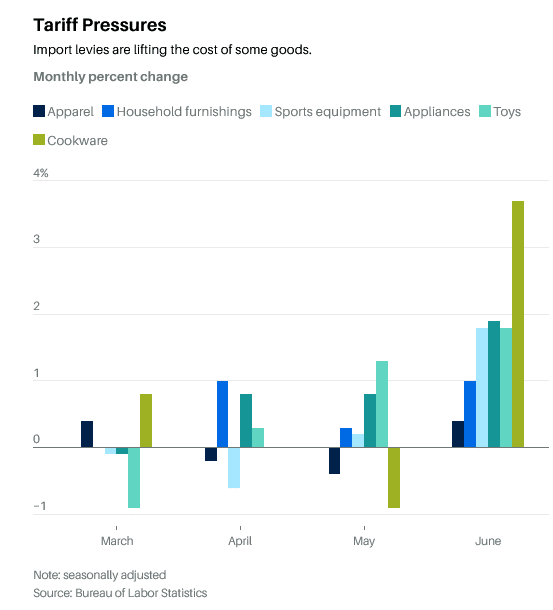

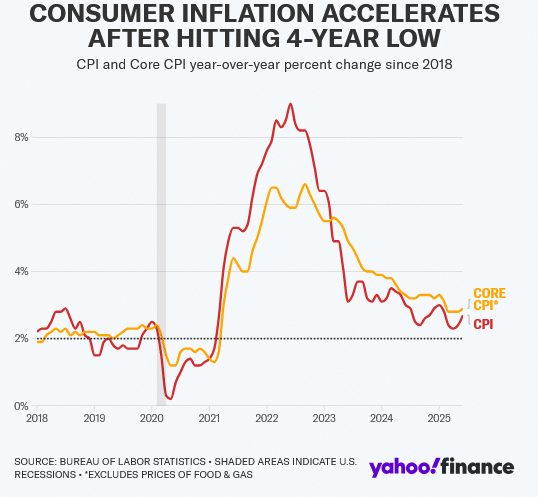

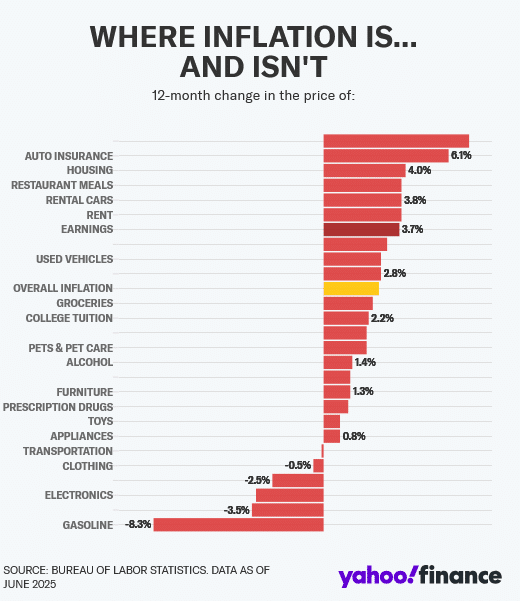

Inflation may not have soared in June, but there are signs that higher tariffs are starting to push up prices. Americans are likely in for more pain in the near term.

The consumer price index was largely in line with estimates, but still jumped to 2.7% in June from 2.4% year over year in May. Core inflation, which removes the more volatile cost of food and energy, also inched up a tenth of a percentage point to 2.9%.

Meanwhile, wholesale inflation as measured by the producer price index released Wednesday, was unchanged in June from May. Core PPI, which excludes food and energy prices, was also flat compared with May.

The BLS, however, did say the headline and core PPI numbers for May were higher than it reported initially. And prices for finished goods rose 0.3% in June from May, which the BLS reported was the largest increase since February.

The recent upticks are by no means as dramatic as in early 2021, when inflation jumped roughly a full percentage point each month from February to May. But it cannot be ignored that the effects of President Donald Trump’s higher tariffs are starting to show up, both in the overall cost of goods and in core goods, which exclude food and energy. A number of factors, including a lack of significant gains in auto prices, ample inventories, and price-sensitive consumers, are masking the extent of the shift.

“We are seeing initial effects of tariff increases on core goods prices,” New York Fed President John Williams said Wednesday night.

Notable increases appeared in categories such as furniture, sports equipment, appliances, clothing, and toys in June. An index of the cost of furnishing and running a household, in particular, rose 1% in June, after increasing 0.3% in May, the BLS reported Tuesday. The cost of recreation—the category includes sporting goods, movie tickets, and theme-park admissions—increased 0.4% over the month.

Prices of apparel, which showed little effect from higher tariffs in recent months, climbed 0.4% in June, reversing months of declines. And the overall cost of core goods saw the largest monthly increase since February.

The breadth of the rising inflation is important, said Omair Sharif, founder and president of the research shop Inflation Insights. He pointed out that nearly all core goods prices outside of autos increased in June, suggesting that companies in general are starting to pass their tariff costs on to their customers.

This “belies” the narrative that tariffs aren’t flowing through into consumer prices, wrote Michael Hanson, economist for J.P. Morgan. “The three-month increases for a range of goods, including household appliances, window and floor coverings, sporting goods, and other household and recreational items, are approaching—if not already well above—10% annualized,” he said.

According to Freya Beamish, chief economist at TS Lombard, 25% of the tariffs in force in June were passed through to customers, up from 15% in May.

That would be boosting the headline inflation numbers, if not for a few patterns that are unlikely to last through the summer. In the first place, frugal consumers are making it hard for businesses to raise prices. The Federal Reserve’s latest Beige Book, released Wednesday, showed businesses’ margins are coming under more pressure as a result.

Declines in the costs of cars and travel are a second factor. Prices for new vehicles fell by 0.3% month over month in June, while the cost of used cars and truck costs slid by 0.7%. Yet the latest readings of the Manheim Used Vehicle Value Index show that prices are on the rise, albeit incrementally. That means car prices will likely stop falling in July.

Read the full artice HERE.

The past six months may seem like a blur, but a clear theme of President Donald Trump’s return to the White House is that it’s been good for the gold market.

While it has been nearly three months since gold climbed past $3,500 an ounce to its highest price on record, five key factors to emerge since the start of Trump’s second term in office are likely to support prices in the months ahead.

They might even prove that the precious metal is becoming a core asset class in investors’ portfolio playbook.

Gold remains a standout asset class as the market heads into the third quarter, with the metal offering “both a potential hedge against geopolitical chaos and an escape from fiat-currency erosion,” said David Miller, co-founder and chief investment officer at Catalyst Funds.

The first key factor supporting gold is demand from central banks, which shows reduced confidence in the power of the U.S. dollar.

Central-bank demand is surging, with BRICS nations, particularly China and India, accelerating their accumulation of gold reserves “as part of broader de-dollarization strategies,” Miller said in emailed commentary.

Official gold holdings by the People’s Bank of China, that country’s central bank, have climbed for eight months in a row, according to a report released Wednesday by the World Gold Council.

Trump’s threatened and imposed tariffs on countries across the globe have sped up the “process of de-dollarization,” said David Russell, global head of market strategy at TradeStation. De-dollarization refers to efforts by some countries to reduce reliance on the U.S. dollar as a reserve currency.

“Trade is becoming less dependent on the U.S. as an end-market and less dependent on the U.S. dollar. It’s becoming more like the 19th century and less like the era following [World War I and World War II],” Russell said in emailed commentary.

“This return to the older model has created a structural demand for gold after decades of neglect,” he said. “Fiat currencies are in decline.”

A decrease in credit quality among developed governments, such as the U.S., is also a major concern for the markets, Russell said.

“We have lost AAA status at the three top rating agencies as deficits mount and the crunch of unfunded liabilities like Social Security approaches,” he said, referring in part to Moody’s move in May to lower its top credit ratings for the U.S. “After decades of kicking the can down the road, we’re running out of road.”

That said, trade policy represents a third factor influencing gold. “Wide budget deficits or increased tariffs,” which reduce demand for Treasurys, both support bullion prices, said Russell.

And with yields on 2-year and 10-year Treasurys down year to date and real rates pressured by inflation, “the opportunity cost of holding gold is falling,” said Miller at Catalyst Funds. That leads to a fourth potentially supportive factor for gold — a revival in investor interest in gold exchange-traded funds and alternatives.

During the first half of this year, global physically backed gold ETFs saw inflows of $38 billion to mark the strongest semiannual performance since the first half of 2020, according to the World Gold Council.

And finally, on a technical level, gold prices held their ground above $3,250 an ounce for much of June, Miller said.

That shows signs of an “upward breakout as volatility returns to equity markets,” he said. Gold for August delivery settled Wednesday at $3,359.10 an ounce.

‘Gold isn’t just a crisis hedge — it’s becoming a core asset class in the modern portfolio playbook.’ — David Miller, Catalyst Funds

The current macroeconomic environment “justifies a meaningful allocation to gold and gold-related strategies,” Miller said.

“The combination of fragile equity sentiment, uncertain policy direction and structural macro headwinds reinforces our view: Gold isn’t just a crisis hedge — it’s becoming a core asset class in the modern portfolio playbook,” he said.

Read the full article HERE.

Central banks are increasingly looking to bolster their gold reserves. And they are turning to mines in their backyard to source the yellow metal.

Besides being cheaper, securing gold directly from mines helps support local industry and bolsters reserves without weighing on foreign exchange reserves, experts said.

While countries such as the Philippines and Ecuador have been doing this for years, more central banks with access to domestic gold mines have started, increased, or are considering direct local purchases, according to the World Gold Council.

Nineteen out of 36 respondents in the World Gold Council’s latest central bank survey said they are buying gold directly from domestic artisanal and small-scale gold miners in local currency. Four are thinking of following suit. This is a slightly higher figure than last year’s survey, when around 14 central banks out of 57 said they were buying directly from domestic sources.

“One trend that we’re seeing is that some central banks, especially in Africa, Latin America, are starting to buy gold directly from domestic, small-scale gold mines, which have really proliferated because of the higher price,” said Shaokai Fan, global head of central Banks at WGC.

Central banks of Colombia, Tanzania, Ghana, Zambia, Mongolia and the Philippines are relying on domestically mined gold to build up reserves, according to the industry body.

Ghana Gold Board — the state agency managing gold purchases on behalf of the Bank of Ghana — in April secured agreements with several mining companies to buy 20% of their gold output, Reuters reported. Last September, Tanzania’s mining authority reportedly mandated that all gold exporters, including miners and traders, put aside at least 20% of their output to sell to the central bank.

“You can make an argument that it’s cheaper than buying gold on the international market, because a lot of these central banks buy gold at a slight discount to the international price,” Fan said.

Traditionally, central banks acquire gold through the global over-the-counter market — typically centered in London — where gold is transacted via major bullion banks, priced in U.S. dollars, euros, or sterling. These purchases often involve high-purity London Good Delivery or LGD bars, which meet global trading standards and are stored in top-tier vaults such as those at the Bank of England.

Because of gold’s soaring prices and its attractiveness as a hedge against geopolitical risks, it is natural that the central banks of producer nations would turn to domestic output, said Adrian Ash, director of research at gold investment firm BullionVault.

Gold prices have been on a tear, scaling fresh highs amid geopolitical uncertainties and waning confidence in other traditional safe havens. Spot gold prices are currently trading at $3,328.3 per ounce, up almost 27% year to date, data from LSEG showed. Buying domestic m

“You’re able to grow your reserves using local currency and therefore not sacrifice another reserve asset [U.S. dollar] to grow your gold reserves.“

Shaokai Fan, World Gold Council

However, countries need to pay for processing and refining the metal to LGD standard — the de facto international benchmark for large gold bullion. These processes need to be done overseas if the country doesn’t have domestic LGD refining, which will add costs, Ash said.

Central banks that buy gold bars from local mines and have domestic LGD refining capacity, nullify those additional costs. The Philippines’ central bank, for instance, is a certified LGD refiner. Kazakhstan has two refiners accredited by the London Bullion Market Association. Russia had seven until they were suspended in 2022 after the country invaded Ukraine. Others such as Ghana and Zambia might need to rely on external refiners, offsetting part of the upfront savings.

Reserve strategy

Another compelling driver for buying domestic gold is monetary flexibility.

Purchasing gold through the international market often requires dollars — a reserve asset. That means central banks must swap one reserve for another. But that won’t be the case if they use local currencies to buy gold from their own backyard.

“You’re able to grow your reserves using local currency and therefore not sacrifice another reserve asset to grow your gold reserves,” said WGC’s Fan.

With rising global debt levels, trade and geopolitical risks on the cards, central banks want to strengthen their reserve buffers to shield against sudden financial shocks. Holding more reserves — in multiple forms — provides ammunition to manage potential crises.

Out of the 73 central banks surveyed by the WGC, around 95% said they expect peers across the world to raise gold reserves over the next year.

In the past, if these central banks wanted to buy gold, they would probably just purchase it on the international market, Fan explained. “But if you have local gold production in your country, a lot of central banks are thinking, well, maybe we can use this local gold production instead and add the reserves this way,” he added.

Supporting local industry

Providing support for domestic mining sectors and respective local communities are also key drivers for central banks purchases via local mines. Demand for gold in some countries is too small, and central banks are incentivized to support mining operations in the country, which in turn generates jobs, said Nicky Shiels, head of research and metals strategy at MKS PAMP.

Shiels, however, noted that purchasing gold via local mines comes with risks.

Central bank purchases through international markets often via leading bullion banks offer greater trust and minimize reputational risks for central banks, she said. Much of the gold being bought domestically comes from artisanal and small-scale gold mining — ASGM has been linked with poor labor practices, environmental damage, and illegal smuggling.

But it can also be argued that central banks, with their institutional credibility and financial weight, are in a good position to formalize and clean up that supply chain, said WGC’s Fan.

“Central banks can harness their massive buying power to do good for these artisanal, small scale miners,” he said.

“Having a credible, large-scale buyer like the central bank gives small-scale miners a legal and fair outlet to sell their gold,” said Fan. “That not only diverts flows away from criminal networks but also improves traceability and accountability.”

“That’s exactly how we describe it as — a win-win.”

Read the full article HERE.

Inflation ticked higher in June, according to new government data released Tuesday, as investors continued to look for signs that President Trump’s tariffs may be starting to work their way through to consumer wallets.

The latest data from the Bureau of Labor Statistics showed that the Consumer Price Index (CPI) increased 2.7% on an annual basis in June, an uptick from May’s 2.4% gain that was driven by a reversal in falling gas prices. Economists had expected headline inflation to come in at 2.6%.

On a monthly basis, prices rose 0.3% compared to May’s 0.1% uptick, matching economists’ estimates..

On a “core” basis, which excludes volatile food and energy costs, CPI rose 2.9% over the past year in June, ahead of May’s 2.8%. Monthly core prices increased 0.2%, also ahead of the prior month’s 0.1% gain.

Heading into the report, economists had expected core CPI to rise 2.9% year over year and 0.3% month over month.

The report landed amid renewed trade tensions between the US and other countries. President Trump has unveiled new letters to over 20 countries outlining tariffs ranging from 20% to 50%, including a 35% duty on Canadian goods and 30% tariffs on imports from Mexico and the European Union.

He has also floated sweeping 15% to 20% tariffs on most trading partners. The EU, in response, is scrambling to negotiate while preparing potential countermeasures.

The back-and-forth raises fresh questions about the Federal Reserve’s rate-cutting path.

Markets still expect the central bank to hold rates steady at its policy meeting in two weeks, largely due to uncertainties on how tariffs will trickle through to prices. The odds of a September cut ticked just below 60% shortly after the release.

Although inflation remained relatively muted in June, there are signs that tariffs may be starting to make their way through the system.

Apparel prices rose 0.4% last month, while footwear saw a 0.7% increase after several months of declines. Furniture and bedding prices also climbed 0.4%, reversing the 0.8% drop the index saw in May, a potential indication that tariff-related cost pressures are beginning to reach consumers.

“With inflation coming in softer than expected for the fifth month in a row, it may initially seem like there is still little sign of the tariff induced boost to inflation that the Fed has been expecting,” Seema Shah, chief global strategist at Principal Asset Management, wrote in reaction to the report. She was referring to the slower than expected monthly gain in core prices. “However, with increases in categories like household furnishings, recreation, and apparel, import levies are slowly filtering through to core goods prices.”

Shah noted that tariffs usually take time to show up in inflation data, and because many imports were front-loaded, only a limited number of goods may have been affected so far. While any inflation bump from tariffs is likely to be temporary, the recent wave of new tariffs suggests the Fed would be wise to hold off on policy changes for the next few months.

Greg Daco, chief economist at EY, echoed that view, emphasizing that the full impact of tariffs has yet to materialize given the latest trade whiplash, but any resulting price increases will likely be temporary.

“A lot of businesses are talking about rapidly passing on the higher tariff shock from these higher duties. So we’re anticipating a rather swift pass through,” he told Yahoo Finance. “But if we are in an environment where there are staggered tariffs over the next year, then there is a risk of more inflation persistence. And I think that’s the key risk for the US economy right now.”

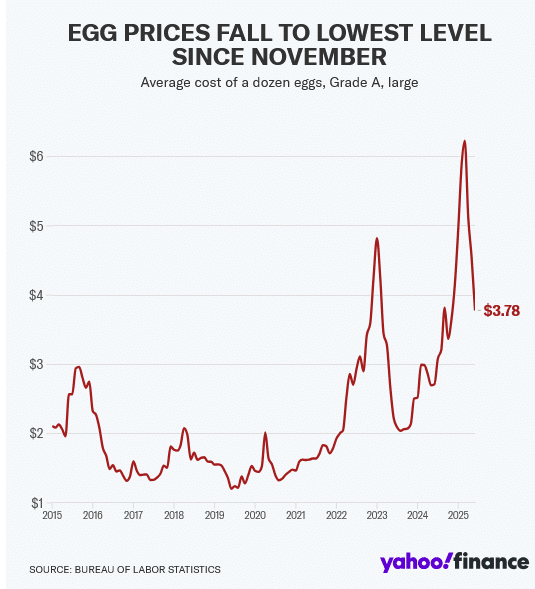

Shelter eases, egg prices drop

Core inflation has remained stubbornly elevated due to sticky costs for shelter and services like insurance and medical care, though a slight moderation in shelter prices helped ease June’s monthly reading.

The shelter index rose 3.8% year over year and 0.2% month over month, down from May’s 3.9% annual increase and 0.3% monthly gain. According to the BLS, shelter remained the largest contributor to the overall monthly rise in prices.

The index for rent and owners’ equivalent rent (OER) rose 0.2% and 0.3%, respectively, over the prior month. Owners’ equivalent rent is the hypothetical rent a homeowner would pay for the same property.

Notably, lodging away from home fell 2.9% in June after a 0.1% decrease in May.

Outside of shelter, the downside surprise in monthly core inflation was also aided by other categories, including a drop in airline fares, used cars and trucks, and new vehicles.

Meanwhile, food prices remained sticky, with the index rising 0.3% for the second straight month.

One notable exception: eggs. Prices dropped 7.4% from May to June after soaring to historic highs, though they remain up about 27% year over year.

Read the full article HERE.

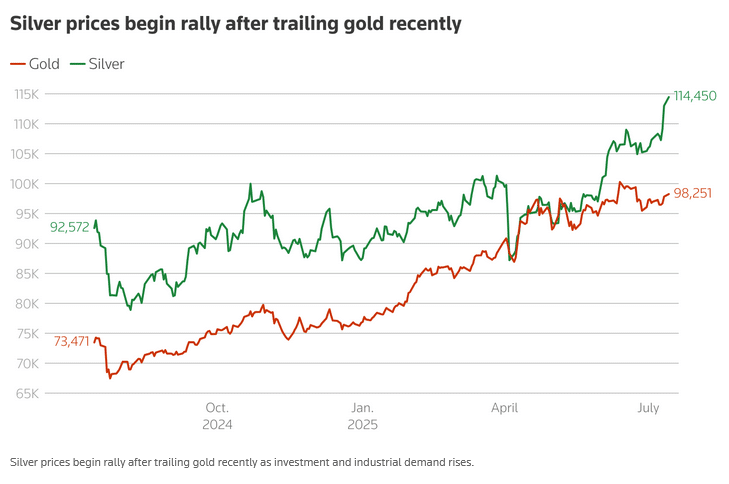

- Investors bet on rally in silver, prefer ETFs over physical

- Silver prices up 21% in three months vs rise of 5% in gold

- Silver ETFs attract 39.25 billion rupees in June qtr

- Gold ETFs lag with inflow of 23.67 billion rupees in June qtr

Indian investors, traditionally obsessed with stockpiling gold, are increasingly turning to silver , which was trading near a 14-year high on Monday, as its returns this year outpaced those of gold.

Imports fill most of the demand in the world’s largest consumer of silver, where domestic prices touched a record high of 114,875 rupees ($1,336) a kg as a production shortfall spurred investors’ hopes for a further rally.

“Gold’s done pretty well for me over the last couple of years,” said Umesh Agarwal, a regular buyer of gold coins, who recently made his first purchase of a one-kilogram bar of silver.

“Now I’m hoping silver follows the same path and gives similar returns.”

Domestic prices of silver have risen 21% in the past three months, outstripping a rise of 5% in gold, as opposed to the scenario of the past year, when gold prices surged 34%, compared to a rise of 23% in silver.

The appetite for silver is driven both by investment and industry needs in areas such as solar energy and electric vehicles, outpacing production, said Chirag Thakkar, chief executive of Amrapali Group Gujarat, a leading silver importer.

“Usually, investors cash in when prices hit record highs, offloading coins and bars or pulling out of exchange-traded funds (ETFs),” he added.

“However, this time, even at record highs, people are investing, rather than selling.”

Silver ETFs attracted inflows of a record 20.04 billion rupees in June, up from 8.53 billion in May, data from the Association of Mutual Funds in India showed.

In the June quarter, silver ETFs attracted inflows of 39.25 billion rupees, far outpacing the 23.67 billion flowing into gold ETFs.

Such ETFs offer investors a convenient way to gain exposure to silver, which is heavy and costly to store and transport, said Vikram Dhawan, head of commodities and fund manager at Nippon India Mutual Fund, which manages metal ETFs.

Volatility in equity markets following U.S. President Donald Trump’s tariffs has also pushed investors to diversify, said a Mumbai-based bullion dealer with a silver importing bank.

Traditionally the choice of budget-conscious rural consumers, silver is increasingly attracting urban buyers as an investment, the dealer added.

Indian retail investment demand rose 7% in the first half of 2025 on the year, fuelled by expectations of a price rally, the Silver Institute said this month.

Silver imports jumped 431% in May on the year to 544.1 tons, while gold imports fell 25% to 30.5 tons, trade ministry data showed.

Read the full article HERE.

Gold prices rose in Asian trade on Friday, recouping some recent losses after safe haven demand was buoyed by U.S. President Donald Trump threatening more trade tariffs, while geopolitical tensions in the Middle East also helped.

Strength in the dollar– which was headed for a weekly gain– kept gains in gold and most other metals subdued on Friday. But silver and platinum were set for strong weekly gains, vastly outperforming gold as they notched fresh multi-year highs this week.

Among industrial metals, U.S. copper futures fell sharply from recent peaks, seeing some profit-taking after Trump’s tariff threat drove stellar gains in the red metal earlier this week.

Spot gold rose 0.5% to $3,341.27 an ounce, while gold futures for September rose 0.9% to $3,354.60/oz by 01:28 ET (05:28 GMT).

Trump’s Canada tariff threat, Middle East tensions boost havens

Trump on Thursday evening said he will impose 35% tariff on Canada from August 1, higher than his previously threatened 25% tariffs and also blindsiding Ottawa after some signs of improving trade relations.

The announcement sparked a risk-off move across major risk-driven assets, and spurred some gains in havens such as gold, and the yen.

On the geopolitical front, signs of little immediate deescalation in the Israel-Hamas war, as Jerusalem continued to launch attacks against the Gaza Strip, kept geopolitical tensions high in the Middle East.

U.S. efforts to broker a ceasefire appeared to have yielded little progress in the past week, despite the White House’s claims that a deal was close.

This trend offered gold some relief, although the yellow metal was nursing a muted weekly performance as it came under pressure from a recovery in the dollar. Speculation over the path of U.S. interest rates also weighed on gold, with the yellow metal remaining squarely within a $3,300/oz to $3,500/oz trading range seen for most of the year.

Platinum, silver greatly outpace gold in recent weeks

Platinum and silver prices steadied near multi-year peaks, and were headed for weekly gains of between 1.9% and 3%. Both metals shot past gold in recent weeks, as they both benefited from increased speculation over tighter supplies and increasing demand in the coming months.

Platinum was set for a sixth consecutive week of gains, as the white metal continued to benefit from a bullish industry report released in late-May. Platinum futures rose 0.3% to $1,420.25/oz and were close a 11-year high.

Silver futures rose for a third straight week, and were up 2.2% to $38.140/oz on Friday– their highest level in nearly 14 years.

Among industrial metals, COMEX U.S. copper futures fell 1.2% to $5.5620 a pound, seeing extended profit-taking after Trump’s threat of a 50% tariff on the red metal sparked strong gains this week. U.S. copper futures had briefly hit record highs.

Benchmark copper futures on the London Metal Exchange were flat at $9,700.55 a ton.

Read the full article HERE.

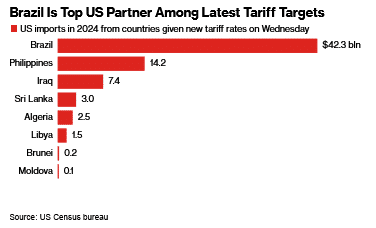

- Donald Trump threatened to impose a 50% tariff on Brazil over its domestic political affairs, citing the treatment of former President Jair Bolsonaro.

- Brazil’s leader Luiz Inacio Lula da Silva responded that his nation will not be “tutored” by anyone and that any unilateral rate hikes will be responded to using Brazil’s economic reciprocity law.

- According to Stephen Olson, visiting senior fellow at ISEAS–Yusof Ishak Institute, it’s unprecedented for the US to add a tariff onto a foreign country to stop a judicial proceeding, and “it signals to US trade partners that any and all issues that catch Trump’s attention could become a problematic part of the trade agenda”.

Donald Trump threatened to impose a 50% tariff on Brazil over its domestic political affairs, the most extreme case yet of the US president weaponizing trade policy to make unrelated demands.

Trump cited the treatment of former President Jair Bolsonaro — a right-wing populist leader — in his letter to Brazil on Wednesday, calling on authorities to drop charges against him over an alleged coup attempt. “This Trial should not be taking place. It is a Witch Hunt that should end IMMEDIATELY!” Trump wrote in the letter.

Brazil’s leftist leader Luiz Inacio Lula da Silva fired back in a social media post, saying his nation will not be “tutored” by anyone. He added that the case against those who planned a coup is a matter solely for the country’s justice system and “not subject to interference or threat.”

“Any unilateral rate hikes will be responded to using Brazil’s economic reciprocity law,” Lula wrote. “The sovereignty, respect and intransigent defense of the Brazilian people’s interests are what guide our relations with the world.”

Trump’s latest threat, against a nation that sells fewer goods to the US than it buys, risks reinforcing concerns that formal trade agreements may offer limited protection against future tariff hikes. It also again shows that the rates Trump unveiled in April on “Liberation Day” carry little meaning.

Trump has previously used tariff threats to accomplish other geopolitical goals. In January, he announced sweeping tariffs on Colombia before abruptly pulling the threat after reaching a deal on the return of deported migrants. He’s also put 20% tariffs on China for its alleged failure to stop the flow of fentanyl to the US, and threatened BRICS nations with higher duties for undermining the dollar.

Unprecedented

Still, it’s unprecedented for the US to add a tariff onto a foreign country to stop a judicial proceeding, according to Stephen Olson, visiting senior fellow at ISEAS–Yusof Ishak Institute and a former US trade negotiator.

“It signals to US trade partners that any and all issues that catch Trump’s attention could become a problematic part of the trade agenda,” Olson said. “It also raises questions as to whether the reciprocal tariff negotiations will ever really settle anything.”

So far, Trump’s flurry of new warnings have done little to rattle global markets as they did when the so-called reciprocal tariffs were announced in April, with traders focusing on Trump’s overall extension of the deadline to Aug. 1. That’s effectively given trading partners an extension for talks as skepticism persists on Wall Street that he will follow through on his import taxes.

Currency Hit

But the move on Brazil shook the real, which slumped as much as 2.9% against the US dollar. US equity futures retreated amid uncertainty over the Trump administration’s trade policies, with S&P 500 contracts slipping 0.2%, even as stocks gained in Europe and Asia.

The Brazil letter was one of several sent by Trump on Wednesday. He levied a 30% rate on Algeria, Libya, Iraq and Sri Lanka, with 25% duties on products from Brunei and Moldova and a 20% rate on goods from the Philippines. They were largely in line with rates Trump previously announced, though he lowered them for Iraq and Sri Lanka while raising them on the Philippines, a US ally.

Brazil is the first country to receive one of Trump’s tariff notifications that was not on the initial list of trading partners when he announced higher so-called reciprocal tariffs in April. And the letter to Brazil also presents a warning shot to the BRICS group of developing nations, which Trump has cast as a threat to the US dollar’s status as the world’s key currency.

Brazil is unusual among Trump’s most recent tariff targets because it runs a deficit in trade with the US, while almost all the others post large surpluses. In 2024, Brazil imported some $44 billion of American products, while US imports from Brazil were around $42 billion, according to the Census Bureau — putting it among the top 20 American trading partners.

Asked what formula he was using to determine the appropriate duty rate for trading partners, Trump told reporters at a White House event on Wednesday that it was “based on common sense, based on deficits, based on how we’ve been over the years, and based on raw numbers.”

“They’re based on very, very substantial facts, and also past history,” he said.

Trump added to uncertainty earlier this week by claiming he was “not 100% firm” on that new cut-off date for talks. He has since sought to signal to investors and trading partners that he is committed to carrying out his tariff threats, vowing Tuesday that “all money will be due and payable starting AUGUST 1, 2025 — No extensions will be granted” on country-specific levies.

Deputy Treasury Secretary Michael Faulkender on Wednesday indicated that even if tariffs kicked into effect, negotiations could continue beyond the August deadline.

“There’s enormous progress that has been made with many of these countries, and for some of them it is just finalizing some of the terms of the framework,” he said in an interview with Bloomberg Television. “Now obviously, the details of the trade agreement will be worked out well beyond August 1st, but a general framework is the objective to have by August 1st.”

Still, the Brazil threat signaled that even if nations strike trade deals with the US by the Aug. 1 deadline, they may still face tariff escalation afterward, according to economists at Barclays Plc. led by Brian Tan.

BRICS, Copper

“We suspect President Trump’s announcement of a 50% tariff on Brazil is likely to erode Emerging Asian policymakers’ confidence that a deal would put an end to uncertainty over US trade policy,” they wrote.

The president has also raised the stakes for two key trading partners, saying the European Union could receive a unilateral tariff rate soon despite progress in negotiations, and vowing to hit India with an additional 10% levy for its participation in the BRICS.

He has raised the specter of more industry-specific tariffs, as well, floating a 50% rate on copper products that sent that metal climbing as high as 17% in New York on Tuesday, a record one-day spike. He also pitched tariffs as high as 200% on pharmaceutical imports if drug companies don’t shift production to the US in the next year.

While Trump has touted his tariff notification letters as deals, even the actual agreements he has managed to strike during the negotiating period with the UK and Vietnam have been far short of comprehensive, leaving many details unclear. Trump also secured a truce with China to lower rates and ease the flow of critical earth minerals.

The result of Trump’s criticism of BRICS economies and his high tariff threats may end up being that it only brings those economies closer together, according to Steven Okun, founder and CEO of APAC Advisors.

“It signals that countries should continue to expect Trump to use tariffs to get what he wants — and there’s limited scope for a reprieve,” he said by phone. “He can add tariffs for whatever reason at any time.”

Read the full article HERE.

Tweaks can’t solve the country’s debt problem. At some point, Washington will have to start over.

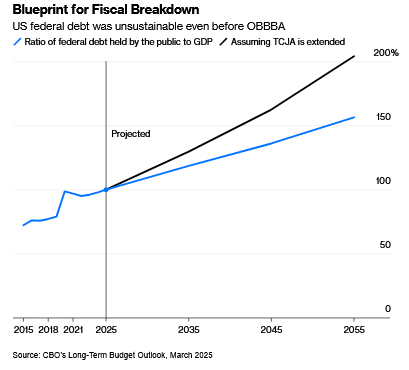

In a remarkable achievement, the One Big Beautiful Bill Act got worse with each iteration before finally being enacted last week. On plausible assumptions, the final version will add more than $5 trillion to deficits over the next 10 years, moving the track of public debt from unsustainable to all but unhinged. As Congress turns to its budget for next year, it must grapple realistically with this looming crisis.

As written, the measure will add about $3 trillion to the expected 10-year deficit. Include interest payments, and the cost rises to nearly $4 trillion. Assume that assorted “temporary” measures are made permanent — which seems reasonable, given that most of the bill’s cost comes from extending supposedly temporary tax cuts passed in 2017 — and the total could be as much as $6 trillion. Federal debt held by the public would climb from 100% of gross domestic product today to 130% by 2034. (After that, it just keeps going up.)

Remember when fiscal conservatives wanted to balance the budget? This plan means annual deficits of more than 7% of GDP even if the economy remains at full employment. Add a recession during the next decade, and the numbers soar off the charts. As the debt rises, the steps needed to rein it in become ever more challenging.

Complicating the task going forward, many of the bill’s provisions were designed to obfuscate its true costs. Temporary tax and spending changes were timed so that the biggest deficit increases were piled into the early part of the decade. (First, the pleasure of lower taxes and higher spending; later, in theory, the pain of higher taxes and lower spending.) For accounting purposes, the bill’s supporters went as far as to claim that it actually reduces projected deficits — relative to a new “current policy” baseline. In effect, this declared the bill’s centerpiece, extending the 2017 Tax Cuts and Jobs Act at a cost of more than $3 trillion, to be a fiscal nonevent.

The magnitude of the challenge means that tweaks alone — such as the $9.4 billion “rescissions” package the president has requested, which the Senate may vote on next week — won’t cut it. Nor will some combination of tariffs, faster growth and cracking down on “waste, fraud and abuse.” What’s required is a comprehensive review of taxes and entitlements.

As a start, Congress should create a bipartisan fiscal commission, on the model of the 2010 Bowles-Simpson panel, to offer an honest assessment of the budget trajectory and propose reforms. The key is to put everything on the table, including Medicare and Social Security. Modest but broad-based tax increases — admittedly, not likely anytime soon — should also be under consideration. Likewise small budget cuts across an array of federal programs. Such changes will of course be unpopular, but the quicker they get underway, the less painful they’ll need to be.

Lawmakers will turn this week to negotiating next year’s budget, very much in a spirit of business as usual. That’s precisely the wrong approach. The Big Beautiful Bill has made the country’s fiscal picture much uglier, and reforms much more urgent. The sooner Washington understands that reality, the better.

Read the full article HERE.