For centuries, gold has been the go-to haven asset in times of political and economic uncertainty. Its status as a reliably high-value commodity that can be transported easily and sold anywhere offers a sense of safety when everything else is in turmoil.

Not everyone’s a fan. Famed investor Warren Buffett has called the precious metal a “sterile” asset, telling Berkshire Hathaway Inc. shareholders in a 2011 letter that “if you own one ounce of gold for an eternity, you will still own one ounce at its end.”

Nonetheless, investors have sought refuge in bullion as the trade and geopolitical agendas of US President Donald Trump send equities, bonds and currencies swinging. They’ve piled into gold-backed exchange-traded funds, with inflows reaching $21 billion in the first quarter, according to the World Gold Council, the highest level since the Covid-19 pandemic.

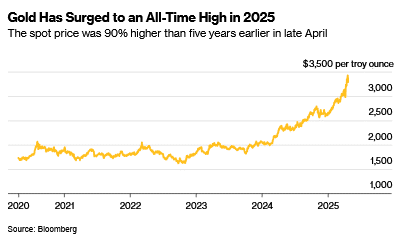

The rush to gold has pushed the spot price to a series of record highs, topping $3,500 in mid-April and extending a ferocious run from last year. The yellow metal has thus far outperformed nearly every other major asset class in 2025.

Demand in China — the top bullion producer and consumer — has been one of the key drivers of gold’s ascent, propelled by concerns about the punitive tariffs Trump has placed on US imports of goods from its largest trading partner.

Gold has a track record of increasing in value in times of market stress. It’s also seen as a hedge against inflation, when the purchasing power of currencies is eroded. Inflation worries are front of mind for many right now as the new duties Trump has imposed on imports into the US, as well as the retaliatory levies introduced by other countries, risk increasing prices across the global economy.

The safe-haven status of gold has been elevated as Trump’s trade agenda shakes confidence in other typical shelters from market gyrations — namely the US dollar and government bonds — and threatens to end the idea of American exceptionalism.

Gold has historically been negatively correlated with the dollar. Because bullion is priced in dollars, when the greenback weakens, gold becomes cheaper for holders of other currencies. In mid-April, the dollar was at a three-year low against other major currencies.

Beyond market movements, owning gold is deeply rooted in Indian and Chinese cultures — two of the world’s largest markets for the metal — where jewelry, bars and other forms of bullion are passed down through generations as a symbol of prosperity and security. Indian households own about 25,000 metric tons of gold, more than five times what’s stored in the US depository at Fort Knox.

They’re famously sensitive to prices, but when gold’s appeal to investors in financial markets starts to fade, physical buyers of jewelry and bars often step in to grab a bargain, putting a floor under prices in the process.

Is it just trade war fears pushing up the gold price?

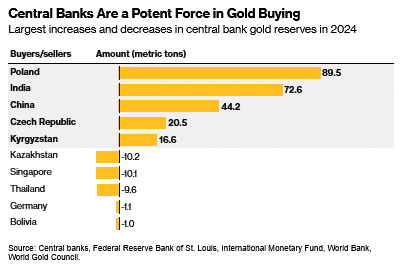

The metal’s blistering price rally since the start of 2024 was partly driven by huge purchases by central banks, particularly in emerging markets as they seek to reduce their dependency on the US dollar, the world’s primary reserve currency. Gold helps diversify a country’s foreign exchange reserves and guard against currency depreciation.

Central banks have been net buyers of gold for the past 15 years, but the speed of their purchases doubled in the wake of Russia’s invasion of Ukraine. As the US and its allies froze Russian central bank funds held in their countries, it underscored how foreign currency assets are vulnerable to sanctions.

In 2024, central banks bought more than 1,000 tons of bullion for the third year in a row, according to the World Gold Council, and they hold around a fifth of all the gold that’s ever been mined.

The sustained enthusiasm of central banks spurred Goldman Sachs Group Inc. to raise its year-end forecast for the gold price to $3,700 per ounce in April. It anticipates that $4,000 could be reached by the middle of next year.

What could halt gold’s rally?

Following a nearly uninterrupted upward march in the gold price since early last year, there could eventually be some consolidation as investors banks their gains. A major de-escalation of Trump’s tariffs and a peace deal between Russia and Ukraine could also spur a price decline.

But central banks have been the most important pillar of support for gold’s bullish momentum, meaning they have the power to do the most damage if they trim their reserves.

There’s no indication any large holder is considering this. The central banks of developed economies have sold very little gold in recent decades compared to the 1990s, when persistent sales sent bullion prices down by more than a quarter over the decade. Amid concerns that those uncoordinated sales were destabilizing the market, the first Central Bank Gold Agreement was struck in 1999, under which signatories agreed to limit their collective sales of bullion.

Does gold being a physical asset cause any issues for investors?

Owning gold typically isn’t free. Because it’s a physical object, holders have to pay for storage, security and insurance.

Investors buying gold bars and coins will usually pay a premium over the spot price. There can be geographic price differentials too and traders take advantage of these arbitrage opportunities.

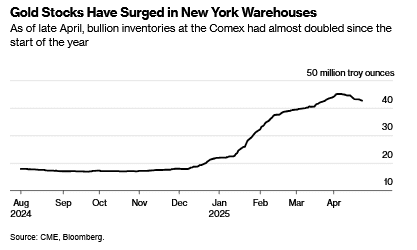

That’s what happened earlier this year when fears that Trump could introduce tariffs on bullion imports pushed gold futures on New York’s Comex significantly above spot prices in London. There was a worldwide dash among those in possession of the physical metal to shift it to the US to capture the large premium and potentially hundreds of millions of dollars in profit.

Gold is usually relatively simple to shift, stashed away in the cargo holds of commercial aircraft, unbeknown to the holiday and business travelers in the cabin above. But it’s not as straightforward as loading up a jet from Heathrow Airport to JFK thanks to a quirk in the global gold market: different size requirements. In London, 400-ounce bars are the standard, while for Comex contracts, traders must deliver 100-ounce or 1-kilogram bars.

That means bullion being sent to Comex warehouses has to first go to refiners in Switzerland to be melted down and recast to the correct dimensions, before journeying on to the US. This creates a bottleneck when there’s a particular rush to rejig the location of bullion stocks.

Read the full article HERE.