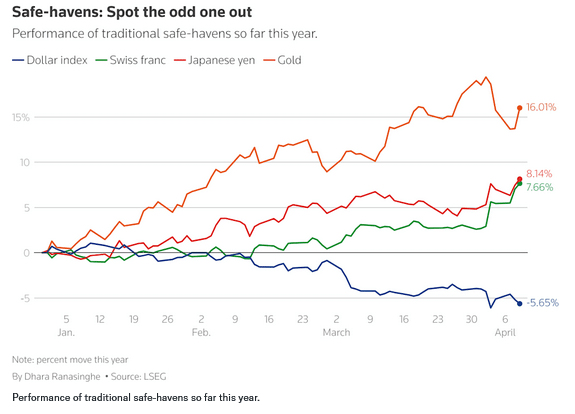

Investors are dumping U.S. assets they usually favour in times of turmoil as fear over the economic impact of U.S. President Donald Trump’s reciprocal tariffs shakes confidence in traditional safe-havens.

The dollar and U.S. Treasuries have taken a beating as Trump’s tariffs, plus a 104% duty on China, took effect, while China swiftly retaliated. In contrast, safe-haven favourites such as gold and the Swiss franc continue to pull in cash.

The rapid rise in U.S. Treasury yields has worried investors, who fear this could be forced selling to cover portfolio losses and a dash for cash, rekindling memories of the COVID-19 market turmoil.

Here is a glance at how traditional safe havens have fared so far during the tariff turbulence:

Dollar takes backseat

The dollar was the first to lose its shine after Trump announced tariffs, when it dropped along with stock markets. This was an unusual move raising questions about the global standing of the U.S. currency, often dubbed “King Dollar” for its strength and dominance in global currency markets.

The dollar has shed more than 5% this year against a basket of other currencies after posting its weakest start to a year since 2016, LSEG data shows.

The dollar’s failure to benefit from rising U.S. Treasury yields has added to investors’ worries because, until now, higher returns on Treasuries relative to other bond markets had boosted the dollar’s appeal.

“The dollar not getting support from (higher) yields suggests the dollar is not a currency safe-haven,” State Street Global Markets’ head of macro strategy Michael Metcalfe said.

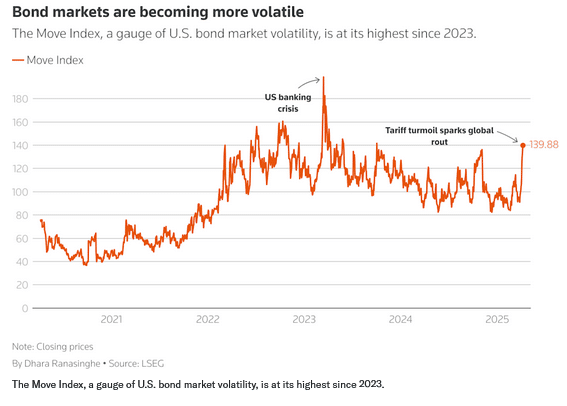

Bond rout

Investors initially rushed into government bonds on heightened recession risks, but that has quickly changed.

After plunging 26 basis points last week, U.S. 10-year Treasury yields have surged more than 40 basis points so far this week. Longer-dated bonds are the worst hit, with 30-year yields up nearly 50 bps, set for their biggest weekly jump since the early 1980s. Bond yields rise when prices fall.

An index of Treasury volatility has risen to its highest since late 2023.

Yields have surged even as traders price in faster U.S. Federal Reserve rate cuts, suggesting deliberate dumping of Treasuries rather than selling driven by changes in economic expectations. This is reflected in a widening gap between Treasury yields and interest rate swaps, derivatives used for hedging.

Pepperstone senior strategist Michael Brown said that pointed to a real lack of desire to hold Treasuries.

“Whether this is participants selling down Treasuries to raise cash in order to meet their liquidity needs, or a representation of how institutional confidence in the U.S. has continued to be eroded, remains to be seen.”

Investors also believe the unwinding of a widely used hedge fund arbitrage trading strategy between cash and positions in Treasury futures, known as the basis trade, is adding to these market moves.

The bond market pain is spreading. In Britain, 30-year bond yields rose to their highest since 1998, putting pressure on the country’s stretched finances.

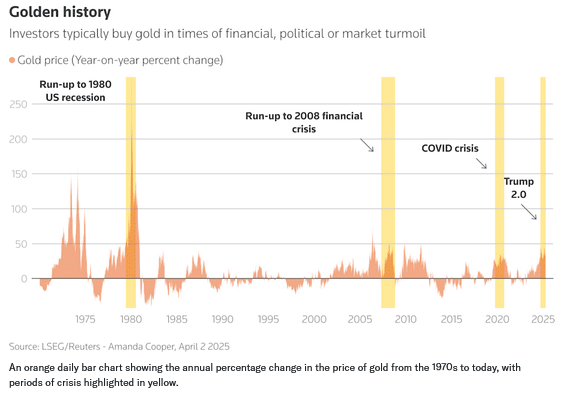

Golden Era

Gold has a long history as a safe-haven asset.

It tends to rise in a financial or political crisis. The 1970s energy crisis, the 1980 U.S. recession, the 2008 global financial crisis and the 2020 COVID-19 pandemic all triggered a rise in gold.

This time gold has surged to all-time highs above $3,000 an ounce, having almost doubled in the past 2-1/2 years. It was caught up in the broader market selling of the past week, as investors rushed to raise cash to plug losses elsewhere.

But gold was up more than 2% on Wednesday, only narrowly below its record peak at $3,167.

Central banks and investors, who scooped up gold as a hedge against the inflation spike after the COVID pandemic, have continued buying even as inflation eased. And with Trump’s isolationist trade policies playing out, more investors are buying it to protect their wealth.

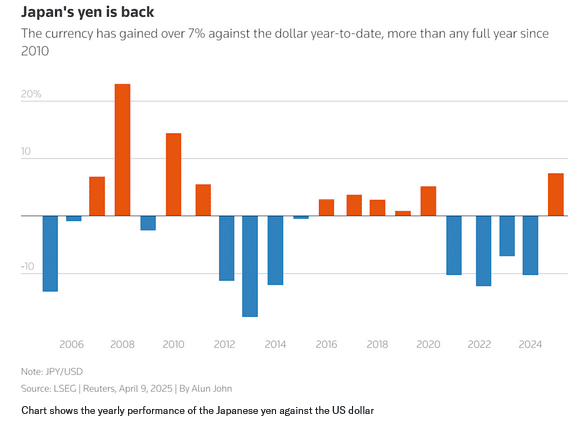

Back in favour

Japan’s yen is often the biggest major currency to benefit from safe-haven flows and typically performs well when stocks falter.

The yen was set for its best day against the dollar since September on Wednesday and has rallied 7.5% so far this year, while another safe-haven favourite, the Swiss franc, has strengthened just as much.

Defensive plays

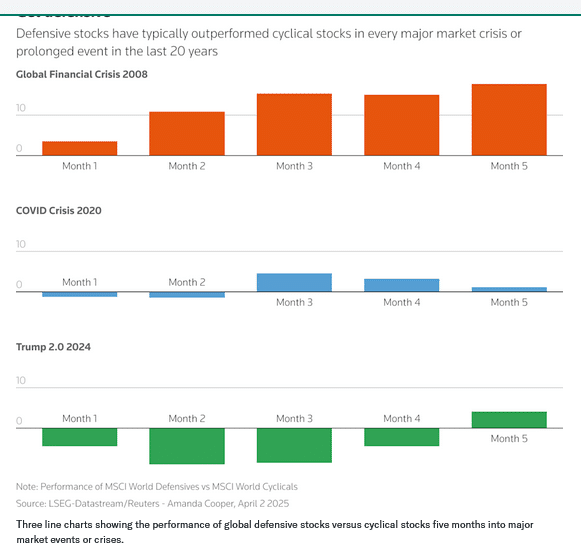

Stocks are usually in the front line in recessions and financial crises. Investors take profits, yanking their cash as they run for shelter. But most cannot abandon the equity market entirely, so when trouble hits, they pile into stocks with recession-proof earnings, such as drugmakers, utilities and food and beverages.

In the last 25 years, so-called defensive stocks have consistently outperformed cyclical stocks that are most closely linked to the global economy, such as technology or mining shares.

Even though there is no sign yet of a recession, a basket of global defensive stocks has fallen less since Trump’s November election win than a basket of cyclicals, reflecting investors’ caution.

Read the full article HERE.