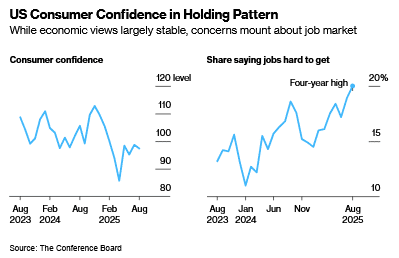

US consumer confidence fell slightly in August as Americans worried more about their prospects of finding a job.

The Conference Board’s gauge of sentiment decreased 1.3 points to 97.4 after an upward revision to the prior month, data out Tuesday showed. The median estimate in a Bloomberg survey of economists called for a reading of 96.5.

A measure of expectations for the next six months declined in August, while present conditions decreased to the lowest since April.

Consumer confidence continues to hover well below levels seen prior to the pandemic. The recent labor-market slowdown has added to economic concerns stemming from President Donald Trump’s tariffs. Job growth and wage gains have significantly slowed, and it’s become increasingly difficult for unemployed Americans to find a new a role.

The share of consumers that said jobs were hard to get rose for a second month to the highest since 2021. The share saying jobs were plentiful was little changed.

The difference between these two — a metric closely followed by economists to gauge the job market — fell slightly, continuing a steady decline over the last three years.

Deterioration in the labor market has become a focal point for Federal Reserve officials as they determine when to resume cutting interest rates. In a speech at the Fed’s annual Jackson Hole conference last week, Chair Jerome Powell left the door open for a potential interest rate cut at the central bank’s next policy meeting in September due to rising risks to the job market.

The share of consumers expecting higher interest rates in the year ahead increased, while fewer anticipated lower rates, according to the Conference Board.

Trump’s ever-changing trade policies have weighed on consumer confidence over the last few months as they anticipate higher prices. Consumers referenced those concerns in write-in responses to the survey, as well as prices for food and groceries. Inflation expectations moved higher.

The report showed buying plans for big-ticket items like cars, refrigerators and washing machines rose while vacation plans were down.

While consumers were negative on the job market, they were generally more upbeat regarding business conditions.

Read the full article HERE.