Inflation has been one of the top concerns for the US economy in 2024. And it looks like fears over sticky prices will continue in 2025.

“We expect a gradual deceleration from where we are, but to levels that are still uncomfortably high for the Fed,” Deutsche Bank chief economist Matthew Luzzetti told Yahoo Finance in an interview.

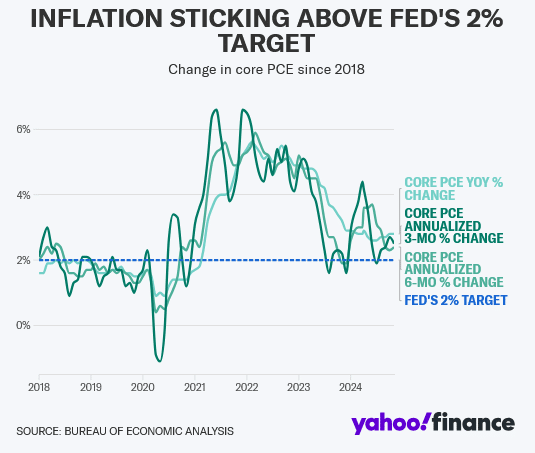

So far this year, inflation has moderated but remains stubbornly above the Federal Reserve’s 2% target on an annual basis, pressured by hotter-than-expected readings on monthly “core” price increases, which strip out volatile food and energy costs.

In November, the core Personal Consumption Expenditures (PCE) index and the core Consumer Price Index (CPI), both closely tracked by the central bank, rose 2.8% and 3.3%, respectively, over the prior-year period.

“Inflation is primarily going to be driven by the services side of the economy,” Luzzetti said, calling out core services like healthcare, insurance, and even airfares. “Shelter inflation is also still high, and although it’ll come down over the next year, it’s likely that it could remain somewhat elevated.”

According to updated economic forecasts from the Fed’s Summary of Economic Projections (SEP), the central bank sees core inflation hitting 2.5% next year, higher than its previous projection of 2.2%, before cooling to 2.2% in 2026 and 2.0% in 2027.

This largely aligns with Wall Street’s current projections. Out of the 58 economists surveyed by Bloomberg, the majority see core PCE moderating to 2.5% in 2025 but they do expect less of a deceleration in 2026, with the bulk of economists anticipating a higher 2.4% reading compared to the Fed.

“The risks are certainly tilted in the direction of higher inflation,” Nancy Vanden Houten, lead US economist at Oxford Economics, told Yahoo Finance. “A lot of the risk comes from the possibility of certain policies being implemented under the Trump administration on tariffs and on immigration.”

President-elect Donald Trump’s proposed policies, such as high tariffs on imported goods, tax cuts for corporations, and curbs on immigration, are considered potentially inflationary by economists.

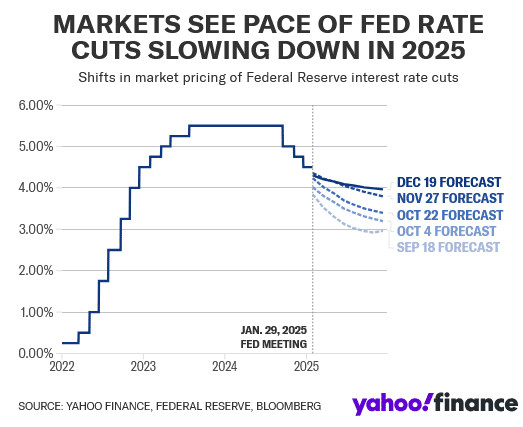

Those policies could further complicate the Federal Reserve’s path forward for interest rates.

In a press conference following the Federal Reserve’s last interest rate decision of the year, Federal Reserve Chair Jerome Powell said the central bank expects “significant policy changes” but cautioned that the extent of policy adjustments remains uncertain.

“We need to see what they are and what effects they have,” he told reporters at the time, adding the Fed is “thinking about these questions” and will have “a much clearer picture” once policies are implemented.

Trump 2.0 and the ‘inflationary spiral’

For some, the picture is already clearer than not.

Nobel Prize-winning economist and Columbia University professor Joseph Stiglitz said at Yahoo Finance’s annual Invest conference last month that the US economy has achieved a soft landing, in which prices stabilize and unemployment remains low. “But that ends Jan. 20,” he warned, referring to Inauguration Day.

Tariffs have been one of the most talked-about promises of Trump’s campaign. The president-elect has pledged to impose blanket tariffs of at least 10% on all trading partners, including a 60% tariff on Chinese imports.

“It will be inflationary,” Stiglitz said. “And then you start thinking of the inflationary spiral, the prices go up. Workers will want more wages. And then you start thinking of what happens if others retaliate [with their own duties].”

Stiglitz believes Powell will raise interest rates if inflation pressures persist.

“You combine the higher interest rates and the retaliation from other countries, you’re going to get a global slowdown,” he said. “Then you have the worst of all possible worlds: inflation and stagnation, or slow growth.”

BNP Paribas issued a grim 2025 outlook, expecting the Fed to pause its easing cycle next year amid a “substantial rise in inflation from late 2025 into 2026” due to the rollout of tariffs. The firm sees CPI settling at 2.9% by the end of next year before climbing to 3.9% by the end of 2026.

Meanwhile, Minneapolis Fed president Neel Kashkari categorized a possible retaliation by other countries as a “tit-for-tat” trade war, which would keep inflation elevated over the long term.

Investors are starting to take notice of the risk. In the latest Global Fund Manager Survey from Bank of America released earlier this month, expectations of a “no landing” scenario, in which the economy continues to grow but inflation pressures persist, hit an eight-month high.

Headwinds and tailwinds

In the United States, Congress typically sets tariffs, but the president has the authority to impose certain ones under special circumstances, and Trump has vowed to do so.

It remains unclear which policies will be a priority once Trump takes office or if he’ll fully commit to the promises he’s already made.

“Our baseline is that we do get tariffs next year, but they start relatively low and targeted,” Luzzetti said, projecting a 20% cumulative rise in tariffs on China, in addition to more targeted levies on Europe.

“Things like the universal baseline tariff, which is this across-the-board tariff rate that Trump has threatened, we don’t think that that gets implemented,” he said.

Still, the economist believes that whatever tariffs Trump does choose to implement will lead to higher inflation over time. He’s baked in zero interest rate cuts from the Federal Reserve next year for that reason.

“Our view is that inflation does not come below 2.5% next year and that the Fed would not be comfortable with that, and therefore would not keep cutting rates,” he said. “But also we have an expectation that the economy will remain quite resilient.”

And the US economy has been resilient throughout the course of 2024. Retail sales once again topped estimates for the month of November, GDP remains strong and above trend, the unemployment rate continues to hover at around 4%, and despite future uncertainty and its bumpy path down to 2%, inflation has moderated.

“There’s just a good amount of tailwinds to an economy that is already receiving solid growth momentum, and the Fed has just undertaken 100 basis points of rate cuts this year,” Luzzetti said. “All that, we think, sets a pretty solid floor under growth over the next year.”

Read full article HERE.